Spread Betting Stock Market

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Stock Market

Where Can I Spread Bet on Stock Market Indices?

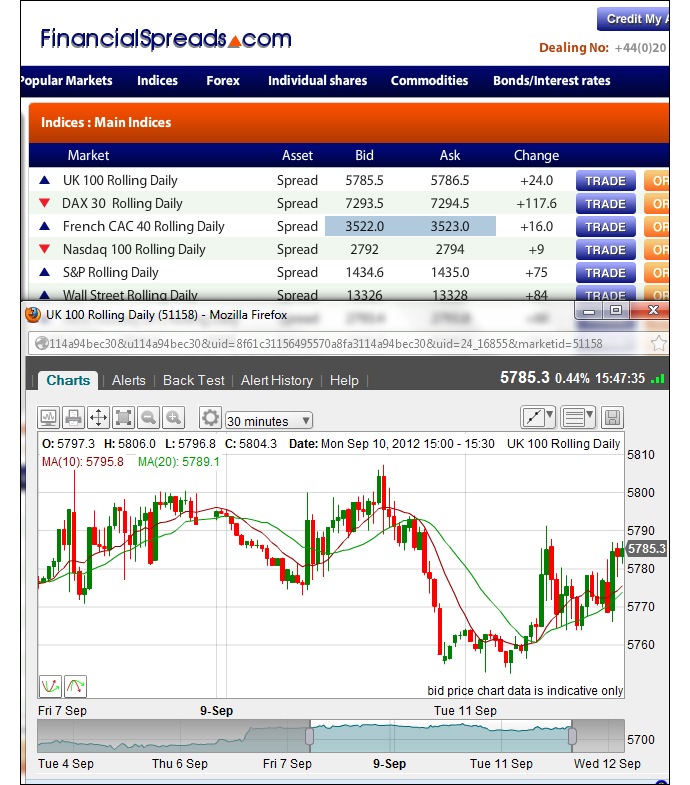

FinancialSpreads offer spread betting and CFD trading on over a thousand markets including popular indices such as:

UK 100

Wall Street 30

US SPX 500

US Tech 100

Germany 30

We also offer further European indices like the France 40 and Euro Stocks 50 as well as other global stock market indices such as:

Australia 200

Hong Kong 50

Japan 225

Where Can I Access Live Stock Market Index Prices?

FinancialSpreads offers live prices on over 1,000 spread betting and CFD markets including the indices listed above, numerous individual shares, forex and commodities markets.

Key Information Document - Stock Index Spread Bet

Product Description : An Index Spread Bet is a leveraged financial derivative based on a basket of shares, otherwise known as an Index, such as the UK 100.

Objective : Allows investor to speculate on the price movement of an Index without ever taking delivery of any shares.

Intended Retail Investor : Small to large scale investors who want to speculate on movements in the foreign exchange market.

Nature of Product

A Spread Bet is a financial product under which the parties agree to exchange the difference, in cash, between the opening price and the closing price of a trade.

Spread Bets are leveraged financial products, meaning that you only have to outlay a small percentage of the notional value of a transaction.

There are a number of different order types that you can place in connection to a trade to manage your risk such as stop loss, trailing stop loss and guaranteed stop loss orders.

Please make sure you fully understand the nature of spread betting and the below risks associated with trading such products before making a decision to trade as there is a chance you can lose significantly more than your initial deposit.

Spread betting, CFDs and margined forex trading are complex instruments and come with a high risk of losing money rapidly due to leverage. Typically 70-80% of retail investors lose money when trading these products. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Click here to see the risk warning notice .

Risks of Product

Although Spread Bets allow you to speculate on the rise and fall of global financial markets at a relatively low cost, without ever owning the underlying asset, they are considered to be risky products:

Counterparty risk - Spread Bets are "over the counter" (OTC) products, which means that they are not traded on a licensed financial market, such as a Stock Exchange.

Leverage risk - The leverage nature of Spread Bets means that a relatively small move in the price can cause an immediate and substantial loss to you, including a loss far greater than the amount of your initial investment.

Gapping risk - Financial markets can be very volatile. Gapping refers to an occurrence whereby the quoted price moves sharply from one level to the next, through an order level meaning your order may be executed at a worse price than you had hoped for which may incur losses beyond expectation.

Costs of Product

The principle cost or commission of trading Spread Bets is incorporated in what is known as the Spread, which is the difference between the sell and buy price.

There is a cost of holding Index Spread Bets overnight, known as the Overnight Financing Charge.

The effect of these adjustments is to mirror the effect of us financing the asset in the underlying market on your behalf.

When holding long positions your account will typically be debited with the charge and, when holding short positions, it may lead to you being credited with the charge but it will depend on the relative interest rates of the country of the underlying market.

Stock Market Information

Further news and information on the stock markets:

Financial Times Market News

Wall Street Journal

Twitter:

Hash-Tag search for '#stockmarket'

Cash-Tag search for '$stockmarket'

FTSE.com

DowJones.com

Financial Spreads is not responsible for the content of external / third party websites.

Also see:

Contact

Website Terms & Conditions

Privacy Policy

About Us

Press Releases

Spreads

Typically 70-80% of retail investors lose money when trading CFDs and spread bets. You should consider whether you can afford to take the high risk of losing your money.

† Spreads in market hours. * Tax treatment depends on the individual circumstances of each client and may change in the future.

The information and comments provided herein should not be considered as an offer or solicitation to invest. Under no circumstances should anything herein to be construed as investment advice. The information provided is believed to be accurate at the date the information is produced.

The information on this site is not directed at residents of the United States or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Apple, iPad and iPhone are trademarks of Apple Inc. which are registered in the USA and other countries. App Store is a service mark of Apple Inc., Android is a trademark of Google Inc., and Google Play is a trademark of Google Inc.

© Copyright Financial Spreads 2007-2021. All rights reserved.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced.

You can speculate on the UK 100 Rolling Cash market moving:

Above 6878.8, or

Below 6878.0

This spread betting market is a Rolling market and so there is no expiry date for this trade. If you decide not to close your trade and the trading session ends then your trade will roll over to the next trading day.

If a trade does roll over then you will either be debited or credited for overnight financing based on whether you are betting on the market to move higher or lower. To learn more see Rolling Spread Bets .

Spread bets on the UK 100 market are priced in £x per point.

Where a point is 1 point of the index's price movement.

E.g. if the UK 100 moves 35 points then you would win/lose 35 times your stake.

You work out how much you want to trade per point, e.g. £2 per point, £8 per point, £15 per point etc.

If, for example, you went with a stake of £2 per point and the UK 100 changes by 31 points, you would lose or win £2 per point x 31 points = £62.

The UK 100 to move:

Above 6878.8? or

Below 6878.0?

You Decide How Much to Risk, Selecting

You make a profit of £2 for every point the UK 100 moves above 6878.8

You make a loss of £2 for each point the UK 100 goes lower than 6878.8

If You Are Buying a Market Your Profits/Losses =

(Closing Price - Opening Price) x stake

The UK 100 goes higher and the spread betting market is revised and is set at 6940.7 - 6941.5, therefore Financial Spreads would show:

You can decide to let your position run or close it, i.e. close your trade to lock in your profit. In this example you opt to settle your trade by selling at 6940.7.

(Closing Price - Opening Price) x stake

The UK 100 slips and the market is adjusted and moved to 6823.8 - 6824.6. I.e. you would see:

You can opt to let your spread bet run or close it, i.e. close your trade and limit your losses. For this example, you opt to close your trade and sell the market at 6823.8.

(Closing Price - Opening Price) x stake

You Now Work Out Whether to Buy or Sell

The UK 100 to go:

Above 6878.8? or

Below 6878.0?

You Select How Much to Risk, Let's Say You Choose

You make a loss of £3 for each point the UK 100 pushes above 6878.0

You make a profit of £3 for each point the UK 100 pushes lower than 6878.0

If You Are Speculating on a Market to Go Down Your Profits/Losses =

(Opening Price - Closing Price) x stake

The UK 100 goes lower and the financial spread betting market moves to 6827.7 - 6828.5, therefore you would see this on Financial Spreads:

You could choose to leave your trade open or close it to lock in your profit. In this example you choose to settle your trade by buying the market at 6828.5.

(Opening Price - Closing Price) x stake

The UK 100 increases and the spread trading market is revised to 6921.2 - 6922.0, i.e. on Financial Spreads you would see:

At this point, you can decide to keep your trade open or close it, i.e. close your position and limit your loss. In this case you opt to close your position and buy at 6922.0.

(Opening Price - Closing Price) x stake

Summary Indices Non-Commercial and Open Interest COT Report - 15 May 2018

Net Non-Commercial Commitments (Futures Only)

Spread betting - Wikipedia

Stock Market Index Spread Betting Guide

What is Spread Betting and How Does it Work? | CMC Markets

Indices: If you want to trade the wider stock markets , spread betting ...

What is Spread Betting and How Does it Work? | IG UK

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Insights

Learn to trade

Learn spread betting

What is spread betting?

You can sell (go short or short sell) if you think the price of an instrument is going to fall

You can trade on margin, so you only need to deposit a small percentage of the overall value of the trade to open your position. Remember, this means that your potential return on investment is magnified, as are your potential losses

Spread betting profits are tax-free*

You can trade on indices, forex, cryptocurrencies, commodities, global shares and treasuries

There is no separate commission charge to pay on spread bets

You get access to 24-hour markets

There is no stamp duty* to pay

Join a trading community committed to your success

Create a relevant trading plan and stick to it

Keep emotions aside from your trading

Evaluate market analysts’ news and write-ups as part of your analysis

Be aware of the macro environment through news outlets

Avoid recommendations and tips from unreliable sources, such as internet forums

Cut your losses short and let your profits run

Test new strategies on your spread betting demo account

Open a spread betting

demo account or

live account .

Accounts can be opened via our website or mobile app. Deposit funds if you have chosen to open a live account.

Research financial instruments to trade. Browse our news and analysis section, and check the insights, market calendar and chart forum platform modules. Live account holders can also access Reuters news and Morningstar fundamental analysis for inspiration.

Go long and 'buy' or go short and 'sell'. Go ahead and ’buy’ the asset if you think the price will rise, or ’sell’ the asset if you think the price will fall.

Follow your spread betting market entry and exit strategy. Based on your trading plan, enter the market at a defined time, and use your risk mitigation strategies like stop-loss orders.

Enter your position size and place your trade. When placing a spread bet, be aware of the full trade value, and don’t forget to add stop-loss and take-profit orders.

Monitor your trade. Keep track of the open trade on your mobile or PC, and close the position as defined in your trading plan.

In this article, we’ll cover the essentials of spread betting , including strategies, tips and examples of a spread bet. This article should guide you towards understanding if spread betting is a suitable trading method for you. Watch the video below to get started.

Spread betting is a tax-efficient* way of speculating on the price movement of thousands of global financial instruments , including spread betting forex , indices, cryptocurrencies, commodities, shares and treasuries. Spread betting is one of the most common ways to trade on price action over several asset classes in the UK and Ireland. Spread betters can trade in both directions (‘buy’ or ‘sell’), and can make use of financial leverage to increase their trade exposure. With a spread betting account, you can choose between trading from home and on-the-go, as our platform is very flexible for traders of all experience levels.

With spread betting trading in the UK, you don't buy or sell the underlying instrument (for example a physical share or commodity). Instead, you place a spread bet based on whether you expect the price of an instrument to go up or down. If you expect the value of a share or commodity to rise, you would open a long position (buy). Conversely, if you expect the share or commodity to fall in value, you would take a short position (sell). You will make a profit or loss based on whether or not the market moves in your chosen direction.

With spread betting, you buy or sell a pre-determined amount per point of movement for the instrument you are trading, such as £5 per point. This is known as your spread bet 'stake' size. This means that for every point that the price of the instrument moves in your favour, you will gain multiples of your stake times the number of points by which the instrument price has moved in your favour. On the other hand, you will lose multiples of your stake for every point the price moves against you. Please note that with spread betting, losses are based on the full value of the position. See our spread betting examples for more information on how to spread bet.

The difference between the buy price and sell price is referred to as the spread. As one of the leading providers of spread betting in the UK, we offer consistently competitive spreads. See our range of markets for more information about our spreads.

Spread betting is a leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position (also called trading on margin ). While margined (or leveraged) trading allows you to magnify your returns, losses will also be magnified as they are based on the full value of the position.

Many investors choose to spread bet on the financial markets as there are advantages of spreading betting over buying physical assets:

Before placing your trade, remember to make sure that you have followed risk-management guidelines as part of your strategy.

A spread-betting strategy is a pre-determined plan that helps you to define your market entry and exit points, and accompanying risk-management conditions such as stop-losses. When utilising a trading plan as part of your wider trading strategy, you aim to create a process in which you can monitor and forecast trade outcomes.

When trading with a spread betting account, it’s best practice to outline and follow your own trading strategy template relative to your needs. Strategy templates define a set of rules you should follow for every trade, helping you to remove emotions and irrational responses from your trading strategy. This helps to keep consistency within your trades, and can help improve your trading mindset. Visit our article on creating a trading strategy template , where you can follow an example to help define your strategy.

Every trader utilises different methods and strategies to suit their trading style. There are, however, some common spread betting tips a trader can utilise in order to maximise their trading potential:

See our article on spread betting tips and strategies , where we cover the topic in more depth.

It's a good idea to keep up to date with current affairs and news because real-world events often influence market prices. As an example, let's look at the UK government’s help to buy housing scheme.

Many believed that this scheme would boost UK home builders' profitability. Let's say you agreed and decided to place a buy spread bet on Barratt Developments at £10 per point just before the market closed.

Let's say that Barratt Developments was trading at 255 / 256 (where 255 is the sell price and 256 is the buy price). In this example, the spread is 1.

Let's assume that you opened a long position at £10 per point because you thought the price of Barratt Developments would go up. For every point that Barratts' share price moved up or down, you would have netted a profit or loss multiplied by your stake amount.

Let's say your spread betting prediction was correct and Barratt Developments' shares then rose to 306 / 307. You decide to close your buy bet by selling at 306 (the current sell price).

The price has moved 50 points (306 sell price – 256 initial buy price) in your favour. Multiply this by your stake of £10 to calculate your profit, which is £500.

Unfortunately, your spread betting prediction was wrong and the price of Barratt Developments' shares dropped over the next month to 206 / 207. You feel that the price is likely to continue dropping, so to limit your losses you decide to sell at 206 (the current sell price) to close the bet.

The price has moved 50 points (256 – 206) against you. Multiply this by your stake of £10 to calculate your loss, which is £500.

Learn more about spread betting for beginners and how to get started, and see our detailed spread betting examples. If you're ready to trade, open an account now.

Seamlessly open and close trades, track your progress and set up alerts

Spread betting works by traders speculating on whether a financial instrument’s price will rise or fall. Spread betters can go long (buy) if they believe the price of an asset will go up, or go short (sell) if they believe the market will start a downtrend. Learn more about spread betting .

Spread betting can be profitable, depending on multiple factors, but it’s also possible to make a loss. Most successful traders manage to make profitable trades by following a systematic trading plan, including in-depth fundamental and technical analysis, risk-management systems and several years of applicable knowledge. Try out a spread betting demo account to practise your trading plan.

Is spread betting taxable in the UK?

If you’re a resident in the UK or Ireland, profits from spread betting are free from capital gains tax (CGT). Additionally, spread betting transactions are exempt from stamp duty. Learn more about the risks of spread betting and the advantages of spread betting here. Please note tax treatment depends on your circumstances and tax laws are subject to change.

Spread betting providers are regulated by the Financial Conduct Authority (FCA) in the UK. It’s compulsory for all UK spread betting providers to be FCA regulated. Find out more about regulations at CMC Markets .

Losses above are based on the full value of the position. Past performance is not indicative of future performance.

^Prices are taken from our platform. Our prices may not be identical to prices for similar financial instruments in the underlying market.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 9,300+ instruments

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Gif Sex Sleeping

Lingerie Stocking Compilation Of Doggy Style Porno

New Porn Massage

Girl Solo Masturbation Video Tori Black

Hardcore Music Porn

/%3Cimg%20src=)

/%3Cimg%20src=)

/cloudfront-us-east-1.images.arcpublishing.com/tgam/5DT2M6TBURB7PKTEQXHTWLTPZE.jpg)