Spread Betting Stocks Shares

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

WHAT COMPANIES’ SHARES CAN I INVEST IN?

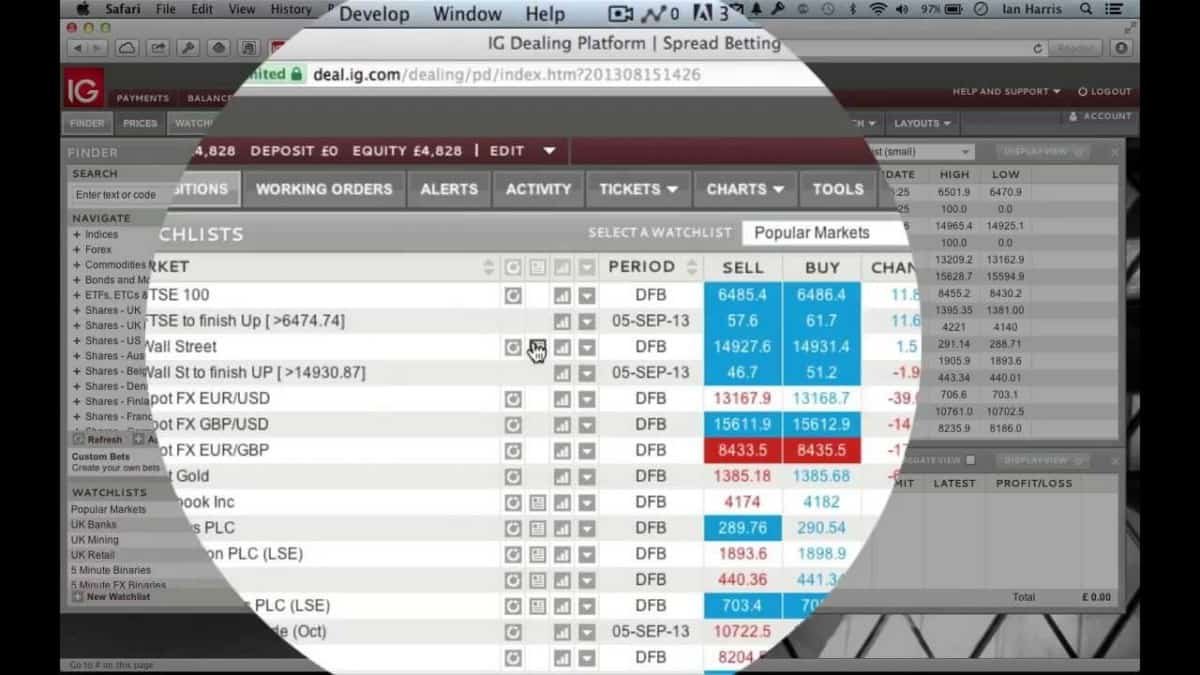

Most companies offer bets on thousands of different companies. They can vary from one spread betting firm to another, but usually include almost all of the shares from the main stock indices around the world.

The FTSE 100 is made up of the 100 biggest companies on the London Stock Exchange by market capitalisation. These companies usually have strong balance sheets and some many are household names, which are easy to keep track of. They are less likely to swing violently one way or another in The FTSE 250 Index is the 250 next biggest companies, and usually got a higher growth potential, and appeal to more informed investors. AIM shares is a market allowing smaller companies to raise money, and can be volatile and open to lots of speculation, with a wider spread.

The Dow Jones Industrial Average, the S&P 500 and NASDAQ are the biggest indices on Wall Street and contain the shares of some of the biggest companies in the world, mostly American ones.

Stocks and equities from the major European exchanges like German DAX30 and French CAC40. These include major companies like BMW, and are the biggest firms by market cap.

WHY SHOULD I SPREAD BET INSTEAD OF JUST BUYING THE SHARES?

TYPES OF BETS – DAILY BETS VS FUTURE BETS

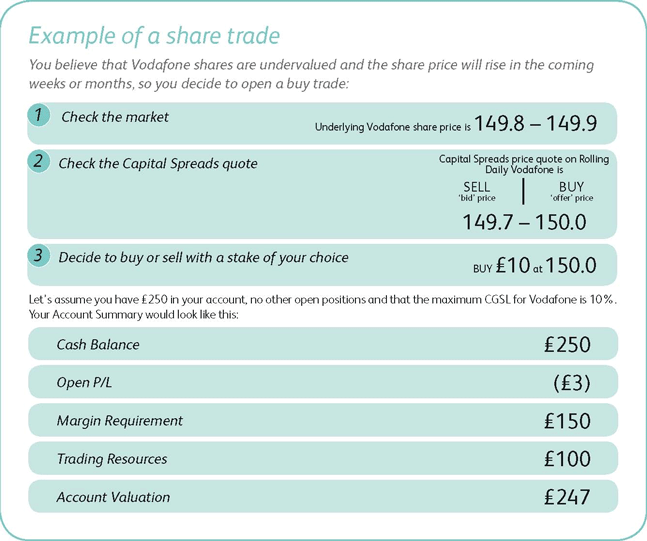

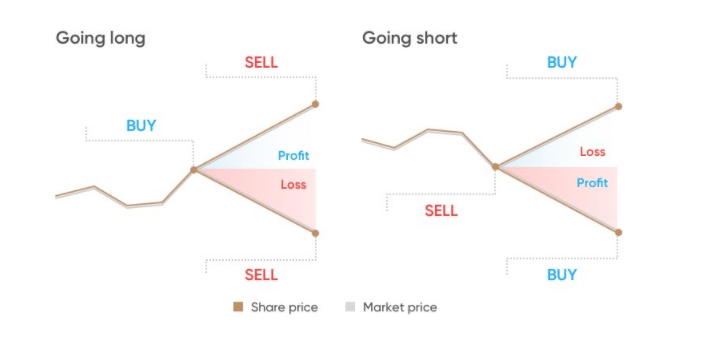

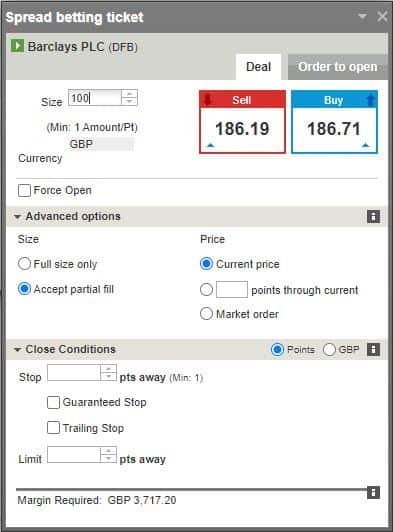

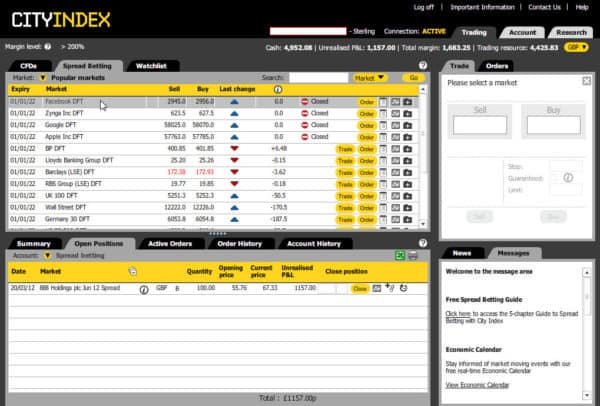

Daily Bets are a cheaper way to invest for a short term trader than buying and selling shares through a broker. These bets are closed on the same day they are opened on the closing bid/offer price of the share. Many traders choose to roll-over these daily bets to the next day. This usually incurs an overnight financing cost. These rollover costs can add up if you keep a Rolling Daily Bet open over an extended period – in that case it may be a better idea to get a futures bet. Share Futures allow you bet on the rise or fall in share price over periods of up to nine months. They are offered on a quarterly basis – March/June/September/December. So if it’s May – the futures would be offered on the price in June, September and December. The spreads on futures shares are wider, because they take into account the costs. But you don’t have to wait until the end of the contract to close the bet – you can close a futures spread bet at any time when you are satisfied with the profit or loss it is currently making.

TIPS FOR SPREAD BETTING ON INDIVIDUAL SHARES

The spread on a share will always be wider than the buy and sell spread on actual share in the underlying market. It’s not a good idea to spread bet on a share for an extended period because the costs of financing a rolling bet can add up. But spread betting on shares is a good way of speculating over the short to medium term. Always use stop-loss orders to mitigate against share price moves against you.

RESOURCES TO KEEP INFORMED ABOUT INDIVIDUAL SHARES

© 2015 SpreadBetting.com. All rights reserved.

Trade spread bets with TradeNation with very competitive spreads!

Thousands of markets to trade including FX, indices, commodities, shares and cryptos!

Trade using the MT4 Platform or

make use of the new CoreTrader 2 Web Trading Platform!

Trading is Risky. 64-80% of retail CFD accounts lose money with this provider.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.

Big Booty Beautiful Girl

Xvideos Com Mature Boy

Femdom Whipping Mature

Watch Porn Video Xxx

Free Film Wife Jav

Spread Betting Stock Shares | Spread Betting

Spread Betting on Stocks

Trading USA Stocks and Shares with Spread Betting

Spread Betting Shares | Major Spread Betting Markets ...

Spread Betting vs Share Dealing - The 6 Pros & 6 Cons (2021)

Basics of Stocks and Shares | SpreadBettingPortal.com

Spread Betting 2021 | Tutorial and Best Spread Betting ...

Spread Betting Stocks Shares