Silver (XAG) Forecast: Can Gold’s Strength Lift Silver Amid Weak Chinese Demand?

Silver Market Recap: Last Week’s Drivers and Forecast

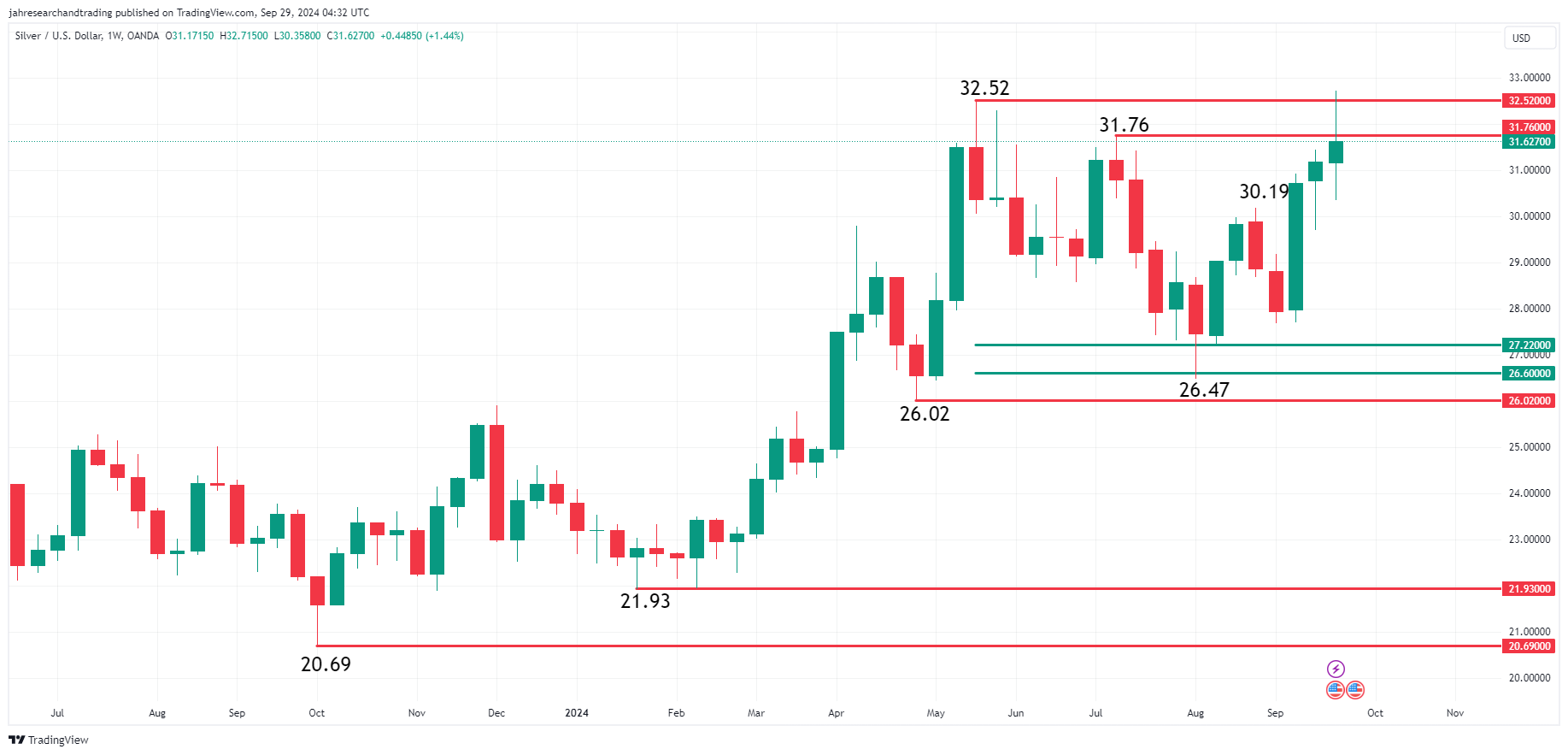

Last week, silver prices experienced a mix of bullish momentum and profit-taking, ultimately settling at $31.63, up 1.44% from the prior week. Several key factors shaped the price action, including U.S. monetary policy, economic uncertainty in China, and ongoing geopolitical tensions.

Fed Rate Cuts and U.S. Dollar Impact

The Federal Reserve’s recent 50-basis point interest rate cut continued to fuel silver’s rally last week. Lower interest rates decrease the opportunity cost of holding non-yielding assets like silver, enhancing its appeal to investors. Traders are now anticipating another potential rate cut at the Fed’s November meeting, with futures markets pricing in a 62% chance of an additional 50-basis point reduction.

This dovish sentiment has helped offset some of the pressure from the strengthening U.S. dollar, which typically weighs on silver prices. However, Treasury yields fell after August’s Personal Consumption Expenditures (PCE) inflation data came in lower than expected, further easing concerns about aggressive Fed tightening.

China’s Economic Woes and Stimulus Efforts

China’s struggling economy added another layer of complexity to silver markets. Although the People’s Bank of China (PBOC) has implemented stimulus measures such as reserve requirement ratio cuts and lower interest rates, economic data continues to point to weakness.

Retail sales, industrial production, and urban investment all underperformed, while property prices fell at their fastest pace in nine years. These factors have dampened Chinese demand for silver, particularly for industrial use. Nonetheless, the PBOC’s actions have provided short-term support, contributing to silver’s upward movement in conjunction with global industrial metal rallies.

Gold’s Performance and Spillover Effects

Gold prices also hit record highs last week, driven by safe-haven demand amidst global economic uncertainties and ongoing geopolitical tensions in the Middle East. With gold up 29% this year, silver benefited from spillover buying as traders sought exposure to precious metals. However, physical demand for silver in key markets like China and India weakened, with some investors opting to cash in on their holdings as prices surged.

Geopolitical Tensions and Safe-Haven Demand

Silver’s role as a hedge against geopolitical risks has been a strong tailwind. Ongoing conflicts in the Middle East, particularly between Israel and Hezbollah, have contributed to heightened safe-haven demand for both gold and silver.

Short-Term Forecast

Looking ahead, silver is likely to remain sensitive to U.S. monetary policy and China’s economic developments. The metal may extend its gains if the Federal Reserve signals further rate cuts, potentially pushing prices toward the key $34.35 level. However, silver’s recent surge above its 50-day moving average suggests that the market could be overbought, increasing the risk of a short-term correction. Profit-taking, coupled with any signs of U.S. economic resilience, could temper further gains. Traders should remain cautious of volatility in the coming weeks.