Private Ltd

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Ltd

Start Up Loans uses cookies on this website. Please visit our Cookie Policy to find out more or if you're happy to receive all cookies, please continue browsing.

Many start up businesses choose to operate as a private limited company. Unlike working as a sole trader or being in a partnership a limited company is a legal entity in its own right. It has a different structure and more complex requirements such as different tax and legal obligations.

The biggest different between going it alone as a sole trader and forming a limited company is that a limited company has special status in the eyes of the law. Part of a limited company’s definition is that it is incorporated – formally set up and registered with Companies House – and it issues shares to its shareholders.

Unsure what legal structure is right for your business? HMRC has a handy video that explains the different legal structures you can use when setting up your company:

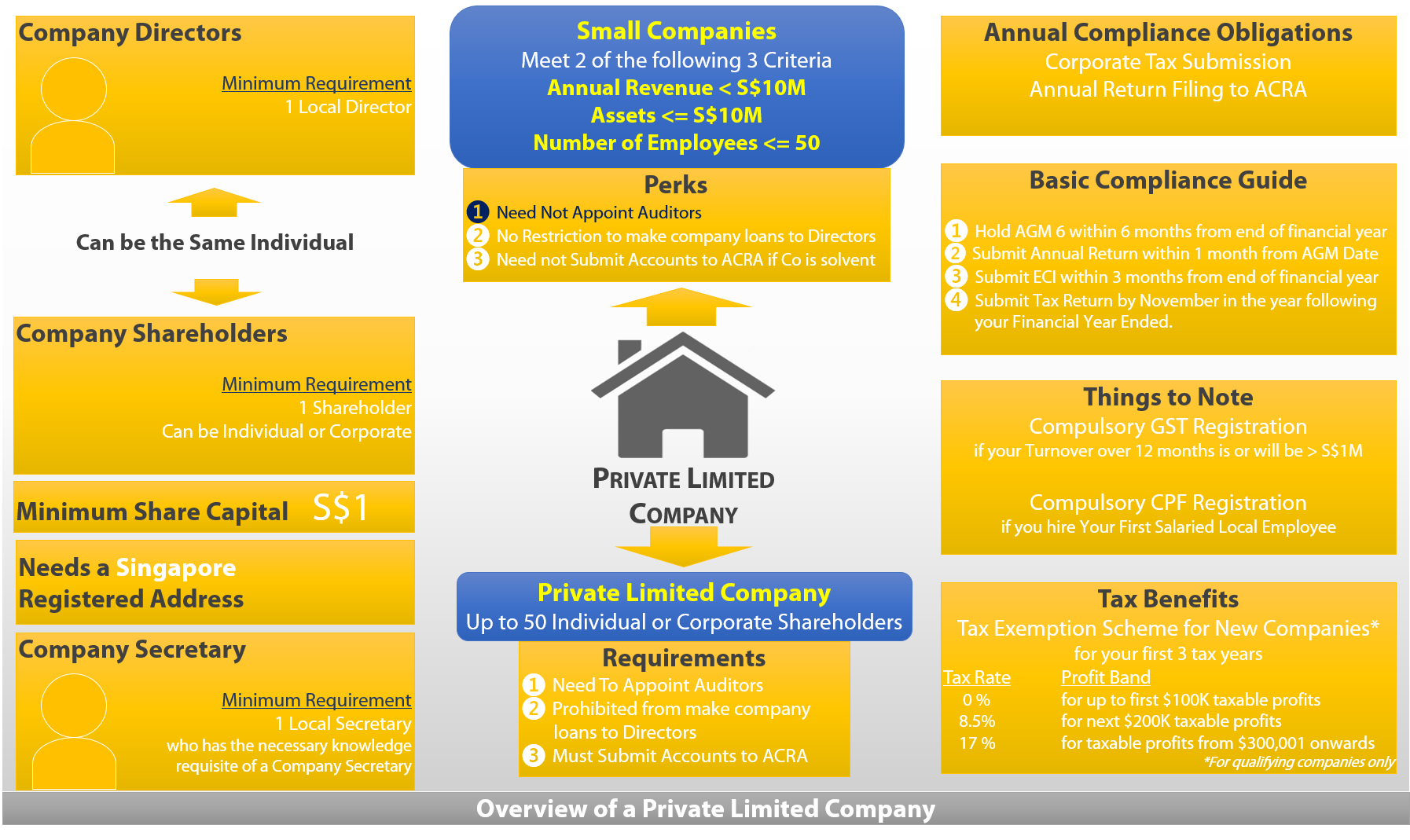

Limited companies can be private or public. Unlike a publicly limited company, where shares are traded on the stock exchange, a private limited company does not publicly trade shares and is limited to a maximum of 50 shareholders.

An example of a private limited company is often a local retailer, such as a shop or restaurant, that does not have a national presence. An example of a publicly limited company is a large corporation such as chain of retailers or restaurants with shares that anyone can buy and sell.

Most private limited companies are small as there is no minimum capital requirement to incorporate a limited company aside from the issuing of at least one share. Initial share capital is commonly around £100 and accounts filed with Companies House are usually modified accounts.

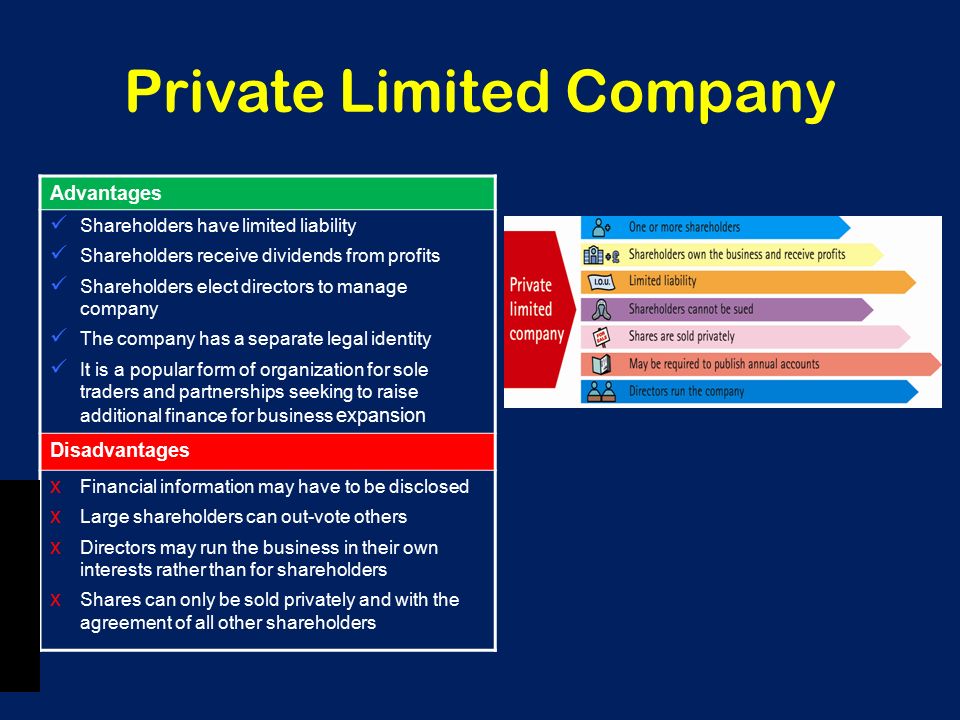

A private limited company is the most common form of UK company incorporation. It is set up directly by registering the company with Companies House. It operates as a distinct legal entity to its directors and shareholders – the company is an ‘individual’ in its own right. This means that all the business assets, liabilities and profits belong to the company itself and the shareholders are not wholly responsible for debts incurred by the company.

Being a director of a limited company is different to being self-employed or operating as a sole trader. A director of a private limited company is considered an employee of the company and, in the event of a legal dispute or problems with debt, it is the private limited company itself that is sued or pursued rather than the directors. This means if the company fails the director’s personal assets such as family home or savings are not at risk – unlike a sole trader, who is held personally accountable for any unpaid debts or legal bills arising from a dispute or insolvency. The shareholder’s liability is limited to the shares they hold in the business – hence the ‘limited’ part of the business structure name.

There are lots of characteristics of a private limited company that cover issues such as borrowing money, paying pensions, reporting business accounts, selling the business or raising capital, and how you pay yourself.

The owners of private limited companies are known as shareholders and each holds a certain number of shares in the business. This means you can set up a limited company yourself – you’d own 100% of all the shares – or with others, dividing the available shares between the shareholders.

To become a shareholder you must purchase one or more shares issued by the company and these are issued when you form the company with each share representing an equal percentage of the business. Additional shares can be created and issued after the business is incorporated and the more shares you hold, the larger the percentage of the business you own.

Directors – known as company officers – manage limited companies and they can be shareholders as well. A limited company must have at least one director and most company owners are directors – meaning you can own and manage a limited company yourself or with others.

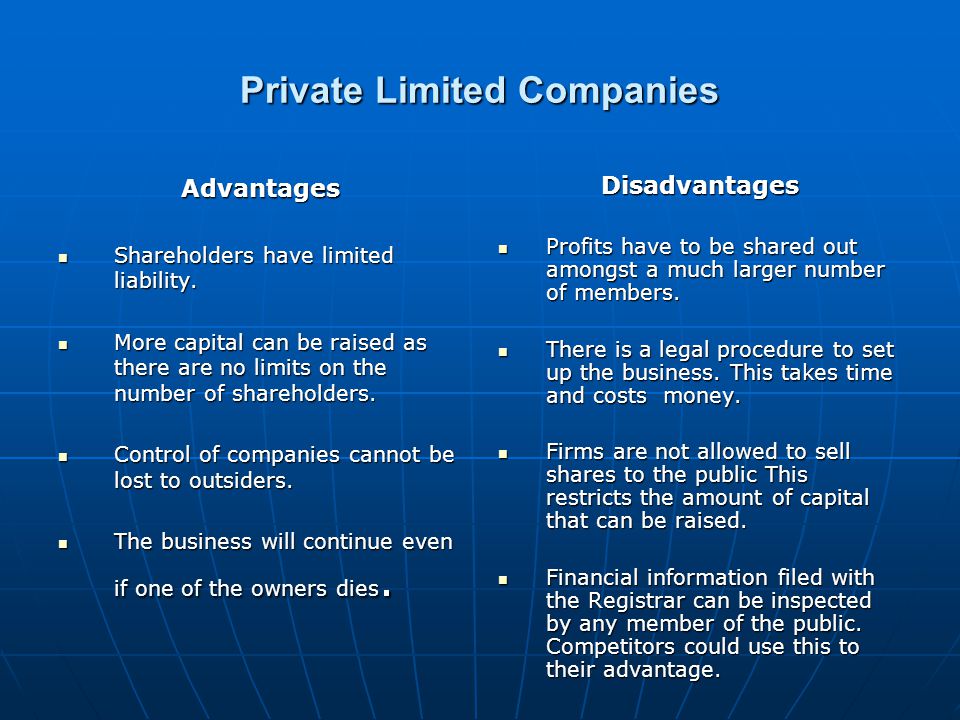

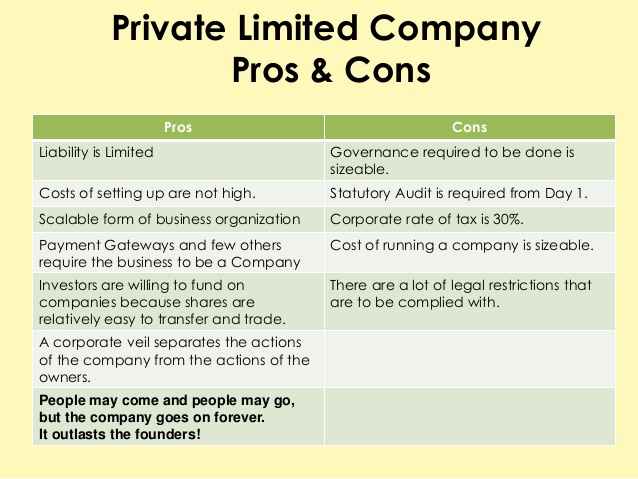

While setting up a limited company and operating it can be a time-consuming task with lots of requirements there are some clear advantages to setting up a private limited company.

Setting up and running a limited company is no small undertaking and while there are many benefits it’s worth noting the potential downsides to setting up a limited company.

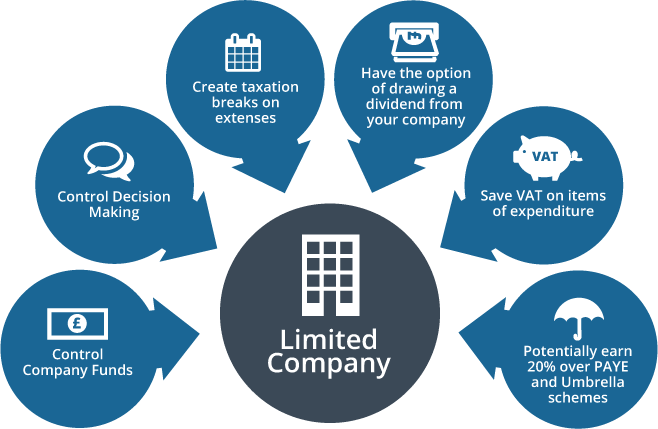

A private limited company must register with HMRC and pay corporation tax on any profits it makes within its financial year – and corporation tax is in addition to any income tax and National Insurance contributions (NICs) employees and directors must pay. A limited company can also pay dividends to shareholders and these are subject to income tax, though exempt from NICs. Payments to employees have to be made via PAYE and the company must as pay NICs to HMRC as part of an employee’s salary.

Employee salaries are classified as a business expense however and can be offset against profits along with all other expenses. This means that a limited company can pay staff, incur costs and purchase services from suppliers and still claim these as expenses to offset tax payable on the income the company generates. The company’s profit is then subject to corporation tax at the current rate of 20%.

Unlike a sole trader, limited companies have differences when it comes to pensions too. Employee pensions can be more generous in terms of benefits and limits – whereas a sole trader can only have a personal pension. However, a limited company has to consider pension arrangements for all employees.

Directors can also borrow from a limited company but be aware that there is a tax charge of 32.5% for loans that are not repaid within nine months of the year end.

Finally, accounts must be prepared annually for a limited company and filed with HMRC and Companies House, and accounts must meet accounting standards.

Loans are strictly for 18s and over. Personal loans for business use only. Finance is subject to status. Terms and conditions apply.

The Start-Up Loans Company is a wholly owned subsidiary of British Business Bank plc. It is a company limited by guarantee, registered in England and Wales, registration number 08117656, registered office at 71-75 Shelton Street, Covent Garden, London, England, WC2H 9JQ. British Business Bank plc is a development bank wholly owned by HM Government. British Business Bank plc and its subsidiaries are not banking institutions and do not operate as such. They are not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). A complete legal structure chart for the group can be found at www.british-business-bank.co.uk © 2021 British Business Bank plc

Private Limited Company | Characteristics, Advantages, etc. | LegalRaasta

What is a private limited company | The essential guide | Start Up Loans

Private company limited by shares | Словари и энциклопедии на Академике

What is a Private Limited Company? | The Formations Company

Private Limited Company: Advantage & Disadvantages(UPDATED)

All languages Abkhaz Adyghe Afrikaans Ainu Akan Altaic Aragonese Arabic Asturian Aymara Azerbaijani Bashkir Bagobo Belarusian Bulgarian Tibetan Standard Buryat Catalan Chechen Shor Cherokee Cheyenne Cree Czech Crimean Tatar language Old Church Slavonic Chuvash Welsh Danish German Dolgan Greek English Esperanto Spanish Estonian Basque Evenki Persian Finnish Faroese French Irish Scottish Gaelic Guaraní Klingon Alsatian Hebrew Hindi Croatian Hornjoserbska Haitian Hungarian Armenian Indonesian Inupiaq Ingush Icelandic Italian Japanese Lojban Georgian Kabyle Karachay Circassian Kazakh Khmer Korean Kumyk Kurdish Komi Kyrgyz Latin Luxembourgish Ladino Lingala Lithuanian Latvian Manchu Mycenaean Moksha Māori Mari Macedonian Komi Mongolian Malay Maya Erzya Dutch Norwegian Nahuatl Orok Nogai Ossetian Ottoman Turkish Panjabi Pāli Polish Papiamento Old Russian Portuguese Quechua Quenya Romanian, Moldavian Aromanian Russian Sanskrit Northern Sami Yakut Slovak Slovene Albanian Serbian Swedish Swahili Sumerian Silesian Tofalar Tajik Thai Turkmen Tagalog Turkish Tatar Tuvan Twi Udmurt Uighur Ukrainian Urdu Idioma urrumano Uzbek Vietnamese Veps Waray Yupik Yiddish Yoruba Chinese

All languages Abkhaz Adyghe Afrikaans Ainu Altaic Arabic Avaric Aymara Azerbaijani Bashkir Belarusian Bulgarian Catalan Chechen Chamorro Shor Cherokee Czech Crimean Tatar language Old Church Slavonic Chuvash Danish German Greek English Esperanto Spanish Estonian Basque Evenki Persian Finnish Faroese French Irish Galician Klingon Alsatian Hebrew Hindi Croatian Haitian Hungarian Armenian Indonesian Ingush Icelandic Italian Ingrian Japanese Georgian Karachay Kazakh Khmer Korean Kumyk Kurdish Latin Lingala Lithuanian Latvian Moksha Māori Mari Macedonian Mongolian Malay Maltese Maya Erzya Dutch Norwegian Ossetian Panjabi Pāli Polish Papiamento Old Russian Pashto Portuguese Quechua Quenya Romanian, Moldavian Russian Yakut Slovak Slovene Albanian Serbian Swedish Swahili Tamil Tajik Thai Turkmen Tagalog Turkish Tatar Udmurt Uighur Ukrainian Urdu Idioma urrumano Uzbek Votic Vietnamese Veps Yiddish Yoruba Chinese

Мы разработали для вас новый сервис!

Пользуясь Скидки.Академик.ру , вы поддерживаете Академик.ру!

A private company limited by shares , usually called a private limited company ( Ltd .) ( though this can theoretically also refer to a private company limited by guarantee ), is a type of company incorporated under the laws of England and Wales , Scotland , that of certain Commonwealth countries and the Republic of Ireland . It has shareholders with limited liability and its shares may not be offered to the general public , unlike those of a public limited company ( plc ).

" Limited by shares " means that the company has shareholders , and that the liability of the shareholders to creditors of the company is limited to the capital originally invested , i . e . the nominal value of the shares and any premium paid in return for the issue of the shares by the company . A shareholder ' s personal assets are thereby protected in the event of the company ' s insolvency , but money invested in the company will be lost .

A limited company may be " private " or " public ". A private limited company ' s disclosure requirements are lighter , but for this reason its shares may not be offered to the general public ( and therefore cannot be traded on a public stock exchange ). This is the major distinguishing feature between a private limited company and a public limited company . Most companies , particularly small companies , are private .

Private companies limited by shares are usually required to have the suffix " Limited " ( often written " Ltd " or " Ltd .") or " Incorporated " (" Inc .") as part of their name , though the latter cannot be used in the UK or the Republic of Ireland ; companies set up by Act of Parliament may not have Limited in their name . In the Republic of Ireland " Teoranta " (" Teo .") may be used instead , largely by Gaeltacht companies . " Cyfyngedig " (" Cyf .") may be used by Welsh companies in a similar fashion .

Every company must have formally appointed company officers at all times . By statute , a private company must have at least one Director and until April 2008 also had to have a Secretary ( see Companies Act 2006 ). The company ' s articles of association may require more than one director in any case , and frequently do . At least one director must be an individual , not another company .

Anybody can be a director , subject to certain exceptions . A person who is an undischarged bankrupt or who has been banned from being a company director by the court will also be restricted . Nor can a person be a director of a limited company if he or she is unable to consent to their appointment . From October 2008 , all directors must be at least 16 years old . This change will be applied retrospectively , with any directors under the age of 16 being removed from the register ( Companies Act 2006 ).

No formal qualifications are required to be a company secretary .

In Scotland the Registrar will not register the appointment of a director under the age of 16 years for any company , as such a child does not have the legal capacity to accept a directorship , under the Age of Legal Capacity ( Scotland ) Act 1991 .

Certain non - British nationals are restricted as to what work they may carry out in the UK .

As of October 2008 ( Companies Act 2006 ), it is no longer necessary to obtain a court order to withhold a director ' s address , as a Service Address can be supplied as well with the residential address being held as protected information at Companies House .

Limited Companies are formed with both an authorised share capital and an issued share capital . The authorised share capital is the total number of shares existing in the company multiplied by the nominal value of each share . Not all such shares may have been issued . The issued share capital is the same calculation in respect of all the issued shares .

A company incorporated in England and Wales can be created with any number of shares of any value , in any currency . For example , there may be 10 , 000 shares with a nominal value of 1p , or 100 shares each of £ 1 . In each case the share capital would be £ 100 .

Unissued shares can be issued at any time by the directors using a Form SH01 - Return of Allotment of Shares ( Pursuant to Companies Act , 2006 ) subject to prior authorisation by the shareholders .

Shares in a private company are usually transferred by private agreement between the seller and the buyer , as shares in a private company may not by law be offered to the general public . A stock transfer form is required to register the transfer with the company . The articles of association of private companies often place restrictions on the transfer of shares .

A company ' s first accounts must start on the day of incorporation . The first financial year must end on the accounting reference date , or a date up to seven days either side of this date . Subsequent accounts start on the day following the year - end date of the previous accounts . They end on the next accounting reference date or a date up to seven days either side .

To help companies meet this filing requirement , Companies House send a pre - printed " shuttle " form to its registered office several weeks before the anniversary of incorporation . This will show the information that has already given to Companies House . If a company ' s accounts are delivered late there is an automatic penalty . This is between £ 100 and £ 1 , 000 for a private company .

The first accounts of a private company must be delivered:

A company may change its accounting reference date by sending Form 225 to the Registrar .

Every company must have a registered office , which does not need to be its usual business address . It is sometimes the company ' s lawyers or accountants , for example . All official letters and documentation from the government departments ( including Inland Revenue and Companies House ) will be sent to this address , and it must be shown on all official company documentation . The registered office can be anywhere in England and Wales ( or Scotland if the company is registered there ). If a company changes its registered office address after incorporation , the new address must be notified to Companies House on Form AD01 .

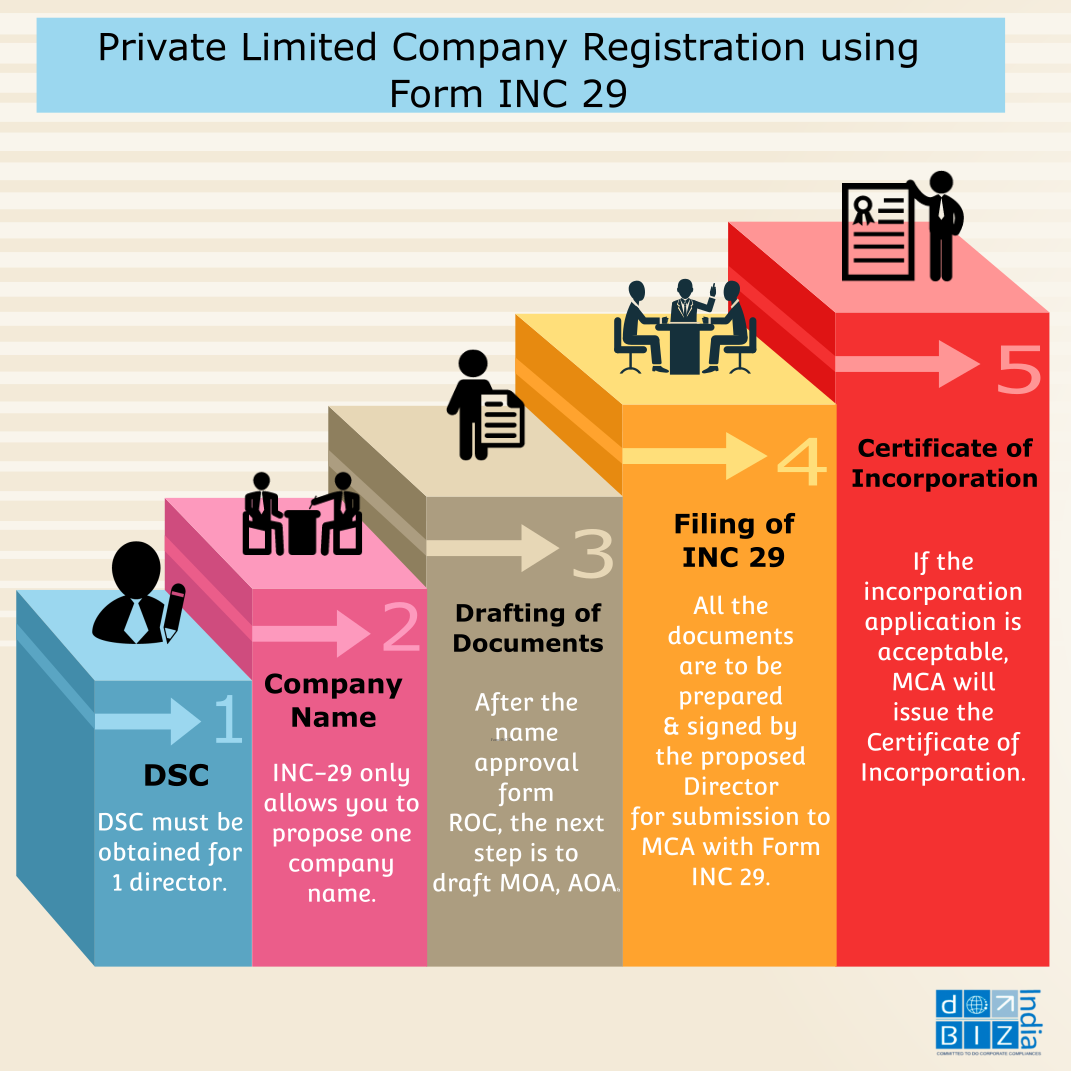

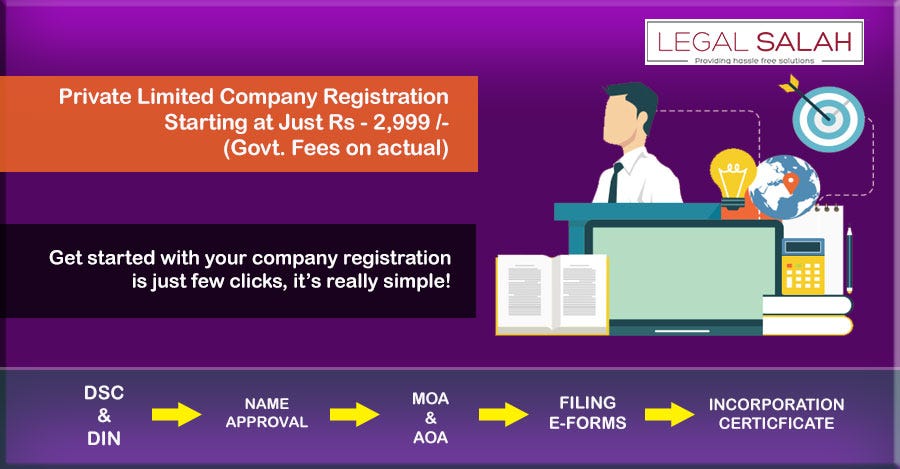

To incorporate a company in the UK ( other than Northern Ireland ) the following documents , together with the registration fee ( currently £ 20 ), must be sent to the Registrar of Companies:

The memorandum of association states the name of the company , the registered office and the company objectives . The objective of a company may simply be stated as being to carry out business as a general commercial company . The memorandum delivered to the Registrar must be signed by each subscriber in front of a witness who must attest the signature .

The articles of association govern the company ' s internal affairs . The company ' s articles delivered to the Registrar must be signed by each subscriber in front of a witness who must attest the signature .

Form IN01 states the first directors , the first secretary and the address of the registered office . Each director must give his or her name , address , date of birth , and occupation . Each officer appointed and each subscriber ( or their agent ) must sign and date the form .

In other jurisdictions companies must make similar applications to the relevant registrar — the Northern Ireland Registrar of Companies in Northern Ireland , the Companies Registration Office , Ireland in the Republic of Ireland , or the Registrar of Companies in India .

In reality it is far easier to contact one of the Company Registration services that can now form a company online without your written signature .

Private companies that have not traded or otherwise carried on business for at least three months may apply to the Registrar to be struck off the register . Alternatively , the company may be voluntarily liquidated .

A private company limited by shares and an unlimited company with a share capital may re - register as a public limited company ( PLC ). A private company must pass a special resolution that it be so re - registered and deliver a copy of the resolution together with an application form 43 ( 3 )( e ) to the Registrar .

Private company limited by guarantee — Companies law Company … Wikipedia

Company limited by guarantee — Aktie der Barnum Bailey Limited Limited Company ( deutsch: limited: beschränkt , hier: haftungsbeschränkt ; company: Firma ) wird im britischen Gesellschaftsrecht die nicht börsennotierte Aktiengesellschaft genannt . Die Limited Company ist in … … Deutsch Wikipedia

private company — Under the Companies Act 1985 , companies are incorporated as either private ( limited ) or public ( Plc ). They are distinguished by different standards of regulation in the Companies Act 1985 and other legislation . Public companies require a … … Law dictionary

private company — noun : a company under British law restricting the right of its stockholders to transfer their shares , limiting its members to 50 exclusive of shareholders who are present or former employees , and not inviting the public to subscribe for any … … Useful english dictionary

Company limited by guarantee — In British or Irish company law , a company limited by guarantee is an alternative type of corporation used primarily for non profit organisations that require legal personality . A guarantee company does not usually have a share capital , but … … Wikipedia

Centum Investment Company Limited — Type Public: NSE USE: ICDC Industry Equity Investments Founded 1967 Headquarters Nairobi , Kenya Key people … Wikipedia

Nottingham and District Tramways Company Limited — was a tramway operator from 1875 to 1897 based in Nottingham in the United Kingdom . Contents 1 Nottingham Tramways Company 1872 1875 2 Nottingham and District Tramways Company Limited 1875 1897 2 . 1 … Wikipedia

Limited — can refer to: * A private company limited by shares , a specific kind of limited company in Commonwealth of Nations commercial law ; often used as a suffix ( Mycompany , Limited or Mycompany , Ltd . ); formerly used for all limited companies . * A … … Wikipedia

Limited Liability Partnership — ( LLP ) ist eine Rechtsform der Personengesellschaften nach britischem / amerikanischem Recht . Am ehesten ist diese Gesellschaftsform mit einer ( im deutschen Recht nicht denkbaren ) Kommanditgesellschaft ohne Komplementär zu umschreiben . Der … … Deutsch Wikipedia

Limited company — Companies law Company … Wikipedia

AB · AG · ANS · A / S · AS · GmbH

K . K . · N . V . · Oy · S . A . · more

Сезон продаж BMW X5 2020 года bmw-premium-msk.ru Рекордные условия на BMW X5 2020 года. В наличии в РОЛЬФ-Премиум. Кредит от 5%. BMW в наличии Кредит от 2% Трейд-ин Сделка за 1 день Содействие в подборе финансовых услуг/организаций … Скрыть объявление

Overwatch Hard Porn

Pee On Live Fish Porno

Outdoor Surprise

Nyx Lingerie 08

Women Nude Outdoor