Secretary Of The Treasury

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Secretary Of The Treasury

The Balance is part of the Dotdash publishing family.

The secretary of the U.S. Treasury Department is the chief financial officer for the federal government. The Treasury secretary's job is to manage the public debt , even though the U.S. Congress controls spending and deficits. Similarly, the Treasury collects taxes, but Congress sets tax policy. The Treasury prints money and manufactures currency, but the Federal Reserve manages the money supply . 1

Although the Treasury Department doesn't set financial policy, Treasury secretaries throughout our nation's history have played crucial roles in the U.S. economy.

On Dec. 1, 2020, President-Elect Joe Biden nominated Janet Yellen to be Secretary of the U.S. Treasury. 2 She must be approved by the U.S. Senate.

Yellen was the Chair of the Federal Reserve between Feb. 3, 2014, and Feb. 3, 2018. She was the first female chair, and would become the first woman Secretary of the U.S. Treasury, if confirmed.

Yellen's experience as a Fed chair gives her a unique advantage as Treasury secretary. She will coordinate U.S. fiscal policy with the monetary policy of current Fed Chair Jerome Powell. They've already worked closely together while both were on the Fed board.

She would take office during extremely challenging times. The COVID-19 pandemic has forced businesses to shut down, causing rising unemployment and shrinking tax revenue. Government spending to combat the recession has sent debt levels skyrocketing to record levels.

Alexander Hamilton was the first Treasury secretary. His first task was to pay off the $50 million debt the United States had incurred to pay for the Revolutionary War. He also absorbed the states' debts. This responsibility established the new country as creditworthy, allowing needed foreign direct investment to build the nation's economy.

Hamilton paid off the debt by issuing the first U.S. Treasury bonds and by establishing the first taxes: on liquor. He created the first federal mint to issue a national currency. He also successfully argued for the first central bank of the United States so the federal government would have a safe place to store funds.

Hamilton's vision was for the federal government to have political dominance over the states. He also pushed the new country to move toward an industrial economy. He was in favor of tariffs to protect these new industries and of increasing liquidity to help start new businesses. 3

Salmon Chase was the Treasury secretary under President Abraham Lincoln. He did two important things: He created the country's banking system and invented the paper currency in use today. Like many Treasury secretaries, he helped fund a war. In this case, he helped fund the Civil War at a cost of $500 million. He did so even though he was opposed to the war and was an anti-slavery activist.

Chase created the first paper dollar bill in 1861, and made sure the phrase "In God We Trust" was stamped on it. In his memory, the $10,000 bill was printed with his face on it from 1928 to 1946. His name lives on in the name of JPMorgan Chase, since the Chase Manhattan Bank was originally named after him. 4

Andrew Mellon's first task as Treasury secretary was to reduce the federal debt resulting from World War I . He proposed to do so by lowering excessive surtaxes on the rich.

He first proposed the supply-side theory in 1924 in his book, "Taxation: the People's Business." He said the rich would use tax cuts to hire more people. That would boost the economy more than tax cuts to the poor. Lowering the rates would also more people to follow the law and pay their taxes. 5 He cut the top marginal rate from 73% in 1921 to 25% in 1929. 6 That lowered the debt from $24 billion in 1921 to $16 billion in 1930. 7

As an ex-officio member of the Federal Reserve Board , Mellon favored interest rate hikes to curtail speculation in 1929. The Fed kept raising rates even though the economy entered a recession in August. 8 That led to the stock market crash in October .

Henry Morgenthau was Treasury secretary under both President Franklin D. Roosevelt and Harry Truman. He was a co-author of the New Deal , an aggressive spending program designed to create jobs, set up social safeguards, and end the Great Depression of 1929 . Morgenthau oversaw the sale of war bonds to finance World War II.

After the war, he proposed the Morgenthau Plan to prevent Germany from building up the economic strength to ever be a military threat again. It was very harsh. It suggested that Germany be divided into two states, its industries annexed by neighboring countries, and its standard of living sharply reduced.

Truman opposed the severity of the plan, but the last part was implemented. A Directive banned assistance to German farmers and prohibited the production of oil, rubber, merchant ships, and aircraft until 1947. 9

Larry Summers was Treasury secretary for President Bill Clinton from 1999 to 2001. He oversaw the repeal of the Glass-Steagall Act that allowed banks to invest in risky assets like collateralized debt obligations .

Summers also was a strong advocate for the deregulation of derivatives . That was one reason why government officials had no idea that the subprime mortgage crisis would spread to the general economy. No one knew how pervasive the use of credit default swaps and other unregulated derivatives had become. 10

Hank Paulson was asked to become Treasury secretary by President George W. Bush in 2006. He was reluctant to leave his position as CEO of Goldman Sachs, but his experience at the firm gave him intimate knowledge that would prove useful when the 2008 financial crisis hit.

Paulson, along with Federal Reserve Chair Ben Bernanke, spearheaded the bailout efforts. He used his personal relationships in the banking industry to force them to accept government ownership. That shielded the weaker banks with the credibility of the stronger ones. 11

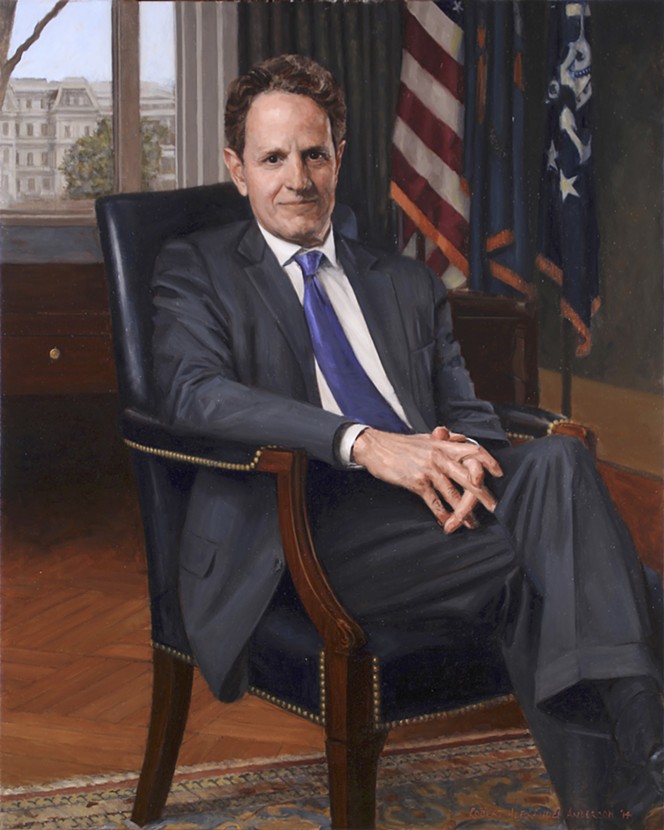

Timothy Geithner served under President Barack Obama during his first term of office. A month after he took office, he launched the $2 trillion Financial Stability Plan, using funds from the Troubled Asset Relief Program . Its goal was to seed a Public-Private Investment Program. He asked banks to match funds to purchase subprime mortgages . 12

Geithner oversaw implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act . It regulates banks to prevent another financial crisis. It also protects borrowers with the Consumer Financial Protection Bureau (CFPB).

Prior to serving as Treasury secretary, Geithner was head of the New York Federal Reserve Bank. In this role, he was intimately involved in guiding the bank bailouts intended to soften the 2008 financial crisis . He also guided European leaders during the financial crisis. 13

Jack Lew's biggest challenge as Treasury secretary was to work with Congress to find the best way to reduce the national debt . Lew was selected by President Obama because he had a lot of experience dealing with budgets and administration.

Lew was Obama's former Chief of Staff, Director of the Office of Management and Budget (OMB), and Chief Operating Officer for Management and Resources in the State Department. He served as OMB Director under President Clinton, where he helped negotiate a bipartisan transition to a balanced budget. 14

Lew previously worked for Citi Global Wealth Management and Citi Alternative Investments. He also was the chief operating officer of New York University. 15

As Treasury secretary, he oversaw negotiations in Congress for the $2 trillion CARES Act. 16 This relief package helped families and businesses during the COVID-19 pandemic.

Mnuchin co-authored and implemented the Tax Cuts and Jobs Act . He also oversaw the subsequent increase in the national debt . He eliminated Dodd-Frank regulations on small banks.

Steve Mnuchin was Donald Trump's campaign finance chairman. Mnuchin earlier was chief information officer at Goldman Sachs. He also worked in mortgage securities. In 2002, he set up his own hedge fund , Dune Capital. 17

The secretary of the Treasury has several important functions. First, he or she advises the president on financial, economic, and tax policies, both domestically and internationally. The secretary also participates in setting fiscal and budgetary policies.

The Treasury secretary manages all the various functions of the Treasury Department. The most important is funding the public debt by overseeing the Treasury auction process.

Taxpayers are most affected by federal tax policy and collecting income taxes through the Treasury's Internal Revenue Service (IRS). The Treasury secretary also oversees the department's function of manufacturing coins and currency, which affects everyone. 1

You have the U.S. Department of Treasury to thank for the IRS, the U.S. Mint, and the Bureau of the Public Debt. These bureaus, along with nine others, are responsible for 98% of the department's workforce. The remaining 2% of the workforce is in the Treasury secretary's office. Although small in numbers, it is very influential in the global economy. 1

Secretary of the Treasury

US Secretary of the Treasury : Function, Bios, Role

What Does the Secretary of the Treasury Do?

Secretary of Treasury - Wiki 24: The premier source for complete episode...

secretary of the Treasury - Translation into Russian... | Reverso Context

The secretary of the Treasury is an appointed Cabinet-level position in the U.S. federal government. The secretary of the Treasury acts as a principal advisor to the President and the Cabinet on economic issues. The United States Department of the Treasury, which the secretary oversees, performs many important functions, including paying the nation's bills, printing money, and collecting taxes. Historically, secretaries of the Treasury have had high-level backgrounds in finance, law, and government. Janet Yellen, former chair of the Federal Reserve, is the current Treasury secretary. She is the first woman to hold either position.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Created in 1798, the U.S. Treasury is the government (Cabinet) department responsible for issuing all Treasury bonds, notes, and bills. Discover more here.

The Bureau of Public Debt was an agency within the United States Department of the Treasury that was responsible for borrowing funds for the federal government to use, maintaining accounts of the government's outstanding debts, and providing services to other federal government agencies.

The Treasury secretary is the head of the U.S. Department of the Treasury and is analogous to that of finance minister in other countries.

The Federal Insurance Office (FIO) is a federal-level national office created in 2010 to address gaps in insurance regulation.

The Old-Age and Survivors Insurance Trust Fund is a U.S. Treasury account that funds Social Security benefits paid to retired workers and their survivors.

President Joe Biden nominated Jennifer Granholm, former governor of Michigan, as secretary of energy.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

The United States Department of the Treasury is a Cabinet-level agency of the federal government. It is responsible for crucial functions that help keep the government running, including paying all U.S. bills, collecting taxes, and managing federal finances.

Another important role that the Department of the Treasury performs is overseeing national banks, which includes the printing and minting of all paper currency and coins in circulation through the Bureau of Engraving and Printing and the United States Mint.

Mostly under the Internal Revenue Service (IRS), the same agency that collects taxes, the Treasury also enforces tax and financial laws, prosecuting alleged tax evaders and financial criminals.

In addition, the department makes recommendations regarding domestic and international financial, monetary, economic, trade, and tax policy, and publishes statistical reports. 1

The President of the United States looks to the secretary of the Treasury as a principal advisor on economic issues. The secretary makes recommendations about domestic and global economic policy and tax policy. The secretary plays a very important part in creating strategies that affect economic and government financial outlooks for issues that the government faces.

Secretaries of the Treasury take part in formulating broad fiscal policies that significantly impact the economy and manage the public debt. The secretary also serves as the financial representative for the United States government. This person is responsible for overseeing the manufacture of U.S. coins and currency and managing the amount of cash that is available to markets.

The secretary of the Treasury has some responsibility for the credit rating of the United States . If the U.S. mismanages money or defaults on debt, the entire economy can be hurt. For that reason, the secretary may take on additional duties not specifically laid out in the job description.

The secretary of the Treasury is chosen by the President of the United States. The candidate must then face U.S. Senate hearings and be confirmed by a majority vote before being sworn in.

The work experience a nominee for Treasury secretary has is typically found in economics, law, business, education, the military, or in a previous government post. The President has the ability to choose a nominee from any walk of American life.

The only rule, as stated in the United States Constitution, is that the President not nominate any member of the House. No member of Congress is permitted to hold a Cabinet position while simultaneously holding a post in the House. Any House member nominated would have to resign to assume the office of the secretary of the Treasury. 2

As of January 2021, the secretary of the Treasury is paid an annual salary of $221,400. 3 4 The General Fund of the Treasury pays the salary.

The amount of time a secretary of the Treasury has in their post is incumbent upon the President’s discretion. The President may dismiss the Treasury secretary at will and replace them at any time. Traditionally, the secretary resigns once the President’s term is over, though in several cases, secretaries have stayed on into new administrations.

Janet Yellen is the current United States Treasury secretary. She was nominated by then President-elect President Joe Biden on Nov. 30, 2020, confirmed by the Senate on Jan. 25, 2021, and sworn in as Treasury secretary the next day. Prior to becoming Treasury secretary she was chair of the U.S. Federal Reserve from 2014-2018, and is the first woman to hold either position. 5

Homemade Blowjob Porno

Mofos Com Net Pickup Video Porn

Img4 Net Jpg Teen Pee

Lingerie 21

Ass Fucking Compilation

:max_bytes(150000):strip_icc()/GettyImages-473996692-57aadfaf3df78cf459370fdb.jpg)