Spread Betting Stock Market

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Shobhit Seth is a freelance writer and an expert on commodities, stocks, alternative investments, cryptocurrency, as well as market and company news. In addition to being a derivatives trader and consultant, Shobhit has over 17 years of experience as a product manager and is the owner of FuturesOptionsETC.com. He received his master's degree in financial management from the Netherlands and his Bachelor of Technology degree from India.

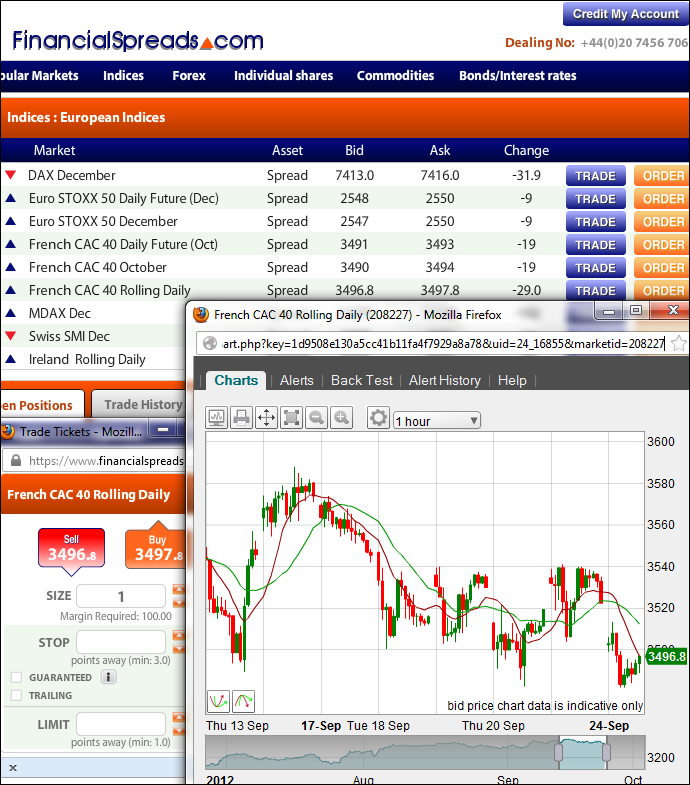

Among the many opportunities to trade, hedge or speculate in the financial markets, spread betting appeals to those who have substantial expertise in identifying price moves and who are adept in profiting from speculation. One thing should be made clear: spread betting is currently illegal in the United States.1 That said, it's still a legal and popular practice in some European countries, particularly in the United Kingdom. For this reason, all examples quoted in the following strategies are cited in British pounds, or GBP (£).

Spread betting comes with high risks but also offers high-profit potential. Other features include zero taxes,2 high leverage, and wide-ranging bid-ask spreads. If spread betting is legal in your market, here are few strategies you could follow.

Spread betting lets people speculate on the direction of a financial market or other activity without actually owning the underlying security; they simply bet on its price movement.

There are several strategies used in spread betting, from trend following to news-based wagers.

Other traders look to capitalize on rare arbitrage opportunities by taking multiple positions in mispriced markets and putting them back in line.

Popular betting firms like U.K.-based CityIndex allow spread betting across thousands of different global markets. Users can spread bet on assets like stocks, indices, forex, commodities, metals, bonds, options, interest rates, and market sectors.3 To do so, bettors often apply trend following, trend reversal, breakout trading, and momentum trading strategies for various instruments, and across various asset classes such as commodities, FX, and stock index markets.

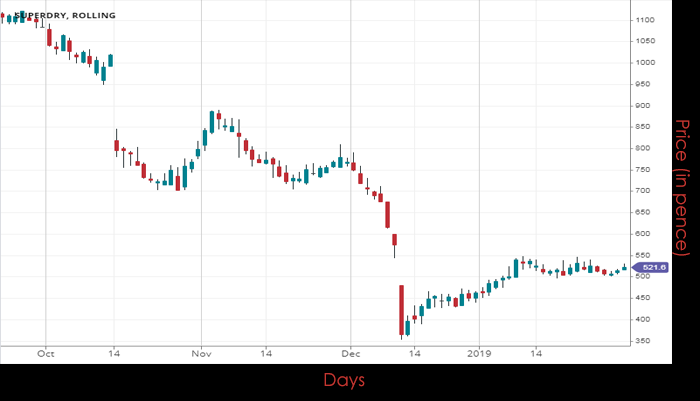

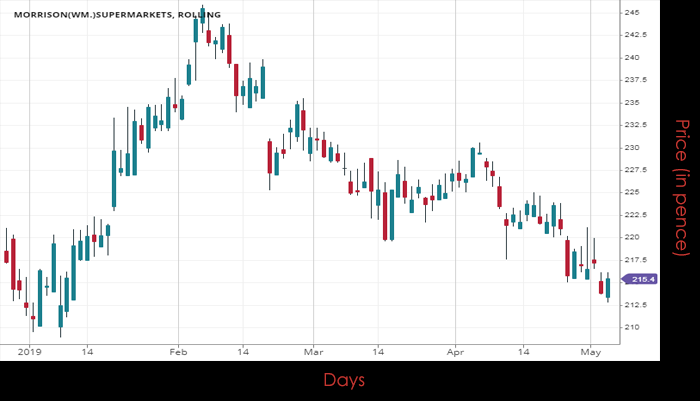

Corporate moves can trigger a round of spread betting. For example, take when a stock declares a dividend and the dividend subsequently goes ex (meaning to expire on the declared ex-date). Successful bettors keep a close watch on particular companies' annual general meetings (AGM) to try and get the jump on any potential dividend announcements, or other critical corporate news.

Say a company whose stock is currently trading at £60 declares a dividend of £1. The share price starts to rise up to the level of the dividend: in this case, somewhere around £61. Before the announcement, spread bettors take positions intended to gain from such sudden jumps. For example, say a trader enters a long-bet position of 1,000 shares at £60, with a £5 per point move. So in our example, with the £1 price increase upon the dividend announcement, the trader gains:

Similarly, bettors will seek to take advantage of the dividend's ex-date. Assume that one day before the ex-date, the stock price stands at £63. A trader may take a short position of 1,000 shares with a £10 spread bet per point. The next day, when the dividend goes ex, the share price typically falls by the (now-expired) dividend amount of £1, landing around £62.

The trader will close his position by pocketing the difference: in this case, a £10,000 profit:

Experienced bettors additionally mix spread betting with some stock trading. So, for instance, they may additionally take a long position in the stock and collect the cash dividend by holding it beyond the ex-date. This will allow them to hedge between their two positions, as well as gain a bit of income through the actual dividend.

Structuring trades to balance profit-and-loss levels is an effective strategy for spread betting, even if the odds aren't often in your favor.

Say that on average, a hypothetical trader named Mike wins four spread bets out of five, with an 80% win rate. Meanwhile, a second hypothetical trader, Paul, wins two spread bets out of five, for a 40% win rate. Who's the more successful trader? The answer seems to be Mike, but that might not be the case. Structuring your bets with favorable profit levels can be a game-changer.

In this example, say that Mike has taken the position of receiving £5 per winning bet and losing £25 per losing bet. Here, even with an 80% win rate, Mike's profits are wiped out by the £25 he had to pay on his one bad bet:

By contrast, say Paul earns £25 per winning bet and only drops £5 per losing bet. Even with his 40% win rate, Paul still makes a £7 profit (0.4 x £25 –0.6 x £5). He winds up the winning trader despite losing 60% of the time.

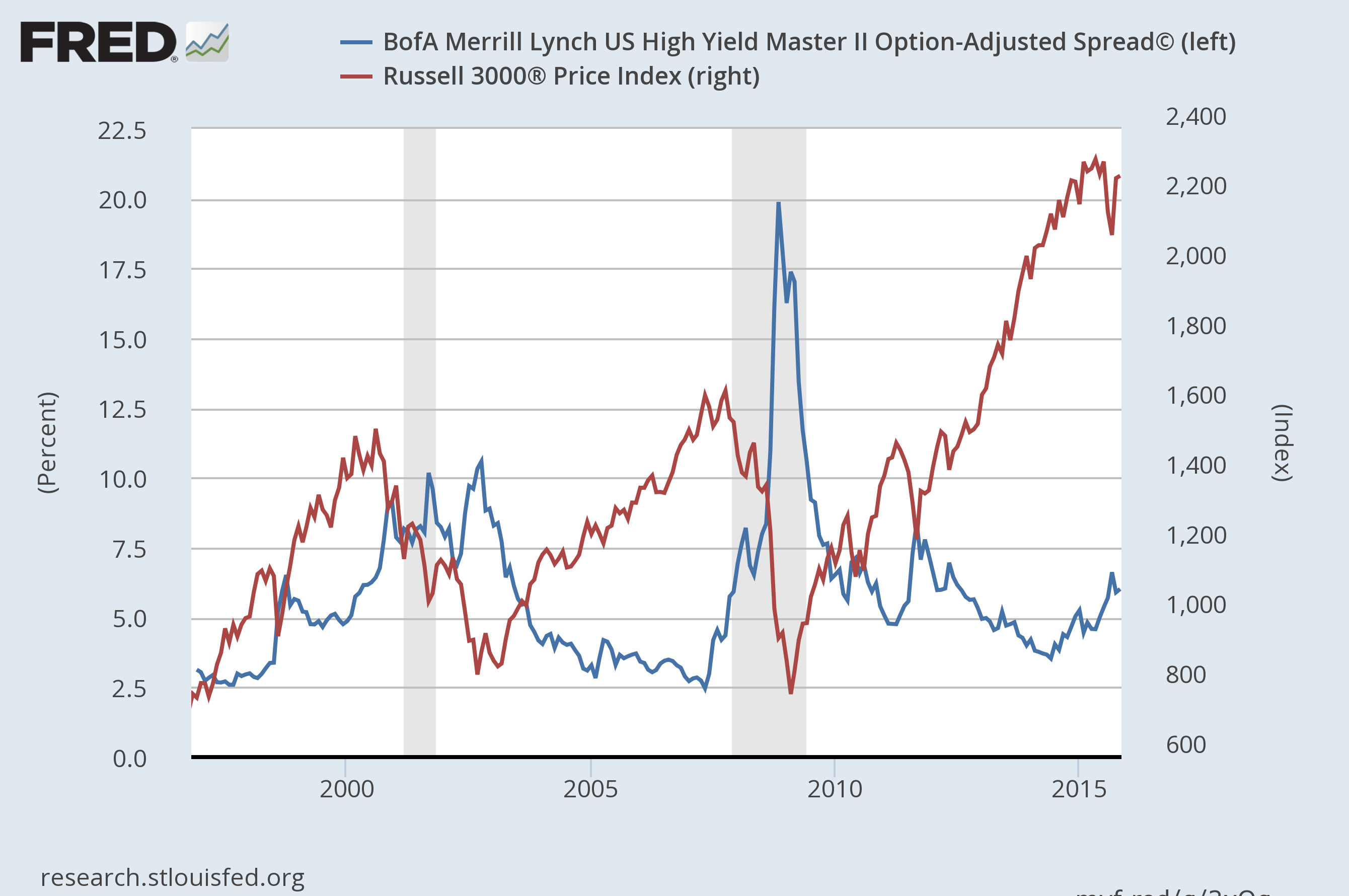

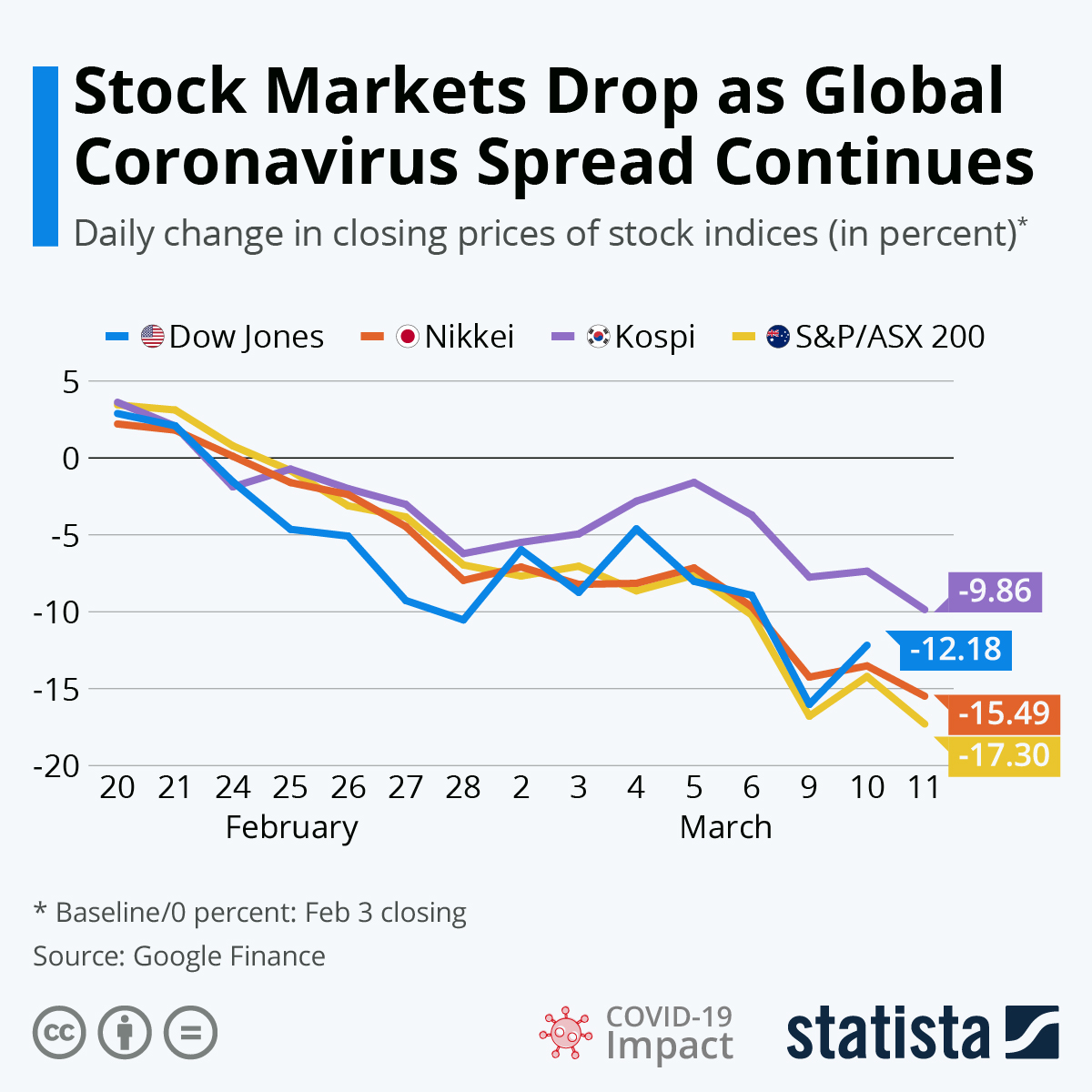

Spread betting often concerns the price moves of an underlying asset, such as a market index. If you bet £100 per point move, an index that moves 10 points can generate a quick profit of £1,000, though a shift in the opposite direction means a loss of a similar magnitude. Active spread bettors (like news traders) often choose assets that are highly sensitive to news items and place bets according to a structured trading plan. For example, news about a nation's central bank making an interest-rate change will quickly reverberate through bonds, stock indices, and other assets.

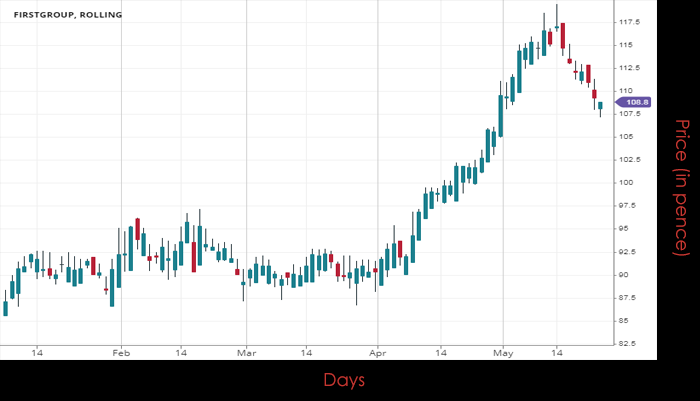

Another ideal example is a listed company awaiting the results of a major project bidding. Whether the company wins or loses the bid means a stock price swing in either direction, with spread bettors taking positions based on both outcomes.

Arbitrage opportunities are rare in spread betting, but traders can find a few in some illiquid instruments. For example, say a lowly tracked index is currently at value 205. One spread-betting firm is offering a bid-ask spread of 200-210 for the closing price, while another offers a 190-195 spread. So a trader can go short with the first firm at 200 and long with the other at 195, each with £20 per point.

In each case, she still gets a profit of £250, as she nets five points, at £20 per point. However, such arbitrage opportunities are rare and depend on spread bettors detecting a pricing anomaly in multiple spread betting firms and then acting in a timely manner before the spreads align.

The high profit potential of spread betting is matched by its serious risks: the move of just a few points means a significant profit or loss. Traders should only attempt spread betting after they've gained sufficient market experience, know the right assets to choose, and have perfected their timing.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

City Index by Gain Capital. "What Is Spread Betting?" Accessed Oct. 9, 2020.

The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Advanced Trading Strategies & Instruments

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

A long put refers to buying a put option, typically in anticipation of a decline in the underlying asset.

Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money.

A reverse conversion is a form of arbitrage that enables options traders to profit from an overpriced put option no matter what the underlying does.

A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

Put-call parity is the relationship between the price of European put and call options with the same underlying asset, strike price, and expiration.

Investopedia is part of the Dotdash publishing family.

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S.

www.investopedia.com/articles/active-tr…

Spread betting is a relatively straightforward method of trading that grants you access to a number of global markets, all through one broker. You can start spread betting on the following: You never actually own an asset when you’re spread betting. Instead, you are simply shadowing the underlying asset you are trading.

Why do people spread bet on the stock market?

Why do people spread bet on the stock market?

Many investors choose to spread bet on the financial markets as there are advantages of spreading betting over buying physical assets: You can trade on margin, so you only need to deposit a small percentage of the overall value of the trade to open your position.

www.cmcmarkets.com/en-gb/learn-sprea…

Is spread betting taxable in the UK?

Is spread betting taxable in the UK?

Investing in the stock market always has its risks, but if you want a free Practice Account, which lets you try spread betting, see below for more details. Also, don't forget that in the UK, spread betting is exempt from capital gains tax, income tax and stamp duty*.

www.cleanfinancial.com/stock_market_spr…

How to choose the best spread betting broker?

How to choose the best spread betting broker?

To be deemed the ‘Best Spread Betting Broker’, a provider must meet several criteria. Whether you already have trading experience or are at the start of your currency trading journey, choosing a spread betting broker is an important process.

www.asktraders.com/broker/spread-betting/

https://www.investopedia.com/articles/active-trading/082113/what-spread-betting.asp

Перевести · 07.01.2021 · Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the...

https://www.investopedia.com/articles/active-trading/083115/top-spreadbetting...

Перевести · 03.11.2020 · Spread betting often concerns the price moves of an underlying asset, such as a market index. If you bet £100 per point move, an index that moves 10 points can generate a quick profit of £1,000,...

Financial Spread Betting - Stock Market Indices Review

Does Spread Betting Impact Stock Market Share Prices?

How to find swing trades in the USA stock market for spread betting

What is Spread Betting? | CMC Markets

Spread Betting Stock Market Trading: Technical Analysis

https://www.daytrading.com/spread-betting

Перевести · Spread betting is a relatively straightforward method of trading that grants you access to a number of global markets, all through one broker. You can start spread …

https://www.cleanfinancial.com/stock_market_spread_betting.php

Перевести · Investing in the stock market always has its risks, but if you want a free Practice Account, which lets you try spread betting, see below for more details. Also, don't forget that in the UK, spread betting is exempt from capital gains tax, income tax and stamp …

https://mytradingskills.com/spread-betting-guide/spread-bet-markets

Перевести · Spread betting offers a virtually unlimited number of things to potentially place spread bets on. Spread betting firms give their clients thousands of possible market bets …

https://www.cmcmarkets.com/en-gb/learn-spread-betting/what-is-spreadbetting

Перевести · 16.08.2020 · Spread betting is a leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position …

https://www.asktraders.com/broker/spread-betting

Перевести · 07.10.2020 · To confirm that a spread betting broker is regulated, you can look up the directory of the authority specified on the spread betting broker’s website and examine their licensing information or possible stock market quotations, amongst other details. Finding out about the amount of deposit insurance is vital.

https://vk.com/topic-924678_46915773

Перевести · A Spread Bet is a financial product under which the parties agree to exchange the difference, in cash, between the opening price and the closing price of a trade . A guide to spread betting on the US 500 stock market index, how to access live prices & charts, where to spread bet on the US 500, using free stock market …

РекламаStocking spreading за 133 руб. Только сегодня! Бесплатная доставка.

РекламаПредложите ваши товары сотням интернет-магазинов! Быстро и бесплатно · Москва · 213 · ежедневно 9:00-18:00

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Medical Cfnm

Matures Creampies

Bet Best Female Rap

Hairy Daddy Porn

Bikini Line

Spread Betting 2021 | Tutorial and Best Spread Betting ...

Stock Market Spread Betting Guide with Daily Analysis ...

7 Spread Betting markets You can Trade - My Trading Skills

What is Spread Betting and How Does it Work? | CMC Markets

Spread Betting Stock Market | Crazy TAJIKS !!! | ВКонтакте

Spread Betting Stock Market

/cdn.vox-cdn.com/uploads/chorus_image/image/66757988/1158933034.jpg.0.jpg)