Rollups Should Be Decentralized By Default.

Michelangelo (https://twitter.com/michelangelow3b)Beginning

Everyone knows the number two cryptocurrency Ethereum but those of us who have experience using the Ethereum ERC-20 network know that sometimes we have to pay hundreds of dollars for a standard transaction because Ethereum is busy.

To avoid this problem, Layer 2 solutions (rollups) were invented that run on top of Ethereum (Layer 1).

Every blockchain should ideally have 3 components: decentralization, security and scalability.

Again, the ideal is to collect all 3 components but at the moment current blockchains can only achieve 2 components sacrificing the third.

Ethereum can provide us decentralization and security but at this moment sacrifices scalability.

For example: Solana can provide us high scalability but decentralization and security are in doubt because we know the previous schedule of Solana’s work.

Based on this, Layer 2 solution is to use the security of Ethereum and provide scalability for Ethereum. L2s achieve this by using rollups that collect user transactions in a batch and send them to Layer 1 (Ethereum). It costs like one transaction in Ethereum Mainnet and then L2s share this fee between all of the users in the batch thus we have good fees in Layer 2 rollups.

Finally, Ethereum can easily scale with Layer 2 solutions, reduce fees per each transaction and make transactions faster but there is a decentralization problem. Currently, every batch of transactions sent from Layer 2 to Layer 1 passes through the single set of hands. These hands violate the principle of decentralization that violates the principle of blockchain. This moment triggers negativity among some users of Layer 2 solutions.

What is sequencer?

As I wrote above, every batch of transactions sent from Layer 2 to Layer 1 passes through the single set of hands. These hands are a centralized sequencer that is responsible for ordering (grouping) transactions, compressing them, bundling them into blocks and sending them to Layer 1.

Currently, all rollups (the most popular: Arbitrum, Optimism, Base, zkSync, Starknet) use centralized sequensers and send all transactions through the single set of hands. This is a problem. This problem is bigger than you think because as a regular user all you see is only fast transaction execution and low fees but you don’t even know what’s under the hood.

After regular users submit transactions from their wallet, the transactions pass to the sequencer that timestamps and orders them into the batches by gas price and sends them to Layer 1 where we can find those transaction batches in blocks.

The sequencer must also prevent double-spending by avoiding the execution of identical transactions (duplicates).

Of course, Layer 2 solutions (rollups) could function without sequencers using Layer 1 (Ethereum) for sequencing but that would be very expensive and time consuming and the idea of rollups would be meaningless. Remember, they were involved to make transactions faster and cheaper with Layer 1 security.

Based on the above, the sequencer becomes essential for rollups but because the current sequencers are completely centralized, a number of problems arise.

The problems of centralized sequencers:

- censorship (censor user transactions)

- MEV extraction (extract the maximal extractable value)

- liveness

Are you hearing these difficult words for the first time? The regular user doesn't even realize what's going on inside the sequencer. Let's break it down with a simple real life example. I'm gonna explain with the example of entering a nightclub:

Imagine a situation where you go to a nightclub. You get in line to enter and the whole line goes through one door and one security guard. In this situation someone from the line can be turned around for inappropriate dress code or age and not allowed into the club (censorship). Someone can be allowed out of the line on friendship thus slowing down other people in the line. Do not exclude the moment when the security guards (sorry) can take bribes (tips) getting personal benefit from it and again let someone through faster than the rest of the line (MEV extraction). So, there is uncontrollable chaos going on. And if the club door closes, you won't be able to enter the club at all and will have to wait for it to open (liveness).

Knowing this will make it easier for you to understand the problems of centralized sequencers:

- censorship - user transactions can be canceled and not executed that is a serious violation of the decentralization principle.

- MEV - sequencer owners can accelerate their transactions to frontrun the user's transactions and extract the maximal extractable value (a simple example is cryptocurrency arbitrage).

- liveness - single sequencer can fail and create a lot of inconvenience for users. Remember, Layer 2 solutions can function without sequencers thanks to Layer 1 (Ethereum) and if the centralized sequencer fails, users can withdraw their funds from the Layer 2 network but it will be very expensive and time consuming.

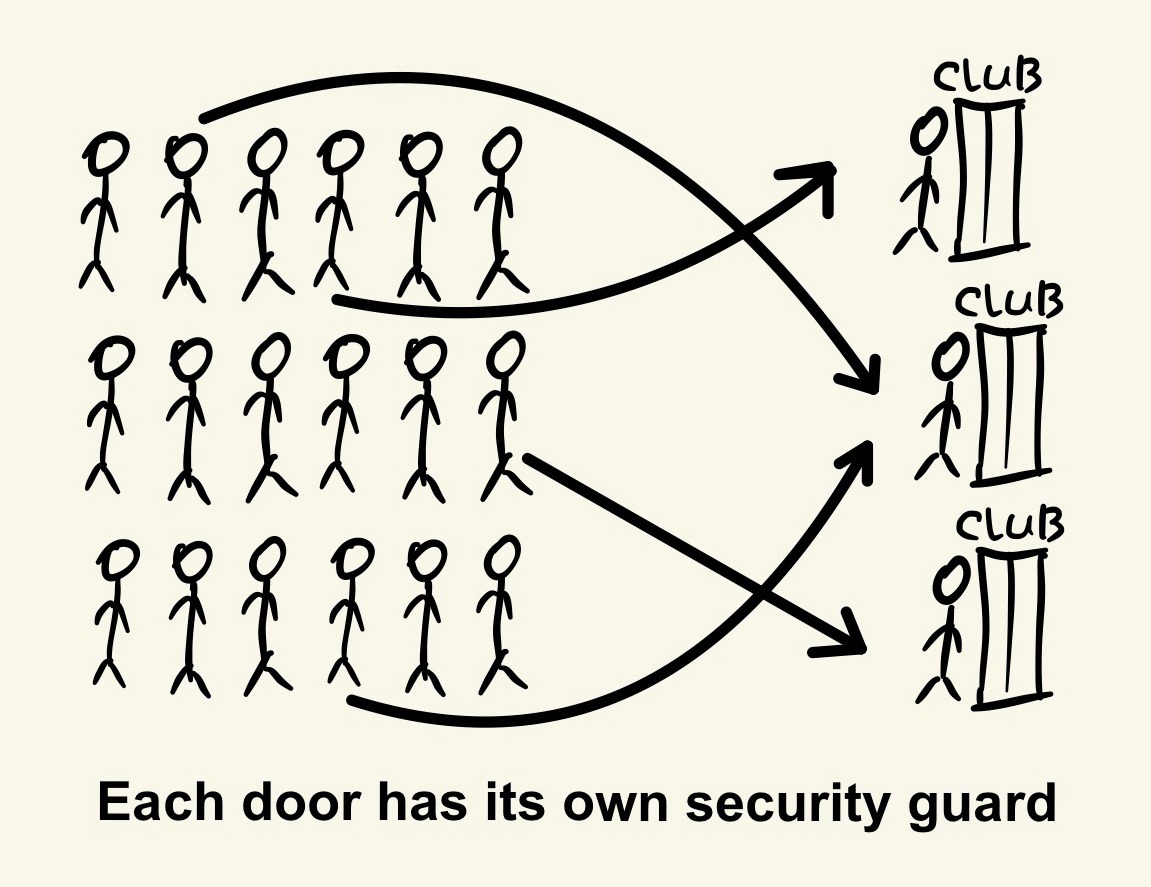

If you have more than one nightclub (sequenser) where to go then you have more option to enter the club though:

To solve all these problems and more, Decentralized Shared Sequencers were invented.

What is Decentralized Shared Sequencers (DSS)?

Decentralized Shared Sequencers are companies that solve the issue of centralized sequencers by offering out-of-the-box solutions with their decentralized sequencers + providing cross-rollups composability.

Like Celestia solves the issue of data availability (DA) because using DA layer on Ethereum is much more expensive, Decentralized Shared Sequencers can solve the issue of centralized sequencers. Just remember who is daddy though :D

Of course, giants like Arbitrum, Optimism, and zkSync may not agree with this solution because they generate significant revenue on their centralized sequencers:

Source: https://defillama.com/fees/arbitrum

Source: https://defillama.com/fees/optimism

Source: https://defillama.com/fees/zksync-era

Revenue: ETH earned from user fees minus cost to send transactions in L1 through a sequencer.

Obviously, these figures do not include the possible MEV we discussed above.

Really good revenue but at one moment sh*t happens:

Source: https://status.arbitrum.io/

Source: https://status.optimism.io/

Only 10 minutes but how many problems for users...

Source: https://uptime.com/statuspage/era/1812322

If sequencers were decentralized this wouldn't happen.

But major players understand that this is a huge revenue and they don't want to give it up for as long as possible. They are dragging out the time. The mainnets of Arbitrum and Optimism were launched in 2021 and as of now (2024) they still promise to solve the issue of centralized sequencers.

Essentially, rollups want to improve their core product first and then decentralize. That's why almost every major rollup has included "decentralized sequencers" in their roadmap. However, "every rollup should be decentralized by default". - Josh Bowen. Users shouldn't expect anything, decentralization should be the default.

Again, why do we use Layer 2 solutions? Cuz we trust Ethereum. But centralized sequencers confuse us. L2s have to be decentralized and clear or we can use other L1s like Solana for cheap and fast transactions. Makes sens.

Based on the above, we can imagine that major players will build their own decentralized sequencers and it's possible although it's time-consuming and expensive.

But if rollups can provide users to stake their native token and become sequencers that will be huge because that solves the issue of centralized sequencers and provides new native token utility. Users who becomes a sequenser will receive fees that's good motivation. Optimism has proposed this scheme but we don't see realization yet.

Probably, are you wondering why Decentralized Shared Sequencers are needed then?

Firstly, again, the big rollups in the market, such as Arbitrum and Optimism, haven't built their decentralized sequencers since 2021. Does that mean they are expecting for something, maybe out-of-the-box solutions?

Offchain Labs (Arbitrum) has partnered with Espresso Systems (one of the companies that builds Decentralized Shared Sequencers) to improve decentralized sequencers:

Madara, who started their project by building a decentralized sequencers for Starknet, has partnered with Radius, who also provides DSS:

Astria is also building Decentralized Shared Sequencers with Celestia's DA and preparing some news about partnerships. Keep your eyes close 👀

It may be easier for major rollups to outsource this task and save a lot of money on building their own decentralized sequencers but we'll see. Time will tell what the big rollups choose: take the decentralization rules and keep their users or generate high revenue on their centralized sequencers and, in the long run, become less attractive as new competitors will appear and there are a lot of them.

Secondly, more and more new rollups will soon appear because even regular users can create their own rollups now thanks to RaaS (Rollups-as-a-Service). Decentralized Shared Sequencers can provide RaaS cross-rollups composability. Users can choose any settings for their rollups, such as type of rollup (ZK, Optimistic, etc.), sequencers, DA layer, for example, and easily create their own rollup. And if we can even trust the centralized Arbitrum or Optimism, which have been on the market for a long time, anything can happen with the new rollups. Again, rollups should be decentralized by default.

So, based on the above, Decentralized Shared Sequencers will be in high demand and may become the future narrative. The companies that build these solutions can become the new gamechangers.

How can Decentralized Shared Sequencers solve the main issues of centralized sequencers?

- censorship - thanks to decentralization it's hard to censor user transactions. However, if one of all sequencers decides not to execute your transaction you will be able to send transaction through other sequencers.

- MEV - some companies who provides DSS can see mempool (the place where user transactions are collected after being submitted from the wallet) and some companies use encrypted mempool by zero-knowledge (a cryptographic method used to prove knowledge about a piece of data, without revealing the data itself). If decentralized shared sequencers can see the mempool it means that MEV searchers can arbitrate fairly. If decentralized shared sequencers can't see the mempool it means that MEV searchers can't do their job but we will see which method will be valued by the market because it's only developing now.

- liveness - if one sequencer is dead, the transactions just go through the others.

Now just look at it and understand the meaning of decentralization again:

The sequencer is your ghost helper for cheap and fast transactions but you have to know what's going on inside to make sure that you don't get cheated.

Follow me on X.

Have a nice day =)