Spread Betting Rollover

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Rollover

Home

Sportsbook Bonuses

Bovada Bonus MyBookie Bonus BetOnline Bonus Betus Bonus Intertops Bonus BetDSI Bonus Bodog Bonus BookMaker Bonus SportsBetting AG Bonus

Sportsbook Reviews

Bovada Review Intertops Review BetOnline Review MyBookie Review GTBets Review BetNow Review BetDSI Sportsbook Review

Deposit Methods

Visa Bitcoin Mastercard Amex Ukash Echeck NETeller Money Order Insa Debit Paypal

Types of Bonuses

Sign Up Bonuses and Online Welcome Bonuses Match Bonuses Deposit Bonuses Rollover Betting Tips No Deposit Bonuses Reload Bonuses What is Rollover? Maximum Bonus Amount? Bonus Codes

News

Please Bet Responsibly. Visitors must be of legal gambling age.

Copyright © 2009 - 2021 SPORTSBOOK BONUS – Bet Smart. The Best Sportsbook Bonuses Online. All Rights Reserved.

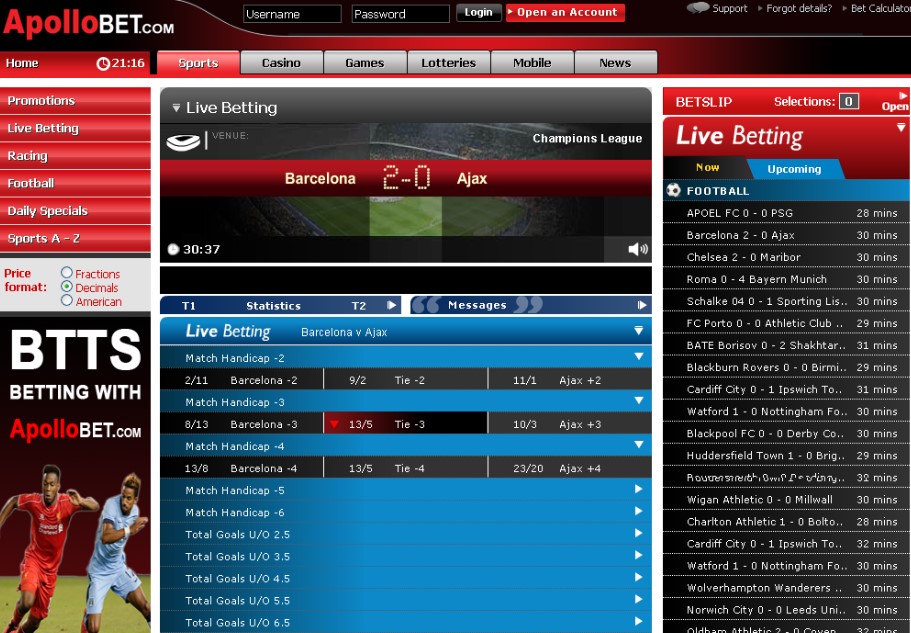

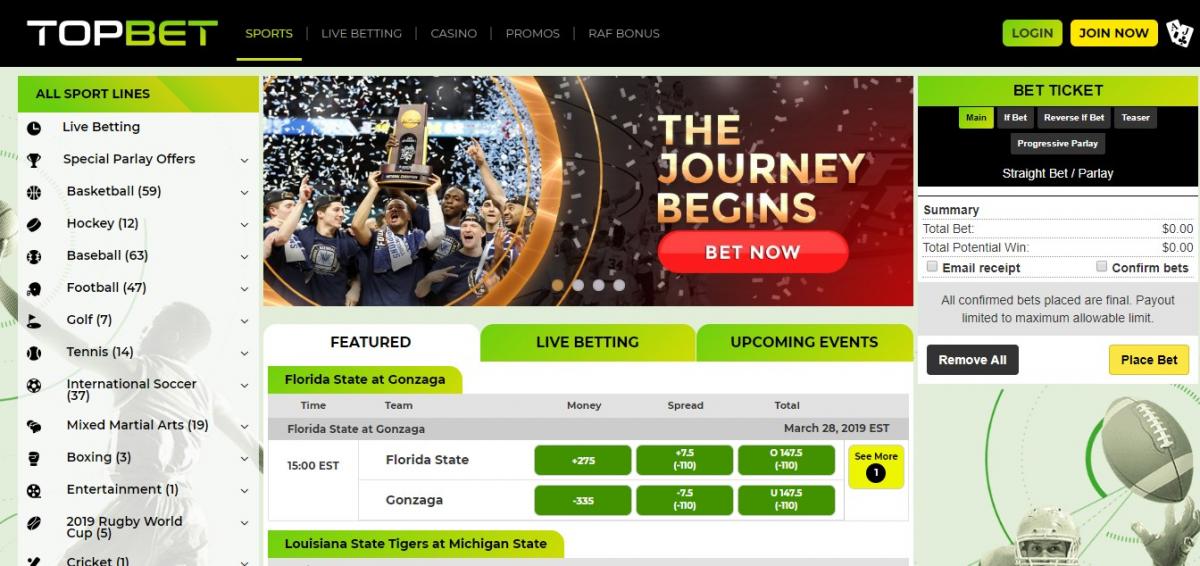

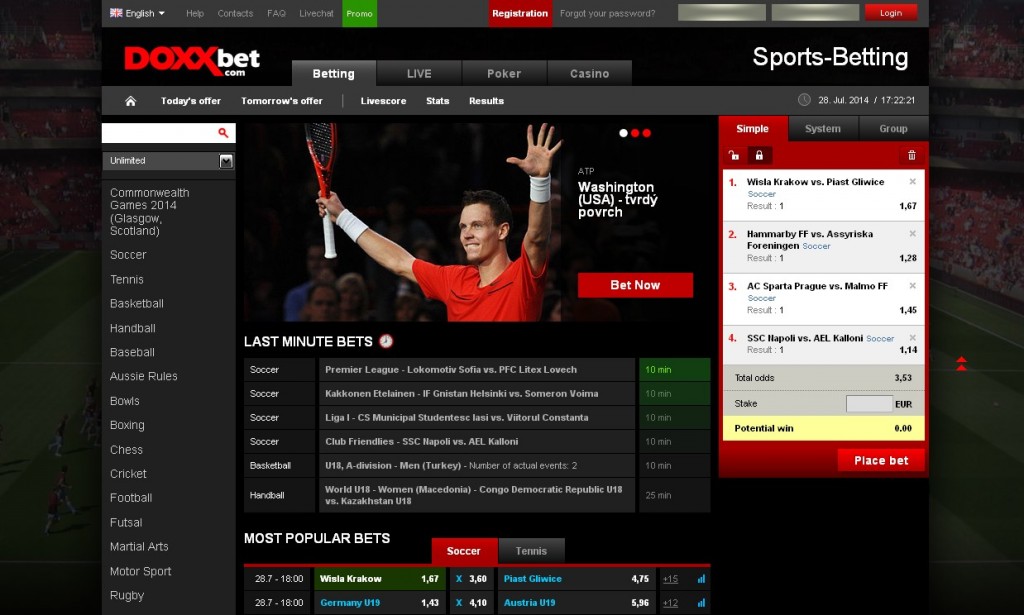

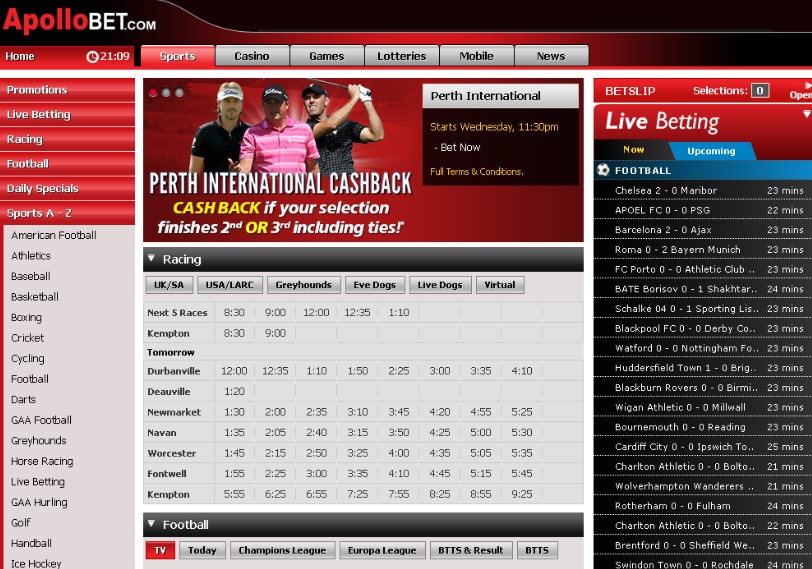

The demand for sports wagering seemingly grows by the day and with loosening laws on the practice, that demand could keep climbing. A number of betting sites have popped up to meet that growing demand, but in turn, created a highly-competitive online market.

Born out of this competition has been many type of bonuses or promotions. Most popular among them are sign-up offers, where sites hand out free money to first-time bettors of that platform upon depositing money into their account. Yes, you read that right — free money!

But as you'll find out, that free money does come with some caveats, mainly in the form of rollover requirements .

Ok so what exactly is this rollover requirement that we speak of?

It's a minimum amount of money you have to wager with that betting site before you're allowed to cash out any funds from your account.

Rollover requirements are typically expressed with multipliers like 3X, 5X, or 8X. These numbers mean the rollover that you have to meet will vary by player, and more specifically, by how much you initially deposited.

Perhaps a simple calculation will best help explain how rollovers work. We'll use a real-life requirement used by Bovada in its sportsbook. The site's rollover requirements sports betting is a modest 5X.

To help unpack that, it's important to also know what their match deposit bonus sports is. For Bovada, it's currently a 50% match with a max earnings of $250.

Say you're a new bettor and load $500 into your account off the bat, meaning you also earned the full match at $250. Therefore, you're starting pot of money on the betting site is $750. This final number — the initial deposit plus free money earned — is what needs to be multiplied with the rollover requirement to meet the minimum wagering requirement.

To continue our example, you start off with $750 in Bovada's sportsbook. With their rollover rate of 5X, that means money isn't withdrawable until you've wagered at least $3,750. Makes sense?

It's worth noting that rollover requirement means the same exact thing as playthrough or wagering requirements . All terms are interchangeable with one another and use depends on the specific betting site.

While sites readily advertise their match bonus, max free money possible, and rollover rates, that's only the tip of the spear. It's highly advised to read through their terms and conditions to understand the full scope of their welcome offer.

The terms and conditions will make you aware of any other red tape associated with the promotion. Spoiler alert: they're usually is more.

Some of these under-the-radar terms outline which games count toward meeting the rollover requirement and which don't. Moreover, free play also expires after a certain point. Thus, if the rollover requirement isn't met before that expiration, a player forfeits it entirely.

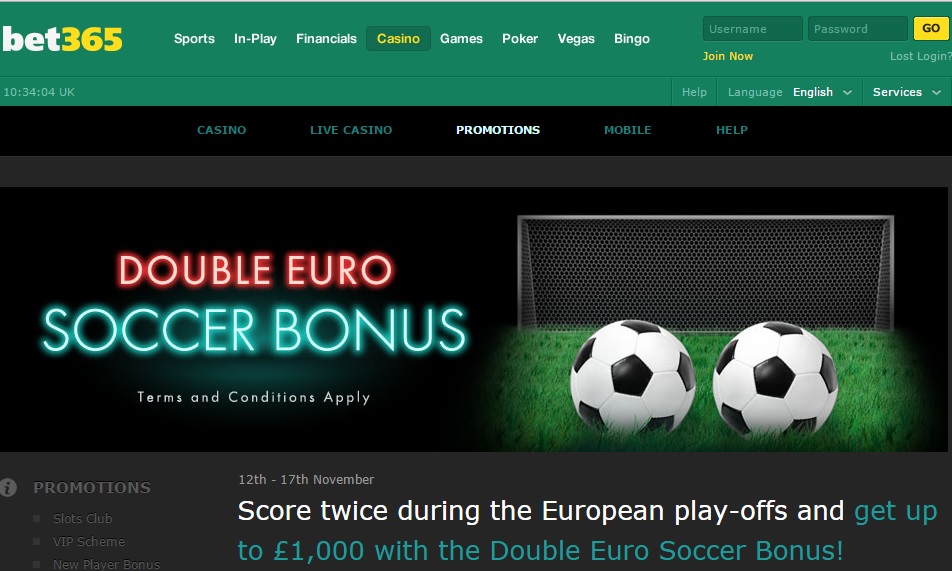

Sportsbooks require these rollovers mainly to minimize risk on their end. Without these rules in place, bettors could jump site to site, taking free money along the way, without the intention of ever sticking around. Obviously, from the perspective of online betting platforms, that's not good for business at all.

Plus, a sign-up offer is very much intended to be a "free trial" of sorts, not unlike a video streaming service or regular computer software. You try out the betting platform — with some free money, of course — and see if it's the right fit for you or not.

Before jumping into any betting site, you should brush up on the best sportsbook sign up bonus currently being offered. Not all offers are one and the same, thus you might be leaving money on the table without doing proper research.

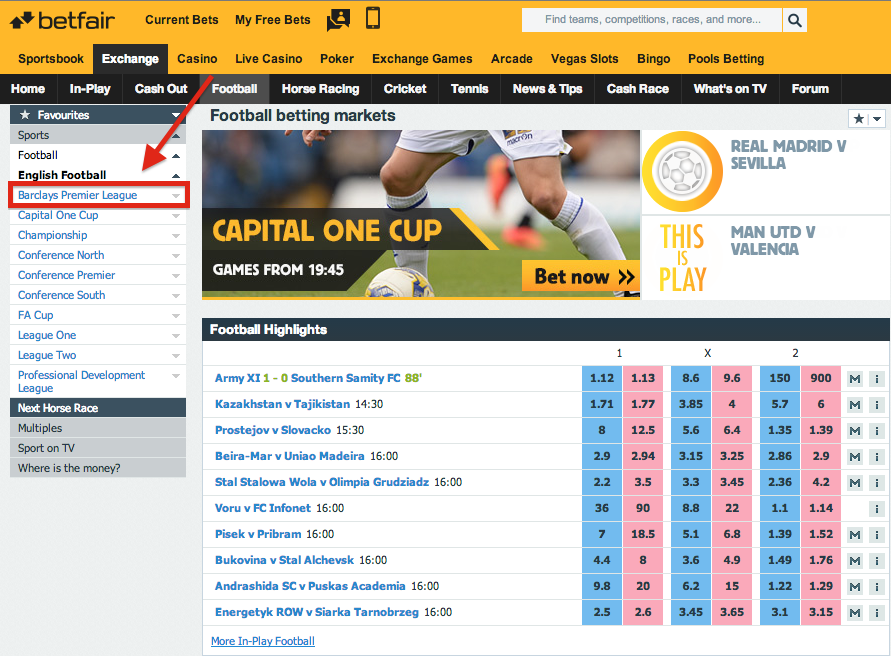

Like we said, welcome offers vary. Not only from site to site, but even within that same site. A platform will offer unique deals for its sportsbook, casino, poker room, etc.

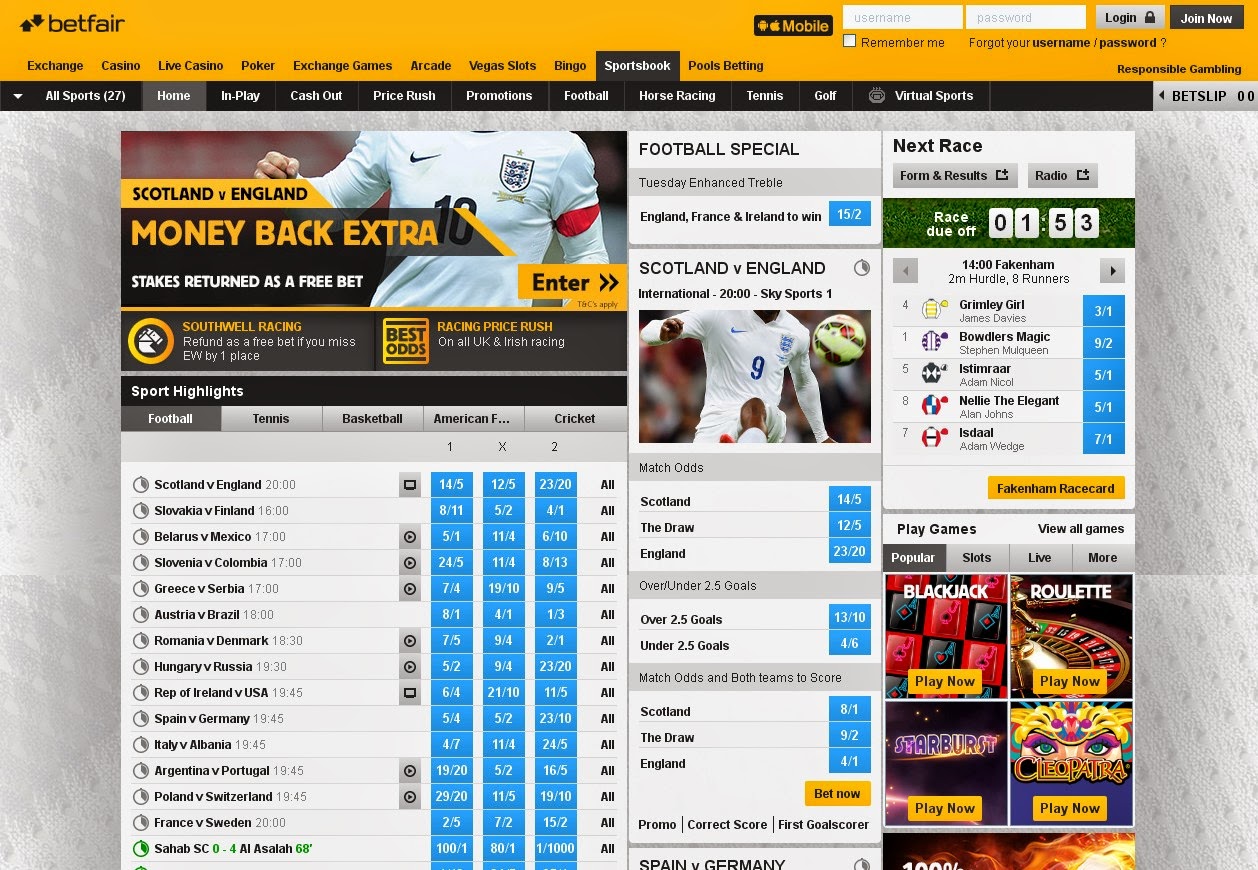

Let's dig into the sportsbook first. Compared to the casino, sport-specific offers appear to be a lot less lucrative . The match percentage and max bonus for sports are typically below the one offered in the casino.

However, there's a tradeoff here. While the sportsbook welcome deal might not be worth as much, its rollover requirement is usually lower . Therefore, it's easier to cash out when using the sportsbook than the casino.

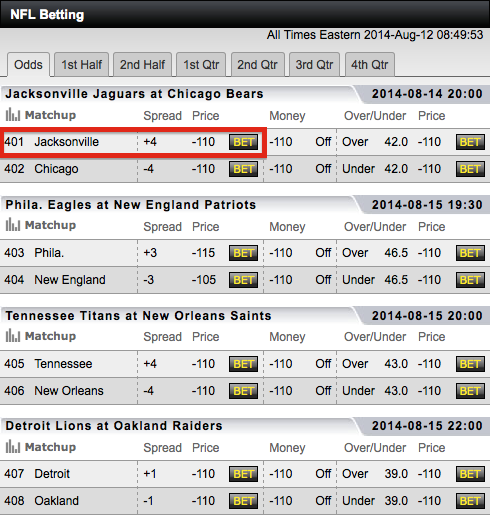

Just as an example, here are playthrough rates offered around the web currently that pertains to the sportsbook. Bovada, as mentioned, is 5X, BetNow is at 8X, and 10X by both Betonline and MyBookie. As you'll see in our next section, that's a very manageable wagering minimum to hit.

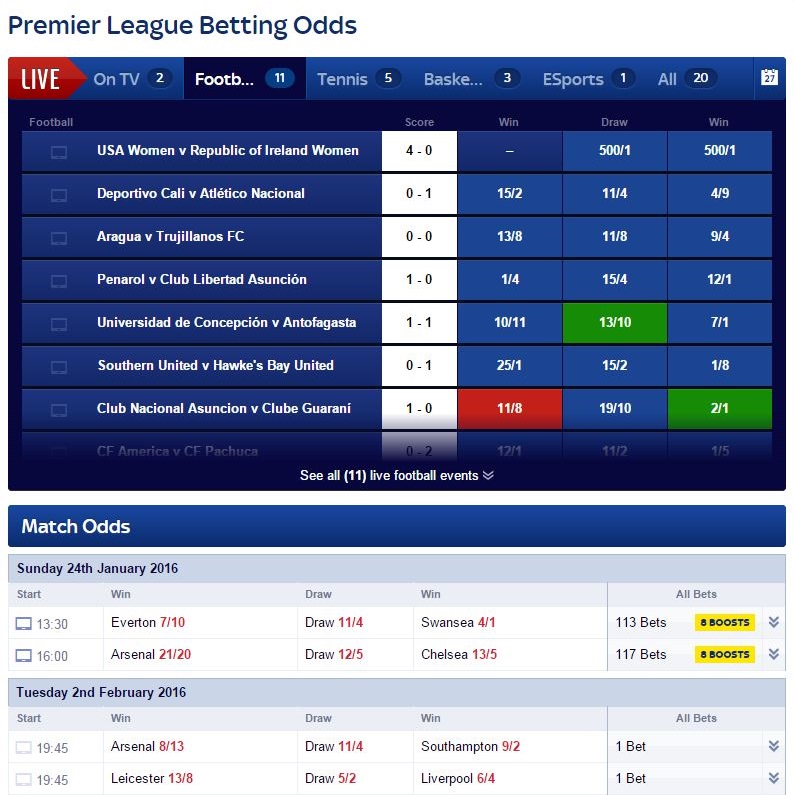

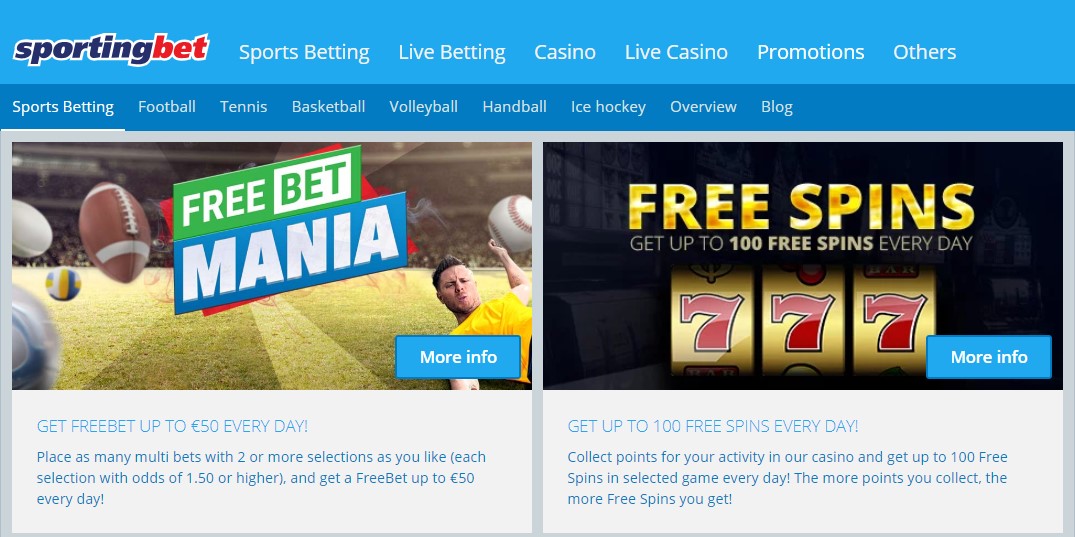

No offers throw out more free money than those coming from a casino, and it's not even close. Don't believe us? Take a look at the max amount allowed (if the highest possible initial deposit is met) at some top sites.

MyBookie is offering up to $750 in free play, before the trio of Bovada, BetOnline, and BetNow reach an eye-popping $3,000. That's only a few examples, but very much the norm in casino promos.

Some books have promos where they'll match not only the first deposit made by a bettor but the two following ones , as well. That's how Bovada, BetOnline, and BetNow do it, hence their steep $3,000 award (it's really $1,000, but can be redeemed three times).

But as we eluded to earlier, the rollover rates associated with casino bonuses are no small thing. The playthrough requirements are many times triple or quadruple of those seen in the sportsbook. For instance, Bovada's rate is 25X, while BetNow's hits 30X, and finally, MyBookie and BetOnline reaches all the way up to 40X.

Poker is usually another standalone platform on a sports betting site , though, sometimes it's lopped into the casino. If it's a separate entity, you can expect some sites to offer a welcome bonus just for it, too.

Typically, these bonuses are similar to the casino counterpart . Take BetOnline as a prime example. The poker room matches an initial deposit dollar-for-dollar up to $1,000 — the same as its casino. Though, it can only be redeemed once, not three times like the casino.

But here's the big difference between casino and the poker room: there are no rollovers with poker (well, sort of). That's because free money is typically redeemed in $5 or $10 spurts in poker, not all at once like with the sportsbook or casino. Receiving free money in intervals effectively acts as a rollover, but just in a roundabout way.

As you've probably now realized, playthrough requirements are nothing to scoff at. They take some commitment to overcome, then smart decision-making to actually retain some of that free play earned. No deposit bonus doesn't mean the sportsbooks are simply giving away money.

But we're here to help. Below are a few must-do rollover betting tips .

We mentioned this one before, but it bears repeating. If you don't read through the T&C — every word, not just skim through it — then you're rollover betting is doomed before it even gets started.

To drive this point home, let's look into Bovada's conditions for its casino offer. Some games in its casino library don't count toward meeting the rollover amount, including craps and live dealer. Therefore, you're better off skipping those games , at least for now.

Outside those two games, the rest of Bovada's casino selection will help you reach the rollover bonus , but some will get you there quicker than others. Under its guidelines, Bovada breaks down how each casino game contributes to the playthrough amount.

The contributions are not even across the board whatsoever. Only five percent of contributions — meaning how much you wagered — in blackjack and baccarat games goes toward the rollover . So if you risked $100 in a single bet, only $5 of it ould be accounted for.

That's practically nothing. Hardly better, video poker counts at 10 percent and table games are 20 percent of money bet.

On the flip side, 100 percent of money gambled on slots counts toward meeting the requirement . So if we're trying to earn the deposit rollover, we're loading up big time on slots and skipping out on everything else.

That's only one example, but it's the norm across many betting sites. The learning lesson here? Know what you're getting into first before signing up for any bonus and read carefully through the terms and conditions.

In what's become common practice across the market, sign-up bonuses typically expire 30 days after you first sign up and make an initial deposit. After this point, if the rollover hasn't been met, all free money is forfeited.

Therefore, you have one month to reach the sports betting rollover or casino one. That may seem like a lot, but when you take into account the amount you need to wager, it might not be. That's why you need to consistently play (on games that count most toward the playthrough, of course).

Bettors are a strategic bunch. Strategic in how they select a sportsbook bonus to jump on or in the sense of just handicapping games.

However, those strategic ways can sometimes lead them astray, particularly when it comes to meeting rollover rates. Realistically, a bettor could just wager both sides of a game , come out close to even afterward, but double up on their playthrough amount.

Bettors have done it, but sportsbooks have caught on. That practice, or any other that attempts to defraud the betting site, is strictly prohibited. Ultimately, betting sites have the right to withhold any money if they believe fraud is the case.

Our word of advice is just not to resort to such tactics . Period. As we've pointed out, there are other ways of meeting the rollover that are completely legal.

Not exactly. There are a few notable exceptions .

One, we've already briefly outlined, poker rooms. Many bonuses revolving the poker room don't have a hard rollover limit . We use the word "hard" loosely here because you still have to play to unlock winnings, but instead of hard money, it's accounted for in "points." Explaining this can get tricky, that's why we advise reading terms and conditions closely.

Two, VIP players — meaning the big-money players — can find themselves the beneficiaries of no-string-attached free money. Perhaps not a huge sum of free money, but still real money regardless. Becoming a VIP requires a lot of time and money , but it's not out of the realm of possibility.

Aside from those two instances, you should expect rollover requirements in most other places. For now, that's how betting sites insure themselves against fraud.

It is absolutely possible to overcome rollover requirements and keep free play as winnings.

Though, it's far from a guarantee. With steep playthrough rates, especially in the casino, you're going to have to play an extended time to hit the wagering minimum. Generally, the more you play, the more the odds favor the house.

However, just having free money to start with is an advantage in itself — in gambling terms, it's EV+ or positive expected value. Therefore, you can think of it as each advantage, yours and the houses, canceling each other out.

From there, you just have to play smart. That starts with picking the right bonus offer . If you fancy yourself as a high roller, then go ahead and chase that high bonus. Or vice-versa, a conversive player should gravitate toward a promotion with low playthrough requirements.

Once you've done your adequate research and picked an appropriate promotion, follow our rollover strategy advice that we previously outlined.

Play your cards right — pun fully intended — and reaching the rollover limit is more than possible.

We've done the research to find out which sportsbooks gives players the biggest bonuses.

There are tons of sportsbooks to choose from but you'll have to see our editors opinions on which are the best.

Your one-stop-shop to get a rundown of all of the sportsbook deposit promotions going on right now!

Super Bowl 2021 Betting Picks: Kansas City Chiefs @ Tampa Bay Buccaneers

UFC 257 Picks: McGregor vs. Poirier Fight Predictions

How do I set up automatic rollover instructions? | IG UK

Betting Rollover : Bonus Wagering Requirements & Rollover Explained

What Is Spread Betting ?

What is Spread Betting and How Does it Work? | CMC Markets

100% rollover betting SLIP win 1000+ euros day 1 , 2/7/2020...

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Forex (FX) is the market where currencies are traded and is a portmanteau of "foreign" and "exchange." Forex also refers to the currencies traded there.

A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

A cash-and-carry trade is an arbitrage strategy that exploits the mispricing between the underlying asset and its corresponding derivative.

Covered interest arbitrage is a strategy where an investor uses a forward contract to hedge against exchange rate risk. Returns are typically small but it can prove effective.

A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

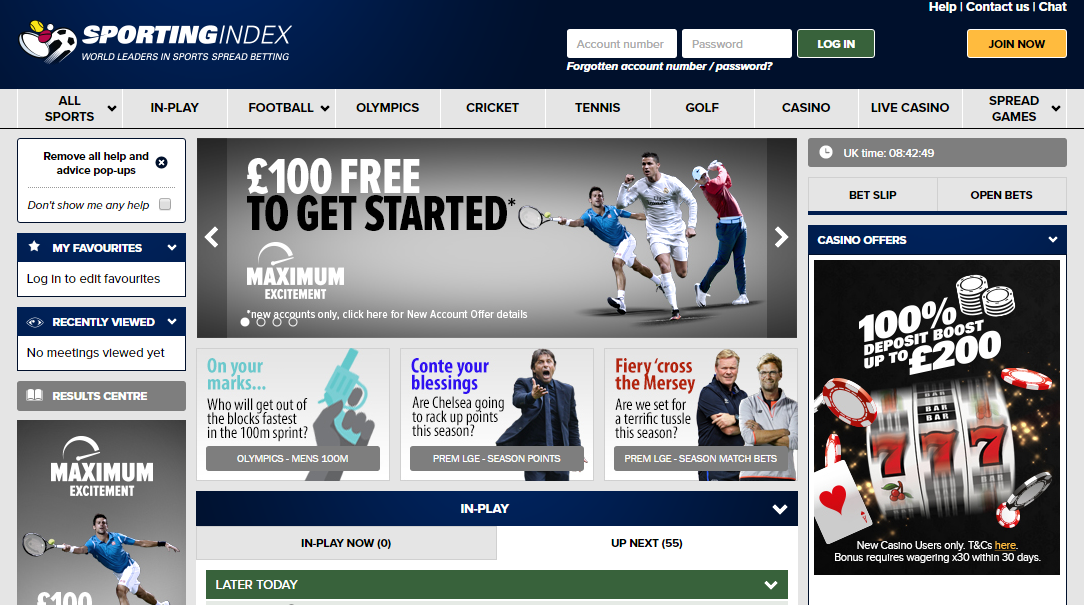

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost .

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

Options Trading Strategy & Education

Double Vag Penetration

Private Browser

Solo Girls Erovideo Hd

Lick Pee Porn

Sperm Hospital Doctor