Share Spread Betting Explained

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

Stock Alert : Amazon Shares are up by 0.80% in the last 24 hours – Buy Stock Here

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit "Cookie Settings" to provide a controlled consent.

The spread is the difference between the buy and sell prices of financial instruments, such as securities, commodities , and indices.

The buy price , also called the bid price , is the highest amount a buyer is willing to pay for a given financial instrument. The selling price , also referred to as the asking price or the offer price , is the lowest price a seller is willing to accept to sell a financial instrument.

Spread betting , also known as spread trading , refers to a trading strategy that enables traders to speculate on the price movements of numerous financial instruments, such as shares , commodities, indices, and currency pairs.

It is a legal and feasible alternative to traditional trading, enabling traders to profit from upward or downward price movements of financial instruments without actually owning the underlying instrument .

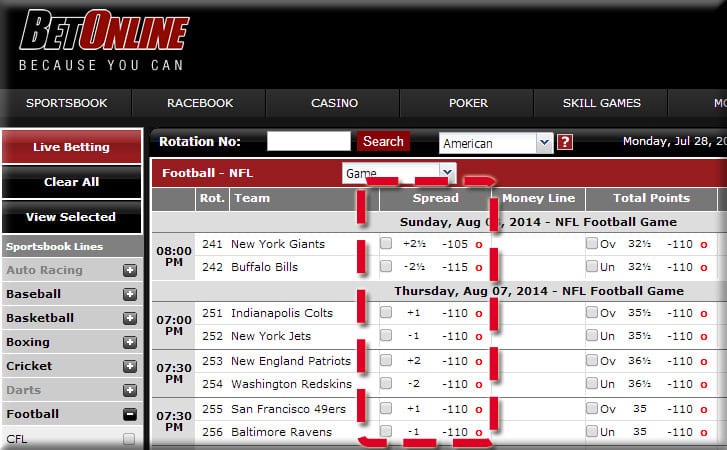

After receiving the ask and bid prices from the broker , the trader bets on whether the price of the underlying asset will be lower than the bid price ( decrease ) or higher than the ask price ( increase ).

If the assumption is that the price will rise, the strategy is to buy and sell higher , referred to as ‘ going long ’. If the expectation is that the price will fall, the strategy is to sell and buy lower , known as ‘ going short ’.

The aim is to generate profits from speculating on the increase or decrease of the underlier's price. However, if a price does not move as expected, a trader can incur losses .

In trading , leverage refers to the strategy where a trader is allowed by a broker to trade with a large amount of money, using almost none of his or her own funds. Brokers allow the use of leverage through margin trading, where a broker lends funds to a trader.

Leverage plays a major role in spread betting , enabling traders to have full market exposure for a small amount of the money actually required to trade.

Leverage enhances profits and losses because they are calculated according to the full amount of the trading position of a trader, not only to the value of the initial deposit .

When you open a position in spread betting, you will be required to deposit a percentage of the full amount of the trade in your spread betting account. This initial deposit is called the deposit margin .

The other type of margin involved in spread betting is the maintenance margin , indicating the additional funds that might be needed to keep your position open when you start to suffer losses that are not covered by the deposit margin.

The term spread in spread betting refers to the difference between the buy and sell price of a given financial instrument as quoted by a spread betting broker or brokerage. Put differently, spread is the charge paid by a spread bettor (trader) to open a trading position.

Typically, the costs of any given spread trade are included in the bid and offer prices . Therefore, a spread bettor will always buy marginally higher than the market price and sell marginally below the market price.

The stake , also referred to as the bet size , is the amount a trader bets how much an underlying asset or underlying market will move ‘per point’ .

A point of movement can represent €1, $1, R1, £1, or one unit of whichever currency you prefer to trade with. It can even be as little as a cent, penny, or the smallest unit any given currency is divided into.

The size of a point depends on, among other things, the underlying asset or liquidity and volatility of the underlying market .

For example , if you open an R2 per point bet on the share price of company ABC and it moves 50 points in your favour, your profit would be R100 (R2 x 50 points). Contrarily, if the price moved 50 points in the opposite direction of your bet, you would incur a loss of R100.

The bet duration is described as the length of time before a position in spread betting expires. Although having fixed timescales, bet duration can vary from a day to several months . However, spread bets can be closed at any point before the nominated expiry date, supposing the spread bet is open for trading.

Let us say company ATZ is currently trading at a sell price of 25020 (R250.20) and a buy price of 25070 (R250.70). Expecting the share price to rise in the next week, you decide to go long on ATZ’s shares, betting R5 per point of movement at 25070 (R250.70).

As you have anticipated, the share price did increase, and you decide to close your position at the sell price of 25130 (R251.30).

Contrary to your expectation, ATZ’s share price declined to 24910 (R249.10). To cut your losses, you decide to close your position and sell the shares immediately.

Keep in mind that not every trading strategy is suitable for every trader. Assess your risk appetite and create a risk management strategy that suits you . Take time and develop your own spread betting strategy .

Find a professional and trusted spread betting broker or brokerage who can provide you with outstanding platforms in order to lead you into the world of spread betting.

Lastly, spread betting provides effective trading tools to mitigate losses .

Note: This article does not intend to provide investment or trading advice. Its aim is solely informative.

Featured SA Shares Writer and Forex Analyst.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Insights

Learn to trade

Learn spread betting

Spread betting shares

Join a trading community committed to your success

Open a live account to start trading on the share market. A live account comes with exclusive features such as our trading forum, market data and access to over 7,750 shares and ETFs. Please note that shares cannot be traded with a demo account.

Strengthen your knowledge on spread betting. If you are a beginner trader, visit our article on ‘ what is spread betting? ’ to learn more information about the product, along with the risks and benefits associated. Our spread betting tips and strategies page is also useful when trading in the financial markets.

Research the stock market. Share prices often rise or fall in value following a company’s news earnings report, a political event or an economic announcement. Learn about various economic indicators that can have an effect on your open position.

Decide whether you want to buy or sell. If you think that the value of the share will rise, you could place a buy order or go long. If you think that the value of the share will decline, you could place a sell order or go short on the asset. Discover how to short stocks .

Familiarise yourself with our execution and order types . Take-profit and stop-loss orders can help to mitigate risk when spread betting in volatile markets, but there is still some risk of slippage and gapping on price charts that traders should look out for.

Learn how to spread bet with our step-by-step video tutorial.

Join a trading community committed to your success

Spread betting is a popular and tax-efficient* method to trade on shares in the UK. When spread betting shares, a trader will open a position based on whether they think that the value of the stock will rise or fall. This way, they can speculate on the underlying price movements of the share without taking ownership of the asset.

Spread betting is a derivative product that differs from traditional share trading , where investors instead buy and sell the asset with the aim of making a profit. This method involves taking full ownership of their investment. When spread betting shares, traders have the opportunity to ‘buy’ and run their profits if the value of the share is increasing, or cut their losses short and ‘sell’ if the instrument starts to decline in value.

Spread betting shares in the UK requires you to trade with leverage . This means that you only need to deposit a percentage of the full trade value in order to open a position, which is known as your deposit. In turn, this gives you better exposure to the stock market without having to physically purchase and own the asset, as it may decline in value over a period of time.

After registering for a live spread betting account , you will have access to over 7,750 shares and ETFs on our online trading platform, Next Generation. You will need to fund your account before opening any live positions. You can then choose your preferred asset and place a buy or sell order, depending on which direction you think the market will head in.

You don’t pay tax on spread bets in the UK or Ireland. This is also true for stamp duty, capital gains tax and commission charges. However, we build an additional spread cost into the share prices that are displayed on our spread betting platform. There are some differences depending on the country of the stock you are spread betting on, which is applicable once your order has been submitted. Read more about our trading fees here.

Most trading strategies for spread betting in the share market focus on short-term profits, rather than long-term profits, which are more suited to investors or shareholders. We have outlined a few of the most popular strategies for spread betting shares below.

Day trading is a popular short-term strategy that involves buying and selling stocks with the aim of closing out all positions before the end of the day. When day trading with a spread betting account, you will not encounter any overnight fees and therefore, any profits you make throughout the day will be untouched. Day traders aim to collect small but consistent profits if the trade is successful. Learn more about how to day trade in the share market.

Swing trading is a medium-term strategy that is more popular with traders who want to hold their positions for a longer period of time, but without taking ownership of the stock. Swing traders aim to capture upswings and downswings in share prices. These positions are typically held for approximately a week, although they can last longer if there is a steady trend and opportunity for profit. Learn how to swing trade stocks .

Position trading strategies allow traders to hold share positions in the long-term, for several months or even years. This type of trader tends to ignore short-term price action and instead focuses on the fundamentals of the company, such as its balance sheets, cash flow and P/E ratio. Position trading closely resembles buying and selling physical shares, although you still do not own the asset and you will be subject to other spread betting costs , such as overnight fees and additional spread charges. Learn more about position trading .

Seamlessly open and close trades, track your progress and set up alerts

The share prices used in this example include the additional built-in spread, as discussed above.

For example, let’s say that we want to spread bet Apple stock .

To have the same exposure as buying 500 shares, we will buy £5 per point. So, £5 x 131 = £655.

The position value of the shares using a spread bet is equivalent to £655 worth of shares. If the value of the share increases or decreases, then the spread bet will follow.

As the margin rate for the share is 20%, £131 will be taken from our spread betting account to act as a deposit for opening a spread bet on Apple’s share price worth £655.

It is important to remember that margin trading means that losses are magnified equally as profits. Sometimes, a loss you make on a spread bet may exceed the amount of margin used as your deposit, and you will be at risk of account close-out. Therefore, a trader may wish to use risk-management tools such as stop-loss and take-profit orders when opening new positions.

Our platform requires spread betters to trade using leverage. This allows you to gain better exposure to the financial markets, but it also means that you could end up losing more capital than you initially planned. Where profits may be magnified, losses will also be magnified.

As mentioned above, stock charts can often gap overnight and open at a much higher or lower price than expected, therefore, your position could massively decrease in value. Where stop-loss orders may not be a useful tool for this, as they do not guarantee to close you out of your position, you could instead use a guaranteed stop-loss . For a premium charge, GSLOs ensure you that you exit a position at your specified price, regardless of market volatility. These are all things to be aware of when spread betting on the share market, as it is known for being particularly volatile.

Spread betting is a popular and tax-free method of trading on the share market, without the requirement of buying shares upfront or taking ownership of the instrument. It is also an effective way to trade on multiple stocks with our share baskets , which are made up of a multitude of thematic shares that can be traded in a singular position. However, spread betting shares still comes with the risks of trading with leverage, market volatility and gapping on price charts. Traders should thoroughly understand the pros and cons of spread betting shares before opening an account with us.

*Tax treatment depends on your individual circumstances. Tax law can change or may differ in a jurisdiction other than the UK.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 300,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 11,000 instruments

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Ability to trade with leverage for better exposure to the share market.

Investors must pay the full value of the share upfront to take ownership of the asset.

Trade tax-free with no commission or stamp duty in the UK and Ireland.

Share traders must pay commission charges, stamp duty and capital gains tax on physical shares.

Spread betting holding costs apply when carrying positions overnight.

As you own the share, there are no overnight fees to pay.

Shares are more often spread bet in the short-term.

Shares are bought and held in the long-term.

With spread bets, you can speculate on both negative and positive price movements – going long or short.

When buying outright shares, investors can only

https://sashares.co.za/spread-betting/

https://www.cmcmarkets.com/en-gb/learn-spread-betting/spread-betting-shares

Russian Soft Tube

Touch Me Tease Me

Brazzers Mom S And Boyfriend

Spread Betting 🥇 Explained for Dummies | SA Shares

Spread Betting Shares: Examples & Strategies | CMC Markets

What is Spread Trading? Spread Betting Explained | Spread ...

How to Spread Bet | Learn Spread Betting | City Index UK

Spread Betting vs Share Dealing - The 6 Pros & 6 Cons (2021)

Sports Spread Betting Odds Explained (How It Works ...

Spread betting - Wikipedia

Spread Betting Explained | Test4test Wiki | Fandom

Bet sports on: Spread betting explained shares

Share Spread Betting Explained