Spread Betting Taxable Uk

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

РекламаСтаньте специалистом по ставкам на спорт. Узнайте, что влияет на коэффициенты. · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

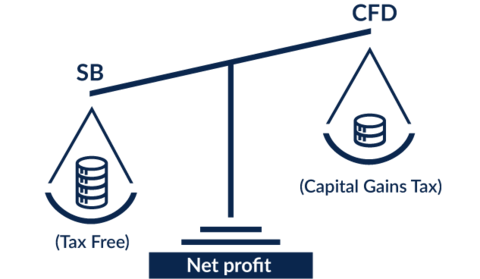

Essentially, spread betting is regarded by UK tax law as a gambling activity, and therefore the profits from spread betting are tax free – i.e., there is no capital gains tax to pay on the earnings generated.

www.independentinvestor.com/spread-bettin…

Do you have to pay tax on spread betting?

Do you have to pay tax on spread betting?

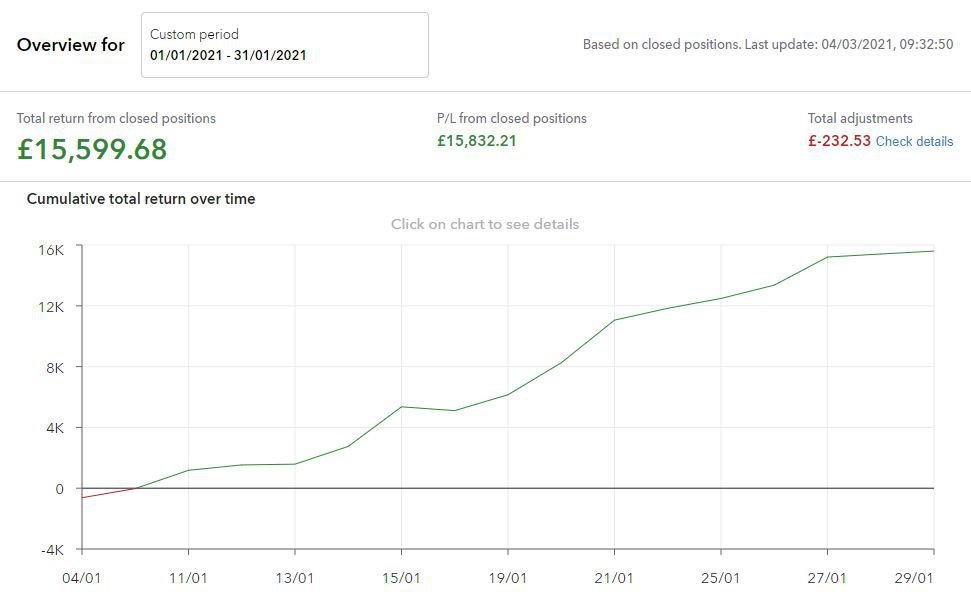

If you have a form of income outside of spread betting and ISA profits then there is no danger of HMRC suddenly deciding your tax-free profits can be taxed as Income Tax. That means you could work four hours a week as a barista in Starbucks and make £2,000,000 in spread betting and your profits would be exempt from tax.

www.shiftingshares.com/spread-betting-ta…

How to open a spread betting account in the UK?

How to open a spread betting account in the UK?

It's quick and easy to open a spread betting account with us. Apply in minutes with our simple application process. Spread betting accounts are only available to traders in the UK and Ireland. * In the UK spread betting profits are exempt from capital gains tax.

pepperstone.com/en-gb/trading/spread-be…

Is there capital gains tax on spread betting in Ireland?

Is there capital gains tax on spread betting in Ireland?

A: Capital Gains Tax does not apply in Ireland either so gains from spread betting in Eire are also tax-free. My understanding is that under current legislation places like Wales and Australia are also free of capital gains tax.

www.financial-spread-betting.com/Tax-fre…

Is there stamp duty on spread betting in the UK?

Is there stamp duty on spread betting in the UK?

The current rate on UK equities is 0.5% of the amount paid to purchase the shares (excluding broker commissions..etc). The stamp duty rate in Ireland is 1%. Spread bets are exempt from the 0.5 per cent stamp duty applicable on UK share purchases which means that short to medium term holdings may work out cheaper than buying the underlying shares.

www.financial-spread-betting.com/Tax-fre…

https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim22015

The taxpayer placing a spread bet is not normally carrying on a trade (see BIM22020 for exceptions). They are not taxable on the profits, nor do they receive relief for their …

https://www.shiftingshares.com/spread-betting-tax

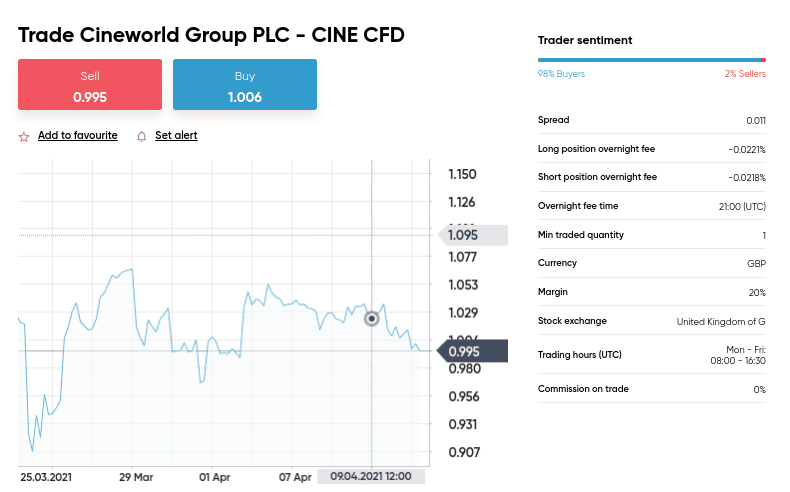

25.03.2021 · Is spread betting taxable? Spread betting is exempt from tax in the UK and Northern Ireland. This means that spread betting profits can be transferred from your trading account to your bank without the need to be declared to HMRC. However, losses on spread bets cannot be offset against Capital Gains Tax. Can spread betting be taxed as Income Tax?

https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim22020

To be taxable, the spread betting wins must come not merely from an opportunity presented by a trade, they must arise from the carrying on of that trade. Whether or not a …

https://www.independentinvestor.com/spread-betting/how-spread-betting-is-taxed

Tax on Trading Activities

Tax on Spread Betting Activities

Questions & Answers

Conclusion

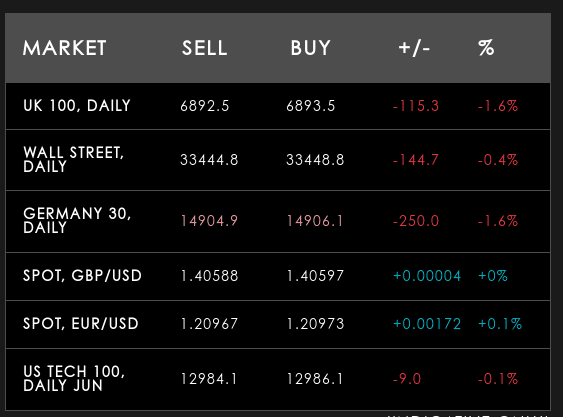

One of the key advantages of spread bettingis that it is taxed accordingly to considerably more favourable rules than other forms of trading. Essentially, spread betting is regarded by UK tax law as a gambling activity, and therefore the profits from spread betting are tax free – i.e., there is no capital gains tax to pay on the earnings generated. Because spre…

www.financial-spread-betting.com/Tax-free.html

Spread bets are exempt from the 0.5 per cent stamp duty applicable on UK share purchases which means that short to medium term holdings may work out cheaper than buying …

CFD Trading vs. Spread Betting – What Are the Differences?

Taxation of Day Traders [Forex, Crypto, Stocks - Can You avoid Tax?]

Why would anyone want to trade the forex markets?

https://www.onlinebetting.org.uk/betting-guides/gambling-and-betting-tax-in-the-uk.html

What Was The Old Gambling Tax Law?

What Is The Current Gambling Tax Law?

Gambling Tax FAQ's

History of Gambling and Betting Taxes

Prior to the 1960 Betting and Gaming Act it was illegal to place cash bets away from licenced race courses and tracks. The 1892 Gaming Act created the Totalisator board, commonly known as the Tote, set up to accept wagers at race courses and greyhound tracks from punters. It was however illegal to take bets off site unless these were made by pos…

https://www.reddit.com/r/Forex/comments/kidymt/is_spread_betting_in_uk_taxable_do_i...

Is Spread betting in UK taxable, do I need to submkt. Questions. Close. 2. Posted by 23 hours ago. Is Spread betting in UK taxable, do I need to submkt. Questions. Hi there, I …

Do not listen to anyone on here, do it all through an accountant and have them tell you what to do. The majority of … read more

Bit late to the party but im pretty sure spread-betting is not taxable since its seen as gambling by the taxman, in the UK … read more

https://www.taxationweb.co.uk/forum/do-profits-from-spread-betting-form-taxable-income...

11.04.2014 · I know there's no Capital Gains Tax or Stamp Duty on spread betting, and a lot of people are saying there's no income tax on SB - but I read the HMRC website (specifically BIM22015 & BIM22020) and I'm wary of the 'no income tax'/'living of Spread betting …

www.tradingspreadbetting.com/trade/trading-and-taxes

From BIM22020 “To be taxable, the spread betting wins must come not merely from an opportunity presented by a trade, they must arise from the carrying on of that trade. Whether or not a particular spread bet is taxable …

РекламаСтаньте специалистом по ставкам на спорт. Узнайте, что влияет на коэффициенты. · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

Accept additional cookies

Reject additional cookies

View cookies

beta This part of GOV.UK is being rebuilt – find out what beta means

From:

HM Revenue & Customs

Published

22 November 2013

Updated:

6 April 2021, see all updates

BIM22015 - Meaning of trade: exceptions and alternatives: betting and gambling - introduction

The basic position is that betting and gambling, as such, do not constitute trading. Rowlatt J said in Graham v Green [1925] 9TC309:

‘A bet is merely an irrational agreement that one person should pay another person on the happening of an event.’

This decision has stood the test of time. In an Australian case, Evans v FCT [1989] 20ATR922, 89ATC4540 Hill J said:

‘There has been no decision of a court in Australia nor, so far as I am aware, in the United Kingdom where it has been held that a mere punter was carrying on a business.’

However, an organised activity to make profits out of the gambling public will normally amount to trading.

Although over time new forms of games of chance have evolved, these principles remain the same. The taxpayer placing a spread bet is not normally carrying on a trade (see BIM22020 for exceptions). They are not taxable on the profits, nor do they receive relief for their losses. The bookmaker organising the spread bet is taxable on their profits.

The section on betting and gambling contains the following further guidance:

Is this page useful?

Yes this page is useful

No this page is not useful

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

Game Show Japanese Son Fucks Family Girls

Wrestling Women Bondage

Pawg Mini Porn

Spit Pets Porn

Child Purenudism Video Junior Miss Nudist Pageant

BIM22015 - Business Income Manual - HMRC internal ... - GOV.UK

Spread Betting Tax in the UK: The 2021 Guide - Shifting Shares

BIM22020 - Business Income Manual - HMRC internal ... - GOV.UK

How Spread Betting Is Taxed - Independent Investor

So is Spread Betting really tax-free?

Tax on Betting and Gambling in the UK – Do you pay tax on ...

Is Spread betting in UK taxable, do I need to submkt : Forex

Trading and Spread Betting Taxes | Trading Spread Betting

Spread Betting Taxable Uk