Spread Betting Tax Us

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Tax Us

Become a fan on Facebook

Follow us on Twitter

Copyright © 2010 - 2020. All Rights Reserved.

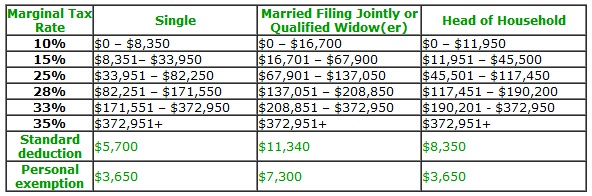

A: The simple answer is yes. Spread betters escape the 18 per cent capital gains tax that shareholders must pay on trading profits (capital gains amounts to the difference between what you pay for an investment and what you eventually sell it for). There is also no stamp duty and no commission on each trade apart from the spread. Not having to pay capital gains tax is a great advantage as it means that you can factor an additional 18% return on your trading profits since you will be saving monies that would have otherwise gone to the tax man. Moreover, with spread betting there is no income tax on dividends; which is levied at rates as high as 50% for high income earners.

However it is important to point out that spread betting may only be tax free if it is not your main source of income. For that reason it is probably not wise when opening a spread betting account to put your job description down as 'day trader' or 'trader' as it would then be rather difficult to claim at a later date that trading was not your main income if the Inland Revenue was to query where you made your money!!!

I actually spent ruddy ages trying to establish the position of spread betting with the revenue, and in the end it was pretty clear - perhaps this will ring true with those who have investigated this with the revenue themselves? If you have a 'subsistence income' (i.e. enough to live off) from an independent source that you pay tax on, then HMRC can't tax you on your spreadbetting activities. It's only if you have no other source of income and you use it for your primary income source that the tax advantages may disappear. Spoke to the revenue office in Nottingham with a technician there, who specialize in people who make a living from gambling, so I guess he knows his stuff. He deals with people playing the horses, dogs, poker, even casino games (!).

The bottom line is that if you are a tax payer who wins at spread betting (or any other forms of gambling for that matter!) you should not be liable for tax on winnings. If you do not have any other regular taxable income other than gambling you will probably be classified as a professional gambler (your trade) and may loose your BIM22017 exemption. In any case if you are employed and pay PAYE you cannot be classed as a professional gambler and so do not need to pay tax on gambling winnings even if they exceed your employed income. The reason HMRC are reluctant ot classify anyone as professional is that a professional gambler could then claim relief against losses from gambling and against the spreadbet companies proportion of their gambling tax.

The vast majority who spreadbet, I would opine, do not do it for a living, and therefore they are completely safe from taxation. Those who do it for a living have enough cash to hire clever accountants who sort it all out for them. Nothing to stop a millionaire trader having a self-employed 'subsistence income' from a bit of consultancy work that he pays tax on. The revenue can challenge it, but due to the nature of current legislation, they're unlikely to win. Thing I discovered after starting work in the Financial Services industry is that tax law is much more open to interpretation than I ever imagined beforehand!

That said, I have never heard of anyone being taxed on spread betting but then people probably don't advertise the fact.

A: Spreadbets are treated differently to contracts for difference. The providers that offer spread betting pay betting duty direct to the HM Revenue & Customs, so the bid-offer spreads tend to be slightly higher to cover the tax. From 6 October 2001 there has been a 3% general betting duty charge on the financial spreadbet company's net stake receipts (that is, the total of all bets received, less any winnings paid out). As such the taxman will treat any gains from spread betting activities as tax-free but this also means that losses cannot be claimed against other income.

Contracts for difference on the other hand have a lower spread and providers to not pay betting duty. But this also means that any realised profits are subject to CGT and therefore exempt from tax on about the first 9k. There is also a risk that if you are professional CFD traders the tax man might argue the point that profits are subject to income tax rather than CGT in this instance.

This is just a basic guidance, seek a specialised accounting firm for advice.

A: With the advent of the internet, many bookies set up offshore offices so that they did not have to pay UK taxes, and also the punter did not have to pay a 9% tax upfront on the bets they made, and the government was losing a lot of tax on the profits of the bookmakers. So in about 2001 - 2002 I believe, tax on winnings was abolished. By scrapping the tax on winnings many more people were encouraged to gamble, and the government was able to collect tax on profits made by the bookmakers, and as it is a fact that more people lose than win, whether that's on spreadbetting or any kind of gambling they collect more this way than taxing the punter, and as has been pointed out, most traders are part time, and the majority lose money, so this could be offset against tax on earnings.

For many reasons I believe the government will not remove the tax free status on spread betting (the most obvious being the immediate loss of the 3pc gaming duty on client losses). More clients lose than win in reality only a percentage make any significant gains (and there is still the CGT threshhold to get over as well) so the tax man would lose on 3pc of clients losses and only gain marginal monies from CGT on the winners. Not only this but the losers would be able to offset their losses again CGT liabilities elsewhere.

To conclude I believe and hope things carry on as they are, I hate giving money to the Chancellor.

A: Stamp duty is a tax applied to UK share purchases only (not sales). The current rate on UK equities is 0.5% of the amount paid to purchase the shares (excluding broker commissions..etc). The stamp duty rate in Ireland is 1%.

Spread bets are exempt from the 0.5 per cent stamp duty applicable on UK share purchases which means that short to medium term holdings may work out cheaper than buying the underlying shares. For instance IG Index charges LIBOR plus 2.5 per cent on long spread betting positions held overnight. Thus, assuming an overnight rate of 0.55 per cent the applicable charge would equate to 3.05 per cent per annum. In these circumstances it would take 60 calendar days for the accumulated financing charge to exceed the stamp duty saving.

Note: For trading of international shares the 0.5% stamp duty on share purchases doesn't apply, although markets like Hong Kong and Singapore have their own comparable taxes.

A: Capital Gains Tax does not apply in Ireland either so gains from spread betting in Eire are also tax-free. My understanding is that under current legislation places like Wales and Australia are also free of capital gains tax.

A: The reason is to raise money for the government and no you can't claim it back! The stamp duty is an additional tax as well as your expenditure (VAT) and various other things (Council Tax, Vehicle Excise Duty etc...). Likewise, Capital Gains Tax (CGT) is payable on disposal of an asset. Changes to the CGT regime in the 2010 emergency budget saw the capital gains tax rate increased when income and gains take you into the higher rate tax bracket, from 18% to 28% (remaining at 18% for any portion remaining in the basic rate band). The annual allowance of £10,100 (2010/11) still remains. If you don't want to pay Stamp Duty use CFDs or spread bets to buy shares or invest in the USA... Spread betting gains are also not subject to Capital Gains Tax.

Note that aside from Ireland and the UK, Switzerland and Greece also charge stamp on equity transactions.

A: My understanding:

You will need to report for investment income and capital gains tax purposes in the UK, assuming you are liable to these taxes (UK resident...etc), just as you would for UK stocks. Whether you need to report capital gains depends on the amount of the gain (i.e. over the annual allowance) OR the total sales proceeds in the tax year (over a set limit - regardless whether you made a gain or not).

You can claim a deduction against UK tax for US withholding tax and the commissions paid. I am not 100% sure but I believe you have to use the exchange rates prevalent on the transaction dates. You are theoretically liable for any currency gains.

The HRMC website has booklets covering most of this.

You will need to keep records to help complete your UK tax return. Unfortunately, the tax summary you get from the US broker will be of no use given they start and end their tax years differently to the UK. However, no issue as firms like E*Trade US have far better on-line systems than the UK ones I've seen. You will be asked to complete a W8 IRS form by your broker (not difficult) so they have evidence you are not a US resident.

Spread betting removes all this hassle (no reporting, currency moves, etc). However, it is not suited to allow investors.

A: It might be best if you consulted a specialised accounting firm on these matters...but from the bottom of my head (and I cannot guarantee that these statements are correct) -:

'But wondered would happen if I decide to do the spread betting full-time and quit my job?'

First, be warned that making a living from spread betting (like any gambling for that matter) is a high risk venture and you might want to consider having a back-up plan to fall back on. I would strongly urge anyone against using his life savings to spread bet with. In fact it might be wise to setup a betting bank for the spread betting to avoid mixing living costs and requirements from gambling results as no matter how successful you might turn out to be - it will still be a roller-coaster as far as profits and losses go.

Would I need to declare myself self-employed?

No, you wouldn't as personal gambling profits are outside the taxation system. However, having said this you might want to consider setting up in some sort of self-employed capacity to produce some stability in earnings in which case you would register.

Would I need to fill in a self-assessment form each year (even if it is free from any taxation)?

Hand it in to the job centre when you register as unemployed. Or a new employer if you went part-time. If you have no job and you aren't registered as self-employed then you would not be paying national insurance but you shouild still pay at least a little amount each financial year to mantain your full pension entitlement.

Also, if I choose to be self-employed (as well as doing spread betting) would I need to declare my winnings with HMRC i.e. would they have concerns with someone only declaring a small amount of (self-employed) income for taxation?

You might want to keep reasonable records of self-employed income and your spread betting activities (statements, bank transfers to and from your spread betting company...etc) so that should your luxury lifestyle exceed your self employed earnings you could show reasonable information on how it was achieved from outside the tax system.

A: I don't believe there should be any liability National Insurance. The starting point for the computation of the Class 4 NICs liabilityis the gain resulting from a trade which is chargeable to income tax under Chapter 2 of Part 2 of ITTOIA 2005. Gambling/spread betting does not fall under 'trading income' and there should be no National Insurance liability.

A: I am based in the UK and have asked the same question of my accountant. My current situation is such that I do some part-time work through my own consultancy ltd company (which pays income tax). Her answer was along the lines that as long as I was registered with the I.R. as self employed and did 'some' work each year then no tax is due on spread betting gains. I have trawled the governments website for info and test cases but they are very vague and couldn't give me a straight answer when I rang them myself.

So it appears that if your only source of income is from spread betting then it may be classified as normal income and therefore becomes taxable. The revenue already have a tax status for full timers referring them as 'professional gamblers'. The case was proven a long-time ago with someone who made his income off the horses. I've not heard of any spread-betters being taken up like this, but the principle is the same.

This means that spreadbetting is only tax free if it is not your main source of income; for example if you also have a day job. Thus to be on the safe side and avoid tax on spread betting you might want to get another side job , say 4-8 hours a week (preferably on weekends, when the market is closed - then you could always say that's your primary income.

However, I would say that if the revenue starts going after people who make money spread betting then it would get reported widely and the end result would be to kill the industry with new account opening plummeting and no taxes would be raised from it anymore. And Gordon knows he makes more money taxing the spread bet losses...

A: A tax charge is incurred only if a person is providing you with an advisory service - in your case I would understand that there is a verbal understanding between friends and an informal agreement that you will participate in any ensuing trading profits - as your friend would be placing the spread bets under his own representation and also on your own behalf any transfers to your bank account would be a receipt from spread betting and therefore would not be taxable.

A: Unfortunately the answer is likely to be 'No' - UK corporate entities that participate in derivative transactions like options/spread bets/CFDs/futures are subject to special tax laws.

Derivative rules stipulate that any spread betting profits made under the name of a company are taxed as income so corporation tax would then be payable. In these circumstances losses would also, however, be deductible against other income and could be carried forward against other income.

A: Clubs are certainly able to spread bet with out paying CGT. It is only businesses and professional traders that run into tax problems. Clubs are not classified as a business according to the Inland Revenue and FCA so are welcome to venture into the world of spread betting.

A: No, you don't pay tax on your winnings, so you can't claim tax on any losses...

A: No, spread bets are not a qualifying investment for a sipp, unlike CFDs, covered warrants/turbos which are eligible.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.

Trade spread bets with Pepperstone with very competitive spreads! Thousands of markets to trade including FX, indices, commodities, shares and cryptos! Trade using the MT4 or MT5 Platforms or make use of the new cTrader Trading Platform! Trading is Risky. 64-80% of retail CFD accounts lose money with this provider.

Spread betting tax avoidance strategies

So is Spread Betting really tax -free?

Advantages Of Spread Betting | Spread Betting Tax | CMC Markets

Spread Betting Tax Benefits - Intertrader

What is Spread Betting and How Does it Work? | IG UK

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Insights

Learn to trade

Learn spread betting

Advantages of spread betting

Join a trading community committed to your success

Speculate on falling markets. When you spread bet, you don't physically buy the instrument on which you are taking a position. You instead speculate on whether you expect prices to rise or fall. This means that if you think the price of a particular instrument is going to fall, you can go short (sell) the product and if you think prices are going to rise, you go long (buy).

No stamp duty. Unlike traditional share trading , you don't have to pay stamp duty when you spread bet because you are not buying the underlying product. Instead, you take a position based on whether you expect the price of that product to rise or fall.

Profits are tax free*. Spread betting profits are exempt from capital gains tax (CGT) in the UK. However, tax treatment depends on individual circumstances and tax laws are subject to change.

Trade using margin. Spread betting is traded on margin (or leverage). Margin trading allows you to do more with your capital – you can open more or bigger positions than you would be able to if you had to fund the full value of the position. For example, if the margin rate for a product is 5%, and you wanted to place a bet worth £200, you would only use £10 from your available account balance to open your position. Remember, however, that spread betting using margin can increase your losses as well as profits as they are relative to the full value of the position.

Risk management. We offer a number of risk management tools, including stop-loss orders . A stop-loss order may help you manage your exposure by setting a price level beyond which you are not prepared to risk any more of your capital on a position. When used effectively, a stop-loss order should automatically close your position if the price of the relevant instrument moves against you and reaches the price level where you wish to exit that position. It's important to remember that regular and trailing stop-losses may not protect you from market gapping or slippage. For 100% certainty that your stop-loss will be executed at the exact price you want, you can use guaranteed stop-loss orders, for a small premium charge. Other risk-management features include trailing stop-loss orders and take-profit market orders .

Access to thousands of global instruments. Spread betting can be a cost-efficient way to speculate on new markets. We offer prices on thousands of shares, plus currencies, indices, commodities and treasuries from across the globe. View our full range of spread betting markets .

Commission-free trading. Spread betting is exempt from many of the costs that you face when you trade shares with a stock broker. For example, there is no commission, stamp duty or capital gains tax to pay. As a company, we are remunerated through the spread we offer on each product. Learn more about spread betting spreads .

24-hour trading. You can spread bet on a huge number of forex pairs 24 hours a day, from Sunday evening through to Friday night. We also offer many indices, commodities and treasuries which are almost tradable around the clock, bar a short break. For example, the UK 100 is available to trade between 1am on Mondays and 9pm on Fridays, apart from two breaks between 9.15pm and 9.30pm, and 10pm to 11pm.

Trade anywhere. You can access our desktop application, online platform and mobile application to spread bet on the go. With cross-device functionality, you can open a trade on your desktop, and close the trade hours later on your mobile device. Our apps also feature fully interactive charts, with over 40 technical indicators. See all features of our mobile trading app .

Unique markets. We offer over 10,000 financial instruments that can be accessed with a spread betting account, includng forex, shares, ETFs, commodities, treasuries, cryptocurrencies and indices. We do also have some unique markets offerings such as crypto indices and commodity indices providing efficient and cost-effective exposure to several markets within an asset class.

Spread betting is a popular form of leveraged trading that allows traders to speculate on financial market movements. Like CFD trading, spread betting is an online form of trading and can be accessed via a trading platform. In this article, we will cover the advantages of spread betting, some of which are unique when placing spread bets.

Spread betting’s unique benefit is that it is exempt from both capital gains tax and stamp duty*. When compared to conventional share trading and CFD trading, spread betting is the only product to offer tax-free trading in the UK and Ireland.

However, tax is not the only advantage spread betting has to offer, so read on to find out more.

See our spread betting guides to discover more about what spread betting is and how it works.

What markets can I access with a spread betting account?

You can access thousands of markets with a spread betting account on our Next Generation platform. With us you can trade on forex, indices, cryptocurrencies, commodities, shares and treasuries. See our range of markets with competitive spread and margin rates, plus market opening hours.

Is spread betting taxable in the UK?

If you’re a resident in the UK or Ireland, profits from spread betting are free from capital gains tax (CGT). However, tax treatment depends on personal circumstances and tax laws, which are subject to change, so please check your eligibility. New to spread betting? Watch our intro video here.

How can I hedge with spread betting?

When you hold a short to mid-term investment, spread betting can be used as a tool to help offset any losses from poorly performing assets in your investment portfolio. Long-term investors tend to avoid hedging as part of their strategy, as long-term investors are less concerned by short-term fluctuations. To get started, try out a spread betting demo account to practise your hedging strategies.

To get started, open a demo account to access our trading platform. Once your account is open, and you have accessed the platform, you can choose to trade from thousands of instruments, ‘buy’ or ‘sell’ with order tickets, and implement risk-management conditions. For a more detailed analysis, see our guide on spread betting for beginners .

*Tax treatment depends on your individual circumstances. Tax law can change or may differ in a jurisdiction other than the UK.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 9,300+ instruments

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Mom Son Nuru Massage Porn

Jules Jordan Sex Video

Russian Double Penetration Chloe

Private Account Instagram

Public Porn Hd

/cdn.vox-cdn.com/uploads/chorus_image/image/64507213/1242337.0.jpg)