Spread Betting Tax Laws Uk

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

Spread betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading these products with this provider. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money.

This website uses cookies to optimize your experience. Find out how we use cookies and how to amend your cookie preferences in our cookie policy.

Address: London EC2V 5DE

Phone: +44 203 364 5189

Email: support@intertrader.com

Customer Care: Monday to Friday 24 hours a day

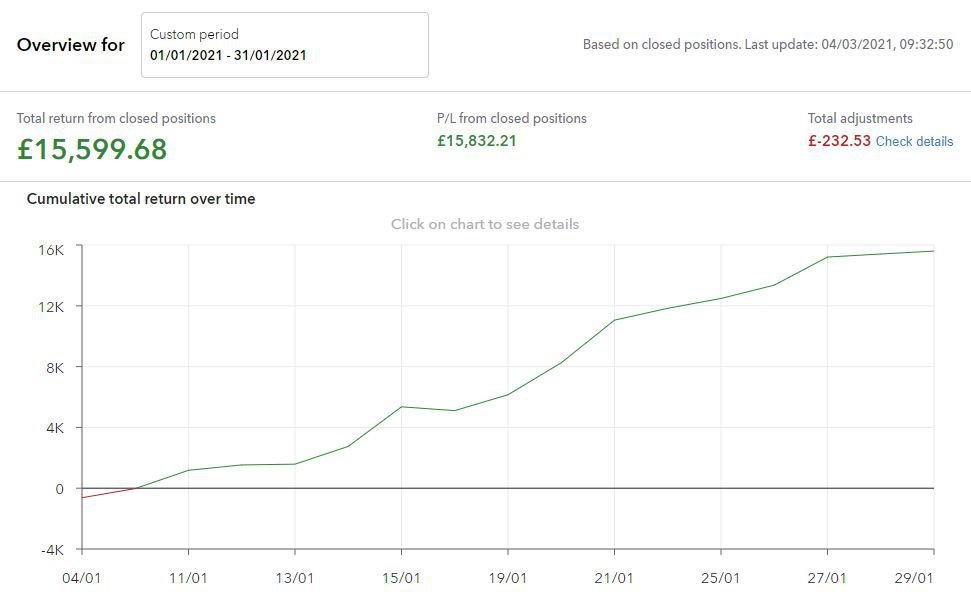

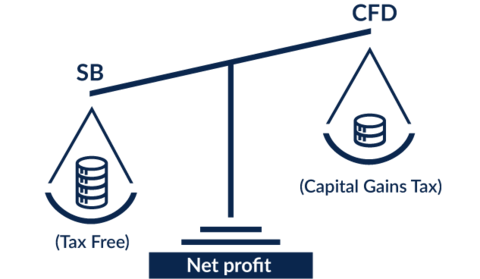

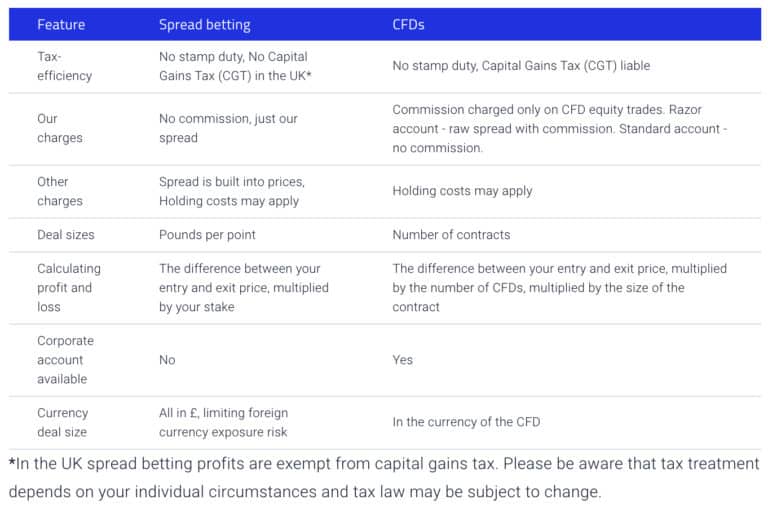

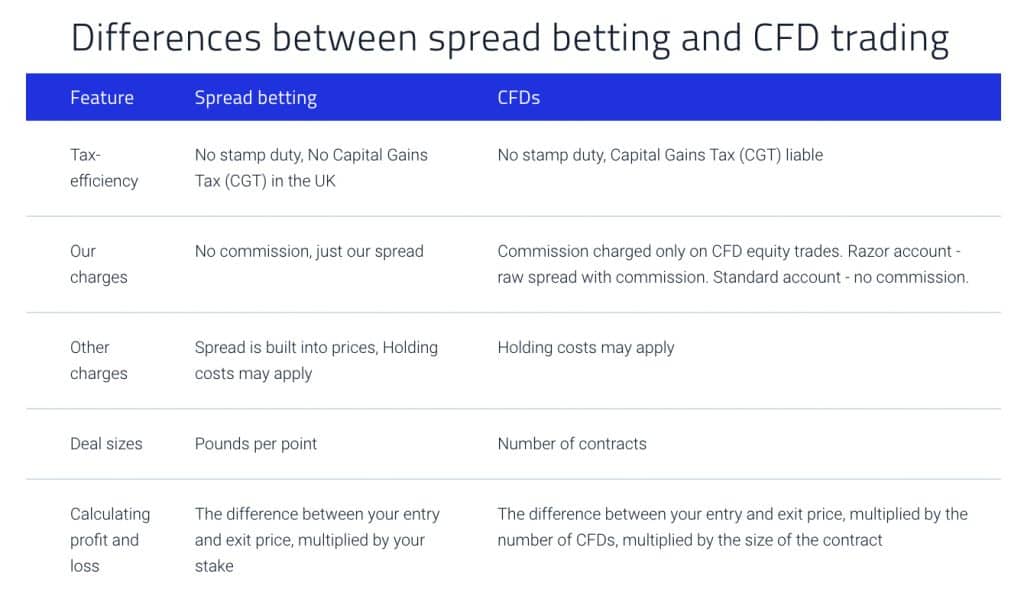

With spread betting you are not making a physical purchase or sale, so you do not incur some of the drawbacks of trading physical assets. Chief among these in the UK is the need to pay stamp duty or Capital Gains Tax on purchases and sales.

And because profits from betting are not taxed in the UK, any money you make from spread betting is yours to keep in full.

We must emphasise that spread betting is only tax-free under current UK tax law, which may change, and that ultimately your tax treatment will depend on your individual circumstances.

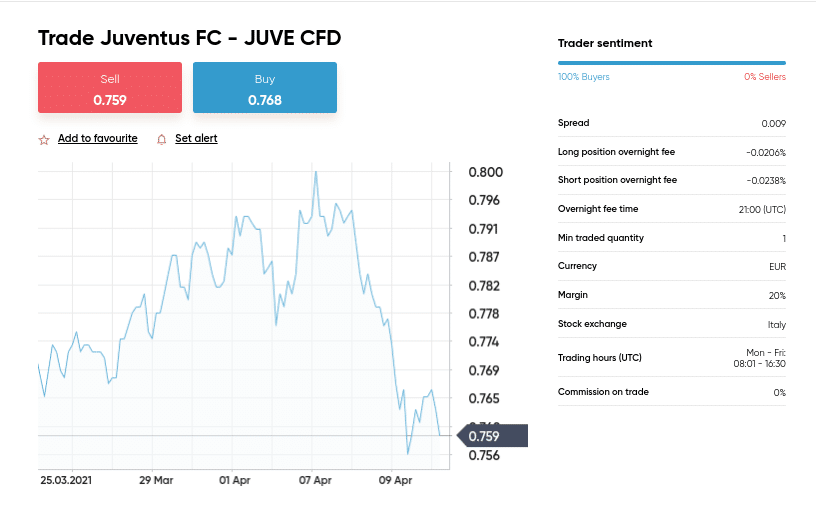

To see how tax-free trading works in detail let’s look at two different ways to gain the same exposure on Vodafone.

Say you buy 1000 Vodafone shares electronically at 225p per share. Not only will this cost you £2250 but you will also have to pay 0.5%, or £11.25, in stamp duty reserve tax. Say the price then rises to 250p per share and you decide to sell all your shares for a profit of £250. You will now be liable for UK Capital Gains Tax (if your total taxable gains for the year exceed your CGT allowance). CGT currently starts at 18% for basic rate UK taxpayers.

Now consider this transaction as a spread bet. For the equivalent exposure you would bet £10 per point on Vodafone at 225. Your initial outlay would be just your margin deposit which could be as low as £60, and you will have no stamp duty to pay. If you later close your position by selling at 250 you would make a clear profit of £250, with no CGT or other deductions.

Of course you might not make a profit, in which case there would be no deductions either way. And any losses from spread betting cannot be claimed as tax relief against other income. But remember that with a physical share trade you have to pay the stamp duty reserve tax at the outset whether your trade goes on to make a profit or not.

For further detail on the tax treatment of spread betting, and your own circumstances, you should always seek independent advice.

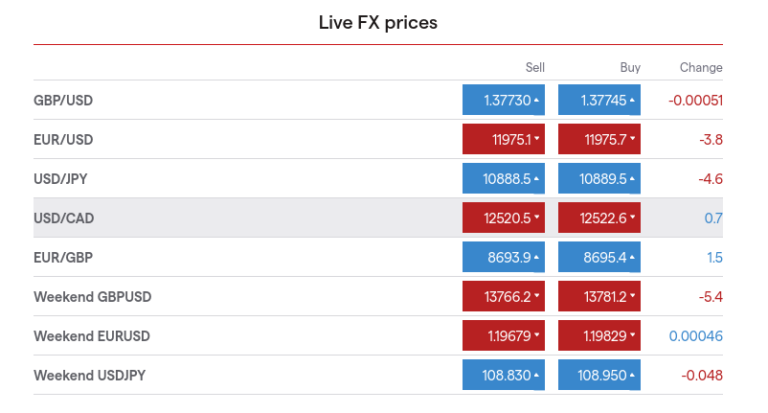

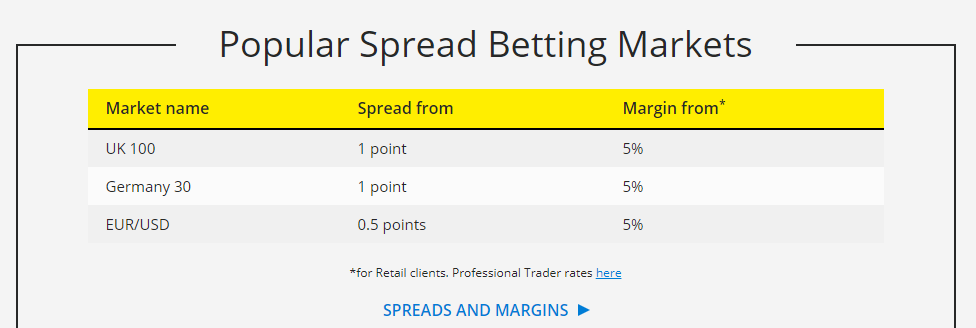

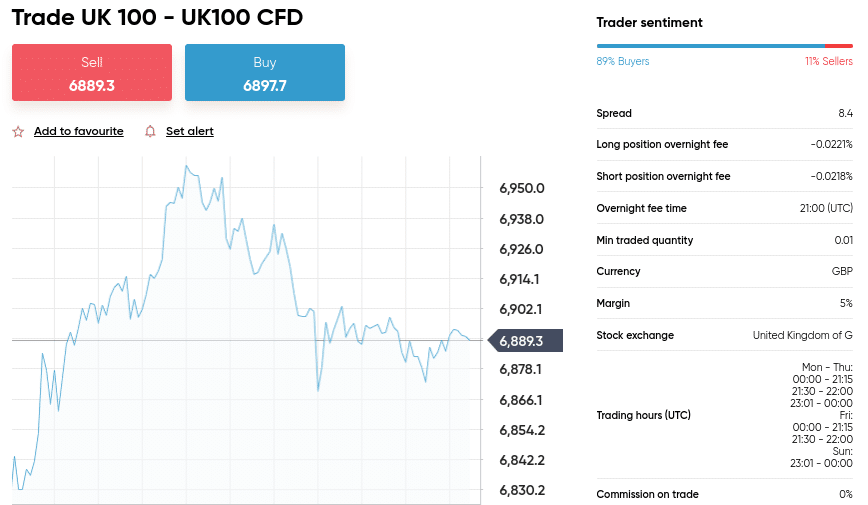

Intertrader does not charge any commission or brokerage fees when you open and close trades. We make our profit from the low spreads we apply. There are no fees for holding an account, so you can leave your account with a zero cash balance at no cost.

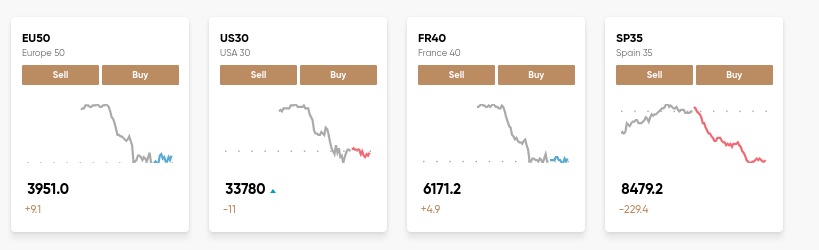

You can go long or short of any market, to profit from both rising and falling prices.

Trading on margin increases the leverage of your investment capital, as your initial outlay reflects only a proportion of your total exposure on a market. For example, if you buy 500 shares of HSBC at 500p, your total investment is £2500. The equivalent spread bet is to buy £5 per point at 500p. This gives you the same total exposure of £2500, but you only need 20% of this amount, or £500, in your Intertrader account to open the position. For professional clients the margin rate is even less, so you only need 5% of the total exposure, or £125, in your account.

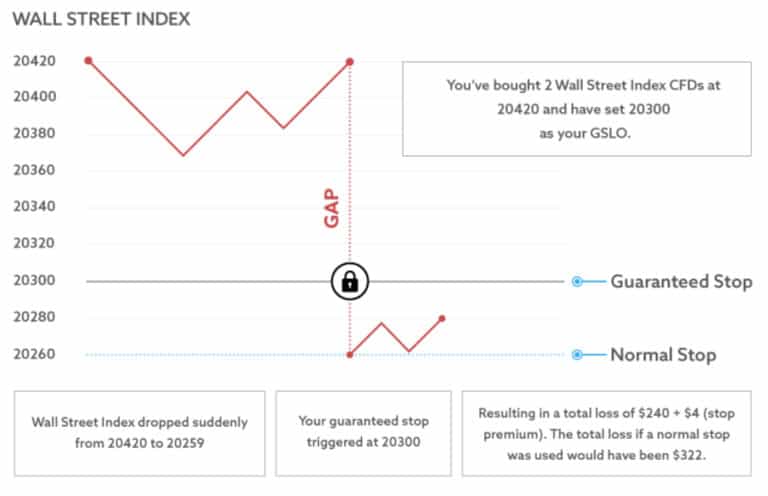

At Intertrader we want to make sure you only take on manageable risks. You can attach a stop-loss to any position, so your financial risk is significantly reduced, and move your stop level at any time either closer to your opening level or further away (subject to available funds on your account). Note that stop-losses are not guaranteed and may be subject to slippage and market gaps in volatile market conditions.

Comparison with traditional stockbroking

Cash outlay (5% margin – pro client)

In the above example, consider that, although your initial outlay is just £700 at our standard margin percentage (for pro clients), you could lose more than this amount due to sudden adverse market movements. In an extreme scenario you could still lose your full exposure of £14,000, for example if the public company goes bust and shares become worthless.

Before you apply for an account, please ensure that you familiarise yourself with the risks involved and that spread betting matches your investment objectives. You may wish to seek independent financial advice before applying for an account. If you are new to trading, we recommend that prior to applying for a live account you open an online Demo Account.

If you want to know more about the risks involved, please read our full Risk Warning.

It’s free to open an account, can take less than five minutes, and there’s no obligation to fund or trade

When you trade with Intertrader you are choosing a trusted provider with an exceptional track record

Address: City Tower, 40 Basinghall St,

London EC2V 5DE

Phone: +44 203 364 5189

Email: support@intertrader.com

Customer Care: Monday to Friday 24 hours a day

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please be aware that there is another website purporting to be Intertrader (a ‘clone firm’). This firm has no connection to Intertrader whatsoever. For more information please see the relevant notes from our regulators, the GFSC and the FCA.

Intertrader's website, services and products are intended for use by or distribution to persons in any country or jurisdiction where such use or distribution is permitted under applicable law or regulation.

Intertrader is a trading name of Intertrader Limited which is owned and controlled by Entain PLC. Intertrader Limited is authorized by the Gibraltar Financial Services Commission and subject to limited regulation by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. Registered address: Suite 6, Atlantic Suites, Europort Avenue, Gibraltar.

October 1, 2013 by Terry posted in • No Comments

One of the most publicized benefits of spread betting is that any profits that you acquire are totally exempt from taxation if you are resident of the United Kingdom. However, why is this and are there any other major implications that should be bought to your attention? Before proceeding further to investigate this subject in more depth, you need to consider the next very important statement:

“Tax laws can alter and can differ in other jurisdictions outside Great Britain. Consequently, you should always take legal and financial advice when evaluating your tax obligations”

Presently, profits produced from financial spread bets are exempt from UK tax. They do not attract either capital gain or income tax liabilities. The reasoning for these decisions are, in each case, totally legitimate and center about the basic issue concerning whether spread betting transactions are gambling bets. For instance, you will only be subjected to capital gain taxation if you sell an asset at a profit. Clearly, as spread bets do not involve the transfer of asset ownership then you should be exempt from this form of taxation.

Nevertheless, you can encounter problems if you create a profit stream from your trading activities which then becomes your principle source of income. Under such circumstances you will be utilizing your expertise and abilities to create a livable salary in a similar way to other consultants, such as doctors and lawyers. If you were fortunate enough to achieve such a desirable status that you will have PAYE obligations. If you are uncertain about your professional status then you should always consult with an appropriate expert about these matters.

What is the viewpoint of the UK government? There are some good reasons why the UK Inland Revenue is not desperately in a hurry to modify the current taxation status of spread betting. This is because not only will profits be subjected to taxation but losses could then be used to offset future taxation liabilities. Such a situation could cause serious problems for the UK authorities. As the majority of spread betters are gamblers and not professional traders, most of them lose consistently as opposed to capturing consistent streams of profits. As such, the Inland Revenue could lose more income than it would gain if it started to tax spreading betting seriously.

Do any other taxation implications exist that you need to consider if you are a UK citizen? Yes, there is. For instance, the downside to your spread betting profits being exempt from tax is that your losses cannot be used to offset your future taxation obligations. In contrast, you would be entitled to this important benefit if you were involved with other more traditional forms of speculation, such as trading the stock and currency markets directly.

The Implications of Tax-Free Spread Betting

As already stated, if you are an UK citizen then your profits will not be subjected to capital gain or income tax levies. In addition, your spread betting activities will not attract stamp duty. You will find that not being eligible to capital gains taxation is a big advantage as this status will prevent you from losing a significant portion of total earnings. There are also no income taxation liabilities pending which could strip as much as 50% of your total returns if you have a high income status.

However, you need to appreciate that your spread betting activities will only remain tax free as long as they does not become your primary source of income. Consequently, many taxation specialists advise that you should list yourself as a trader or day trader when you initially open an account with a spread betting broker. This is because if you do not undertake such a step then you could experience difficulties verifying that spread betting is not your key source of income if the UK Inland Revenue should query your status at a later date.

Essentially, if you earn enough to survive by using other legitimate sources of income then your spread betting income will not be subjected to taxation. You will only encounter problems if this is not the case and you are living totally from the earnings acquired from your spread betting pursuits. If you have any doubts whatsoever, then you are advised to consult with the UK Inland Revenue directly in order to resolve any uncertainties.

In a nutshell, if you are a successful spreading betting trader who earns a consistent stream of sizeable profits then you will be exempt from any form of taxation as long as this is not your primary source of income. In contrast, if you do not have another taxable occupation then the Inland Revenue will classify you as a professional gambler and you will lose your valuable tax exemption status.

So for the sake of total clarity, if you already pay Income Tax though some other form of employment then your spread betting activities will not be subjected to taxation even if the profits that you acquire exceed your income. This is because you will not be categorized as a professional gambler under such circumstances.

The primary reason why the Inland Revenue is so reluctant to classify you as a professional gambler is that you will then be entitled to use your trading losses and costs to offset your future taxation obligations. Currently, as the majority of UK spread betters are not full-time gamblers then they are not subjected to any form of taxation.

If you were so fortunate as to make a living from this form of speculation then you may be so wealthy that you could recruit the professional services of an accountant to address your taxation issues. In addition, you could also provide yourself with some form of protection by creating a self-employed subsistence income which could attract PAYE. However, if you do adopt such a ploy then you must appreciate that UK taxation laws are open to interpretation as well as being updated on a regular basis, especially to address any loopholes.

---------------------------------------------------------

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. This website is free for you to use but we may receive commission from the companies we feature on this site. Click here for more information.

@ 2015 Investoo.com, All rights reserved.

Videorama Erotic Clips

Eve Angel Tube

Mixed Girl Naked Booty

Jav Incest Hot

Lesbian Cunnilingus Compilation

Spread Betting Tax Benefits - Intertrader

Spread Betting and Tax in the UK - Investoo.com

How Spread Betting Is Taxed - Independent Investor

Tax on Betting and Gambling in the UK – Do you pay tax on ...

BIM22015 - Business Income Manual - HMRC internal ... - GOV.UK

UK Tax on Forex, CFD Trading & Spread Betting

So is Spread Betting really tax-free?

Trading and Spread Betting Taxes | Trading Spread Betting

Spread Betting Tax Laws Uk