Spread Betting Tutorial Video

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Business of Betting Podcast•1 тыс. просмотров

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Trade over 11,000 instruments on the world's largest markets

Award-winning web and mobile platforms built for serious traders

Get market-moving news, analysis and exclusive educational content

For over 30 years, we've been the trusted trading provider for serious traders

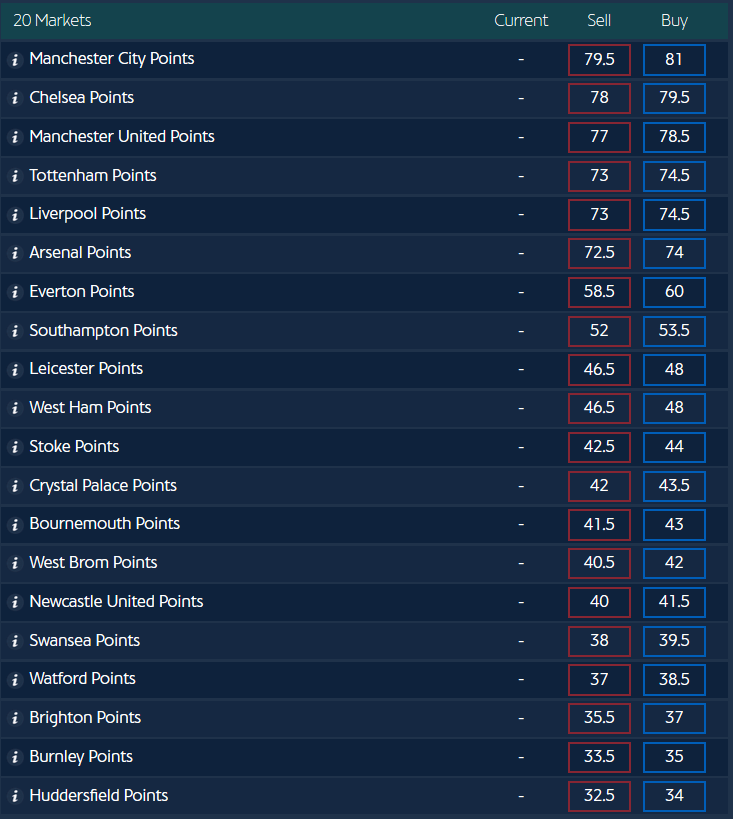

Spread betting is a tax-efficient* way of trading the financial markets in the UK. Spread betting allows you to speculate on the underlying price movements of financial instruments without taking ownership of the asset. This means that you can open long positions (buy) or short positions (sell) based on whether you think that the price of the asset will rise or fall over a period of time.

Traders can spread bet on a range of markets, including forex, shares, commodities, indices and treasuries. Learn how to spread bet on over 11,000 securities on our award-winning Next Generation trading platform**, and get to know the exclusive trading tools and technical features that we offer to aid your trading strategies.

Get tight spreads, no hidden fees and access to 11,000+ instruments.

Get tight spreads, no hidden fees and access to 11,000+ instruments.

We have put together a spread betting tutorial video that runs through the process of placing a trade on our spread betting platform. We also explain our charting features in further detail below and cover examples of spread betting on popular assets on our platform. Learn about getting started with trading on our platform with our step-by-step guide.

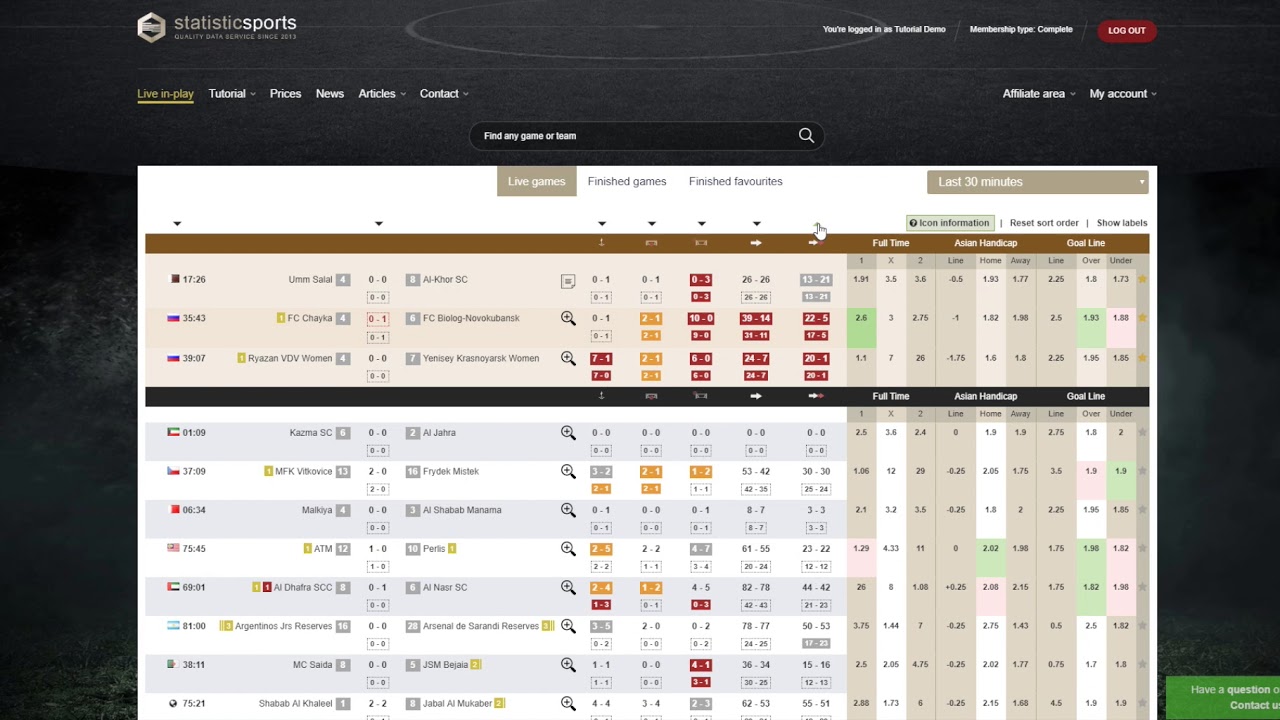

After registering for a spread betting account, you will have access to our advanced trading platform. You are able to speculate on the price movements of over 11,000 financial instruments, which are displayed in our Product Library.

You can filter the library by asset class (type), industry (sub-type), region and region, and whether you want to trade cash or forward assets. We also have some pre-determined categories that are exclusive to the platform, such as the biggest risers and fallers of the day in price and popular products that traders spread bet on the most. Our ‘Hot Products’ feature is updated hourly with financial instruments whose recent trade volume has increased significantly versus the monthly average. Learn more about our Hot Products tool.

You can search the product library before creating an account by visiting our instruments pages. These come with live price charts and detailed information about margin rates, trading hours and holding costs for each individual instrument.

Share baskets in particular are exclusive products to CMC Markets and they mirror a stock index in the way that they are constructed and traded. You can spread bet on thematic share baskets that contain a number of stocks within a particular industry, such as renewable energy, software as a service and oil and gas. These help to diversify your trading portfolio and also come with lower holding costs and zero commission fees. However, other charges apply, so please see our platform for more details. Learn more about thematic investing.

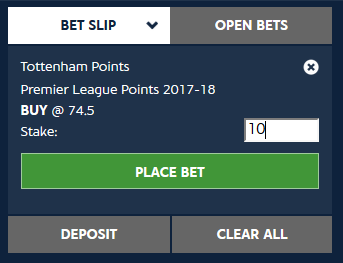

Once you have selected the instrument that you would like to trade, you can place a buy or sell spread bet order. To do this, simply open the trading chart and click on the order ticket on the right-hand side of the screen.

You can choose your order type between market, limit and stop-entry orders. You can specify the exact price that you would like a trade to be executed at with limit orders, whereas market orders execute the trade immediately at the prevailing price. The latter is the most common type of execution.

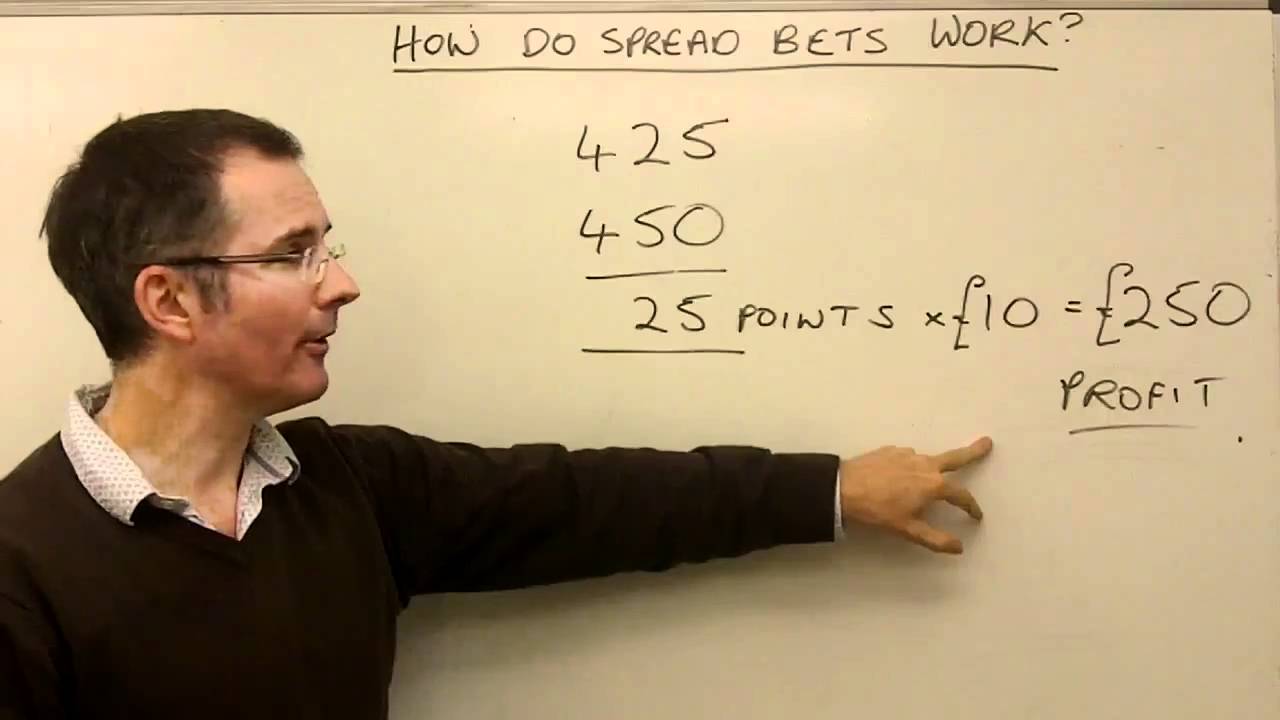

When you place a spread bet order, the ticket will provide you with more details of the trade. As shown above, you must enter a price per point, which will tell you the full value of the position. As spread betting requires trading on margin, this will also tell you the amount of capital that will be required to open a position. This is your deposit for the trade. Margin and leverage come with many risks, so it’s important that you understand the consequences of spread betting before entering the market. The ticket also highlights spread costs and potential overnight fees.

Spread betters often use risk-management tools such as stop-losses when placing an order, which you can do directly from the order ticket. Regular stop-loss orders help to close out the position if the price starts to go against you, but these do not take into account market volatility, gapping or slippage. Therefore, some traders opt for a guaranteed stop-loss instead, which ensures that you exit the trade at an exact price that you specify for a fee. Read more about stop-loss orders.

Once you have placed a buy or sell order, you can monitor your spread bet positions via the Account section of the platform. This includes both open and upcoming positions. You can also set up trading alerts for your desktop and mobile devices so that you don’t miss out on price drops, news announcements and calendar events that may have an effect on your positions.

These can also help you to make new trading decisions. For example, if a particular share price has dropped due to a poor earnings report, this may encourage you to buy the share while it is on discount, or short sell the stock for which you already have an open spread bet position in order to avoid long-term losses.

We have a variety of trading tools on our platform for the purpose of carrying out thorough technical analysis. This is particularly useful for short-term traders who spend a lot of time analysing price charts for sudden fluctuations.

Our chart pattern scanner automatically screens trading charts for price action and to identify patterns such as wedges, triangles, head and shoulders, double tops and bottoms and cup and handles. You can look for breakout and emerging patterns that have already been identified on the platform, or you can open a trading chart for a specific asset that you want to analyse and apply the tool manually, as shown below using the Patterns tab. You can also make use of our drawing tools to apply trendlines, buy and sell arrows and support and resistance levels for further analysis.

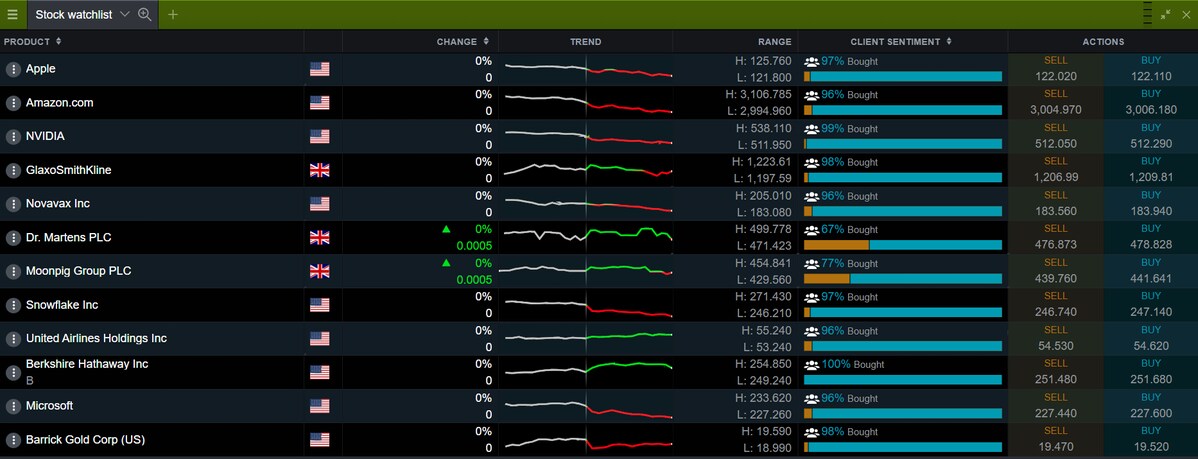

On our platform, it is possible to create your own watchlists that can be populated with instruments from any asset class. This helps you to monitor price movements for the particular shares or currency pairs, for example, that you are wanting to spread bet on. As shown below, our stock watchlist shows the overall trend that the asset is heading in, along with its change in price and other technicals. Learn how to create customisable watchlists.

It can be difficult to know whether to place a buy or sell order, which is why we have created a tool to reflect market sentiment on our platform. Our client sentiment indicator shows the percentage of traders that are buying and selling the asset, which can help aid your trading decisions when going to place a spread bet order.

A live spread betting account provides traders with additional features to those already mentioned in this article. This includes a trading forum, a form of social trading where you can share chart analysis and interact with our market analysts for certain instruments. We also offer news reports and headlines from Reuters, where the company also provides data for our economic calendar.

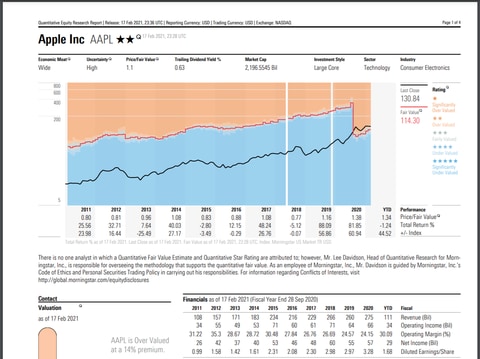

Our Morningstar equity research reports cover detailed information about a wide range of shares on that are available for spread betting on our platform. This includes revenue by year, P/E ratios, market cap, dividend yield and other statistics that are particularly useful when performing fundamental analysis of a company.

All of these unique features can help you to make trading decisions within the financial markets, whether it be related to shares through Morningstar reports, or the forex, commodity and index markets through all other platform features.

Our mobile trading application comes as a 2-in-1 spread betting and CFD trading app. This can be downloaded for iOS and Android devices, meaning that you can place spread bet orders via mobile and tablet when you are on the go. We have also ensured that the Next Generation platform is mobile friendly and comes with responsive charts, layouts and a customisable dashboard. Our spread betting app can be tailored to suit each individual trader’s needs.

How to spread bet the financial markets

Open a spread betting account. You will automatically get access to our demo trading account, which allows you to spread bet with £10,000 worth of virtual funds beforehand. When you are ready, you can deposit funds into a live account and start trading the live markets.

Consult our spread betting courses. There are many short and long-term strategies that you can use with spread bets, such as day trading, swing trading and position trading. These guides cover each strategy with examples of how they can be applied to the financial markets.

Read more about our trading fees. Although spread betting is tax-free and you don’t need to pay stamp duty, capital gains tax or commission charges, you may still be subject to holding costs if carrying positions overnight. When spread betting shares, there is also an additional cost built into the spread, so you should ensure that you have sufficient capital to cover your account.

As demonstrated, our Next Generation trading platform comes with a multitude of technical and fundamental analysis resources to help you spread bet within the financial markets. Explore more video trading tutorials that cover how to use all of the above tools on our platform in further detail.

Spread betting is a tax-efficient* way of speculating on the price movements of financial instruments. You buy or sell a pre-determined amount per point of movement, which is your stake size. For every point that the instrument moves in your favour, you will profit, and vice-versa for every point the market moves against you, you will make a loss. Read our spread betting examples.

What financial markets can you spread bet on?

At CMC Markets, you can spread bet on over 11,000 instruments across the financial markets, including forex, indices, commodities, shares, ETFs and treasuries. We also offer exclusive CFD share baskets, which can help to diversify your portfolio. Browse our range of markets.

Open a live spread betting account to deposit funds and start trading the live markets. If you would prefer to practise trading first, open a demo spread betting account to trade risk-free with £10,000 worth of virtual funds.

You can use a hedging strategy when spread betting by opening multiple positions to offset negative price movements. To see how this can be achieved in the forex market, read our article on forex hedging to get started.

Can you spread bet without leverage?

As spread betting is a form of derivative trading, you must use leverage on all trades that you open. This is because the aim of spread betting is to borrow funds from a broker in order to magnify trading gains (or losses), without paying the full value of the position upfront. Learn how to trade with leverage efficiently.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

**No1 Web-Based Platform, ForexBrokers.com Awards 2020; Best Telephone & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD & FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Platform Features & Best Mobile/Tablet App, Investment Trends 2019 UK Leverage Trading Report.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Get tight spreads, no hidden fees, access to 11,000+ instruments and more.

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy.

Rajce Girl Pussy

Xxx Seksi Kino

Russian Team Porno Tube

Incest 3d Clips

Http Porno365 Sex Models

Spread Betting - Beginner Video Tutorial | AvaTrade

Spread Betting Tutorial | How to Spread Bet | CMC Markets

Spread Betting - Beginner Video Tutorial | AvaTrade

Guide To Sports Spread Betting - Bet Chat

Spread betting tutorial | A step by step guide to spread ...

Spread Betting 2021 | Tutorial and Best Spread Betting ...

A Guide to Spread Betting: Learn The Basics - Best Free Bets

How to Spread Bet | Learn Spread Betting | City Index UK

Spread Betting Tutorial Video