Sports Spread Betting Demo Account

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

A spread betting demo account – flavour but not the thrills?

Get your free daily newsletter: Actionable insight every morning for the self-directed investor.

Join

For residents of the UK and Ireland, it is relatively easy to get started with a spread betting demo account. Most Brokers are not required to perform the number of checks and collect as much personal information for a demo account as they do for a live account. Setting up a demo account is generally a speedy process.

A spread betting demo account will let you practice trading with paper money – which means your profits and losses will not be real. It will give you a feel for the platform you choose before you commit real money.

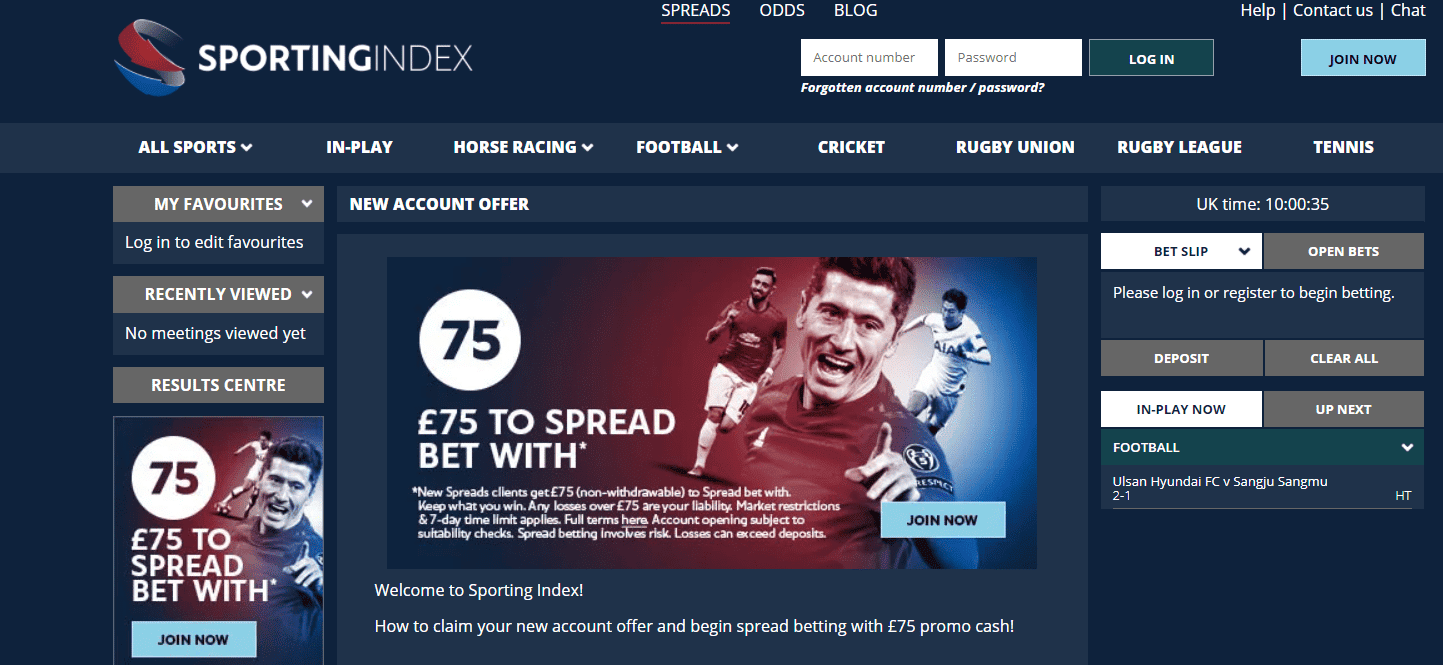

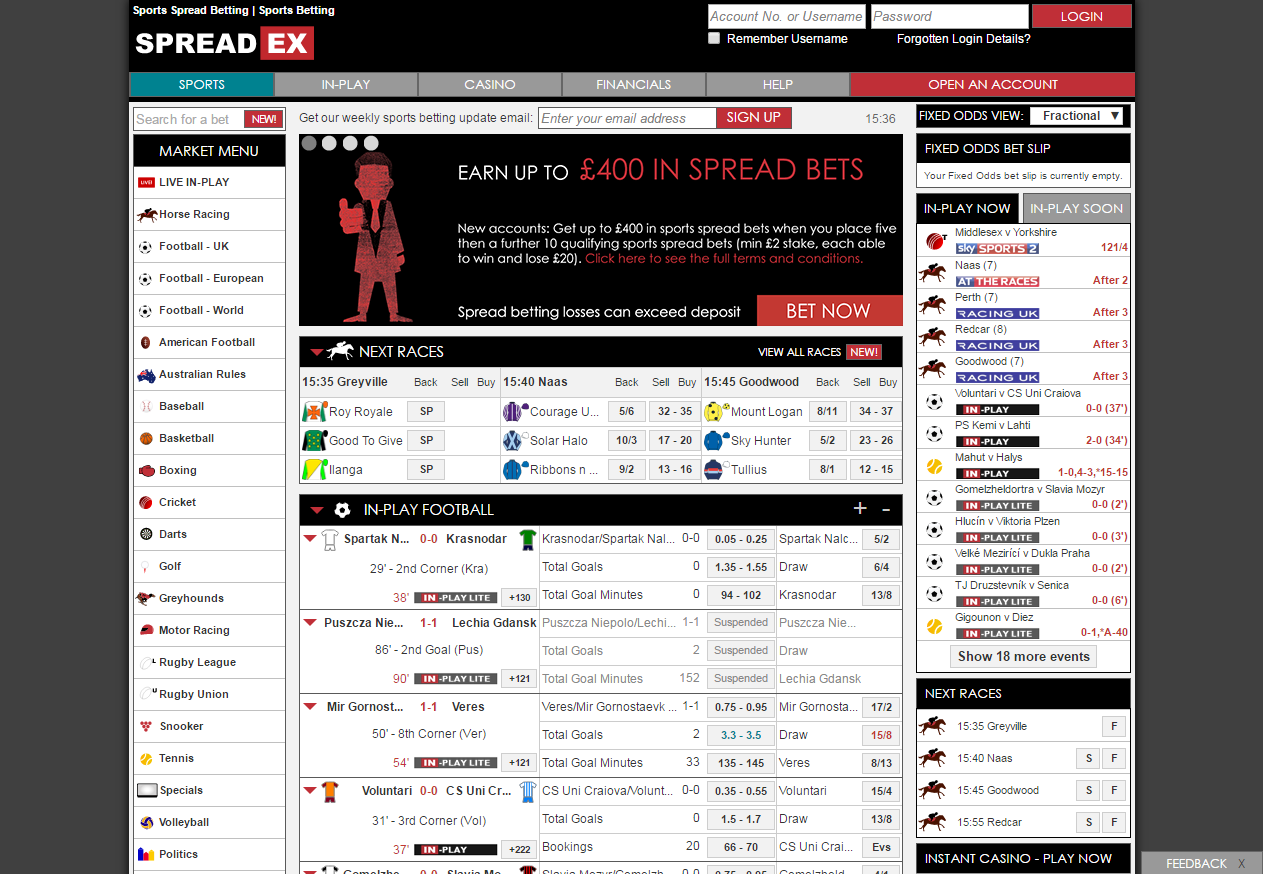

We’ve compiled a comprehensive list of spread betting demo accounts for you to cast your eye over. Follow the links to find our independent review of each broker. Before you make any kind of decision on which spread betting demo account you wish to trial though, take a look at our short guide to choosing a spread betting demo account below.

The new Pepperstone spread betting account enables novice traders to spread bet from 20p per point on a range of Indices, Commodities and Currencies. There’s flexibility to increase stake sizes as you gain in confidence. See our full Pepperstone review

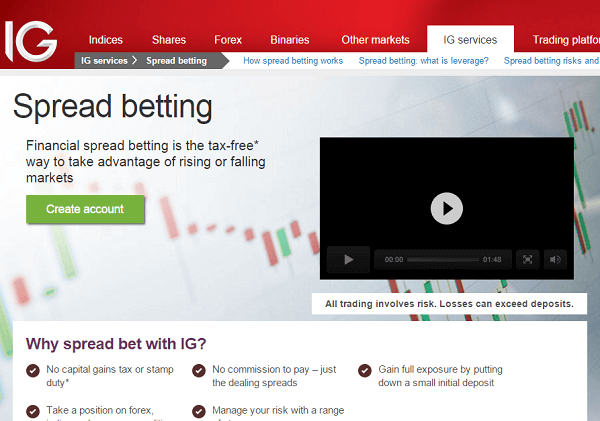

IG offers reduced minimum deal or trade sizes for all new spread betting clients for the first 31 days – enabling novice traders to trade at 25% of the normal trading position across all 17,000 markets available, including Stocks, Indices, Commodities and Currencies. See our full IG review

Founded in 2001 and regulated by the FCA, ActivTrades platform is simple to use with an emphasis on risk management tools and competitive spreads. Clients can spread bet from as little as 10p per point making it a good option for beginners.

Markets.com enable new clients to trade on their platform from 50p per stake across a range of indexes, currencies and commodities.

The Armchair Trader is paid for by our partners through clicks, views and advertorials. So if you open an account through a link on the site, we may receive a fee for providing the introduction. This fee will in no way be passed on to you from our partners.

For beginners, a spread betting demo account offers you an opportunity to understand how fast the markets move, and will let you explore some of the other facilities spread betting companies offer, like market news and charting.

Bear in mind a demo account may not incorporate all of the markets you would expect from a funded account and the prices quoted may not necessarily be the live prices. However, most of the popular markets are likely to be available, giving you a chance to practice your trading strategies risk free and developing a style of trading that works for you.

It is important to bear in mind that a spread betting demo account will not necessarily prepare you for live trading.

There is an added pressure that comes with trading real money that you simply can’t replicate with a demo account.

This is where your trading strategy will be invaluable. You will need to strive to formulate and hone your strategies using your spread betting demo account so that your trades become a simple function.

Removing emotion from your trading before you do it for real with a live account will help you avoid the big losses that come from beginner’s mistakes. Trading with real money is a game changer.

A spread betting demo account will allow you to monitor the underlying performance price of your chosen markets and understand their relationship with other markets and events over time.

A good spread betting demo account will also offer you the opportunity to manage your risk by setting stop orders as you would with a live account.

We’ve taken a look at all of the online platforms available and put together this list of the best spreadbetting platforms for beginners. Each platform offers a limited risk feature that will significantly reduce your exposure to losses while you learn to trade.

Before you go ahead and sign up for a spread betting demo account, we’ll explain how you should go about choosing your spread betting broker

Choosing the right broker can be a bewildering process. There are now more companies offering access to the financial markets than ever before. The barriers to entry are lower, while the big, established firms are seeking ways to innovate, and to provide products and services that others cannot afford to deliver.

In addition, the overall cost of trading is coming down as more firms seek to compete on price. For the new trader, this is a great time to be starting out, as many companies will bend over backwards to win your business.

Competition is hot out there for your business, but not all brokers offer the same suite of products and services. It is fair to say that some are better positioned to deal with the beginner than others.

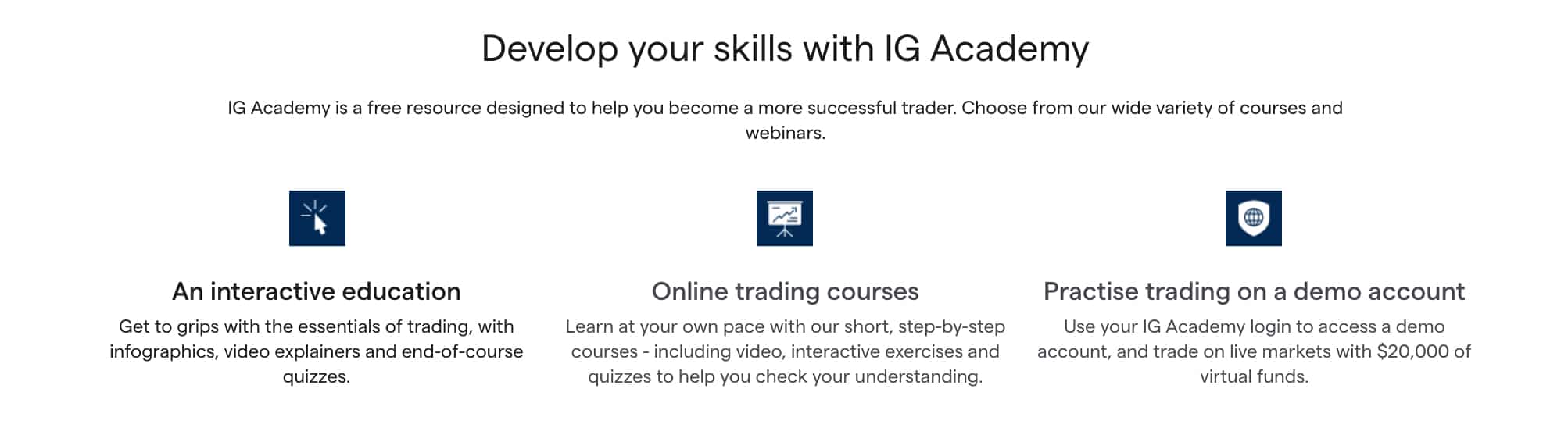

For starters, some of the bigger companies have had the resources to invest in substantial educational programmes, which include colourful trading guides, videos, seminars and access to trading coaches who can answer your questions. These are usually offered free, and The Armchair Trader would encourage you to take advantage of them.

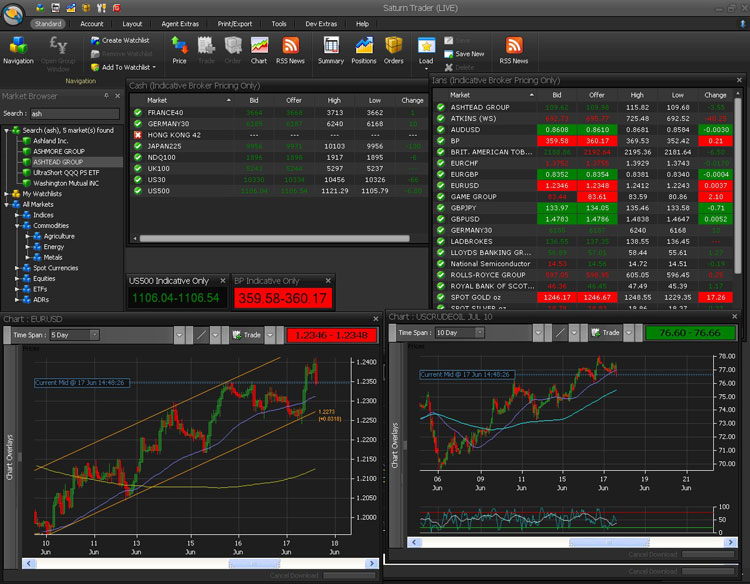

Many brokers use different trading ‘platforms’ – the system you use to place your trades, follow prices, even do some analysis on. These are getting more sophisticated all the time, so it is important that you familiarise yourself with a spread betting demo account before you commit your funds to a live trading account.

Much is made of these platforms, and indeed they can cost a considerable amount of time and money to build from scratch, so their creators can feel justly proud of them.

But trading platforms are not the be-all and end-all. A poorly designed trading interface, however, can really cripple your ability to trade financial markets online.

Brokers will be able to take you through the process of familiarising yourself properly with the way their trading platform works, and it is essential that you do get to grips with it, or costly mistakes can occur later.

The majority of brokers now offer mobile applications (‘apps’) that allow traders to follow markets and trade on the move.

Obviously, there are limitations on just how much functionality can be delivered to a mobile device. If trading when you are out and about is important to you, you’ll need to choose a broker that offers the mobile technology you need.

Next, look at how much firms are asking as a minimum account opening sum. This still varies quite widely. Some companies are not only set up to cater to novice traders, they are also equipped to service thousands of retail clients, even those only prepared to stake a maximum of a few hundred dollars.

Others will only be interested in the big money traders.

When brokers compete on price – and they are increasingly having to do this – they compete on the size of their spreads.

One of the ways brokers make their money is by quoting a spread which is marginally wider than the spread they can get themselves in the market from their prime brokers.

Fifteen years ago, when there were fewer brokers competing in this space, they could afford to quote nice, fat spreads.

Nowadays, spreads are getting narrower all the time, and according to some sources within the business, some spreads are now so narrow that firms have to be running some of these tight markets at a loss, in order to attract new business.

We are seeing record narrow levels in spreads on some key markets, like the big stock market indexes. These are already highly liquid markets, with plenty of volume in the futures markets, so brokers can already afford to transfer this level of market activity to their customers in the form of tighter spreads.

Not all brokers are convinced that competing on spreads is the way to go, and they quietly maintain the conviction that a shiny new trading platform or a bigger range of markets will still allow them to compete. Time – and the consumer – will tell.

The range of markets offered can be important to some traders. Much of the volume in trading at any given brokerage will be in a small handful of key, headline markets.

These include the big financial indexes, the most important currency pairs, and the commodities that are most closely followed by the media, economists and global trading desks.

Indeed, 80 per cent or more of the volume of trading in any given month will be accounted for by fewer than a dozen markets.

This means most of the traders, and most of the money, are focusing on the same prices. These are the markets where brokers will be competing most aggressively when it comes to hacking down spreads and margins. Outside these markets, the pricing will not necessarily be as competitive.

While it is true that deeper pockets can also provide superior products and services to the trader, this is not always the case.

However, publishers of financial magazines always need to have one eye on their bottom line, and glitzy black tie awards ceremonies, while making everyone feel good about themselves, also contribute heavily to magazines’ profits.

Our advice to the beginning trader: don’t be guided by how many awards a company has won.

Marketing departments love to plaster them all over their advertising, but the proof of the pudding, as always, is in the eating.

Astute traders will use more than one broker account.

The primary reason for doing so is to allow proper comparison of the prices between them.

If a trader is focusing in particular on a handful of markets, he can develop a good idea of where a price should be, and place trades with the firm that can offer the most competitive prices most consistently.

While this is less of an issue for the beginner, it is worth considering further down the line if you have the spare capital to commit to a second account.

Brokers are in the business of lending money.

The very fact that they offer margin trading facilities means they are offering credit.

When opening a live account with an online broker, you are entering into a credit agreement. The company concerned will analyse your financial circumstances, just as a mortgage lender would, to assess whether you can afford to trade in the first place.

The most important thing we want you to take away from this is to do your homework before you commit to a broker.

Take the opportunity to trial a few spread betting demo accounts and meet with a selection of brokers through their education offerings, in person at their offices if you can, and get a full understanding of the tools you will need in your armoury in order to implement your trading strategy.

Want to read more? You can get a copy of our Beginners Guide to Choosing the right Spread Betting Company which features a more in depth look at the topic. Get your FREE copy here.

Spread betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between [74-89]% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please note that % may be changing every quarter depending how this number looked in the previous period.

Become a better investor with SharePad Designed to give you the confidence to pick your own investments, Sharepad gives you access to a wealth of information on UK, US & European stocks. Find out more

Please note this article does not constitute investment advice. Investors are encouraged to do their own research beforehand or consult a professional advisor.

Stuart Fieldhouse has spent 25 years in journalism and marketing, including as a wealth management editor for the Financial Times group, covering capital markets and international private banking, and as an investment banking correspondent for Euromoney in Hong Kong. He was the founder editor of The Hedge Fund Journal.

Stuart has worked at CMC Markets, supporting the re-launch of its global financial spread betting and CFD trading platforms. He is also the author of two books on trading, published by Financial Times Pearson. Based in The Armchair Trader’s London office, Stuart continues to advise fund managers, private banks, family offices and other financial institutions.

Here are some of the smaller companies we are following most closely. They all represent significant growth stories in our view. Our in-depth reports go into more detail on why we like them.

Get your free daily newsletter: Actionable insight every morning for the self-directed investor.

Join

Our partners are established, regulated businesses and we are grateful for their support.

All financial investments involve an element of risk. The value of your investment may fall as well as rise and you may get back less than your initial investment. With Spread bets and CFDs your losses may exceed your deposits.

Our mission is to educate and inspire private investors. With greater access to the financial markets than ever before, we'd like to see everyone use the markets to grow their wealth and gain long term financial independence

36 Spital Square,

4th Floor,

London

E1 6DY

Copyright Armchair Trader Ltd 2021 - Registered in England No. 07549040

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Practise Spread Betting or CFD trading

With a demo account there’s no cost and no obligation. You can practise trades on your demo account for two weeks. Demo accounts have a limited range of markets for you to trade and all price data is live. Simply sign up and login.

United Kingdom

Afghanistan

Åland Islands

Albania

Algeria

American Samoa

Andorra

Angola

Anguilla

Antarctica

Antigua And Barbuda

Argentina

Armenia

Aruba

Australia

Austria

Azerbaijan

Bahamas

Bahrain

Bangladesh

Barbados

Belarus

Belgium

Belize

Benin

Bermuda

Bhutan

Bolivia

Bosnia And Herzegovina

Botswana

Bouvet Island

Brazil

British Indian Ocean Territory

Brunei Darussalam

Bulgaria

Burkina Faso

Burundi

Cambodia

Cameroon

Canada

Cape Verde

Cayman Islands

Central African Republic

Chad

Chile

China

Christmas Island

Cocos (Keeling) Islands

Colombia

Comoros

Congo

Congo, The Democratic Republic Of The

Cook Islands

Costa Rica

Cote D'ivoire

Croatia

Cuba

Cyprus

Czech Republic

Denmark

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Estonia

Ethiopia

Falkland Islands (Malvinas)

Faroe Islands

Fiji

Finland

France

French Guiana

French Polynesia

French Southern Territories

Gabon

Gambia

Georgia

Germany

Ghana

Gibraltar

Greece

Greenland

Grenada

Guadeloupe

Guam

Guatemala

Guinea

Guinea-Bissau

Guyana

Haiti

Heard/Mcdonald Islands

Holy See (Vatican City State)

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran, Islamic Republic Of

Iraq

Ireland

Israel

Italy

Jamaica

Japan

Jordan

Kazakhstan

Kenya

Kiribati

Korea, Democratic People's Republic Of

Korea, Republic Of

Kuwait

Kyrgyzstan

Lao People's Democratic Republic

Latvia

Lebanon

Lesotho

Liberia

Libyan Arab Jamahiriya

Liechtenstein

Lithuania

Luxembourg

Macao

Macedonia, The Former Yugoslav Republic Of

Madagascar

Malawi

Malaysia

Maldives

Mali

Malta

Marshall Islands

Martinique

Mauritania

Mauritius

Mayotte

Mexico

Micronesia, Federated States Of

Moldova, Republic Of

Monaco

Mongolia

Montserrat

Morocco

Mozambique

Myanmar

Namibia

Nauru

Nepal

Netherlands

New Caledonia

New Zealand

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Northern Mariana Islands

Norway

Oman

Pakistan

Palau

Palestinian Territory, Occupied

Panama

Papua New Guinea

Paraguay

Peru

Philippines

Pitcairn

Poland

Portugal

Puerto Rico

Qatar

Reunion

Romania

Russian Federation

Rwanda

Saint Helena

Saint Kitts And Nevis

Saint Lucia

Saint Pierre And Miquelon

Saint Vincent And The Grenadines

Samoa

San Marino

Sao Tome And Principe

Saudi Arabia

Senegal

Serbia

Seychelles

Sierra Leone

Singapore

Slovakia

Slovenia

Solomon Islands

Somalia

South Africa

South Georgia

Spain

Sri Lanka

Sudan

Suriname

Svalbard And Jan Mayen

Swaziland

Sweden

Switzerland

Syrian Arab Republic

Taiwan, Province Of China

Tajikistan

Tanzania, United Republic Of

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad And Tobago

Tunisia

Turkey

Turkmenistan

Turks And Caicos Islands

Tuvalu

Uganda

Ukraine

United Arab Emirates

United States

United States Minor Outlying Islands

Uruguay

Uzbekistan

Vanuatu

Venezuela

Viet Nam

Virgin Islands, British

Virgin Islands, U.S.

Wallis And Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

We would like to keep you up to date on our products and services that you have requested from us. We would also like to communicate with you about other opportunities for existing and new products and services that may be of interest to you. You can opt-out at any time by contacting us here or by clicking ‘’unsubscribe’’ on the bottom of our emails.

Not sure about how to get the maximum from our platform? One of our team can talk and walk through everything from basic trades to advanced features step by step, at a time that suits you.

Yes, I'd like to schedule a platform tour

This field is for validation purposes and should be left unchanged.

New to spread betting, forex and CFD trading? A demo account lets you practise real trades with no risk.

Practise trading with £25,000 virtual funds

Develop your strategies with no risk

Learn how our risk management tools work

With a demo account there’s no cost and no obligation. You can practise trading via your demo account for two weeks. Demo accounts enable you to have a go at trading a limited a range of markets, risk free. Simply sign up and login.

A demo account is designed for traders who are new to spread betting, forex and CFD trading. It gives you an opportunity to learn about online trading without risking your own money. It’s also a chance to experience Spread Co’s trading platforms. For example, you’ll be able to try out some of the powerful charting features, and see first-hand how stop loss and limit orders can help you manage risk.

Importantly, a demo account will help you build your experience of trading in shares, currencies and indices, and help you fine tune the strategies that will work best for you. When you’re ready, opening a live trading account is simple, and we’ll help you every step of the way.

Spread Co Limited is a limited liability company registered in England and Wales with its registered office at 22 Bruton Street, London W1J 6QE. Company No. 05614477. Spread Co Limited is authorised and regulated by the Financial Conduct Authority. Register No. 446677.

Tf2 Female Pyro Sexy Model

Hot Pornstars Solo

Mouth Scat Mistress

Art Incest Pics Sex

Women Orgy Videos

Demo Accounts | Spread Betting

Get the best out of your spread betting demo account

Demo Spread Betting Accounts

Spread Betting - Free Demo Account - Accendo Markets

Create Demo Account - Intertrader

Try our Demo account - Sportmarket PRO

Demo Trading Account | Open Trading Demo Account

Demo Trading Account | Try IG's Trading Simulator | IG UK

Sports Spread Betting Demo Account