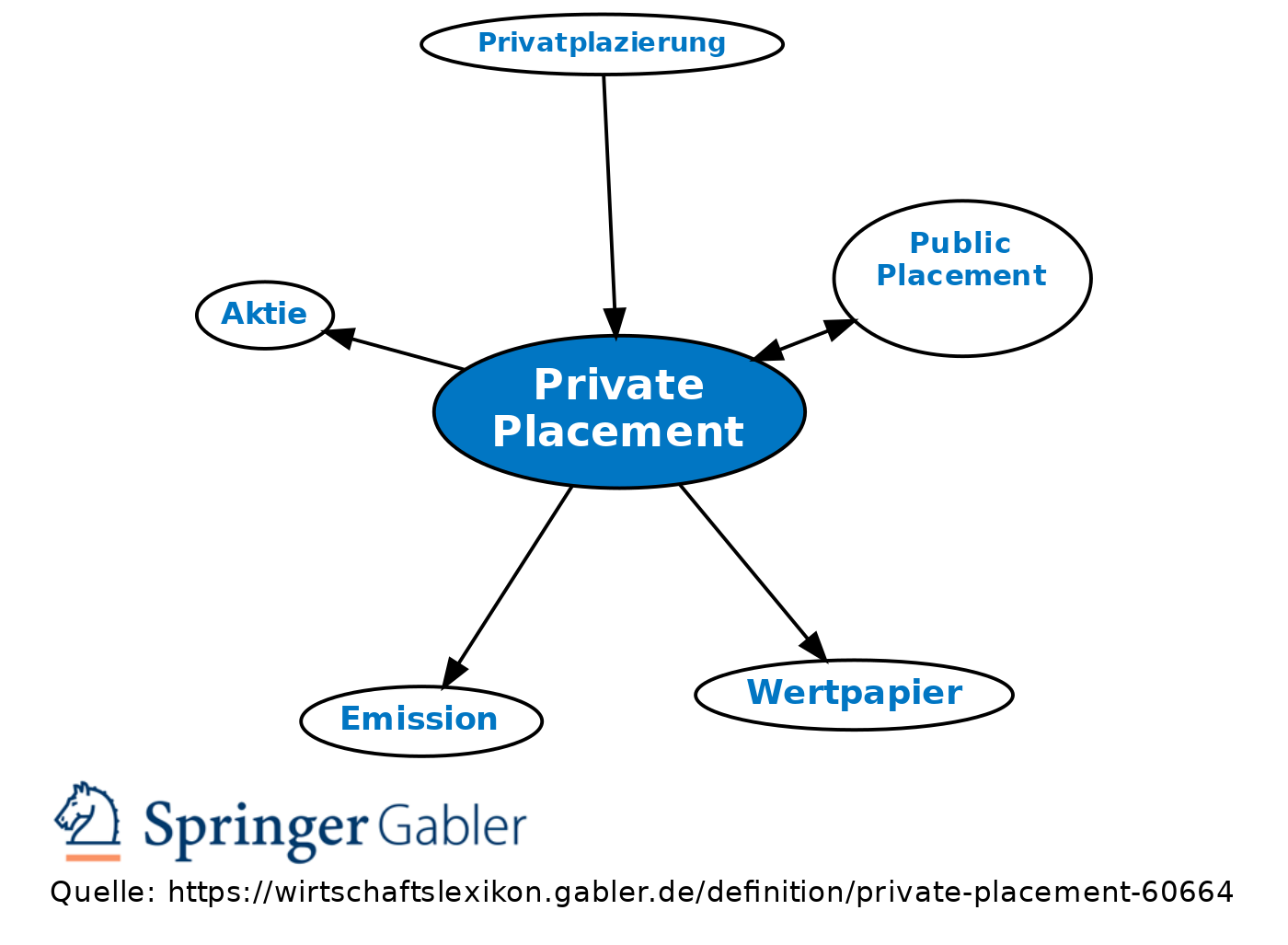

Private Placement

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

Private placement (or non-public offering) is a funding round of securities which are sold not through a public offering, but rather through a private offering, mostly to a small number of chosen investors. Generally, these investors include friends and family, accredited investors, and institutional investors.[1]

PIPE (Private Investment in Public Equity) deals are one type of private placement. SEDA (Standby Equity Distribution Agreement) is also a form of private placement. They are considered to present lower transaction costs for the issuer than public offerings.[2]

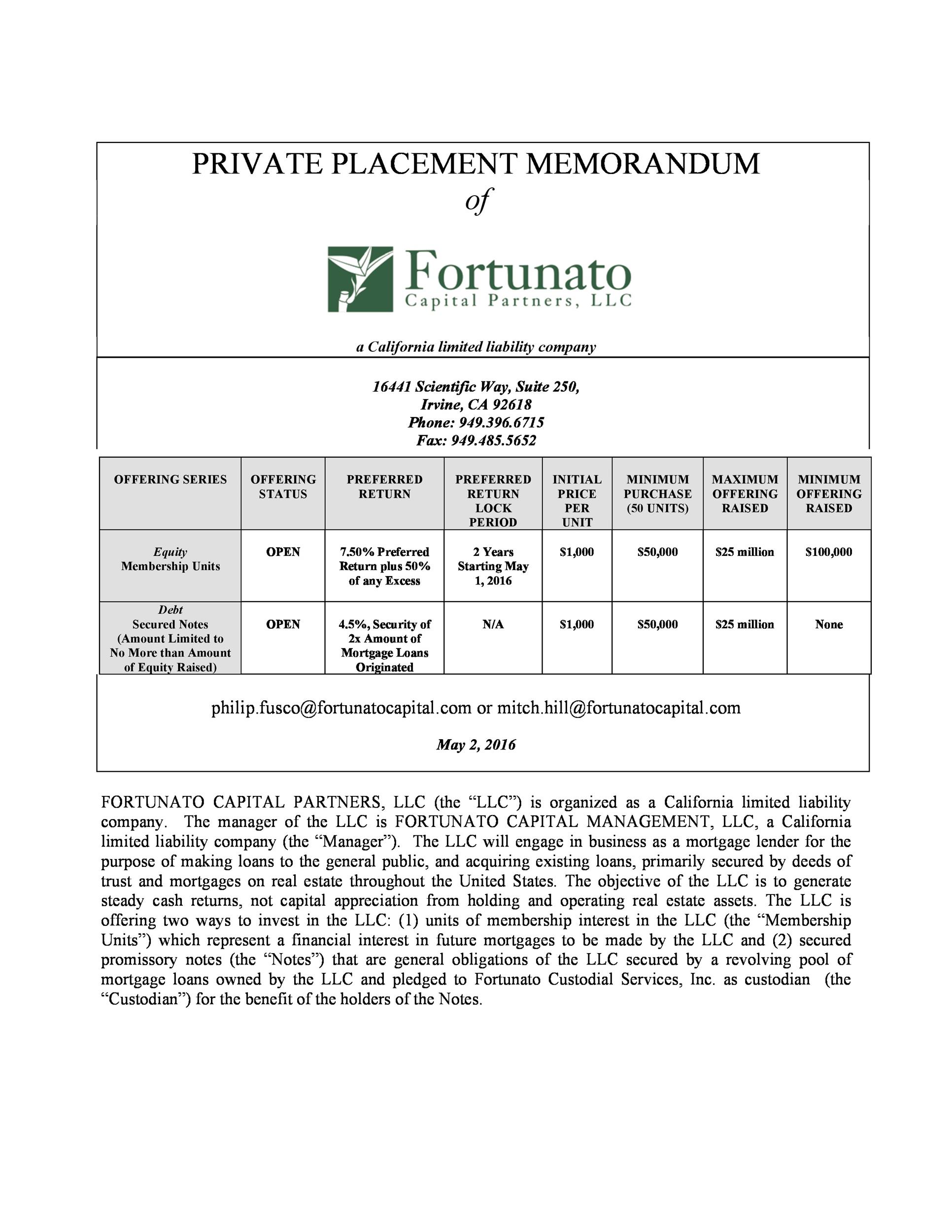

Since private placements are not offered to the general public, they are prospectus exempt. Instead, they are issued through Offering Memorandum. Private placements come with a great deal of administration and have normally been sold through financial institutions such as investment banks. New FinTech companies now offer an automated, online process making it easier to reach potential investors and reduce the administration.

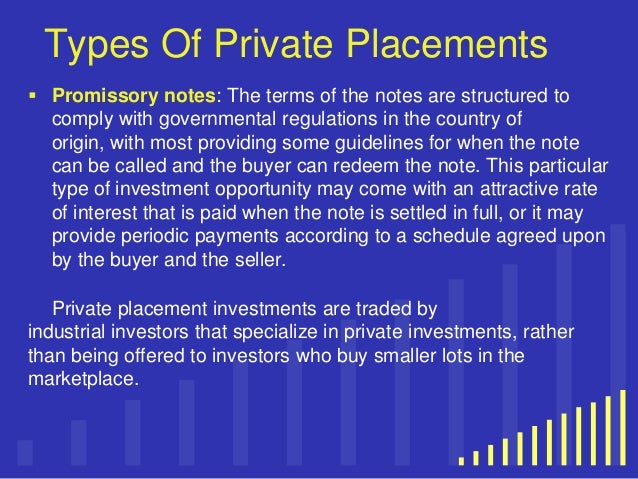

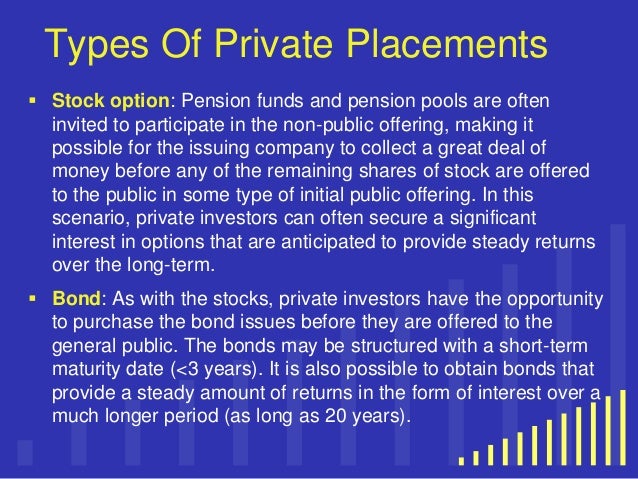

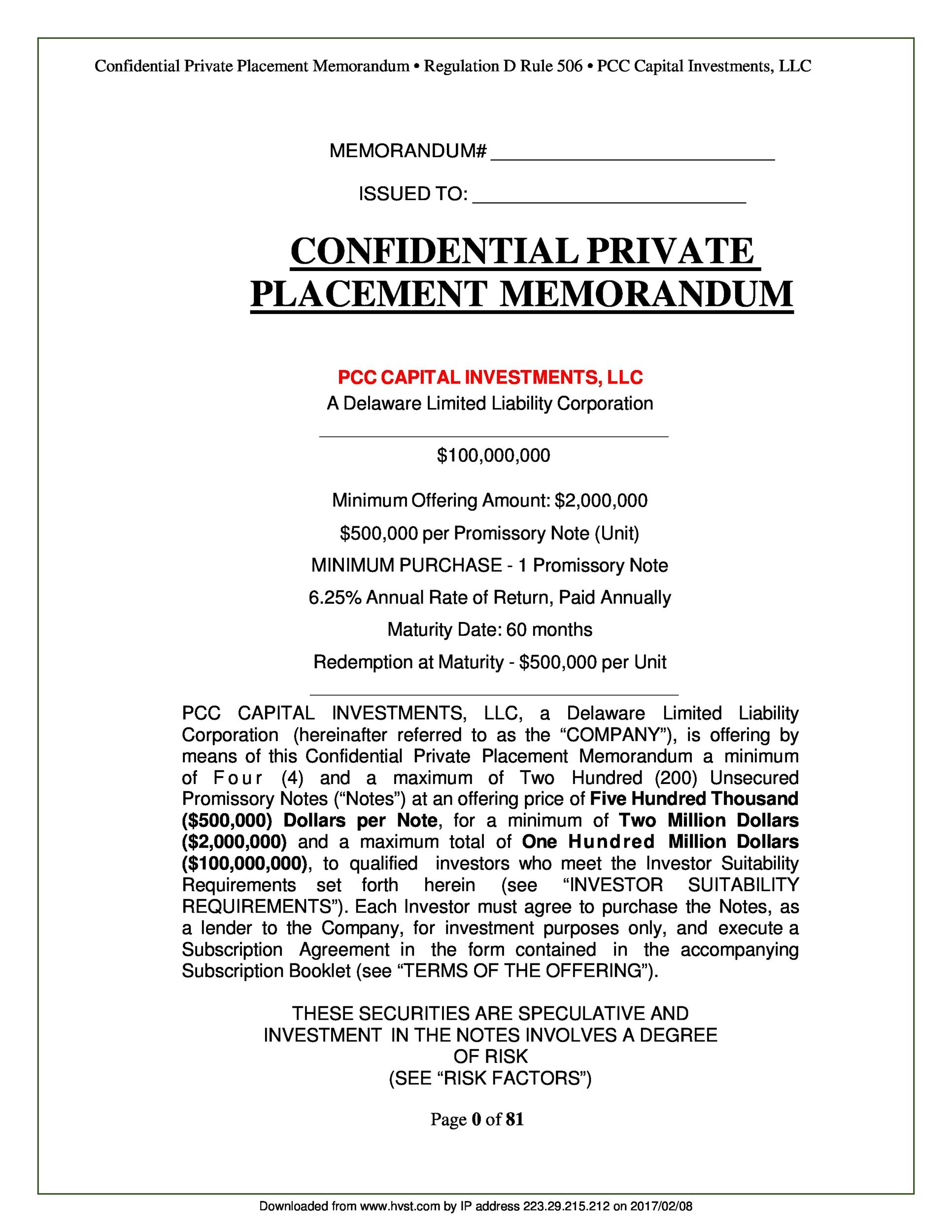

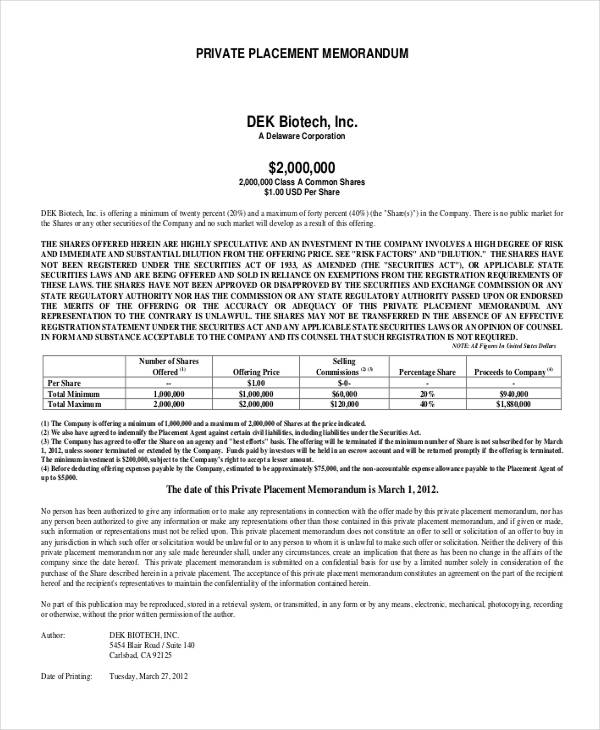

Although these placements are subject to the Securities Act of 1933, the securities offered do not have to be registered with the Securities and Exchange Commission if the issuance of the securities conforms to an exemption from registrations as set forth in the Securities Act of 1933 and the associated SEC rules put into effect.[3] Most private placements are offered under the Rules known as Regulation D. Different rules under Regulation D provide stipulations for offering a Private Placement, such as required financial criteria for investors or solicitation allowances.[4] Private placements may typically consist of offers of common stock or preferred stock or other forms of membership interests, warrants or promissory notes (including convertible promissory notes), bonds, and purchasers are often institutional investors such as banks, insurance companies or pension funds. Common exemptions from the Securities Act of 1933 allow an unlimited number of accredited investors to purchase securities in an offering. Generally, accredited investors are those with a net worth in excess of $1 million or annual income exceeding $200,000 or $300,000 combined with a spouse.[5] Under these exemptions, no more than 35 non-accredited investors may participate in a private placement.[6] In most cases, all investors must have sufficient financial knowledge and experience to be capable of evaluating the risks and merits of investing in a company.

Thomson Reuters provides annual and semiannual rankings of private placement agencies by capital raised.

^ Comptroller of the Currency Administrator of National Banks (March 1990). Private placements: Comptroller's Handbook (PDF). US Department of the Treasury. Retrieved 2009-06-13.

^ Securities and Exchange Commission (2006). Frequently Asked Questions About PIPES (PDF) (Report). p. 1. Retrieved 30 October 2020.

^ "Introduction to Private Placements". seclaw.com.

^ "Regulation D Offerings: 506B vs 506C". AccreditedInvestors.net.

^ "SEC.gov - Accredited Investors". sec.gov. 16 July 2012.

^ Morgan, Thomas; Lewis and Roca LLP (March 6, 2013). "Raising Capital - What You Don't Know Could Hurt You". The National Law Review. Retrieved March 17, 2013.

Content is available under CC BY-SA 3.0 unless otherwise noted.

Our website requires features that may not be fully supported by your current browser. Please try an other one.

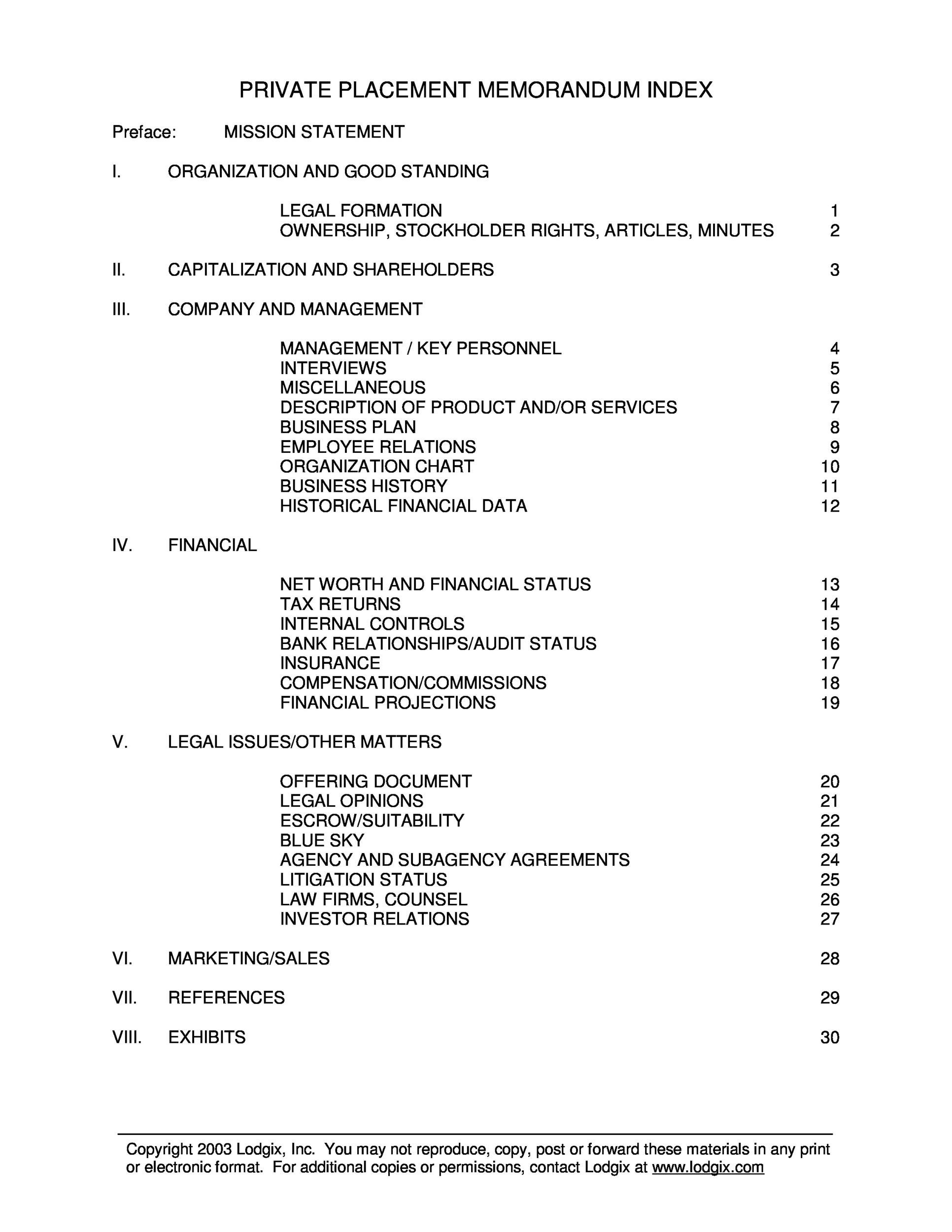

As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors. There may be as few as one investor for any issue.

The three most important features that would classify a securities issue as a private placement are:

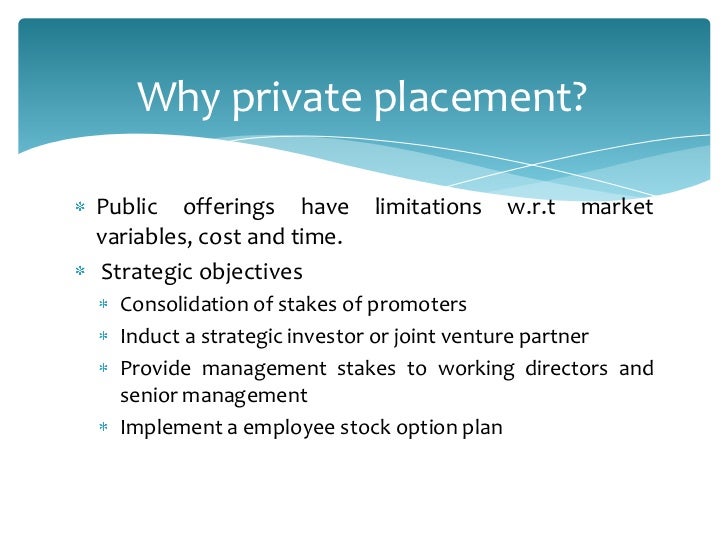

Companies, both public and private, issue in the private placement market for a variety of reasons, including a desire to access long-term, fixed-rate capital, diversify financing sources, add additional financing capacity beyond existing investors (banks, private equity, etc.) or, in the case of privately held businesses, to maintain confidentiality.

Since private placements are offered only to a limited pool of accredited investors, they are exempt from registering with the Securities and Exchange Commission (SEC). This affords the issuer the opportunity to avoid certain costs associated with a public offering as well as allows for more flexibility regarding structure and terms.

The most common type of private placement is long-term, fixed-rate senior debt, but there is an endless array of structuring alternatives. One of the key advantages of a private placement is its flexibility. Private placement debt securities are similar to bonds or bank loans and can either be secured, meaning they are backed by collateral, or unsecured, where collateral is not required. In addition to senior debt, other types of private placement debt issuances include:

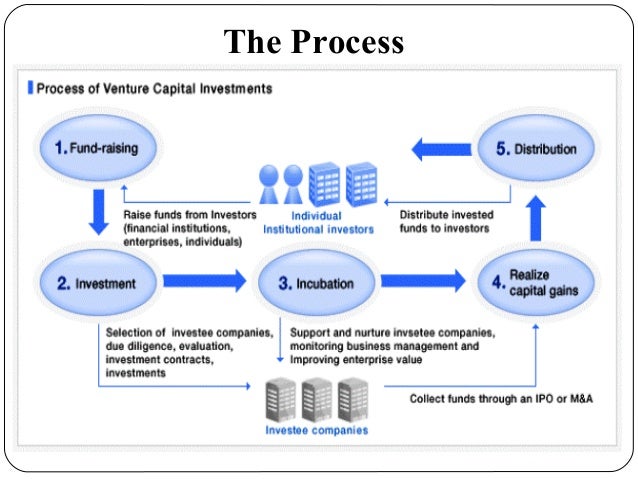

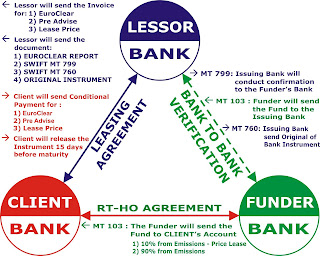

Traditionally, middle-market companies have issued debt in the private placement market through two primary channels:

A private placement issuance is a way for institutional investors to lend to companies in a similar fashion as banks, with a “buy-and-hold” approach, and with no required trading or public disclosures. Historically, insurance companies refer to investments as purchasing “notes,” while banks make “loans.”

Types of Capital Available to Businesses

When businesses are started, they are often funded by the owners or a family loan. However, as they grow, many companies are unable to finance all needs solely from internal cash flows. When capital needs exceed cash-on-hand, businesses can utilize the following types of capital:

Private placements present the following advantages:

Long-term capital is congruent with a company’s long-term investments. Thus, capital raised from issuing a private placement is most commonly used to support long-term initiatives versus short-term needs, such as working capital. Companies, both public and private, use the capital raised from private placements in the following ways:

Private placement debt is predominantly a fixed-income note that pays a set coupon, on a negotiated schedule. Private placements are priced similarly to public securities, where pricing is determined by the U.S. Treasury rate, with the addition of a credit risk premium.

Repayment of the principal can be accomplished in several ways, depending on the credit quality and needs of the issuer, such as sinking fund payments (amortization) or “bullets” as well as tailored/bespoke amortization. Interest is typically paid quarterly or semi-annually.

A private placement allows for tailored terms and structures to meet the specific financing needs of the issuer.

There are important considerations for a company when determining whether to issue a private placement. When choosing a private placement investor or lender, some key characteristics to look for are:

Ultimately, it is most important to find a private placement investor who can offer financing best fitted for the goals of your business. If you’re interested in issuing a private placement, Prudential Private Capital is here to help. View a private placement example.

*An investor is considered “accredited” if they meet minimum financial net worth qualifications as well as other requirements set by the federal government; They are considered to be more experienced and are the only investors allowed to purchase private placements. Being accredited should imply that the investor has the knowledge required to make prudent investment decisions but also that they can afford to take a loss should something go wrong.

Receive our latest perspectives on business issues, industry trends, and economic insights.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

We look forward to hearing from you.

Prudential is authorized to transact business in all U.S.states and the District of Columbia. Product availability varies by state and country. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide. © Copyright 2021 Prudential Financial, Inc., Newark,NJ USA. All rights reserved. Prudential Financial is a service mark of The Prudential Insurance Company of America, Newark, NJ, and its affiliates. Prudential Financial, Inc. of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Your personal information may be stored and processed in any country where PGIM has facilities or in which we engage service providers and if you provide Personal Information to us you consent to the transfer of that information to countries outside your country of residence, including the United States, which may have different data protection rules than those of your country.

Erotic Shooting

Daddys Soccerboy Porn

Outdoor Html

Open Tits

Big Tits Public

Private Placement Definition - investopedia.com

Private placement - Wikipedia

What is a Private Placement?

Private Placement