Spread Analysis

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Analysis

Prices are increasing in February, lock in current rate for life by Signing Up Today

Volume Spread Analysis – How to Apply it Like a Professional Trader

Home / Forex / Currency , Futures , Technical Analysis , Trading Strategies / Volume Spread Analysis – How to Apply it Like a Professional Trader

By George | 2019-08-06T12:51:07-04:00 July 25th, 2018 |

Owner, founder and head trader at TRADEPRO Academy.

frolep rotrem January 16, 2020 at 5:35 am - Reply

If you want to be a professional trader then you're in the right place. Nothing short of excellent educational content ... that is continually growing and being updated. They give you all the tools to become a successful Futures, Options or Stock Trader. And on top of that you get an amazing psychology course in the Elite Membership that won't only change your career, it will change your life! Thank you TradePro! read more

It is hands down THE best place to learn and continue developing one's career in trading as being part of an amazing ... trading community! read more

I can't say enough good stuff about TPA...If you really want to learn to be a great trader...this is the place.

Awesome course. Awesome people...if you want to succeed as a trader, this is where you should call home

The team at TradePro are excellent. The education is top notch - from Learning fundamentals through to day trading like ... a pro. Importantly, it also covers trading pshychology and a plan to be consistently profitable.The community is inclusive and an important aspect of developing your skills and keeping a growth mindset as you build your trading career.I highly recommend joining the community. read more

+1 866-887-2338 support@tradeproacademy.com 1179 King Street West Suite 215 Toronto, ON M6K 3C5

Copyright 2012 - 2019 TRADEPRO Academy TM Inc. | All Rights Reserved

You have likely heard the term Volume Spread Analysis before. It is often abbreviated as just VSA.

If you have heard of it, chances are you have been put off by how confusing it is.

In today’s article I will show you the simplified and practical way to use VSA.

Theoretically, you will find that mastering VSA will take a long time as it gets complex. However, always remember that theory is not what makes you money in the market.

It is only the beginning, the real secret sauce is perfecting your execution methods and risk management.

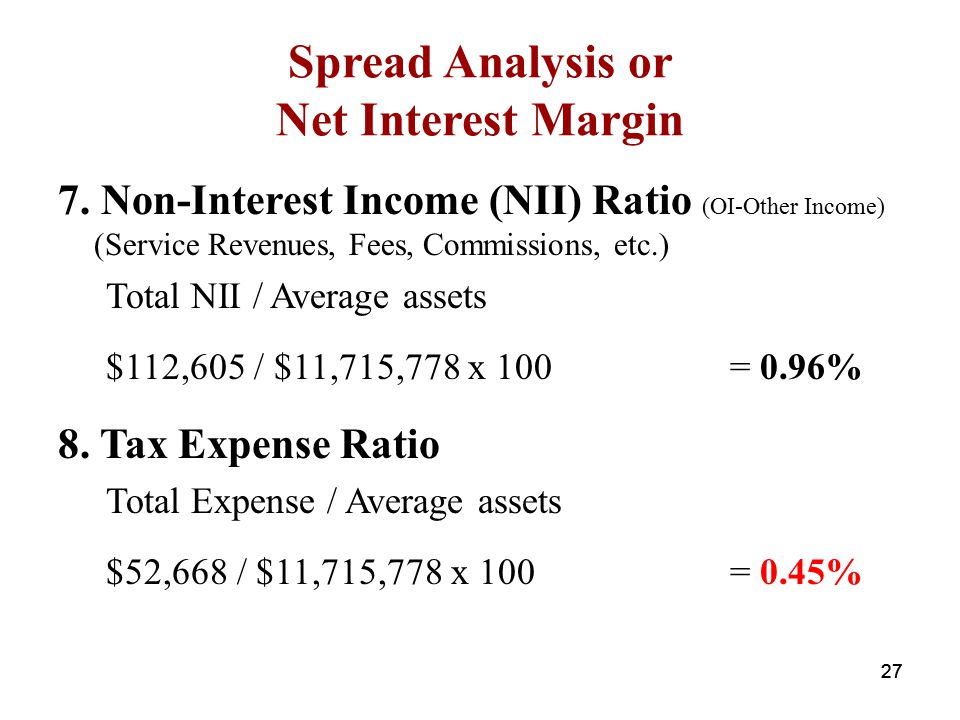

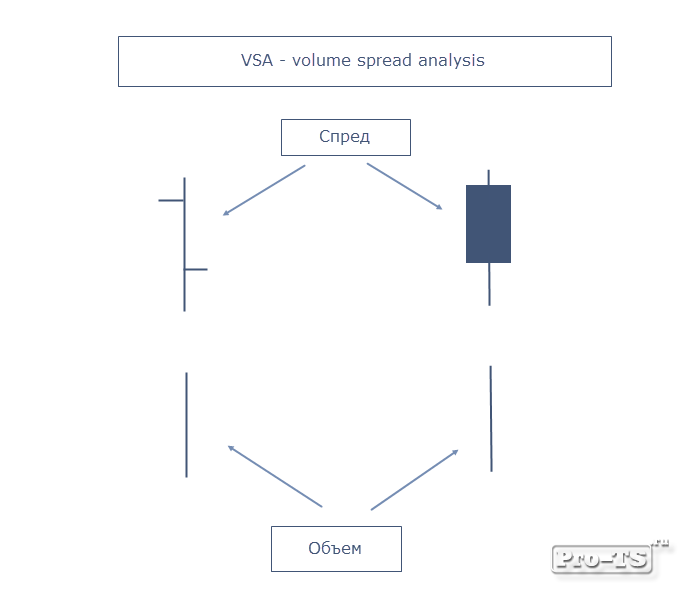

VSA is a comparison of the distance between a period high and low to the total volume traded.

That is, what is the difference between the closing price and the open price of the candle. Furthermore, how does that distance compare to the volume traded?

If you are starting to get confused at this point, hang tight as I will illustrate it with real world examples shortly.

Before you continue, it is recommended to read up on trading volume in this article if you need a refresher.

Before I show you the visual examples of VSA I want to explain the two strategies.

I will jump into each of these strategies into more details and illustrate a trade setup to help you better understand VSA.

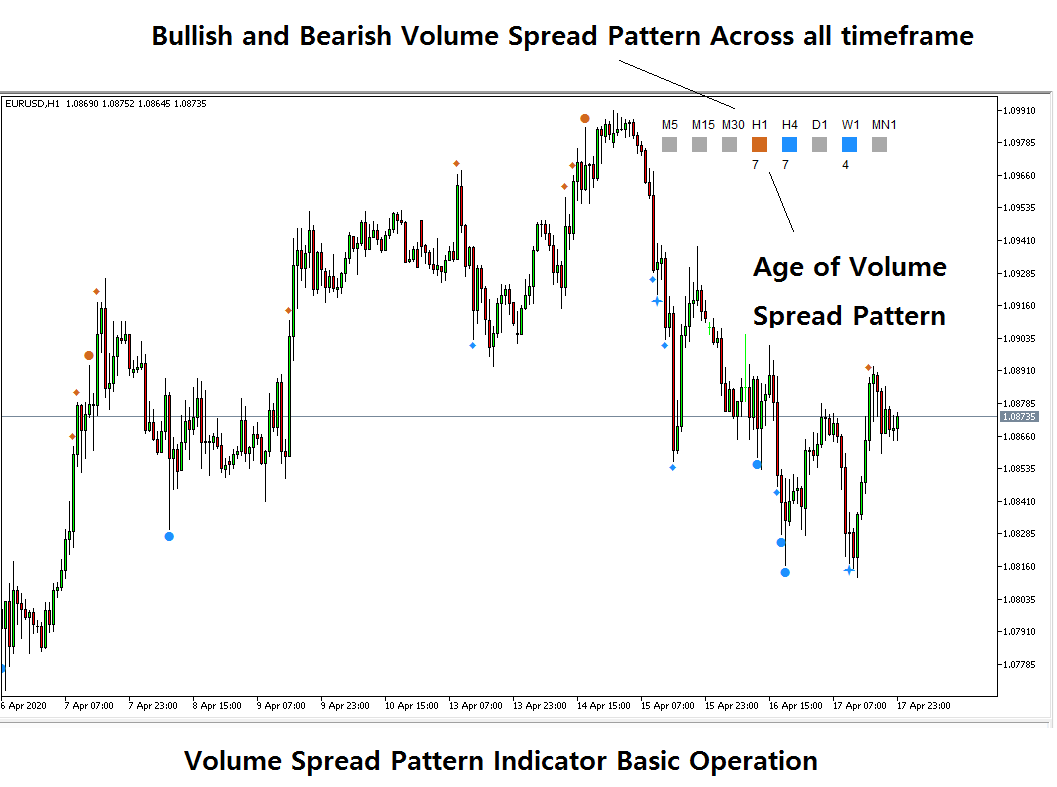

Both of these trading strategies work on any time frame. If you are swing trading or day trading, it does not matter.

You will find that VSA is equally powerful on all time frames and especially effective on multiple time frame analysis.

This simple trading strategy will be very effective when applied to your current strategy.

Remember that not trading strategy is stand-alone perfect out of the box. Everything requires constant adjustment and this is just one tool to be combined with others for more precision and success.

Volume Spread Analysis – Short opportunity when:

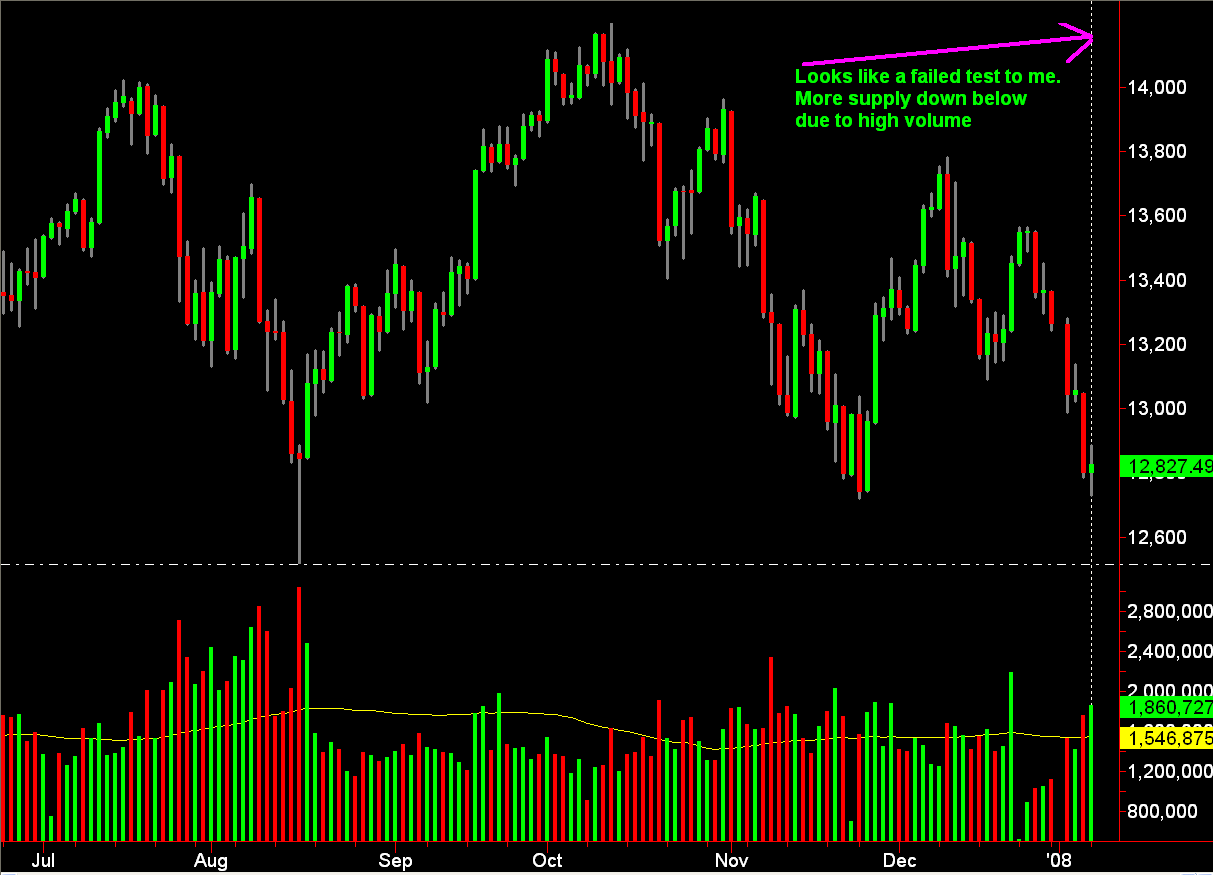

In the char below you can see an example of this setup on the Apple daily chart.

Volume Spread Analysis – No demand on up bar.

But how did this trade opportunity workout?

You can see in the next chart that our VSA was followed by a 6.06% drop in just 8 trading days! This is an amazing trading opportunity.

This becomes even more profitable when you combine it with options trading.

Now let’s flip the setup and look at how to use volume spread analysis to catch long reversal trades.

As you can see on the chart below, the candle range (high minus low) is very narrow. This is a low spread.

At the same time you can see that volume was also weaker than the past two days.

This indicates a lack of selling pressure, and a potential exhaustion of the selling wave.

Therefore, you are looking for a long opportunity.

Once you get your other trading strategy qualifiers present you can try a low risk, high probability long here.

You can see that this trade setup generated a whopping 15% return in just 12 trading days. That is a great return for less than a three week holding period.

The information contained in this post is solely for educational purposes, and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. TRADEPRO Academy is not responsible for any liabilities arising as a result of your market involvement or individual trade activities.

Thank you, I have recently been searching for info approximately this topic for ages and yours is the greatest I’ve found out till now. However, what about the bottom line? Are you positive in regards to the source?

Transforming individuals into profitable traders, and providing a community of professionals for constant growth.

Volume Spread Analysis in Trading - Price Action Analysis

Volume Spread Analysis - How to Apply it Like a Professional Trader

Your First Guide to Volume Spread Analysis (VSA) - Trading Setups Review

Volume Spread Analysis - Basics

Price Volume Analysis (Channel Members) - YouTube

This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. By clicking the consent button, you agree to allow the site to use, collect and/or store cookies.

You are here: Home / Trading Articles / Your First Guide to Volume Spread Analysis (VSA)

Trading Strategies, Guides, and Articles for Active Technical Traders

By Galen Woods in Trading Articles on October 21, 2014

You have heard of Volume Spread Analysis and the value it might add to your analysis. But it sounds like a convoluted trading method with uncommon terms like “No Demand Bar” and “Stopping Volume”. Is VSA really that inaccessible?

Together, let’s take the first step to understanding VSA. With this guide, you will find that VSA is an intuitive method after all.

VSA is the study of the relationship between volume and price to predict market direction.

In particular, it pays attention to:

There are three big names in VSA’s development.

Jesse Livermore spoke of a theory based on market manipulation. He also worked his theory in his legendary trading career. However, he did not pass down concrete trading methods. His legacy is that of a trader and not an educator.

Richard Wyckoff was much more interested in education. To find methods that work in the markets, he interviewed top traders including Jesse Livermore. Wyckoff proposed the idea of a “Composite Trader” that embodies the entire market. He used the “Composite Trader” to explain the market phases of accumulation, markup, distribution, and markdown .

Neither Jesse Livermore nor Richard Wyckoff used the term “Volume Spread Analysis”. It was Tom Williams who used the term to describe the methods he built based on the Richard Wyckoff’s ideas. Tom Williams’ books and software has helped to propel the concepts of VSA among traders.

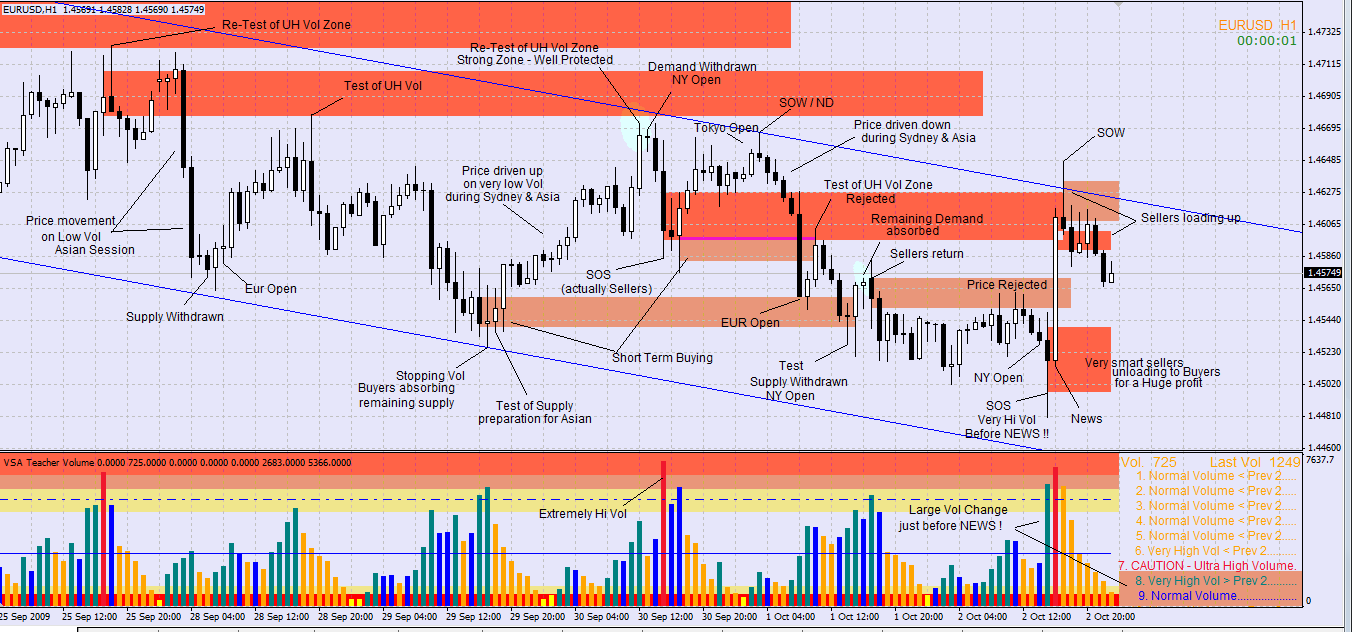

The basic idea is that the public can only make money from the markets if we understand what the professional traders are doing. And professional traders are not small players. They play big.

Hence, they leave their footprints in volume data. When the professionals are active, the market shows high trading volume. Conversely, when the market volume is low, the professionals might be holding their horses.

It follows that in order to get a sense of what the big guys are up to, looking at just price action is not enough. We need to look at price together with volume.

VSA focuses on price and volume and seeks to find the actions of professional traders. Hence, as long as a market has a group of professionals and offers reliable price and volume data, the trading premise of VSA holds.

Almost all financial markets (stocks, futures, forex) seem to fit the bill.

However, in the spot forex market, volume is a tricky concept. You will not get actual traded volume. You get tick volume which measures the times the price ticks up or down. If you intend to use VSA methods for trading spot forex, you need to decide if your source of tick volume is a reliable proxy for actual volume. (Need help deciding? The ForexFactory forum has a discussion on trading forex with VSA .)

I will not sugar-coat the fact that VSA is difficult to master. This is because traders have interpreted various VSA concepts differently. To trade well with VSA requires years of practice and market observation. (Consider how much time Jesse Livermore, Richard Wyckoff, and Tom Williams spent studying the markets.)

Nonetheless, we can still improve our trading with basic VSA concepts that are easy to understand. Hence, in this first guide, we will look at two simple VSA concepts.

(The following definitions are based on Tom Williams’ book on VSA – Master the Markets .)

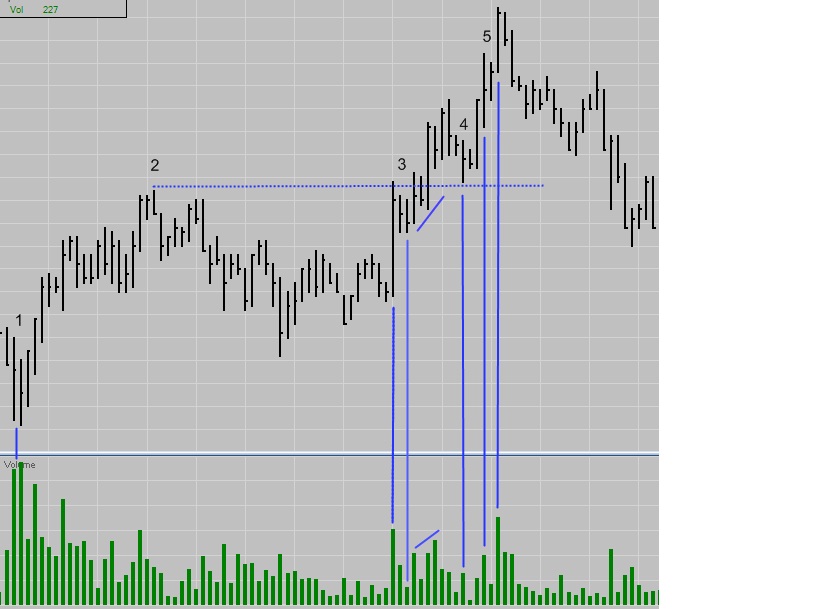

If the market rises with contracting spread and volume, the market is not showing demand. Without demand, it is not likely to continue rising.

If the market falls with decreasing spread and volume, the market is not interested in selling. Thus, it is not likely that the market will continue to fall.

To find “No Selling Pressure” bars:

In the two examples below, we will use a 20-period simple moving average as our trend indicator. Our aim is to use the concepts of “No Demand” and “No Selling Pressure” to find trend retracement trades.

In the charts below, I have marked the “No Demand” bars with red arrows and the “No Selling Pressure” bars with green arrows. (Click on the images to zoom.)

This chart shows the daily bars of Deere & Company (DE).

This chart shows the daily bars of The Proctor & Gamble Company (PG).

VSA is gaining in popularity, and there is no lack of resources to advance your understanding.

There are great discussions on VSA on Traders Laboratory and Forex Factory . To find information on VSA in popular trading forums with a click, try our Trading Forums Search Engine .

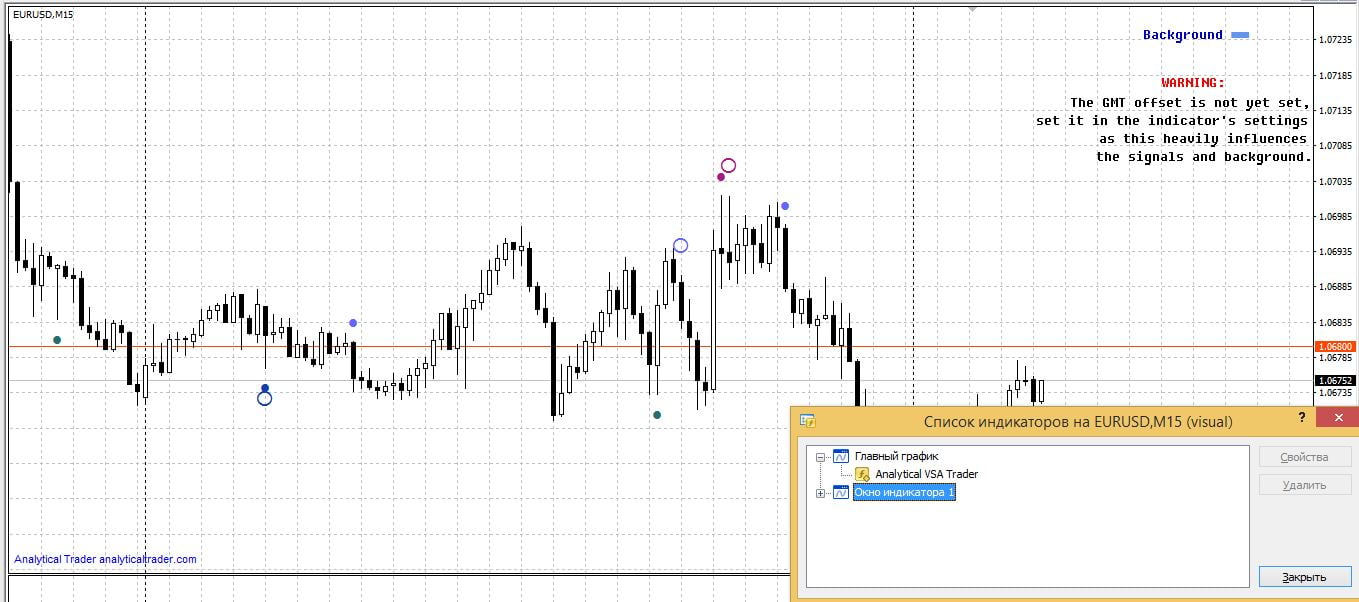

There are many software that claim to use VSA techniques to help you trade better. I would not comment on their efficacy as I have not used them.

But I am sure that no software will bring you trading success unless you truly understand the VSA principles. Hence, you should definitely learn as much as you can about VSA, before relying on a software for your analysis. This approach will make sure that you do not use the software blindly, if you do buy one.

These are not classic VSA methods, but they will help you understand the interaction between price and volume.

Volume is valuable because it offers another market dimension for analysis. Volume is also dangerous because it confuses those who do not understand it.

Take one step at a time. Pick up VSA concepts steadily and use them in your trading prudently. Once volume starts to make sense to you, you will see progress but improvements will not come overnight.

Price and volume giving conflicting signals? Master price before volume. Learn more about my price action trading course.

Read more about Trading Trend , Volume

Day Trading With Price Action – A complete course that teaches you the art of price action trading.

Perfectly structured with step-by-step guides to help you understand the principles of price action analysis.

Always perplexed when Doji appeared near inflexion points like price cutting the sma, now a tool vsa to unravel some possible action, will try and revert.

very good hints. already using VSA in trading futures. Thanks

May I ask how has your trading journey been using VSA?

are there available indicators or strategy programme regarding vsa and above theory?

You can google for the many vendors offering indicators based on VSA. I’m not familiar with them so I can’t provide the details. But you should definitely get one that’s not a black box. This means that the logic behind the indicators should be transparent to you. This is a sustainable option that’s friendly for learning VSA concepts.

In the examples above, I used a bare basic custom indicator to find the No Demand and No Selling Pressure Bars. I’ll consider adding some parameters and including it in the TSR indicator Pack .

Mr. Woods, Above article discusses VSA pointers very well and is in line with Wyckoffian logic and teachings of Tom Williams. However, the description of your course describes it as “Price Action” course. Do you incorporate ‘Volume Action’ in the course or is it excluded?

My course focuses on price action. It’s important to understand price before studying volume. Hence, to avoid confusion, I’ve not included volume tactics in the course. On top of that, volume analysis deserves an entire tome on its own.

Does volume mean the size of the candle body?

Hi, it takes the definition in this Wiki entry .

Hi Haramohan, there are some book recommendations in this post, and if you need some more ideas, you can refer to this review as well.

Your email address will not be published. Required fields are marked *

Get a Free Course Chapter from Galen Woods' Day Trading With Price Action Course [PDF]

Plus, our latest trading guides and tips in right your inbox.

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

The website contents are only for educational purposes. All trades are random examples selected to present the trading setups and are not real trades. All trademarks belong to their respective owners. We are not registered with any regulating body that allows us to give financial and investment advice.

Private Mature Porno

Public Beach Sex Movies

Threesome Sex Massage

Outdoor Experience

Private Hotel

+_+YM+03-13+(3+Min)+_+YM+03-13+(2+Min)+_+YM+03-13+(5+Min)+_+YM+03-13+(180+Seconds)++2_20_2013.jpg)