Spread Betting Made Easy

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Made Easy

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Spread bet to speculate on rising and falling market prices. Learn how to spread bet in six steps – covering everything from opening an account to making your first trade.

Start trading today. Call 0800 195 3100 or email newaccounts.uk@ig.com . We’re here 24 hours a day, from 8am Saturday to 10pm Friday.

Spread betting is a way to speculate on the future direction of a market’s price. If you expect an asset’s price to rise, you’d open a position to ‘buy’ and if you expect an asset’s price to fall, you’d opt to ‘sell’.

When you spread bet, you’ll be putting up a certain amount of capital per point of movement in the underlying market. Your profit and loss would then be multiplied by this amount to get your final sum.

For example, you thought a stock was going to increase in price so you opened a spread bet for £10 per point. If the stock increases in price by 10 points, you’d have made £100 (10 x 10), but if it decreased by 5 points, you’d lose £50 (50 x 100).

Spread betting is also leveraged, which means you’ll only need to put down a small initial deposit to open a trade. Your end total is then calculated using your full exposure – meaning your profits and losses could be magnified.

Open a live account via our online form – you could be ready to trade in minutes, and there’s no obligation to add funds until you want to place a trade.

Alternatively, you can practise trading first in our risk-free demo account.

A trading plan outlines your motivation, time commitment, goals, attitude to risk, available capital, markets to trade and preferred strategies. Creating one is particularly important if you’re new to the markets as it can help you take the emotion out of your decision making. It will also provide some structure for when you open and close your positions.

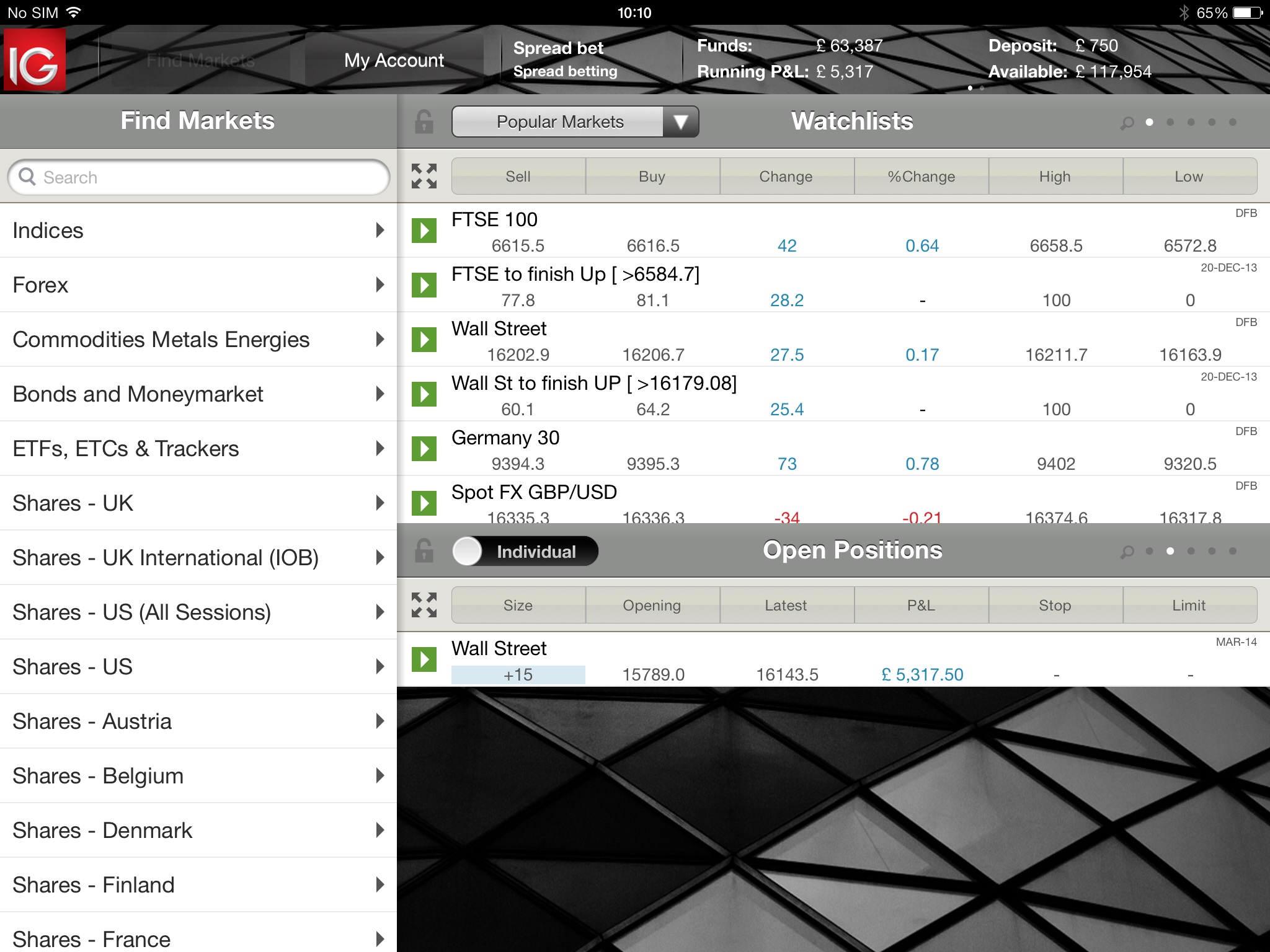

Once you're logged in to our platform or app, you can choose from 17,000 markets, including:

Of course, with so many markets to choose from, it can be difficult to know where to start. That's why we offer a range of tools and resources to help you analyse markets and identify opportunities:

Get technical and fundamental analysis straight from our in-house team

Keep your finger on the pulse with unique price and economic data alerts

Get actionable ‘buy’ and ‘sell’ suggestions based on analysis

Discover price trends using popular indicators such as MACD and Bollinger bands

See a full schedule of macroeconomic events and company announcements

Narrow down your choice of share by fundamentals, location, index and industry sector

Access unique insights including the day's recent activity and client sentiment

Start spread betting on our award-winning suite of platforms, including:

These can all be tailored to suit your trading style and preferences, with personalised alerts, interactive charts and risk management tools.

Find out more about our trading platforms

When you open your platform, you’ll be able to search for a market in the top left corner or browse through each asset class.

After you’ve opened the deal ticket for your chosen market, you’ll need to choose whether to buy or sell the market – depending on whether you think the asset will rise or fall in price. You’ll also need to decide on your bet size, which will determine the margin you pay.

Finally, before you enter the market, it’s important to consider how you’ll manage your risk . Attaching stops or limits to your position will automatically close your trade once it hits a certain level – a stop-loss order can minimise your potential loss, while a limit-close order can help lock in any profits.

Once you’re ready, it’s time to open your trade. You can then monitor the profit or loss of your position in the ‘open positions’ section of the dealing platform.

When you decide it’s time to close your position, you just click ‘close’ to realise your profit or loss.

Whichever market you’re interested in, it’s important to understand how much capital you’re putting at risk. For spread betting, the calculation for this is:

Capital at risk = bet size x market price (in points)

When you spread bet, the market price will be displayed in points. For example, if you were trading a forex pair, instead of a price of ‘1.12980’ you would see a price of ‘11298.0’. So, a trade worth £10 per point of movement, would mean you’re putting a total of £112,980 at risk (11298.0 x 10).

As spread betting is a leveraged product, you will only need to cover the margin as opposed to the full value of the trade. The spread betting calculation for margin is:

Margin = margin factor x total exposure.

For the above example, if the margin factor was 3.33%, you would only have to put down £3762.23 (3.33% x £112,980) to open the trade. Leverage could potentially magnify your profit and loss, as they’re calculated using the full size of your trade – in this case, £112,980 – not just the margin.

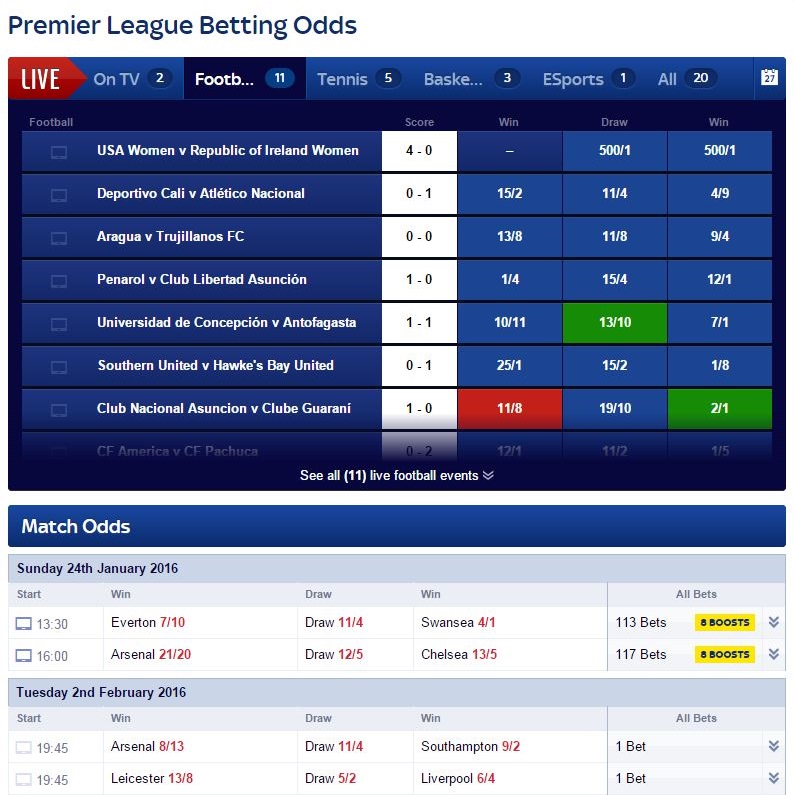

You decide to spread bet on Barclays stock, which is currently trading at 150.25. If there was a one-point spread, you would be presented with a buy price of 150.75 and a sell price of 149.75.

You open a long spread bet position on Barclays, buying at £10 per point of movement at 150.75. If Barclays shares had a margin requirement of 20%, you’d need to deposit £301.50 (£10 x 150.75 x 20%).

Let’s say Barclays shares increased to 170.75, you might decide to close your position to take your profit.

You’d close the spread bet position at the new sell price of 170.25. As the market has moved in your favour by 19.5 points (170.25 - 150.75), your profit would be £195 (19.5 x £10). You won’t pay any tax on your profits. However, you would have to pay funding charges to keep your position open overnight.

However, let’s say shares of Barclays fell instead, down to 130.25, there would be a new sell price of 129.75. As the market has moved against you by 21 points (129.75 - 150.75), you’d be looking at a loss of £210 (210 x £10), plus any additional funding charges.

You decide to spread bet on forex on EUR/USD, which is trading at £1.19129. You think that the dollar is going to rise against the euro, so you decide to sell the currency pair.

As spread betting markets are listed in points, when you enter the platform you would see a market price of 11912.9. And, because of the spread, you would see a sell price of 11912.6 and a buy price of 11913.2.

You open the trade for £15 per point at 11912.6 and as EUR/USD has a margin factor of 3.33%, you’d need to deposit £5950.35 (£15 x 11912.6 x 3.33%).

Say EUR/USD fell to 11890.1, with a buy price of 11890.4 and a sell price of 11889.8. As the market has moved by 22.2 points (11912.6 - 11890.4), you’d have a total profit of £333 (£15 x 22.2). Remember, if you’d kept this position open overnight then your total profit would be lower because of funding charges.

However, let’s say EUR/USD rises instead. So, you’d close your position at the new buy price of 11936.0. As the price has moved against you by 23.4 points (11912.6 - 11936.0), you would have made a loss of £351 (£15 x 23.4), plus any funding charges.

You want to spread bet on the FTSE 100, which has an underlying market value of 7114. We’ll apply a one-point spread, so you can sell it at 7113.5 or buy at 7114.5.

As you anticipate that the FTSE 100 is going to rise, you opt to buy at £10 per point at 7114.5. The FTSE 100 has a margin factor of 5%, you’d only need to deposit £3557.30 (£10 x 7114.5 x 5%).

Let’s say your prediction is correct and the FTSE 100 increases in value. You close your position when the market reaches 7150 – at the new sell price of 7149.5.

As the market moved in you favour by 35 points (7149.5 – 7114.5), your profit would be calculated by multiplying this figure by the amount you’ve bet per point. This gives you a profit of £350 (£10 x 35) minus any funding costs.

However, let’s say the FTSE declined in price, instead of rallying. So, you decide to cut your losses when it hits 7078 – with a sell price of 7077.5.

The market has moved against you by 37 points (7077.5 - 7114.5), giving you a loss of £370 (£10 x 37), plus any overnight funding charges if the position was open for more than one day.

You decide to spread bet on gold, which is currently trading at 1315.70, with a buy price of 1316.00 and a sell price of 1315.40. As you believe the price of gold is due to decline, you open a spread bet to sell the commodity for £30 per point of movement.

Gold has a margin factor of 5%, so you would need to put down £1973.10 (£30 x 1315.40 x 5%) to open the position.

Let’s say the price of gold did fall, down to a new price of 1300.10. You close your position at the new buy price of 1300.40.

As the market has moved in your favour by 15 points (1315.40 - 1300.40), you would be taking a profit of £450 (15 x £30). If you had kept your position open overnight, you would also have funding charges to pay.

However, if you were incorrect and the market price of gold rose instead, to 1335.70, you would have made a loss. You’d close your position, at the new buy price of 1335.40.

As the market has moved against you by 20 points (1315.40 - 1335.40), your total loss for the commodity spread bet would be £600 (20 x £30), plus any funding charges.

If you’re a retail trader, you can spread bet on over 17,000 markets including forex, shares, indices and commodities. Professional traders are also able to spread bet on cryptocurrency markets, but trading crypto derivatives isn’t available to retail traders.

Spread betting is available to anyone who has sufficient knowledge and experience of trading. This will be assessed during the application process for an account with us.

Spread betting can be a useful tool for anyone who wants a range of asset classes, tax-free trading, and the opportunity to speculate on markets that are rising and falling in price. However, if you don’t feel ready to start trading live markets, you can start by building your knowledge with IG Academy’s range of online courses, or trading in a risk-free environment with an IG demo account .

The cost of spread betting depends on the bet size that you choose, how much capital you are willing to put up, and how long you keep your trade open for. Before you start to spread bet, it is important to establish what your parameters for trading are, and how much capital you can afford to risk.

Find out more about IG’s spread betting charges .

To open a new spread betting account with us, you just need to fill out a simple form so that we can establish your previous experience and available funds. This way we can ensure that you get the best trading experience possible.

Our mobile trading apps, state-of-the-art technology and free educational tools make the process of switching your account to us an effortless experience. So, you can be signed up and ready to trade within minutes.

Find out more about spread betting and test yourself with IG Academy’s range of online courses.

Discover the differences between spread betting and CFD trading

Learn about risk management tools including stops and limits

Browser-based desktop trading and native apps for all devices

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

What Is Spread Betting ?

How to Spread Bet on Shares, Forex and More | Spread Bet Calculator | IG UK

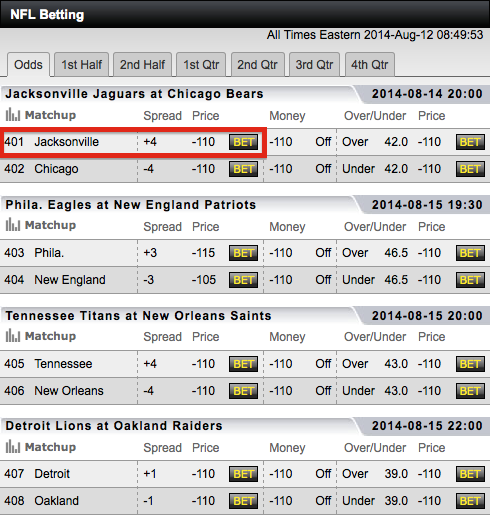

Ease of Understanding - it is often easier to understand spread betting ...

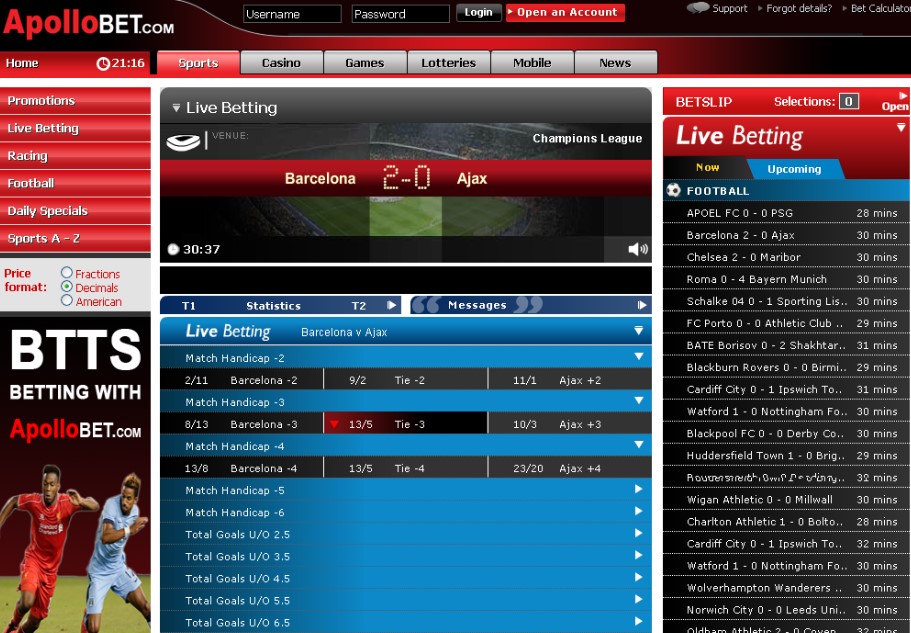

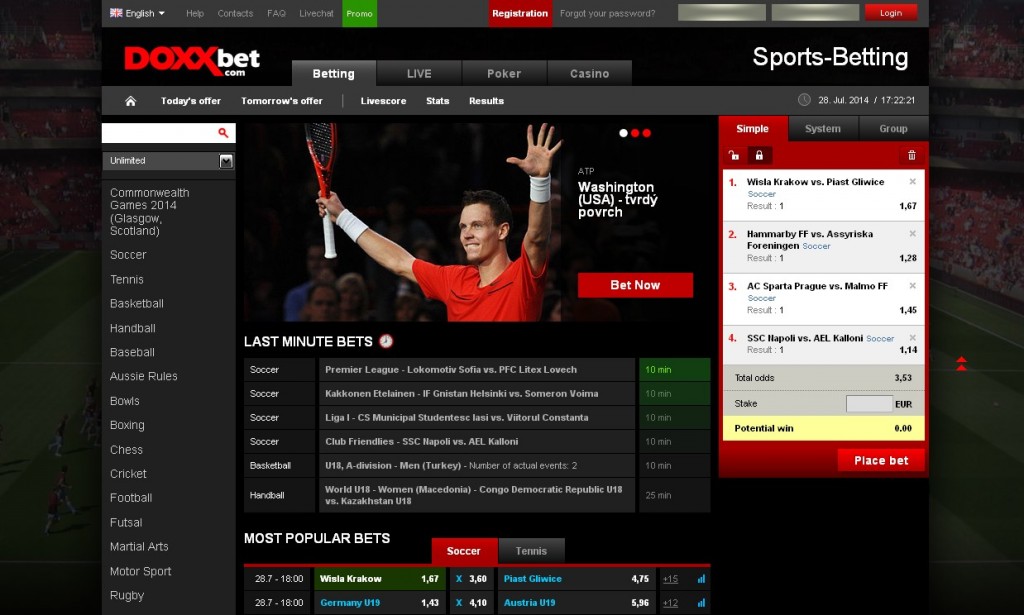

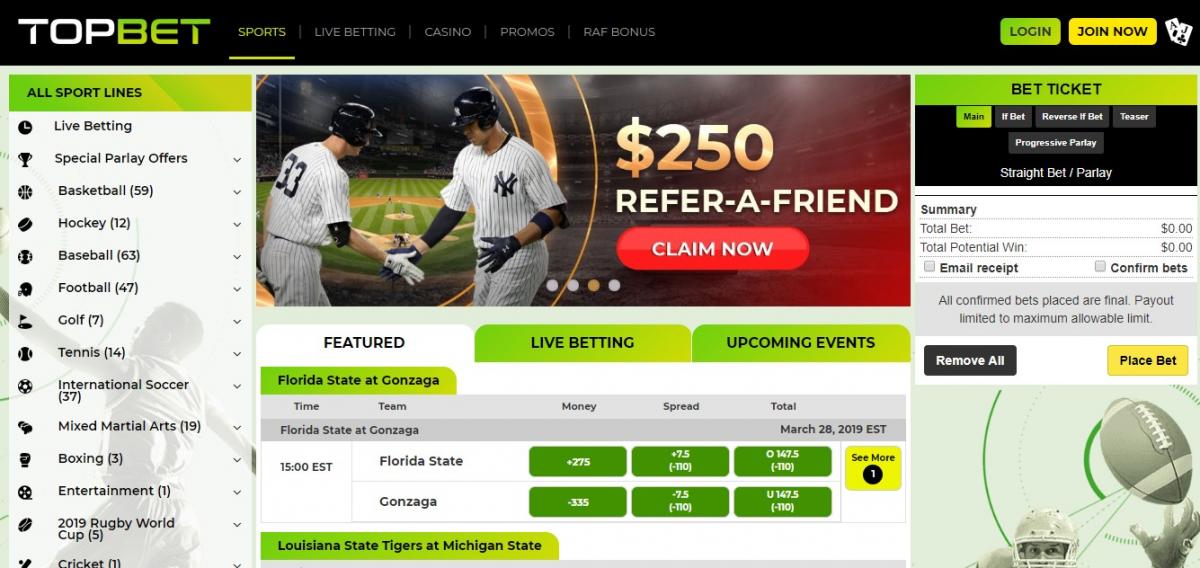

Spread betting in sport | What is spread betting ? | OddsMonkey

What is Spread Betting and How Does it Work? | CMC Markets

What is Spread Betting?

Spread betting is a tax free* cost effective alternative to traditional trading.

It allows you to speculate on the movement of stocks, shares and other assets without using a stockbroker or market maker, which means that you do not have to pay the normal commissions or fees.

We make a 'spread' around a live, underlying market price, e.g. the actual price of gold, and you can bet on whether this market will rise or fall.

This means that you can make a profit from both rising and falling markets, however, if the market doesn't move as planned then you can lose money.

Spread betting, CFDs and margined forex trading are leveraged products which carry a high level of risk to your capital. Please ensure spread betting, CFDs and margined forex meet your investment objectives and, if necessary, seek independent advice. Click here to see the full risk warning notice.

How Does Spread Betting Work?

Spread betting can be an efficient investment option for trading the financial markets.

Not only is it very versatile, allowing you to either go long (buy) or short (sell) a market, it can also help to reduce your trading costs because you do not pay traditional stock broker commissions.

In fact, if you are a UK resident, then your profits are tax free*.

You can also use spread betting as a hedging tool, i.e. to protect investments in an existing portfolio.

Spread Betting Markets

You are not restricted to share trading, you can trade stock market indices like the UK 100, US SPX 500, Germany 30 etc.

You can also spread bet on a wide range of other financial markets like crude oil, gold and forex markets like EUR/USD, GBP/USD etc.

With spread betting you do not have to speculate on the markets moving up in order to make a profit. With spread betting you can also Sell markets i.e. bet on them to go down

What is the "Spread"?

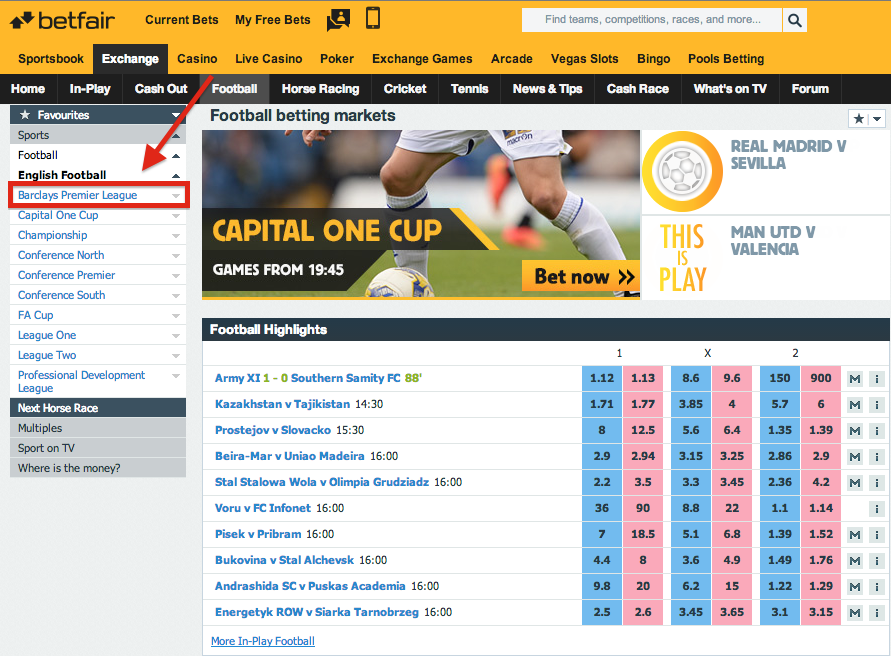

The "spread" in the phrase 'spread betting' refers to the Sell (Bid) and Buy (Offer) price quoted by a spread betting company.

This price is calculated around the live (or the estimated future) market price of a financial product.

For example, if the FTSE 100 is currently trading at 6229 then our quote for the UK 100 might be 6228.5-6229.2, i.e. a 0.7 point 'spread'.

The Sell (Bid) price is the price you would sell at if you thought the market would go down.

Conversely, the Buy (Offer) price is the price you would buy at if you felt that the market would go up.

What are the Benefits of Spread Betting?

Wide Range of Markets - spread betting allows investors access to many markets that were previously restricted to institutions, banks and wealthy investors - read more

No Commissions or Broker's Fees - read more

Trading on Margin - you can start trading with a small amount of capital. Leveraged trading certainly has it's advantages but it's important to remember that it's classed as high risk - read more

Tax Free Profits* - gains are tax free. Unlike share trading or CFD trading where your gains are potentially taxed at your current income tax rate, spread bets are not subject to capital gains tax - read more

The Risks of Financial Spread Betting

Do Not Forget the Downside

Although you can make substantial profits from spread betting, if the markets move against your bet, your losses can also be substantial.

Spread betting, CFDs and margined forex trading are leveraged products which carry a high level of risk to your capital. You should ensure spread betting, CFDs and margined forex meet your investment objectives and, if necessary, seek independent advice. Click here to see the full risk warning notice.

Note that you can use Stop orders and Guaranteed Stop orders to help reduce your downside.

With our standard FinancialSpreads+ accounts, Stop orders are automatically added to each trade. With Financial Spreads MT4 accounts, Stop orders are not automatically added to each trade however, we recommend that you add a Stop order manually.

With any account, if a Stop order is triggered it is subject to market gaps unless you specified for your Stop order to be guaranteed.

What Markets Can I Spread Bet on?

One of the problems for spread betting companies is the word 'betting' as it can often provide a false impression to the marketplace.

Spread betting is in fact a highly adaptable trading tool.

With a Financial Spreads account, we offer spread betting markets on more than 1,000 global assets including:

World Stock Market Indices

UK 100

Germany 30

Wall Street

US 500

Japan 225

Other International Indices

Individual Shares

UK Stocks

US Stocks

Other International Stocks

Foreign Exchange Pairs

Majors - USD/JPY , EUR/USD , GBP/USD etc

Minors

Exotics

Commodities

Metals - gold , silver

Energies - Brent crude oil , US crude oil ,

Brent/US crude differential

Also see:

Contact

Website Terms & Conditions

Privacy Policy

About Us

Press Releases

Spreads

Typically 70-80% of retail investors lose money when trading CFDs and spread bets. You should consider whether you can afford to take the high risk of losing your money.

† Spreads in market hours. * Tax treatment depends on the individual circumstances of each client and may change in the future.

The information and comments provided herein should not be considered as an offer or solicitation to invest. Under no circumstances should anything herein to be construed as investment advice. The information provided is believed to be accurate at the date the information is produced.

The information on this site is not directed at residents of the United States or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Apple, iPad and iPhone are trademarks of Apple Inc. which are registered in the USA and other countries. App Store is a service mark of Apple Inc., Android is a trademark of Google Inc., and Google Play is a trademark of Google Inc.

© Copyright Financial Spreads 2007-2021. All rights reserved.

Prices shown are delayed by 15 minutes, indicative only, and subject to our website terms and conditions .

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced.

6268.0 (the sell price) - 6269.0 (the buy price)

You can take a position on this UK 100 Rolling Daily market (which has a 1 point spread) to move:

Above 6269.0, or

Below 6268.0

This is a Rolling Daily spread bet which means that there is no expiry date. If you don't close your trade and the trading session ends then your position will automatically roll over into the next trading day.

Note that if a trade rolls over then you will normally either be charged or receive a small fee for overnight financing based upon whether you are speculating on the market to fall or rise. For more information also see Rolling Spread Betting .

Spread bets on the UK 100 market are made in £x per point.

Where a point is 1 point of the index's price movement.

E.g. if the UK 100 changes by 30 points then you would win / lose 30 multiples of your stake.

You decide how much you want to trade per point, e.g. £1 per point, £4 per point, £20 per point etc.

If you decided on a stake of £3 per point and the UK 100 moves by 24 points, you would lose/win £3 per point x 24 points = £72.

The UK 100 to go:

Above 6269.0? or

Below 6268.0?

You Select Your Stake Size, Opting for

You make a profit of £2 for each point the UK 100 moves above 6269.0

You make a loss of £2 for every point the UK 100 falls below 6269.0

If You Are Betting on a Market to Increase Your Profits/Losses =

(Closing Price - Opening Price) x stake

The UK 100 climbs to 6325.9 and so our financial spread betting market is adjusted and moved to 6325.4 - 6326.4, i.e. the market moves to:

At this point, you may opt to let your spread bet run or close it, i.e. close your trade for a profit. In this example you choose to close your position. To close your trade you simply place a bet in the opposite direction (with the same stake size). So to close this £2 buy trade you place a £2 sell trade. The reality is slightly less confusing because when you are logged in, you can simply click the 'Close' button.

(Closing Price - Opening Price) x stake

The UK 100 drops and the Financial Spreads market becomes 6218.8 - 6219.8, therefore you would see this on our platform:

You may decide to keep your trade open or close it, i.e. close your trade to limit your losses. In this case you decide to close your trade by selling the market at 6218.8.

(Closing Price - Opening Price) x stake

You Now Decide Whether to Go Long or Short

The UK 100 to push:

Above 6269.0? or

Below 6268.0?

You Select How Much to Risk, Let's Assume You Opt For

You make a loss of £3 for every point the UK 100 moves higher than 6268.0

You make a profit of £3 for every point the UK 100 goes lower than 6268.0

When Going Short of a Market Your Profits/Losses =

(Opening Price - Closing Price) x stake

The UK 100 falls to 6222.4 and so our spread betting market is adjusted to 6221.9 - 6222.9, therefore you'd see:

You can choose to let your spread bet run or close it and lock in your profit. In this example you choose to close your position by buying at 6222.9.

(Opening Price - Closing Price) x stake

The UK 100 increases and the spread trading market adjusts and moves to 6307.1 - 6308.1, i.e.

You can decide to let your trade run or close it, i.e. close your position to limit your losses. In this example you decide to close your trade and therefore buy the market at 6308.1.

(Opening Price - Closing Price) x stake

Sissy Lingerie

Private Beauty

Asian Sex Massage Hd

Monique Alexander Double Penetration

Massage 19 Porn