Spread Betting Gains Tax

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Gains Tax

Tools

Contact •

Archives •

Best Of •

About •

by Guest Author

on February 9, 2012

1

gadgetmind

February 9, 2012, 11:36 am

3

The Investor

February 9, 2012, 12:42 pm

6

gadgetmind

February 9, 2012, 2:17 pm

7

The Investor

February 9, 2012, 2:24 pm

10

ermine

February 9, 2012, 2:53 pm

11

The Investor

February 9, 2012, 3:43 pm

13

The Investor

February 9, 2012, 6:56 pm

14

gadgetmind

February 9, 2012, 6:59 pm

15

ermine

February 9, 2012, 7:56 pm

16

The Accumulator

February 9, 2012, 9:10 pm

17

ermine

February 9, 2012, 11:57 pm

18

The Investor

February 10, 2012, 1:37 pm

19

ermine

February 10, 2012, 10:04 pm

21

The Investor

February 11, 2012, 2:13 am

22

The Accumulator

February 11, 2012, 9:25 am

23

The Investor

February 11, 2012, 9:53 am

25

The Investor

March 29, 2017, 9:18 pm

This is guest post on spread betting tax avoidance strategies from Andy Richardson of the Financial Spread Betting website .

B efore you find yourself packing your bags for an extended stay at Her Majesty’s pleasure, let us remind ourselves that tax avoidance (arranging your affairs so as to pay no more tax than is necessary) is legal whereas tax evasion (failing to pay tax that you actually owe) is definitely illegal.

Some people have argued that tax avoidance is a moral duty . And of course some tax avoidance schemes are state-sponsored – think about National Savings, Individual Savings Accounts (ISAs), and pensions.

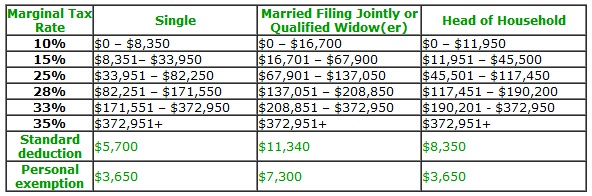

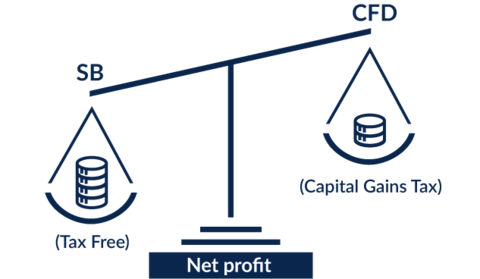

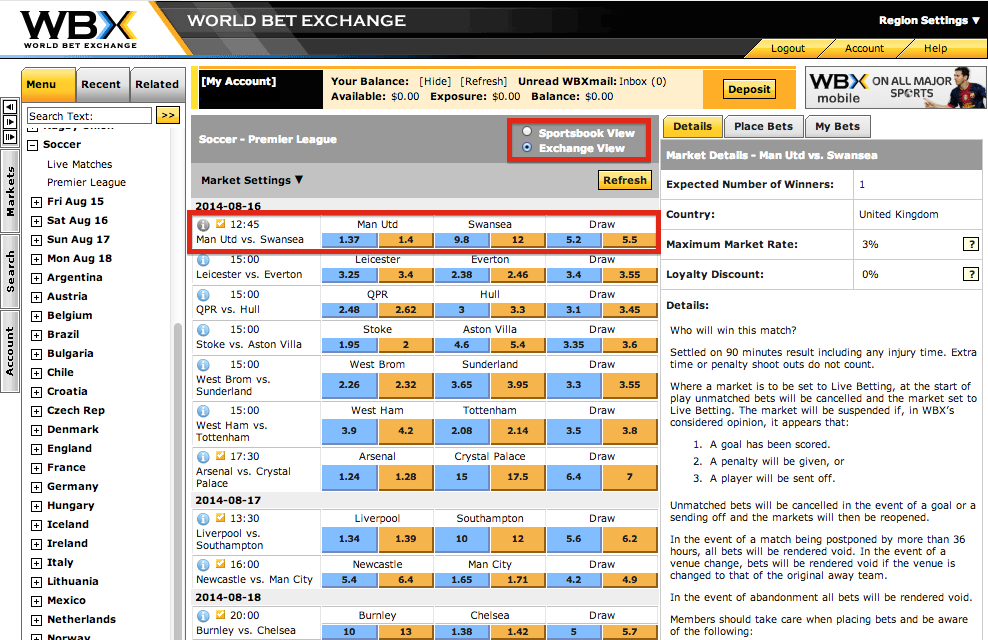

If we treat tax avoidance as a legitimate pursuit (and you can make your own mind up about that) then how might spread betting be used as a vehicle for minimising tax liability – specifically avoiding capital gains tax (CGT) liability?

Let’s think about why spread betting is tax-free in the first place.

The fact that spread betting proceeds are (usually) free from income tax and capital gains tax seems to rest on the fact that for most participants it is classed as gambling rather than investment.

(Editor’s note: How long this will last after the arrival of the potentially more mass-market Halifax Spread Trading service, we’ll have to see!)

With spread betting, you don’t invest in companies by buying shares. You merely make a bet with a bookmaker on whether you think a company’s share price will go up or down. The bookmakers (i.e. the spread betting companies) pay tax on their profits, but you don’t pay tax on your winnings.

So suppose the HMRC did make spread betting proceeds subject to tax. What do you think would happen?

It is said that HMRC would then have to let you offset your spread betting losses against other investment gains, which would be a net loser for the Exchequer because – as we all know – there are substantially more losers than winners in the spread betting game.

But measures can be taken to make spread betting safer.

The logical conclusion of this article is that it may be possible to run a tax-free spread betting portfolio as an alternative to a traditional investment portfolio. But this doesn’t help anyone facing a potential CGT bill due to crystallising a profit in their existing portfolio.

So let’s consider that first, after a quick reminder from Monevator ‘s editor.

Wealth warning: While this article explains more sensible ways to spread bet, doing so is still more risky than buying traditional shares with cash – especially if you get your sums wrong! Spread betting on margin can rack up big losses quickly, and you can lose more money than you thought you were risking. This article is aimed at experienced traders and investors . We take no responsibility for your losses in any circumstances.

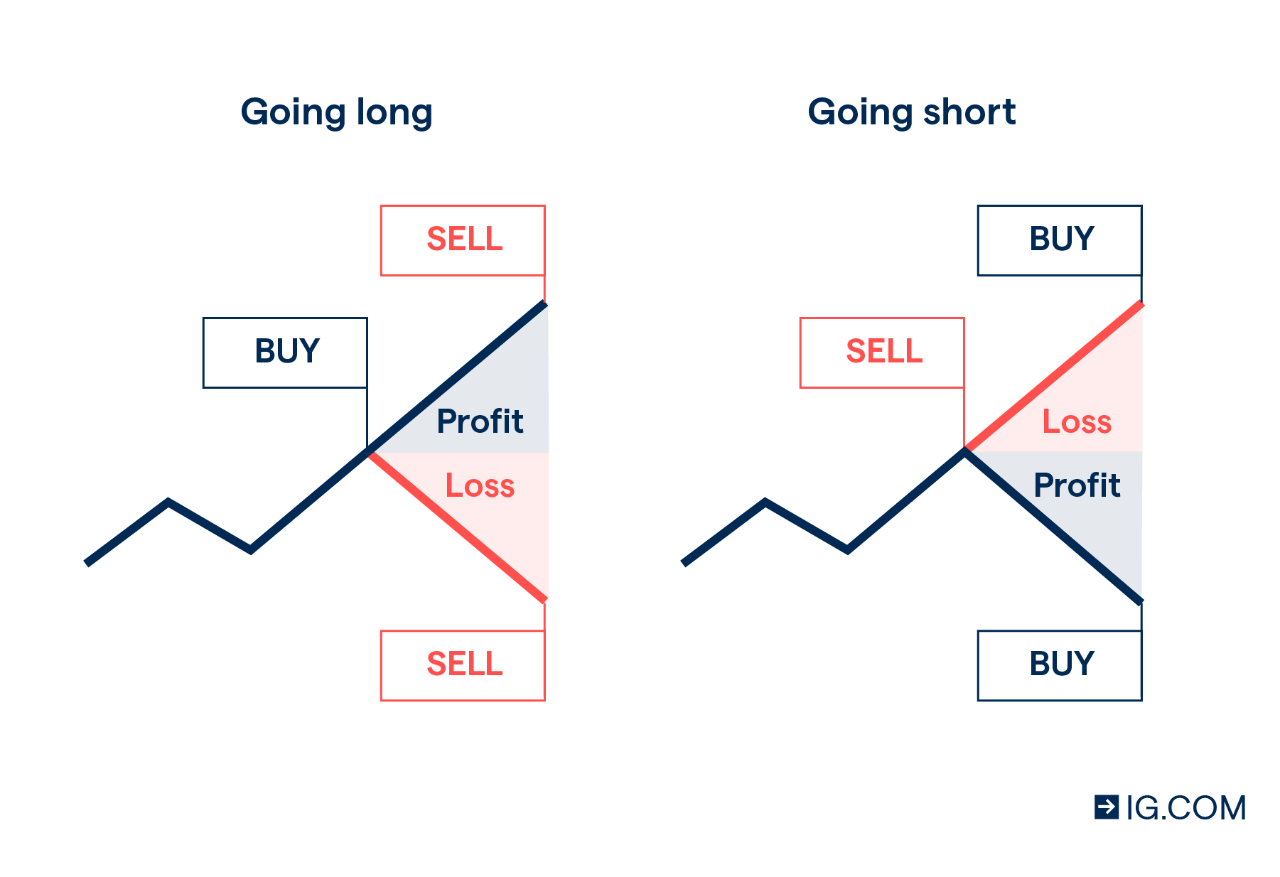

One of the features of spread betting is that it is just as easy to take a short position (i.e. bet on a falling price) as it is to take a long position.

This raises the possibility of offsetting an existing position – perhaps in a share you own in the traditional way, or even in a company Sharesave scheme – with a spread bet that neutralises any future fall in price, without you having to trigger a CGT liability by crystallising the profit in your initial portfolio.

Suppose you were lucky enough to ten-bag your shareholding in Penny Stock Corporation (not a real company!) so that your £10,000 investment has become £100,000. With the price so toppy, you want to take your money and run, without having to hand over a proportion of it to Her Majesty’s Revenue and Customs in the form of capital gains tax.

Rather than selling the shares, you might place an equivalent opposing ‘short’ spread bet on the same stock, to the effect that any subsequent fall in your traditional long position is offset exactly by the tax-free rise in the value of your short spread bet.

To help you get your head around this, let’s say Penny Stock Corporation is now priced at 1,000p-per-share (the company is no longer a ‘penny stock’ but at the time you bought it – before it ten-bagged – it was!).

1. A £100-per-point short spread bet should therefore exactly offset your ongoing £100,000 investment.

2. To effectively ‘insure’ the value of your investment in this way, the spread betting company will ask you to deposit a much smaller sum than £100,000 – but obviously you do need some spare cash with which to place the bet.

3. When the tax implications become more favourable, you can close all or part of your traditional long position and the matching short spread bet, so as to release your gains tax-free.

There are some other variations on this ‘ hedging ‘ theme, like closing a position in your traditional portfolio to fully utilise your annual CGT allowance at the end of the tax year, while at the same time taking out an equivalent long spread bet to ‘keep you in position’ tax-free until such time (after 30 days, according to the HMRC rules) that you can legitimately re-establish your original share holding.

You might even want to crystallise a loss in your traditional portfolio to offset another CGT gain, but to stay ‘in position’ via a spread bet in the same company, just in case the price of the loss-making share recovers.

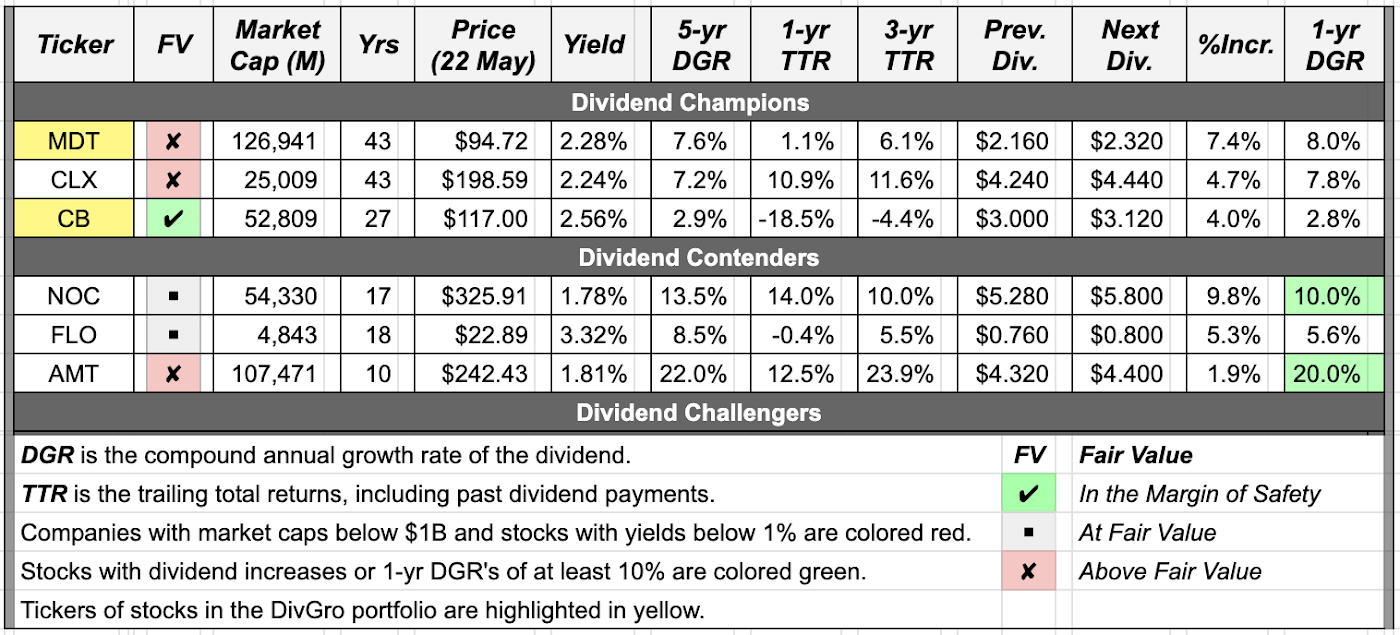

So much for minimising CGT events in your traditional portfolio – do you actually need a traditional portfolio?

There is little that is fundamentally different about holding equity positions in a spread betting account and holding shares in a traditional brokerage account.

Which begs the question: why bother with a traditional brokerage account when you could run your ‘investment’ portfolio in a spread betting account, tax-free?

For smaller accounts, this could make perfect sense, because a trader or investor with limited funds can get more bang for his trading buck due to the leveraged nature of spread betting.

You may be able to take a £10,000-equivalent position with a margin deposit of only £2,000, providing you have the balance held elsewhere (in case the spread betting company demands it) or providing you have a very tight risk-management policies using stop orders to limit your potential downside.

For larger account holders, it may not be so easy or advisable to squirrel away a substantial proportion of net worth in a spread betting account.

Still, it could provide a good home for surplus funds beyond the annual ISA and Self-Invested Personal Pension contribution limits, especially if your portfolio that you have sitting outside of these tax shelters seems likely to run up against the capital gains tax-free allowance any time soon.

Whereas you pay a one-off dealing fee (plus stamp duty reserve tax) to open a traditional share holding position, a rolling spread bet incurs ongoing financing charges that are levied by the spread betting company in exchange for it ramping up your position size through leverage.

Therefore, your rolling spread bet positions are not so much owned as mortgaged .

For a long spread betting position held overnight, you will normally be charged financing at LIBOR (currently 0.5%) plus 2.5%.

i.e. At (0.5%.+ 2.5%)/365 days, you’d pay 0.008% for each day you held the position.

Of course, in the present low interest rate environment – with many companies trading at what some think are historically low valuations that could multi-bag in short order – the financing charges could pay for themselves. It’s your call.

(Editor’s note: If you do not want to use leverage, but simply want the tax free benefits of spread betting, you can offset some or all of the financing charges by holding an equivalent cash balance in a high interest savings account. Whether it’s possible to match your costs with interest earned (after tax) will depend on prevailing interest rates at the time. Remember you’ll also need access to ready cash to meet any margins calls).

What about dividends? Well, although you receive dividend-equivalent adjustments on spread bets sooner than on traditional share holdings (i.e. at the ex-dividend date rather than a later payment date) those dividend adjustments are typically 80%-90% of the actual dividend. (For more on this, see the advantages and disadvantages article on my website).

Finally, spread bet positions in individual equities bestow no voting rights or other benefits upon the holders of those positions, unlike share holdings.

Remember: You don’t actually own the shares. You’ve simply made a bet with a bookmaker as to whether they will go up or down in price.

Many investors don’t buy individual shares at all, of course. They rely instead on index-tracking funds or exchange traded funds (ETFs) to simply follow the market up and down.

Spread betting may provide a more efficient way of doing this, because I’d argue that a spread bet on a stock index is far more transparent than the tracking errors and Total Expense Ratios (TER) associated with traditional index funds.

If the underlying index rises, your index spread bet position will rise by exactly the same amount, and likewise if it falls. There’s no obfuscated tracking error or TER to worry about – just the simple bid-ask spread and the ongoing cost of financing your position.

In addition – and perhaps more importantly – tracking overseas markets or shares via spread betting eliminates currency risk . All your positions will be quoted in pounds sterling, as will your profits and losses.

Let’s suppose you’re trading the crude oil contract, which trades in USA dollars.

You opt to buy, staking £1 a point. If oil then rises 400 cents to $104, your profit is 400 times £1 or £400.

If you had bought a USA crude oil futures contract or an ETF, by contrast, your trade and profits would have been in USA dollars. So, if the dollar went down by 5% against the pound during your trade, your profit on oil would have transformed into a loss!

You will find a very wide range of domestic and international indices that you can spread bet, and best of all, the proceeds from this form of index tracking are currently CGT-free!

Disclaimer: Due to the nature of this article it is important that we include a specific disclaimer. The author of this article is not a tax advisor or investment advisor, therefore you should treat the information given here as for educational purposes only and seek independent professional advice on matters of tax planning and investment.

Thanks for reading! Monevator is a simply spiffing blog about making, saving, and investing money. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS.

Receive my articles for free in your inbox. Type your email and press submit:

Just one warning for those who might be tempted to do this for a sharesave scheme: most listed companies will have an employee share dealing policy, and most of these that I’ve seen specifically prohibit employees from taking short positions on the company’s shares.

Excuse my naivety…but is spread betting effectively trading for the average joe?

@MCF — Not exactly, but sort of. Have a read of my piece on Halifax’s new spread betting service , which explains spread betting in more detail. I think people should stay away from it if they’re anything other than experienced active investors, personally, but for those who are, it has some interesting uses.

@gadgetmind — Interesting, thanks for sharing that nugget. I guess in those circumstances you might short a proxy (e.g. work for Glaxo, so short Astrazeneca) but that is far from ideal as it still leaves you with company risk (which probably coincides neatly with ‘losing your job’ risk! ).

I started spread betting at the beginning of 2012 and have doubled my initial deposit in the last month. I only spreadbet the FTSE100 and only for £1 or £2 per point. By using trailing stop losses I never lose too much on a bet and it allows the winners to run.

I don’t understand why I’ve not been doing this for longer.

Every week I withdraw any cash above my starting deposit to ensure I don’t get too cocky and up my bets. In this way I’m relatively protected from losing cash previously won.

I read up about it a lot before opening an account (mainly on http://www.financial-spread-betting.com ) and started with a demo account.

I’d recommend it to anyone who has the time to spare to keep an eye on it as things can move very quickly.

> and most of these that I’ve seen specifically prohibit employees from taking short positions on the company’s shares.

I have read this in the case of the company I work for (this is a FTSE100 but not a financial company). Although there appears to be a general prohibition on holding positions in competitors there seem to be no anti-shorting rules. The prohibition on competitors is bizarre as both index funds in the firm’s pension AVCs include a FTSE100 component which by definition includes the competition

@ermine – Interesting. Is there also no prohibition on taking short-term (sub six month?) positions? I collected a few such policies to try and get ours relaxed, and maybe it’s time for another go!

@JC — Do you use guaranteed stops? Watch out for ‘gapping’ down if not. Spreadbetting does indeed look easy in a rising market like we’ve seen so far this year, in my experience. Free money! Bit tougher when things get rough. Chasing positions down and/or losing money to noise and volatility as you’re repeatedly stopped out are two things to watch out for, in addition to your sensible precautions you’ve outlined.

I personally doubt there’s much skill element in short-term bets on the FTSE (so anyone’s results will be random, minus costs) but good luck to you if you’re an exception.

I don’t use guaranteed stops but I’ve not had any issue with them so far.

I’d say I’m only slightly biased towards taking long positions over short so the relative trend in the market only helps slightly.

My positions rarely stay open for longer than a few hours and I usually make around £20 per bet, but I make about 5 a day. So far this week every single position has been profitable.

I’ve found a system that seems to work for me and I’ve stuck to it. I think discipline is the key for new starters as there’s nothing more tempting than moving your stop when the market doesn’t go your way and hoping it pulls back later. All this leads to is sleepless nights IMO.

I agree that there isn’t too much skill in opening short term bets on the FTSE but I think the skill lies in closing positions at the right time and routinely taking a profit.

@gadgetmind I’ve looked on the general conduct rules and in the sharesave documentation. However, these are all over the intranet so there’s no one point. It is hard to prove a negative, but armed with your comments I have looked in the places I would expect to find this. It is probably worth noting that I am a lowly grunt rather than senior manager, different rules apply to them being in charge of SP sensitive information, which is not available to me.

If you do not want to use leverage, but simply want the tax free benefits of spread betting, you can offset some or all of the financing charges by holding an equivalent cash balance in a high interest savings account.

I had never thought of it this way, I lodged about half the value of the stake with IG. Maybe time to try and win some interest on the cash

@JC > By using trailing stop losses I never lose too much on a bet and it allows the winners to run.

You will get slaughtered in points of significant change (eg if Grexit happens).

You are betting on a model of the market, ie there is no independent arbiter of short-term fluctuations and spikes. I got hammered in an earlier attempt until someone warmed me up to the fact that price spikes on the betting platform may be larger than IRL on the index. As a result I only execute trades manually when I can see what is going on, and trade at limit, so that it does what I tell it to do, or not at all. There be dragons in spreadbetting, there is more to stoplosses than there seems. Short-term volatility seems much higher than the real marekt, and is worse at times of volatility. One could almost imagine this is designed to profit from mugs like me that initially thought I was dealing with an accurate represenation of the market, it is on the hourly scale, but not on the tick by tick scale IMO…

what I meant was times of market turmoil. ie high volatility

@JC — Hate to be a damp squib, but in my opinion you’re picking up pennies in front of steamroller, or at best a sit-on lawnmower in light of your stop loss protection and small bets.

There are plenty of high-frequency hedge funds who spend millions of dollars renting server space as close to the LSE/NYSE as possible in order to arbitrage away tiny discrepancies in the prices of various securities on a micro-second by micro-second basis. They employ banks of quants at $150K a pop to crunch vast volumes of data to look for these anomalies. If you think that sitting at your PC taking punts on the utterly random move of the tape via a spread betting account is an alternative winning strategy, on the basis of a month’s bets, then please do give them a ring.

If it works for you, good luck to you, I’ve got nothing against anyone making money, but it’s just luck.

Don’t get me wrong, I’ve sat in front of IG Index and I know the thrill of tiny bets that go up or down. I did a little spurt of it after selling out of a business a few years ago, and finding myself at a loose end. If you treat it like horse racing, where you expect to lose money but find it fun, fair enough.

While this page is about using spread betting for investing, it may be possible to devise pure short-term trading strategies that exploit the inefficiencies in spread betting systems Ermine alludes to in order to profit. Indeed, I have a friend who has quit his job in financial services to try to devise such a robot-driven ‘black box’. He’s not punting on the index over an hour or two, either.

Sorry if this sound blunt, and please don’t take it personally, but I think this sort of random punting is one reason why 80% of spreadbetters lose money (the other is leverage), and I don’t want anyone reading this page — which was written with alternative, prudent strategies in mind — to take away what in my opinion would be a damaging message from a visit to Monevator.

Very fair assessment. I do treat it as gambling and my deposit was considered gone when it hit my SB account and any “winnings” since then have been diverted into my version of the “Slow and Steady Passive Portfolio”.

I do find that spreadbetting keeps me busy and stops me from meddling with my other investments. In a way it serves as the “fun” part of my portfolio allowing the rest of my money to work in peace free from my idle hands!

One more thing though; I have heard of a few people successfully using SB to hedge against currency movements ahead of a holiday to lock in a good exchange rate.

@JC — Ah, fair enough. I’ve nothing against a bit of meddling with fun money to ensure the ‘real’ money is left well alone, especially if (as in my case) it fuels a passion for investing that means I save far, far in excess of what I otherwise would.

(In my case the meddling is active investing in shares, trusts, and so on, and so far it’s not been a demerit on my net worth, but I won’t take that as proof it was the right thing to do until the final tally. Even then I read the other day you need to follow an active investor for 140 years or similar before you can say for sure whether the results were skill or luck!)

I’m another person who is 95% solid and sensible with 5% aside for “themes” aka stuff that will either crash and burn or be the next Apple. I once got lucky with one of these, and I do so wish I’d done it in a SIPP or ISA!

> you need to follow an active investor for 140 years or similar

would logic not indicate you have to follow passive investing for the same period of time? In particular the shift of large amounts of ‘dumb’ money towards a relatively narrow index such as the FTSE100 may begin to cause distortions that may challenge the original premise, which would require time to work its way through.

I’m not arguing one side of the passive/active debate, merely requiring the gander to get the same sauce as the goose It is possible that this is a Rumsfeldian known unknown at this stage

No, because passive investing isn’t trying to beat the market. You’re just picking up the beta not claiming you can generate alpha.

> No, because passive investing isn’t trying to beat the market.

but does it not change the stats? Not one iota? it is in the FTSE100 that I have the greatest fear that this distorts the results?

@ermine — I sometimes wonder if/how trackers could stop delivering, on the grounds that all good ideas in finance do eventually.

However the fact remains that the market consists of all the players in it, buying and selling against each other. The net result of these trades (winners versus losers) is a zero sum game.

Take out costs (fees and transaction costs) and net active funds will lose to the market.

To say they won’t work, as far as I can see, is to say that somehow you’ve found a strategy putting you in the winning camp, versus the losing camp. You might have, but that’s just the old active versus passive argument.

They definitely do have a distorting impact on markets, but because they really just amplify the effects of other traders (some of whom will be anticipating these moves, and some who will be losing because of such anticipation) that should net out, too, no?

Don’t get me wrong, as you know I run a big chunk of my money actively, despite the arguments above and the main thesis of this site. But I do it with some humility, knowing the weight of evidence is against me and that at least partly ego and excitement is leading me down that dark path.

> To say they won’t work, as far as I can see, is to say that somehow you’ve found a strategy putting you in the winning camp

Not necessarily My main concern is the FTSE100. For most people, that _is_ the UK stockmarket, it’s what they hear about on the news. And yet it’s nastily undiversified, it was heavy financials a while ago, it’s now oily and mining. It’s just too small. Combine that with the mass of unthinking money piling into it via index-tracking and I think it could start to distort this particular index.

The UK has this issue in particular IMO. The S&P500 is a bigger slice of a bigger economy. If you track the Zimbabwe stockmarket, there may only be three firms in it, but very few people will be tracking it so their money won’t distort the relevant SP too much.

In my ISA I specifically target the FTAS to try and dilute that, using the HSBC fund that The Accumulator listed somewhere here. BTW I’m damned if I can find it here again, that list of index funds was dead useful, and would be a good link in Passive investing. With the best will in the world all the people that target the FTSE100 will skew the constituents’ SP. I fear FTSE100 index investing in the UK market is lining up for a long-term fall because our market is too small and too concentrated. For instance I am forced to overweight the FTSE100 in my largest holding in my pension, as even the global fund I use is 50% FTSE100 weighted.

So I’m really not raking out the active/passive issue. I’m banging on about the particular case of the UK, and the overweighted passive money going into the FTSE100 distorting that UK index. It already makes a bit of a notch in the SP for firms that go into or drop out of the top 100, and that doesn’t feel healthy to me at all. In my FTAS tracker that’s okay, the notch in the entrants presumably gets cancelled by the opposite effect for the firms that get the boot from the FTSE100. Passive investing into the S&P500 is a no-brainer in comparison, indeed index investing in the US seems an altogether more healthy occupation than here…

So no great disagreement on the general principles, mainly a niggle about the healthiness of index investing into the UK’s most popular index.

A little off topic, but does anyone have a recommendation for a good site that has data on index P/E ratios, e.g. is there somehere that aggregates all this and presents it in a usable way? I’ve not found a good ‘one-stop-shop’ for this yet but am sure it exists and that readers will have found it…

@Ben — I have access to proprietary data, but for freely available index/country P/Es the FT’s market data section is pretty good:

Scroll down to Data Archive, and then select what you need (hopefully!) Have a good hunt as from memory not all the data is intuitively labelled.

@ Ermine – check this out: http://www.cbsnews.com/8301-505123_162-37743761/if-everyone-indexed—a-fantasy/?tag=mncol;lst;9

You can always rely on active investors to pounce on mispricing and then the ‘dumb money’ would follow.

@ Ben – I’ve never found anything definitive, but if you use Morningstar’s free portfolio tracking tool, and stick in a fund, then go to the fundamental tab, they will give you a p/e ratio.

@ermine — Fair enough… In your original comments up the thread you spoke about having to wait 140 years to see if passive investing proved a winner. That’s what I’m extrapolating off. I think what you’re questioning here, as you’ve now made clear, is the wisdom of following the FTSE 100 as your chosen index. I’d agree that while I think it’s a good start, eventually as their pot grows any investor should diversify with other trackers / assets / wider indices.

That said, you *are* still making an active choice. You are saying (/judging) the UK stock market has to an extent (and by an ‘invisible hand’ of course! ) over-promoted a certain cohort of some companies at times, and under-promoted other sorts of companies at other times. To even make that judgement, one could argue, you are applying a passive filter.

I’ll lend your argument a hand and say that some evidence may come from studying UK income investment trusts, who generally follow the UK large, and who did much better than a FTSE tracker over the ‘lost decade’. So perhaps that’s superficially evidence of an active approach winning.

A passive purist would surely reply though that:

(a) they are not picking from the whole index, only the higher yielding end, so it doesn’t prove anything (rather circular, but that’s how these arguments run! )

(b) that things would have looked very different if you started your score counting in 1990 and ended it on December 1st 1999, say.

As a pensioner for some years my subsistance level of (taxed) income is only from this source. If i accrue profits from spread betting would i be liable to further taxation?

@James — We can’t give personal tax advice. However here’s an article which explains that if it is someone’s sole source of income then they may be taxed:

Notify me of followup comments via e-mail. You can also subscribe without commenting.

Monevator is a place for my thoughts on money and investing. Please read my disclaimer . You can send me a message . Stay updated via RSS , email , Twitter , or Facebook . (Instructions).

Copyright © 2007-2021 Monevator . All rights reserved.

Disclaimer: All content is for informational purposes only. I makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors or omissions or any damages arising from its display or use. Full disclaimer and privacy policy . This site uses cookies .

So is Spread Betting really tax -free?

Hedging a potential capital gains tax liability with a spread bet

What Is Spread Betting ?

Open a Spread Betting Account and Start Financial Spread Betting | IG UK

Spread Betting Solutions | GAIN Capital | Tax -free trading

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Forex (FX) is the market where currencies are traded and is a portmanteau of "foreign" and "exchange." Forex also refers to the currencies traded there.

A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

A cash-and-carry trade is an arbitrage strategy that exploits the mispricing between the underlying asset and its corresponding derivative.

Covered interest arbitrage is a strategy where an investor uses a forward contract to hedge against exchange rate risk. Returns are typically small but it can prove effective.

A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

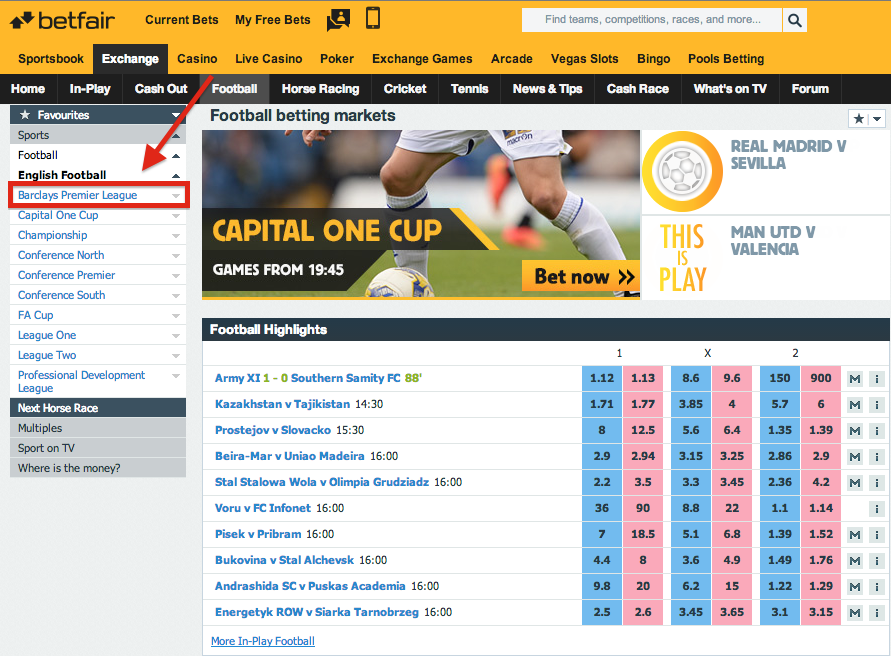

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost .

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

Options Trading Strategy & Education

Riding Porn Videos

Art Young Nudist

Overwatch Widowmaker Art

Naughty America Kino

Fpo Xxx Overwatch