Spread Betting News Uk

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

https://www.bbc.co.uk/news/business-38222623

Перевести · 06.12.2016 · Spread betting on financial markets by the general public will be more tightly regulated by the financial watchdog. The Financial Conduct …

https://www.compareforexbrokers.com/uk/best-spread-betting-platforms

Перевести · 16.07.2021 · Spread Betting in the United Kingdom requires a good platform (MT4/MT5) and the top UK spread betting broker. The 2021 UK best spreads betting platform was based on features, fees and the range of financial markets offered.

How to spread bet | How to trade with IG

Spread Betting For Shares Traders | IG

Swing trading/Spread Betting the USA - David Paul : VectorVest UK

https://www.daytrading.com/spread-betting

Перевести · In the UK, for example, HMRC deem spread betting tax-free. However, if spread betting is your sole income in 2017, you may find many countries deem it taxable. If you’re spread betting as non-UK …

https://www.bbc.com/news/business-38222623

Перевести · 06.12.2016 · Spread betting on financial markets by the general public will be more tightly regulated by the financial watchdog. The Financial Conduct …

https://www.online-betting.me.uk/news/spread-betting

Перевести · Spread betting is a form of gambling on the outcome of any event where the more accurate the gamble, the more is won and conversely the less accurate the more is lost. The spread represents the index firms’ margin. For example, if a bettor places a bet on an underdog in an American football game when the spread is 3.5 points, he is said to take the points; he will win his bet …

How does spread betting work in the UK?

How does spread betting work in the UK?

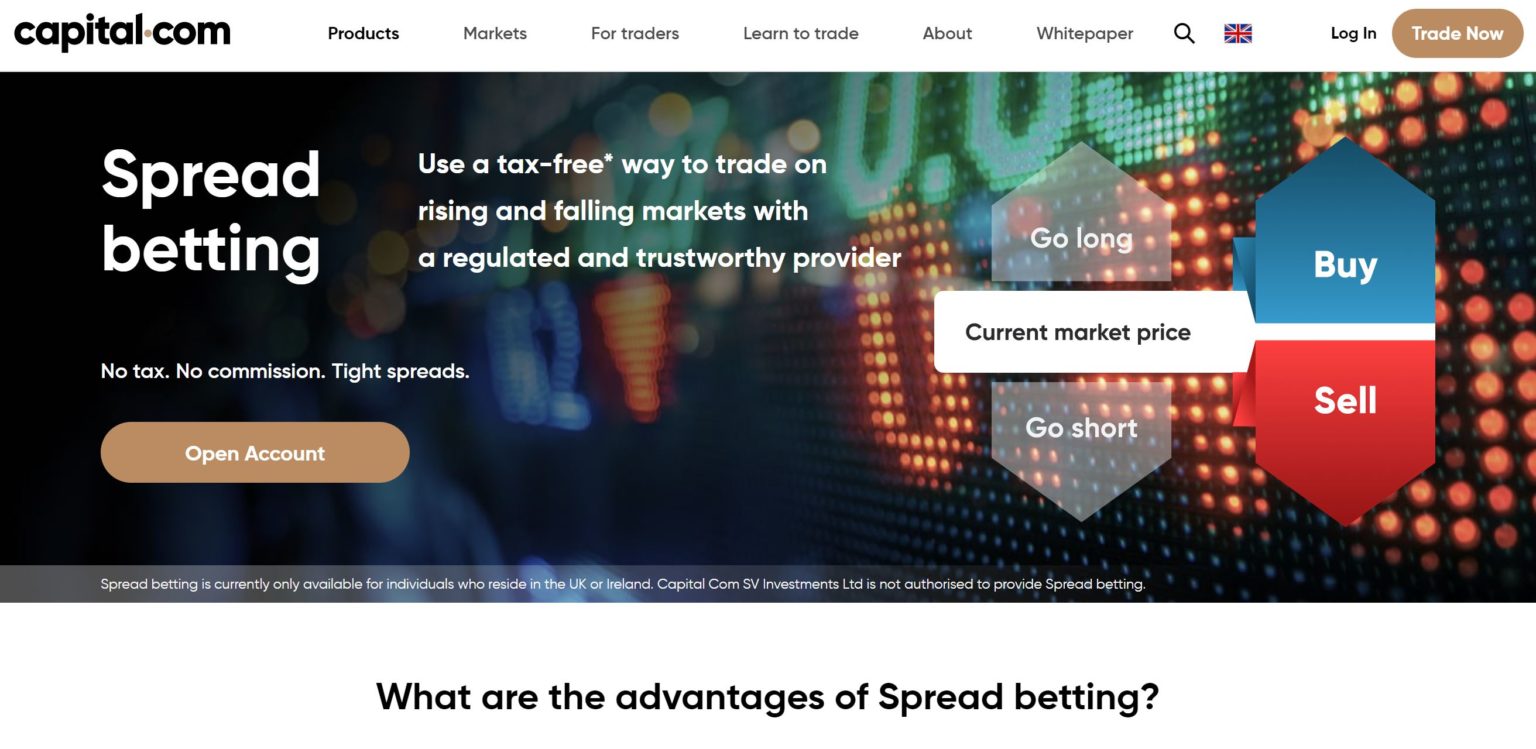

A spread betting broker will accept bets from clients on a value per point movement basis that are structured as trades. For tax purposes these trades are structures as bets so there is no capital gains tax due on profits. Financial spread betting is unique to the UK because of its tax benefits.

goodmoneyguide.com/financial-spread-bett…

Are there any forex brokers that offer spread betting?

Are there any forex brokers that offer spread betting?

Spread betting has been around for a long time, but not all forex brokers have caught up with how popular it is. On top of that, while there are many that offer spread betting, there are plenty of brokers that lack the experience and technology traders really want. Don’t just sign up to the first spread betting broker you come across.

investingoal.com/uk-spread-betting-forex-b…

Which is the best spread betting platform for beginners?

Which is the best spread betting platform for beginners?

As well as MT4’s inbuilt technical indicators, IG Markets offers an add-on package that provides an additional 12 MT4 add-ons. Overall, IG is the best spread betting broker for beginners based on the provider’s trading platform, customer service and range of markets.

www.compareforexbrokers.com/uk/best-spr…

How can I withdraw money from my spread betting account?

How can I withdraw money from my spread betting account?

To deposit and withdraw funds from a trading account, customers can make bank transfers and use a credit card (Mastercard and Visa). As a spread betting and CFD broker, Pepperstone is overseen by the Financial Conduct Authority in the United Kingdom.

www.compareforexbrokers.com/uk/best-spr…

https://www.profitaccumulator.co.uk/news/matched-betting/what-is-spread-betting

Перевести · 02.08.2019 · Spread betting is not restricted to betting on the events of a given match, there are a number of longer-term spread betting markets are available. In the Premier League, for example, a bookmaker will offer a spread on the total points a team will achieve at the end of the season, allowing bettors to buy or sell if they think the prediction is correct or incorrect.

https://goodmoneyguide.com/financial-spread-betting

Перевести · 12.07.2021 · Spread betting in the UK is only possible because there is no capital gains tax on spread betting profits. This does of course mean that you cannot offset spread betting losses, and tax laws can and always will change. Spread betting outside the UK does not exist, as UK spread betters are the only traders that benefit from the tax breaks.

https://investingoal.com/uk-spread-betting-forex-brokers

Перевести · AvaTrade is another of the top forex brokers to also offer spread betting as an option through their dedicated platform. With spread betting being legal in the UK and Ireland, this means that many traders choose AvaTrade as their spread betting broker. They are a well respected Irish broker who are regulated there also.

https://uk.advfn.com/broker-listing/spread-betting

Перевести · IG Spread Betting. The UK’s No.1 spread betting provider by number of active financial spread betting accounts according to Investment Trends UK …

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Spread betting and trading using spread bets, is a high-risk high-reward, and tax-efficient way of speculating on the markets. From spread betting platforms to how to trade and different strategies, this page will break down everything you need to get started. We also list the best spread betting providers 2021 in the top list below.

CFDs and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs.

CFDs and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs.

72.6% of retail investor accounts lose money when trading CFDs with this provider

72.6% of retail investor accounts lose money when trading CFDs with this provider

Spreads from 0.6 on popular markets, and best margin rates in the industry. Spread bet tax free in the UK, across any of 3 trading platforms.

Spreads from 0.6 on popular markets, and best margin rates in the industry. Spread bet tax free in the UK, across any of 3 trading platforms.

Oanda offer spread betting via OANDA Europe Ltd to UK and Ireland residents only. Trade over 100 assets with no commission and no minimum trade size.

Oanda offer spread betting via OANDA Europe Ltd to UK and Ireland residents only. Trade over 100 assets with no commission and no minimum trade size.

IG offer spread betting, CFD and Forex trading across a range of markets. They are FCA Regulated, boast a great trading app and have a 40 track record of excellence.

IG offer spread betting, CFD and Forex trading across a range of markets. They are FCA Regulated, boast a great trading app and have a 40 track record of excellence.

Core Spreads offers easy-access spread betting on US, UK & European equities, plus indices, commodities and forex.

Core Spreads offers easy-access spread betting on US, UK & European equities, plus indices, commodities and forex.

Start leveraged spread betting in 1,000 assets at Trade.com

Start leveraged spread betting in 1,000 assets at Trade.com

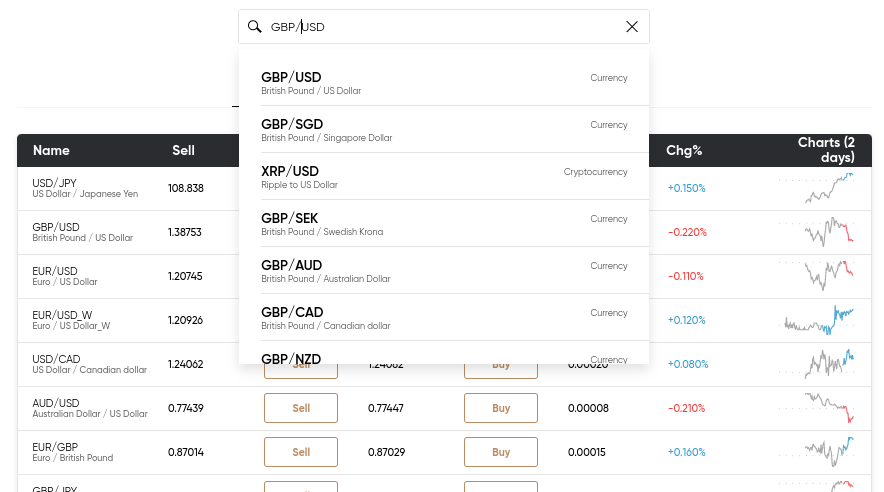

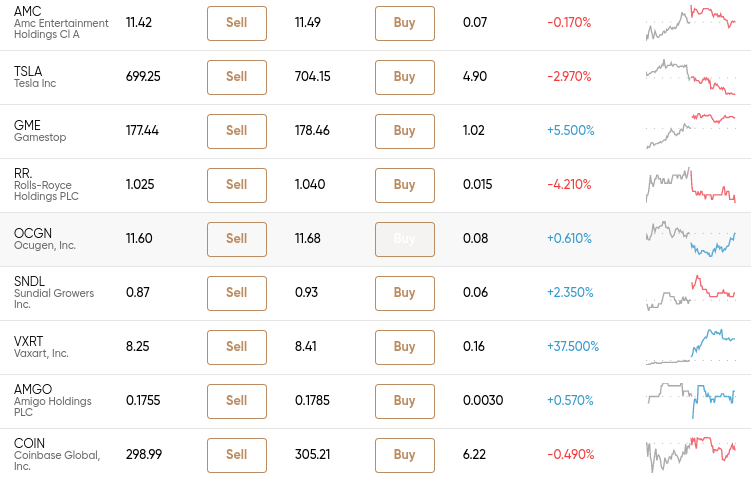

Spread betting is a relatively straightforward method of trading that grants you access to a number of global markets, all through one broker. You can start spread betting on the following:

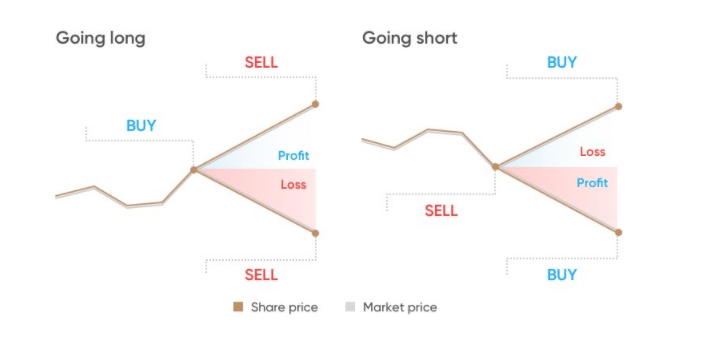

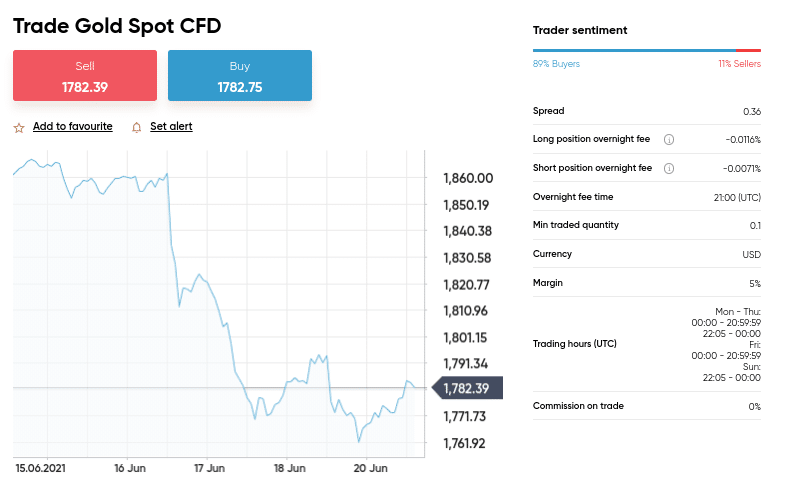

You never actually own an asset when you’re spread betting. Instead, you are simply shadowing the underlying asset you are trading. Investors are speculating as to whether the security’s price will rise or fall, using the prices put forward by the broker.

Spread betting reviews in the UK often brand this type of trading as simply gambling.

However, this is not entirely fair. In the UK, this is an instrument that is fully regulated by the Financial Conduct Authority (FCA).

Switched on spread betters and traders will hone their craft and trade with a similar attitude to those day trading stocks, futures and other traditional instruments.

You trade instead of just laying a bet. Then once the bet is live you will hold your position until the opportune moment arises.

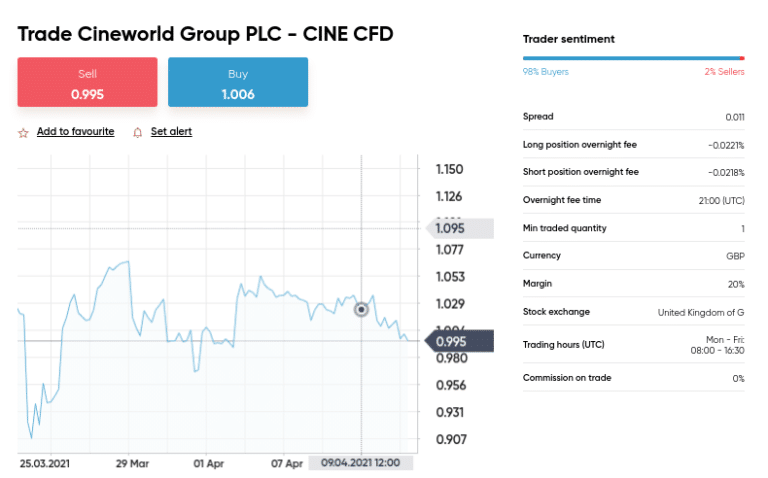

Spread betting firms will offer you a prediction (spread) of where they think a certain share or index will close at a specific time. You will then trade (bet) on the accuracy of that estimation.

So, if you think the prediction is too low, you could ‘buy’ on the price. Alternatively, if you believe the spread is too high, you can ‘sell’.

Let us say that Waitrose opened the day at 325p and you want to trade on short-term movements in their shares. You may see a broker quote 325p to 326p (the spread). However, you believe the share will finish higher, so you buy at £100 per point movement at 326p.

If, at the end of the day Waitrose ends at 330p, that’s four points higher than the firm’s buy price. So, you’d win £400. On the flip side, if Waitrose finished the day two points from the buy price, at 324p, you would lose £200.

Why do an increasing number of people look to make a living spread betting? For several very good reasons. All of which are outlined below.

Spread betting full time as a job could well be worth your while if the following sounds like you:

Despite the long list of spread betting pros, there also exists several cons you should be aware of:

As appealing as it is, spread betting to make a living isn’t always straightforward. So, the most successful spread betting winners are those that go in with their eyes open to the dangers.

Below is a spread betting glossary, where you’ll find a breakdown of all the essential jargon.

If you’re going to start spread betting for a living you’ll need to get familiar with all of the above terms.

Here’s is a simple step-by-step guide to starting your spread betting career.

Your broker will be your gateway to the market via the trading account. They will facilitate your trades and their platform is where you’ll spend numerous hours a day. However, with so many brokers offering a similar service, what should you look for?

For more guidance and a brokers comparison, see our brokers list.

Once your spread betting account is set up and funded, placing a trade is relatively straightforward. You will need to do the following:

You can be the smartest person in every room, but without an effective trading plan, spread betting isn’t worth it. Fund your account without a well planned strategy and it won’t be long before that account is empty.

So, regardless of whether you’re using scalping or moving averages, what makes a successful strategy?

If you’re looking at historical data to predict future fluctuations, then you’re probably going to use charts and patterns. Conduct a thorough broker comparison to make sure their charting tools will meet your requirements. Most platforms today offer all the standard bar, line, and candlestick charts, plus a range of signals.

Some of the more advanced platform offerings will give you additional graphs and features that allow for smarter pattern detection. If you can create charts that paint a clear picture of where the price has been and where it is going, you’ll have that all-important edge over the rest of the market.

If technical analysis strategies like trend reversal, breakout trading, and momentum techniques don’t appeal to you, then you can always buy and sell based on news events. Big corporate moves are often the catalyst for a round of spread betting.

Let’s say, Facebook declares a dividend, which subsequently expires. Some switched on individuals will monitor Facebook’s annual general meetings (AGM), to stay ahead of any potential dividend announcements.

For example, let us pretend Facebook stock was trading at £100 and it declared a dividend of £1. The share price may then start to increase to the level of the dividend. In this example, around £101. You would take a position before this announcement to profit from the price jump. If you took a position of 1,000 shares at £100, with £10 per point move, you’d gain £1,000 * £1 * £10 = £10,000.

An effective spread betting strategy balances profit-and-loss levels. Let’s say Ralph, a trader, wins four spread bets out of five, with an average win rate of 80%.

Ralph also has a friend and fellow trader called Charles, who wins two spread bets out of five, giving him a 40% win rate. It may appear that Ralph is the more successful trader, but this is not necessarily the case. For structuring your bets with advantageous profit levels can seriously enhance your performance.

Let’s say Ralph has taken the position of receiving £10 for each winning bet and losing £40 per each losing bet. Even with an 80% win rate, Ralph’s profits are cleared out by the £40 he loses for just one wrong bet (0.8 * £10 – 0.2 * £40 = £0).

Whereas Charles, takes £25 on each successful bet and drops just £5 per losing bet. So, even with his 40% win rate, Charles will still make a £7 profit (0.4 * £25 – 0.6 * £5). Despite losing 60% of the time, Charles still ends up the winning trader.

An effective strategy, therefore, means more than a high win rate. It requires a system that balances your profit-and-loss levels with your average win rate to consistently stay in the black.

For more guidance and shares strategies, see our strategy page.

Whether you are considering spread betting on currency or any other markets, you can use the above as an effective beginners guide for getting set up.

As Paul Tudor Jones pointed out – “The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge.”

Markets change, as do financial instruments. If you want to stay ahead, you need to change along with them. Fortunately, there exists a multitude of spread betting resources out there. To name just a few:

Whether you’re spread betting, or a CFD day trader, all of the above will help feed you the information you need to start turning a profit. It is those that don’t seek help and advice, when they lack spread betting experience, who end up with disappointing returns.

Spread betting 101 – follow the news. Markets are constantly changing in reaction to news events. That’s why the best spread betting platforms offer live news feeds. You can even find news resourced dedicated to specific markets. Some of the best sources available are as follows:

A spread betting practice demo account is the ideal way to get to grips with the basics. You can identify mistakes, perfect your strategy and get familiar with the trading environment.

It’s also a fantastic way to trial your broker and platform first. Most of the big brokers now provide this service, free of charge. Your account is funded with simulated money, so you don’t have to risk real capital until you are comfortable. What have you got to lose by using a demo account first?

If you want to join the trading hall of fame with the likes of George Soros, you’ll need an effective way of looking back and analysing your past performances and what you traded.

Keeping a spread betting trading journal is a fantastic place to start. You can keep your journal on an Excel spreadsheet, just include all the essential information:

Take a note of this and you’ll find identifying areas for improvement and strategy flaws far easier. Keeping such a dairy is one of the first bits of advice you’ll get in spread betting lessons.

Spread betting millionaires and gurus will have a risk management system they stick to religiously. Entering into the trading arena without such a strategy is the first step towards a series of financial disasters.

Therefore, many suggest never risking more than 2% of your account balance on a single trade. If your balance currently sits at £20,000, you’d never risk more than £400 on a single trade. This will protect you from losing more than you can afford and keep you swinging in the long-term.

Technology has brought with it a world of useful tools, among which is automated trading. Once you have developed an effective strategy and the corresponding algorithm, you can use robots to place your bets following pre-determined criteria. This will allow you to place a much higher volume of trades, across a range of markets.

You can even get automated tax software that keeps a detailed record of all your trades, allowing you to file your tax return at the end of the year with ease.

These algorithms are sophisticated and straightforward to set up. Most importantly though, they will save you considerable time, allowing you to focus your efforts on turning a profit.

It’s important you factor your country’s tax rules into your financial forecasting. In the UK, for example, HMRC deem spread betting tax-free. However, if spread betting is your sole income in 2017, you may find many countries deem it taxable.

If you’re spread betting as non-UK residents, note regulations vary between Australia, India, Malaysia, Ireland, Singapore, Nigeria, Germany, Dubai, Greece, and New Zealand.

So, do your homework and find out if you will be taxed on your profits, and if so, how much. Will it fall under a capital gains tax regime, business income tax, or another?

It’s also worth noting tax avoidance can bring with it severe consequences. Some system’s tax rules impose hefty fines, whilst others could see you face jail time.

For more guidance, see our taxes page.

Spread betting has an ominous name, perhaps undeservedly. However, despite some bad press, there are many out there who have generated life-changing profits with this financial instrument. If you’re looking for inspiration, then read about some of the big wins below.

One whale shorted Facebook when it made its anticlimactic New York Debut in May 2012. The individual believed the stock would fall on the 21st May, and they got it spot on. Shares dipped by $4. An online calculator indicates the person in question made more than $8,000 a point, giving them a total profit of nearly $3 million.

Using IG index, some big hitters cottoned on to a dramatic decrease in price from $1.45 to $1.25 in just 12 months. That 2000 point move saw some individuals selling at $25,000 a point. That’s a total profit of around $50 million.

One switched on individual accumulated £110,000 in earnings, in just 10 seconds, when he bet the Bank of England would slash interest rates by more than 1% in November 2008. The market jumped to 96.31, netting him 51 times his £2120 stake.

So, there are plenty of spread betting kings out there, making an extremely good living. But to answer the question on many people’s lips, spread betting- how much can you make? As the above examples show, some people become millionaires.

Are you wondering whether you should go with spread betting or CFD trading? Both are leveraged instruments, but the tax treatment, amongst others, is not the same. Here we’ll explore

Christy Love Mom Magazine Xxx

Bi Anal Orgy

Old Grannies Cellulite Pussy Belly

Mom S Having A Great Time

Shemale Porno Download Free

The idiot's guide to spread betting - BBC News

Spread Betting 2021 | Tutorial and Best Spread Betting ...

The idiot's guide to spread betting - BBC News

Spread Betting - online-betting.me.uk

Top 10 Spread Betting Brokers | ADVFN

Spread Betting News Uk