Right Here Are The Requirements For An Individual Funding

Article writer-Cooper Hove

The fundamental requirements for a Personal loan are not extremely different from those of various other types of loans. Generally, candidates must have a consistent income. Yet in some cases, the demands for an Individual funding may vary. Sometimes, you can be rejected a lending, if your income is not sufficient to pay the overall amount obtained. These situations may be classified as a bad credit report car loan. For this reason, it is critical to check if the amount you require will in fact satisfy your month-to-month payments.

Once you have actually inspected the demands, you need to request a Personal funding. Normally, lenders will certainly look at your credit rating, payment history, and also debt-to-income proportion to identify if you are a great prospect for the finance. They will additionally intend to see documents of your go back to function. Nonetheless, you must note that the age requirement for this kind of financing varies based upon loan provider as well as state regulations. Some states need that you go to least 19 years old.

Individuals frequently require an Individual funding for emergencies, or to cover a costly occasion. Individual financings are a fantastic means to fill up these spaces in your month-to-month budget. You can pay for a brand-new cars and truck, go to a getaway, or pay for an unique occasion. On discover here of that, an Individual Financing can fill up a spending plan space if you require it. The rates of interest and also month-to-month repayment will certainly stay fixed throughout the funding. The very best component is that an individual can pay off the funding in as little as 2 to five years.

You may not qualify for an Individual car loan if you have poor credit report, but if your credit rating is great, you can get one. The quantity of the loan depends on $100,000 and also can be settled over one to 7 years. An Individual Finance is typically a high-interest option contrasted to a residence equity lending or a credit line, yet it is not impossible to qualify for one. You may even qualify for a reduced rate with a co-signer, which is an additional bonus!

An Individual Funding from Personal can be extremely handy if you require cash for an emergency. The prices can range from 5% to 36%, depending on your credit report. If you have great debt, you can select a longer repayment term to avoid paying added rate of interest. Depending on your requirements, you can likewise select a much shorter term, which implies you can pay off the financing quicker. And remember, all finances included a minimal month-to-month settlement of $50.

The final approval of your Personal Financing can take just a couple of hrs to a day or even a week. The moment it takes for the funds to be deposited in your account will depend upon when you applied as well as exactly how swiftly you sent the needed records. If you apply prior to 4:30 p.m. ET on a company day, funds should be offered the same day. Relying on your bank, nonetheless, your funds may use up to three days to reach your account.

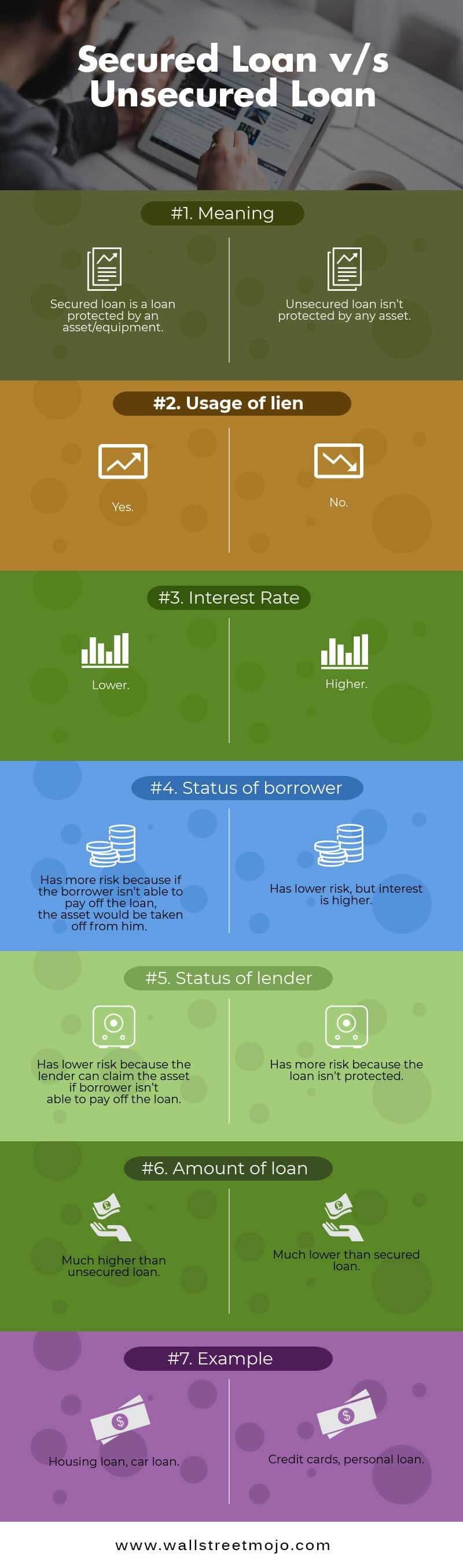

Protected Individual Loans - This type of Personal Funding needs you to place some form of security versus the financing. These possessions can vary from your cars and truck to your residence. Nevertheless, in many cases, they need you to place some kind of collateral to secure the finance. try this website can also use your residence or boat as collateral to obtain a secured Personal car loan. As well as you can constantly utilize your cosigner to obtain the financing accepted. There are some advantages to having a cosigner for a safeguarded Personal Financing, and also you may intend to explore a Personal lending if you require money.

The optimum finance amount relies on your revenue and also credit rating. Nevertheless, not all candidates will be authorized for the complete financing amount. Depending on your state, an individual can obtain a funding as much as $10k for various purposes. Besides, the minimum loan amount varies from state to state. For example, in GA, it's $3100, while in hello, it's $2100. In MA and NM, you can get a loan approximately $7k. As well as in OH, the minimum funding amount is $6,000! You need to additionally be of adultness to agreement. As well as an US resident or homeowner.

A Personal funding is a terrific choice for people with poor credit or who want emergency cash. Sometimes, you can make an application for a finance online as well as receive the financing within a couple of organization days. As well as if you require cash quickly, a Personal car loan will provide you the satisfaction you require. But ensure to check your credit report before making an application for a financing. This is crucial due to the fact that a poor credit score can negatively impact your authorization.