Spread Betting Brokers

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Brokers

Welcome to BrokerNotes. This site uses cookies - here's our cookie policy . Ok

Sort By

SORT

Our Pick

Most Popular

Lowest Spread

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Central Bank of Ireland, ASIC, IIROC, FSA, FSB, UAE and BVI.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority, ASIC and MAS.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority and ASIC.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority and ASIC.

Established in 2007

HQ in Australia.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

What can you trade?

Forex

Crypto currencies

Indices

Commodities

Stocks

ETFs

Regulated by: Financial Conduct Authority.

Platforms

MT4

MT5

Web Trader

Mobile App

Funding Methods

Credit cards

PayPal

Bank transfer

It's fast, easy and 100% free!

Ready to find your broker?

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

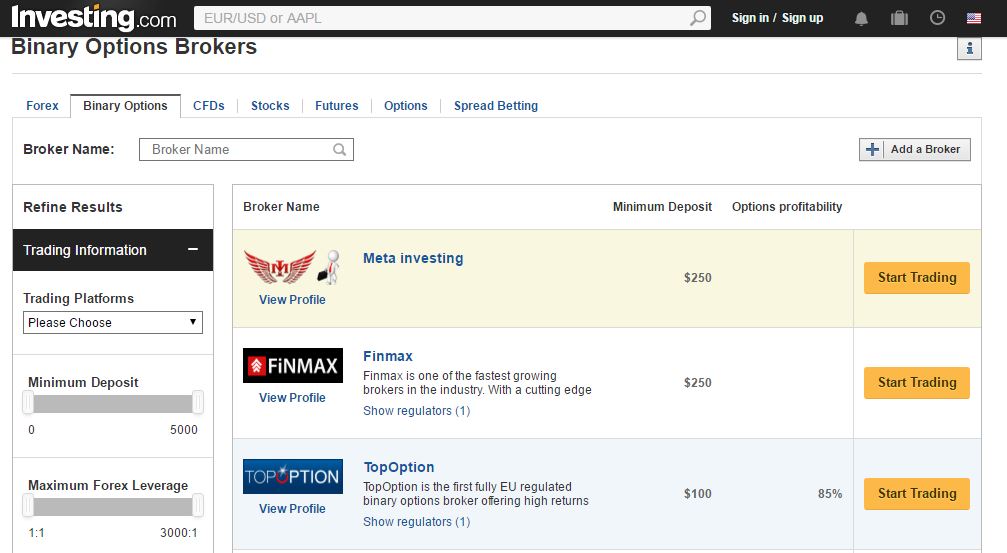

For our spread betting comparison, we found 11 brokers that are suitable and accept traders from Russian Federation.

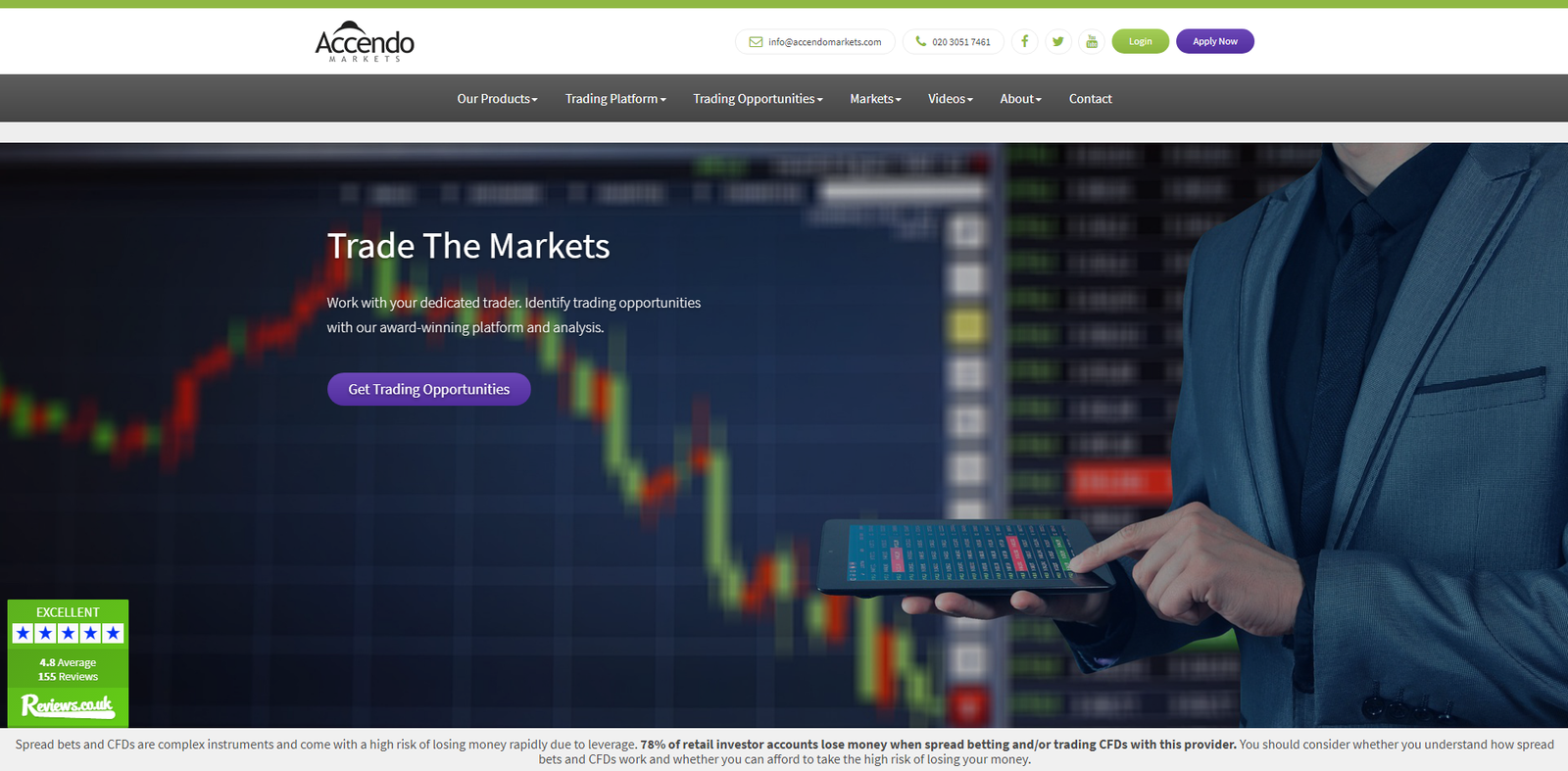

79% of retail investor accounts lose money when trading CFDs with this provider.

73% of retail investor accounts lose money when trading CFDs with this provider

Read our in-depth

City Index review

76% of retail investor accounts lose money when trading spread bets and CFDs with this provider

68.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

67% of retail investors lose money when trading spread bets and CFDs with this provider.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

Spread betting revolutionised speculation on the financial markets. This unique form of trading facilitates taking a directional risk in the financial markets for a wide audience previously unable to participate in major market moves.

Although the bucket shops of the early 1900s started the phenomenon, the modern concept of spread betting began in the UK in the mid-1970s when trading gold for speculative purposes was illegal.

IG Markets ‘ founder Stuart Wheeler had the idea of letting people trade gold as an index and in 1975, the International Gold or IG Index began trading. It was the forerunner of all the current spread betting bookmakers.

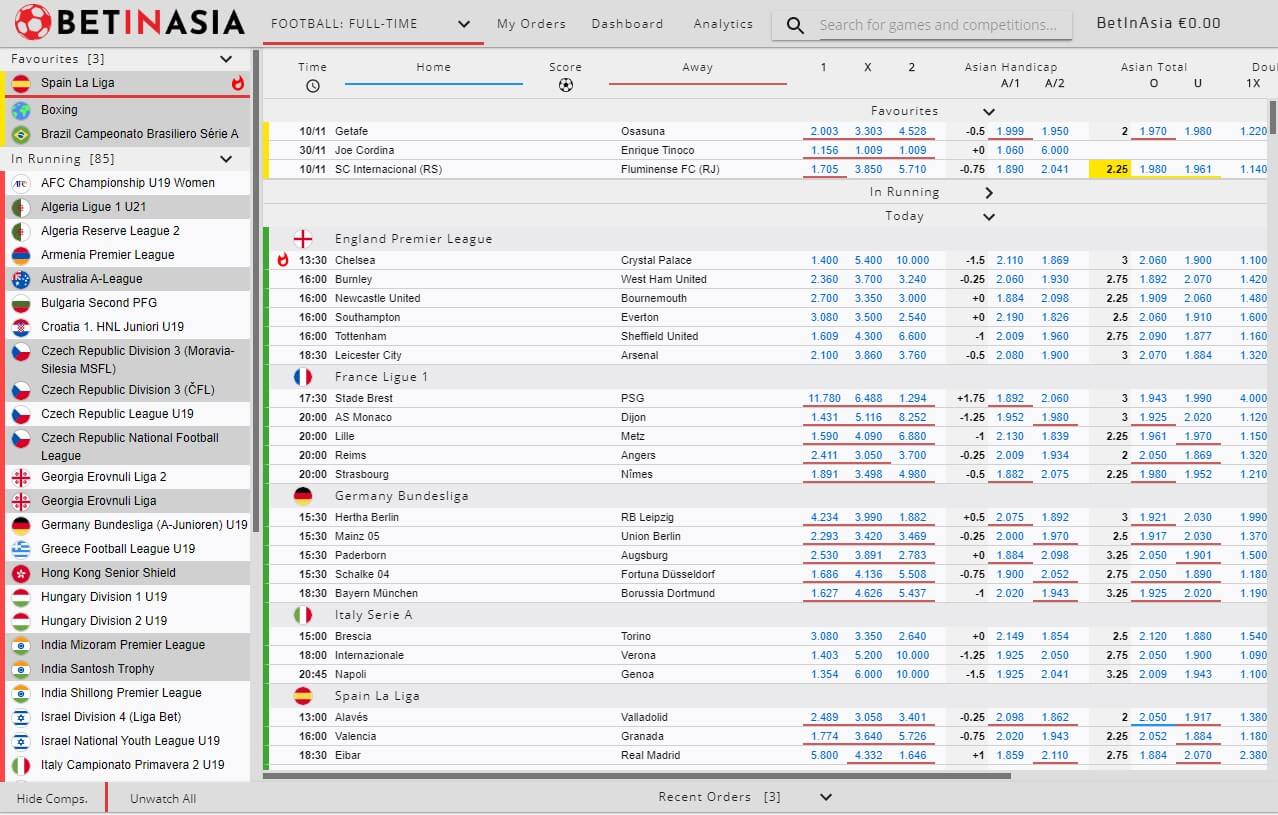

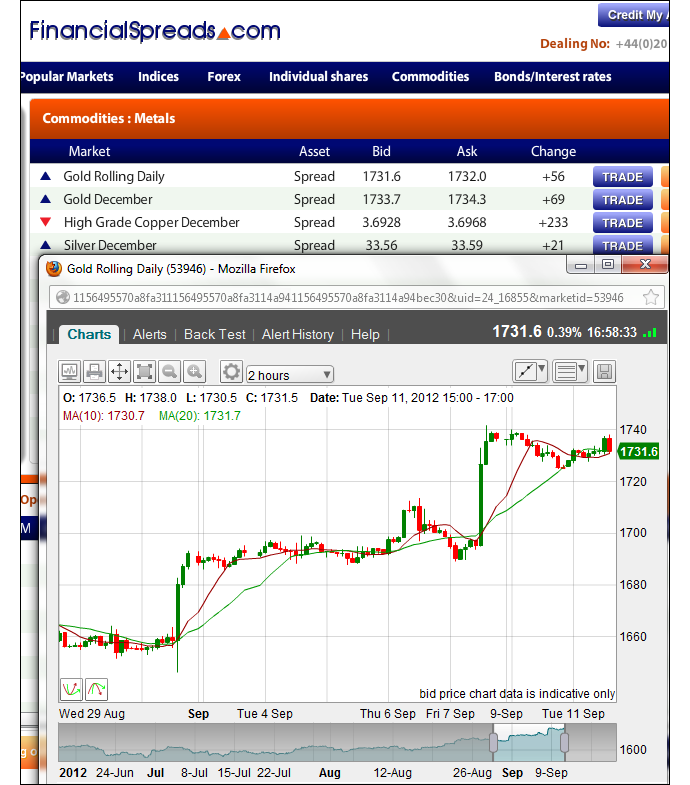

Today, speculators have a variety of spread betting platforms and brokers to choose from and trade the following markets: bonds, commodities , cryptocurrencies , ETFs, equities, forex currency pairs , and precious metals. Spread bets are even placed on futures and options markets, as well as on the outcome of events like sports matches and political elections.

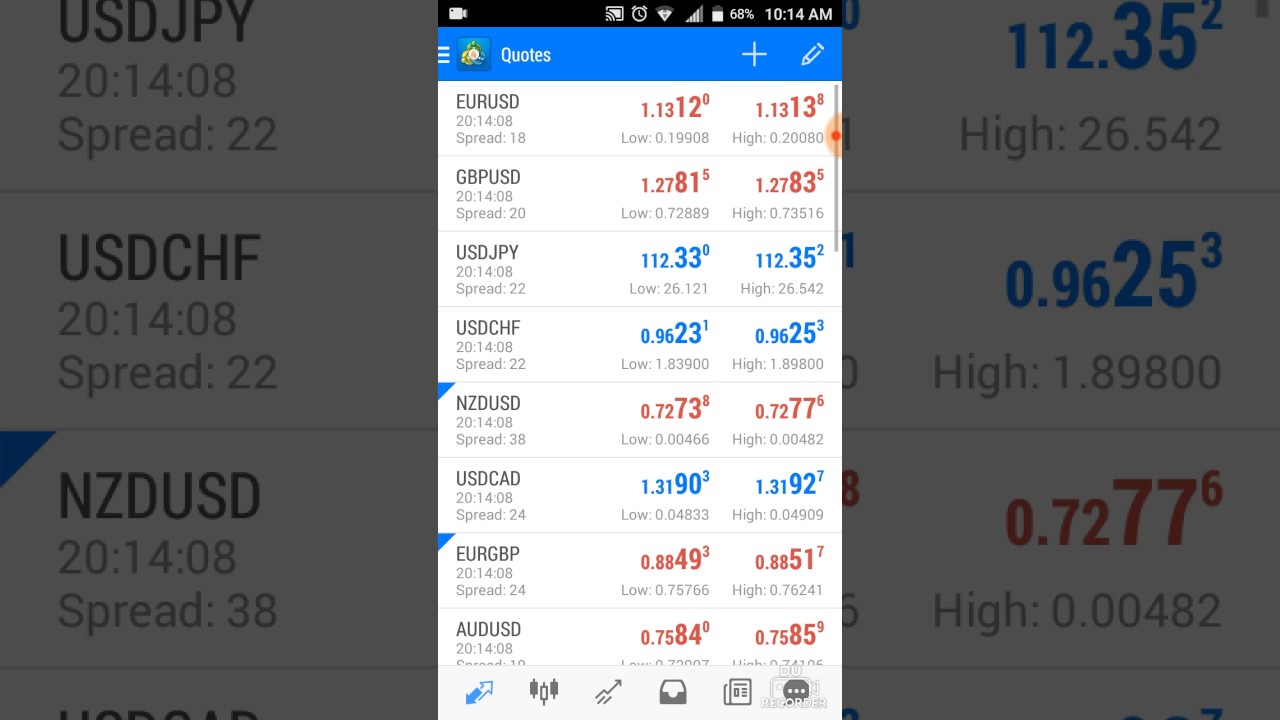

The concept of spread betting consists of having an opinion on the outcome of an event, such as the direction of a financial market, and placing a bet or stake that may benefit from that outcome with a broker. As an example, spread betting forex currency pairs is speculating on the future direction of specific currency pairs like the EUR/USD .

The spread bettor takes one side of a two-sided market, they either sell on the bid side (going short), or they buy on the offer side (going long). The spread bettor either profits if the result favours their bet or loses if the outcome goes against their bet.

The amount won or lost is calculated by taking the closeout or settlement price minus the opening price, dividing by the point size, and then multiplying the result by the stake amount. Click here to see a spread betting example.

A key advantage to financial spread betting is the transaction gets treated as a bet in the UK, so no special spread betting tax UK clients need to worry about ever gets imposed. This means no Capital Gains Tax, Income Tax or Stamp Duty gets charged to diminish betting profits, if any. Conversely, losses are not tax deductible.

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK

Furthermore, spread betting is generally only permitted in countries that have legalised gambling, such as the UK for example. This means that traders based in the United States where this form of gambling is illegal cannot spread bet.

Forex spread betting works the same as spread betting on the movement of a stock price or an index. Also, when spread betting on currency pairs, a rolling spot quote means the bet does not expire but instead gets rolled over for another session, which may result in a small rollover charge.

For example, a spread betting broker might quote a bid/offer of 1.1450/1.1451 for the EUR/USD currency pair.

A bet or stake of £5.00 for every pip, or $0.0001, that the Euro increases above 1.1451 could be made that would pay off with the EUR/USD rate anywhere above 1.1451 upon closeout.

If the currency pair’s exchange rate declines, the bettor would have to pay £5.00 for every pip the EUR/USD pair trades below 1.1451.

Accordingly, if the exchange rate rises as anticipated to end up at 1.1491/1.1492 when the bet is closed out, the gain would be:

(1.1491-1.1451)/0.0001 x £5.00 = + £200.00.

Conversely, if the exchange rate falls unexpectedly to end up at 1.1431/1.1432 upon closeout, the loss would be:

(1.1431-1.1451)/0.0001 x £5.00 = – £100.00

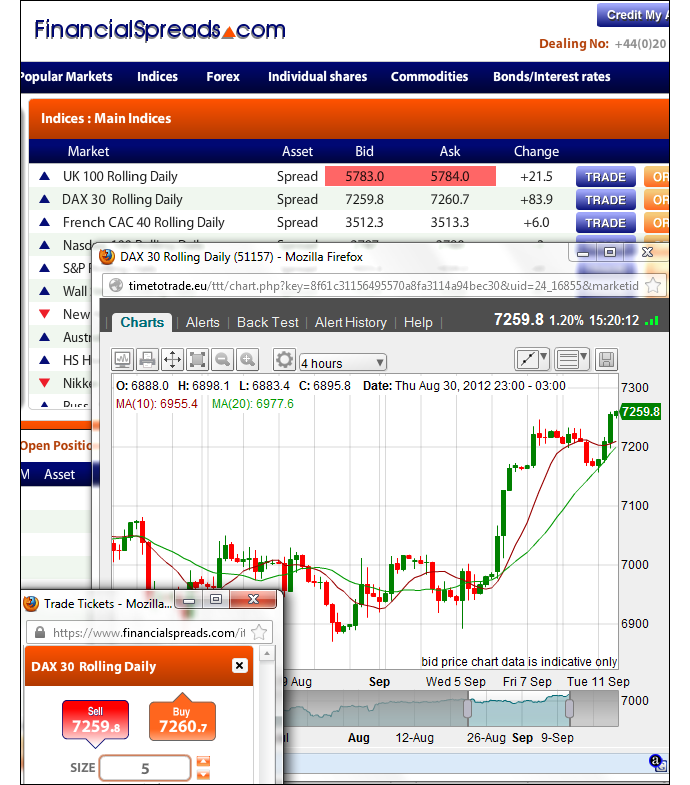

One of the most important factors when selecting a spread betting broker consists of the upfront costs of placing a trade that depends on the “spread”, which is the difference between the bid (sell) and offer (buy) prices of the underlying asset quoted.

Brokers make their money from the difference in the bid/offer spread, so they generally charge no commission and the trader pays the spread to access the particular market that they are speculating in. For this reason, speculators would typically be better off choosing a broker with tight, competitive dealing spreads.

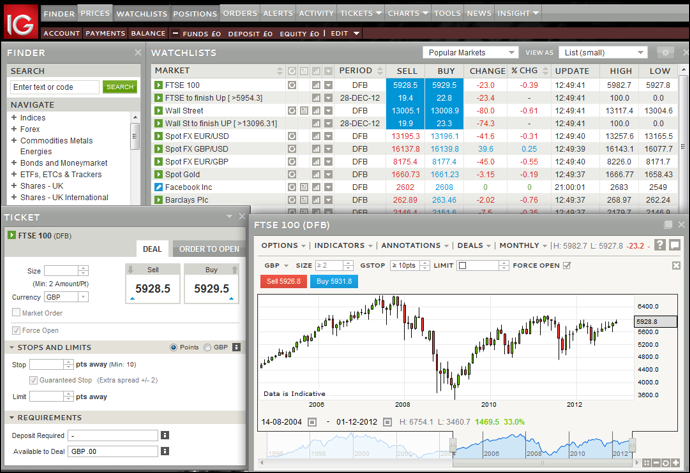

As concrete examples of spreads at major brokers like IG and CityIndex, the FTSE 100 daily spread is one point, while the Wall Street daily spread is 1.6 points, although IG offers variable spreads while CityIndex offers fixed spreads. Both require putting up a five per cent margin to speculate on those indices, and the minimum bet amount or stake in either stock market index is £0.50/point.

As an example, the two-way quote to spread bet on the FTSE 100 could be 7,103.84/7,105.44, so if a trader took a minimum stake of £0.50/point anticipating the market rising, they would get into that bet at the buy price of 7,105.44. The FTSE 100 would have to increase by 1.6 points to break even (excluding any other fees), as it would be sold at the bid price. For example, if it increased by exactly 1.6 points, the bid and offer price would be 7,105.44/7,107.04 and the trade could exit the position at the same price they bought in for.

Scalping, which is a viable very short-term trading strategy relies on tight spreads. Because of this reason, scalping is somewhat unsuitable for a spread betting account due to the wider spreads seen versus a zero spread or ECN forex trading account, so finding a spread betting broker for scalping can be challenging.

The margin requirement for a spread bet consists of the amount the spread betting broker requires a speculator to deposit to establish a spread bet, which generally represents a fraction of the value of the underlying asset. Margin requirements for spread betting vary among the different brokers and generally depend on the underlying assets that are traded.

Margin gets calculated as a percentage of the value of the underlying asset and can range from 3% to 50% depending on the liquidity and volatility in that particular market.

To determine the margin required to open a bet, multiply the notional amount of the trade, which is the stake multiplied by the asset’s price, by the relevant margin percentage.

For instance, if Vodafone Group PLC’s margin requirement was 20%, a trader wants to place a £1 per point spread bet, and the current price of Vodafone is 150p, the notional amount of the trade is 150 * £1 = £150. So, the required minimum deposit to open the trade would be 20% of £150 which is £30. However, a trader would need to deposit more than the minimum to avoid margin calls which would close the trade if the price moves against them.

For long-term traders, the interest charge becomes an important factor to take into account. If you take advantage of the leverages offered by a broker, you are borrowing capital for trading from the brokerage firms.

Interest is charged on the borrowed funds and can accumulate rapidly. The interest can either work in your favour or cut into your profits depending on the asset and position taken. Be sure to check the broker’s interest policy. For example, IG charge 2.5% plus the interbank rate for long positions held overnight.

Regulation is one of the most important factors to consider when choosing a spread betting broker. Security of a trader’s funds should place near the top of their list of priorities when choosing a spread betting broker, and good regulation helps assure this.

Reputable spread betting brokers should be regulated in the UK, by the FCA or Financial Conduct Authority . Brokers regulated by the FCA offers a certain degree of protection for each client’s funds. Most importantly, the FCA requires all spread betting firms to maintain their client’s funds in accounts that are segregated from the funds of the company. This prevents brokers from withdrawing client funds or using them for operational expenses.

While the FCA allows spread betting brokers to advise clients on the most suitable type of spread bet, the regulator prohibits spread betting firms to give clients any financial advice. This means that brokers cannot recommend trades, when to liquidate them or when to take profits on their trade. Be cautious if a firm is offering this kind of advice as it could be going against the FCA regulatory guidelines.

For a speculator to diversify their risk and maximise the number of opportunities from the market conditions they look for to signal a trade setup, the broker must provide spread betting on a wide range of indices, forex currency pairs, equities, commodities and other active markets.

A further consideration when choosing a broker for spread betting consists of the expertise the broker exhibits in executing transactions in each particular market. In general, the more markets a broker offers access to has substantial advantages to a speculator, largely because they only need a single spread betting account instead of many accounts held at different brokers to vary their trading activities among diverse markets.

When spread betting on foreign currency denominated assets, there should be no currency risk when liquidating the position. In other words, if a spread bet was made in the UK, and the GBP/USD rate declined or appreciated, the return or loss on the spread bet should still reflect the percentage gain or loss seen on the underlying asset or currency pair and be paid out in that percentage in Pounds Sterling.

For example, if a UK based speculator places a £0.50 per $1 move bet on a U.S. stock worth $10 per share, and the market then moves up to $15 per share upon closeout.

The return on the bet should be 50 percent regardless of the Pound Sterling/U.S. Dollar exchange rate. The spread bet would therefore pay out £0.50 per $1 point move or £2.50 for a $5 move and without translating that $5 move from U.S. Dollars back into Sterling. Similarly, if the market moved down to $5 per share, the loss incurred is -50% or -£2.50.

Customer service in spread betting is an important factor just as it is in other types of trading. The broker should be available at all times. This is important when the trader needs to quickly withdraw from certain positions or if the platform breaks down during trading hours.

Some brokers may only offer email or phone support where others like City Index will offer email, phone and live chat support via their website.

Daily spreads for the FTSE 100 and Wall Street indices, as well as rolling spreads for the GBP/USD and EUR/USD currency pairs, are commonly used for comparing spreads among different brokers. Although traders should see what spread betting broker best suits their particular situation and offers the best spreads for their preferred asset classes.

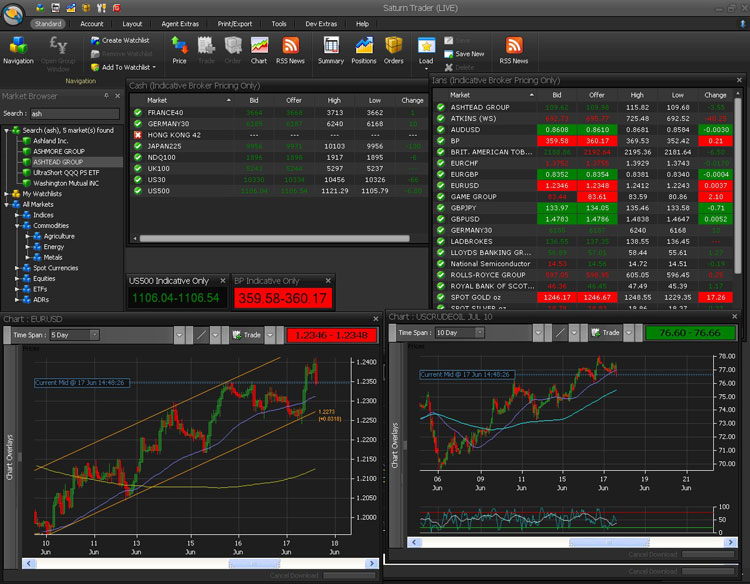

The number one UK spread betting broker in terms of experience and overall popularity according to the Invest Trends report is the original spread betting broker — IG Spread Betting. You can compare the features of their award-winning proprietary web-based, mobile and tablet betting platforms here. This broker has the most active financial spread betting UK and foreign accounts, according to Investment Trends’ UK Leveraged Trading Report for 2018 cited in their annual report , and provides access to over 15,000 markets.

Another UK broker, City Index’ Spread Betting Account has similar dealing spreads to IG, offers access to over 12,000 markets, and was voted the UK’s Best Spread Betting Service by Shares Award.

City Index also offers several platforms including a downloadable AT Pro platform, Web Trader and mobile trading apps. City Index received the award for the best spread betting platform in 2017 according to ADVFN , and the best spread betting app for mobile devices for 2018 according to OPWA.

City Index also provides support for using the popular MetaTrader 4 or MT4 online dealing platform for spread betting, which can be used to run and create Expert Advisors that trade automatically, as well as custom indicators.

Each of the aforementioned spread betting brokers has different minimum stakes and daily spreads on the FTSE 100 and Wall Street instruments, as well as offering forex-related spreads, so visit their websites for additional information.

Can the broker fix any trading errors that occur?

Admittedly, it’s usually hard to determine with a high degree of certainty whether a spread betting brokerage firm will go belly up. But there are certain precautions you can take. You can check whether the firm is well capitalised and financially sound.

Any company can experience trading errors both from dealers and clients. However, the broker should be able to sort out such problems quickly and efficiently. This might give a slight edge over public companies compared to private ones because they are required by law to make their financial accounts public on a regular basis, for example, you can view the annual returns of publicly listed companies like Plus500 and IG.

Finding the best broker among the many spread betting brokers and platforms available to suit your particular needs is an important step.

One should research a number of important factors when selecting a broker, such as spreads, margin requirements, regulatory status, reputation, account types, and tradeable assets.

The spread betting companies in the list above accept UK clients, are regulated in the UK and offer a good range of financial products to bet on, click here to see the list.

BrokerNotes Ltd is an Appointed Representative of Resolution Compliance Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN: 574048). BrokerNotes Ltd is registered in England and Wales. Company No. 10464674. Registered office: Thames Wing, Howbery Park, Wallingford, OX10 8BA, UK.

Copyright © 2014-2021 BrokerNotes Ltd

Disclaimer: BrokerNotes.co is for informational purposes only. This website does not provide investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Rates and terms set on third-party websites are subject to change without notice. Please note that BrokerNotes.co has financial relationships with some of the merchants mentioned here and may be compensated if consumers choose to utilise some of the links located throughout the content on this site.

Spread Betting Companies 2021 | Best Spread Betting Brokers

Compare Spread Betting Brokers (UK)

Top 10 Spread Betting Brokers - Compare UK Platforms | GMG

Spread Betting Brokers - Investing.com UK

Best Spread Betting Brokers 2020 - TradingBrokers.com

What is spread betting video transcript

Spread betting brokers let you bet on the financial markets through their online platforms. Compare UK brokers that offer spread betting accounts and choose the one which offers the best features, cheapest prices and deposit protection for your needs.

Financial spread betting is unique to the UK because of its tax benefits. However, there are still only a handful of brokers that offer it. In our guide to choosing a financial spread betting broker, we highlight which spread betting broker is best at what they do, who they are most appropriate for and how to compare them to get the right broker for you.

Spread betting is a way to bet on the rise and fall of the prices of an asset, like a stock, commodity or financial instrument. You do not own the underlying asset but make money by predicting correctly if the value of your chosen asset will rise or fall in a given timescale. You can spread bet on anything, from shares to gold and crude, FX or house prices. There are a few key differences between traditional investing. Firstly, it’s a bet so there is no tax on profits. Secondly, you trade on margin as you bet on a per point basis, so you can make or lose much more than your stake – which makes spread betting a high risk or high reward product. Many of the spread betting brokers listed in our comparison tables have very good education articles, videos and demo accounts for potential clients to practice on. Here is a full explanation of what is spread betting is, so you can get more detail and learn our top tips.

There are quite a few spread betting brokers in the UK and the differences between them run deeper than just the spreads they offer.

For the most part, they offer access to similar markets, with closely competitive spreads and similar analysis and strategic tools. We covered in some depth how to choose the best spread betting broker .

The differences between spread betting brokers generally tend to be in things like customer service, supporting content and educational tools, and the prices they offer, known as the spreads.

Here is a summary of some of the best spread betting brokers, based on more than just the spreads they offer:

If you are new to spread betting, you will be classified as a "retail trader", which means you get more protection from the regulator, restricted margin rates and standard fees. However, if you are a more experienced trader and can prove it, you may be eligible to upgrade to a "professional trader". Being a professional trader means you get lower fees and more leverage, but less protection against losses.

If you are looking for a review on the top spread betting firms in the UK, you have come to the right place. We only list regulated brokers that offer secure platforms, tight spreads and quick execution on FX, Equities, Commodities, Indices and Fixed Income.

You can also post your ratings and account reviews to let other traders know what you think.

We review the best spread betting brokers and look at the top accounts. Our expert reviews are a detailed assessment based on first-hand experiences with each of the major spread betting companies.

We also consolidate user reviews so you can read real-life trader experiences and get an idea of the best features that each broker offers. You can also share your opinion on the best brokers by voting in our broker awards .

Make sure your broker offers tight spreads. The spreads and how tight they are is an important part of trading through a spread betting broker, as spreads impact how quickly you can make money.

However, there are other important considerations to take into account as well. For example, a broker may try to win your business by marketing ultra-tight spreads on a couple of the main products, but then increase spreads on the more exotic asset classes.

You also need to make sure when you pick a broker that they offer consistently tight spreads, and not just during normal trading hours. Securing tight spreads when you want to trade is more important to your profits than choosing a broker that offers the cheapest spreads.

Spreads can also vary on the asset class. In some circumstances, it may be best to go with a broker that has consistently tight spreads throughout their entire asset class range rather than just on a few key products.

That being said, it ultimately depends upon what and how you trade. For example, if you only trade two or three indices and FX pairs, then a broker that will give you the lowest trading costs on these assets will likely make the most sense; then use alternative accounts for other instruments.

Choosing a broker that works best for your strategy, your budget, your ambitions and your preferences will be much more beneficial than arbitrarily choosing the tightest spreads.

Some spread betting companies focus on tight spreads on a few key markets. Others focus on providing a good overall value and service. When opening a new account, have in mind what asset classes and individual instruments you want to trade.

If you have AIM and small-cap shares, you will need a spread betting broker that specialises in them, like Spreadex, ETX capital or IG. Here is the best way to spread bet on the AIM market .

You may need to consider separate accounts if you have a favourite broker for one market but want to trade on a market that they don't offer. However, remember that all brokers will offer the major index, commodities and FX pairs though.

Although they aren't the only consideration to factor in when choosing a spread betting broker, tight spreads are certainly an important aspect that should not be overlooked. When comparing how tight spreads are among spread betting companies, you must also look at the overall offering, as being taken in by the initial spread may have a detrimental effect on your trading if you are trading exotic products.

You need the spread betting broker you use to be financially secure and established.

Before opening an account, always do some background research into the company, as there have been a few examples of spread betting companies going bankrupt and traders having problems getting their funds back.

An easy way to keep an eye on a company’s financials is to go with brokers that have traded themselves on the London Stock Exchange. Being a public company means that you have to submit financial reports regularly. The share price and market cap are also good indicators of whether or not a company is heading for trouble.

If a broker is not listed on the Stock Exchange, you can have a look at their accounts on Companies House or websites like duedil.com. If you are trading through a spread betting white label, it’s important to check just what balance sheet you are using – the brand or the underlying provider.

Checking your spread betting broker is FCA-regulated and covered by FSCS protection is also a sensible step. All of the brokers in our comparison are fully regulated and eligible for FSCS deposit protection.

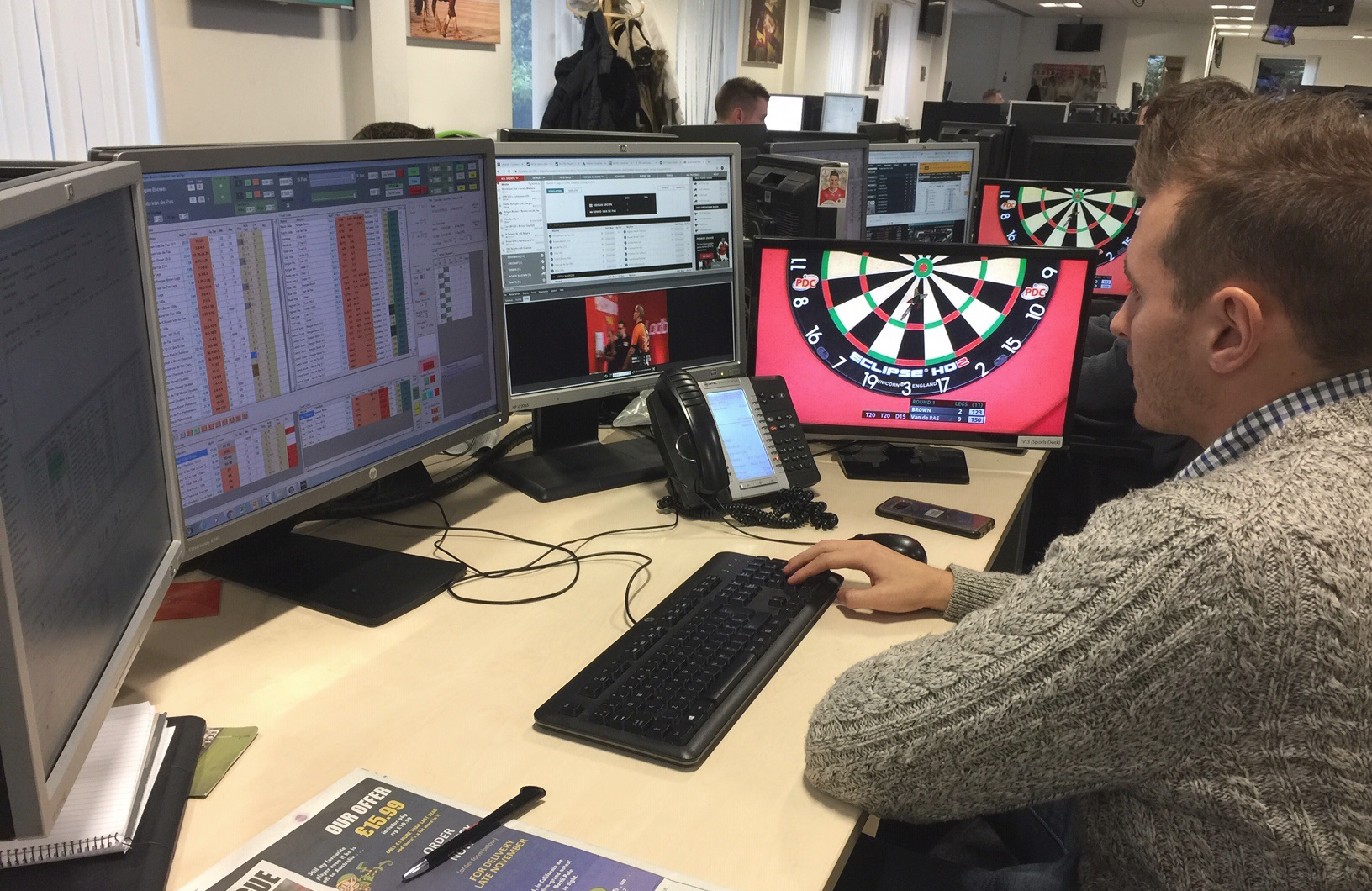

MT4 is one of the best ways to trade FX online, and many spread betting brokers now offer MT4 as a platform. If you are interested in spread betting on MT4, you can review the best MT4 spread betting accounts here . Spread betting companies that provide MT4 give clients the ability to upload and purchase custom indicators, then run automated trading strategies based on pre-set technical perimeters. Traders can also follow “Expert Advisors” and trade based on established FX strategies without the need to manually execute trades.

Today, due to regulation and competition, most brokers’ spreads and prices will be fairly similar, but on occasion, there may be an opportunity to arbitrage between brokers. But to be honest, the way information is distributed and based on how competitive the industry legitimate, arbitrage opportunities will be rare.

It is worth researching the spreads that brokers offer on markets you are interested in trading before you commit to choosing a broker. You want to know that you're able to trade with tight spreads on markets relevant to you before you add funds and use your budget.

Spread betting brokers in the UK are regulated by the FCA , and the FCA register provides a database of the company status, the management and also their regulated employment history. By searching the register, you can quite easily find out what experience and pedigree your broker has.

Never trade with a company that is not regulated by the FCA. Most brokers display their regulatory status in the footer of the website at the bottom.

Our spread betting company comparison tables only include spread betting brokers that are regulated.

You will need to choose a broker that offers the service, markets and account support and educational material that complement your trading strategy. Your personal preference can make a big difference in how you interact with the trading platform, the brokers and ultimately, how you pick the right spread betting broker can affect your win/loss ratio of trades.

Our rankings are based on extensive product testing and our industry survey, which measures customer satisfaction on 10 key spread betting account features.

IG is the largest and oldest spread betting company in the world. Founded in 1974, they are the default spread betting broker for new and experienced traders.

Pepperstone are a relatively new broker that focus on a simple trading platform with tight pricing. If you are new to spread betting, always make sure you get lots of information from third parties before trading, and keep it as simple as possible.

IG: Despite being the largest and oldest spread betting firm ( read IG review ), IG can still compete with the nimble upstarts that are trying to win market share on pricing. They offer by far the widest range of markets, but because of their size, do widen the spreads on peripheral instruments a little more. As their spreads are variable, it also means that when the markets are volatile, they could be wider. Whilst it could be bad for traders in the short term, it is an indication that the firm is hedging correctly, which will benefit everyone in the long run.

CMC Markets ( read CMC Markets review ) : as well as being one of the biggest brokers out there, you can also trade a wide range of commodities on MT4 and equities through ETX Trader Pro (the better platform).

Pepperstone ( read Pepperstone review ) are all about tight spreads of the major pairs.

The FX market is the most traded asset class in the world and one of the most popular asset classes with spread betting brokers.

The major pairs offer great liquidity, tight pricing and good intra-day trading ranges. Because of this, brokers can offer low margin rates, meaning high leverage. So spread betting on FX is one of the best ways to trade foreign exchange. You can compare the best Forex brokers here .

Spread betting on Forex is all about tight prices, speed and market timing. It is one of the most actively traded markets in the world. Positions are generally turned over much faster than any other asset class, and traders aim to take quick profits. Finding a spread betting broker with really tight FX spreads can make a big difference to your profit and loss at the end of the trading day.

If you are looking for a new broker that offers little more than your current one, then here is how to choose a broker that can give you more. Undoubtedly, an advantage for your trading strategy can come in the form of sentiment, data, news or analysis. It’s up to you as a trader to find the best edge for your trading.

CMC Markets is one of the most established spread betting brokers and offers a wide variety of webinars, trading tools and indicators on their online platform. IG has lots of sentiment, data and analysis tools, whilst Spreadex have a great reputation for giving this customer what they want.

Due to regulation, spread betting brokers can be quite similar these days, especially in terms of their pricing and the ultimate service they offer.

However, one thing to look out for if you are after value (other than tight spreads) is what else you get as part of the account package. Some spread betting accounts provide access to third-party research and analysis services.

Others provide direct market access and some are stripped to the bone and offer nothing other than access to the platform. If you are happy to have various screens open then this may appeal, but a comparison table like ours will give you a good indication of what additional services spread betting accounts will give you.

Having the ability to close your trades, open new positions or check market movements on the go can be very important. So choosing a broker that offers a mobile app that gives you this ability makes sense.

You can compare the best Financial Spread Betting Mobile Apps to make sure that you don’t lose touch with the market for the moment. Most brokers still offer dealing support by phone, but with high-risk bets on, you need to be connected all the time.

Spread betting is a highly-regulated financial product and profits are free of capital gains tax. However, if you're new to spread betting, here are the brokers with the best educational resources and tools to help you get started.

IG: Put simply, they are the biggest spread betting and CFD broker in the world. They are listed on the London Stock Exchange and are currently valued at over £3bn. If you plan on becoming a full-time professional trader or have a very large amount of money to trade, their platform and staff can cater to your needs as your trading progresses. Read our expert and IG client reviews here .

Spreadex: Nice old school broker. Based in St Albans, just outside of London. Helpful staff, excellent customer service and a simple to use platform. Spreadex also has one of the largest market ranges, allowing new traders to experiment with all sorts of trading, from small caps to crypto to fixed income. Plus, you can spread bet on the horses and football at the weekend with their sports spread betting offering. Read our expert and Spreadex client reviews here .

IG – Of course, being the oldest and biggest spread betting firm, IG are a clear choice for HNW (high net-worth) clients. They have a huge balance sheet and are also listed on the LSE, so it should be very clear if the firm is having difficulties. Read IG reviews .

Spreadex is one of the most well-established spread betting brokers. They launched in 1999 and probably offer the widest range of markets, phone trading and excellent personal service. You can read our interview with Spreadex CEO Jonathan Hufford here.

Spreadex is one of those brokers that people like doing business with. They don't offer the tightest spreads or even the widest range of markets. But, they do offer a slightly more personal service. It's their small brokerage attitude that makes them worth trading through.

IG are one of the largest brokers in the UK. Clients mainly trade via their well-established platform. However, as MT4 is such a popular choice for FX traders, they recently launched a Metatrader 4 option. IG MT4 spread betting offers spread on EURUSD from 0.6 points, free VPS for expert advisors, free broker apps, and 18 free bespoke add-ons and indicators.

What are the golden rules to spread betting?

There are some key principles that all spread betting traders should adhere to if they want to make money.

If not, you may find that paying a bit more attention to your strategy, discipline and objectives will make a big difference.

A strategy is key to spread betting. Having a clear idea of how you want to trade will give you the best chance of maximising profits and reducing losses. If you are just getting started in spread betting and looking for a basic strategy that promotes good trading, we've put together a quick summary of three simple strategies that should help you find your feet.

What are the advantages of spread betting over other types of trading?

What is the B book run by spread betting brokers?

The B book has a pretty bad reputation, rather unjustly. It’s a little unfair as the industry wouldn’t exist without it. Some ask how can the B Book model in spread betting still exists in the current financial climate? The answer is simple; without it, all the brokers would go out of business.

Essentially, the B book means that the broker will take the other side of a trade for some time. By doing so, the broker accumulates asset value on the opposite side of your trade, meaning that when another client bets the opposite way, they only have one transaction to facilitate over two, as an A book broker might. This efficiency essentially allows brokers to pass on cheaper trading costs to their clients.

Who are the most popular spread betting brokers?

Spread betting is dominated by several firms, but as there are relatively few barriers to entering the market, new firms arrive all the time. At the moment, the two largest publicly-listed financial spread betting firms are IG and CMC Markets.

Can you spread bet on Bitcoin and Cryptocurrency?

No. The FCA has banned trading on cryptocurrencies. However, you can buy and sell cryptocurrencies through crypto exchanges .

Can you spread bet in volatile markets?

Various indicators will show you how volatile the market is. In most cases, a moving market is easier to trade than a stagnant one. You can spread bet on market volatility using the VIX , a futures contract based in Chicago. It’s not the easiest indicator to follow or understand but once mastered, it can be an invaluable tool.

Where can I find spread betting tips?

Our tips and strategies explaining how to spread bet can help you effectively navigate the world of spread betting.

The financial markets are difficult to profit from, and spread betting is a high-risk, leveraged way of speculating that can result in significant wins and losses. Make sure you fully understand the risks involved by familiarising yourself with how it works.

Where can I spread bet on smaller cap stocks?

There are pros and cons to spread betting on the smaller stocks. A pro is that if they skyrocket, you don’t have to pay tax on your winnings. The cons are that they are illiquid and as such can be very volatile.

The best way to spread bet on the AIM market is through a spread betting broker you have a good relationship with, who talks to the market directly. Even if you are a big client, you may find the dealers get frustrated. But if you hold the positions long enough, you’ll also end up paying a lot in interest overnight funding .

Is technical or fundamental analysis more effective when spread betting?

Most spread traders use technical analysis as it can provide a good visual representation of the market and is generally more relevant to short-term movements. However, it is based on historic events.

Fundamental analysis instead looks at what a company could be worth in the future.

Technical analysis vs fundamental analysis in spread betting is a debate that will probably go on forever, but for the most part, there is value in doing both, and it is largely down to personal preference as to what you rely on more.

Can you profit from company profit warnings with spread betting?

It is possible to profit when stocks fall in the market by betting on a company underperforming. This is known as shorting a stock. They say profit warnings come in threes, so there are many bear traders out there stalking the market for potential victims. Shorting stocks is how you use spread betting to bet on a downward market, and this can be profitable, but beware as losses are unlimited. You can only make as much as your stake goes to zero, but in theory, a stock price can go on up forever. Compare spread betting brokers for shorting stock .

What is the difference between spread betting and CFDs (Contracts for difference)?

CFDs are for professional traders who use them for direct market access and anonymity (to an extent). Outside the UK, CFDs are used by private clients as there are no tax benefits. Read what the difference is between spread betting and CFDs for more information.

Can I hedge my investment portfolio with spread betting?

There are pros and cons to hedging with spread betting . Using spread betting as a hedging tool can be an efficient way to manage a profitable position for tax purposes.

Understanding how spread betting markets work is not likely to help you guarantee you will make money. Profitability in spread betting ultimately boils down to calling the market correctly.

However, understanding the mechanics of the markets and what makes them work may be something that helps you feel more comfortable interacting with them.

Should I choose an FCA-regulated broker?

By ensuring your spread betting broker is fully authorised and regulated by the FCA, some of your funds will be protected under the FSCS. The FCA also requires spread betting brokers to report regularly and have adequate compliance procedures in place to treat customers fairly. The Good Money Guide only shows brokers who are authorised and registered with the FCA, and as such, offer FSCS protection for their customers’ money.

Should I choose a spread betting broker who offers credit?

Some brokers offer credit accounts. This means that if you are a good client, you can put a trade on without having any cash in your account. You will have to fund the account, but by having a bit of credit, it means you can put a trade on quickly without having to wait for funds to be added.

Be careful not to bet more than you can afford, as any losses, credit funded or not, will have to be repaid to the broker.

Should I choose a spread betting account that offers social trading features?

Social trading is big business now. It allows you to execute the same trades as the best customer of a specific broker. If a broker allows social trading, they will show the performance and trades of traders that make money. You can then allocate a certain amount of capital to follow their real live positions.

Which are the best spread betting platforms for beginners?

This is a tricky question as there is no one size fits all spread betting broker for beginners. If you want to find out which is the best spread betting platform for beginners, our guides can help explain the advantages and disadvantages of each. But beware, if you are a beginner spread better, although it has high rewards, it is very risky. So make sure you fully understand how spread betting works before you start trading.

The simple answer to this is yes. Spread betting provides access to an unprecedented range of markets. The simple fact of the matter is that markets do one of two things. They either go up or go down. It is the rate at which they do so and whether you pick the right direction that determines if you make money.

Spread betting is not like placing a normal bet where your losses are capped at the initial stake. You are betting a certain amount per point move of an asset.

If the asset is priced at 100, it means that if it goes to 0 and you have bet £1 per point, you can lose £100. So for a £1 bet, your potential downside is 100x your stake.

On the plus side, if the price goes to 500, you make £400, which is a monster return for a £1 bet. You can read our article on how spread betting works here .

Making money from spread betting isn't something that just happens, you will need to plan and to stick to a strategy to stand the best chance of making money from spread betting. Many spread betting and CFD traders lose money .

You will also need to budget carefully and do your research before you begin.

One of the most important factors in spread betting is choosing a broker you are comfortable and happy with. A good broker can offer much more than just the ability to make trades but also advice, educational tools, strategies and market insights.

There are many factors involved in choosing the right broker, including; liquidity, financial stability, range of markets, spread width, and educational and research tools. Read our guide on how to choose the right spread betting broker before you open an account.

Where can I find a list of spread betting forex brokers?

You can find a list of forex spread betting brokers in our comparison . As always, when you are looking for a spread betting forex broker, make sure they are regulated by the FCA and listed on the Good Money Guide.

Why is spread betting exclusively available in the UK?

Spread betting in the UK is only possible because there is no capital gains tax on spread betting profits. This does of course mean that you cannot offset spread betting losses, and tax laws can and always will change. Spread betting outside the UK does not exist, as UK spread betters are the only traders that benefit from the tax breaks.

Can I still get rewards and introductory offers from brokers?

Not really. Spread betting offers don't exist anymore as the regulators thought the ones that brokers were offering were attracting the wrong sort of client to spread betting. Instead, now brokers have to provide a better service, tighter pricing, and access to more markets. So actually, the reduction of spread betting offers is a good thing for traders.

Which is the best spread betting platform? Should I choose an award-winning broker?

Many financial websites give out awards to the best spread betting platforms each year. However, take them all with a pinch of salt, as many of these award ceremonies tend to give awards to all brokers in one way or another in exchange for sponsorship. However, Good Money Guide's annual awards are different.

We run an annual, unbiased and independent awards ceremony and decide the winners based on:

Where can I find a list of MT4 spread betting brokers?

You can view our MT4 brokers that offer spread betting in our MT4 broker comparison table . Most decent spread betting brokers will have their own trading platforms, but, because of the massive appeal of MT4, good spread betting brokers will also offer this as an option. Here's where you can find out where to trade options as a spread bet and the best brokers are to do so with.

Can you use spread betting as a tool for arbitrage between brokers?

Punters have been trying to beat the man for centuries and spread betting is no different. In the case of spread betting, brokerage arbitrage appears that the scales are against the customer. There are countless cases of punters finding loopholes in the dealing systems of various stock and spread betting brokers, and (quite innocently) trading to take advantage of them. After all, arbitrage between markets is a legitimate trading strategy.

However, the brokers will always win when it comes down to it. Don’t bother, as this sort of behaviour can be seen as market manipulation and may result in fines from the FCA. Stick to the basic principles of buying low and selling high. It’s the facts.

Can I spread bet on the property markets?

It is possible to spread bet on the UK property market but only through a small number of brokers. Spreads will be wide and the market does not move much. If you manage to track down a price, check how long it will be honoured for and what size you can bet. It may be a good hedge against a property portfolio, but check the funding rates for short positions if that is your intention.

Can you get welcome offers and trading bonuses in spread betting?

Spread betting brokers are regulated by the FCA and are not allowed to offer welcome bonuses anymore. If a broker does offer you a cash bonus for signing up, it may be a scam. You can check that a broker is regulated by the FCA on the FCA register .

If you think that an unauthorised broker is trying to scam you, you can report them to the FCA .

Can you make money as a spread bet trader?

Commonly, only around 20% of retail clients make money with spread betting. If you are a complete beginner or new to trading altogether then the sensible thing to do is to read around the subject, define a strategy and practice spread betting using a free demo account before you commit any real money.

Are white label spread betting brokers any good?

Some are good, others are just pointless. A white label gives established financial companies the opportunity to give their client base an additional service or another way of doing business with them.

Many customers in the financial industry are loyal to brands that help them make and save money or provide good advice. However, choosing a white label broker that doesn’t already provide their customers with financial services has no value. You will likely be much better off going with one of the major, established spread betting providers.

Read our Spread Betting Guides & Tips

Do spread betting brokers want you to lose money?

Spread betting brokers prefer you to make money. Spread betting is not an evil industry and it offers some of the best customer service and retention rates around. One of the most important aspects of business for brokers is client retention, and clients who make money with a broker are far more likely to stay loyal than those who lose. This is one of the reasons why spread betting brokers like to see clients making money and why many profitable clients might choose to stay loyal to the same broker for decades.

Why do most people lose money spread betting?

Here is the main reason why most spread betting brokers lose money . In short, the answer is a simple one, which involves spread betting brokers not having enough experience. Amateur or beginner traders are often guilty of over trading, over leveraging and not cutting their losses or running their profits. However, spread betting is not an easy way to make money, and should not be marketed or promoted as such.

It is a facility to bet on the financial markets to be used appropriately. Most brokers do a good job of ensuring that clients have some investment experience before allowing them an account.

Should I find a training course to learn spread betting?

If you’ve just asked yourself “Should I enroll on a trading course to learn spread betting?” then the answer is normally no, you shouldn’t. You should avoid spread betting altogether. It’s a high-risk product for high-risk, experienced investors. Also, most of the trading courses you will have seen advertised are run by people with little or no knowledge of the actual market, and for the most part, if they were good traders, they certainly wouldn’t be teaching.

We have put together some reliable online resources to help you learn to spread bet. We can also recommend these spread betting books as valuable resources for traders of all experience levels.

Trading is not complicated. If you see an event you bet that the market is going to go up or down in reaction to it. However, there are some fundamental rules that you should consider […]

Gain Capital (recently acquired by StoneX) subsidiary City Index has launched a new options product via its Singapore and Australian offices. The new product is an exotic option known as knockout, these type of options […]

What are the Best Currency Pairs to Trade? That’s a question that every forex trader will have asked themselves many times and they will likely do so again throughout their trading journey. The reason for […]

FCA to Ban Cryptocurrency CFDs from 6th January 2021 The FCA has banned cryptocurrency CFDs to retail traders and flexed its post Brexit muscles today and for the first time since the UK left the […]

A user has asked: I’m looking for somewhere that offers trading options on the US markets? Answer: You will need a broker that offers options trading to UK residents. Options trading is much more common […]

We talk endlessly about CFD (contracts for difference) scams and how to avoid them. We’ve done surveys on what people do when they spot fake investment ads online, written guides about how to avoid getting […]

More M&A activity in the margin trading sector with the announcement of the acquisition of financial spread betting and CFD broker ETX Capital by Swiss-based Guru Capital from its private equity owners, JRJ Group. This […]

Which online trading platforms allow you to place stops on option trades? A user has asked: I am looking for a UK based broker with a comprehensible (to me) platform/trade station for trading US (only) […]

TigerWit, one of the newest CFD brokers has announced record revenues for their year ended March 2020. CFD brokers have generally benefitted from the recent market volatility generated from the COVID-19 panic. Although forex brokers […]

Whether or not you morally agree with shorting the market during a crisis, it happens. But have brokers seen an increase in shorting the market during the Coronavirus pandemic? The FCA has not banned shorting […]

As more stockbrokers move to working from home in the wake of the Coronavirus pandemic, and staff move to ensure critical financial trading and investment platform remain online can you still open a new trading […]

We have recently witnessed an unprecedented period of volatility across the financial markets with many being “Limit Down” on a regular basis. Those of us with a few grey hairs on our head (should that […]

A while ago when EMSA introduced extended risk warnings to show what percentage of retail clients lose money when trading online we did a little feature on whether or not you should choose a broker […]

We are well and truly into the New Year now and whilst markets remain relatively sedate, we have an opportunity to look back and take stock of 2019, to discover what last year may be […]

A reader has asked: Which forex brokers offer a welcome bonus and won’t scam me? The quick answer is this, none. No decent broker will offer you a welcome bonus for signing up. If they […]

We talk to Ryan O’Dougherty from CMC Markets about spread betting, what is spread betting, who it’s for, what are the main benefits, the main risks, the best time to trade, and also, the most common mistakes traders make and how to avoid them.

Whilst ETX Capital can trace its roots back to 1965, it did not launch TradIndex until 2002. That makes IG the most established spread betting broker having launched in 1974 ( read IG reviews ). Followed closely by City Index and CMC Markets.

The Good Money Guide is a London based guide to trading and investment accounts for clients based in the UK, Europe, Asia, South Africa, and Australia. For more information on how this site makes money please find out more about us .

The information contained in this website is for informational purposes only and does not constitute financial advice. The material does not contain (and should not be construed as containing) investment advice or an investment recommendation, or, an offer of or solicitation for, a transaction in any financial instrument.

ALL INVESTING INVOLVES RISK. Investing, Derivatives, Spread betting and CFD trading carry a high level of risk to your capital and can result in losses that exceed your initial deposit. They may not be suitable for everyone, so please ensure that you fully understand the risks involved. ESMA & FCA Risk Warning – “CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 68-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Capital at risk”

Phone: 0203 865 4698 Address: 4 Old Park Lane, London, England, W1K 1QW Send A Message Press & Media

All content copyright Good Money Guide. GoodMoneyGuide.com is owned and operated by RJBCO Ltd. Registered in England & Wales, Company Number: 07134687. Registered office at 4 Old Park Lane, Mayfair, London, England, W1K 1QW. VAT registration number: 324242143. Data protection registration number: ZA468875

Sensual Nights

Mom Masturbating Hidden Cam

Mature Big Ass Fuck

Overwatch Tumblr

Big Mature Riding Porn