Spread Betting Leverage Uk

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

РекламаНаучитесь составлять эффективные прогнозы и управлять линиями. Скидка до -30%! · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

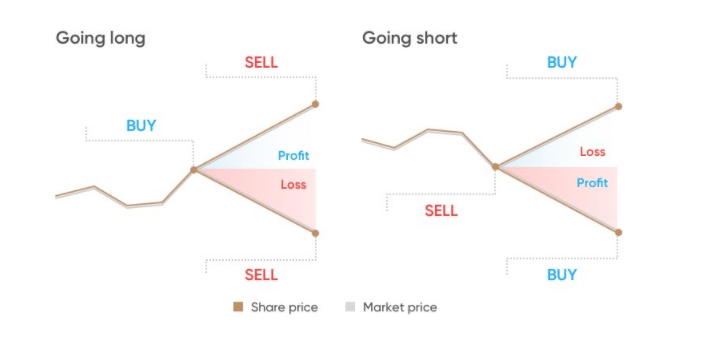

The main leveraged products are: Spread betting (UK only) A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction – but more loss if it goes the other way. Contracts for difference (CFDs)

www.ig.com/uk/risk-management/what-is-leverage

What do you need to know about spread betting?

What do you need to know about spread betting?

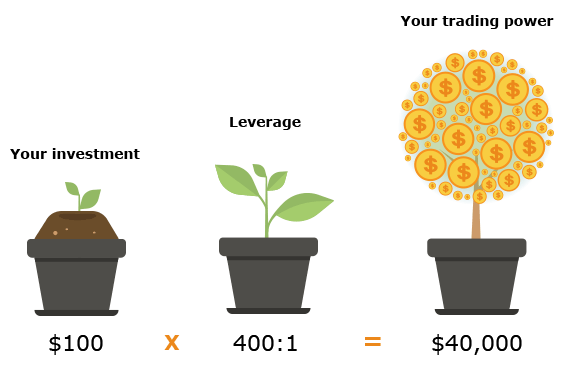

What is margin and leverage? When you trade using a Spread Betting account, you trade on leverage, which allows you to gain a larger market exposure than may otherwise be possible with more traditional forms of investing.

www.cityindex.co.uk/spread-betting/margin …

What does leverage mean in a spread betting account?

What does leverage mean in a spread betting account?

Leverage means you can open a position with a small deposit (margin) instead of paying the full value of your position. Loss and profit are still calculated based on the full position size and can substantially outweigh your margin.

Who is the best spread betting broker in the UK?

Who is the best spread betting broker in the UK?

As a spread betting and CFD broker, Pepperstone is overseen by the Financial Conduct Authority in the United Kingdom. The FCA ensures brokers follow UK regulation and that retail investor accounts are receiving a fair brokerage service.

www.compareforexbrokers.com/uk/best-spr…

How to open a leverage trading account in the UK?

How to open a leverage trading account in the UK?

Call 0800 195 3100 or email newaccounts.uk@ig.com to talk about opening a trading account. We’re here 24 hours a day, from 8am Saturday to 10pm Friday. Leverage is a key feature of CFD trading and spread betting, and can be a powerful tool for a trader.

www.ig.com/uk/risk-management/what-is-le…

https://www.cityindex.co.uk/spread-betting/margin-and-leverage

Spread betting leverage explained. Spread betting is a leveraged product. This means that you only need to deposit a small fraction of the overall value of any trade, known as margin. For example, if the margin …

https://www.ig.com/uk/risk-management/what-is-leverage

The main leveraged products are: Spread betting (UK only) A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction – but more loss if it goes …

https://www.compareforexbrokers.com/uk/best-spread-betting-platforms

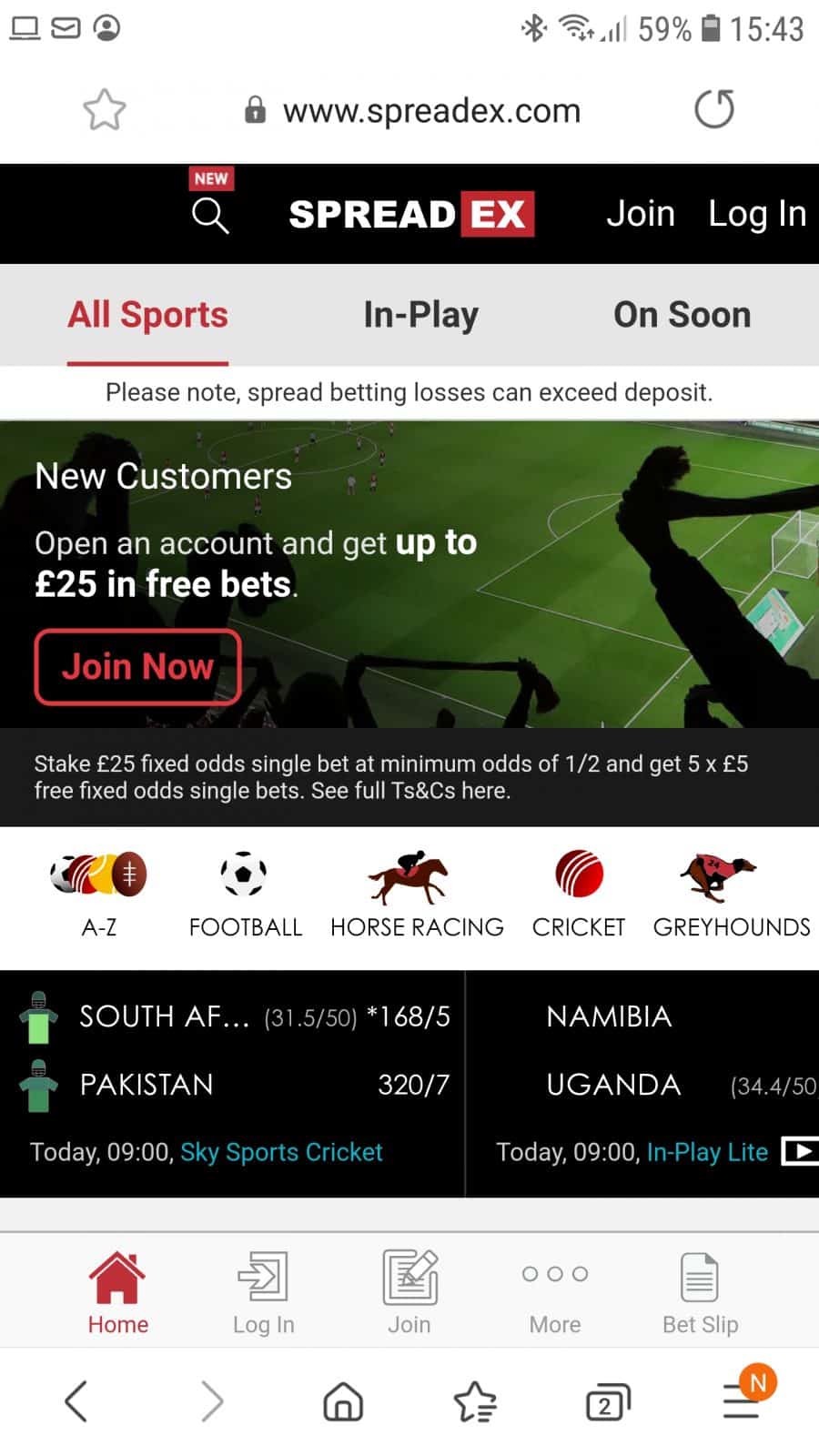

02.08.2021 · Unlike sports spread betting, financial spread betting involves leverage allowing UK traders to trade on market volatility. Below are the main elements to understand if your considering this trading type. What Is Spread Betting?

https://www.economywatch.com/uk/spread-betting

An additional benefit that the best spread betting UK brokers offer is leverage. In a nutshell, leverage allows you to trade with more money than you have deposited in your trading account. Leverage is usually displayed …

https://tradingplatforms.com/uk/spread-betting

08.03.2021 · You can also spread bet with leverage – meaning you can trade with more than your account balance permits. As per UK regulations, this is capped at 1:30 on major forex pairs and less on other assets.

ETX Capital Review - UK Spread Betting Company

How much leverage do you normally apply?

Opening a Live Spread Betting Account!? THINGS to KNOW ❗

CFDs versus Spread Betting and MetaTrader

ETX Capital Review - Spread Betting Company

https://www.oanda.com/uk-en/trading/spreads-margin

We offer clients the ability to trade with leverage. This means that you can enter into trades larger than your account balance and trade without depositing the full value of the trade that you wish to open. One of the benefits of trading with leverage …

https://buyshares.co.uk/spread-betting-brokers

20.08.2021 · FXCM – 100% Commission-Free UK Spread Betting Broker FXCM is an online trading platform that offers two key markets – CFDs and spread betting. It’s one of the best forex brokers in the UK …

https://brokernotes.co/compare-spread-betting-brokers

Best Spread Betting Platform UK. Another UK broker, City Index’ Spread Betting Account has similar dealing spreads to IG, offers access to over 12,000 markets, and was voted the UK’s Best Spread Betting Service …

РекламаНаучитесь составлять эффективные прогнозы и управлять линиями. Скидка до -30%! · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

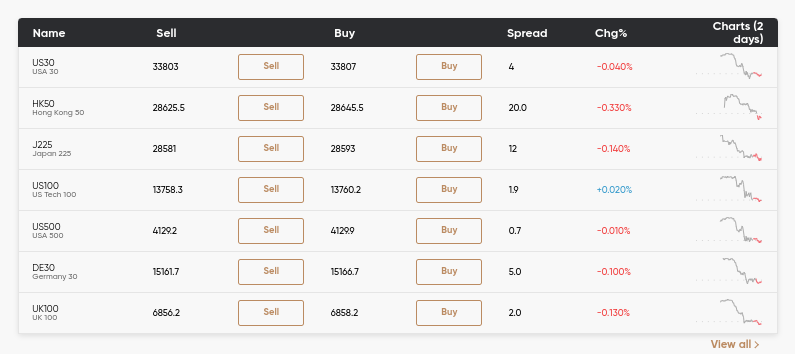

Indices trading as Spread Betting and CFD Trading on 21 global Indices. Spreads from 0.3 points

Shares trading as Spread Betting and CFD Trading on over 4500+ global shares. Spreads from 0.1% each side

FX trading on 84 FX pairs as Spread Betting, CFD Trading and FX on MT4. Spreads from 0.5 points

Spread Betting and CFD Trading on other markets including Commodities, Metals, Bonds, Interest Rates and Options.

Spread Bet and Trade CFDs on our award-winning platforms‡ across over 12,000 markets including Indices, Shares and FX.

Get the latest breaking news, market analysis and insight from our expert Analysts to help inform your trading decisions.

Enhance your trading performance or learn to trade with City Index’s videos and tutorials.

Learn more about how trading on margin and leverage impacts your trading.

Spread Betting is a leveraged product which means that you can start trading using a relatively small initial deposit.

When you trade using a Spread Betting account, you trade on leverage, which allows you to gain a larger market exposure than may otherwise be possible with more traditional forms of investing. Trading on leverage can enhance your profits, but equally can increase your risk so make sure you understand how much you are risking with each position and use a risk management strategy that protects you against rapid market movement.

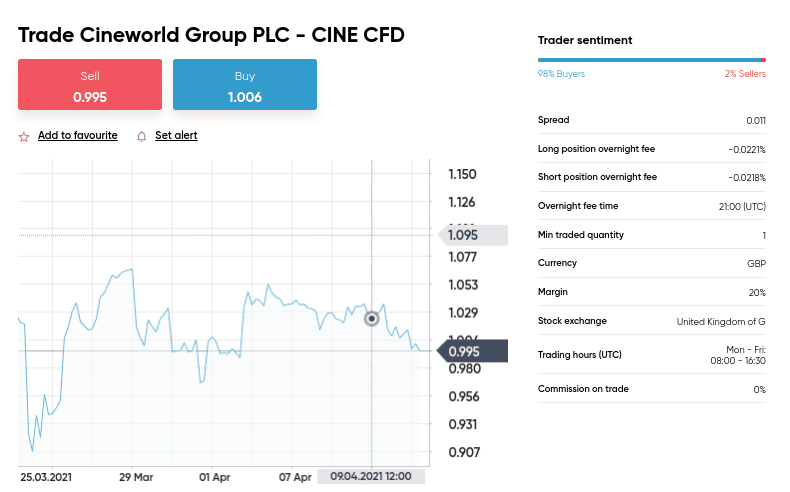

Margin is the amount of money or deposit you are required to have in your account in order to open a position. Because you are trading on leverage and your positions are magnified, you will need to have sufficient funds in your account in order to protect you against market movements. The amount you will be required to deposit is expressed as a percentage of your total position size. For more volatile markets, the margin level will almost always be higher.

Spread betting is a leveraged product. This means that you only need to deposit a small fraction of the overall value of any trade, known as margin.

For example, if the margin requirement for a trade is 20% then you would need 20% of the full value of the trade in your account to open the position.

If you buy 1,000 shares in ABC plc and its share price is 500p, your total investment is £5,000. The equivalent spread bet would be £10 per point on the same company.

In this example you are required to deposit £1,000 to open the equivalent of a £5,000 investment. This is how trading on margin leverages your position, freeing up additional funds to use on other products.

Trading on leverage means that you benefit from much larger market exposure from your initial capital outlay, increasing your potential profits. But, this also means that you are exposed to more risk if the trade goes against you and your losses will also be magnified.

In the example below you can see how trading on leverage has helped magnify profits compared to a similar investment using more traditional forms on share trading. Your Spread Bet in ABC plc is successful and you decide to close out your trade with a £100 profit. The return on your spread bet deposit is 10%, whereas the return on your share trade is 2%.

Remember, trading on leverages magnifies your losses as well as your profits and it is important that you understand the downsides of greater market exposure. The example below is based on the same trade as the profit example above, though in this example the market has moved against you and your losses are magnified.Your trade in ABC plc is unsuccessful and you decide to close out your trade with a £100 loss. The return on your spread bet deposit is -10%, whereas the return on your share trade is -2%.

Margin requirements refer to the amount of capital you will need in your account to cover your position. Margin requirements are expressed as a percentage of the total value of your position. Please note margin requirements vary across markets. Generally speaking, the higher the margin factor the riskier the market. Please see the relevant Market Information sheet on the trading platform for full details.

A margin call is a warning that the capital in your account has dropped below the required minimum amount needed to keep your position open. You should always ensure you have sufficient funds in your account to cover any losses for the period that you decide to maintain your trade.

If you don't, you could quickly find yourself on a margin call which puts you at risk of having your position automatically closed out.

The Margin Level Indicator on the City Index platform represents the level of cover you have associated with your open positions. It is located in the upper left corner of the trading platform. It displays one of the three scenarios listed below:

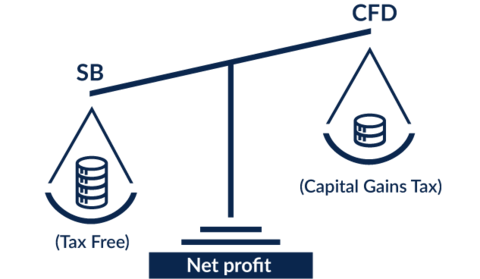

Start Spread Betting and pay no UK stamp duty or UK Capital Gains Tax*

Create Account

View spreads, margins and commissions for City Index products

Take control of your trading with powerful platforms and tools

View upcoming trading opportunities for the weeks ahead

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

‡ Voted “Best Professional Trading Platform”, “Best CFD Provider” and “Overall Personal Wealth Provider” at the OPWA Awards 2021.

Voted “Best Platform for the Active Trader” at the ADVFN Financial Awards 2021. Voted “Best CFD Provider” at the ADVFN International Financial Awards 2020. Voted “Best Mobile Application” and “Best Spread Betting Provider” at the OPWA Awards 2019.

We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Full details are in our Cookie Policy.

Naked Women Japan

A Wife And Mother Gameplay 0.9

Seventeen Club Lesbian Pissing

Trans Shemale Teen

Porno Young Piss

Spread Betting Margin & Leverage Explained | City Index UK

What is Leverage in Trading? | IG UK

UK Best Spread Betting Platforms: The Complete List (2021)

Spread Betting UK | What Is Spread Betting? Full 2021 Guide

Best Spread Betting Platform UK 2021 - Trading Platforms UK

Spreads and Margin | Leverage Trading | Margin & Leverage ...

Best Spread Betting Platform UK - Top 7 Brokers Compared

Top 10 Spread Betting Platforms With Low Spreads for UK ...

Spread Betting Leverage Uk