STAKING

iMeGeneral

- Locked staking

- Flexing staking

- DeFi-staking

Staking in iMe

🔮 General

What is staking

Staking is a kind of alternative to traditional mining. Users receive a reward, but at the same time they can afford not to buy expensive hardware. The income percentage can be different - it all depends on the chosen coin and the period of its holding.

Staking should be understood as receiving passive income by a simple holding of cryptocurrencies.

Such a process uses the Proof of Stake (PoS) algorithm. PoS is one of the methods to protect the blockchain from interference and used data inaccuracy.

When users choose a blockchain with such an algorithm and hold cryptocurrencies on their wallets, they are rewarded. This encourages system participants to get involved in the staking process and thereby ensure the efficiency of the blockchain.

When using the PoS algorithm, the following principle applies: the larger the amount stored by a user, the more blocks he will be able to generate.

Proof of Stake (PoS) which makes staking available, is used in the following cryptocurrencies:

Cardano, Tezos, Solana, Algorand, Cosmos, TRON, EOS, DASH and others.

An important advantage of staking is that it is a full-fledged substitute for mining. Users can make money on cryptocurrency without using specialized equipment.

Also, many projects that do not have their own blockchain create staking programs for their tokens in order to reward holders for holding tokens.

Types of staking

By its operation principle, staking resembles a bank deposit - the user transfers money to the account, does not touch it, and it brings him a passive income. The more money is in the account, the higher is the level of profit.

In addition to this basic working scheme, staking of individual blockchains or projects may have its own conditions.

Locked Staking

With this approach, the user is required to specify in advance for what period he is placing assets on the account. The tokens owner has the opportunity to choose a convenient period, but then he will not be able to change it. For example, if a quarter has been set, then it will not be possible to pick up the coins earlier.

With this type of staking, users receive a fixed fee. Such contracts usually have a higher interest rate, so this option is chosen by those who want to get more income in the end.

Let's take ETH 2.0 staking program as an example. To become a validator in it, you need to replenish your wallet with at least 32 ETH. The annual percentage rate (APR) will be from 2 to 20%. It depends on the total number of coins that are locked for staking. This is the exact case when the entry threshold for staking is much higher compared to traditional mining.

Flexible Staking

With this type of staking coins, there is no the end date of the period of its holding. The user can stop participating in the staking process whenever he or she sees fit. Interest will accrue until the staking participant withdraws their tokens.

In most cases, the reward begins to arrive within 24 hours from the moment the flexible contract is opened. But payments may not be made every day. The most common option is once a month.

Flexible staking is suitable for those who do not like to freeze their digital assets for a long time and are used to flexible asset management. Coins placed on such a wallet bring passive income, and you can pick it up at any time.

DeFi-Staking (Decentralized staking)

DeFi should be understood as decentralized finance. These are various services based on a blockchain.

DeFi projects are based on the smart contracts use. They are good because it provides automatic execution of transactions in compliance with predetermined conditions for their conduction. The system is designed to accurately and intelligently control the execution of transactions.

DeFi staking attracts users for several reasons:

- The ability of quick withdrawals.

- Higher profitability. Interest rates in DeFi staking is higher and the entry threshold is lower. When operating with conventional blockchains using PoS, it is difficult to earn more than 10% per year. By choosing DeFi, the user can expect higher profit, depending on the chosen coin and term.

- Guaranteed terms through the use of smart contracts.

- Money-back guarantee regardless of the operator providing the staking program. Even if the operator ceases to exist, you can always refer to a smart contract on a blockchain to withdraw your funds.

Guaranteed payments. The user is protected from fraud not only by smart contracts, but also by the authority of the platform itself.

Staking continues to be a popular form of income as it provides a good level of profit and does not involve high risks.

Risks of staking

With this type of earning, the main risk is considered to be a possible price fall of a crypto asset. The lower the coin rate, the smaller the amount (in fiat) will be 10%, 25% or 100% of the reward.

For this reason, you need to choose coins with a low volatility level. The best option is an asset that demonstrates, if not dynamic, but stable growth. Cryptocurrency with a high level of volatility can be a problem, especially with fixed staking. In case of a strong drawdown, the user will not be able to sell it, when he sees the beginning of the price fall.

Newcomers to the world of cryptocurrencies often think that the higher the APR / APY rates, the better and more profitable for the project and the community. But it is not always the case. Professionals understand that the staking rate is not taken from the ceiling, although many projects do this to attract new participants and create a temporary effect. Issuing rewards for staking is an increase in the circulation of tokens, which has a direct impact on token inflation. Therefore, if you see a project with a high staking rate, then you should think about it, study the project in more details and take into account all possible risks. As a rule, the price of the token falls after the first rewards are issued at high APR/APY rates.

It is also worth considering the risk of losing an account in online service or on a cryptocurrency exchange, as well as closing such online services themselves. Therefore, it is safer to use decentralized staking, running on smart contracts, which guarantee their work even if the services themselves, which initially provide the interface for staking programs, are closed.

⚠️ Important! If someone asks to send funds directly to them, this is a clear sign of a scam. Such requests should be ignored.

💰 Staking in iMe

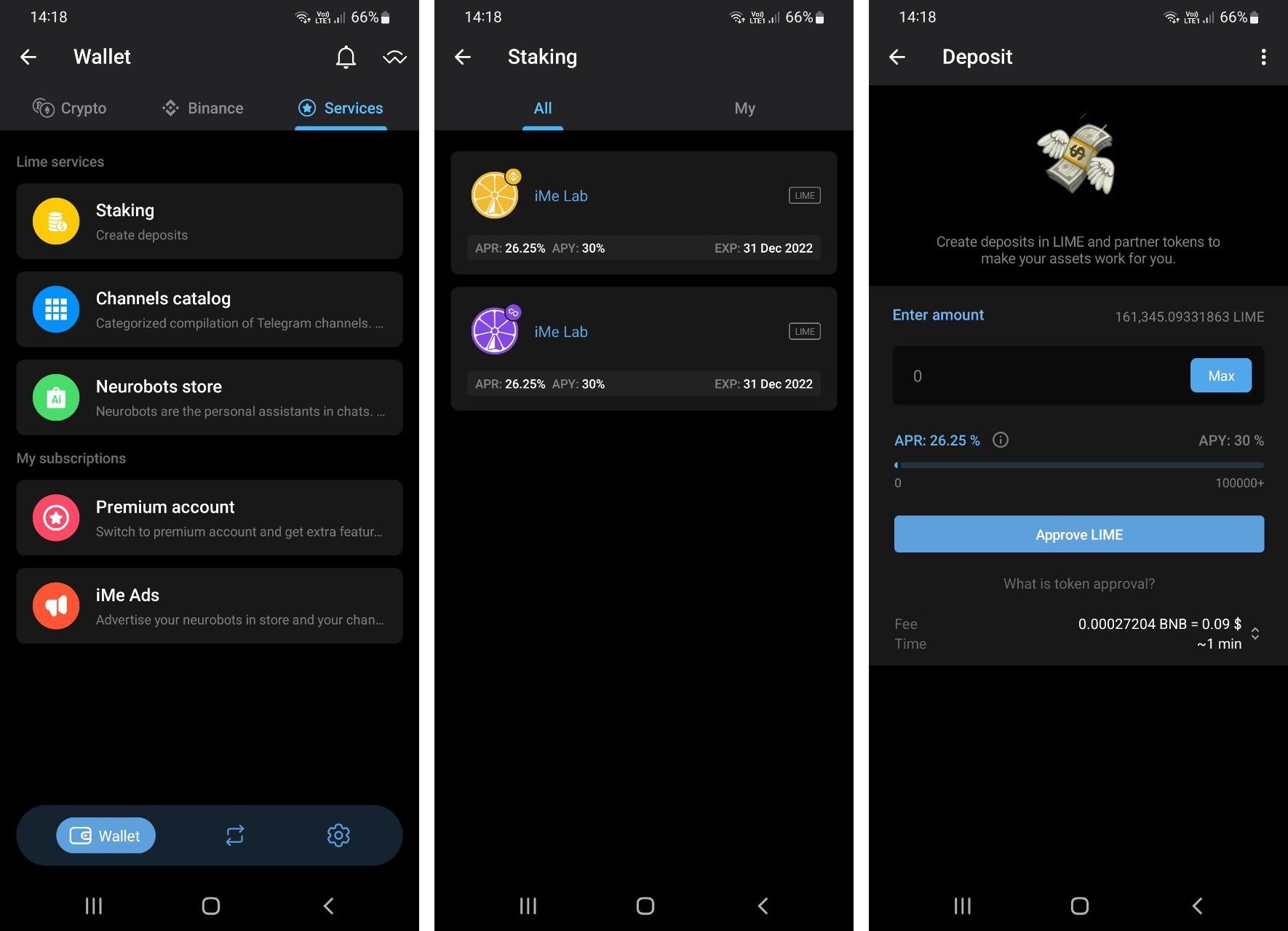

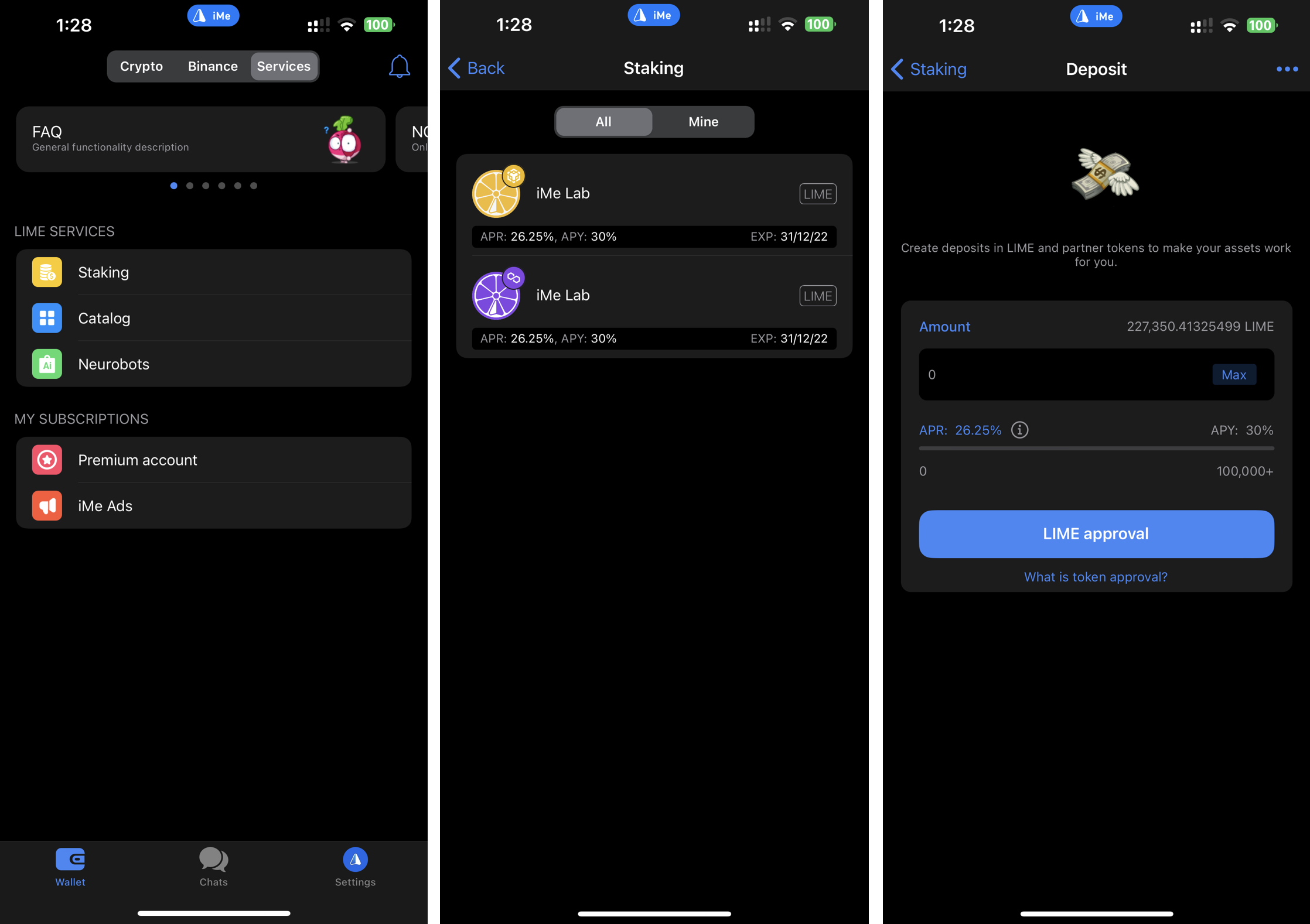

Staking programs are displayed in the wallet in Services section - Staking, as they are released.

In the Services section - Staking you will find 2 tabs: All and My.

The All tab displays all available staking from projects and all your active staking at the moment.

The My tab displays all types of your stakes only:

- Active - an open deposit in the current (incomplete) staking program;

- Available for withdrawal - a completed staking program in which you have participated, but have not yet withdrawn all tokens;

- Closed - a completed staking program in which you have participated and have already withdrawn all tokens.

Type of staking

When developing staking in iMe, we proceeded from the 2 most important principles for users - convenience and security.

iMe staking is perpetual, with daily interest accrual at 00:00 UTC, and decentralized or DeFi staking based on smart contracts. All transactions in iMe are regulated by smart contracts, what provides the necessary security and guarantees for the execution of these transactions.

Available in the iMe app for iOS and Android in the wallet under Services.

Interest rates

Annual Percentage Yield (APY) takes into account interest accrued quarterly, monthly, weekly or daily, but Annual Percentage Rate (APR) does not. This simple difference can significantly change the calculation of returns over a given period. Therefore, it is important to understand how these two metrics are calculated and how they affect digital media revenue.

APR is the annual percentage rate, the percentage you earn on your invested assets over the course of a year, expressed as a percentage.

If we assume that interest is accrued daily, then the accrual of daily profit will be the same every time, depending on the number of tokens you have deposited.

The calculation formula is as follows:

Daily profit = Total number of staked tokens × (APR for staked token ÷ 365)

For example, if you have deposited 10,000 USDT for a guaranteed APR of 69%, you could receive 18.9 USDT the next day.

The calculation looks like 10,000 × (0.69 ÷ 365) = 18.9 USDT.

After a year, your total profit will be 18.9 × 365 = 6,900 USDT, which is 69% of the 10,000 USDT staked.

APY - Annual Percentage Yield, is the annual rate of return on investment, taking into account compound interest that accumulates or grows along with the balance sheet. Compound interest includes the interest earned on the original deposit plus the interest earned on that interest.

If we assume that interest is calculated daily, then the daily yield is the interest rate that will be credited to your wallet depending on the number of tokens you have deposited.

The calculation formula is as follows:

Daily yield = Total staked tokens × (APY for staked token ÷ 365)

For example, if you have deposited 10,000 USDT with a 100% Guaranteed APY, you could receive 27.39 USDT the next day.

The calculation looks like 10,000 × (1 ÷ 365) = 27.39 USDT.

Accordingly, on the second day, the initially placed tokens and the accrued daily yield are already taken into account, for which the next daily yield is calculated in total. And so on every day.

After a year, your total profit will be 9,924 USDT, which corresponds to 99.24% of the amount of staked 10,000 USDT.

Using compound interest APY, you will earn much more on your investment than with APR. Please note that interest varies depending on the frequency of accrual: the more often, the more earnings. Daily accrual will bring more interest than monthly.

Transactions and gas payment

When creating transactions with staking, Gas payment is required for each transaction conducted within the framework of staking, because. transactions take place on the blockchain.

Gas is paid for with the main coin of the respective blockchain. If transactions are on the Ethereum blockchain, then gas is in ETH, if on BNB Chain, then gas is in BNB, if on Polygon, then gas is in MATIC, etc.

Transactions types:

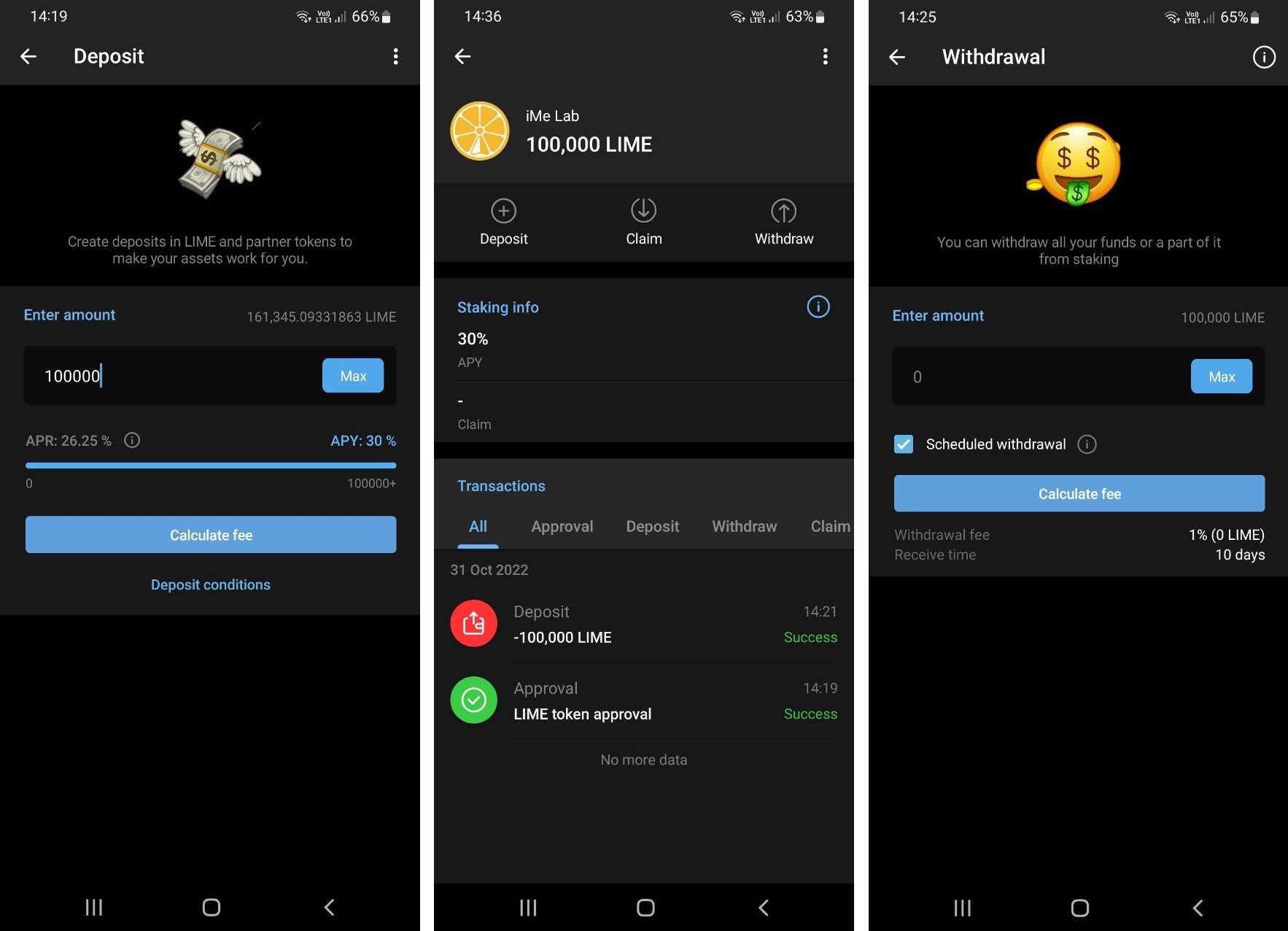

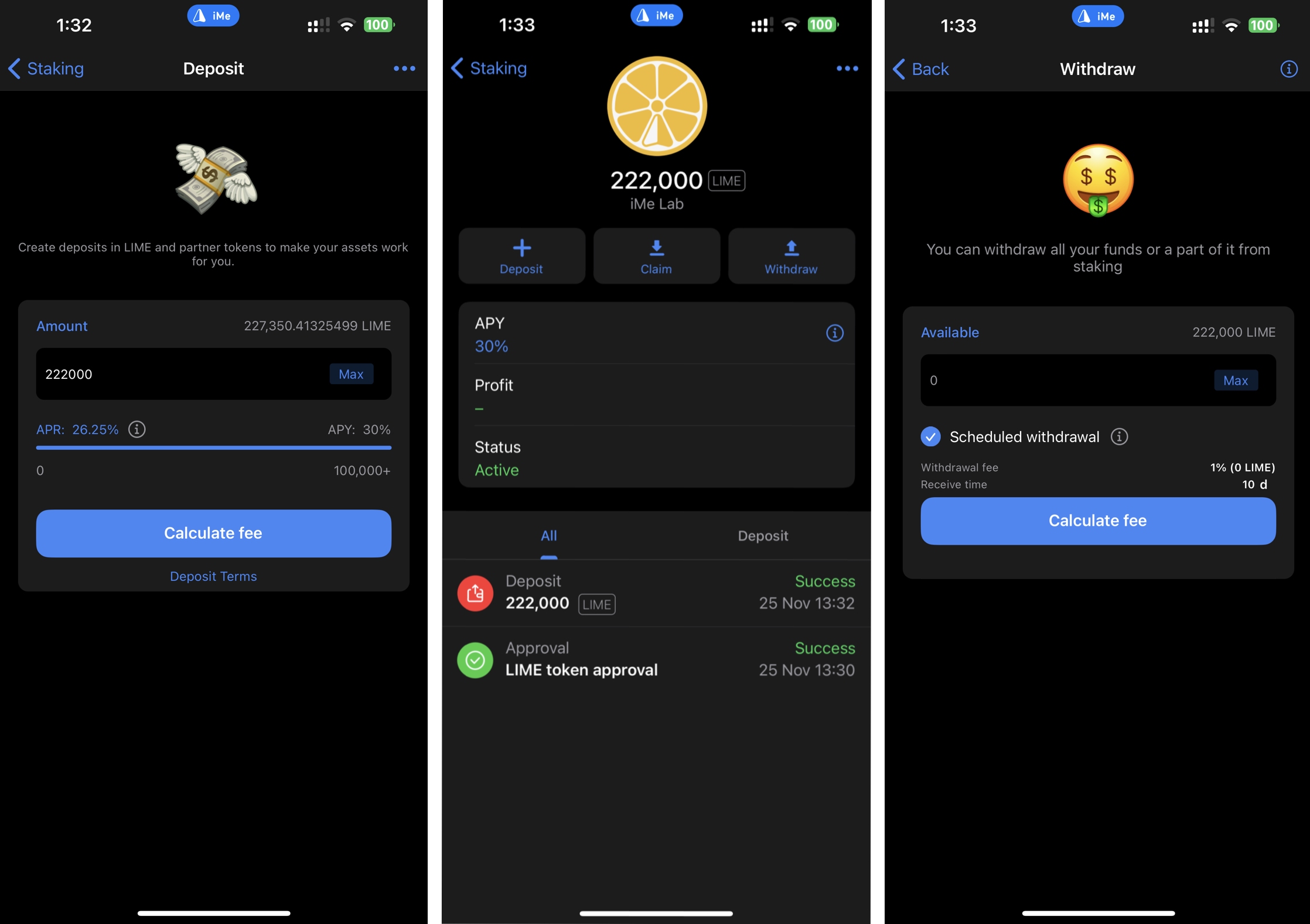

- Approval of a token is a one-time operation within a specific token to give permission to a smart contract to work with your token. This operation is necessary before starting to create a deposit on staking. There is no need to re-approve for the same token. Gas is taken for the operation of accessing the smart contract.

- Creating a deposit - sending tokens from your wallet address to the smart contract address. The gas is taken to carry out the transfer transaction.

- Replenishment of the deposit - adding the number of tokens to active staking, similar to creating a deposit. The gas is taken to carry out the transfer transaction.

- Withdrawal - an application for full or partial withdrawal of your tokens from the smart contract address back to your wallet address.

- With a scheduled withdrawal, gas is taken for the operation of sending a request to a smart contract. The order is executed after the number of days set by the staking program. The tokens claimed for withdrawal will be displayed in the Claim section.

- With an immediate withdrawal, the gas is taken to complete the application and send tokens to your wallet address from the smart contract address. The request is executed immediately, and the tokens are credited to your balance.

- When withdrawing after the completion of the staking program, the gas is taken to process the request and send tokens to your wallet address from the smart contract address. A request for withdrawal after the completion of staking is not required, tokens are transferred immediately.

- Claim - claiming of tokens previously declared for withdrawal from the smart contract address to your wallet address. The gas is taken to carry out the transfer transaction.

iMe fees

iMe takes its own fee for providing the staking platform. iMe fees are only charged to users when withdrawing LIME tokens from active staking. The fee is taken in those tokens that are staked.

For partner staking programs, the same principle is used, but the commission remains on the side of the partner who owns his token.

The fee may differ for staking different tokens and change, depending on the ongoing promotions. Also, there is a different fee for different ways to withdraw tokens.

Ways to withdraw tokens:

- Scheduled withdrawal - the user submits a request to withdraw tokens from the smart contract address to their wallet address. The execution of the request occurs within the period established by this staking program, as a rule, after 10 days. At the time of request, the accrual of interest on the amount of declared tokens for withdrawal stops. The fee for the scheduled withdrawal is small, as a rule, from 0 to 5 percent of the amount of withdrawn tokens.

- Immediate withdrawal - the transfer of tokens from the smart contract address to your wallet address at the time of the withdrawal request, without waiting for the execution of the request, as with a scheduled withdrawal. The fee for such a withdrawal will be higher than for the scheduled withdrawal, usually from 5 to 15 percent of the amount of withdrawn tokens.

- Withdrawal from the completed program - after the end of the staking program, you can withdraw your tokens without any fee, paying only gas for transferring tokens from the smart contract address to your wallet address. A withdrawal request after the completion of staking is not required, tokens are transferred immediately.

Adding tokens

You can add tokens to your opened deposit at any time.

To do this, please go to your active staking program and click on the Deposit button with the Plus icon, enter the desired amount of tokens to add to the deposit and confirm the sending.

When adding tokens to the deposit, gas is taken for transferring tokens from your wallet address to the smart contract address.

Available tokens

LIME tokens are currently available for staking on the BNB Chain and Polygon networks.

We continue to develop this functionality and plan to expand staking for partner tokens.

Staking partner tokens will be available to iMe users who will have the required LIME level.

LIME staking

LIME staking is available on both networks: BNB Chain and Polygon, under the same conditions.

iMe applies both APR and APY interest rates.

First LIME staking program

Staking program period:

Start on 31st of January, 2023, end on the 30th of June, 2023.

Interest rates:

The APR rate for the first LIME staking program is 8% and applies to LIME staking up to 100,000 tokens.

The APY rate is calculated from the APR rate, and with APR = 8% and with daily interest, the APY rate = 8.327%.

APY staking becomes available when staking LIME in the amount of 100,000 tokens.

The change from APR to APY occurs automatically when the total number of staked LIME tokens within the same network reaches 100k.

Conditions for withdrawing tokens:

- Scheduled withdrawal - withdrawal after 10 days of the request creation, iMe fee is 1%.

- Immediate withdrawal - withdrawal without waiting, iMe fee is 10%.

- Withdrawal from the completed program is without waiting, there is no iMe fee. This withdrawal will become possible after 30th of June, 2023 at 00:00 UTC.

Future LIME staking programs may change APR and APY rates, as well as iMe fees when withdrawing tokens from staking.

Disclaimer

- This message was prepared only for informational purposes and can be edited.

- This article should not be relied upon or used as the basis for any investment decision, or should be construed as a recommendation to enter into any transaction or as a recommendation for any investment strategy.

- Articles prepared by iMe Lab are not related to the provision of advisory services in relation to investment, tax, legal, financial, accounting, advisory or any other related services and do not constitute recommendations for the purchase, sale or ownership of any asset.

- This message is not a personal recommendation and does not take into account whether any deal or transaction is suitable for a particular person.

- The information contained in this article is based on sources believed to be reliable, but is not guaranteed to be accurate or complete.

- iMe Lab is not responsible for information obtained from third party sources or statistical and analytical services.

- Any opinions or assessments expressed here reflect the judgment made as of this date and can be edited without notice.

Neither iMe Lab nor any of its directors, officers, employees, representatives or agents shall be liable in any way for any direct or indirect damages (whether in contract, tort or otherwise) arising from the use of this article or its contents, or reliance on the information contained here.

🌐 Our official resources:

App Store / Google Play / APK / Desktop