SCALE/TON as an Example of the Liquidity Pools’ Economics

Scaleton UniversityAll computations are model-based; this article should be used for informational purposes only. The pool operation algorithm, member income sharing regulations, and the size and mechanism of commission payouts are all independently determined by each exchange. The transaction fees of the network should be taken into consideration, as they increase the cost of operations with tokens.

Investors attempt to profit from the volatility of cryptocurrency prices. Another option for decentralized exchanges that use liquidity pools is to put your own money into the pool.

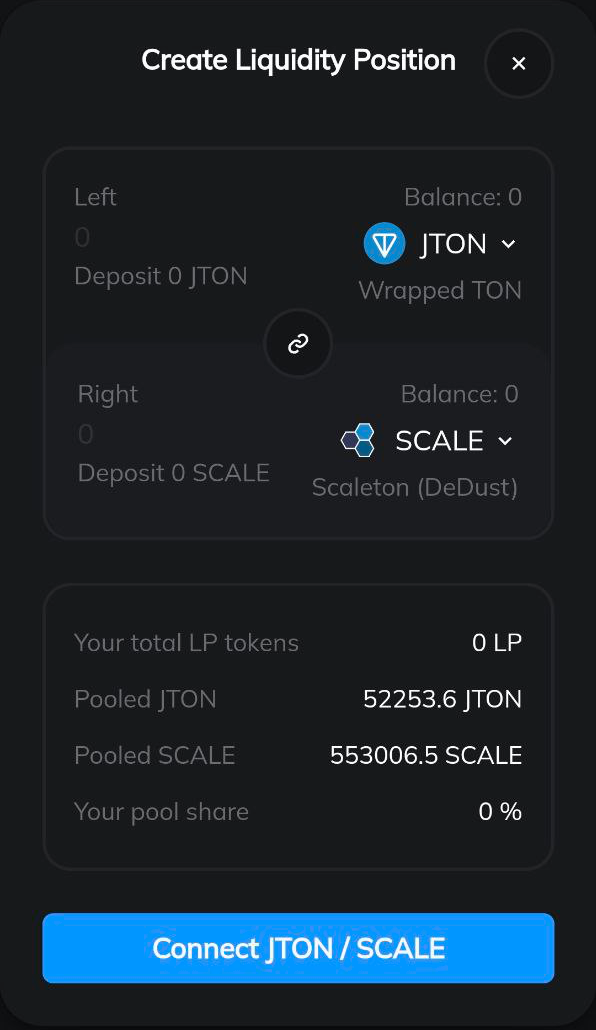

DeDust.io liquidity pools

DeDust.io retains a 0.5% commission in TON for each transaction. For the TON/SCALE pair, the amount is added to the pool and hence distributed among all participants. The distribution may alter in the future; for tokens other than TON/SCALE and BOLT/SCALE, 0.3% goes to the pool and 0.2% goes to the exchange. The more transactions there are, the more TON the participants receive. Instead of TON, DeDust.io uses jTON tokens, which are associated with certain nuances. Although no distinctions will be made in the following text, the tokens are technically different.

The pool operation example

Consider a pool of 1000 SCALE and 100 TON with the algorithm that maintains the permanent equation: s SCALE * t TON = k. For this pool, k = 1000 SCALE * 100 TON = 100000. The equilibrium rate t/s = 100 TON / 1000 SCALE = 0.1 TON/SCALE, that is, selling 1 SCALE yields 0.1 TON.

A new member brings to the pool 200 SCALE and 20 TON, k = (1000 SCALE + 200 SCALE) * (100 TON + 20 TON) = 144000. The new member’s share in the pool: 16.67% = 20 TON / 120 TON. Estimated value of the invested tokens: 40 TON = 200 SCALE * 0.1 TON/SCALE + 20 TON.

The exchange receives a request to sell 10 TON for SCALE. The commission is 0.5% * 10 TON = 0.05 TON. The pool receives: 10.05 TON = 10 TON + 0.05 TON.

To keep k = 144000 there should be 1107.26644 SCALE remaining in the pool: 1107.26644 SCALE * (120 TON + 10.05 TON) = 144000. Rounded values are provided for convenience. The seller in exchange for his 10 TON will receive 92.73356 SCALE = 1200 SCALE - 1107.26644 SCALE at the actual exchange rate 0.10784 TON/SCALE = 10 TON / 92.73356 SCALE.

The pool's new equilibrium rate has increased, which will be used to calculate SCALE and TON values when new participants add liquidity: 0.11745 TON/SCALE = 130.05 TON / 1107.26644 SCALE.

When the exchange sells SCALE for TON, the procedure works similarly. The equilibrium rate will decrease in this circumstance, and the volume of SCALE in the pool will grow due to the decrease in TON.

Pool participant’s records

A participant with a 16.67% share owns 184.54441 SCALE = 16.67% * 1107.26644 SCALE and 21.675 TON = 16.67% * 130.05 TON in the final pool. These sums will be collected when funds are withdrawn from the pool. It should be noted that the figures differ from the 200 SCALE and 20 TON that were originally entered.

Estimated token value: 184.54441 SCALE * 0.11745 TON/SCALE + 21.675 TON = 43.35 TON. The difference between the initial assessment of the deposited funds 3.35 TON = 43.35 TON - 40 TON. The figure does not match the expected commission share: 16.67% * 0.05 TON = 0.00833 TON. The difference is due to the change in the volumes of SCALE and TON in the pool, and the assessment is also carried out at a new equilibrium rate.

Without contributing funds to the pool, the user would have 200 SCALE and 20 TON, which at the new rate gives 43.49028 TON = 200 SCALE * 1107.26644 SCALE + 20 TON. The gap between the first estimate and the final estimate is greater: 3.49028 TON. The reason is due to a decrease in SCALE volume and an increase in TON as a result of a transaction on the exchange: a pool participant sold his share of SCALE in exchange for TON.

The difference in results between placing funds into the pool and keeping them in the wallet is called non-permanent losses. Over time, the commission accumulated in the pool can compensate for the ensuing disparity. When prices are highly volatile, the difference can be significant. It will take a long time and a large number of transactions on the exchange for commission income to be equal.

Important details

The higher the trading volume on the exchange, the greater the income of the pool participants; commission is calculated based on turnover.

The smaller the participant's pool share, the less profit he will make at a certain trading volume; the commission amount is limited and is distributed among all pool members.

The number of tokens withdrawn from the pool may differ from those originally added to the pool. The structure of the pool alters during trades according to the exchange's rebalancing algorithm.

Keeping tokens in a wallet can result in better outcomes than placing them in a pool, especially at 100X: rebalancing the pool lowers the volume of currency that is getting more expensive.

When adding and withdrawing funds from the pool, network transaction fees and commissions have an impact on the final result, which is especially crucial for small sums.

Original: https://telegra.ph/EHkonomika-pulov-likvidnosti-na-primere-SCALETON-01-16