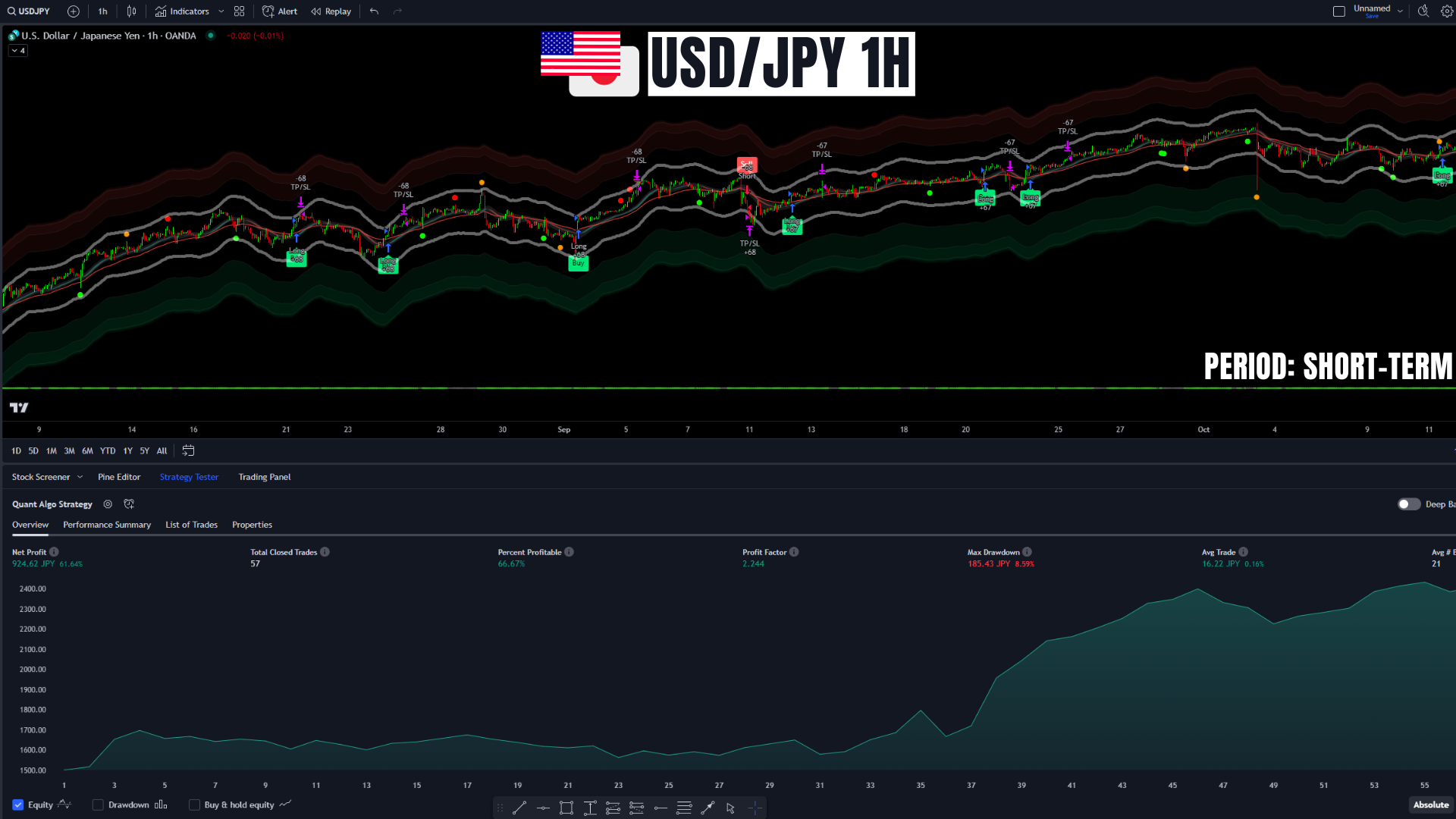

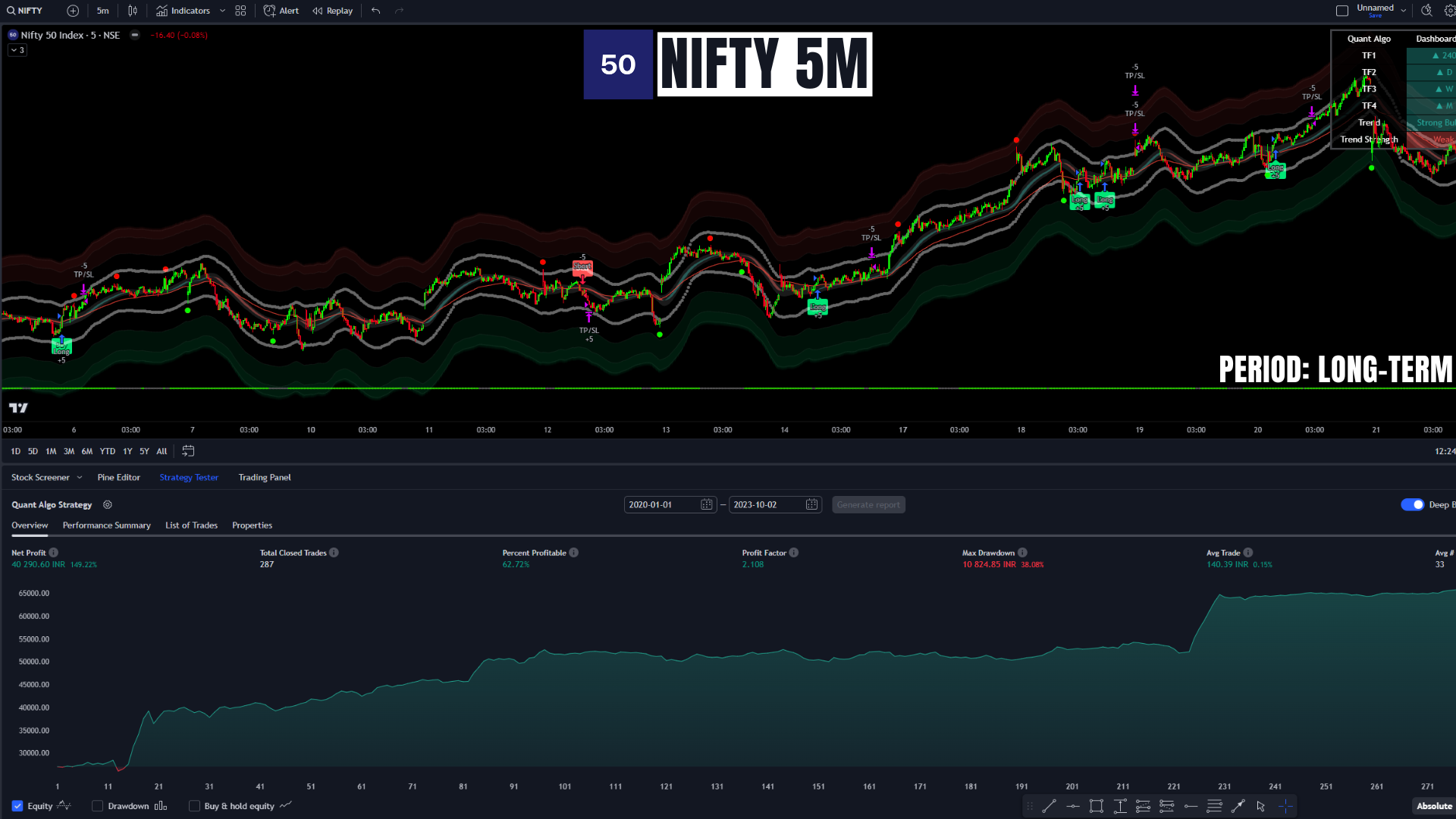

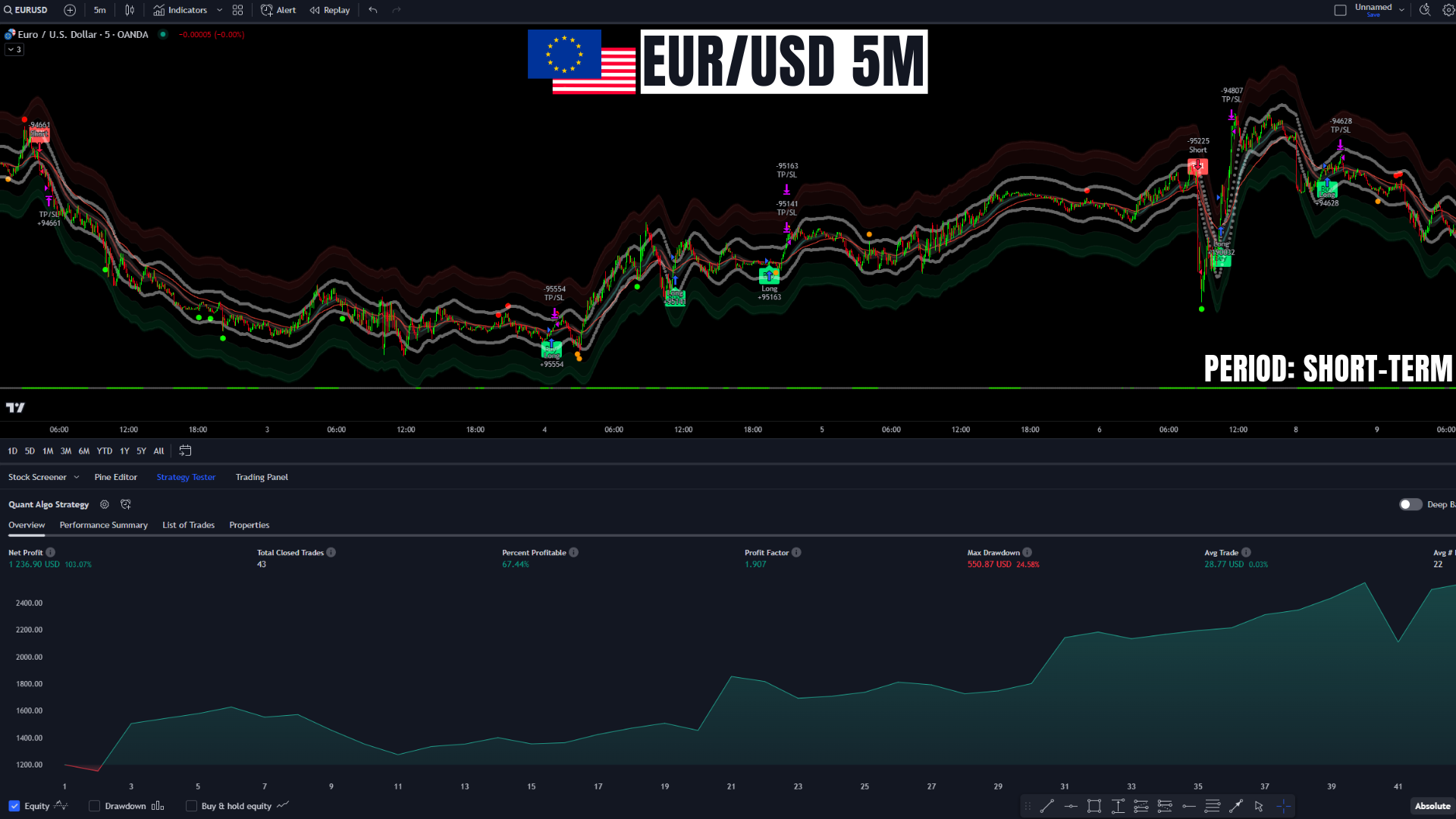

Quant Algo V2.1 - Backtesting Results

Quant CapitalWHAT DO YOU NEED TO KNOW?

Before we proceed, let's take a quick look at essential concepts linked to the backtesting results:

- To start, it's important to mention that the win rate presented in these backtests is essentially your worst-case scenario. This is because you have the flexibility to filter out, further confirm, or leverage signals from the list of exceptions, thereby turning a losing trade into a winning one. This can boost the overall win rate by 10-20%.

- Avoid placing excessive emphasis on the profit figure in backtests because we only used the TP1 target for all trades to maintain simplicity, but when utilizing our dynamic position management technique, the number can potentially increase by a factor of at least 10.

- Finally, certain assets offer two setting options: aggressive and conservative. The distinction is straightforward; aggressive settings result in a greater number of trades but typically come with a lower win rate and a higher max drawdown.

- Disclaimer: Backtesting results are provided for educational purposes exclusively. Please be aware that the values obtained from backtesting do not assure identical future performance.