Shopping a Home? Hang in There.

We & rsquo; re still in a sellers & rsquo; market. And if you & rsquo; re looking to purchase a home, that means you & rsquo; re likely facing some unique obstacles, like trouble finding a home and volatile mortgage rates. Keep in mind, there are some advantages to being a purchaser in todayâ& rsquo; s market that provide you excellent factor to stick with your search. Here are a few of them.

Long-Term Benefits Outweigh Short-Term Challenges

Owning a house grows your net worth â-- and given that developing that wealth takes time, it makes sense to begin as quickly as you can. If you wait to buy and keep renting, youâ& rsquo; ll miss out on out on those monthly real estate payments going towards your house equity. Freddie Mac homeownership /4-benefits-owning-home" rel="noopener noreferrer" target="_blank">puts it in this manner:â& ldquo; Homeownership not only develops a sense of pride and achievement, but itâ& rsquo; s likewise a crucial action toward accomplishing long-term monetary stability.â& rdquo; The crucial there is long-term since the monetary benefits homeownership provides, like house worth appreciation and equity, grow in time. Those advantages deserve the short-term difficulties todayâ& rsquo; s sellers & rsquo; market presents. Home Mortgage Rates Are Constantly Changing

Home mortgage rates have actually been hovering around 6.5% over the last several months. As Sam Khater, Chief Economist at Freddie Mac, notes, theyâ& rsquo; ve been coming down some just recently:

â& ldquo; Economic unpredictability continues tobring home loan rates down. Over the last a number of weeks, decreasing rates have brought customers back to the market ...â& rdquo; Lower mortgage rates improve your buying power when you purchase, and that can help make homeownership more budget friendly. Hannah Jones, Economic Data Analyst at realtor.com, explains:

â& ldquo; As we move into the spring buying season, mortgage rates have ticked lower, a welcomed sign of development towards affordability.â& rdquo; The recent drop in home mortgage rates is good news if you couldnâ& rsquo; t afford to purchase a house when they peaked.

House Prices Will Increase

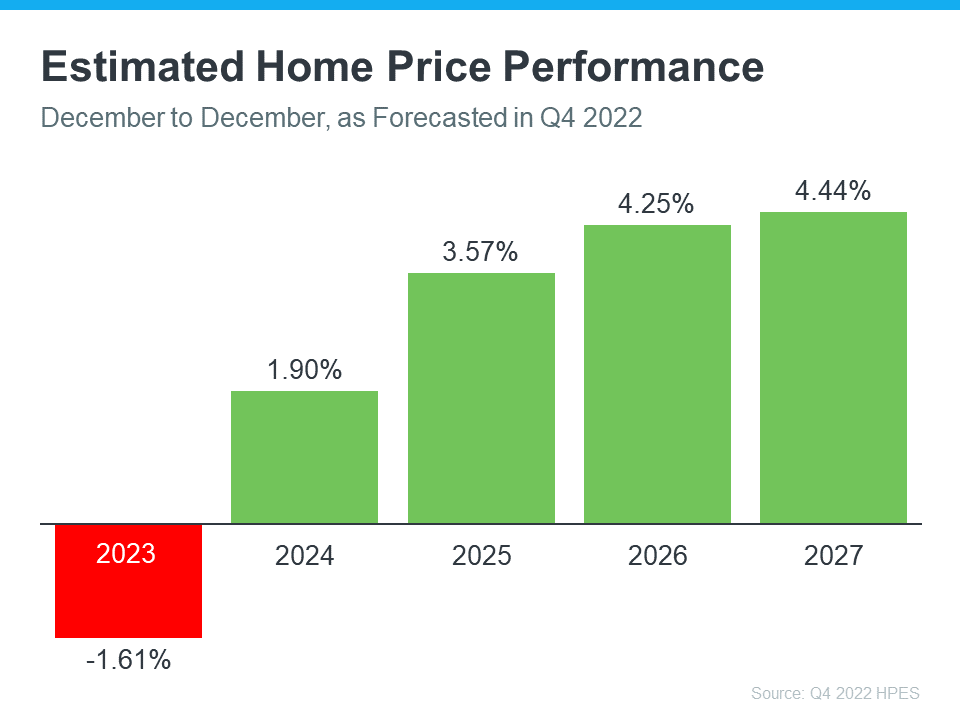

According to the Home Price Expectation Survey, which surveys over 100 genuine estate specialists, house worths will increase gradually over the next couple of years after a minor decline this year (see chart listed below):Rising home costs in the coming years indicates 2 things for you as a buyer:

- Waiting to purchase a house could mean itâ& rsquo; ll end up being more costly to do so.

- Buying now means the value of your house, and your net worth, will likely grow in time.

Bottom Line

If youâ& rsquo; ve been shopping a home, hang in there. Mortgage rates have actually ticked down some just recently, home costs are anticipated to increase in the coming years, and the long-term advantages of homeownership exceed a lot of the short-term challenges.And if you & rsquo; re looking to purchase a house, that implies you & rsquo; re most likely dealing with some unique obstacles, like problem discovering a house and volatile home mortgage rates. Home loan rates have been hovering around 6.5% over the last several months.