Send money abroad at the best exchange rate

kishanSend money abroad at the best exchange rate

How to Send Money Abroad: The Ultimate Guide?

When an individual or business needs to make international transfers or payments for the first time, can be difficult for them to know where to start and how to follow through with the process. Most people tend to go to their bank despite the fact that various cheaper alternatives exist. When it comes to currency exchange, there are many other great services out there, which offer additional benefits at a cost far less.

Competition in this market has increased in recent years. For decades, the market share is divided between the bank and the two giants, Western Union, and MoneyGram. Although the latter two operators may still control much more than half of the money transfer market, they are now facing new, online money transfer operators and the competition brought by new technologies.

Summary

· Check your options

· Determine your needs

· Compare the available solutions

· Consider the timing of the exchange

1. Check your options to send money overseas

Use your bank

The most obvious solution in the market. Most of the banks provide abroad money transfer solutions. A bank can provide express services for urgent transfer, although it will cost an additional fee.

· Pros: safe, secure and simple as a bank you already have all your personal information and will guide you through the transfer process. An easy option if the recipient uses the same bank as you (for example if you and your recipient both had HSBC accounts in different countries, so you can perform your transfers at low cost).

· Cons: fees imposed by major banks. In addition, the exchange rate is applied for a transfer away from the best exchange rate in the market today. What's more, you do not know the amount of the transfer will be charged in advance; You will only know the cost after the money has been deposited into the recipient's account. Additionally, you must have an account in your country to send money to, which means you can only make a bank transfer to the bank.

· Tip: to avoid double charges applied by both the sender and the receiving bank you may want to open a foreign account via a branch of "home" bank. This will help to facilitate the transfer. This is very useful for those who have an interest in making regular transfers.

Use of foreign exchange (FX) broker

Brokers are specialists in foreign currency. They are highly efficient experts that wish to optimize the cost of money transfers involving large sums of money. UK companies, in particular, have access to some of the best financial services cost in the world.

· Pros: they have a better exchange rate than banks.

· Cons: No minimum transfer amount to operate, so they are not the best choice to make small transactions.

· Tip: FX broker can provide regular transfer and you can lock in exchange for regular payments to prevent currency volatility. You can also make a "forward contract", which means locking levels for the foreseeable future in which you know that you will need to make a big transfer. Or, if you do not hurry, you can create a "limit order" to get notified when the level reaches the desired level.

Using traditional money transfer operators (MTO)

Two giants of traditional service provider Western Union and MoneyGram. With these two operators, there are many ways to send money (bank transfer, credit card, a cash deposit) and many ways to receive it (cash pick-ups, physical delivery).

· Pros: well-known solutions are trusted worldwide. Present almost everywhere and on every street corner in many global cities (more than 460 000 institutions throughout more than 200 countries). Useful if the recipients do not have bank accounts.

· Cons: Very expensive and not optimized for ease of use online. They are far from one of the cheapest way to transfer money.

Use MTO online, peer-to-peer companies (P2P)

Many innovative, online company's peer-to-peer is established right after

Many innovative, online company's peer-to-peer was established right after the financial crisis of 2008, following an increase of public mistrust of banks. Peer-to-peer money transfer services specialize in matching people who need to send money in the currency against, prepare cheap direct transfer between the two. In this way, they can reduce the cost of the exchange rate are usually imposed unfairly by banks and traditional service providers.

· Pros: the cheapest way to send money, highly flexible, multiple payment and shipping methods.

· Cons: some MTOs have a maximum transfer amount.

Using the network blockchain

The blockchain network is a network based on new revolutionary technology. In the future, they will be the cheapest and fastest way to send money and make payments abroad.

· Pros: the cheapest way to send money, probably the fastest way in some cases.

· Cons: limited market liquidity.

2. Determine your needs to send money overseas

To find the best way to send money internationally, first think about the following questions:

· How / Where form (cash, mobile phones, bank accounts) that you want to send money (pay-ins)?

· How often do you send money (frequency) - the payment of one-off or regular payment?

· Where do you send money (state)?

· How much money do you send (number)?

· How quickly should the money be sent to the recipient (delay)?

· How / Where form (cash, mobile phones, bank accounts) that you want the money received (pay-out)?

· What is the purpose of your transfer? (Send money, online shopping: using a credit card)?

It is important that you consider how much money should be transferred and how quickly the transaction to be completed. Do you want the fastest possible transfer? Or maybe you want the cheapest? Maybe you just want a user-friendly solution that is the easiest and most? Currently, the process of sending money abroad can be completed almost instantly and performed from almost anywhere, although it can be expensive if you choose to pay for express service, for example. That is one reason why it is important to determine if you need an urgent transfer. Considering how many sent is also important because the cost is not the same in accordance with the amount transferred. The best solution for small transfers may not be the same for a larger amount.

There are many ways to send money overseas but in many cases, when sending money online you will need the following information:

· full name and address of the recipient

· Beneficiary IBAN (International Bank Account Number) or account number

Name and address of the recipient banks - including BIC /SWIFT/clearing code (ex: suppose you transfer money to commercial bank Colombo city so you have commercial bank swift code and you can find it from some website which listed here 1) bankifscswiftcode.com 2) ifsccodeofbank.in )

· Some countries may require some extra information for security issues.

PS :

1) Affiliate Payments Top 10 Frequently Asked Questions

2) Best Ways to Send Money Internationally

3) Best ways to send money abroad

3. Compare the solutions available to send money overseas

The best solution for the transaction depends on the 5 features that have been determined in advance.

Payment method

Available in a choice of payment by bank transfer, credit/debit card or cash deposit. Transfers can be more expensive or slower, depending on the method of pay-ins. In general, bank deposits will take longer than a card or cash deposit, but the transfer to the more expensive cards.

Delivery method

There are various options available to receive money in the receiver country: bank deposits, cash pick-ups, prepaid debit cards, ATM withdrawals or SWIFT. There are also other options such as email, mobile phone recharge, mobile wallet, and home delivery.

transfer delay

The transfer speed depends on the MTO selected. In general, if you need an urgent transfer, the fastest way to send money abroad is to make a payment by credit card and receive it as cash pick-ups, or via mobile; Alternatively, you can use the services of express MTO, although this will be more expensive.

transfer fees

There are two types of fees charged on transactions. There is a flat fee, which depends on the amount sent, and then there is what we call the "hidden costs", relating to the exchange rate used/charged by money transfer operators. What often happens when comparing a good money transfer solutions provider offering lower transaction costs but a lower rate, or offer a higher exchange rate but higher transaction costs. This can make comparing costs are very complex, because you have to consider the total cost of the transfer and not only see the fixed costs announced by MTO.

Tip: look out for hidden costs currency transfers.

user experience

Some of the services that are easier to use than others because all steps can be taken to validate online transactions. Other MTOs requesting a phone call to validate the identity of the user or do not provide prices online to do a cost-estimation.

Traditionally, when it comes to the cost estimate, these are the steps that you might follow:

· Watch the exchange every day online to see if it was a good day for transfer

· Browse online for money transfer operators and see which provide routes currency

· Unlocks all side by side and make the solution cost estimates take on their respective websites this MTO

· Look at the MTO that offers the most foreign currency for the amount sent and compare it with the real exchange rate

· Choose the cheapest option if the time required to complete the transfer in accordance with your needs

· Test whether the solution is easy to use, or if it takes too much time to create and validate an account, upload documents, and complete the transaction

· For ordinary transfer, do not forget to check out the available solutions for policy-CHANGING PRICES some MTOs

As you may be aware, finding the best solutions adapted to transfer can easily be a time consuming and confusing. First, you have to find all the possible options for the currency you need, and then you have to fight through the calculation of comparisons involving the combination of the cost and the exchange rate, to determine which are the most cost (taking into account the delay and the method of payment/delivery) ,

Or, to avoid all these steps, you can only use a money transfer service comparison. When going on vacation, you are most likely to compare flights or hotels, and you may use a comparison service to do so. , If you have to look at all of the companies near your destination individually, imagine how time-consuming it would be! It is exactly the same to transfer money.

A service of money transfer comparison is very useful because it gives you pay and pay-out possibility, delay the transaction, and the right amount in costs that will be taken to a certain amount sent (no hidden charges). It shows the exact amount of foreign currency to be received for a certain amount sent, by calculating the "effective exchange rate". Effective exchange rate takes into account both fixed costs and the exchange rate costs.

Effective exchange rate => amount received / total amount sent

MTOs have their own way to charge transfer in combination with repair costs and the cost of the exchange rate. That is why it is important to determine the effective exchange rate because it is a combination of both transaction costs and exchange rates.

Tip: A comparison services like Moneytis.com can recommend solutions to you for a particular transaction. Calculation of the best solutions is made of 3 scores, which is obtained based on the following criteria:

· Transfer fee

· transfer delay

· User experience

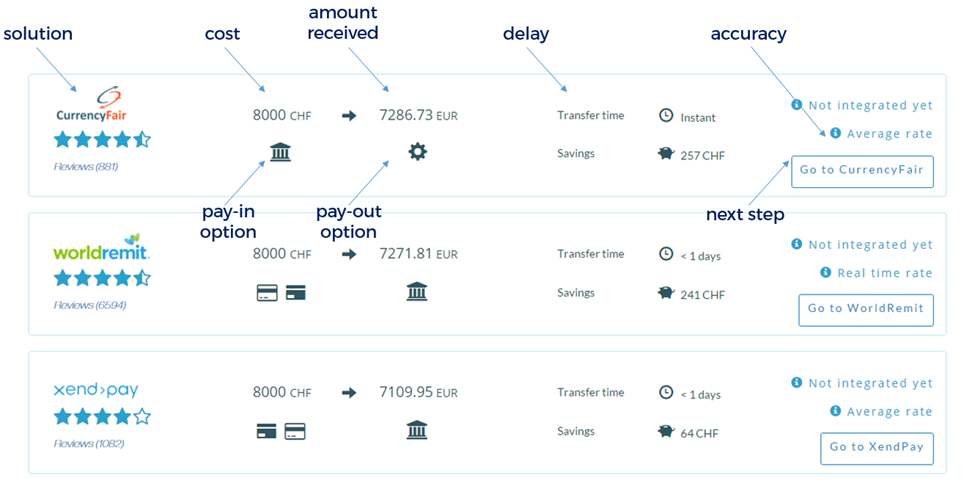

Below you can see a comparison to send 8000CHF from Switzerland to France. We have the amount received, delay, pay-in and pay-out selection.

4. Consider the timing of the exchange

Finally, choose the right solution for a good transfer, but choosing the right time is the best. currency exchange rate constantly varies and can vary widely for volatile currency. What does it mean for international money transfer? By sending money overseas in a timely manner, the transfer is optimized and money saved. Depending on the daily exchange rate of the market, there can be times better than others to complete the transfer of money. The higher the rate, the more money you will get.

Comparing the cost of transfers and delays are good, but what is also important is the simplicity of use of the chosen solution. If the transfer delay is short, but the creation account is too long or too complicated, the end result is that it is not an efficient service.

Related Topics

3) How to Withdraw Money Through Skrill in Bangladesh