Spread Betting Promotion Uk

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

Most of us are familiar with regular fixed odds betting. That’s when a bookmaker offers specific odds on a match, or a race or a game. So in terms of horse racing, Tiger Roll was 5/1 to win the Grand National. That means for every £1 you bet on him, you would have received £5 back if he actually won it.

It’s simple. If you bet on a winner, you win. If you back a loser you lose.

The additional option for most of us is the each-way bet. This is where you place an extra wager on the ‘place’. So if you back Tiger Roll each-way, even if he doesn’t win, you could still get some money back if he finished 2nd, 3rd or 4th in the race.

Spread Betting is yet another way to place a wager but in a different way entirely.

Imagine you follow a specific football team in the Premier League. You’re confident that they are going to have a great season and win the title. The bookmaker then creates a spread. It’s an arbitrary points system that has nothing to do with Premier League points. But it will look like the following:

It’s a way of gauging the likelihood of the chances of a team’s success. It’s done in the same way traditional odds represent a team’s chances of winning. So imagine the ‘spread’ for your team is set by the bookmaker at 58 – 59 points.

You think your team will win so you bet over the 58-59 spread. Of course, if you don’t think they will actually win the League you bet ‘under’ the 58 – 59 points spread.

This is when spread betting can get a little complicated. Let’s say your team goes on to win the league, they will get awarded the maximum 60 points by the bookmakers spread system.

So the points difference between ‘over 58-59’ and the 60 points allocated by the bookie is 1 point. For every 1 point over your correct bet, you get £10 back.

Now let’s say that you had bet your team ‘Under’ the spread of 58-59 points. They have a poor run and end up finishing in third place. Based on the spread system, they would be awarded 30 points by the bookmakers for finishing in this position.

The difference between the original bookmakers spread at 58-59 points and the 30 points they ended up with is 28.

Take that 28 and multiply it by your original stake, which was £10. As a result, your £10 bet would net you £280.

Of course, this type of betting can also work against you. Using the example above, had you bet ‘Over’ the 58-59, believing that your team would romp home and win the title, then you would be liable to a substantial loss.

How? Take the 58-59 points that you originally bet on, take away the 30 points that they ended up on and you are left with 28. Unlike the outcome above, you now owe £280. This is opposed to just losing your £10 stake like you would in regular fixed odds betting.

Spread betting can be highly profitable, but it comes with a large element of risk. You could lose more than your original stake.

Despite this, it is hugely popular and used a lot in football. You can bet on the spread of goals that will be scored in a game, all the way through to who will win the title. You even spread bet on the total goal minutes in a game.

So if a game ends up 1-1 and the first goal was scored in the 25th minute and the second goal was scored in the 56th minute then the total minutes will be 81. If the spread was set at between 126 -136 minutes and you bet ‘under’ – you win! If you bet over the spread – you lose.

There are ways to limit your risk as spread betting companies allow you a ‘Stop Loss’ option when placing a bet. This means you can set a limit on how much you could lose. This also affects how much you could win too.

When new to spread betting try to avoid betting on sports with large spread liabilities such as cricket games. Also, keep your stakes low. A £5 bet in the traditional bookmakers would not be considered a big bet but in spread betting a £5 bet could open you up to serious losses depending on the markets.

Place 5 x £10 bets to get a £20 free bet. Repeat 5 times to get £100 in free bets.

New customer offer. Place 5 x £10 or more bets to receive £20 in free bets. Repeat up to 5 times to receive maximum £100 bonus. Min odds 1/2 (1.5). Exchange bets excluded. Payment restrictions apply. T&Cs apply. 18+ begambleaware.org. #ad. Please bet responsibly.

New 18+ UK customers only. Register using the promo code ‘FOOTBALL40’, deposit and place first bet of £10 on football (cumulative price evens+) in one bet transaction. First bet must settle within the Promo Period (00:00 05/08/21 – 23:59 29/08/21).£30 in Free Bets credited within 10 hours of bet settlement and expire after 7 days. Additional £10 in Free Bets only credited if first bet doesn’t win. Payment restrictions apply. SMS validation may be required. Full T&Cs Apply. 18+ begambleaware.org. #ad.

Free bets & promotional offers are only available to new customers, unless otherwise stated. Wagering requirements and other terms & conditions apply.

Information appearing on BetPromo.uk does not constitute professional advice or recommendation.

Website Features Advertorial Content.

Please gamble responsibly.

Need help? contact BeGambleAware.org

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

Check to enable permanent hiding of message bar and refuse all cookies if you do not opt in. We need 2 cookies to store this setting. Otherwise you will be prompted again when opening a new browser window or new a tab.

Click to enable/disable essential site cookies.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

Please enable this feature in your browser settings and reload the page.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Click to enable/disable Google Webfonts.

Click to enable/disable Google Maps.

Click to enable/disable Google reCaptcha.

Click to enable/disable video embeds.

The following cookies are also needed - You can choose if you want to allow them:

Please enable this feature in your browser settings and reload the page.

Please enable this feature in your browser settings and reload the page.

Please enable this feature in your browser settings and reload the page.

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Home » Spread Betting UK – Spread Betting Explained

4, August 2021 | Last Updated: 17, August 2021

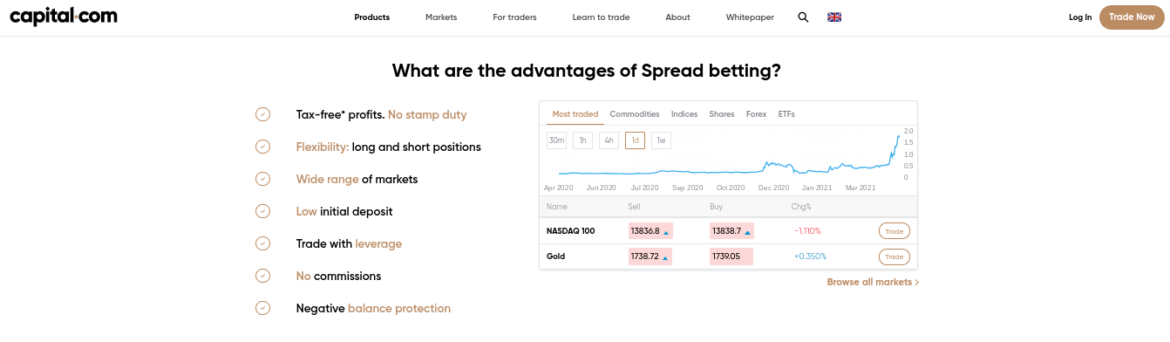

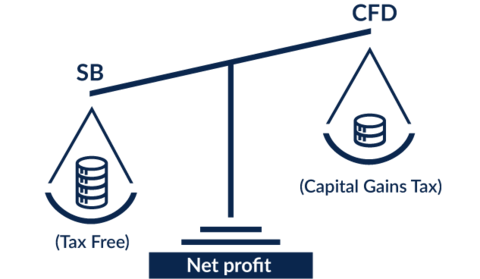

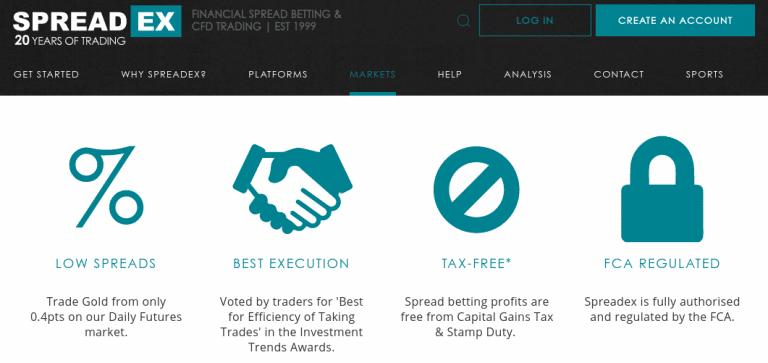

Spread betting is a form of financial trading that comes with a major stand-out benefit – all profits are exempt from capital gains and stamp duty tax. In addition to this, the best spread betting brokers offer thousands of financial markets, leverage, low fees, and even the ability to short-sell.

In this guide, we explain the ins and outs of how spread betting in the UK works and which brokers are worth considering in 2021.

In order to get your spread betting UK journey off to a flying start – you’ll need a good broker by your side. Below you will find a list of the best spread betting brokers in the UK for 2021.

We review the above spread betting UK brokers further down in this guide.

If you’re completely new to spread betting in the UK – below you will find a quickfire guide on how this form of financial trading works.

And that’s it – you’ve just placed your first spread betting UK trade at Capital.com!

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.25% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

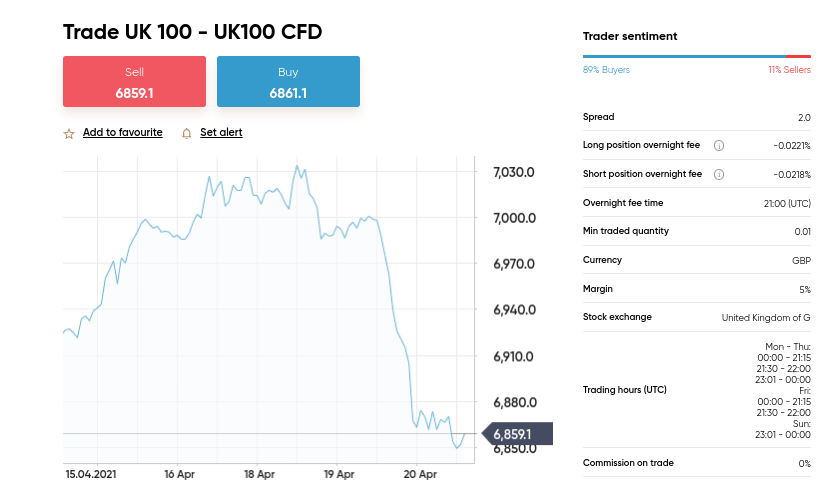

In a nutshell, spread betting is a form of financial trading that allows you to speculate on the future value of an asset. For example, if AstraZeneca shares are trading at £8.20 on the London Stock Exchange – you need to decide whether you think the price will rise or fall. If you predict the future price of the shares correctly – you will make a profit.

In this sense, spread betting is very similar to CFD trading. After all, when you place a spread betting order – you do not own the underlying asset. Instead, you are merely looking to predict whether the asset will increase or decrease in value. One of the major benefits of choosing a spread betting UK platform is that all profits are exempt from tax.

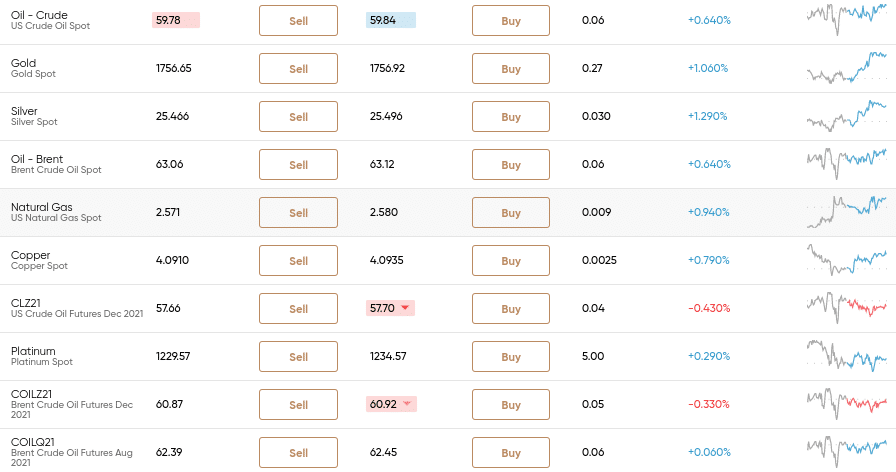

This includes both capital gains and stamp duty tax – so you get to keep all profits for yourself. In addition to this, many spread betting platforms in the UK offer thousands of markets – which ranges from UK and international stocks, ETFs, forex, precious metals (e.g. gold), oil, indices, and more.

Plus, you can also trade with leverage – which allows you to amplify the size of your stake. Furthermore, and as we cover later in our spread betting UK broker reviews – the best platforms in this space allow you to trade on a 0% commission basis. All in all, if you’re looking to speculate on the financial markets – spread betting is well worth considering.

So now that we have covered the basics of how spread betting in the UK works – we can now walk you through a more detailed explanation.

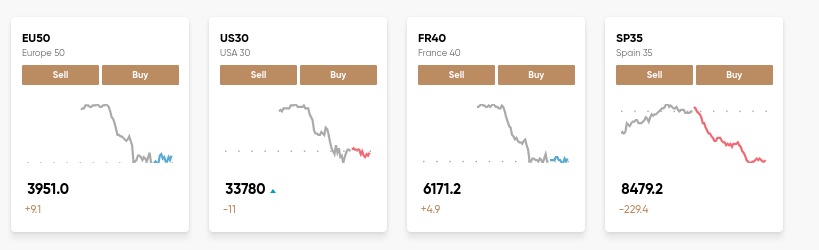

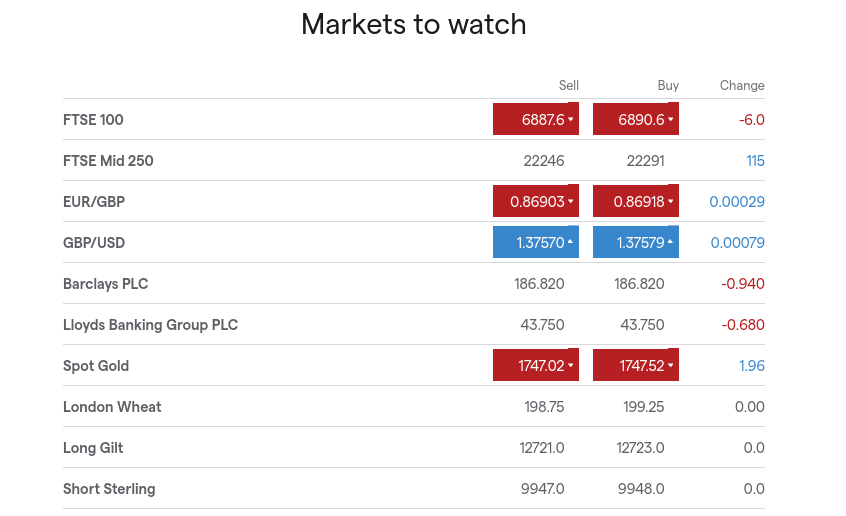

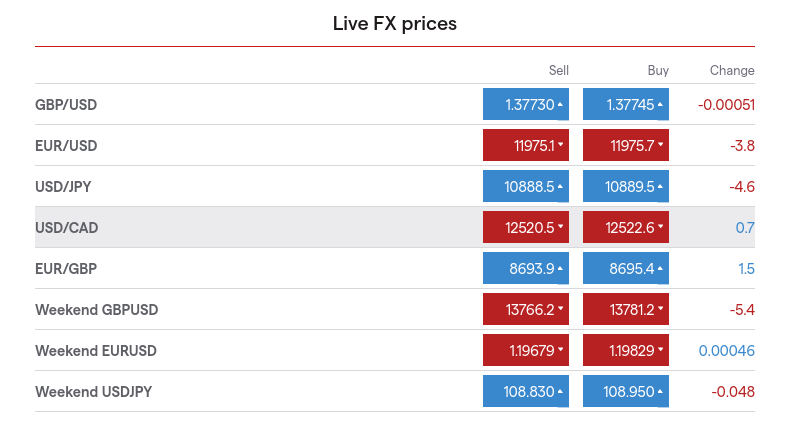

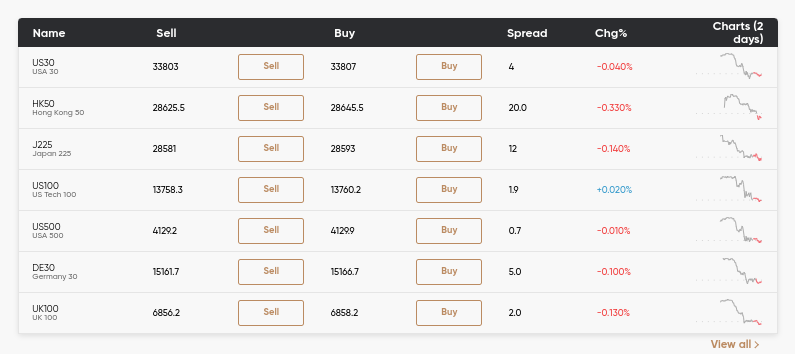

First and foremost, let’s have a quick look at the many spread betting UK markets that you will likely have access to when signing up with a top-rated broker.

As you can see from the above list, the best spread betting UK sites give you access to a wide range of financial markets. As such, you’ll never be short of trading opportunities.

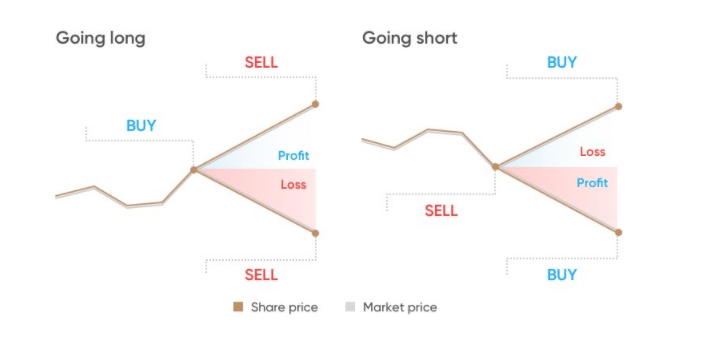

Once you have decided which financial instrument that you wish to spread bet, you then need to decide whether you think the price of the asset will rise or fall. This is another major benefit of choosing a spread betting UK platform as opposed to a traditional brokerage firm – as you always have the option of going long or short on your chosen market.

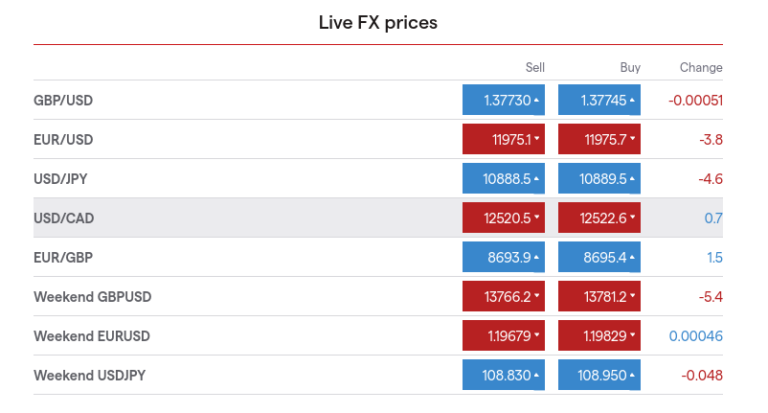

Here’s what you need to know about buy and sell orders:

If you place a buy order and the price of asset rises – then you will make a profit by closing the position with a sell order. And similarly – if you place a sell order and the asset falls in value, you can lock in your profits by closing the position with a buy order.

So far – the basics of spread betting UK might appear somewhat simple. However, we now need to move on to the point movement system that is utilized by spread betting brokers – which might be unfamiliar territory for you.

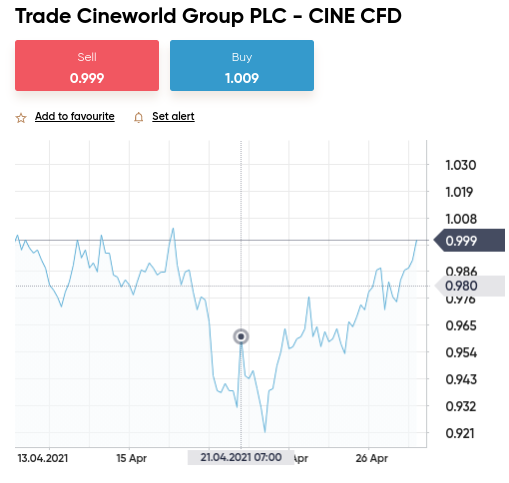

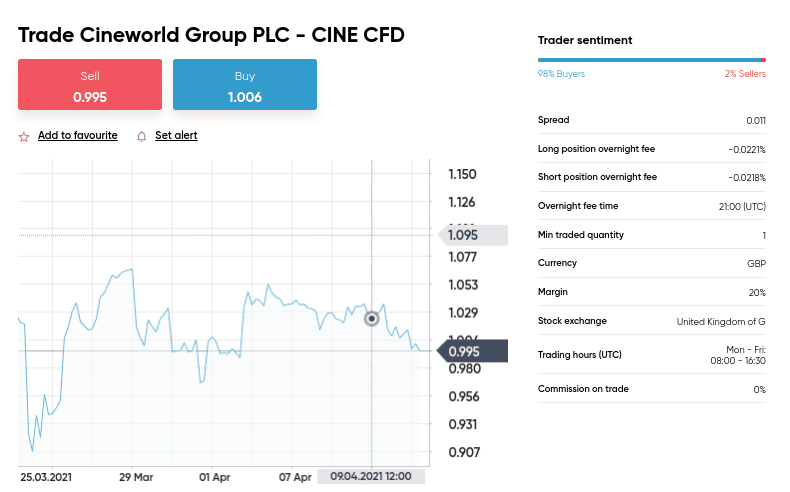

In a nutshell, when you buy traditional shares in the UK – the price of the respective stock moves in pence. For example, if you buy Cineworld shares at 82.01p and sell them at 85.05p – that’s a profit of 3.04p for each stock that you bought. However, in the case of spread betting UK – this price movement would be depicted in points. Furthermore, the point system operates in units – so 1p might amount to 100 points.

Let’s look at an example to help clear the mist:

The amount of money that you made on the above trade would be dictated by the size of your stake per point – which we cover shortly. But first – it’s worth us giving you another quick example of how to spread betting point system works to ensure there is no ambiguity.

To clarify, although a sum of [$70.50-$66.80] gives us a figure of $3.70 – don’t forget that 1 point amounts to 1 cent. As such, $3.70 amounts to 370 points.

Once you get your head around the point movement system – understanding the spread betting UK arena is actually very simple. As such, we now move on to stakes. Put simply, when you speculate on your chosen financial instrument – you need to tell your broker how much you wish to stake per point movement.

Many spread betting brokers in the UK allow you to trade from just 10p per point – which is great if you are just starting out. In order to determine your profits or losses – your chosen stake is multiplied by the number of points that the asset moves by.

Let’s look at an example to help clear the mist:

If, on the other hand, you staked just 10p per point on this trade – your profit would have amounted to £30 (300 points x 10p). Or, if you had staked £10 per point, your profit would have amounted to £3,000 (300 points x £10). As such can see, your profits are fully dictated by how much you decide to stake per point. This is also the case with losses – so it’s important to tread carefully if you are completely new to spread betting UK.

By this point in our spread betting UK guide – you should have a firm understanding of how to place orders. Next, we need to talk about the ‘duration’ of your chosen market. Put simply, when you’re spread betting a financial instrument – you do not own it. Instead, the spread betting market will track the price of the asset in real-time.

For example, if HSBC shares are trading at 401.90p on the London Stock Exchange – the spread betting market will mirror this price. A direct consequence of this is that spread betting brokers always place a market duration on your trades. You often get two options in this respect – which we explain below:

Irrespective of which duration you opt for – if you have an open position when the market shuts – the broker will automatically close your outstanding trades. With that in mind, beginners will be best suited for a quarterly funded bet – as you will have more time to assess the market and make an informed decision. Daily funded bets, on the other hand, are more suited for experienced day traders.

So now that you have a firm understanding of how spread betting UK works – we can now talk about the many benefits that this form of financial trading offers.

As we briefly covered earlier, spread betting profits in the UK are completely exempt from taxation. Not only does this include stamp duty (0.5%) – but capital gains tax (10-20% depending on your tax band). This is in stark contrast to traditional investment vehicles in the UK – which attract both of the aforementioned tax liabilities.

At the other end of the spectrum, if you risked £5,000 on a BT share trade via a spread betting broker – you wouldn’t pay any stamp duty. Already, that’s saved you £25. If you then closed the position at a profit of £2,500 – you would get to keep it all for yourself – not least because spread betting is exempt from capital gains tax.

When you purchase traditional shares – you are hoping that the markets are bullish – meaning that there are more buyers than sellers. In other words, the only way that you will make money from your traditional share investment is if the value of the stocks rises. This is where spread betting UK once again stands out – as the best brokers in this industry support buy and sell orders on all markets.

For example, there would have been plenty of short-selling opportunities in early 2020 when the impact of the coronavirus pandemic crahsed the stock markets. Similarly, if you think that at over $70 per barrel of crude oil is overvalued – once again you can attempt to profit from this by placing a sell order at your chosen spread betting broker.

Later in this guide on spread betting UK – we review three of the best platforms that are active in this space. All three brokers have one thing in common – they allow you to spread bet without paying any commission.

This means that in addition to 0% stamp duty and 0% capital gains tax – you’ll also be able to place buy and sell orders without paying a single penny in commissions or dealing fees. In addition to this, you’ll also benefit from super-low spreads.

Crucially, because you are not buying the underlying asset – top-rated platforms like Capital.com offer some of the tightest spreads in the industry.

When you use a traditional online broker to trade – you will likely have access to a small number of markets. This might include a collection of UK shares and perhaps some ETFs and mutual funds. However, when you use a spread betting UK broker – expect to come across thousands of financial assets.

As we covered earlier, this will include everything from shares, ETFs, and indices to forex, precious metals, and energies. This gives you ample opportunities to enter trades throughout the day.

For example, if tensions in the Middle East are on the rise, you might decide to place a buy order on crude oil – not least because global supply levels will likely fall. Or, if Turkey announces that its GDP fell by 2% in the prior quarter – you might decide to short-sell TRY/USD.

An additional benefit that the best spread betting UK brokers offer is leverage. In a nutshell, leverage allows you to trade with more money than you have deposited in your trading account. Leverage is usually displayed as a ratio – like 1:5. This means that a £50 stake would be amplified by a factor of 5 – taking your position to £250. Or, a leverage ratio of 1:20 would boost a £50 stake to £1,000.

All of the spread betting UK platforms that we review later in this guide offer leverage. The limits that you have access to as a UK retail trader are capped by the FCA to ensure you do not trade with more than you can afford to lose.

If you’re new to spread betting leverage – check out the example below:

Teen Babes Ass

My Daughter Porno Tube Clips

Striptease Dance Porno Classic

Jb Video Pov

German Truck Simulator Mods

Spread Betting UK | What Is Spread Betting? Full 2021 Guide

Spread Betting UK - Open a Spread Betting Account ...

Spread Betting UK - Top Offers and Brokers 2021

Championship Spread Betting - Spread Bet on the Championship

Spread Betting Regulations in the UK and Market ...

Spread Betting Promotion Uk