Spread Betting Advantages

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Advantages

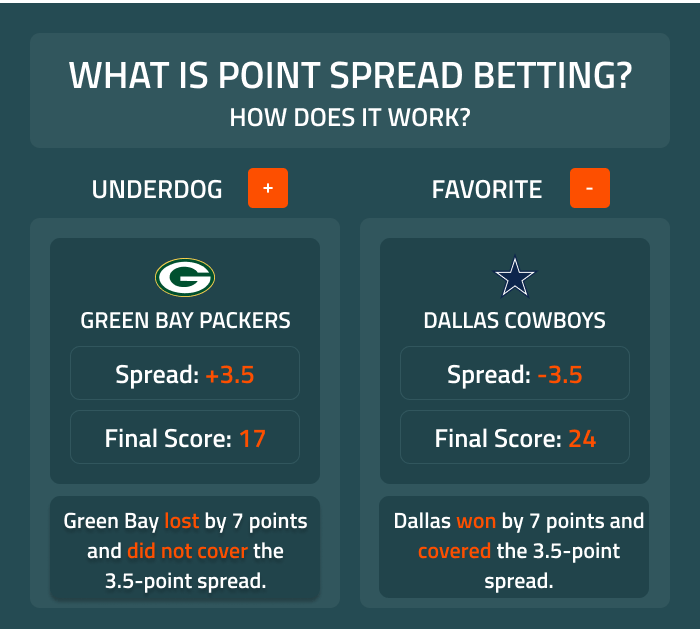

Today, spread betting is the biggest and most common form of financial betting in the UK. Quite simply, you bet on a financial market with a spread of prices and returns based on the likely direction of that market.

The huge rise in popularity of spread betting — especially in the UK where a number of successful companies boast tens of thousands of loyal customers — is a direct consequence of its flexibility. The advantages of spread betting include:

Trading with smaller amounts of money, which can be great for beginner investors.

Instant access to a huge range of markets.

Excellent technology and Internet support.

Unique markets, such as on property, and binary bets, which are similar to fixed odds bets, in which you know exactly what you stand to gain or lose when you place the bet. In binary bets, you wager on whether the asset (or index) will close higher or lower than the current spot price by the end of the day.

Leverage, which is useful if you know what you’re doing!

Just in case you think that spread betting sounds too good to be true . . . you may be right! Spread betting is for certain investors only, and most people are advised to steer well clear of it. First and foremost spread betting is incredibly risky and for tactical, short-term investors who think they know the likely direction of a stock market on a day-to-day basis.

Most statistics coming out of major spread-betting companies suggest that the vast majority of spread bets lose investors money, which helps explain why companies such as IG Index have become so incredibly successful, boasting many tens of thousands of investors actively trading, many on a daily basis, wracking up dealing charges as they take bets on the direction of the financial markets.

The specific risks to look out for include:

Unlimited losses: Therefore ensure you make use of stop losses and other risk-control measures.

Wide bid-offer spreads: Spread-bet brokers make their money from the spread; the bid-offer prices quoted are often wider than if trading the cash product.

Credit offered: If you have a good credit rating, spread betters offer credit accounts. Avoid like the plague!

David Stevenson is a columnist for the Financial Times where he writes the Adventurous Investor section. He is also a columnist for Investors Chronicle and author of Investing in Shares For Dummies, UK edition.

Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. Whether it’s to pass that big test, qualify for that big promotion or even master that cooking technique; people who rely on dummies, rely on it to learn the critical skills and relevant information necessary for success.

Copyright © 2021 & Trademark by John Wiley & Sons, Inc . All rights reserved.

Spread betting - Wikipedia

The Advantages and Disadvantages of Spread Betting in the UK - dummies

Advantages Of Spread Betting | Spread Betting Tax | CMC Markets

Advantages and disadvantages of financial spread betting

What is Spread Betting and How Does it Work? | IG UK

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Insights

Learn to trade

Learn spread betting

Advantages of spread betting

Join a trading community committed to your success

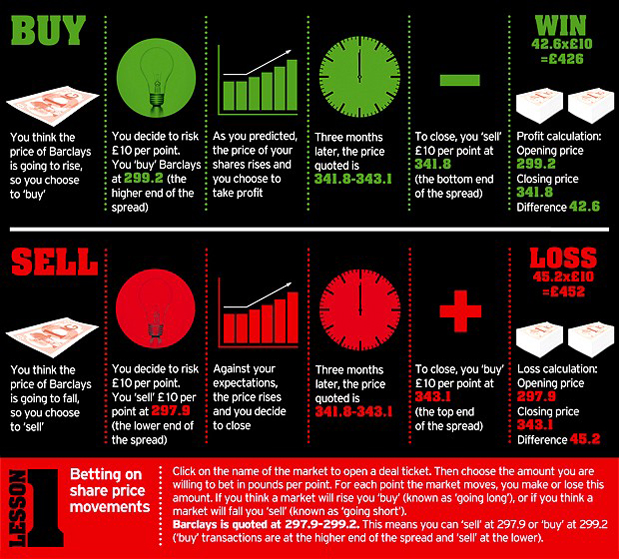

Speculate on falling markets. When you spread bet, you don't physically buy the instrument on which you are taking a position. You instead speculate on whether you expect prices to rise or fall. This means that if you think the price of a particular instrument is going to fall, you can go short (sell) the product and if you think prices are going to rise, you go long (buy).

No stamp duty. Unlike traditional share trading , you don't have to pay stamp duty when you spread bet because you are not buying the underlying product. Instead, you take a position based on whether you expect the price of that product to rise or fall.

Profits are tax free*. Spread betting profits are exempt from capital gains tax (CGT) in the UK. However, tax treatment depends on individual circumstances and tax laws are subject to change.

Trade using margin. Spread betting is traded on margin (or leverage). Margin trading allows you to do more with your capital – you can open more or bigger positions than you would be able to if you had to fund the full value of the position. For example, if the margin rate for a product is 5%, and you wanted to place a bet worth £200, you would only use £10 from your available account balance to open your position. Remember, however, that spread betting using margin can increase your losses as well as profits as they are relative to the full value of the position.

Risk management. We offer a number of risk management tools, including stop-loss orders . A stop-loss order may help you manage your exposure by setting a price level beyond which you are not prepared to risk any more of your capital on a position. When used effectively, a stop-loss order should automatically close your position if the price of the relevant instrument moves against you and reaches the price level where you wish to exit that position. It's important to remember that regular and trailing stop-losses may not protect you from market gapping or slippage. For 100% certainty that your stop-loss will be executed at the exact price you want, you can use guaranteed stop-loss orders, for a small premium charge. Other risk-management features include trailing stop-loss orders and take-profit market orders .

Access to thousands of global instruments. Spread betting can be a cost-efficient way to speculate on new markets. We offer prices on thousands of shares, plus currencies, indices, commodities and treasuries from across the globe. View our full range of spread betting markets .

Commission-free trading. Spread betting is exempt from many of the costs that you face when you trade shares with a stock broker. For example, there is no commission, stamp duty or capital gains tax to pay. As a company, we are remunerated through the spread we offer on each product. Learn more about spread betting spreads .

24-hour trading. You can spread bet on a huge number of forex pairs 24 hours a day, from Sunday evening through to Friday night. We also offer many indices, commodities and treasuries which are almost tradable around the clock, bar a short break. For example, the UK 100 is available to trade between 1am on Mondays and 9pm on Fridays, apart from two breaks between 9.15pm and 9.30pm, and 10pm to 11pm.

Trade anywhere. You can access our desktop application, online platform and mobile application to spread bet on the go. With cross-device functionality, you can open a trade on your desktop, and close the trade hours later on your mobile device. Our apps also feature fully interactive charts, with over 40 technical indicators. See all features of our mobile trading app .

Unique markets. We offer over 10,000 financial instruments that can be accessed with a spread betting account, includng forex, shares, ETFs, commodities, treasuries, cryptocurrencies and indices. We do also have some unique markets offerings such as crypto indices and commodity indices providing efficient and cost-effective exposure to several markets within an asset class.

Spread betting is a popular form of leveraged trading that allows traders to speculate on financial market movements. Like CFD trading, spread betting is an online form of trading and can be accessed via a trading platform. In this article, we will cover the advantages of spread betting, some of which are unique when placing spread bets.

Spread betting’s unique benefit is that it is exempt from both capital gains tax and stamp duty*. When compared to conventional share trading and CFD trading, spread betting is the only product to offer tax-free trading in the UK and Ireland.

However, tax is not the only advantage spread betting has to offer, so read on to find out more.

See our spread betting guides to discover more about what spread betting is and how it works.

What markets can I access with a spread betting account?

You can access thousands of markets with a spread betting account on our Next Generation platform. With us you can trade on forex, indices, cryptocurrencies, commodities, shares and treasuries. See our range of markets with competitive spread and margin rates, plus market opening hours.

Is spread betting taxable in the UK?

If you’re a resident in the UK or Ireland, profits from spread betting are free from capital gains tax (CGT). However, tax treatment depends on personal circumstances and tax laws, which are subject to change, so please check your eligibility. New to spread betting? Watch our intro video here.

How can I hedge with spread betting?

When you hold a short to mid-term investment, spread betting can be used as a tool to help offset any losses from poorly performing assets in your investment portfolio. Long-term investors tend to avoid hedging as part of their strategy, as long-term investors are less concerned by short-term fluctuations. To get started, try out a spread betting demo account to practise your hedging strategies.

To get started, open a demo account to access our trading platform. Once your account is open, and you have accessed the platform, you can choose to trade from thousands of instruments, ‘buy’ or ‘sell’ with order tickets, and implement risk-management conditions. For a more detailed analysis, see our guide on spread betting for beginners .

*Tax treatment depends on your individual circumstances. Tax law can change or may differ in a jurisdiction other than the UK.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 9,300+ instruments

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Wife Missionary Porno

Hugo Boss Private Accord

Chez Massage Porn

Xhamster Best Free Porn

Slut Outdoor