Put Spread

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

Toggle navigation The Options Guide

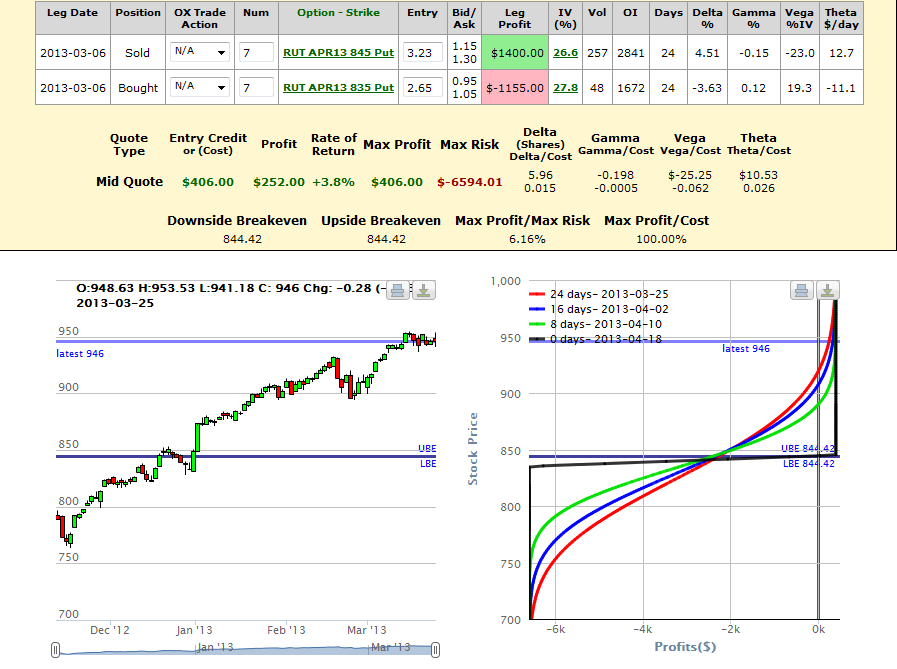

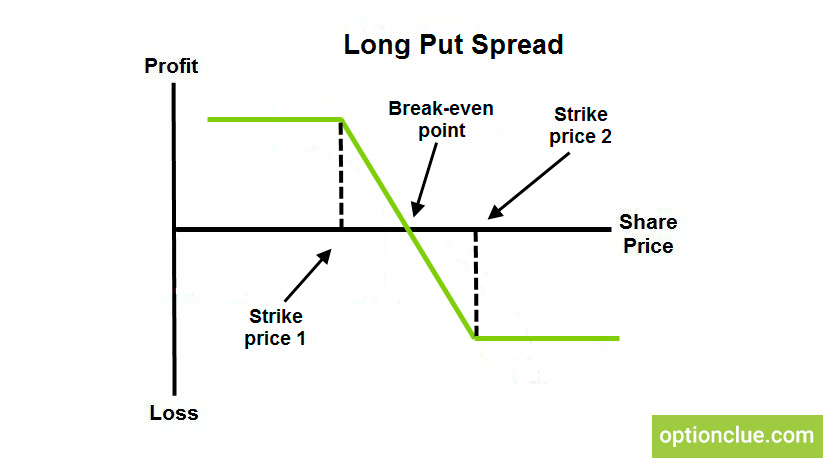

A put spread is an option spread strategy that is created when equal number of put options are bought and sold simultaneously. Unlike the put buying strategy in which the profit potential is unlimited, the maximum profit generated by put spreads are limited but they are also, however, relatively cheaper to employ. Additionally, unlike the outright purchase of put options which can only be employed by bearish investors, put spreads can be constructed to profit from a bull, bear or neutral market.

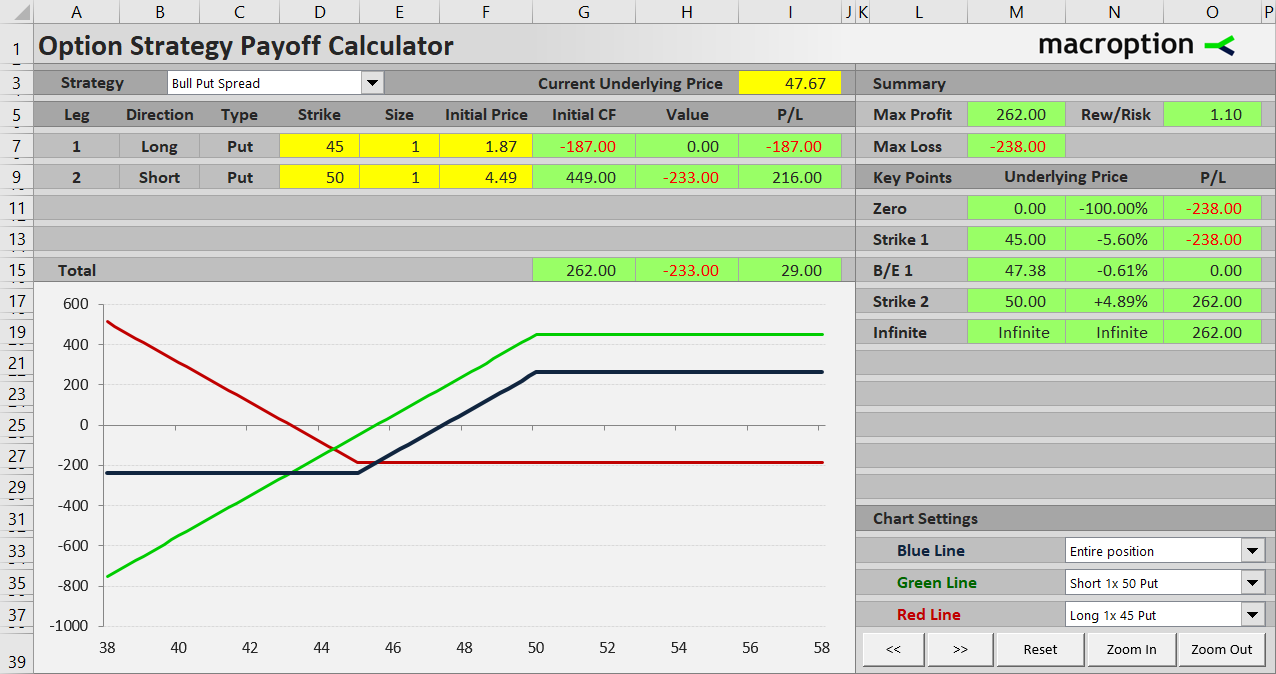

One of the most basic spread strategies to implement in options trading is the vertical spread. A vertical put spread is created when the short puts and the long puts have the same expiration date but different strike prices. Vertical put spreads can be bullish or bearish.

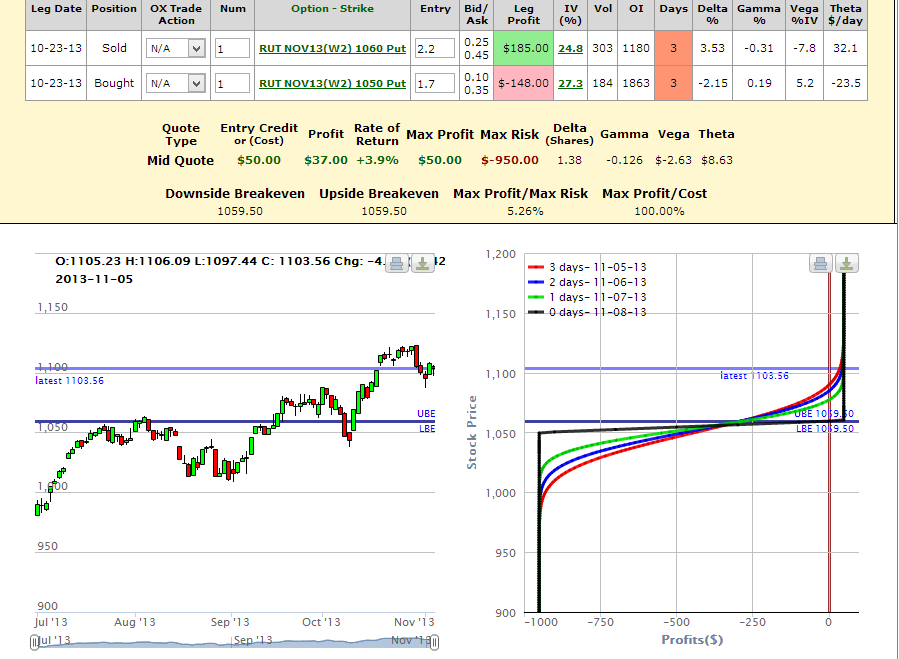

The vertical bull put spread, or simply bull put spread, is used when the option trader thinks that the underlying security's price will rise before the put options expire.

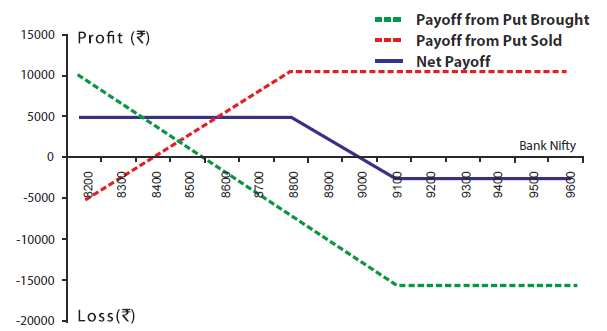

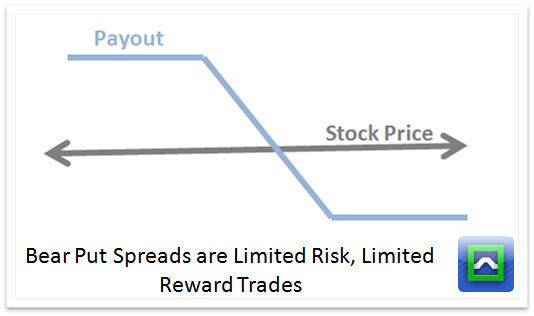

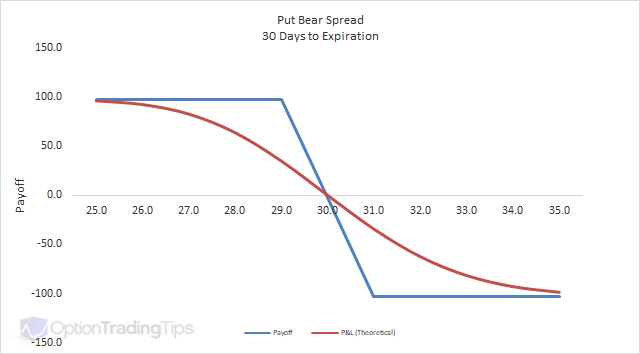

The vertical bear put spread, or simply bear put spread, is employed by the option trader who believes that the price of the underlying security will fall before the put options expire.

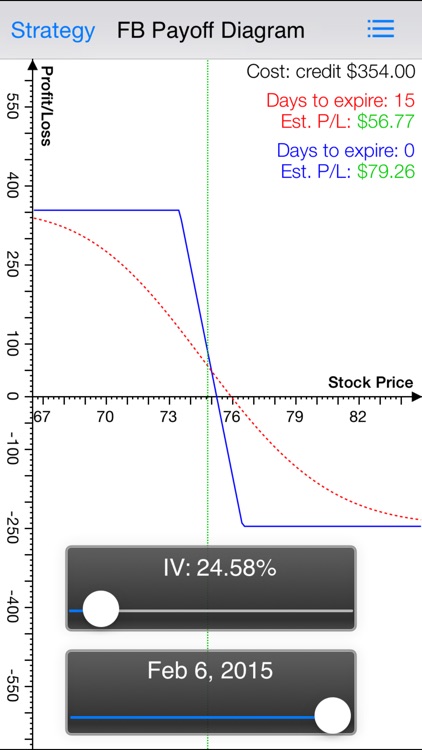

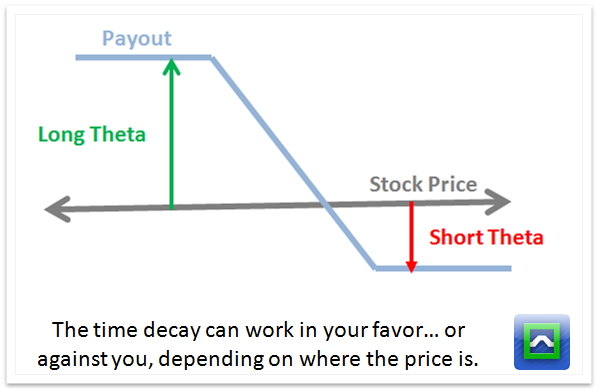

A calendar put spread is created when long term put options are bought and near term put options with the same strike price are sold. Depending on the near term outlook, either the neutral calendar put spread or the bear calendar put spread can be employed.

When the option trader's near term outlook on the underlying is neutral, a neutral calendar put spread can be implemented using at-the-money put options to construct the spread. The main objective of the neutral calendar put spread strategy is to profit from the rapid time decay of the near term options.

Investors employing the bear calendar put spread are bearish on the underlying on the long term and are selling the near term puts with the intention of riding the long term puts for a discount and sometimes even for free. Out-of-the-money put options are used to construct the bear calendar put spread.

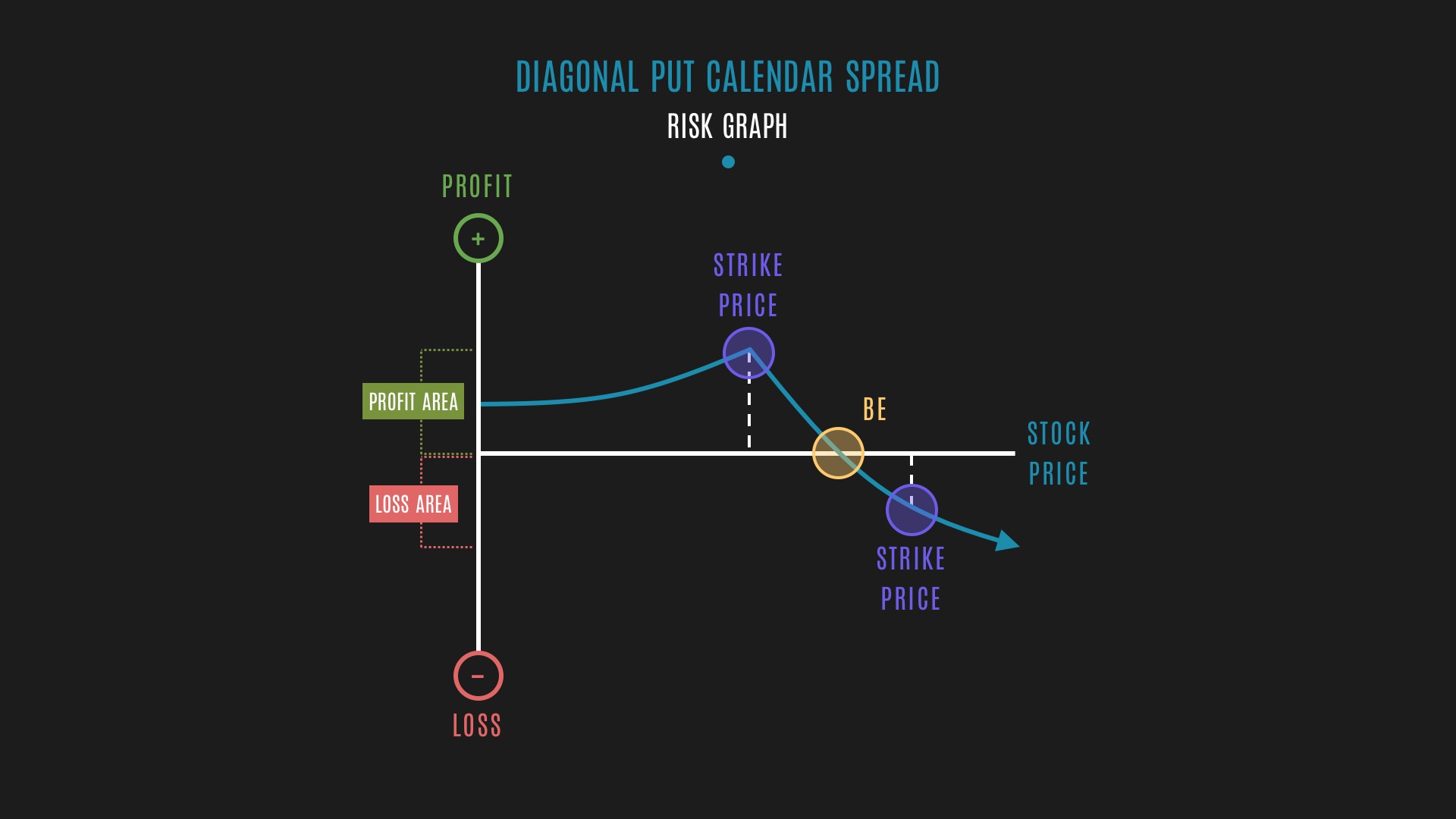

A diagonal put spread is created when long term put options are bought and near term put options with a higher strike price are sold. The diagonal put spread is actually very similar to the bear calendar put spread. The main difference is that the near term outlook of the diagonal bear put spread is slightly more bearish.

Buying straddles is a great way to play earnings. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. For instance, a sell off can occur even though the earnings report is good if investors had expected great results....[Read on...]

If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount....[Read on...]

Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time.....[Read on...]

If you are investing the Peter Lynch style, trying to predict the next multi-bagger, then you would want to find out more about LEAPS® and why I consider them to be a great option for investing in the next Microsoft®.... [Read on...]

Cash dividends issued by stocks have big impact on their option prices. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date....[Read on...]

As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. In place of holding the underlying stock in the covered call strategy, the alternative....[Read on...]

Some stocks pay generous dividends every quarter. You qualify for the dividend if you are holding on the shares before the ex-dividend date....[Read on...]

To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. A most common way to do that is to buy stocks on margin....[Read on...]

Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading.... [Read on...]

Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator.... [Read on...]

Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in 1969. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa.... [Read on...]

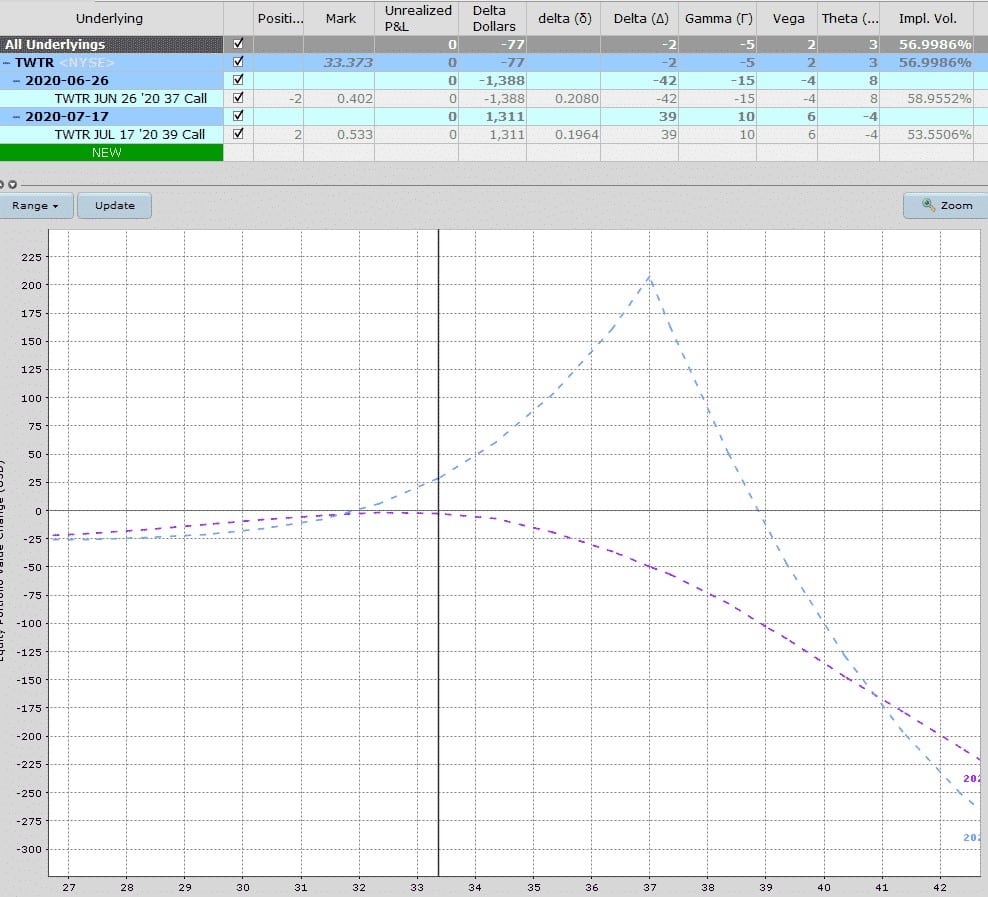

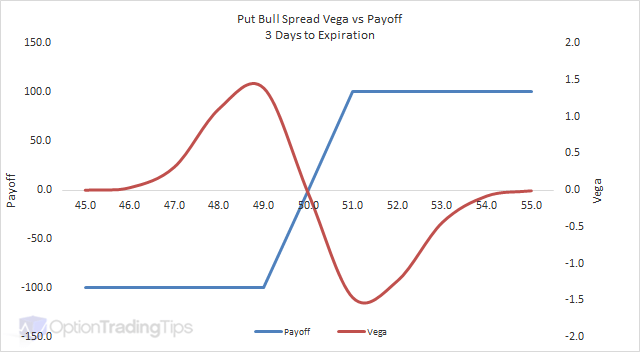

In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. They are known as "the greeks".... [Read on...]

Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow.... [Read on...]

Outlook on Underlying:

Arbitrage

Bearish

Bullish

Neutral - Bearish on Volatility

Neutral - Bullish on Volatility

Profit Potential:

Limited

Unlimited

Loss Potential:

Limited

Unlimited

Credit/Debit:

Credit

Debit

No. Legs:

1

2

3

4

Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. You should not risk more than you afford to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. TheOptionsGuide.com shall not be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon.

General Risk Warning:

The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose.

Home | About Us | Terms of Use | Disclaimer | Privacy Policy | Sitemap

Copyright 2017. TheOptionsGuide.com - All Rights Reserved.

theoptionsguide.com/put-spread.aspx

A put spread is an option spread strategy that is created when equal number of put options are bought and sold simultaneously. Unlike the put buying strategy in which the profit potential is unlimited, the maximum profit generated by put spreads are limited but they are also, however, relatively cheaper to employ.

theoptionsguide.com/put-spread.aspx

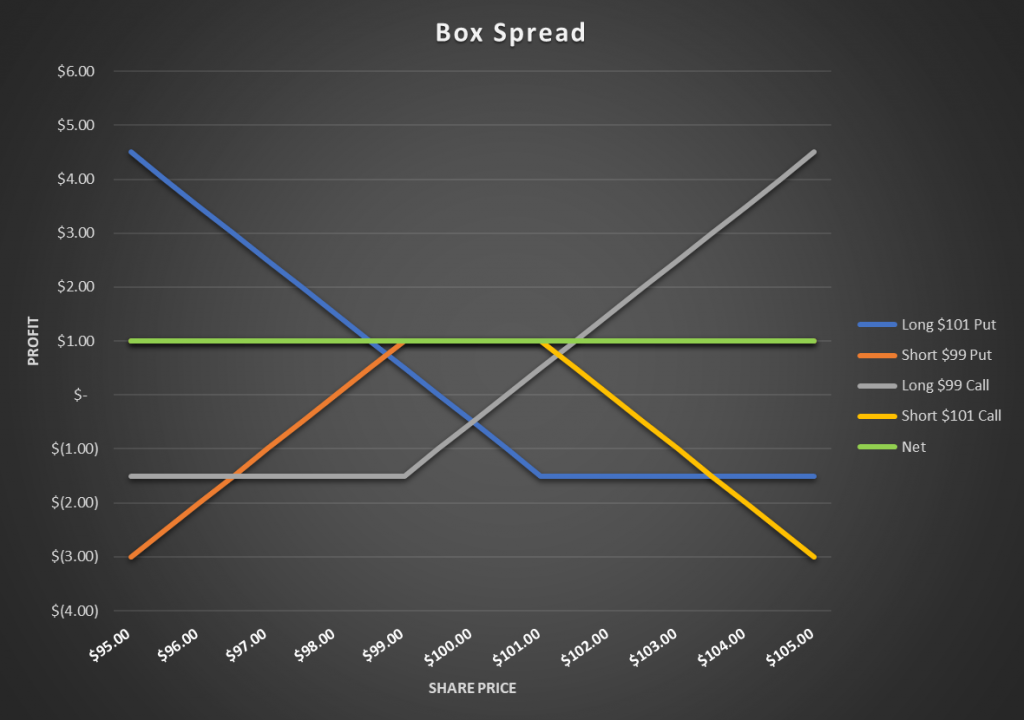

A box spread is an options arbitrage strategy that combines buying a bull call spread with a matching bear put spread. A bull put spread is an income-generating options strategy that is used when the investor expects a moderate rise in the price of the underlying asset.

www.investopedia.com/terms/b/bearputspr…

A bull put spread is an income-generating options strategy that is used when the investor expects a moderate rise in the price of the underlying asset. A box spread is an options arbitrage strategy that combines buying a bull call spread with a matching bear put spread.

www.investopedia.com/terms/b/bearputspr…

This is an advanced topic in Option Theory. Please refer to this Options Glossary if you do not understand any of the terms. A call spread is an option strategy in which a call option is bought, and another less expensive call option is sold. A put spread is an option strategy in which a put option is bought,...

brilliant.org/wiki/call-and-put-spreads/

https://theoptionsguide.com/put-spread.aspx

Vertical Put Spread

Calendar (Horizontal) Put Spread

Diagonal Put Spread

Continue Reading...

A calendar put spread is created when long term put options are bought and near term put options with the same strike price are sold. Depending on the near term outlook, either the neutral calendar put spread or the bear calendar put spread can be employed.

https://broker.ru/f/reg/archive/attachment-06/spec_put_spread-140217.pdf

«Пут-спрэд» («Put-spread») (далее – Контракт), а также порядок их возникновения, изменения и прекращения. II. Термины и определения 2.1.

Bear Put Spread Option Strategy - Put Debit Spreads

Bull Put Spread Option Strategy - Options Trading Strategies - Bullish Options Strategies

Bull Put Spread Options Strategy (Best Guide w/ Examples)

Trade Checklist: Vertical Put Credit Spread | Options Trading Concepts

Bear Put Spread Guide | Vertical Spread Option Strategies

Bear Put Spread Options Strategy (TUTORIAL TRADE EXAMPLES)

https://economy_en_ru.academic.ru/52285/put_spread

Перевести · бирж. пут спред, спред пут (опционная стратегия, заключающаяся в одновременной покупке и продаже опционов пут на один и тот же актив, но с разными ценами исполнения) See: bear put spread, bull put spread, call spread, put …

https://www.investopedia.com/terms/b/bullputspread.asp

Перевести · A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset. The strategy pays a credit initially and uses two put options...

https://www.investopedia.com/terms/b/bearputspread.asp

Перевести · What Is a Bear Put Spread? A bear put spread is a type of options strategy where an investor or trader expects a moderate-to-large decline in the price of a security or asset and wants to reduce...

https://brilliant.org/wiki/call-and-put-spreads

Перевести · A put spread refers to buying a put on a strike, and selling another put on a lower strike of the same expiry. Most often, the strikes of the spread are on the same side of the underlying (i.e. both higher, or both …

https://epsilonoptions.com/options-spreads

Перевести · This is the put version of the bull call spread: ie an amount is paid up front which rises in value should the stock will move in the right particular direction (‘down’, compared to ‘up’ for the bear call spread). For example: Buy IBM Nov 160 Put 2.00 Sell IBM Nov 155 Put …

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Chubby Ebony Porn

Big Dragon Dildo

Cute Naked Teen Girl

Bikini Barista

Molly Boobs

Put Spreads Explained | The Options & Futures Guide

Спецификация внебиржевого опционного контракта тип «П…

put spread - это... Что такое put spread?

Bull Put Spread Definition - investopedia.com

Bear Put Spread Definition - investopedia.com

Call and Put Spreads | Brilliant Math & Science Wiki

Options Spreads: Put & Call Combination Strategies

Put Spread

%3amax_bytes(150000)%3astrip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)