Public Private Partnership

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Public Private Partnership

Recent Additions

Consumer Price Index (CPI)

Leadership

Collective Bargaining

Hire Purchase System

Product Positioning

Merger

Bank Audit

Employee Welfare

Sales Forecast

Retail Banking Vs Corporate Banking

Learn about Investing & Business related terms

September 30, 2019 by Prachi M Leave a Comment

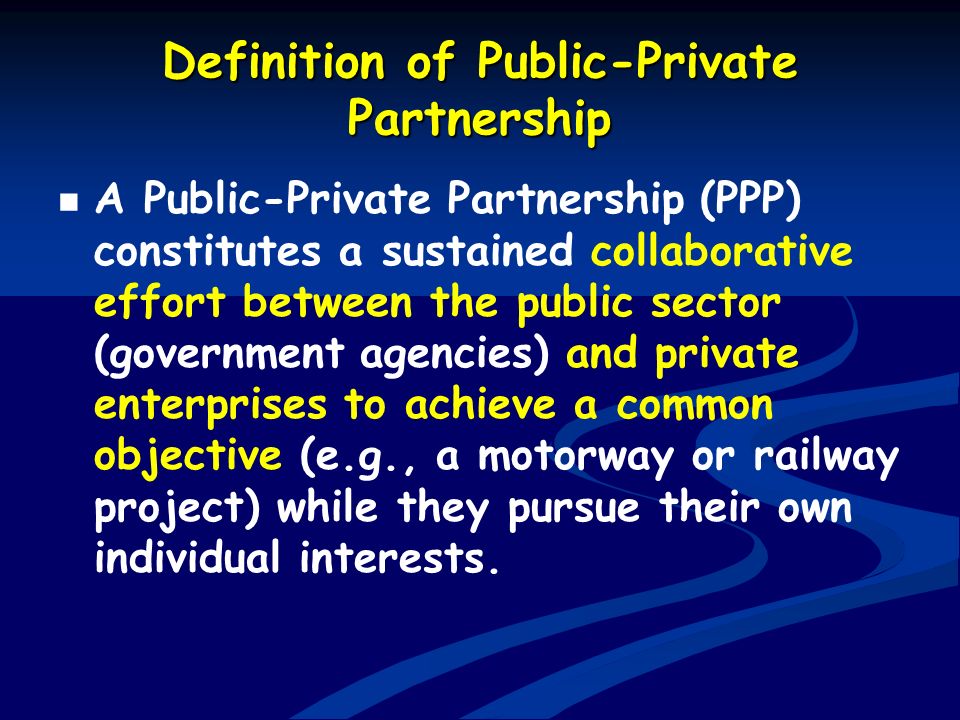

Definition : Public-private partnership (PPP) is a model where the government associates with private companies to accomplish infrastructure projects. This alliance between both the parties, ensure financing, designing, flourishing and maintaining of the infrastructural amenities within the country.

The PPP approach initiates the efficient facilitation of public goods to the people. This is because, such projects are handed over to the relevant private entities, who hold expertise and knowledge in their field.

To understand the PPP concept, we must know its fundamental characteristics. Some of these are discussed in detail below:

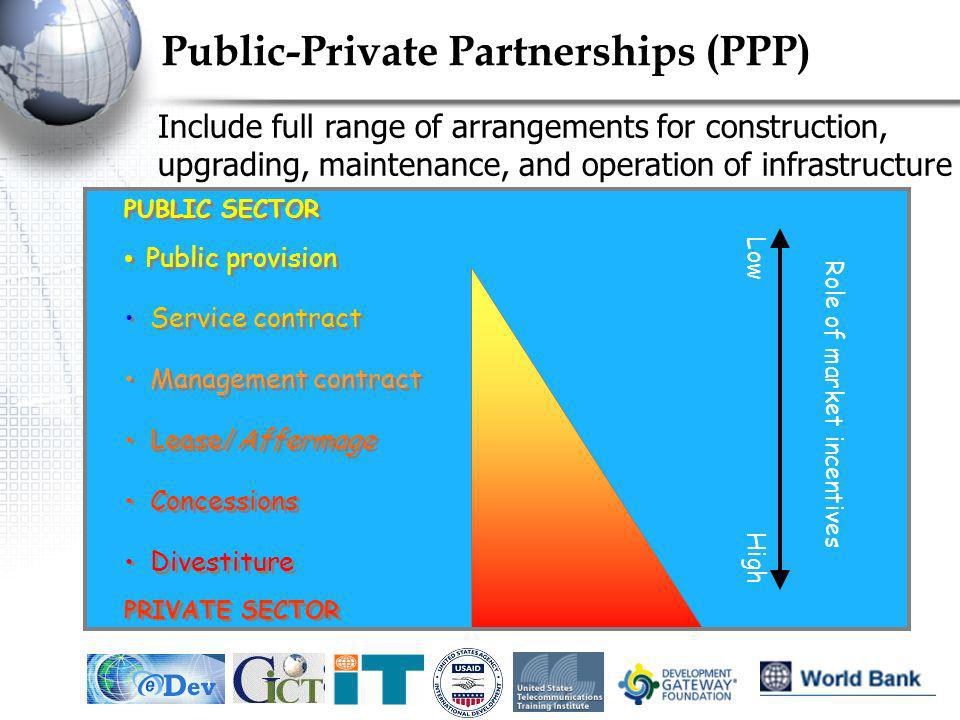

When we talk about the public-private partnership, we come across various ways in which this approach functions. To understand some of the frequently adopted PPP structures, read below:

The toll road construction projects are illustrated under this conventional model. The private company construct the road, collect toll or revenue (for the contract period) and then pass its possession to the government.

It is though very similar to the BOT model; here, the possession of the facility remains with the private entity itself.

To recover the cost of construction and incur gains, the private firm, after development, keeps the possession of the facility up to the contract period. After which it passes on the ownership to the public sector.

The private company uses a leased public property to develop a facility. It functions on this property for the lease period to recover cost and earn revenue. Later as the lease expires, the land is handed over, back to the government.

This is the basic form of P3 where the private company layouts and constructs the facility as per the government requirements, after complete risk assessment. In return, it takes a fixed amount as its charges.

The private sector firm undertakes a project to design the layout, build the facility and meet the capital cost involved in such designing and construction.

In the DBFO model, the private company is responsible for planning the project layout, facility construction, arranging the required capital and operating it till the grant period. The facility operations revenue meets the cost incurred and generates profit to the company.

This model can also be termed as a management contract. Here, the public sector entity remains associated with the project from the beginning to the end.

The process starts right from designing of the layout, to construction, funding and lifetime maintenance of the facility. The firm either charges a fixed sum or shares profit; also, it is involved in the project’s managerial decision making.

It is an extended version of DBFO. Here, the private firm prepares the blueprint, builds up the facility, invest the required sum and carry out the operations to generate revenue. Since the company undertakes the project for a long-term, it has to take care of the maintenance work too.

In the DCMF model, the private entity understands the government specifications and accordingly designs, develops, upkeeps and invest in a facility. This facility is then leased out to the government body itself.

This model involves assigning of a sub-contract to the private companies for running and up keeping a facility.

The firms which undertake such projects are experts in maintenance work. Also, the possession of the facility remains with the government body. The revenue for private entities is commonly generated through a performance-based fee. In some cases, the companies charge a lump sum and fixed price for their services.

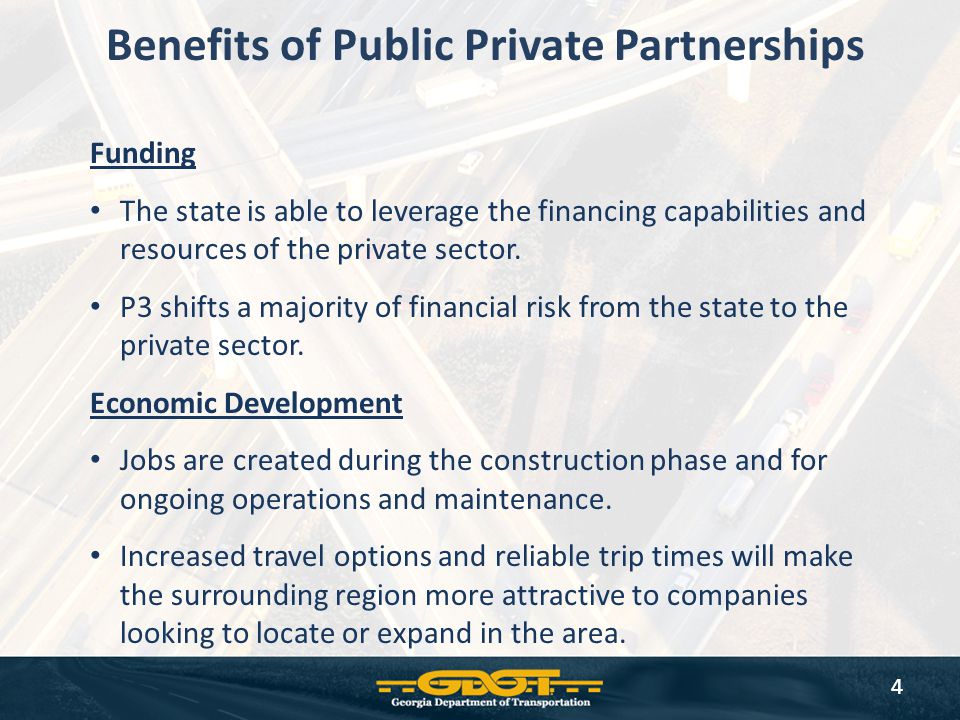

The PPP approach is highly beneficial for the government, the country, the economy, the private organizations and the public. Given below are some of the prominent pros of this concept:

On the one hand, it helps to improve the infrastructure conditions in a country. Whereas, on the other hand, it has the following limitations:

The public relations officer noticed the problem of conveyance between the two villages in her area, which were separated by a river. The only means of reaching the other village was through boats. Therefore, she proposed the bridge construction project in front of the government; to establish connectivity between the villages.

The task being highly complicated, the government decided to go for a PPP approach for this project.

Let us now understand how the project in the above illustration will proceed, through the following significant steps involved in it:

Collaboration is inevitable when it comes to substantial infrastructure projects requiring high investment and expertise.

Therefore, the government prefers to take the assistance of professionals in the field. Here, comes the role of private companies for the accomplishment of such projects.

Your email address will not be published. Required fields are marked *

PPPLRC-HOME | Public private partnership

What is Public - Private Partnership (PPP)? - The Investors Book

Public - Private Partnerships Definition

Public – private partnership — Wikipedia Republished // WIKI 2

Public Private Partnership

Public-private partnerships allow large-scale government projects, such as roads, bridges, or hospitals, to be completed with private funding. These partnerships work well when private sector technology and innovation combine with public sector incentives to complete work on time and within budget. Risks for private enterprise include cost overruns, technical defects, and an inability to meet quality standards, while for public partners, agreed-upon usage fees may not be supported by demand—for example, for a toll road or a bridge. Despite their advantages, public-private partnerships are often criticized for blurring the lines between legitimate public purposes and private for-profit activity, and for perceived exploitation of the public due to self-dealing and rent seeking that may occur.

This video file cannot be played. (Error Code: 102630)

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

A private finance initiative is a method of providing funds for major capital investments, where private firms complete and manage public projects.

Infrastructure refers broadly to the basic physical systems of a business, region, or nation. Examples include roads, sewer systems, power lines, and ports.

Overlapping debt refers to the financial obligations of one political jurisdiction that also falls partly on a nearby jurisdiction.

A type of municipal bond whose principal and coupon are repaid from the toll revenues collected from the public project that was funded by that issue.

An economic theory arguing that rising public sector spending drives down or even eliminates private sector spending.

A revenue bond is a municipal bond supported by the revenue from a specific project, such as a toll bridge, highway or local stadium.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

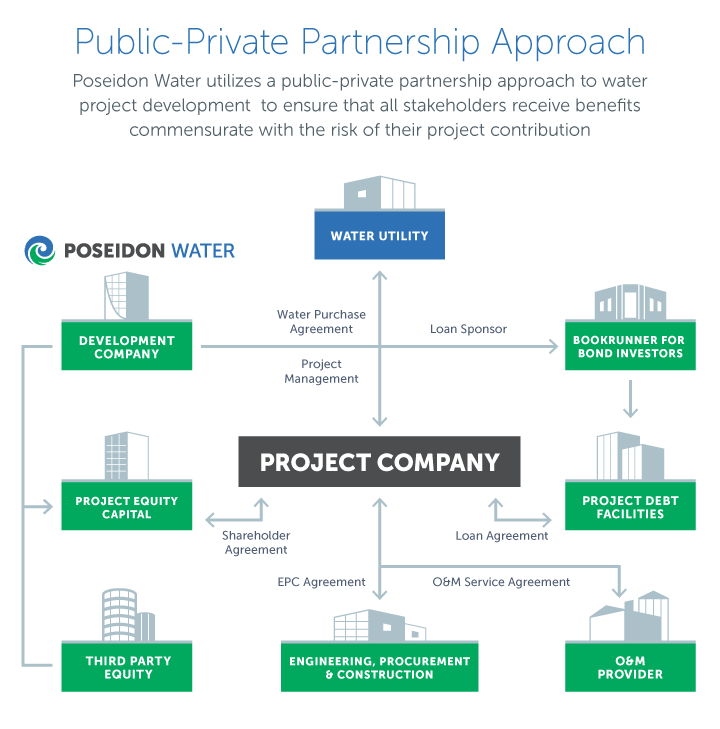

Public-private partnerships involve collaboration between a government agency and a private-sector company that can be used to finance, build, and operate projects, such as public transportation networks, parks, and convention centers. Financing a project through a public-private partnership can allow a project to be completed sooner or make it a possibility in the first place. Public-private partnerships often involve concessions of tax or other operating revenue, protection from liability, or partial ownership rights over nominally public services and property to private sector, for-profit entities.

A city government, for example, might be heavily indebted and unable to undertake a capital-intensive building project, but a private enterprise might be interested in funding its construction in exchange for receiving the operating profits once the project is complete.

Public-private partnerships typically have contract periods of 25 to 30 years or longer. Financing comes partly from the private sector but requires payments from the public sector and/or users over the project's lifetime. The private partner participates in designing, completing, implementing, and funding the project, while the public partner focuses on defining and monitoring compliance with the objectives. Risks are distributed between the public and private partners through a process of negotiation, ideally though not always according to the ability of each to assess, control, and cope with them.

Although public works and services may be paid for through a fee from the public authority's revenue budget, such as with hospital projects, concessions may involve the right to direct users' payments—for example, with toll highways. In cases such as shadow tolls for highways, payments are based on actual usage of the service. When wastewater treatment is involved, payment is made with fees collected from users.

Public-private partnerships are typically found in transport and municipal or environmental infrastructure and public service accommodations.

Partnerships between private companies and governments provide advantages to both parties. Private-sector technology and innovation, for example, can help improve the operational efficiency of providing public services. The public sector, for its part, provides incentives for the private sector to deliver projects on time and within budget. In addition, creating economic diversification makes the country more competitive in facilitating its infrastructure base and boosting associated construction, equipment, support services, and other businesses.

The private partner may face special risks from engaging in a public-private partnership. Physical infrastructure, such as roads or railways, involve construction risks. If the product is not delivered on time, exceeds cost estimates, or has technical defects, the private partner typically bears the burden. In addition, the private partner faces availability risk if it cannot provide the service promised. A company may not meet safety or other relevant quality standards, for example, when running a prison, hospital, or school. Demand risk occurs when there are fewer users than expected for the service or infrastructure, such as toll roads, bridges, or tunnels. However, this risk can be shifted to the public partner, if the public partner agreed to pay a minimum fee no matter the demand.

Public-private partnerships also create risks from the general public's and taxpayers' point of view. Private operators' partnership with the government may insulate them from accountability to the users of the public service for cutting too many corners, providing substandard service, or even violating peoples' civil or Constitutional rights. At the same time, the private partner may enjoy a position to raise tolls, rates, and fees for captive consumers who may be compelled by law or geographic natural monopoly to pay for their services.

Lastly, as with any situation where ownership and decision rights are separated, public-private partnerships can create complex principal-agent problems . This may facilitate corrupt dealings, pay-offs to political cronies, and general rent seeking activity by attenuating the link between the private parties who make important decisions over a project, from which they stand to benefit, and accountability to the taxpayers who foot at least part of the bill and who may be left holding the bag in terms of ultimate liability for the project's outcome.

Public-private partnerships are typically found in transport infrastructure such as highways, airports, railroads, bridges, and tunnels. Examples of municipal and environmental infrastructure include water and wastewater facilities. Public service accommodations include school buildings, prisons, student dormitories, and entertainment or sports facilities.

Double Penetration Nicolly Pantoja

Naked Hd

Penetration Porno Video

Sophie Naked

Outdoor Fi