Some Of Employer Identification Number (EIN) - Practical Law

What is an Employer Identification Number (EIN)? - Square Things To Know Before You Get This

Page Last Evaluated or Upgraded: 06-Aug-2021.

Page Last Reviewed or Upgraded: 02-Jul-2021.

When does the IRS require an EIN number? The has specific, recognized guidelines that determine when you require to look for an EIN for your company. Your business has employees Your company is a collaboration or corporation Your service files excise taxes Your business withholds taxes for nonwage earnings paid to a nonresident alien All organizations can benefit from having an EIN.

Need help beginning an organization? Read our thorough how to begin a company guide. If your service structure is a without employees (and doesn't file any excise or pension plan income tax return), then you are to get an Employer Recognition Number (EIN). Key Reference with staff members to have an EIN.

The Definitive Guide to EIN Lookup: How to Find Your Own and Other's EINs

Our sole proprietorship to LLC guide can help you decide when to take the next action in growing your organization. It's advised that taxpayers get an EIN number in order to open an organization bank account, build company credit, and lower the risk of identity theft. Discover more about EINs for Sole Proprietorships.

Single-member LLCs to have an EIN if they have staff members. It's still suggested (and often needed) to open a bank account, to employ staff members later on, and in order to maintain your business veil. Discover more about EINs for Single-Member LLCs. If your organization structure is a partnership or multi-member LLC, you to get an EIN number because the LLC need to file a and supply to members of the LLC.

EIN Number for Solo 401k Retirement Trust - My Solo 401k Financial

EIN Number for Solo 401k Retirement Trust - My Solo 401k FinancialCorporations If you have an S corporation tax structure, you are required to have an EIN for tax reporting functions. If you have a C corporation, your organization is viewed as a different entity and you to get an EIN for tax reporting purposes. If your organization structure is a not-for-profit, you are required to have an Employer ID Number for tax reporting purposes.

How to Find Your Legal Business Name and Employer Identification Number (EIN/TIN) – TOOTRiS Help & Knowledge Base for Parents & Providers

How to Find Your Legal Business Name and Employer Identification Number (EIN/TIN) – TOOTRiS Help & Knowledge Base for Parents & Providers About That EIN — Union Baptist Association

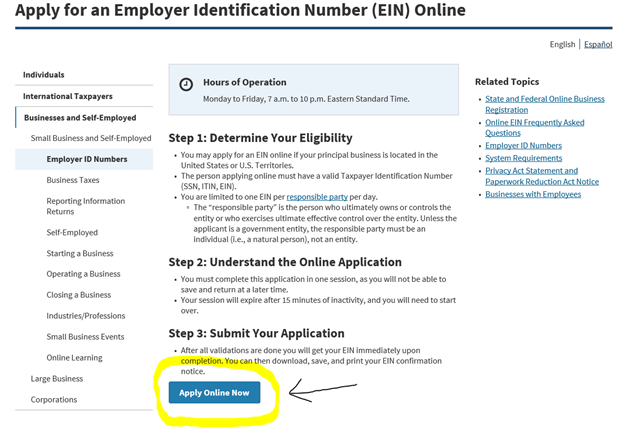

About That EIN — Union Baptist AssociationYou can visit the online internal revenue service site and follow their step-by-step application procedure as soon as your service is formally formed. The EIN Assistant provides questions and responses, however we've also below. form your organization before getting an EIN. The IRS will request for your service formation date and legal business name.