Spread Betting Com

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Com

From Wikipedia, the free encyclopedia

^ The Sunday Times : "World Cup to kick off boom in spread betting"

^ "The perils of spread-betting" . The Times . Sep 20, 2007. Archived from the original on July 19, 2008.

^ "Gambling Commission - Home" . www.gamblingcommission.gov.uk .

^ Gambling Times: What are the Odds? Archived 2011-02-04 at the Wayback Machine

^ The Sunday Times: Spread betting

^ "Income Tax – Assessable income derivation of income – spread betting" . Australian Government ATO. 3 March 2010 . Retrieved 26 January 2011 .

^ Budworth, David. "Spread-betting fails investors in trouble" . thetimes.co.uk . Retrieved 11 October 2013 .

^ Pfanner, Eric. "Spread-bets on Cup venture into bizarre - Technology - International Herald Tribune" . The New York Times . Retrieved 11 October 2013 .

^ Rayman, Richard. "White Paper on Spread Betting" (PDF) . Cass Business School . Retrieved 11 October 2013 .

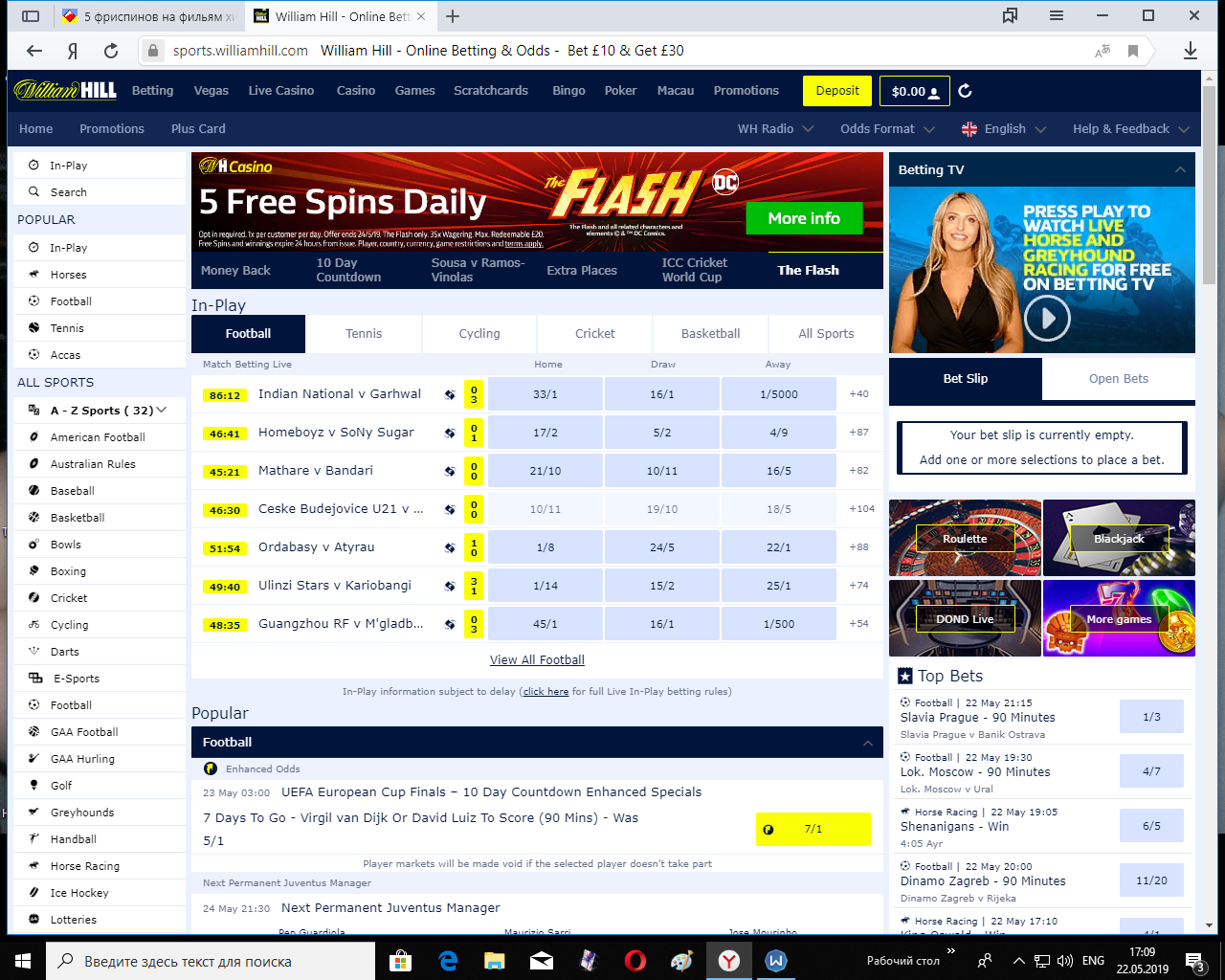

Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple "win or lose" outcome, such as fixed-odds (or money-line) betting or parimutuel betting .

A spread is a range of outcomes and the bet is whether the outcome will be above or below the spread. Spread betting has been a major growth market in the UK in recent years, with the number of gamblers heading towards one million. [1] Financial spread betting (see below) can carry a high level of risk if there is no "stop". [2] In the UK, spread betting is regulated by the Financial Conduct Authority rather than the Gambling Commission . [3]

The general purpose of spread betting is to create an active market for both sides of a binary wager , even if the outcome of an event may appear prima facie to be biased towards one side or the other. In a sporting event a strong team may be matched up against a historically weaker team; almost every game has a favorite and an underdog . If the wager is simply "Will the favorite win?", more bets are likely to be made for the favorite, possibly to such an extent that there would be very few betters willing to take the underdog.

The point spread is essentially a handicap towards the underdog. The wager becomes "Will the favorite win by more than the point spread?" The point spread can be moved to any level to create an equal number of participants on each side of the wager. This allows a bookmaker to act as a market maker by accepting wagers on both sides of the spread. The bookmaker charges a commission , or vigorish , and acts as the counterparty for each participant. As long as the total amount wagered on each side is roughly equal, the bookmaker is unconcerned with the actual outcome; profits instead come from the commissions.

Because the spread is intended to create an equal number of wagers on either side, the implied probability is 50% for both sides of the wager. To profit, the bookmaker must pay one side (or both sides) less than this notional amount. In practice, spreads may be perceived as slightly favoring one side, and bookmakers often revise their odds to manage their event risk.

One important assumption is that to be credited with a win, either team only needs to win by the minimum of the rules of the game, without regard to the margin of victory. This implies that teams in a winning position will not necessarily try to extend their margin—and more importantly, each team is only playing to win rather than to beat the point spread. This assumption does not necessarily hold in all situations. For example, at the end of a season, the total points scored by a team can affect future events such as playoff seeding and positioning for the amateur draft, and teams may "run up" the score in such situations. In virtually all sports, players and other on-field contributors are forbidden from being involved in sports betting and thus have no incentive to consider the point spread during play; any attempt to manipulate the outcome of a game for gambling purposes would be considered match fixing , and the penalty is typically a lifetime banishment from the sport; such is the lack of tolerance for manipulating the result of a sporting event for such purposes.

Spread betting was invented by Charles K. McNeil , a mathematics teacher from Connecticut who became a bookmaker in Chicago in the 1940s. [4] In North America , the gambler usually wagers that the difference between the scores of two teams will be less than or greater than the value specified by the bookmaker , with even money for either option. An example:

Spreads are frequently, though not always, specified in half-point fractions to eliminate the possibility of a tie, known as a push . In the event of a push, the game is considered no action , and no money is won or lost. However, this is not a desirable outcome for the sports book, as they are forced to refund every bet, and although both the book and its bettors will be even, if the cost of overhead is taken into account, the book has actually lost money by taking bets on the event. Sports books are generally permitted to state "ties win" or "ties lose" to avoid the necessity of refunding every bet.

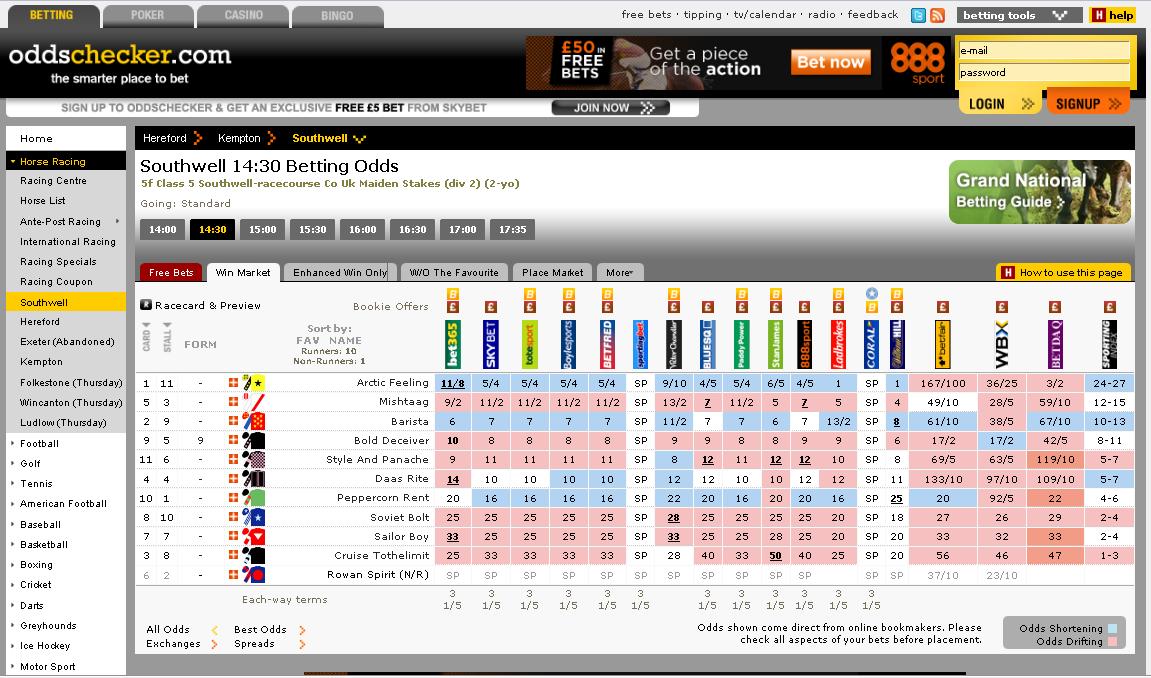

Betting on sporting events has long been the most popular form of spread betting. Whilst most bets the casino offers to players have a built in house edge, betting on the spread offers an opportunity for the astute gambler. When a casino accepts a spread bet, it gives the player the odds of 10 to 11, or -110. That means that for every 11 dollars the player wagers, the player will win 10, slightly lower than an even money bet. If team A is playing team B, the casino is not concerned with who wins the game; they are only concerned with taking an equal amount of money of both sides. For example, if one player takes team A and the other takes team B and each wager $110 to win $100, it doesn't matter what team wins; the casino makes money. They take $100 of the $110 from the losing bet and pay the winner, keeping the extra $10 for themselves. This is the house edge. The goal of the casino is to set a line that encourages an equal amount of action on both sides, thereby guaranteeing a profit. This also explains how money can be made by the astute gambler. If casinos set lines to encourage an equal amount of money on both sides, it sets them based on the public perception of the team, not necessarily the real strength of the teams. Many things can affect public perception, which moves the line away from what the real line should be. This gap between the Vegas line, the real line, and differences between other sports books betting lines and spreads is where value can be found.

A teaser is a bet that alters the spread in the gambler's favor by a predetermined margin – in American football the teaser margin is often six points. For example, if the line is 3.5 points and bettors want to place a teaser bet on the underdog, they take 9.5 points instead; a teaser bet on the favorite would mean that the gambler takes 2.5 points instead of having to give the 3.5. In return for the additional points, the payout if the gambler wins is less than even money , or the gambler must wager on more than one event and both events must win. In this way it is very similar to a parlay . At some establishments, the "reverse teaser" also exists, which alters the spread against the gambler, who gets paid at more than evens if the bet wins.

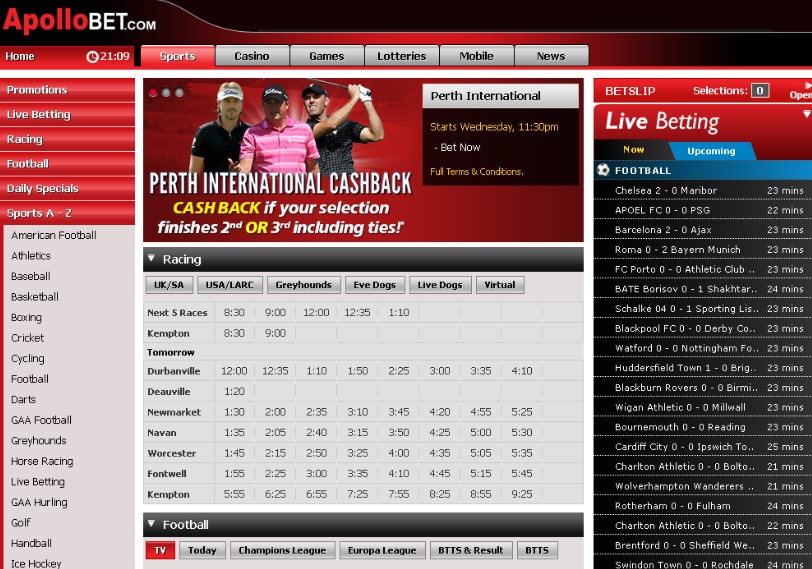

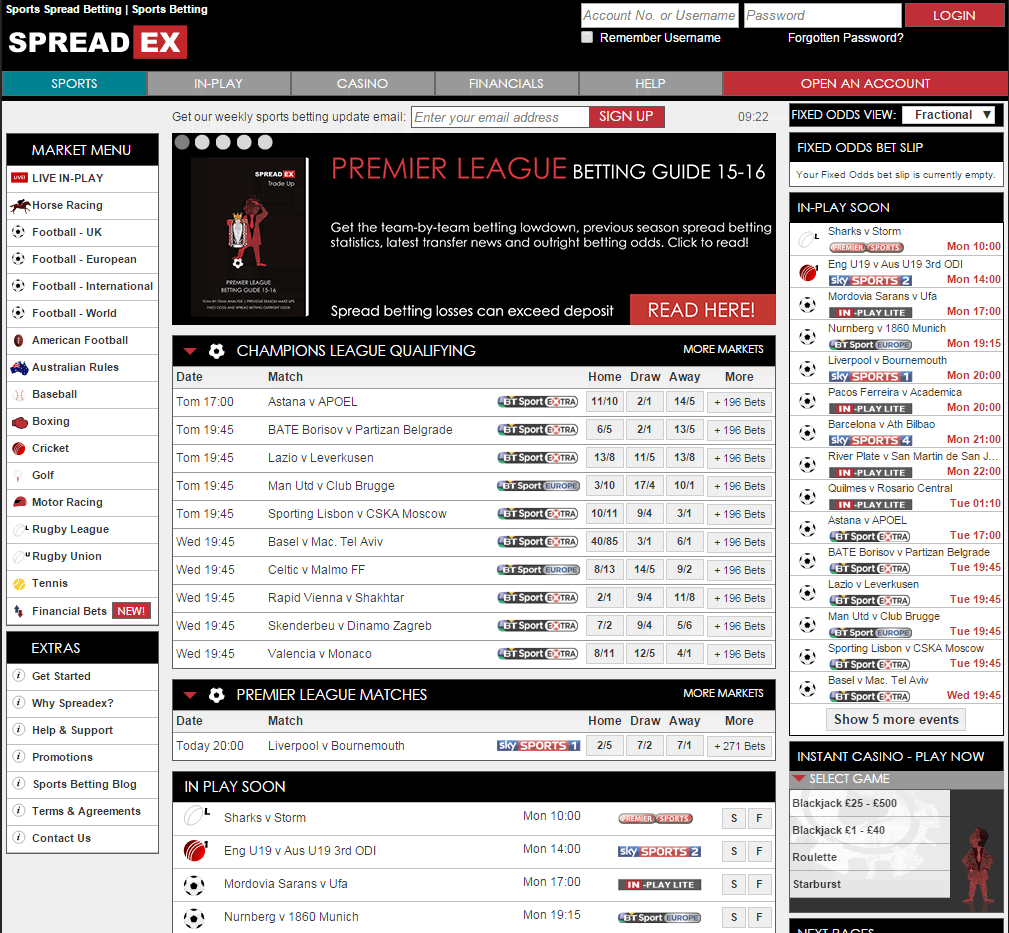

In the United Kingdom , sports spread betting became popular in the late 1980s by offering an alternative form of sports wagering to traditional fixed odds , or fixed-risk, betting. With fixed odds betting , a gambler places a fixed-risk stake on stated fractional or decimal odds on the outcome of a sporting event that would give a known return for that outcome occurring or a known loss if that outcome doesn't occur (the initial stake). With sports spread betting, gamblers are instead betting on whether a specified outcome in a sports event will end up being above or below a ‘spread’ offered by a sports spread betting firm, with profits or losses determined by how much above or below the spread the final outcome finishes at.

The spread on offer will refer to the betting firm's prediction on the range of a final outcome for a particular occurrence in a sports event, e.g., the total number of goals to be scored in a football (US: soccer) match, the number of runs to be scored by a team in a cricket match or the number of lengths between the winner and second-placed finisher in a horse race.

The gambler can elect to ‘buy’ or ‘sell’ on the spread depending on whether they think the final outcome will be higher than the top end of the spread on offer, or lower than the bottom end of the spread. The more right the gambler is then the more they will win, but the more wrong they are then the more they can lose.

The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level. This reflects the fundamental difference between sports spread betting and fixed odds sports betting in that both the level of winnings and level of losses are not fixed and can end up being many multiples of the original stake size selected.

For example, in a cricket match a sports spread betting firm may list the spread of a team's predicted runs at 340 – 350. The gambler can elect to ‘buy’ at 350 if they think the team will score more than 350 runs in total, or sell at 340 if they think the team will score less than 340. If the gambler elects to buy at 350 and the team scores 400 runs in total, the gambler will have won 50 unit points multiplied by their initial stake. But if the team only scores 300 runs then the gambler will have lost 50 unit points multiplied by their initial stake.

It is important to note the difference between spreads in sports wagering in the U.S. and sports spread betting in the UK. In the U.S. betting on the spread is effectively still a fixed risk bet on a line offered by the bookmaker with a known return if the gambler correctly bets with either the underdog or the favourite on the line offered and a known loss if the gambler incorrectly bets on the line. In the UK betting above or below the spread does not have a known final profit or loss, with these figures determined by the number of unit points the level of the final outcome ends up being either above or below the spread, multiplied by the stake chosen by the gambler.

For UK spread betting firms, any final outcome that finishes in the middle of the spread will result in profits from both sides of the book as both buyers and sellers will have ended up making unit point losses. So in the example above, if the cricket team ended up scoring 345 runs both buyers at 350 and sellers at 340 would have ended up with losses of five unit points multiplied by their stake.

In addition to the spread bet, a very common "side bet" on an event is the total (commonly called the over/under or O/U ) bet. This is a bet on the total number of points scored by both teams. Suppose team A is playing team B and the total is set at 44.5 points. If the final score is team A 24, team B 17, the total is 41 and bettors who took the under will win. If the final score is team A 30, team B 31, the total is 61 and bettors who took the over will win. The total is popular because it allows gamblers to bet on their overall perception of the game (e.g., a high-scoring offensive show or a defensive battle) without needing to pick the actual winner.

In the UK, these bets are sometimes called spread bets, but rather than a simple win/loss, the bet pays more or less depending on how far from the spread the final result is.

Example: In a football match the bookmaker believes that 12 or 13 corners will occur, thus the spread is set at 12–13.

In North American sports betting many of these wagers would be classified as over-under (or, more commonly today, total ) bets rather than spread bets. However, these are for one side or another of a total only, and do not increase the amount won or lost as the actual moves away from the bookmaker's prediction. Instead, over-under or total bets are handled much like point-spread bets on a team, with the usual 10/11 (4.55%) commission applied. Many Nevada sports books allow these bets in parlays , just like team point spread bets. This makes it possible to bet, for instance, team A and the over , and be paid if both

(Such parlays usually pay off at odds of 13:5 with no commission charge, just as a standard two-team parlay would.)

The mathematical analysis of spreads and spread betting is a large and growing subject. For example, sports that have simple 1-point scoring systems ( e.g., baseball , hockey , and soccer ) may be analysed using Poisson and Skellam statistics.

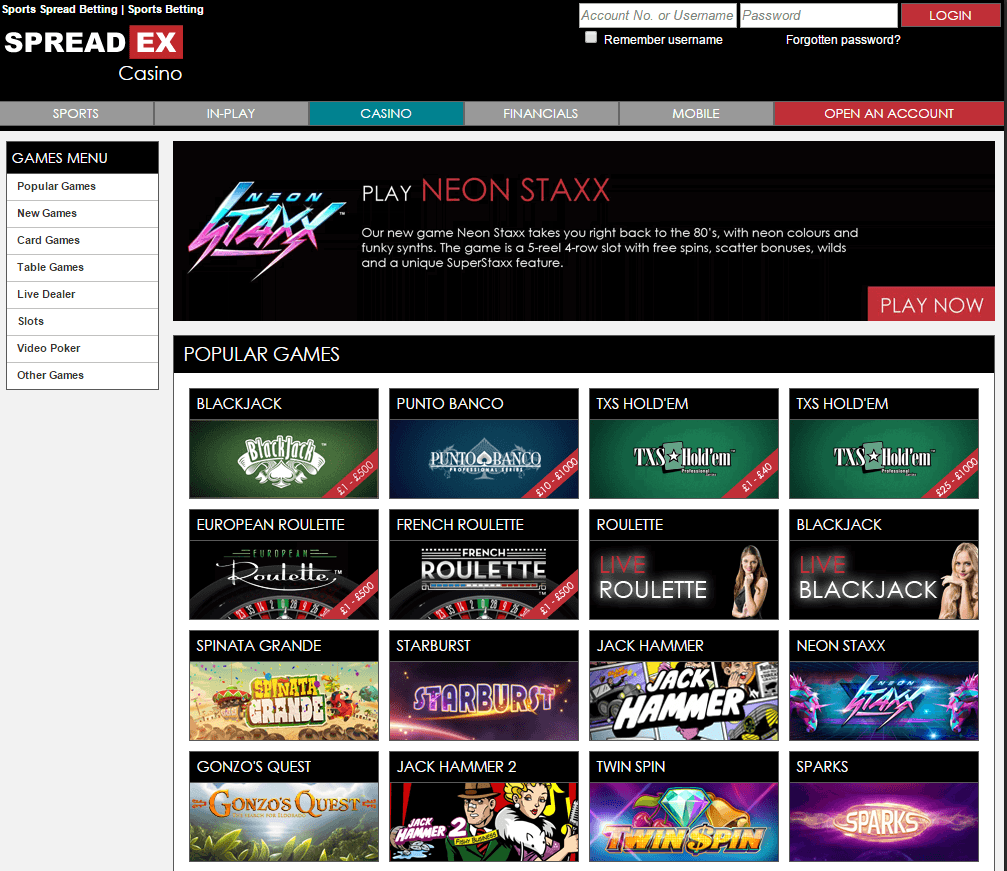

By far the largest part of the official market in the UK concerns financial instruments; the leading spread-betting companies make most of their revenues from financial markets, their sports operations being much less significant. Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being

Financial spread betting is a way to speculate on financial markets in the same way as trading a number of derivatives . In particular, the financial derivative Contract for difference (CFD) mirrors the spread bet in many ways. In fact, a number of financial derivative trading companies offer both financial spread bets and CFDs in parallel using the same trading platform.

Unlike fixed-odds betting, the amount won or lost can be unlimited as there is no single stake to limit any loss. However, it is usually possible to negotiate limits with the bookmaker:

Spread betting has moved outside the ambit of sport and financial markets (that is, those dealing solely with share, bonds and derivatives), to cover a wide range of markets, such as house prices. [5] By paying attention to the external factors, such as weather and time of day, those who are betting using a point spread can be better prepared when it comes to obtaining a favorable outcome. Additionally, by avoiding the favourite-longshot bias , where the expected returns on bets placed at shorter odds exceed that of bets placed at the longer odds, and not betting with one's favorite team, but rather with the team that has been shown to be better when playing in a specific weather condition and time of day, the possibility of arriving at a positive outcome is increased.

In the UK and some other European countries the profit from spread betting is free from tax. The tax authorities of these countries designate financial spread betting as gambling and not investing, meaning it is free from capital gains tax and stamp duty , despite the fact that it is regulated as a financial product by the Financial Conduct Authority in the UK. Most traders are also not liable for income tax unless they rely solely on their profits from financial spread betting to support themselves. The popularity of financial spread betting in the UK and some other European countries, compared to trading other speculative financial instruments such as CFDs and futures is partly due to this tax advantage. However, this also means any losses cannot be offset against future earnings for tax calculations.

Conversely, in most other countries financial spread betting income is considered taxable. For example, the Australian Tax Office issued a decision in March 2010 saying "Yes, the gains from financial spread betting are assessable income under section 6-5 or section 15-15 of the ITAA 1997". [6] Similarly, any losses on the spread betting contracts are deductible. This has resulted in a much lower interest in financial spread betting in those countries.

Suppose Lloyds Bank is trading on the market at 410p bid, and 411p offer. A spread-betting company is also offering 410-411p. We use cash bets with no definite expiry , or "rolling daily bets" as they are referred to by the spread betting companies.

If I think the share price is going to go up, I might bet £10 a point ( i.e., £10 per penny the shares moves) at 411p. We use the offer price since I am "buying" the share (betting on its increase). Note that my total loss (if Lloyds Bank went to 0p) could be up to £4110, so this is as risky as buying 1000 of the shares normally.

If a bet goes overnight, the bettor is charged a financing cost (or receives it, if the bettor is shorting the stock). This might be set at LIBOR + a certain percentage , usually around 2-3%.

Thus, in the example, if Lloyds Bank are trading at 411p, then for every day I keep the bet open I am charged [taking finance cost to be 7%] ((411p x 10) * 7% / 365 ) = £0.78821 (or 78.8p)

On top of this, the bettor needs an amount as collateral in the spread-betting account to cover potential losses. Usually this is either 5 or 10% of the total exposure you are taking on but can go up to 100% on illiquid stocks. In this case £4110 * 0.1 or 0.05 = £411.00 or £205.50

If at the end of the bet Lloyds Bank traded at 400-401p, I need to cover that £4110 – £400*10 (£4000) = £110 difference by putting extra deposit (or collateral) into the account.

The punter usually receives all dividends and other corporate adjustments in the financing charge each night. For example, suppose Lloyds Bank goes ex-dividend with dividend of 23.5p. The bettor receives that amount. The exact amount received varies depending on the rules and policies of the spread betting company, and the taxes that are normally charged in the home tax country of the shares.

According to an article in The Times dated 10 April 2009, approximately 30,000 spread bet accounts were opened in the previous year, and that the largest study of gambling in the UK on behalf of the Gambling Commission found that serious problems developed in almost 15% of spread betters compared to 1% of other gambling. [7] A report from Cass Business School found that only 1 in 5 gamblers ends up a winner. [8] As noted in the report, this corresponds to the same ratio of successful gamblers in regular trading. [9] Evidence from spread betting firms themselves actually put this closer to being 1 in 10 traders as being profitable. [ citation needed ]

Spread Betting Course

Spread betting - Wikipedia

What Is Spread Betting ?

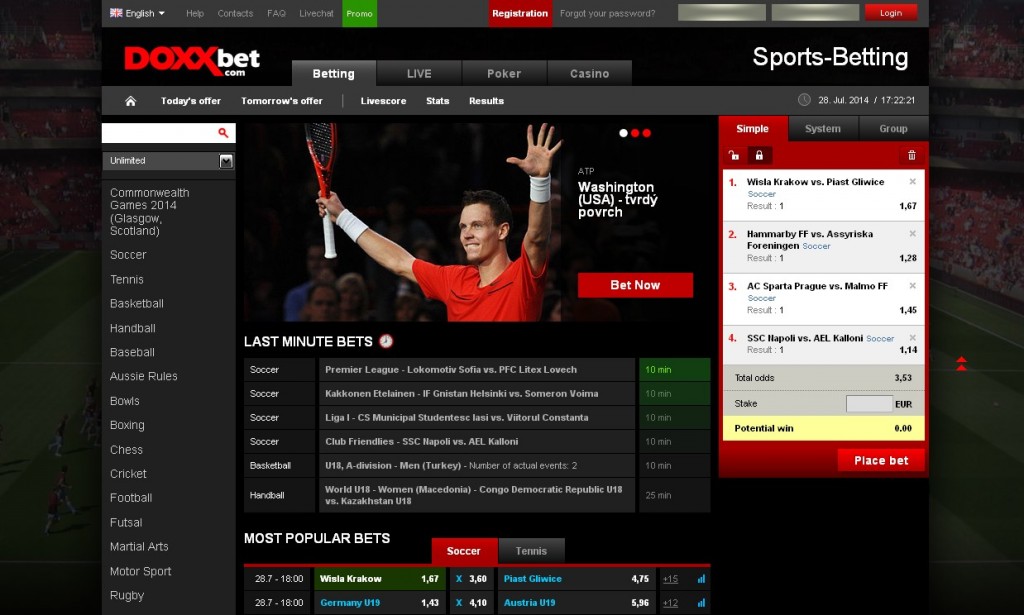

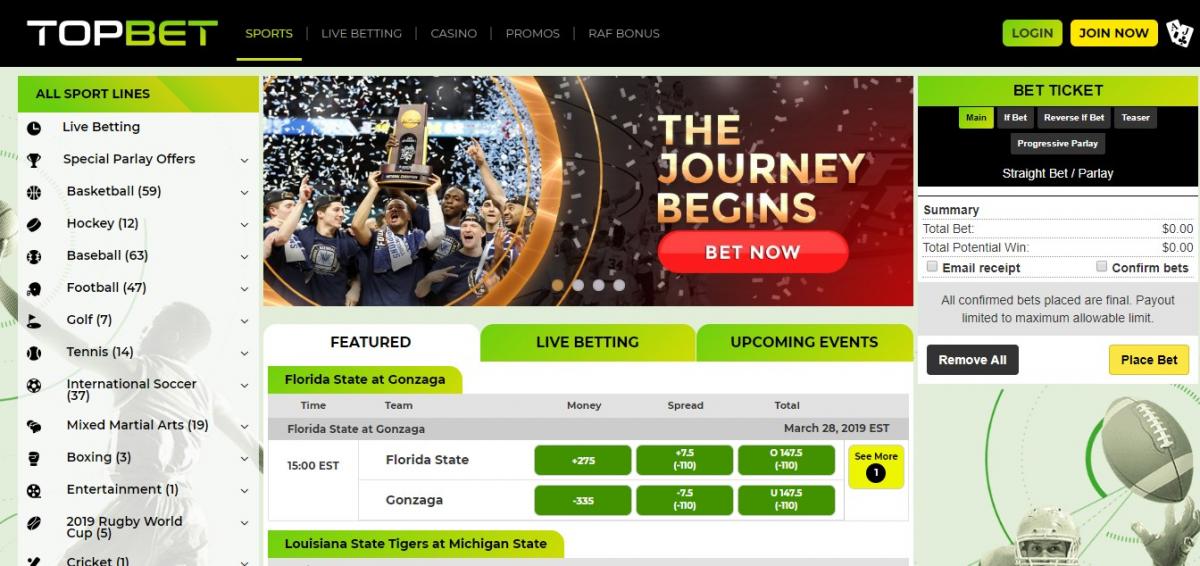

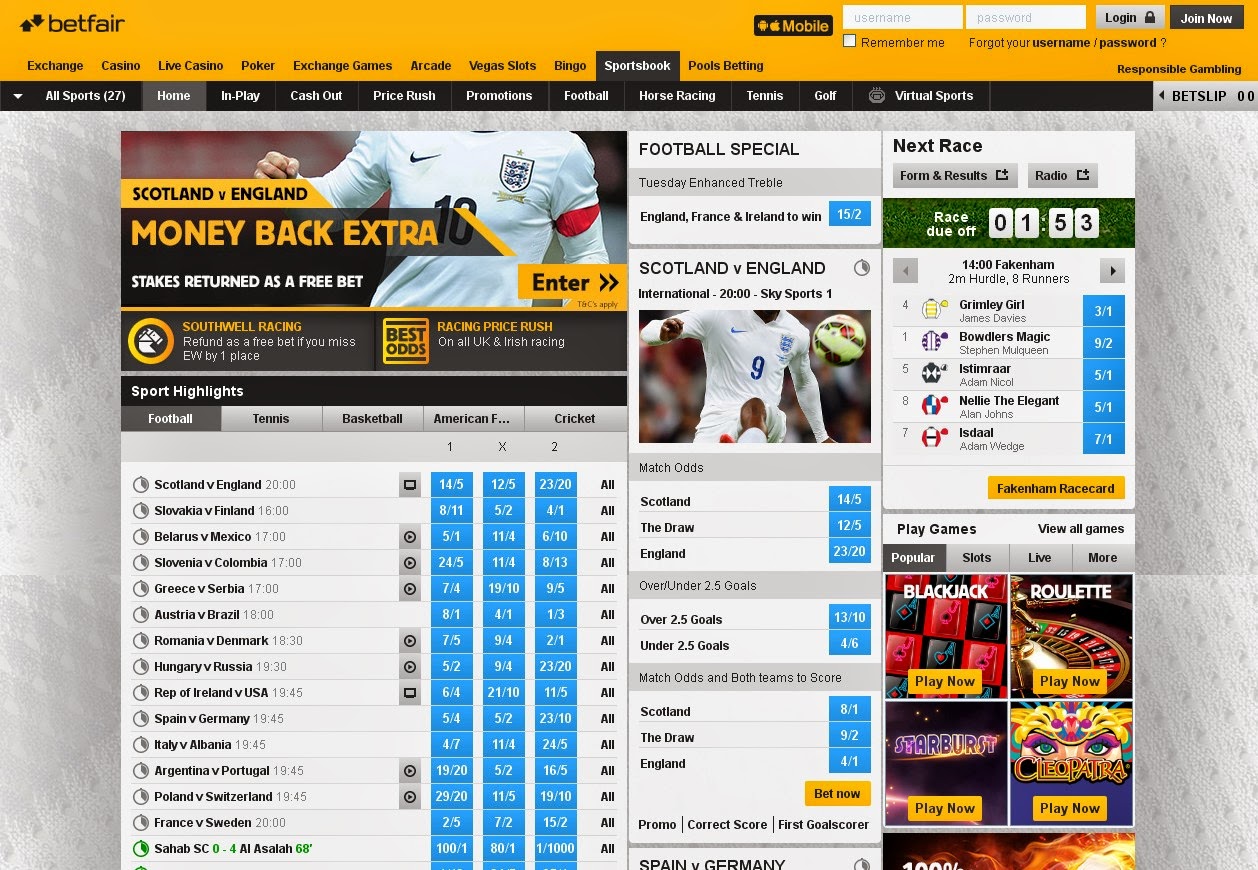

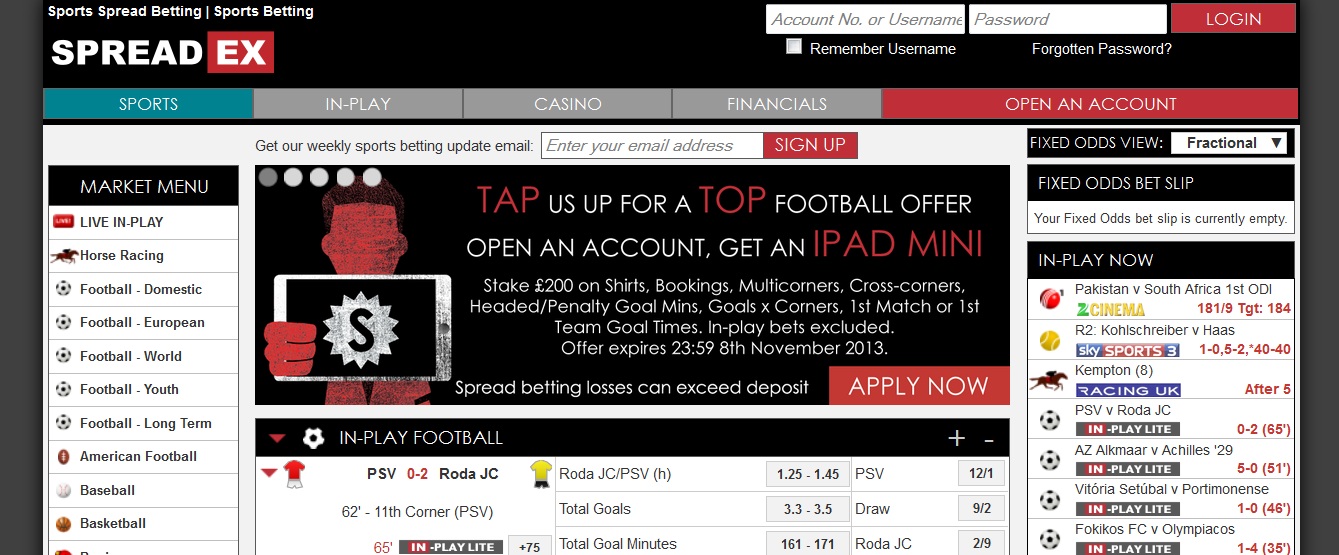

Financial & Sports Spread Betting | Spreadex

Spread betting | Spread bet with zero commission and tight... | Capital. com

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Forex (FX) is the market where currencies are traded and is a portmanteau of "foreign" and "exchange." Forex also refers to the currencies traded there.

A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

A cash-and-carry trade is an arbitrage strategy that exploits the mispricing between the underlying asset and its corresponding derivative.

Covered interest arbitrage is a strategy where an investor uses a forward contract to hedge against exchange rate risk. Returns are typically small but it can prove effective.

A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost .

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

Options Trading Strategy & Education

Facesitting Secretary

Sex Lesbi Massage

Sex Toy 00

Naughty America Girlfriend

Granny Hunters