Rumored Buzz on Illinois SR-22 Insurance

Some Known Details About Mandatory Insurance FAQs - Missouri Department of Revenue

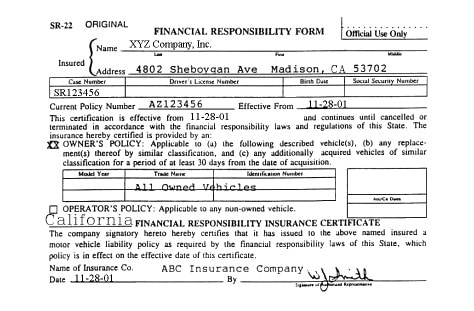

SR-22 insurance coverage may also be required if you've declined to grant a blood-alcohol test. An SR-22 auto insurance coverage adheres to Texas' minimum liability insurance requirements, however the insurer likewise files a certificate straight with the state suggesting your policy adheres to Texas' monetary duty laws. Though an SR-22 form is essentially proof of protection, the state will not accept your insurance card or your policy as options.

If your policy lapses or is canceled throughout this period, the insurance company is needed to inform the state. If you stop working to submit a new SR-22 after cancellation or nonrenewal, your license and registration can be suspended once again. You'll not just have to acquire a brand-new auto insurance plan, however you'll likewise need to pay the reinstatement costs a 2nd time, so it is necessary not to have a space in protection.

Otherwise, your insurance provider will continue submitting the SR-22 with the Texas DPS. What is SR-22A insurance? Instead of SR-22 insurance coverage, the court might need you to acquire SR-22A insurance in order to renew your license. Check it Out -22A insurance, which is particular to a few states consisting of Texas, requires premium payments in six-month installments instead of the typical regular monthly billing for a basic SR-22.

8 Simple Techniques For SR 22 insurance : How much does it cost

Non-owner SR-22 insurance in Texas If you need an SR-22 filing to restore your license, but you do not have a lorry signed up in your name, you can acquire a to meet the state's requirement. Non-owner SR-22 insurance coverage in Texas supplies liability coverage that meets the state's requirements and offers coverage whenever you drive an automobile coming from someone else.

SR22 GTSX TURBO XPLANE 11 – Carenado

SR22 GTSX TURBO XPLANE 11 – Carenado Cirrus SR22 - Wikipedia

Cirrus SR22 - WikipediaIn Florida the required SR-22 filing limits are: $10,000 per person $20,000 per accident of Bodily Injury (BI) limitations. $10,000 of Home Damage (PD) liability for each event $10,000 of Injury Protection (PIP) per person, per occurrence If you are in the process of taking a trip out of state and you cause a mishap, you will require your insurance firm to accredit in writing that your existing insurance plan (out of state policy) is in compliance with the minimum liability requirements.