Sports Spread Betting Arbitrage

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

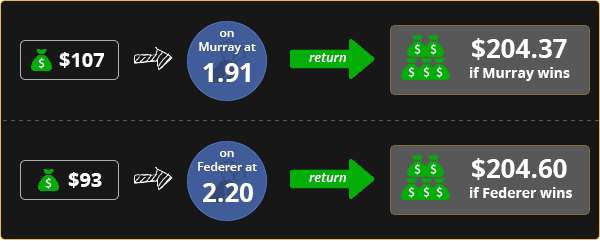

Arbitrage or Scalping put simply is the action of betting on both sides of a game at different sports books to guarantee a profit no matter the outcome of the game.

Arbitrage is not a new concept by any means. It has been done in the stock and other financial markets for years. It’s also been done in sports betting for some time however it wasn’t as easy or as profitable before internet sports books came on the scene.

Before the internet, bettors in Las Vegas would need to make mad dashes from sports book to sports book in hopes of catching a scalp before lines moved. Now bettors can shop multiple prices within a short period of time and capitalize on line variances that in the past would of took hours to collect.

I like to explain scalping to people with the following example using Major League Baseball money lines.

Sports book A has the Detroit Tigers listed at +120

Sports book B has the Texas Rangers listed at -110

As you can see from this example the difference in these lines is $10.

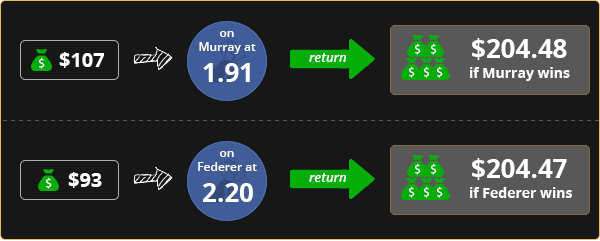

So, if Nancy was to bet Detroit at sports book A for $100 she would win $220 if the Tigers won (her $100 stake + $120 in profit).

To complete the scalp Nancy would also need to bet Texas at sports book B for $-110 and if the Rangers won she would win $210 (her $110 stake and $100 in profit).

Now, as you can see from the above example that no matter which team wins the game Nancy will make $10.

There a number of factors to consider when calculating potential profit from scalping. First of which is your bankroll and betting limits. The more money you can devote to scalping and the higher limits your sports book will take play a key role in how much return you can expect.

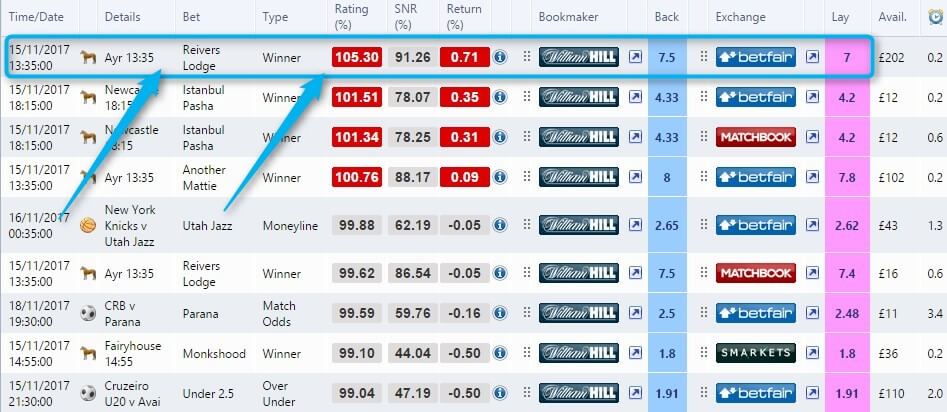

Next is the availability of the variances. Sometimes you can sit at your computer all day and watch the scalps just roll in. Other times, you may only see a couple of scalps per day. Because you are at the mercy of the oddsmakers line movements you really can never predict how many scalps will be available to you.

Lastly, the amount of the variances will play a big role in your bottom line. On average, most scalps range from a few cents up to around twenty cents. Occasionally you will be able to find one higher but they are the exception, not the rule and generally are only available for a matter of minutes. The key to managing these variances is to be able to have the patience to pass on the variances of only a couple cents and wait for the ones that are around ten cents or more.

What Do You Need to Get Started in Arbitrage?

You can start scalping with just a computer, some money and a handful of funded sports book accounts. However to make it worth doing you will need a couple of essentials.

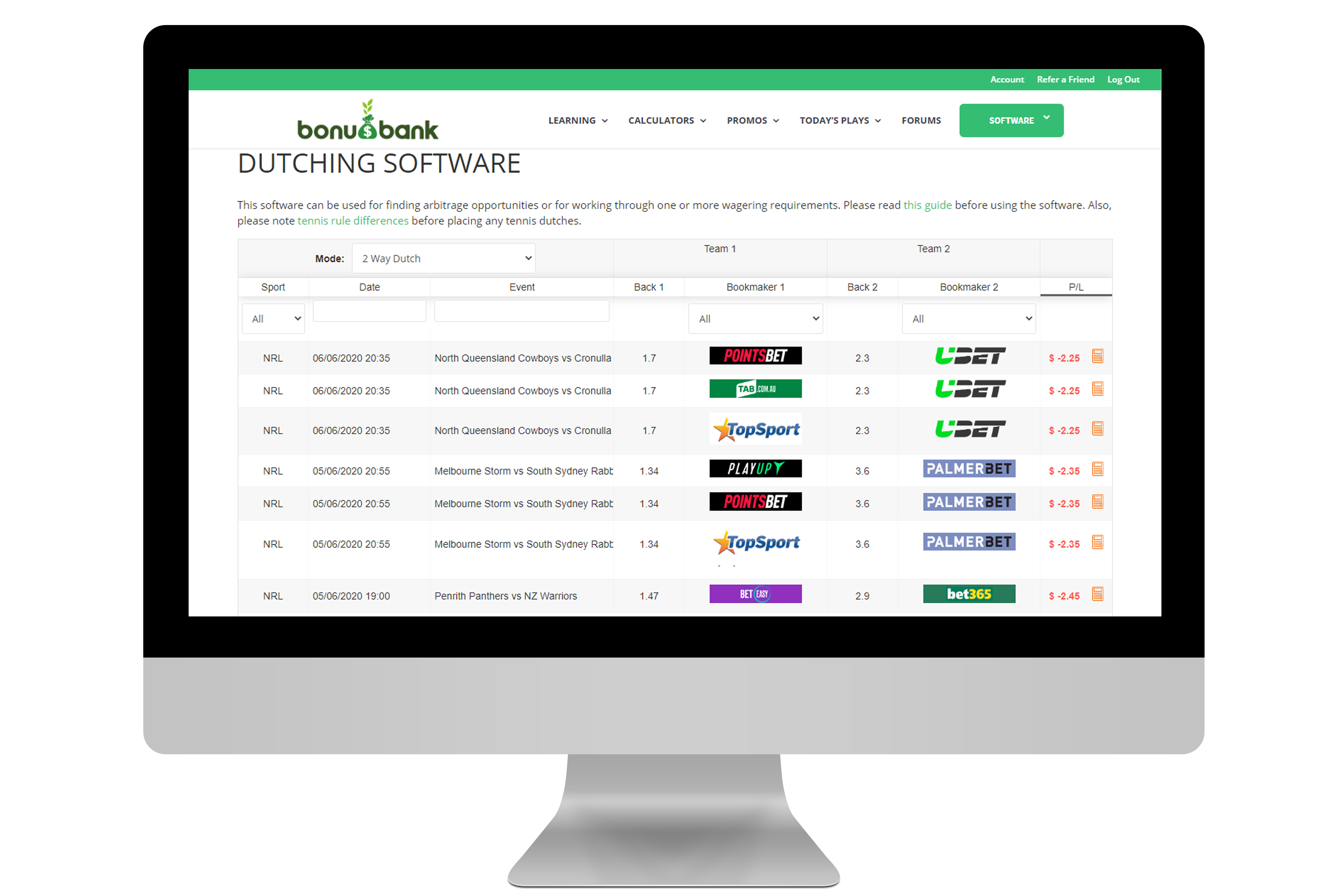

Because you are dealing in real money you want to do everything possible to minimize mistakes that could cost you dearly. That’s where the Arbitrage Calculator comes in. Essentially an Arbitrage Calculator is either a spreadsheet or web based program that calculates your scalp for you to eliminate the guess work and the mistakes.

You input the amount you wish to bet, the odds at sports book A and the odds and sports book B and the calculator will tell you how much to bet at each sports book. There are many sites online that offer these calculators for free and some will even calculate your expected return for you and keep track of your winnings. Click here to get TheSpread.com's Free Sports Arbitrage/Scalp Calculator.

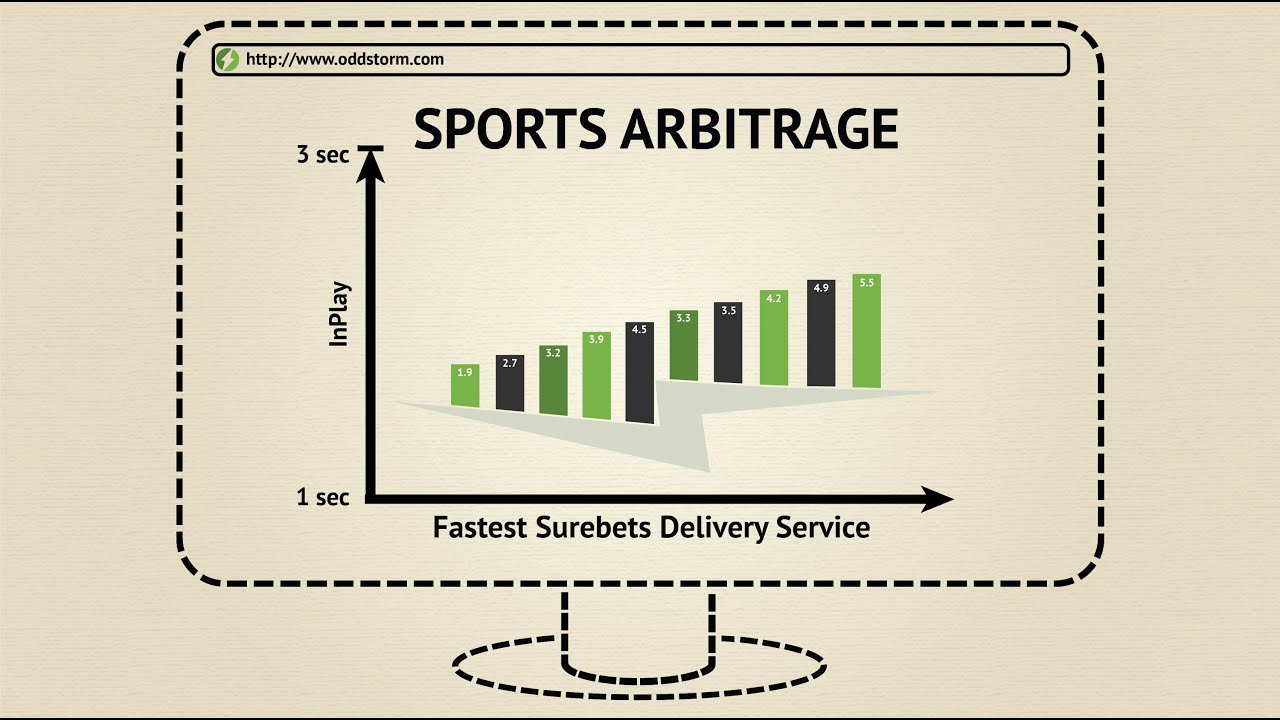

This is not completely essential to scalping however it will make your life a whole lot easier. Without a lines program, you will be resigned to manually visiting each sports book constantly to check the most current lines. This is incredibly time consuming and often times you will miss a scalp because of it.

With a line services you will be able to view the latest odds from dozens of sports books at once and in real-time. Many have scalp alerts built into the program which will give you an audible alert or a pop-up when a scalp is available.

Some of the more popular ones available today are Sports Insights and Line Tracker. Prices range from $300-$600/month.

Are you new to Sports Betting? If you are or, if you just want to try betting an unfamiliar sport, here are some guides to help you out!

A Beginner's Guide to Online Casinos Playing games is an important part in many of our lives – there’s evidence that humans have found ways to play since the very early days of the evolution of our...

Bet on Some Great Heavyweight Boxing 2021 was supposed to be the year when we finally saw Anthony Joshua take on Tyson Fury for four world heavyweight titles.

Finding The Right Handicapping Service If you consider yourself an avid sports fan while also being an avid sports bettor, you are always looking for ways to improve the overall winning percentage of...

What is the Point Spread & How to Bet It Even those who are not regular sport betting enthusiasts will have heard the term ‘points spread’

Bears 50/1 Odds in Illinois Sportsbooks The Chicago Bears created excitement in April when they traded up for franchise quarterback Justin Fields in the 2021 NFL Draft

How to Bet MLB Baseball - Baseball Betting Explained

THIS IS NOT A GAMBLING SITE – If you think you have a gambling problem click here.

Disclaimer: This site is for informational and entertainment purposes only. Individual users are responsible for the laws regarding accessing gambling information from their jurisdictions. Many countries around the world prohibit gambling, please check the laws in your location. Any use of this information that may violate any federal, state, local or international law is strictly prohibited.

Copyright: The information contained on TheSpread.com website is protected by international copyright and may not be reproduced, or redistributed in any way without expressed written consent.

About: TheSpread.com is the largest sports betting news site in the United States. We provide point spread news, odds, statistics and information to over 175 countries around the world each year. Our coverage includes all North American College and Professional Sports as well as entertainment, political and proposition wagering news.

©1999-2019 TheSpread.com

JOIN THE FREE THESPREAD EMAIL CLUB!

SUBSCRIBE ME TO THESPREAD MAILING LIST

Arbitragers (arbitrageurs in english) are - at least in the eyes of the industry - the pariahs of spread betting, living on the back of the firms and other punters, taking money out of the industry without risking any of their own. The firms work to spot them and their tricks in what is a constant battle of wits. And they are the clients most likely to have their accounts closed when they are found out.

Must as the firms love in-running trading, there is one thing that they hate with a passion - the client who trade arbitrages.

The business of exploiting arbitrage is a long and difficult road, at least in its simplest form. The theory is that spread betters can take advantage of differences in prices between the firms. So, suppose we have a rugby union international between England and Wales. Sporting has England favourites by 20-23 points but Spreadex, when they go up with their quote, think England will only win by 14-17 points. Bettors who sell supremacy with Sporting at 20 and then buy supremacy with Spreadex at 17 for the same stakes are guaranteeing themselves a profit of three times their stake, no matter what the final result. Suppose we stake GBP10 a point, then we win GBP30. If England win by 50, we lose GBP300 with Sporting (50-20 equals 30 times our GBP10 stake), but we win GBP330 with Spreadex (50-17 equals 33 times our GBP10 stake). If England lose the game or win by less than 20, we still make GBP30 except it is from Sporting instead of Spreadex.

It is fair to say that every day these discrepancies in the prices of the firms exist across most events. All the arber needs to do is spot the difference between the firms.

That's the theory. The reality can be different. Firstly, the margins the arber can make are generally relatively small - only a few points at most. To make the system pay in the long run, large credit accounts are needed with all the major firms. Also when there is a difference between firms on a market price, it does not tend to last for long. When the phones start ringing off the hook at 10 a.m. in the spread offices, it is not just punters looking for value - it is arbers getting on.

Paul Austin at IG says his firm know who their arbers are.

'It is the same people ringing first thing in the morning to get those prices and then trade against them with another firm. It takes money out of the industry and for the genuine clients it means they find it harder to get the price they want.'.

One insider estimates that arbitrage cost his firm a total of GBP250,000 every year - money taken out of the industry for no risk.

The firms have their methods of stopping the practice. When an arber - or 'alpha' as IG traders call them - comes on to the phones he may be quoted a different price, or just part of his stake at the price and the rest at a quote more in line with their rivals.

At this stage the tactics can become more devious: fake accounts, trading with other people's accounts, closing out trades just through the internet to disguise arbitrages and avoid voice recognition are all common strategms The policy has also obvious problems. For all the seemingly safe profit an arber might make on a series of trades, it only takes on mistake for disaster to strike. Getting a bet on with one firm, but not the corresponding bet with another is a constant risk. Stop losses on certain bets or a different policy on the settled result also need to be taken into consideration.

Despite the problems, there is probably a hard core of 200 determined arbers who play the markets simply for the differences in prices, scrambling for prices when the offices open and monitoring the markets for the slightest opportunity.

Arbitrage opportunities can comes in many forms, however not all of which will bring contempt from the spread firms.

Technical arbitrages can be created by betting in different markets on the same event, which offers the possibility of large returns for little or no risk. Professionals look to take advantage of small variations in the markets by betting in certain proportions to guarantee a profit. These are often on indices for an event where firms have a different scale of settlement (so, for instance in Superbowl betting Sporting Indes have a 100-70-50-33-20 scale while IG award 60-40-30-20-10). By investing in the correct proportions, traders can lock in a profit once they have calculated the mathematics of the prices.

Traders also make profits from forecasting the movement of a price before the event takes place. As we discussed earlier, predicting how your fellow gamblers will act, and the direction a quote will move in, puts us at a big advantage. Taking this to its logical conclusion, professional gamblers (often betting with large stakes) will move into a market when it is first put up on the basis that they know how the majority of gamblers will act. They will assess how spread bettors will react to a game and look to make money before events unfold.

For example a popular team is made favourite in a rugby match and the Racing Post tip them a good bet because news has come through that their opponents have injuries to key players. The arbers will then buy early with the express view of closing out shortly before kick-off after the price has moved in their direction. The scheme never involves leaving a bet open until an event starts, even if it means making a loss. The plan is to make a steady profit over time.

Not that movement of quotes is always that small. Tipsters, rumours, injury news, all can mean a big surge in the price.

In the 1994 World Cup one of the biggest ever betting plunges went belly-up when money from across the world was piled on Cameroon to beat Russia. The Russians were already out of the tournament after losing their first two group games and were expected to put up a limp display against the African side. Rumours were rife suggesting that the Russians were going to throw the game and the Cameroon price came in from 13-8 to 4-5 - a shift reflected on the spread, with Cameroon moving from nearly a goal underdog, to a goal favourite within just a few hours' trading. In the event, the game was won 6-1 by the Russians after Oleg Salenko scored five goals: a disaster if a supremacy buyer of Cameroon stayed in until the end of the match, but a handsome profit for anyone who followed the money, but got out before kick-off.

Another area where money-makers will look to trade are markets such as total points in rugby where poor advance weather forecasts mean the price will have to come down significantly. The aim again is to close out with a profit once the price has moved, but before the event takes place. The system relies on good information and an awareness of how the spread firms and other bettors will react.

A trading system which is more easily available to the everyday spread bettor is fixed-odds hedging. This is where spread betting position is off-set by a fixed-odds bet and can be seen in several forms.

One of the simplest fixed-odds hedging methods can be seen in the index markets. For example, in the first and second group rounds of the Champions League, weak group favourites provide a potential killing. European football is always more difficult to assess because of the relatively limited number of games played between clubs from different countries. Consequently, big-name Spanish and Italian teams are often made favourites without necessarily always justifying it. On a group index where the winners are given 25 points, the second placed team 10, third five and last team nothing, it is not unusual to see favourites given an opening quote of 18.5-20. On the fixed-odds, the team will be slightly odds on. By selling the favourites on the spread, but backing them on fixed-odds to win the group, the effect can be to have a bet to nothing. If the team wins the group, the spread bet loses, but the cost are largely covered by the fixed-odds win. If the team comes second, there should be a small profit. If the team comes third or fourth, serious money can be made.

The skill is in spotting the opportunity and getting the mathematics - which are not as complicated as they seem - correct.

Betting consultant Joe Saumarez Smith says:

"Fixed-odds arbitrages are among my favourite bets

because they have the potential to be very profitable

for a limited risk. The firms do not object to them

in my experience because you are risking money with

them, even if you're limiting your exposure overall."

Please do not copy/paste this content without permission. If you want to use any of it on your website contact us via email at traderATfinancial-spread-betting.com (remove the AT and substitute by @).

Copyright © 2010 - 2020. All Rights Reserved.

Double Toys Lesbian

Velma Cosplay 18

Video Japanese Undressed Voyeur Punyo Locker

Voyeur Dressing And Undressing Girls Com

Lesbian Crime Stories 4

What is Sports Arbitrage? Sports Arbitrage Explained

Arbitrage Sports SpreadBetting

Arbitrage Sports SpreadBetting - financial-spread-betting.com

A Guide to Arbitrage with Spread Betting - CleanFinancial.com

Sports Spread Betting Arbitrage | Sport News and Guide

Technical Arbitrage and Hedging in Sports Spread Betting

Sports Spread Betting Arbitrage - OTOCONTESSS SPORT

LIVERPOOL FANS CLUB SPORT: Sports Spread Betting Arbitrage

Sports Spread Betting Arbitrage