Special Fund

PM NavasTreatment of Special Funds(Tournament Fund,Lottery fund etc)

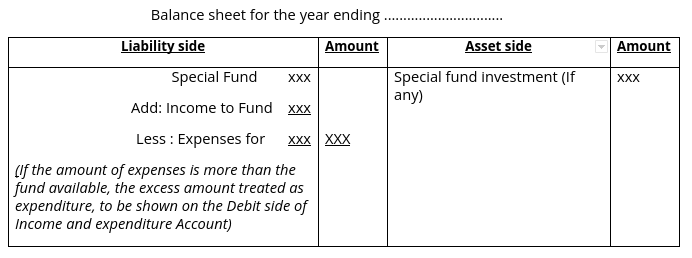

If there is any special purpose fund, eg. Tournament fund, Charity Fund,Prize Fund, Endowment Fund etc. and there are certain items of expenses and incomes relating to that fund ,then incomes and expenses should not be shown in the income and expenditure account but income should be added to the fund and expenses deducted from such fund on the liabilities side of the balance sheet.

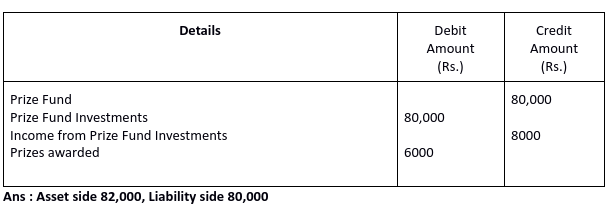

Q 22 - Show how you would deal with the following items in the financial statements of a Club:

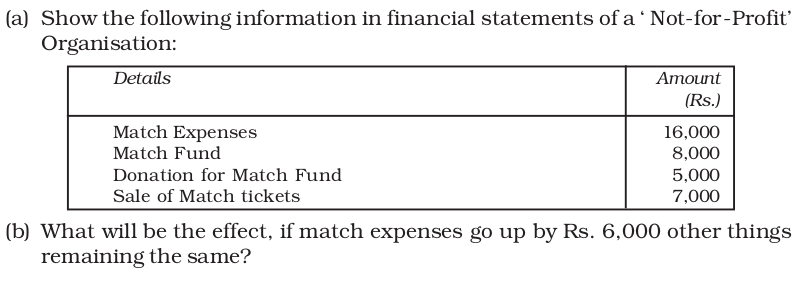

Q 23 -

Ans : a ) 4000

b) If match expenses go up by Rs. 6,000, the net balance of the match fund becomes negative i.e. Debit exceeds the Credit, and the resultant debit balance of Rs. 2,000 shall be charged to the Income and Expenditure Account of that year.

Q 24 - Show how the following items will appear in the financial statement of a Not-for-Profit

organisation :

(i) Cricket Match fund ` 40,00,000

(ii) Cricket Match Expenses ` 23,00,000

(iii) Donations received for conducting cricket matches ` 12,00,000

(iv) Sale of Cricket Match tickets ` 16,00,000

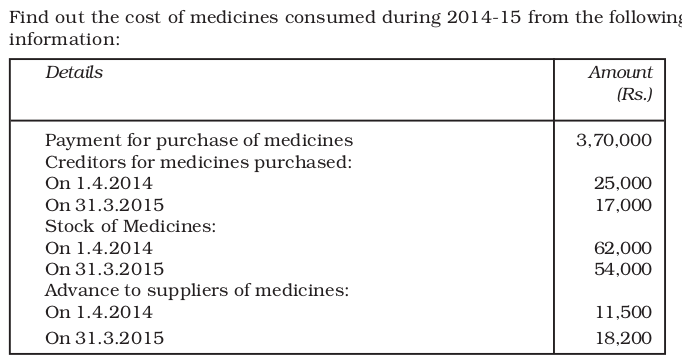

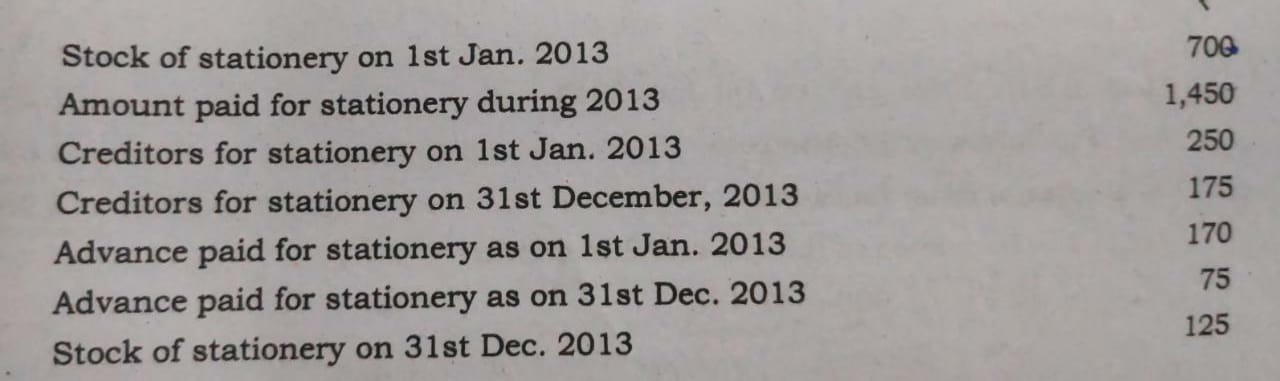

Calculation of Expense Stock Items Used

Items like stationery ,sports materials like bats,balls etc are called expenditure stock items.The value of that type of items which remain unused should be deducted from the total amount spent , so that only the amount actually used up is debited to Income and Expenditure Account.

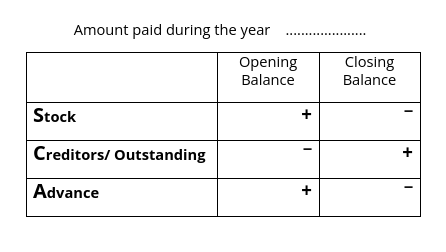

Calculation of amount debited to Income and expenditure Account.

Method - 1

Opening Stock of stationery - xxx

Add : Amount paid during the year - xxx

Xxx

Less : Closing stock of stationery - xxx - To be shown in Asset side of B/S

Stationery Items used during the year - xxx - Debited to I&E A/c, Expenditure side.

Q 25 - The Receipt and Payment Account shows a payment for stationery amounting to Rs. 40,000 and there is an opening and closing stationery amounting to Rs. 12,000 and Rs. 15,000. Calculate the amount of expense on stationery during the yaer.

Ans : 37000

Q 26

Q 27 - From the following particulars ,calculate the amount to be debited to income and Expenditure Acount for the year ending 31 st December 2013,In respect of stationery items consumed.

Ans :Stationery items used during the year debited to IE A/c :2045

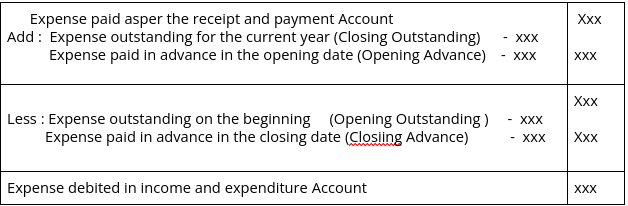

Calculation of salary debited to Income and Expenditure Account

Expenses (like salary )paid during the year and outstanding for the current year is to be debited to Income and Expenditure Account.

Calculation:

Q 28 - From the following particulars ,arrive at the amount os salary to be debited to the Income and Expenditure Account for the year ending 31st march 2014

Salary paid during the year - 18,000

Salary unpaid on 31-3-2014 - 5,500

Slary unpaid on 01-04-2013 - 7,400

Salary prepaid on 01-04-2013 - 4,300

Salary prepaid on 31-03-2014 - 5,700

Ans : Salary to be dibited to IE A/c - 14,700

Q 29 -From the following details ascertain the amount of salary to be debited to Income and

Expenditure Account :

Salary paid during 2020-21 - 30,000

Salary outstanding on 31-03-2021 - 3,200

Salary outstanding on 31-03-2020 - 1,600

Salary paid in advance on 31-03-2021 - 800

Ans : 30,800