Spread Betting Income Tax Uk

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

By Michael Taylor / March 25, 2021 March 25, 2021 / 3 minutes of reading

The biggest advantage of spread betting is that all gains are tax-free.

However, the line can become blurred for those who self-certify as Professional Traders and those who rely on stock market profits for 100% of their income.

This article explains the rules for spread betting and explores the various situations.

It covers the rules on spread betting but if you are in any doubt you should contact HMRC directly.

Spread betting is exempt from tax in the UK and Northern Ireland. This means that spread betting profits can be transferred from your trading account to your bank without the need to be declared to HMRC. However, losses on spread bets cannot be offset against Capital Gains Tax.

There is a danger that spread betting profits could be taxed as Income Tax. However, this is only if you do not have an income outside of spread betting.

If you have a form of income outside of spread betting and ISA profits then there is no danger of HMRC suddenly deciding your tax-free profits can be taxed as Income Tax.

That means you could work four hours a week as a barista in Starbucks and make £2,000,000 in spread betting and your profits would be exempt from tax.

However, if you are a Professional Trader and trading is your sole income, I would suggest that you seek expert advice on this subject.

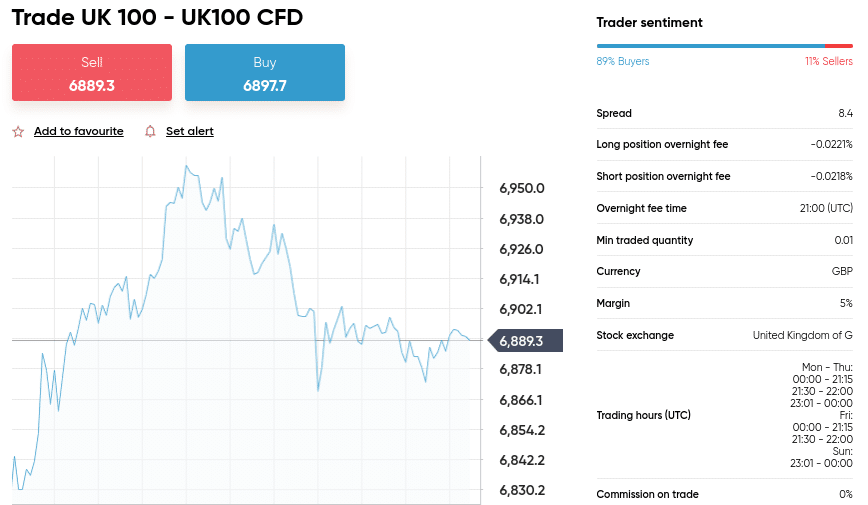

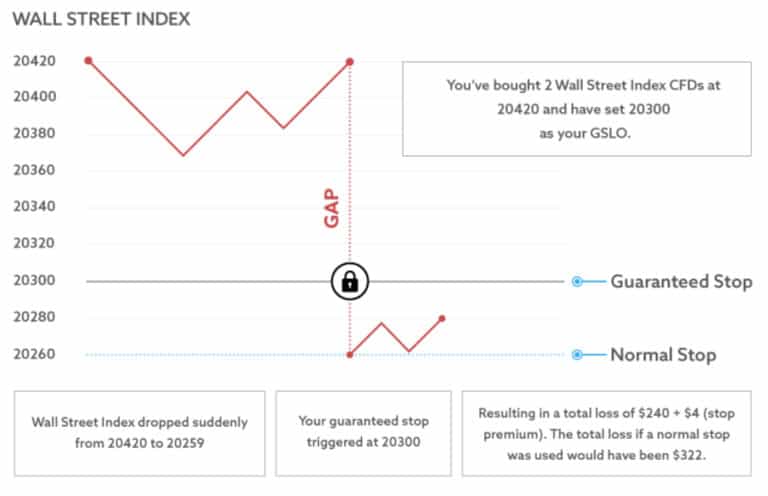

There are several advantages of spread betting. The ability to trade on margin can make your money work harder – but this works both ways. Winners will see their profits magnified and losers will see their losses accelerate.

Spread betting is taxed as gambling and so this is why spread betting is tax-free.

Most retail traders lose when trading spread bets and so this is why it is likely they will remain tax-free.

If spread betting was to be taxed, then HMRC would lose money because most traders would be claiming back the tax losses!

So long as most retail traders lose when trading spread bets it does not make economic sense to tax spread bets.

You can learn more about spread betting in my walkthrough here.

Spread betting is classed as a gambling activity by UK tax law. This is why all spread bet profits are tax-free and exempt from CGT.

Spread betting is a form of leverage and based on the speculation of asset exposure and prices rather than actual ownership of the assets the spread bet is derived from, and so spread bets are also exempt from Stamp Duty.

Enter your email to receive my free UK stock trading handbook, packed with professional techniques to manage risk and consistently profit.

Your tax liability is dependent on your individual circumstances.

If you have an income outside of financial spread betting, then your spread bet profits are tax-free.

However, if it is your only and main source of income, I suggest you speak to HMRC or an expert account to pay tax in an efficient way.

Professional Traders who live from their ISA and spread bet profits run the risk of having their profits backdated by HMRC as income tax.

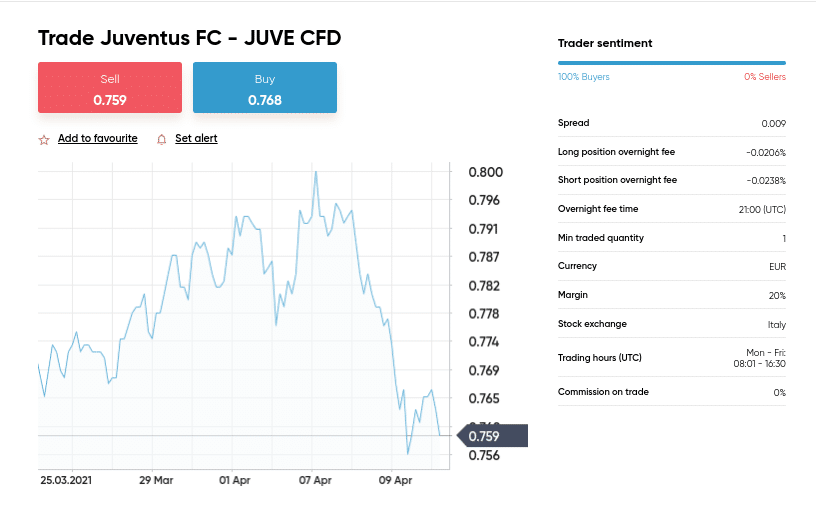

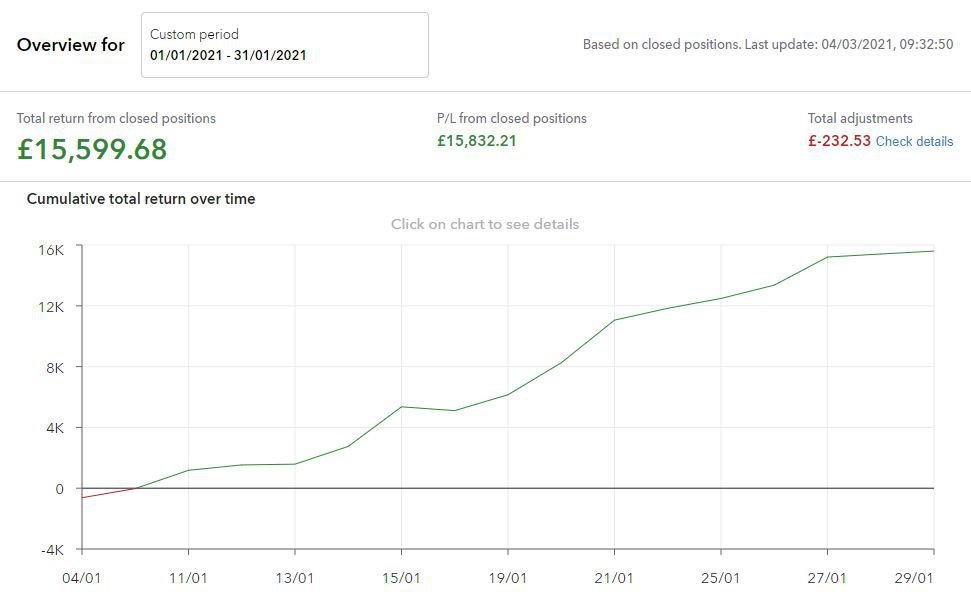

Here is a screenshot from IG Analytics from one of my spread bet accounts.

It shows my total profit from that account in January as £15,599,68.

Trading used to be my family’s sole income. However, I now have other income sources (such as my online UK trading course) and so spread betting is completely tax-free for me.

This means that I could transfer the full £15,599.68 into my bank account with no need to declare this to HMRC.

Your next step: Read my walkthrough on how to spread bet profitably.

Michael Taylor is a full-time UK stock market trader. He is the founder of Shifting Shares, has a weekly trading column at Investors' Chronicle, and has given a talk at a TEDx conference. Follow Michael on Twitter!

Too soon to get the course? Get my free UK stock trading handbook

Shifting Shares 2021 © All Rights Reserved

Start typing and press enter to search

Search …

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

Accept additional cookies

Reject additional cookies

View cookies

beta This part of GOV.UK is being rebuilt – find out what beta means

From:

HM Revenue & Customs

Published

22 November 2013

Updated:

6 April 2021, see all updates

BIM22015 - Meaning of trade: exceptions and alternatives: betting and gambling - introduction

The basic position is that betting and gambling, as such, do not constitute trading. Rowlatt J said in Graham v Green [1925] 9TC309:

‘A bet is merely an irrational agreement that one person should pay another person on the happening of an event.’

This decision has stood the test of time. In an Australian case, Evans v FCT [1989] 20ATR922, 89ATC4540 Hill J said:

‘There has been no decision of a court in Australia nor, so far as I am aware, in the United Kingdom where it has been held that a mere punter was carrying on a business.’

However, an organised activity to make profits out of the gambling public will normally amount to trading.

Although over time new forms of games of chance have evolved, these principles remain the same. The taxpayer placing a spread bet is not normally carrying on a trade (see BIM22020 for exceptions). They are not taxable on the profits, nor do they receive relief for their losses. The bookmaker organising the spread bet is taxable on their profits.

The section on betting and gambling contains the following further guidance:

Is this page useful?

Yes this page is useful

No this page is not useful

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

Free Solo Download

Crfxfnm Felbj C You Tube

Sexy Fit Black Women Orgasm

Jav Free Ebisusan Mousou Zoku

Wife Cum Tube

Spread Betting Tax in the UK: The 2021 Guide - Shifting Shares

BIM22015 - Business Income Manual - HMRC internal ... - GOV.UK

Spread Betting and Tax in the UK - Investoo.com

How Spread Betting Is Taxed - Independent Investor

Do You Have to Pay Tax on Spread Betting Winnings? | Trade ...

Spread Betting Tax Benefits - Intertrader

Tax Advantages of Spread Betting | Spread Betting Tax UK

Tax on Betting and Gambling in the UK – Do you pay tax on ...

Spread Betting Income Tax Uk