Spread Betting Leverage Uk

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

What is the number one mistake traders make?

We reveal the top potential pitfall and how to avoid it

Learn from data gleaned from over 100,000 IG accounts

Discover how to stick to your plan and increase chances of success

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

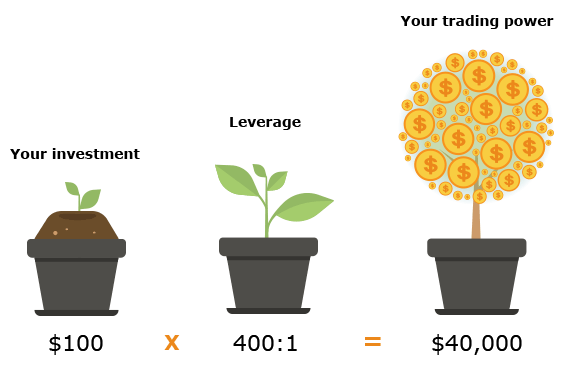

Leverage enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade. Leveraged products, such as spread betting and CFDs, magnify your potential profit – but also your potential loss.

Interested in spread betting with IG?

Call 0800 195 3100 or email newaccountenquiries.uk@ig.com to talk about opening a trading account. We’re available from 8am to 6pm (UK time), Monday to Friday.

Leverage is a key feature of CFD trading and spread betting, and can be a powerful tool for a trader. You can use it to take advantage of comparatively small price movements, ‘gear’ your portfolio for greater exposure, or to make your capital go further. Here’s a guide to making the most out of leverage – including how it works, when it’s used, and how to keep your risk in check.

Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you’re putting down a fraction of the full value of your trade – and your provider is loaning you the rest. Your total exposure compared to your margin is known as the leverage ratio . For example, let’s say you want to buy 1000 shares of a company at a share price of 100p. To open a conventional trade with a stockbroker, you would be required to pay 1000 x 100p for an exposure of £1000 (ignoring any commission or other charges). If the company’s share price goes up by 20p, your 1000 shares are now worth 120p each. If you close your position, then you’d have made a £200 profit from your original £1000.

If the market had gone the other way and shares of the company had fallen by 20p, you would have lost £200, or a fifth of what you paid for the shares.

Or you could have opened your trade with a leveraged provider, who might have a margin requirement of 10% on the same shares.

Here, you’d only have to pay 10% of your £1000 exposure, or £100, to open the position.

If the company’s share price rises to 120p, you would still make the same profit of £200, but at a considerably reduced cost.

If the shares had fallen by 20p then you would have lost £200, which is twice your initial deposit.

The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset itself.

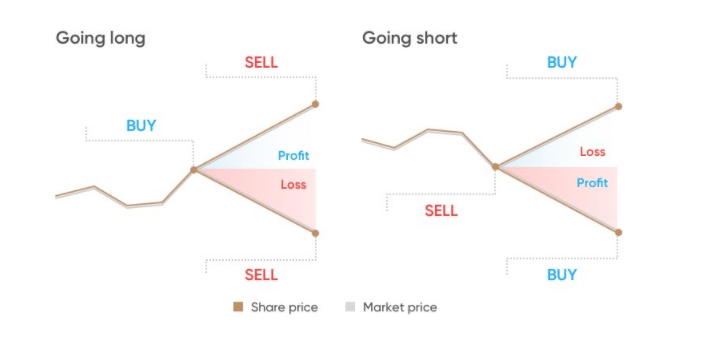

A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction – but more loss if it goes the other way.

An agreement with a provider to exchange the difference in price of a particular financial product between the time the position is opened and when it is closed.

Visit spread betting vs CFDs to learn more about the differences between these products.

There are lots of other leveraged products available, such as options , futures and some exchange traded funds (ETFs) . Though they work in different ways, all have the potential to increase profit as well as loss.

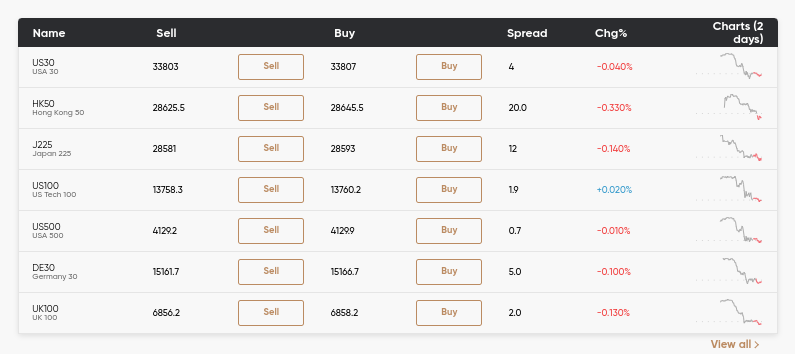

Some of the markets you can trade using leverage are:

Provided you understand how leveraged trading works, it can be an extremely powerful trading tool. Here are just a few of the benefits:

Though spread betting, CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential downside of using such products as well. Here are a few key things to consider:

Leveraged trading can be risky as losses may exceed your initial outlay, but there are numerous risk-management tools that can be used to reduce your potential loss, including:

Attaching a stop to your position can restrict your losses if a price moves against you. However, markets move quickly and certain conditions may result in your stop not being triggered at the price you’ve set.

These work in the same way as basic stops, but will always be filled at exactly the level you’ve set, even if gapping or slippage occurs. If your stop is triggered, there will be a small premium to pay in addition to normal transaction fees.

UK regulation ensures you cannot lose more than the equity available on your account. If your balance does go negative, we’ll bring it back up to zero at no cost to you. 1

Using stops is a popular way to reduce the risk of leverage, but there are numerous other tools available – including price alerts and limit orders.

Leverage ratio is a measurement of your trade’s total exposure compared to its margin requirement. Your leverage ratio will vary, depending on the market you are trading, who you are trading it with, and the size of your position.

Using the example from earlier, a 10% margin would provide the same exposure as a £1000 investment with just £100 margin. This gives a leverage ratio of 10:1.

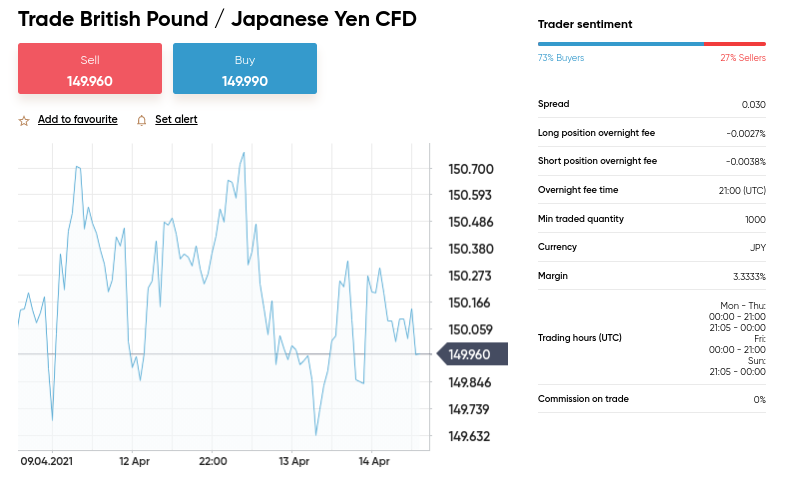

Often the more volatile or less liquid an underlying market, the lower the leverage on offer in order to protect your position from rapid price movements. On the other hand, extremely liquid markets, such as forex, can have particularly high leverage ratios.

Here’s how different degrees of leverage affect your exposure (and thus profit potential and maximum loss) for an initial investment of £1000:

When researching leveraged trading providers, you might come across higher leverage ratios – but using excessive leverage can have a negative impact on your positions.

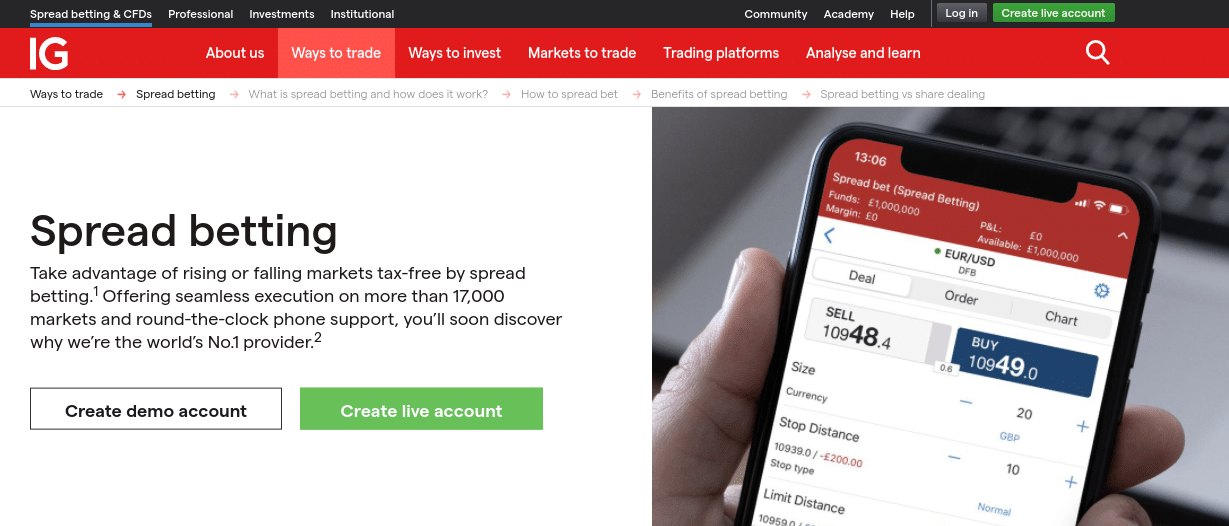

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade on the move with our natively designed, award-winning trading app

With 45 years of experience, we’re proud to offer a truly market-leading service

Take control of your trading using a range of risk management tools

Take advantage of rising and falling markets by spread betting with IG

Open a CFD account with IG and access thousands of financial markets

1 Negative balance protection applies to trading-related debt only and is not available to professional traders.

Interested in opening an account? Contact 0800 195 3100 or newaccountenquiries.uk@ig.com

Want to check on your application’s progress? Email newaccounts.uk@ig.com

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Home » UK Brokers » Best Spread Betting Platforms UK

78.2% of retail CFD accounts lose money

73% of retail investor accounts lose money when trading CFDs with this provider

77% of retail investor accounts lose money when trading CFDs with this provider.

73% of retail CFD accounts lose money

76.14% of retail CFD accounts lose money

$50 depending on payment method) Standard Account $25,000 Active traders

Commission rebates for active traders

Excellent performance and slippage metrics supplied

Spread Betting: Standard Account, No Commission Spreads

FXCM Spread Betting: Standard Account, No Commission Spreads

FXCM Active Trader: Standard Account, No Commission Spreads

The top spread betting FCA regulated brokers with great trading platforms and lowest spreads were compared. The best spread betting company for each type of UK trader was found based on September 2021 factors including fees.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

The best UK spread betting platforms in 2021 are the following.

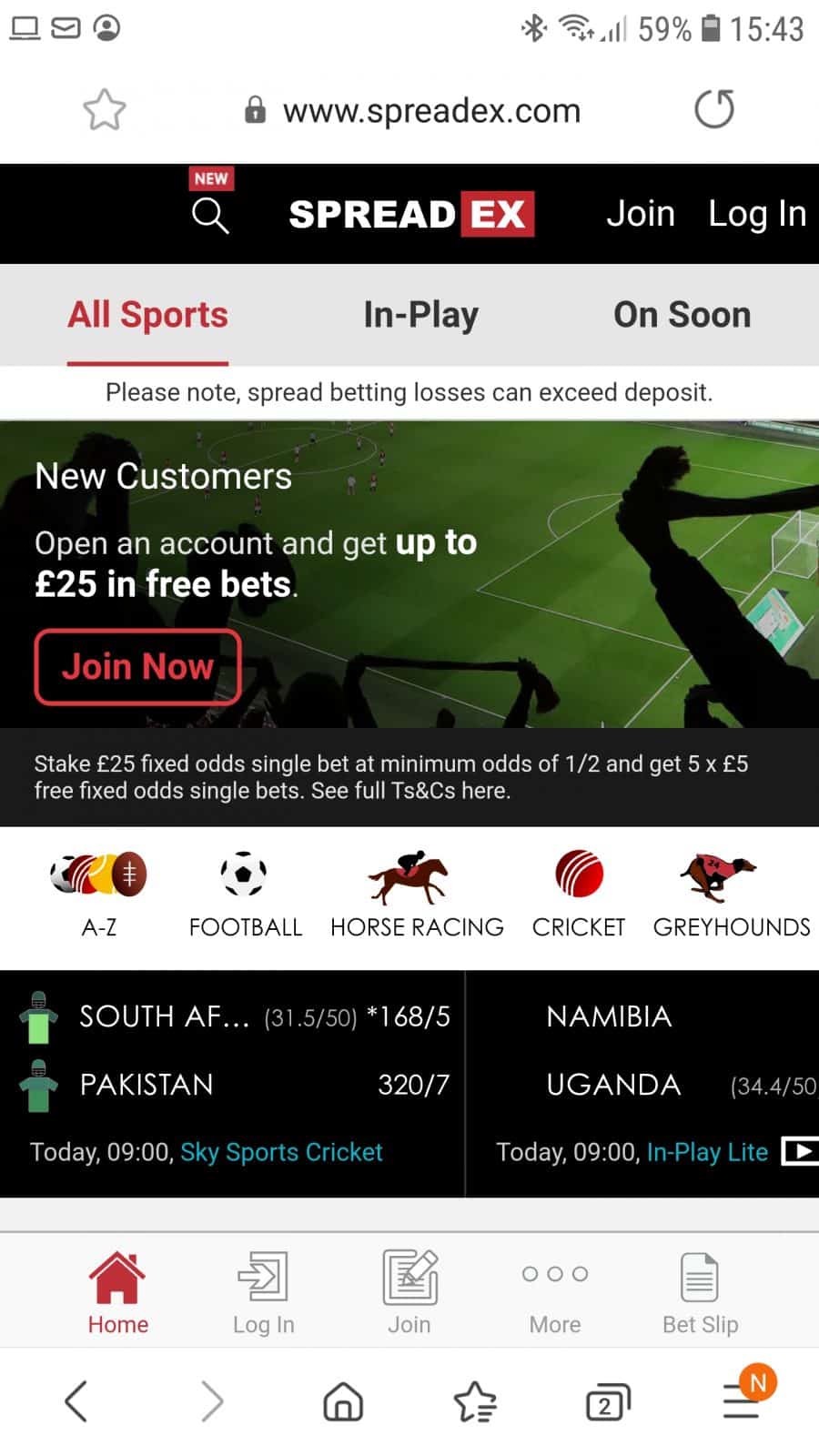

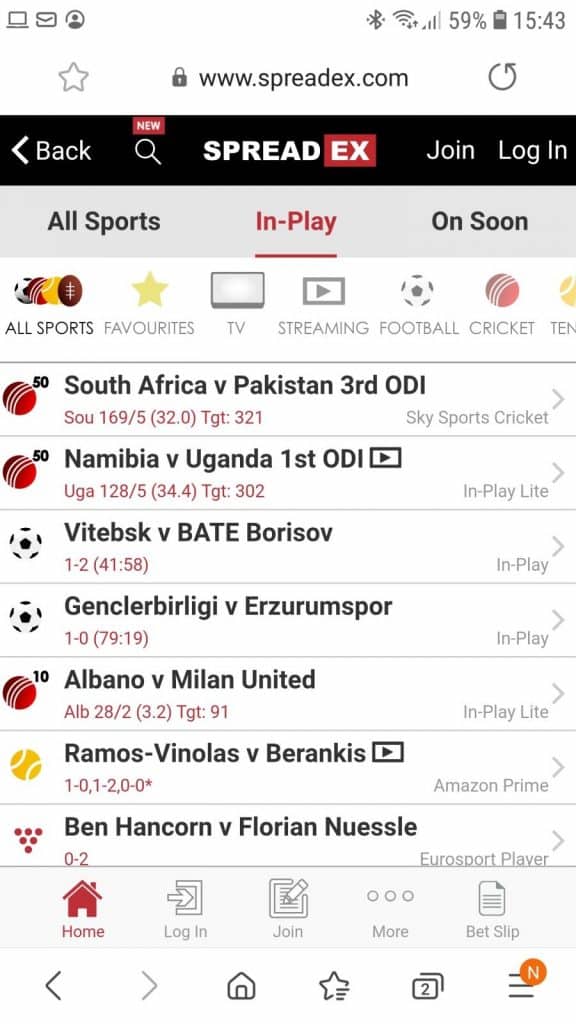

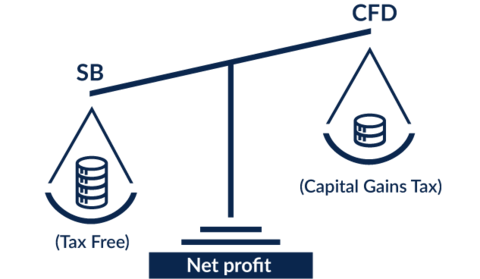

Spread betting and CFD trading are similar in the sense that investors are trading leveraged products and speculating on the direction a financial market will move.

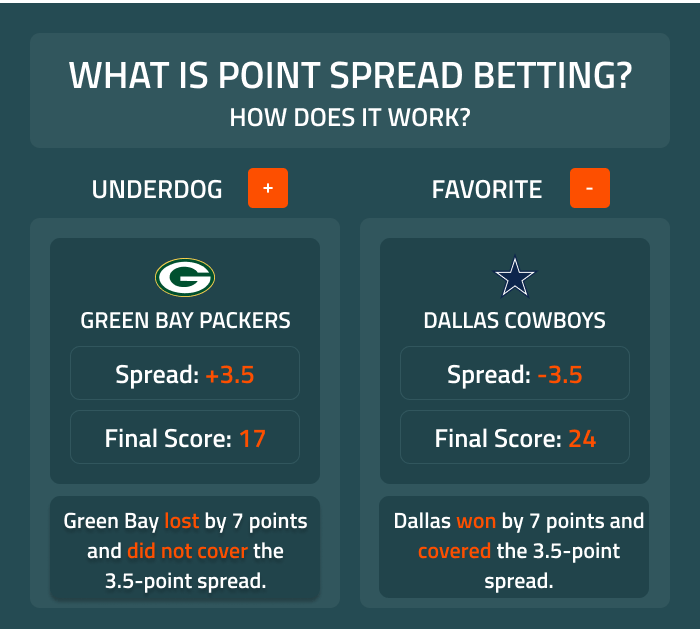

The main difference is that when spread betting, a trader is not buying and selling a derivative contract. Rather, traders bet on price movements, deciding on the amount to bet per point of price movement. Spread betters decide the ‘stake’ per price movement they wish to trade, with profits being made when the market moves in favour of the bet.

When compared to CFD trading, spread betting is more tax efficient. UK tax laws mean any gains made from CFD trading are subject to Capital Gains Tax (CGT). As spread betting involves no contracts, profits avoid both stamp duty and Capital Gains Tax, which means it can be considered a tax-free trading strategy.

When spread betting forex, traders do not pay any flat-rate commission and therefore bet on spreads available to those using Pepperstone Standard account.

With the Standard account, Pepperstone offers minimum spreads as low as 1.0 pips on major currency pairs such as the EUR/GBP, AUD/JPY, AUD/USD, CHF/JPY, CHF/SGD and EUR/USD. The table below shows the average spreads for major currencies available to spread bet with Pepperstone. Compared to brokers such as CMC Markets and FxPro, Pepperstone offers tighter average spreads on a wider range of fx pairs than its competitors.

Data taken from broker website. Accurate as at 01/09/2021

Pepperstone is a no dealing desk broker with the main benefits including:

Pepperstone gained its reputation as one of the best brokers for ultra-tight forex spreads due to its NDD execution and top-tier liquidity providers. Although they don’t offer specific investment advice, the brokers offer educational resources suited to both beginner and experienced traders. While cryptocurrencies were available in the past, recent changes to FCA regulation have restricted the ability of retail traders to access crypto markets such as Bitcoin or Bitcoin cash.

When spread betting with Pepperstone, customers can choose between MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. Both platforms offer a good range of financial instruments as well as various technical analysis tools to develop spread betting trading strategies. Trading tools and features available on both MT4 and MT5 include:

MT4 and MT5 are available as desktop platforms, web trader platforms or mobile and tablet spread betting apps that are compatible with iOS and Android devices.

Before spread betting with real money, traders can sign up for Pepperstone’s demo account that is available with both MetaTrader 4 and MetaTrader 5. To start trading with real money, a Pepperstone spread betting account can easily be opened online with no initial minimum deposit , although the broker recommends depositing at least £200. To deposit and withdraw funds from a trading account, customers can make bank transfers and use a credit card (Mastercard and Visa).

As a spread betting and CFD broker, Pepperstone is overseen by the Financial Conduct Authority in the United Kingdom. The FCA ensures brokers follow UK regulation and that retail investor accounts are receiving a fair brokerage service. While Pepperstone’s Australian subsidiary is regulated by the Australian Securities and Investments Commission (ASIC), spread betting is not permitted in Australia and even outside the UK.

The overall rating is based on review by our experts

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investors lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

FXCM is one of the largest brokers to offer spread betting. Choosing FXCM comes with a number of strengths. These include

FXCM gives you a choice of two trading accounts for spread betting. The first is the retail spread betting account, the second is the active trader account.

The FXCM retail spread betting account works the same as their CFD trading account. This means you get the same spreads you would if you were trading CFD financial instruments such as Forex, Shares, Indices, and other products FXCM offer.

FXCM does not charge commissions which means the markup is included as part of the spread. Spreads for the FXCM account are as follows:

Data taken from broker website. Accurate as at 01/09/2021

If you are after the tightest spreads for spread betting, then you should consider the Active Trader account. Active Traders is only for the serious trader who is prepared to bet in high volumes.

To qualify for an active trader account you will need to bet or trade a monthly notional volume of at least 150 million and maintain equity above $25,000. While spreads are tighter there are commission costs you will have to pay (which is unusual for a spread betting account).

For every $1 million you bet, you will pay $25 in commission when you open and close your bet.

Other benefits of the Active trader account include:

The following table lists the average spreads FXCM offer for Active Traders:

Data taken from broker website. Accurate as at 01/09/2021

Choosing FXCM means you get a large and diverse range of financial instruments you can use for trading. Products include:

One of the major features is the range of shares FXCM. Spread betters are not restricted to shares from the US NASDAQ or NYSE like many other brokers only offer but shares across multiple markets. This means you not only can bet on popular shares based in the US like Facebook, Zoom, Microsoft, Alphabet (Google), and Tesla but also shares in other markets such as AstraZeneca and BP.

In addition to shares, FXCM also offers trading baskets. Available baskets include forex baskets and stock baskets. Trading baskets are a compilation of common assets grouped to form a kind of index.

There are 3 Forex Baskets available. These are The Dow Jones Dollar Index Basket (US Dollar), The JPY Basket which is called the YES index, and the EM Basket or Emerging Markets Index.

The difference between each index is the number of currencies that make up the index.

The other trading baskets consist of stocks ground by a particular theme. Examples include FAANG which compiles stocks of the 5 biggest I.T. companies on the US Stock exchange and US Automotive (US.AUTO) which consists of 5 of the largest automobile companies on the US stock exchange.

FXCM gives you a choice of 2 trading platforms for Spread betting. These are Trading Station Web and MetaTrader 4.

Trading Station Web is FXCM’s in-house developed trading platform built following feedback from FXCM clients. The platform was recently updated using HTML5 making it suitable for Windows and Mac browsers and is also available for Android and iOS mobiles.

Features of Trading Station include:

1 As per FXCM’s Spread Report (Q1 2021)

²FXCM can be compensated in several ways, which include but are not limited to adding a mark-up to the spreads it receives from its liquidity providers, adding a mark-up rollover, etc. Commission-based pricing is applicable to Active Trader account types

3 Cryptocurrency Products are currently not available to retail clients residing in the UK

4 Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. It can also just as dramatically amplify your losses. Trading foreign exchange/CFDs with any level of leverage may not be suitable for all investors.

Markets.com is one of the best brokers that is regulated by the FCA (Financial Conduct Authority) which allows you to spread bet. They have a wide range of platforms to offer including their top-tier proprietary platform Marketsx and the most popular MetaTrader 4 & 5 available.

Markets.com offers you some of the most competitive spreads compared to a lot of the brokers on the market. While they do not display their average spreads on their website like the majority of other brokers, we had our skilled analysts look at some of their live spreads. As can be seen below, their live spreads are some of the lowest in the industry with EUR/USD being 0.60 pips and EUR/JPY being 0.70. This can be compared to FXCM’s spreads of 1.30 & 2.10 for the same pairs.

Markets.com has the widest range of platforms that offer spread betting for their UK and Ireland residents. Their own platform Marketsx is one of the most advanced platforms that offers over 200 different assets ranging from forex currency pairs to blended stock baskets.

Marketsx is your all-in-one trading platform offering a multitude of features. Trading has been made easy with Markets.com’s range of tools including technical, sentimental, and fundamental analysis to help you make the most informed decision. Marketsx includes advanced charting features as well including indicators, multiple time periods, and oscillators to give a better view of the financial markets.

If you want a platform that is used by most traders around the world, then the MetaTrader platforms are the best option. Some of their main features are listed below:

Markets.com offers one of the best knowledge centers for anyone to

https://www.ig.com/uk/risk-management/what-is-leverage

https://www.compareforexbrokers.com/uk/best-spread-betting-platforms/

Porn Video Miyabi Kayy Hd 21 Naturals

Fuck Mom While Dad

Lesbians Video Tv

What is Leverage in Trading? | IG UK

UK Best Spread Betting Platforms: The Complete List (2021)

Spread Betting UK | What Is Spread Betting? Full 2021 Guide

Spread Betting UK - Open a Spread Betting Account ...

Best Spread Betting Platform UK 2021 - Trading Platforms UK

Spreads and Margin | Leverage Trading | Margin & Leverage ...

Open a Spread Betting Account with the UK's Best Platform ...

Best Spread Betting Platform UK - Top 7 Brokers Compared

Top 10 Best UK Spread Betting Brokers 2021 [UK Spread Betting]

Spread Betting Leverage Uk