Some Of Preneed Life Insurance, Funeral and Memorial Planning

The Ultimate Guide To Best Burial Insurance Companies - USA Life Team

Final Decision Your option of burial insurance coverage depends upon your health and finances. People in excellent health can select from lots of coverage options. Whereas for those who require a guaranteed approval policy, the alternatives are more restricted. We have actually provided alternatives to match most situations. Mutual of Omaha was our total burial insurance option, as there's guaranteed coverage to age 85 without any underwriting.

If you're looking for a simple application process, consider AARP. It's our pick for ease of application as there's no medical examination or case history questions, and they will not decline you coverage for any pre-existing health conditions. For those who choose a higher coverage level, take a look at World Life policies with advantages of approximately $100,000.

You may even have the ability to get coverage the same day you apply. Compare Providers Finest Overall $40,000 Best For Ease of Application $25,000 Best For Highest Coverage $100,000 Best for No Waiting Duration $35,000 Frequently Asked Questions What Is Burial Insurance coverage? Burial insurance coverage is a kind of entire life insurance that business offer in little quantities to cover the funeral, burial, or cremation expenses when the policyholder passes away.

:max_bytes(150000):strip_icc()/gerber-life-insurance-b9a17219f3ef468a9958014b24727dee.jpg) Top 10 Best Burial Insurance & Final Expense Insurance Companies – Top Quote Life Insurance

Top 10 Best Burial Insurance & Final Expense Insurance Companies – Top Quote Life InsuranceAll About Preneed Life Insurance, Funeral and Memorial Planning

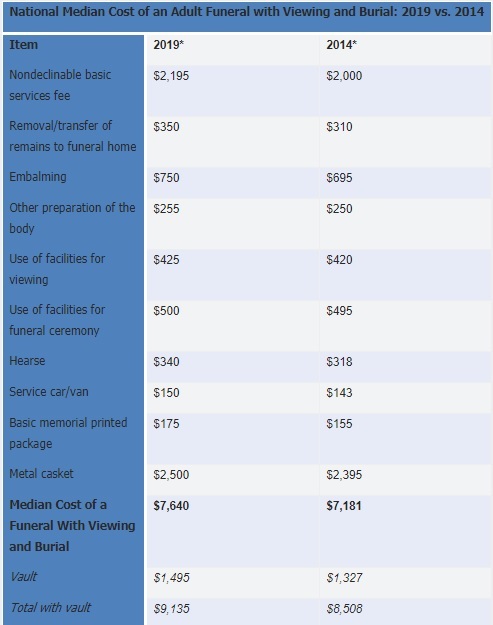

In addition to the burial, the payment can cover outstanding medical expenses, other debts, or any legal expenses. Burial insurance plan aren't suggested for people with households who need a life insurance coverage product to cover pricey mortgages or kids's college tuition. Sometimes called final cost protection, these policies typically have maximum protection amounts of $25,000$50,000.

Best Burial Insurance and Final Expense Insurance of 2022

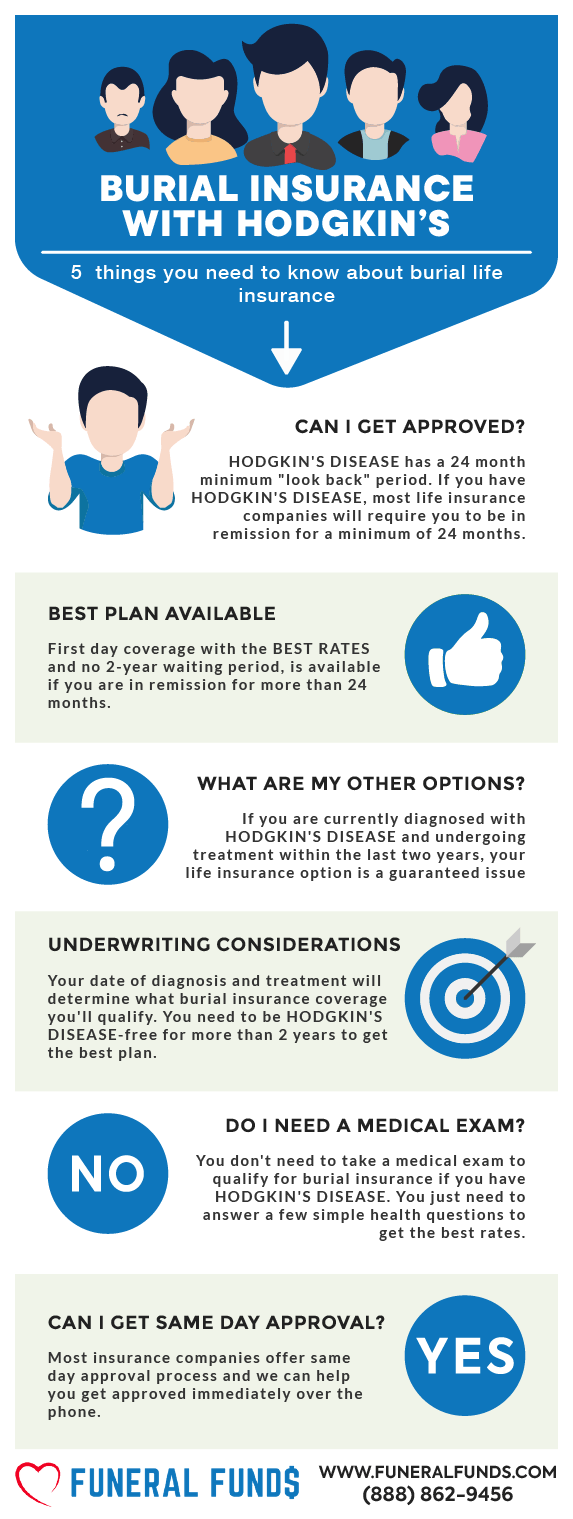

Best Burial Insurance and Final Expense Insurance of 2022Most insurance provider use their premiums on a guaranteed basis, which means that you won't be denied coverage no matter what health concerns you have. How Another Point of View Does Burial Insurance Coverage Expense? It's challenging to determine an overall cost for burial insurance because the rates differ according to several aspects. The greater the coverage level, the greater the cost.

With some policies, your health may impact the cost. During our research study, we discovered policies ranged from under $10 a month to as much as $300 a month for a specific in their 80s. Exist Numerous Choices for Protection? If you are looking for an insurance coverage policy to cover funeral costs, it's worth keeping in mind burial insurance is simply one type of life insurance coverage and there are other choices: If you have a particular monetary commitment that has an endpoint, such as a mortgage, term life insurance is a good alternative.