Some Of Top Strategies to Halt Wage Garnishment in Maryland

Dealing with Back: Reliable Methods to Quit Wage Garnishment in Maryland

Dealing along with wage garnishment can be a stressful and frustrating encounter. If you are encountering this scenario in Maryland, it is essential to comprehend your civil rights and the possibilities offered to cease wage garnishment. In this message, we will certainly discover some reliable approaches that can easily aid you battle back and recover control over your funds.

1. Know the Laws Pertaining to Wage Garnishment in Maryland

Prior to taking any kind of activity, it is necessary to familiarize yourself along with the laws controling wage garnishment in Maryland. Under federal legislation, creditors can garnish up to 25% of your disposable earnings or the quantity by which your weekly profit goes beyond 30 times the minimum wage, whichever is a lot less. However, Maryland has actually its own set of guidelines that provide additional defenses for workers.

In Maryland, financial institutions maynot garnish wages unless they have secured a judgment versus you in court of law. In addition, certain types of income such as Social Security perks and joblessness settlement are excused from wage garnishment. Understanding these rules will certainly assist you establish whether your earnings are being dressed up suitably.

2. Look for Lawful Advice

If you find yourself encountering wage garnishment, it is suggested to look for lawful recommendations coming from an experienced attorney specializing in financial debt assortment or buyer security rule. A proficient legal representative may evaluate your situation and assist you with the legal procedure while guarding your civil rights.

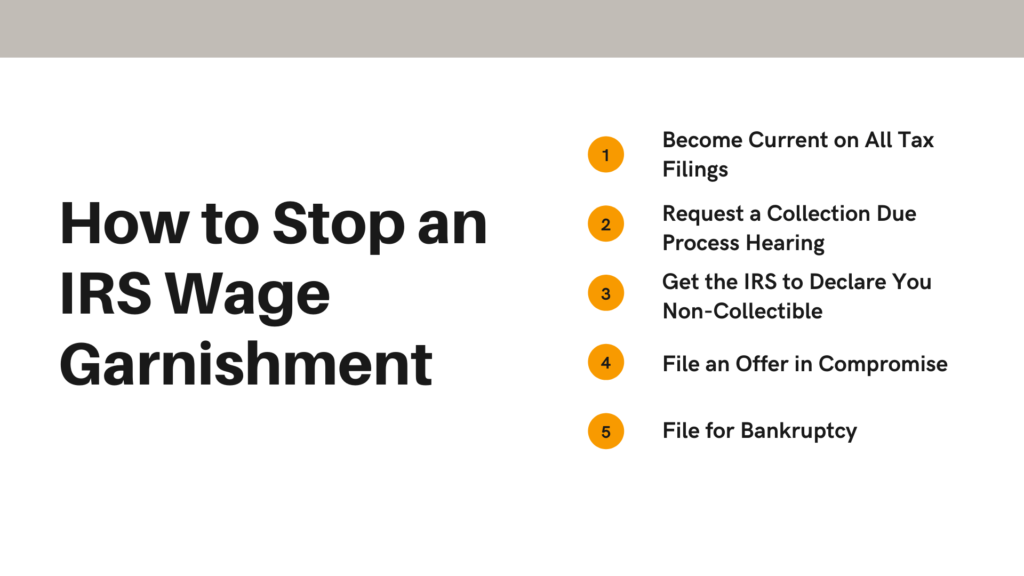

3. File for Insolvency

One choice to quit wage garnishment is filing for bankruptcy under Chapter 7 or Chapter 13 of the United States Bankruptcy Code. Upon submitting for insolvency, an automatic remain goes into result, which briefly stop all compilation activities consisting of wage garnishments.

Section 7 insolvency permits people along with limited income and properties to discharge their financial obligations entirely while likely defending specific exempt building coming from clearance. On the various other hand, Chapter 13 personal bankruptcy includes producing a settlement strategy over three to five years located on one's throw away revenue.

It is important to note that insolvency need to be thought about as a last retreat, as it has long-term economic consequences. Speaking with with a personal bankruptcy legal representative may aid you find out if this is the best choice for your certain scenario.

4. Negotiate a Repayment Planning

In some situations, working out a payment planning directly along with the financial institution may be an efficient technique to quit wage garnishment. Creditors are typically prepared to work with people who show a legitimate devotion to fixing their financial obligations. By recommending a affordable settlement program located on your financial situation, you might be capable to get to an agreement that stops additional wage garnishment.

5. Request a Hearing

If you think that the wage garnishment is improper or unfair, you possess the right to request a hearing in court. This are going to allow you to provide proof and disagreements sustaining your insurance claim versus the financial institution or collection agency.

To request a hearing in Maryland, you have to file an exemption insurance claim create within 30 days of getting the Notice of Intent to Dress up Wages. The court will certainly after that arrange a hearing where each celebrations may show their situation. It is suggested to seek advice from with an lawyer before asking for a hearing, as they can easily lead you by means of the process and aid develop your defense.

6. Look for This Is Noteworthy

Engaging with debt counseling solutions can offer valuable assistance and assistance when working with wage garnishment or various other financial battle. These companies give specialist assistance on handling financial obligation effectively and may aid in discussing alternate repayment setups with creditors.

7. Stay Proactive and Interact

Finally, it is critical to remain aggressive throughout this procedure and sustain available communication collections with your collectors or compilation firms. Maintain precise records of all communication and repayments made towards your financial debts.

By revealing your readiness to take care of the problem head-on and working towards finding options, you may be capable to stop or stop wage garnishment entirely.

In conclusion, facing wage garnishment may really feel overwhelming; however, there are actually successful strategies accessible to stop it in Maryland. Understanding the legislations neighboring wage garnishment, looking for legal guidance, thinking about personal bankruptcy as a final hotel, haggling settlement program, asking for a hearing, looking for debt therapy services, and staying positive and communicative are all strategies that may aid you gain back management over your funds. Bear in mind to seek advice from along with professionals who may lead you through this method and secure your rights.