Proof of Stake. Is it halal?

Halal or Haram? If you want to share your opinion about cryptocurrencies and blockchain technologies, please welcome Telegram chat. We need to know what you think!

In our previous article, we considered the issue of what is forbidden and what is allowed in Islam working with cryptocurrencies. We turned to the experience of Islamic scholars studying this issue and to the basic rules of Islamic finance, without knowledge and understanding of which is impossible to give an unambiguous assessment of this important issue. But the question of the halal nature of cryptocurrencies and their applicability in Islamic finance leads us to another question: Can the use of technology be used by the followers of Islam? In this article, we consider the applicability of Proof of stake technology.

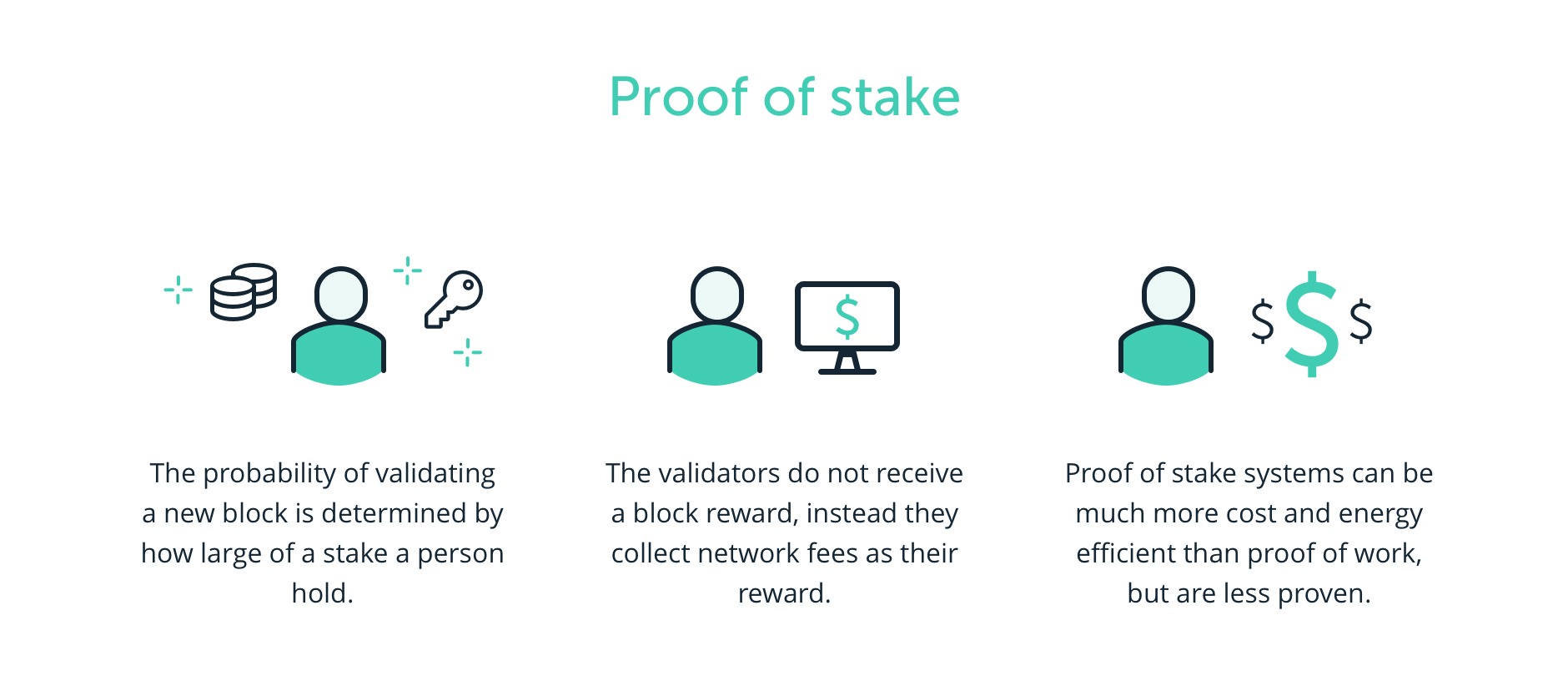

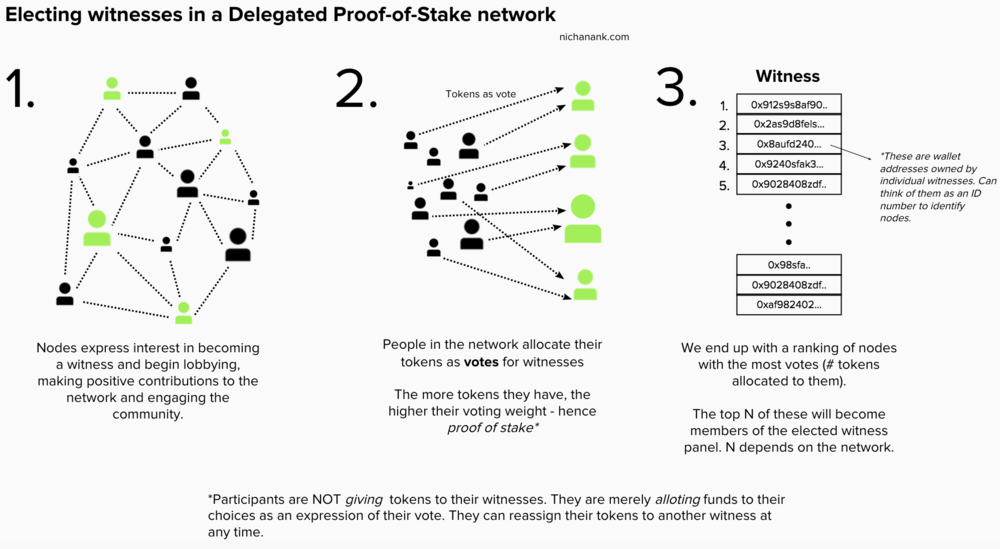

First, let's see what the Proof of Stake (POS) is? Proof of stake is a type of consensus mechanism used to validate cryptocurrency transactions. With this system, owners of the cryptocurrency can stake their coins, which gives them the right to check new blocks of transactions and add them to the blockchain. When a block of transactions is ready to be processed, the cryptocurrency's proof-of-stake protocol will choose a validator node to review the block. The validator checks if the transactions in the block are correct? If so, they add the block to the blockchain and receive crypto rewards for their contribution. However, if a validator proposes adding a block with inaccurate information, they lose some of their staked holdings as a penalty.

In a sense, Proof of Stake has elements of riba ( ربا), because it involves making money with money without performing any actions. Of course, in this matter it is appropriate to look at the Islamic definition of riba. Sometimes riba is translated as interest but in fact riba is somewhat more than just interest.

Riba in Shariah is an illegal increase in money or certain goods, stipulated when transferring money in debt or concluding a transaction. A riba is also called a transaction in which one party acquires a profit without spending any labour for this. Most scholars recognize two types of riba: «riba an nasiya» and «riba al fadl». The first type of riba relates to lending, and the second to sales. Of course, there is no sale in Proof of Stake, so the similarity of this technology is more in line with «riba an nasiah».

The most obvious example is borrowing money and waiting for a larger amount to be returned. However, this also includes selling something with deferred payment with an agreement that the price of the item will increase if payment is not received by a certain date. But in Proof of Stake digital currency is motionless (tokens are held in the user's wallet, at user’ address), which means that it is immobilized, and the owner cannot delete it. At the same time, the owner helps to secure the entire network by verifying transactions. Proof of Stake actually acts as a deposit and if the owner of the coins behaves dishonestly, he will lose his deposit.

The deposits are allowed in Islam and from the investor's point of view there is actually no big difference between a savings account with interest or a certificate of deposit and a confirmation of its share. With both you deposit money and with both you get a predetermined profit. In the case of a savings account, you make a profit because your money is used by the bank to provide loans.

The strongest argument in favor of the admissibility and use of Proof of Stake is the idea that it is a service, which is that the reward for the block is a payment for this service. The argument against it is as follows: a Muslim is not allowed to earn money from money. Proof of stake, like riba, tends to concentrate wealth, making the rich richer and the poor poorer. In Proof of Stake systems, the addresses where more currency is placed are more likely to be the ones who will accept the block and receive a reward for the block. Then they can put their profits on the line, thereby increasing the likelihood of receiving future rewards for the block.

This is an area where Proof of Stake is totally different from riba because in the case of Proof of Stake the wealth earned by the participants is not taken from anyone, rather it is created using a consensus protocol and a reward scheme of any blockchain or network. In the case of obtaining a loan, the borrower is forced to pay out of his own wealth or labour into the lender's pocket. The main problem here is the problem of making a profit from other people's losses. This is a serious moral hazard because it means that people have a direct monetary incentive, for example, to start wars and subsequently finance reconstruction.

Allah knows best!

Halal or Haram? If you want to share your opinion about cryptocurrencies and blockchain technologies, please welcome Telegram chat. We need to know what you think!