Raid (Eng)

https://icodrops.com/

https://t.me/IcoDropsReport - ICO reviews channel

https://twitter.com/ICODrops - Twitter

https://t.me/joinchat/FoisO0k4-XXBkPEikfdgow - English chat

UPDATE: there was new negative information revealed about the project on March 14, 2019. You can find it by searching for the 'UPDATE' keyword.

Raid is a decentralized ecosystem for gaming data that enables searching for such type of data, buying or selling it, rewarding users who provide it and tracking gaming history along with ads game releases.

Timeframe:

There were no typical Seed/Private Sale rounds and no funds that participated in them.

The public sale has two stages:

1) The round of sales on the Korean platform Cobak that occurred on March, 6 (as per the admin of the official Telegram group it 'closed in one minute');

2) The round of sales on Bittrex, which is scheduled for March 15, 2019, and will finish either on March 18, 2019 or when the hard cap will be reached.

Metrics:

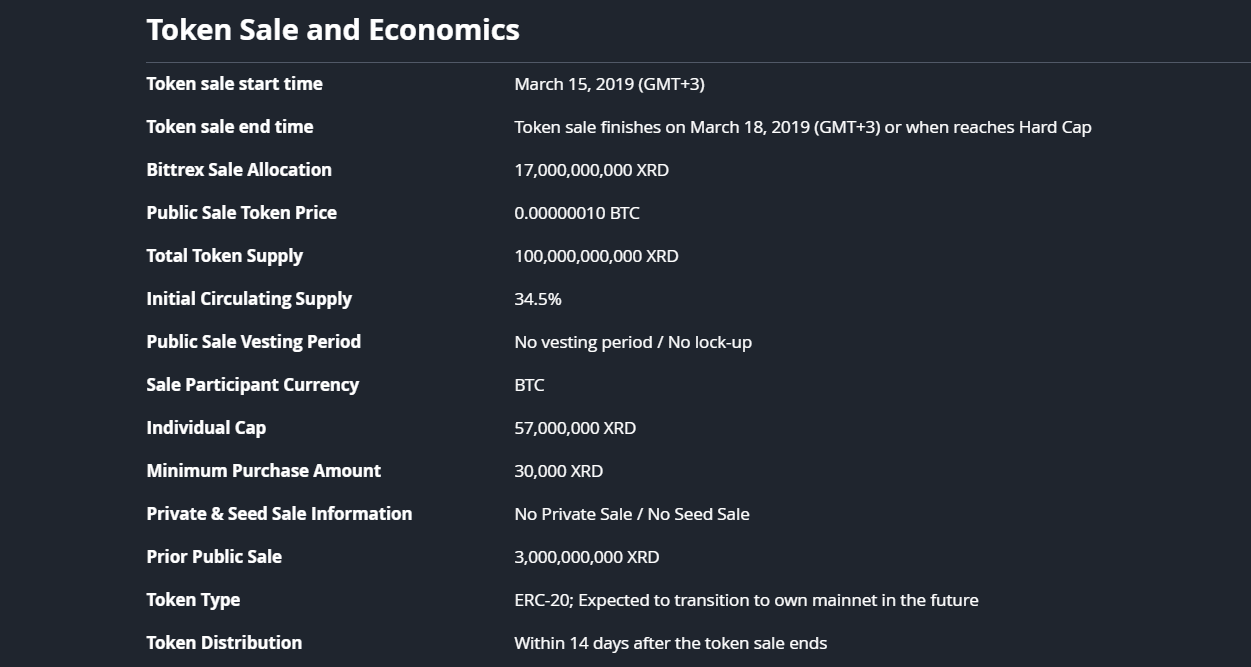

Ticker: RAID.

Token standard: ERC20 (subsequently, the token should migrate to its own standard).

Total supply of tokens: 100 billion.

Token price: 0.00000010 BTC (the fundraising is conducted in BTC).

The same price was offered during both public rounds on the two platforms, but there was different supply: 3 billion tokens for Cobak and 17 billion for Bittrex. There is no lock-up or vesting planned for the public sale tokens.

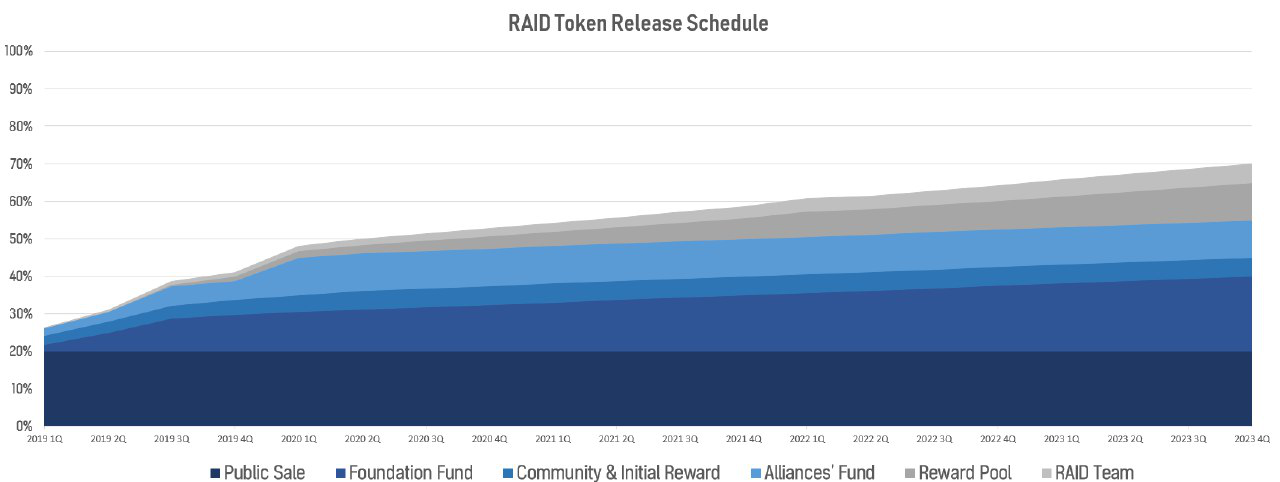

However, other tokens have such lock-up and vesting periods:

- Alliance's tokens: 2 years; - tokens of the team & foundation: 5 years; - rewards: 20 years.

Team doesn't clarify about the number of tokens in initial circulation.

The project's official Telegram group's admin mentioned that 'Bittrex displays incorrect information about 34.5 billion tokens and it soon will be fixed'.

The distribution of tokens will happen within 14 days after the public sale's end. The apparent assumption about listing on Bittrex hasn't yet been commented upon.

The total project's valuation is 10 000 BTC or roughly 39 million USD by today's prices.

Social metrics:

The official website has 78 visitors daily, but these metric changes fast.

The official Twitter was initiated in February 2019, and now has 157 followers and 11 tweets. There's a minimum level of activity, only essential news-posts.

The official project's Telegram group was created on March, 1, at the time of this review it had 800+ users joined, admins are answering the community's questions. There is no plan to launch any airdrop or bounty campaign.

Additional information: the official Korean Telegram group was incepted on March, 5 (1 day before the sale), currently it has 380 users; there are also groups in Kakao Talk with 1100 & 1500 users joined.

Key players:

The team:

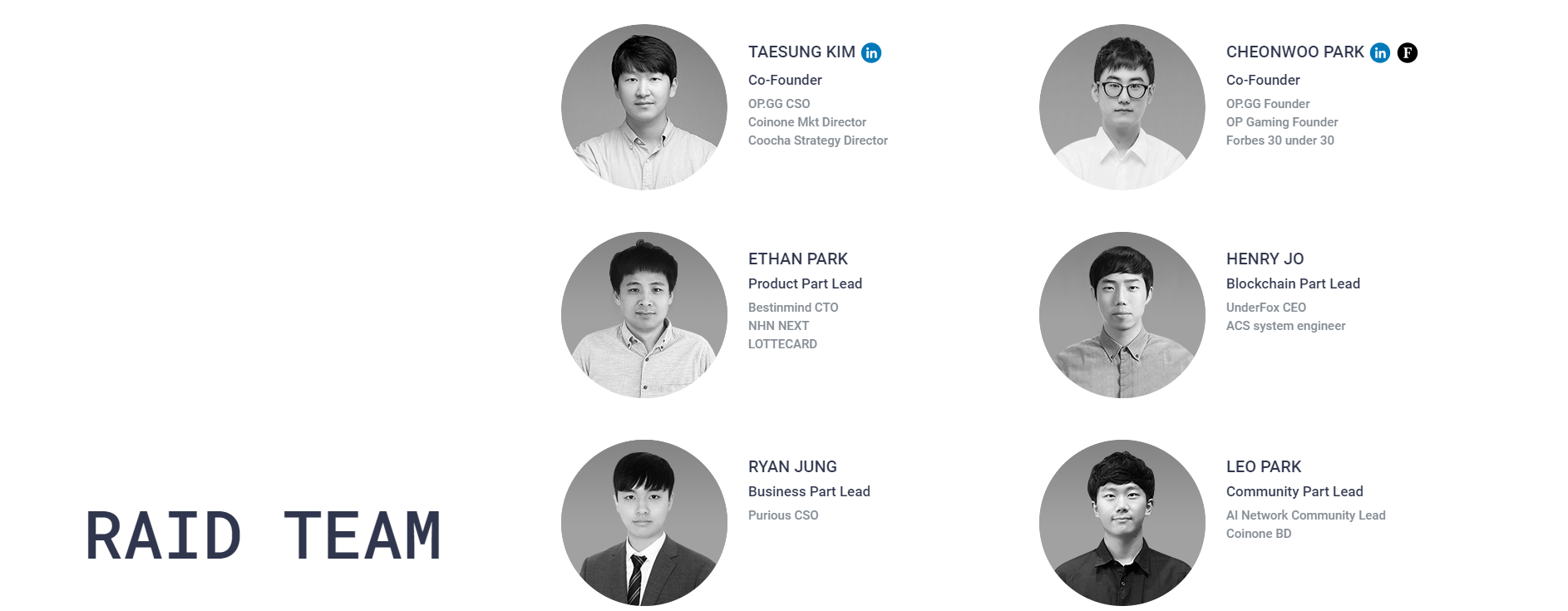

The team is comprised of 6 members, and we managed to find LinkedIn profiles of the founders, but not for the employees.

Taesung Kim is a co-founder and CEO. He acted as chief strategy officer at OP.GG (the key RAID's partner) from 2015 to 2017. Later on, he spent nine months in 2018 as CEO of CoinOne Labs (a South-Korean exchange, do not confuse it with OneCoin Ponzi scheme). Before that, he was strategy director of Yello Mobile (a common Korean mobile platform) for 1.5 years.

Cheonwoo Park is a co-founder. Cheonwoo has been founder and CEO of OP.GG (key RAID's partner) since 2013 (more than five years). He made it to Forbes' 30 for 30 Asia in 2018. In March 2018, Cheonwoo also founded and still manages another company: OP GAMING ESPORTS (there is no data available about it, the company's LinkedIn profile sends to OP.GG).

Ethan Park is a product part lead. His profile mentions that he worked as CTO at BestinmMind (there is a GitHub profile with the same name, the company's website isn't functioning).

Henry Jo is a blockchain part lead. He is known as former CEO of UnderFox.

Ryan Jung is a business part lead.

Leo Park is a community part lead. As the official website states, Leo previously worked at a Korean crypto exchange Coinone as a business development manager, and also at AI Network (a Korean blockchain startup) as a community manager.

There is not much information available about the team members, except for the co-founders.

UPDATE: All of the partnerships mentioned below turned out to be insolvent. We will leave them for the record.

Key partner:

OP.GG is a Korean startup (launched in 2013) that is focused on gaming data analytics for users. It tracks gaming data for such large projects, as DOTA 2, PUBG, League of Legends, Overwatch, Battlegrounds - compiles leaderboards and ranking lists. The team also trains cybersport teams to participate in various disciplines within tournaments. According to Alexa, the project's official website ranks in top-400 with 19.8 million visits a month (the team states that they have 45 active users monthly). The official app OP.GG has more than 1 million downloads (35.000 reviews in Play Store, user rating is 4.2).

Strategic partners:

Riotgames is a U.S.-based gave development company founded in 2006. The company's first office was opened in Los Angeles, and currently, it has offices in 10 of the world's largest cities (Berlin, Shanghai, Singapore, and others), there are around 2500 employees. The team's most famous product is League of Legends (the second popular MOBA game worldwide that comes after DOTA 2), they also develop games for iOS and Android. In addition to that, they organize gaming tournaments with massive prize pools. At this point, the team is supporting its existing projects and plans to develop a new MOBA game.

League of legends is a child of Riotgames (a dedicated legal entity was created because the game became very popular and got a huge fan base).

PUBG Corporation is a child of a Korean company Bluehole, founded in 2007. Like Riotgames, PUBG Corporation is another remarkable company on in gaming sphere, which launched the ultra-successful (more than 13 million copies sold via Steam in 6 months) and still popular battle royale genre shooter Playerunknown's Battlegrounds in 2017.

Supercell is a Finnish mobile game developer. It was founded in 2010, the company's capitalization exceeds 2 billion USD. The most significant amount of operating revenue was achieved by Supercell in 2015 and reached 800 million USD. It launched one of the most popular games Clash Royale (more than 100 million downloads in Google Play).

Partners:

Twitch is a video streaming service that specializes in computer games, including gameplay livestreams and cybersport tournaments. It was acquired in 2014 by Amazon for 970 million USD. Twitch user base is 15 million players, and it has 45 million unique monthly visitors.

Overwolf is a platform for creating videogame extensions (according to Alexa, it has roughly 30 million visitors a year, and occupies 21357's place in the Global Rank). The company began as a startup in 2010, they are now producing two types of extensions: 1) incorporated in games' engines with the help of original developers that require players exit game and visit external link or other actions (payment, consuming content, etc.), used on mobile platforms; 2) external extensions for videogames that help players perform specific actions and/or make playing easier, used in cybersport and MMO RPGs.

OGN (on game net) is a Korean video game company focused in translations of cybersport events and providing information about videogames. According to Wikipedia, it's the most influential videogame streaming company in South Korea. It was founded in 2000. A significant partnership with PUBG was planned. OGN invested more than 100 million USD in North American streaming services in 2018.

4:33 Creative Lab is a South Korean mobile game developer for Android and iOS. It's a startup initiated in 2009. The project raised 100 million USD. There are roughly 5 million downloads of the company's games in Google Play.

Technology and idea

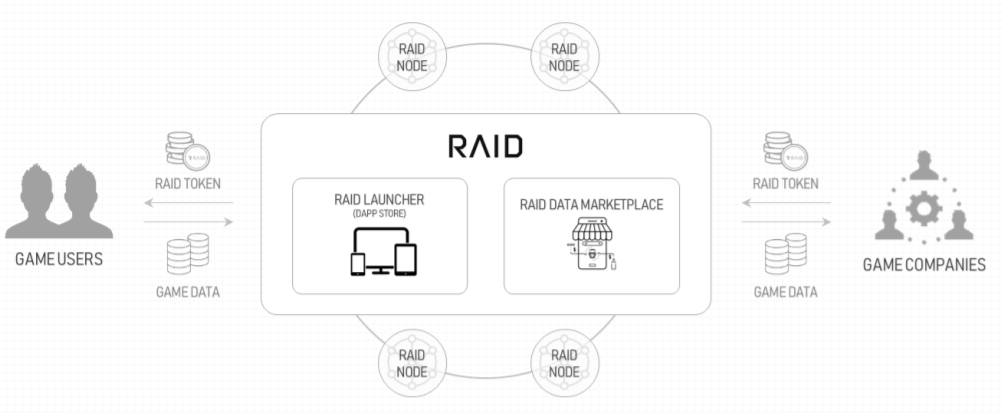

The idea of the project can be illustrated as follows:

Users sell their data for tokens via the marketplace to gaming companies.

The team states that the market for gaming data is estimated at 150 billion USD in yearly revenue, everything is monopolized by large players, which leads to increased prices and waiting time for data if its delivery is even possible. This is the problem the team aims to solve.

The project's architecture consists of:

Most of the names are self-explanatory, we will pay extra attention to the Raid Launcher that is essentially an app on a consumer's device that allows interacting with the network: connecting to the marketplace, manage own data, tokens, and in-game items. This will be the interface that the majority of the network's users will interact with.

As the Roadmap states, Raid Launcher (Beta) & Mainnet are planned to be launched in Q2, 2019. The marketplace is scheduled for Q4, 2019.

Governance and validation will be performed by selected nodes: gaming websites, companies, developers, and others that bring value to the system.

The consensus algorithm is called Ripple Protocol Consensus Algorithm. In its terms, previously selected validators process all the data before it's included into a next block in rounds. As soon as the data cell gets over 50%, it is sent to the next round. Otherwise, it loses its chance to be recorded in the block. As soon as a cell gets over 80%, it's automatically considered confirmed and will be included in a block after the remaining data is processed. The timeframe for decision making and writing is 5 seconds.

The token will be used within network as a currency by players to sell their data, by companies to buy players' data, for estimating value of data, for rewarding validators from the dedicated pool of tokens, for buying & selling in-game items, and as an in-game currency (or as a part of an in-game economics).

MVP release is scheduled for Q2, 2019.

The team mentions the availability of the testnet that at this moment is only presented by transactions explorer on the project's website. Admin says that there is no public GitHub.

Addendum / summary / opinions

We can't evaluate the project without mentioning Bittrex & Bittorent (due to the similar metrics and the fact that both projects are the first ICOs on the corresponding exchanges this year). That is why we will add them to our review of strengths and weaknesses.

- Relative lack of hype. The public sale will begin in less than two days, after 12 hours since the ICO announcement the Telegram group had 700 users, and at the time of the announcement, it had only 40 users. Unfortunately, we can't say how many people were in the Bittorent's group at the time of the sale, but now there are 64.000 users. Our report states that in 12 hours after the Bittorrent's group inception there were 2500 users. Our rough estimation is that the interest from the community, in this case, is 3 or more times less, than in the case with Bittorent. At least it's like that for now. And this is considering that the projects have similar metrics.

- Decreased popularity of Bittrex. Fr0m the end of 2017 Binance has been rightfully called the world's first crypto exchange. Bittrex was at the peak of its popularity 1.5 years ago. It was the entry point for many people in mid-2017. Since then, the exchange has been in a sort of a downtrend. As per Coinmarketcap, Bittrex currently is ranked 45. To be honest, we haven't seen any initial listings of new community's tokens for quite some time.

- Niche & competition. The project solves an issue of a certain industry. This is a vast industry, indeed. However, an infrastructure blockchain project would look more appealing. Moreover, the majority of the gaming-related projects had poor launches. Nonetheless, some had relative success.

- The team. There is not enough information to make an accurate estimation. Both of the co-founders come from OP.GG, which is the project's key partner. That's it.

+ Partners. There are well-known industry players. Most of them are based in South Korea that is the world's videogame center.

+ Bittrex. Despite what we previously mentioned about the popularity of Bittrex, this is an established exchange with a good reputation gained through the years. Will this attempt to attract new users and increase the liquidity successful? We'll see soon.

+ The new trend and demand for token sales on exchanges. Many people discussed what will launch the new ICO wave: STO & security tokens, Ethereum's comeback, ICO TON, etc. Like it always is, everyone was wrong. The latest trend is conducting ICOs on exchanges' Launchpad analogs, and currently, the interest is growing.

+ Token distribution. There were no pre- or private sales. Only the public sale is planned. The project admins state that the tokens for the rest of the holders will be locked for the periods of two to five years. This is the first time in a while that we see such a good set-up for public participants.

+ Individual cap. Only 300 people will be enough to reach the hard cap. This increases chances to close the sale within seconds and hype up the exchange.

UPDATE: --- Partnerships. Here we will change the mentioned strength for an extra weakness. 24 hours before the sale, the project's partners announced that they are not affiliated with it and that they partner with OP.GG, instead of Raid. 15 hours before the sale OP.GG itself published an announcement about termination its partnership with Raid (the project's admin highlights that the partnership was suspended and not terminated). The combination of these events caused aggressive feedback from the community along with the uncertainty about the availability of any adequate relationships between Raid and companies mentioned in this report.

We shall also add that since the inception of the official Telegram group none of the co-founders has appeared there. A single admin is performing the entire communication.

P.S. Ecosystems like RAID always raised questions about the incentives for the users to connect to the network, set up the wallets and fiddle with blockchains.

The motivation for businesses is clear: they want to buy large chunks of reliable data for the lower prices. But what about the users? Let's assume that a user gets 0.05 USD for selling one piece of data. How often will companies buy from me and how much should they sell before reaching a meaningful amount of money? Is it worth it?

We will see about this as soon as one of such marketplaces reaches mass adoption.