Private Loan

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Loan

Все языки Абхазский Адыгейский Африкаанс Айнский язык Акан Алтайский Арагонский Арабский Астурийский Аймара Азербайджанский Башкирский Багобо Белорусский Болгарский Тибетский Бурятский Каталанский Чеченский Шорский Чероки Шайенского Кри Чешский Крымскотатарский Церковнославянский (Старославянский) Чувашский Валлийский Датский Немецкий Долганский Греческий Английский Эсперанто Испанский Эстонский Баскский Эвенкийский Персидский Финский Фарерский Французский Ирландский Гэльский Гуарани Клингонский Эльзасский Иврит Хинди Хорватский Верхнелужицкий Гаитянский Венгерский Армянский Индонезийский Инупиак Ингушский Исландский Итальянский Японский Грузинский Карачаевский Черкесский Казахский Кхмерский Корейский Кумыкский Курдский Коми Киргизский Латинский Люксембургский Сефардский Лингала Литовский Латышский Маньчжурский Микенский Мокшанский Маори Марийский Македонский Коми Монгольский Малайский Майя Эрзянский Нидерландский Норвежский Науатль Орокский Ногайский Осетинский Османский Пенджабский Пали Польский Папьяменто Древнерусский язык Португальский Кечуа Квенья Румынский, Молдавский Арумынский Русский Санскрит Северносаамский Якутский Словацкий Словенский Албанский Сербский Шведский Суахили Шумерский Силезский Тофаларский Таджикский Тайский Туркменский Тагальский Турецкий Татарский Тувинский Тви Удмурдский Уйгурский Украинский Урду Урумский Узбекский Вьетнамский Вепсский Варайский Юпийский Идиш Йоруба Китайский

Все языки Русский Персидский Испанский Иврит Немецкий Норвежский Итальянский Суахили Казахский Нидерландский Хорватский Датский Украинский Китайский Каталанский Албанский Курдский Индонезийский Вьетнамский Маори Тагальский Урду Исландский Венгерский Хинди Ирландский Фарерский Португальский Французский Болгарский Турецкий Словенский Польский Арабский Литовский Монгольский Тайский Пали Македонский Корейский Латышский Грузинский Шведский Румынский, Молдавский Японский Чешский Финский Сербский Словацкий Гаитянский Армянский Эстонский Греческий Английский Латинский Древнерусский язык Церковнославянский (Старославянский) Азербайджанский Тамильский Квенья Африкаанс Папьяменто Мокшанский Йоруба Эрзянский Марийский Чувашский Удмурдский Татарский Уйгурский Малайский Мальтийский Чероки Чаморро Клингонский Баскский

Перевод:

с английского на русский

с русского на английский

С русского на:

Английский

С английского на:

Все языки Испанский Русский

а ) ( заем , предоставленный частным лицом , а не в рамках государственной кредитной программы )

б ) ( заем , полученный частным лицом , а не государственным учреждением )

Книги

Challenges of the Housing Economy . An International Perspective , Michael White . This timely book addresses key challenges faced by policy makers and the house - building industry in a post - credit crunch world . It examines the implications for households , the housing … Подробнее Купить за 10269 . 66 руб электронная книга

M & A . A Practical Guide to Doing the Deal , Jeffrey Hooke C .. The comprehensive M & A guide , updated to reflect the latest changes in the M & A environment M & A , Second Edition provides a practical primer on mergers and acquisitions for a broad base of … Подробнее Купить за 7154 . 35 руб электронная книга

Private Debt . Opportunities in Corporate Direct Lending , Stephen Nesbitt L .. The essential resource for navigating the growing direct loan market Private Debt: Opportunities in Corporate Direct Lending provides investors with a single , comprehensive resource for … Подробнее Купить за 3898 . 47 руб электронная книга

Другие книги по запросу « private loan » >>

Мы разработали для вас новый сервис!

Пользуясь Скидки.Академик.ру , вы поддерживаете Академик.ру!

Private Activity Bond — In general , a private activity bond is a bond issued by or on behalf of local or state government for the purpose of financing the project of a private user . Section 141 ( a ) of the Internal Revenue Code provides that the term private activity bond … Wikipedia

Private money investing — is the reverse side of hard money lending , a type of financing in which a borrower receives funds based on the value of real estate owned by the borrower . Private Money Investing (“ PMI ”) concerns the SOURCE of the funds lent to hard money … … Wikipedia

Private student loan ( United States ) — Private Student Loans A private student loan is a financing option for higher education in the United States that can either supplement or replace federally guaranteed loans such as Stafford loans , Perkins loans and PLUS loans . These are … … Wikipedia

Private equity in the 21st century — relates to one of the major periods in the history of private equity and venture capital . Within the broader private equity industry , two distinct sub industries , leveraged buyouts and venture capital experienced growth along parallel although … … Wikipedia

Private equity in the 1990s — relates to one of the major periods in the history of private equity and venture capital . Within the broader private equity industry , two distinct sub industries , leveraged buyouts and venture capital experienced growth along parallel although … … Wikipedia

Private money — is a commonly used term in banking and finance . It refers to lending money to a company or individual by a private individual or organization . While banks are traditional sources of financing for real estate , and other purposes , private money is … … Wikipedia

Loan modification in the United States — Loan modification , the systematic alteration of contactual mortgage loan agreements , has been practiced in the United States since the 1930s . During the Great Depression loan modification programs took place at the state level in an effort to … … Wikipedia

private mortgage insurance — n: insurance that a lender may require a borrower to purchase to cover losses in the event of default of a residential loan esp . when the borrower is giving the lender a mortgage on property in which the borrower has less than 20 percent equity … … Law dictionary

loan notes — Debt securities or instruments . They may be offered by a buyer or bidder , often as an alternative to cash in a takeover and can be a useful method , subject to the satisfaction of certain conditions , of enabling a selling shareholder to defer any … … Law dictionary

loan note — Debt securities or instruments . They may be offered by a buyer or bidder , often as an alternative to cash in a takeover and can be a useful method , subject to the satisfaction of certain conditions , of enabling a selling shareholder to defer any … … Law dictionary

private label pool — private pool , private label pool Mortgage backed securities not issued by or guaranteed by a U . S government agency or U . S . government sponsored enterprise . The mortgage loans comprising private pools are generally loans that do not meet GNMA ,… … Financial and business terms

Private loan · LHV

private loan — с английского на русский

3 Ways to Get a Personal Loan From a Private Lender - wikiHow

What Is a Private Student Loan ? - NerdWallet

Private Loans I Need a Loan

We use cookies to make wikiHow great. By using our site, you agree to our cookie policy . Cookie Settings

Understand the difference between private lenders and public lenders. Private lenders are not banks, financial institutions, or credit unions. Instead, private lenders are non-institutional lenders who as companies or individuals loan money to others. Those who receive loans from private lenders are typically awarded money based on their relationship with the private lender. [1]

X

Research source

Distinguish private lender personal loans from other types of loans. Private lender loans are provided without the borrower having to specify what that the personal loan money will be spent on. In contrast, loans from public lenders are typically categorized by the loan’s use, i.e., mortgage loans, student loans and auto loans. [2]

X

Research source

Note that a personal loan is very different from a payday loan. Payday loans are very short-term, very high interest loans (sometimes interest rates can be as high as 700%), and typically involve no credit check. These loans are intended to provide financing until the next paycheck is due. A personal loan, on the other hand, typically has a longer-term, as well as much lower interest rates, and may involve some form of credit examination. While both of these can be offered by private lenders, payday loans should be be avoided due to high interest and massive fees for late repayment.

There are two basic types of private lender loans; those secured by collateral, and unsecured private loans.

Unlike most public loans, private personal loans are typically secured by a deed of trust or note, in order to ensure repayment to the lender, and typically have higher interest rates than other types of loans.

Learn the benefits of seeking a private personal loan. There are multiple benefits to seeking a private personal loan as opposed to a traditional bank loan. Typically, if you have poor credit or difficulty attaining a traditional bank loan, a personal loan from a private lender should be explored as a means to obtain credit.

Possibility of approval with a poor credit score : Traditional banks have a loan granting process that heavily factors in credit score. This is due to the fact that banks are often regulated and therefore have stricter lending practices in order to meet their obligations to depositors. Private lenders have no such obligation, and therefore can lend regardless of your credit score.

Fast approval process : If you need money quickly, traditional bank loans can often have an onerous and time consuming application process. Loans from private lenders, on the other hand, can often only take a couple of days to move from processing to approval and funding. [3]

X

Research source

Generally easier approval : Loan applications to traditional banks are not just denied due to poor credit. They can also be denied due to other factors, like self-employment. Private lenders are more likely to grant approval in these situations as long as you can demonstrate income, and/or have assets to use as collateral.

More affordable than credit cards : While a personal loan from a private lender is typically more costly than one from a bank, they are typically cheaper than the most easily approved form of bank credit — credit cards.

Consider the risks of obtaining a personal loan from a private lender. Like any financial decision, a careful consideration of the risks is absolutely essential before proceeding. Some of the major risks involved with obtaining credit from a private lender include:

Loans from private lenders are more costly : This is the major risk. A private lender does not have access to cheap funds in the same way a bank does, which means loans are more costly. For example, a personal loan from a bank may cost 6% annually, whereas a private lender may have rates at 10% to 17%. This can lead to significantly higher costs over time. [4]

X

Research source

Payback periods may be shorter : Lenders may be less generous in terms of payback period, and as a result you may observe higher monthly payments in addition to steeper interest rates. This is because these lenders typically want a fast return on their investment.

Consider whether you have collateral to secure a private loan. Private lenders such as businesses very often require borrowers to present collateral as a means to secure the loan. Securing a loan means that there is something of value that the private lender gains ownership and control over if the borrower does not pay of the loan.

A deed of trust, along with a promissory note, are presented by a borrower as a means of providing collateral to secure a private loan. [5]

X

Research source

A deed of trust allows you to use real property, such as your home, as collateral to secure your obligations under the private loan.

Trust deeds are always accompanied with a promissory note, which outlines the terms of the loan agreement and the amount of the private loan. The note is signed by the owner of the property underlying the deed, and contains a promise to repay the private loan.

A third party, such as a broker or title company, acts as trustee to the deed and has legal ownership over the property/collateral. The trustee cannot control the property as long as the borrower fulfills his obligations under the loan agreement.

If the borrower defaults, it is the trustee who has to power to sell the property and dispenses the proceeds to the lender.

Trustees are not required on all private loans. For example, family or personal loans rarely have a trustee, although the lender may have to use courts to foreclose on collateral, depending upon terms of the loan.

Determine if the return on your purchase makes the cost worthwhile. The high cost of a private loan means you should ask yourself if what you are using the loaned money for is worth the additional cost.

For example, using such a loan to fund consumption (things like leisure spending, which offers a 0% return) may be unwise, whereas using it to fund an investment such as business supplies or education that can generate a return can make the use of private lending worthwhile.

Examine if cash can be used to fund some or all of the purchase. If the return on the purchase does indeed make the cost worthwhile, examine if it can be partially funded using existing savings, or if money can be saved over time to fund the purchase.

This can reduce interest costs through potentially smaller loans, or prevent the need for a loan all together. Seriously consider cash as an option if you intend to make a consumption-based purchase (like a vacation or a new television), that offers no return.

Evaluate alternatives to traditional bank loans. Follow up on more advantageous loan options and/or loan alternatives before going with a private personal loan, which could have higher interest rates, stricter repayment terms and greater up-front costs than alternative lending options. [6]

X

Research source

Consider opening a line of credit, or a merchant cash advance if you are looking to borrow funds to purchase goods and supplies for your business. While good credit may play a large role in the ability to access these types of loan, it is possible to get a loan with poor credit .

Consider using a credit card instead of a personal loan if you need money for a one-time expense, such as a dental visit, or to cover the costs of a trip.

Public loans can be accessed from a wide assortment of sources including the federal government, banks and financial institutions, local chambers of commerce, as well as from non-traditional private lenders.

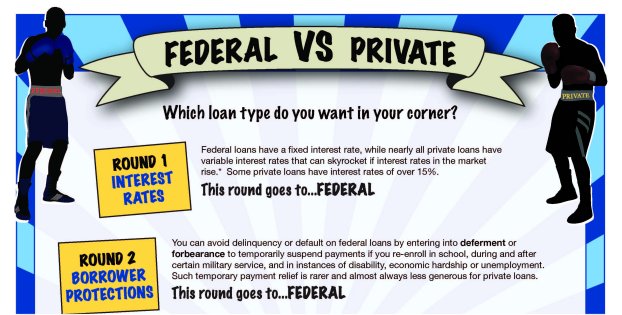

Historically, public loans from federal funds or subsidized programs typically come with more favorable terms, such as significantly lower, fixed interest rates.

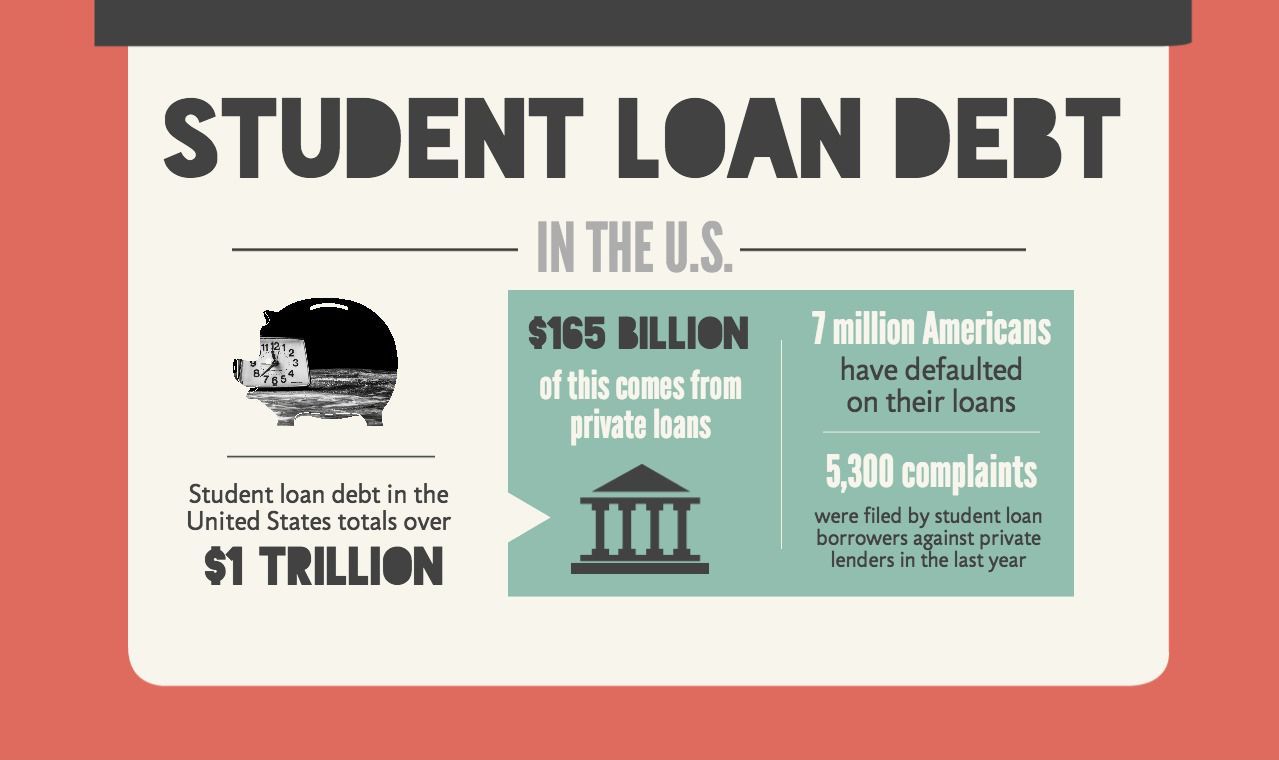

Consider public student loan options before resorting to a private lender personal loan. A private lender personal loan should be the last option you utilize when looking for money to pay for your education. Federal student loans can be accessed by simply submitting a FASFA application online , while the process for locating private lender loans can be more onerous. [7]

X

Research source

Federal student loans are a more attractive borrowing option because they come with significantly lower interest rates than private lender loans. Federal student loans have fixed interest rates ranging from 3%–8%, and the set interest rate is based on the loan type and use.

Private lender loans can have widely varying interest rates, but undoubtedly will be higher than 7%. While federal student loan interest rates are set in stone by Congress, the interest rate extended in a private lender loan is completely up to the lender.

Understand the available private lender personal loan options. Private lenders can be both individuals and companies. Common private lenders can be friends, family, business acquaintances, or any other person interested in making an investment in the form of a loan. Private lender companies include specialized private lenders, venture capital firms, investment firms, as well as peer-to-peer lenders. [8]

X

Research source

Focusing on private lender companies that have been accredited and approved by governments and/or business and trade organizations is a good place to start your private lender search.

After becoming aware of all the various places to get private lender personal loans, it is important to explore each and every option in search of the best deal. Get quotes from at least five separate businesses before selecting one, and do not be afraid to negotiate. Do not assume that an initial quote is a final offer, and typically rates can be talked down, especially if you can demonstrate another lender offers better rates. In addition, offer collateral if possible, this can often reduce rates significantly.

Websites like Bankrate.com and CreditKarma.com are excellent websites to compare rates.

Contact friends, family and business acquaintances. The great thing about private lender personal loans is that they don’t have all of the pomp and circumstance that comes with traditional bank loans. In fact, in order to have an oral private personal loan agreement, all it takes is for a person you know to agree to loan you money. However, if a friend, family member or business acquaintance has agreed to lend you money, you should make sure to have the agreement contained in a written contract that outlines the loan amount and terms of repayment. [9]

X

Research source

When pursuing private loans from people that you know, you should approach the situation as a negotiation and business interaction. This means that you should have documentation of your credit worthiness available in case they ask to see it.

Be flexible about the loan amount and agreement terms. Doing so could potentially result in you having a low, or even no interest rate.

Be aware that failure to repay this loan to your friend, family member, or business acquaintance may damage your relationship to this person.

Collect proof of creditworthiness, income and asset documentation. Borrowers need to be prepared to make sure that they look as creditworthy as possible. You should have the ability to show continuous sources of income, savings and physical assets that can be used to secure the debt. [10]

X

Research source

Explore specialized private lender options. Specialized private lenders are companies that are in the business of extending personal loans. Check with your local Better Business Bureau for the specialized private lender companies operating in your community that extend personal loans. [11]

X

Research source

Better Business Bureau

Explore peer-to-peer lender websites. In recent years peer-to-peer lender companies such as Prosper have been popping up online. These companies allow potential borrowers to create a profile and list the loan amount they require. Members act as lenders deciding to contribute small or large amounts as a means to fund the loan. The peer-to-peer company collects the donated money and dispenses the proceeds to the lender, who then pays it back directly to the company. [12]

X

Research source

These sorts of lenders typically have fairly stringent standards in terms of credit and income. If you are approved, however, you are then assigned to a risk category, and then an interest rate is offered based on your level of risk. Credit standards, however, may still be less stringent then traditional banks, so this option should be explored. [13]

X

Research source

Peer-to-peer lending allows you to obtain your money very quickly relative to a traditional bank (often on the same day).

The two dominant peer-to-peer lending sites in the U.S. are Prosper and Lending Club. Simply visit their websites to receive instructions on opening an account, or research other peer-to-peer lenders online.

I live with family and I work part time and my husband is on benefits. Could we still be accepted for a private loan?

Some lenders may publicize their lending requirements. If not, a conversation with the lender prior to application is warranted. Lenders do not want to go through the expense of underwriting a loan that is unlikely to occur.

How do I tell other people about a positive experience with a private lender?

Use online review services like Yelp! and Google Places to review local private lenders.

What can I do if my credit score has dropped so low that I can't get a loan?

Borrow money from personal lenders and build your credit.

Can I get a private loan for home renovations?

I want to purchase a property worth $250,000, but my aunt is selling to me for $90,000. The house is rented. I'm retired - can I qualify for a personal loan using the property as a collateral?

As you have described it, this sounds like a situation in which a lender might well be interested in extending a loan. Specific conditions, however, could discourage a lender from doing so. Contact your preferred lender for details.

I need to know if there's a way I can borrow a small amount. I'm unemployed and I'm going through a lawsuit, which is not my fault, but I'm suing and it's going to mediation--plus I'm waiting to be approved for my disability, which I was declined for twice, but now I have to appear in front of the judge. What can I do?

You are a credit risk to the Nth degree. You don't have a source of income and you're trying to get on disability. Your best bet: reach out to your family.

Does this work at an international level or national, and what are the minimum and maximum loans offered? Also, how long does it take to get a loan?

Policies on maximum amounts and international lending are specific to each private lender. For example, one lender might cap personal loans at $15,000 while another might offer up to $35,000 to qualified borrowers.

Can I have a loan for a personal problem?

Yes, depending on your income, credit, etc. you should be able to get a personal loan. However, if you have poor credit, low income, etc., you may have more difficulty securing a loan.

What is the best way to get a loan to purchase a house?

Mortgage loans are distinct from personal loans. The best way to obtain a mortgage loan is to work with a financial institution like a bank or credit union. If you are having trouble qualifying for a loan, you may be able to take advantage of programs offered by the Federal Housing Administration (FHA), which can make home ownership more affordable.

Where can I obtain a loan using my future federal income taxes?

You can obtain a loan known as a tax refund advance from the tax preparation service you use to file your taxes. You will receive the loan as soon as your taxes are accepted by the IRS. You then forfeit your return to the tax preparation service in exchange for the advance.

Can I get an instant, online, emergency loan to help pay for my child's education in a Kenyan high school? An organization or a private lender is fine with me. I just need help.

How do I get a personal loan to buy out a coowner?

How do I get a loan for a car wreck settlement?

Can I refinance out of foreclosure or get a second mortgage to pay arrears and reinstate the original loan?

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 214,112 times.

"There is lots of information in this article. It is presented logically, is clearly written, and easy to understand. In addition to explaining private lenders, there is good advice on subjects to be considered before deciding on a loan. Well done." ..." more

Helpful how-tos delivered to your inbox every week!

By signing up you are agreeing to receive emails according to our privacy policy.

Last Updated: March 29, 2019

References

Approved

More than a few individuals and families need personal loans from time to time, but not all people know how to go out into the lending market in order to access the money that they need. In fact, most people don’t even consider personal loans as an option, instead deciding to rack up credit card debt. However, personal loans often come with lower interest rates than credit cards, and are surprisingly easy to access. Some good, timely advice on solid lending procedures can help inexperienced borrowers get a personal loan from a private lender in order to better their overall personal financial situation.

Conte Elegant Lingerie

Youporn Com Lesbian Sex

Granny Eating

Porn Film Double Penetration

Porn Hardcore Retro

h_647" width="550" alt="Private Loan" title="Private Loan">al_c" width="550" alt="Private Loan" title="Private Loan">q_80/file.png" width="550" alt="Private Loan" title="Private Loan">

h_647" width="550" alt="Private Loan" title="Private Loan">al_c" width="550" alt="Private Loan" title="Private Loan">q_80/file.png" width="550" alt="Private Loan" title="Private Loan">