Private Limited Liability Company

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

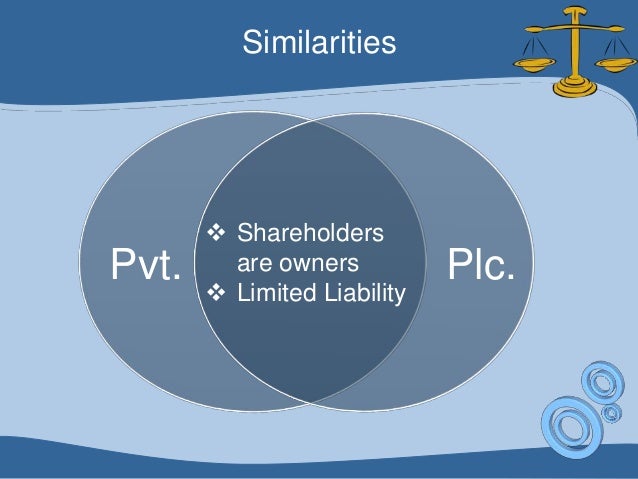

Combining the aspects of both partnerships and corporations

Home › Resources › Knowledge › Strategy › Limited Liability Company (LLC)

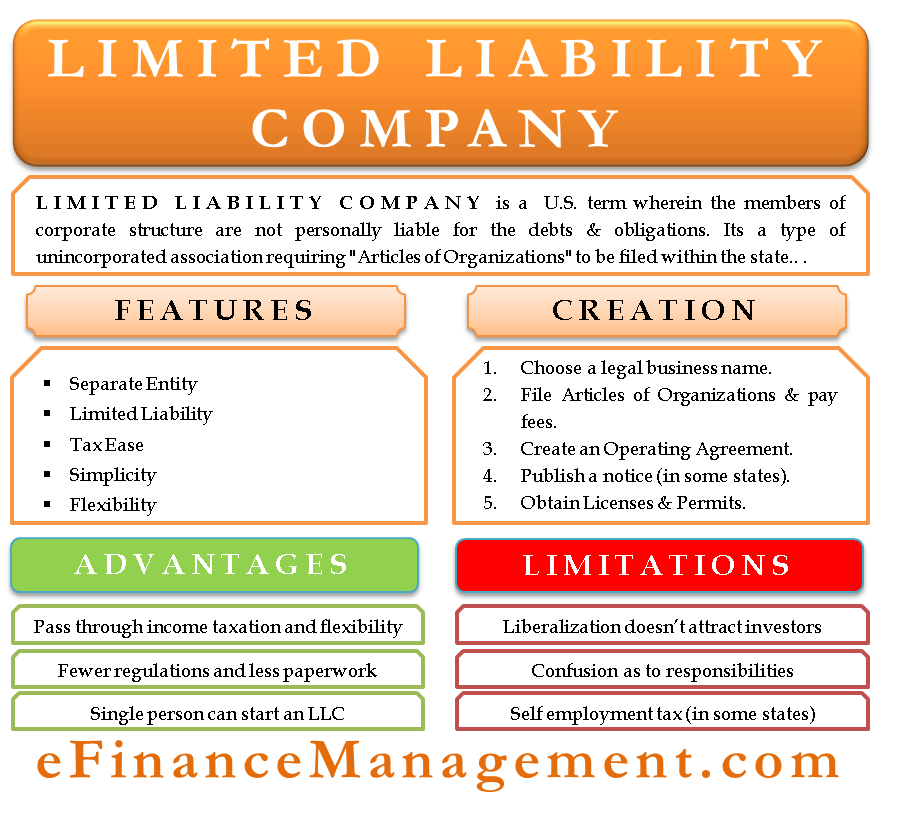

A limited liability company (LLC) is a business structure for private companies Privately Held Company A privately held company is a company’s whose shares are owned by individuals or corporations and that does not offer equity interests to investors in the form of stock shares traded on a public stock exchange. in the United States, one that combines aspects of partnerships General Partnership A General Partnership (GP) is an agreement between partners to establish and run a business together. It is one of the most common legal entities to form a business. All partners in a general partnership are responsible for the business and are subject to unlimited liability for business debts. and corporations. Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial institutions. Limited liability companies benefit from the flexibility and flow-through taxation of partnerships and sole proprietorships, Proprietor Proprietor means to have ownership of something. Sole proprietorship is the simplest form of business where one person owns the business. while maintaining the limited liability status of corporations.

If you’re looking to start a company, make sure to check out CFI’s introduction to corporate finance course !

Limited liability companies offer flexibility and protection. This makes the corporate structure appealing to business owners. Rather than shareholders, Stakeholder vs. Shareholder The terms “stakeholder” and “shareholder” are often used interchangeably in the business environment. Looking closely at the meanings of stakeholder vs shareholder, there are key differences in usage. Generally, a shareholder is a stakeholder of the company while a stakeholder is not necessarily a shareholder. business owners of limited liability companies are referred to as members.

An LLC can choose between different tax treatments. They can choose to adopt the tax regime of sole proprietorships, partnerships, S corporations, or C corporations. This provides the company with the option of being treated as a flow-through entity, so long as it does not choose to be treated as a C corporation.

The income of a flow-through entity is treated as the income of its owners. That means that owners of an LLC are able to avoid double taxation. With double taxation, income gets taxed both at the corporate level and also when distributed as dividends Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend. to owners. With an LLC, income is only taxed at an individual member level, rather than at the company level.

If the company chooses to be taxed as a partnership, its income can be allocated across members in forms other than ownership percentage. Members agree upon this in the operating agreement.

The operating agreement of the company acts in a way similar to the bylaws of a corporation. Below is a comparison of terms between an LLC and a corporation:

The document governs the company’s finances, organization, structure, and operations. Unlike corporations that are required to appoint officers or a board of directors Board of Directors A board of directors is a panel of people elected to represent shareholders. Every public company is required to install a board of directors. , an LLC is more flexible with its management structures Corporate Structure Corporate structure refers to the organization of different departments or business units within a company. Depending on a company’s goals and the industry . This, too, is decided on and stated in the operating agreement.

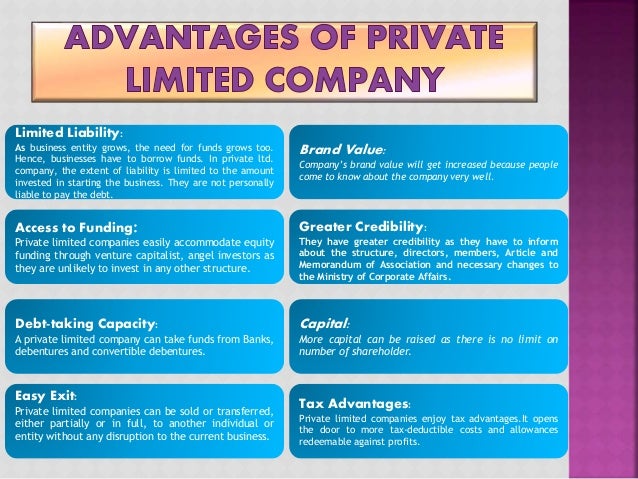

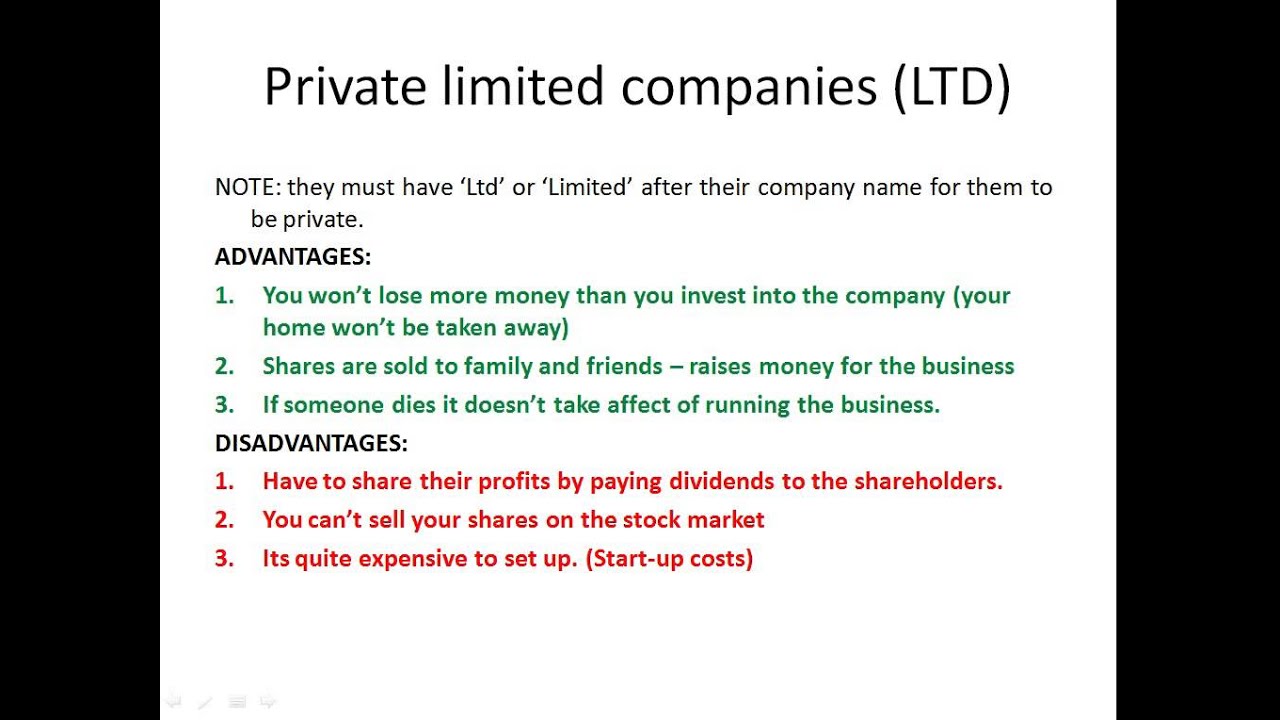

Limited liability companies additionally benefit from the advantages of corporations. The largest benefit is the company’s limited liability status. The company exists as its own legal entity. This protects members and owners from being held personally liable for the operations and debts of the business.

A simple example would be if an employee of the company is found conducting illegal environmental activities. Legal action can be threatened against the company to pay for damages. The court can go after the assets of the firm, but not the owners, to pay for the damages. The exception would be if the owner was aware of the illegal activities and continually allowed them to happen.

The main disadvantages of limited liability companies are the fees and taxes associated with the business structure. However, as LLCs are governed differently by each state, regulations also become a disadvantage.

Though owners of a limited liability company benefit by avoiding double-taxation, they are required to pay self-employment taxes. These taxes are paid twice as the owner is both the employee and the employer.

Some states also demand an annual fee for the limited liability benefits that LLCs provide their members. This fee is sometimes referred to as a franchise tax. For example, the state of California charges an $800 annual fee that increases with net income Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through for limited liability companies.

As mentioned previously, an LLC is governed by state law, which can drastically change how the company behaves in different scenarios. As an example, when a member of the limited liability company passes away, some states may dissolve the company. In other states, the company will continue to exist and the deceased member’s membership shares are passed to their executor.

These cases show the default resolutions set by the state. Members of an LLC can decide how they want the company to proceed in situations such as the above, and note it in the operating agreement. As you can see, the operating agreement is a critical document that members should not ignore when creating the company.

It is also important to consider how the company might function in international markets. For example, an American LLC is likely to be treated as a corporation in Canada, as the distinction between the two is not recognized in Canada.

Looking into starting a business? Corporate Finance Institute offers other resources that will help you expand your knowledge and achieve your goals. Check out the CFI links below:

Learn to perform Strategic Analysis in CFI’s online Business Strategy Course ! The comprehensive course covers all the most important topics in corporate strategy!

From Wikipedia, the free encyclopedia

"LLC" redirects here. For other uses, see LLC (disambiguation) .

This article is about the United States of America-specific business entity form. For limited liability companies, see Limited company . For a general discussion of entities with limited liability, see Private limited company .

This section possibly contains original research . Please improve it by verifying the claims made and adding inline citations . Statements consisting only of original research should be removed. ( February 2021 ) ( Learn how and when to remove this template message )

This use of tax residence and citizenship may be confusing or unclear to readers . Please help clarify the use of tax residence and citizenship . There might be a discussion about this on the talk page . ( August 2021 ) ( Learn how and when to remove this template message )

This section possibly contains original research . Please improve it by verifying the claims made and adding inline citations . Statements consisting only of original research should be removed. ( February 2021 ) ( Learn how and when to remove this template message )

^ Schwindt, Kari (1996). "Limited Liability Companies: Issues in Member Liability" . UCLA Law Review . 44 : 1541.

^ "Limited Liability Company (LLC)" . Internal Revenue Service . Retrieved 9 October 2019 .

^ McCray, Richard A.; Thomas, Ward L. "Limited Liability Companies as Exempt Organizations" (PDF) . Internal Revenue Service . Retrieved 9 October 2019 .

^ Jump up to: a b Akalp, Neil (10 August 2016). "Should You Structure Your Accounting Firm as an LLC, PLLC or PC?" . Accounting Today . SourceMedia . Retrieved 9 October 2019 .

^ Larson, Aaron (8 May 2018). "What is a Limited Liability Company (LLC)" . ExpertLaw .

^ Bischoff, Bill (1 May 2017). "The advantages of owning real estate in a single-member LLC" . MarketWatch, Inc .

^ Johnston, Kevin. "What Is the Difference Between a Shareholder Vs. a LLC Member?" . Hearst Newspapers, LLC . Houston Chronicle . Retrieved 9 October 2019 .

^ Friedman, Scott E. (1996). Forming Your Own Limilted Liability Company . Dearborn Trade Publishing. p. 60. ISBN 9780936894935 .

^ Macey, Jonathan R. (27 March 2014). "The Three Justifications for Piercing the Corporate Veil" . The Three Justifications for Piercing the Corporate Veil .

^ Klein, Shaun M. (1996). "Piercing the Veil of the Limited Liability Company, from Sure Bet to Long Shot: Gallinger v. North Star Hospital Mutual Assurance, Ltd" . Journal of Corporate Law . 22 : 131.

^ Vandervoort, Jeffrey K. (2004). "Piercing the Veil of Limited Liability Companies: The Need for a Better Standard" . DePaul Business and Commercial Law Journal . 3 : 51.

^ Adkisson, Jay (30 April 2013). "The Misunderstood Charging Order" . Forbes .

^ See, e.g., "Delaware Code, Title 6, Chapter 18, Limited Liability Company Act" . State of Delaware . Retrieved 9 October 2019 .

^ Jump up to: a b c d Maynard, Therese H.; Warren, Dana M.; Trevino, Shannon (2018). Business Planning: Financing the Start-Up Business and Venture Capital Financing (3rd ed.). New York: Wolters Kluwer. p. 137. ISBN 9781454882152 . Retrieved 22 September 2020 .

^ United States v. Kintner , 216 F.2d 418 (9th Cir. 1954).

^ Jump up to: a b c d Field, Heather M. (January 2009). "Checking In on 'Check the Box ' " . Loyola of Los Angeles Law Review . 42 (2): 451–528 . Retrieved 22 September 2020 .

^ "LLCs: Is the Future Here? A History and Prognosis" . www.americanbar.org . October 2004. Archived from the original on 2 May 2018.

^ "Pros and Cons of a Limited Liability Company (LLC)" . AllBusiness.com . Retrieved 9 October 2019 .

^ Miller, Shari P. "Single Member LLC Vs. Sole Proprietorship Liability" . Houston Chronicle . Hearst Newspapers, LLC . Retrieved 9 October 2019 .

^ "Gatz Properties, LLC v. Auriga Capital Corp., 59 A. 3d 1206 (2012)" . Google Scholar . Retrieved 9 October 2019 .

^ Falby, Bruce E. (22 August 2013). "Delaware amends its LLC Act: managers and controllers owe fiduciary duties unless LLC agreement provides otherwise" . DLA Piper .

^ Bainbridge, Stephen (27 September 2014). "Didn't sign your LLC operating agreement? Think that'll get you off? Think again" . ProfessorBainbridge.com .

^ "Register Your Business" . SBA . U.S. Small Business Administration . Retrieved 9 October 2019 .

^ "Instruction SS-4 (Rev. January 2011)" (PDF) . Retrieved 9 October 2019 .

^ "LLC Filing as a Corporation or Partnership" . IRS . Internal Revenue Service . Retrieved 9 October 2019 .

^ Everett, John; Henning, Cherie; Raabe, William (August 2010). "Converting a C Corporation into an LLC: Quantifying the Tax Costs and Benefits" . Journal of Taxation . 113 (2).

^ "IRS Form 8832 (Rev. January 2011)" (PDF) . Retrieved 9 October 2019 .

^ "Tax Advantages of Corporations - Updated for Tax Year 2016" . TurboTax . Retrieved 9 October 2019 .

^ Avi-Yonah, Reuven S. (September 2004). "Corporations, Society, and the State: A Defense of the Corporate Tax" . Virginia Law Review . 90 (5): 1193–1255. doi : 10.2307/3202379 . ISSN 0042-6601 . JSTOR 3202379 .

^ Sim, Michael (2018). "Limited Liability and the Known Unknown" . Duke Law Journal . 68 : 275–332. doi : 10.2139/ssrn.3121519 . ISSN 1556-5068 . S2CID 44186028 .

^ Hamill, Susan Pace (November 1996). "The Limited Liability Company: A Catalyst Exposing the Corporate Integration Question" . Michigan Law Review . 95 (2): 393–446. doi : 10.2307/1290118 . ISSN 0026-2234 . JSTOR 1290118 .

^ Hansmann, Henry; Kraakman, Reinier (May 1991). "Toward Unlimited Shareholder Liability for Corporate Torts" . The Yale Law Journal . 100 (7): 1879. doi : 10.2307/796812 . ISSN 0044-0094 . JSTOR 796812 .

^ "Sturm v. Harb Development, 298 Conn. 124, 2 A.3d 859 (2010)" . Google Scholar . Retrieved 9 October 2019 .

^ Parsons, James (1 February 2019). "Here Are the Benefits of Multiple LLCs or Corporations for Your Businesses" . Entrepreneur .

^ Brown, Robert L.; Gutterman, Alan S. (2005). Emerging Companies Guide: A Resource for Professionals and Entrepreneurs . American Bar Association. p. 68. ISBN 1590314662 .

^ Auerbach, Alan J.; Hines, Jr., James R.; Slemrod, Joel (2007). Taxing Corporate Income in the 21st Century . Cambridge University Press. p. 240. ISBN 978-1139464512 .

^ For example, HMRC in the United Kingdom , "HMRC Tax Manuals, DT19853A" . Gov.UK . Government of the United Kingdom. 25 May 2017.

^ Badger, Emily (30 April 2018). "Anonymous Owner, L.L.C.: Why It Has Become So Easy to Hide in the Housing Market" . The New York Times .

^ Jump up to: a b Watson, Libby (6 April 2016). "Why are there so many anonymous companies in Delaware?" . Sunlight Foundation .

Wiki Loves Monuments: your chance to support Russian cultural heritage!

Photograph a monument and win!

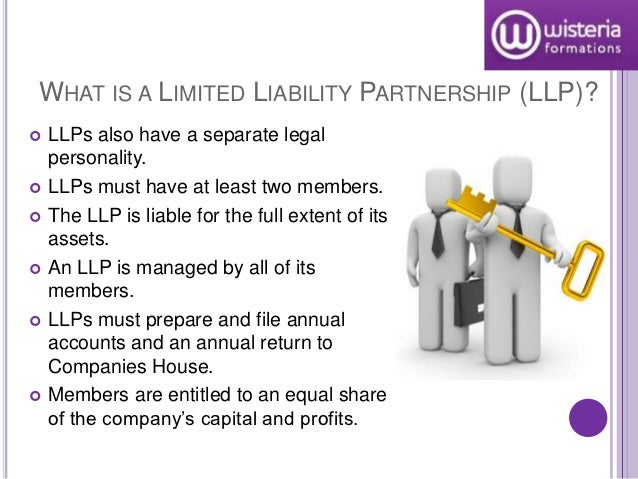

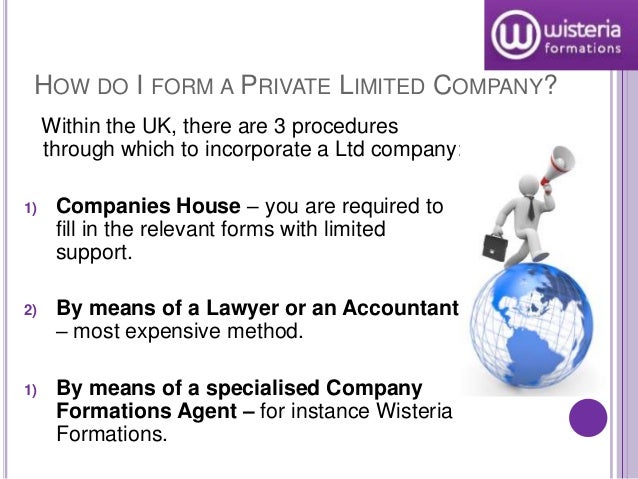

A limited liability company ( LLC ) is the US -specific form of a private limited company . It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation . [1] An LLC is not a corporation under state law; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, [2] and, under certain circumstances, LLCs may be organized as not-for-profit. [3] In certain U.S. states (for example, Texas), businesses that provide professional services requiring a state professional license, such as legal or medical services , may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company ( PLLC ). [4]

An LLC is a hybrid legal entity having certain characteristics of both a corporation and a partnership or sole proprietorship (depending on how many owners there are). An LLC is a type of unincorporated association distinct from a corporation. The primary characteristic an LLC shares with a corporation is limited liability , and the primary characteristic it shares with a partnership is the availability of pass-through income taxation . [5] As a business entity, an LLC is often more flexible than a corporation and may be well-suited for companies with a single owner. [6]

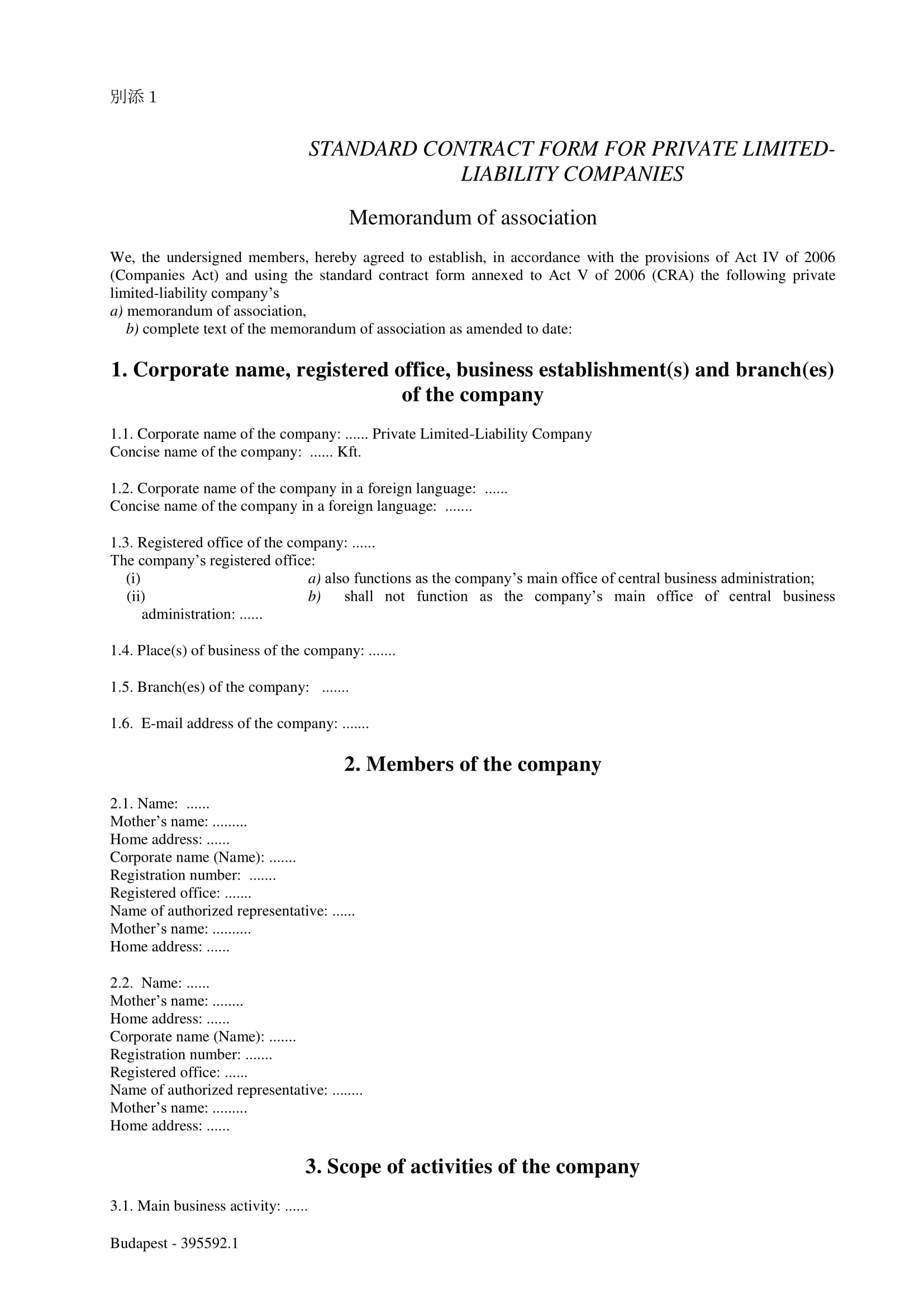

Although LLCs and corporations both possess some analogous features, the basic terminology commonly associated with each type of legal entity, at least within the United States, is sometimes different. When an LLC is formed, it is said to be "organized", not "incorporated" or "chartered", and its founding document is likewise known as its " articles of organization ," instead of its " articles of incorporation " or its "corporate charter". Internal operations of an LLC are further governed by its " operating agreement ," rather than its " bylaws ." The owner of beneficial rights in an LLC is known as a "member," rather than a " shareholder .” [7] Additionally, ownership in an LLC is represented by a "membership interest" or an "LLC interest" (sometimes measured in "membership units" or just "units" and at other times simply stated only as percentages ), rather than represented by " shares of stock " or just "shares" (with ownership measured by the number of shares held by each shareholder). Similarly, when issued in physical rather than electronic form, a document evidencing ownership rights in an LLC is called a "membership certificate" rather than a " stock certificate ". [8]

In the absence of express statutory guidance, most American courts have held that LLC members are subject to the same common law alter ego piercing theories as corporate shareholders. [9] However, it is more difficult to pierce the LLC veil because LLCs do not have many formalities to maintain. As long as the LLC and the members do not commingle funds, it is difficult to pierce the LLC veil. [10] [11] Membership interests in LLCs and partnership interests are also afforded a significant level of protection through the charging order mechanism. The charging order limits the creditor of a debtor-partner or a debtor-member to the debtor's share of distributions, without conferring on the creditor any voting or management rights. [12]

Limited liability company members may, in certain circumstances, also incur a personal liability in cases where distributions to members render the LLC insolvent. [13]

The first state to enact a law authorizing the creation of limited liability companies was Wyoming in 1977. [14]

From 1960 to 1997, the classification of unincorporated business associations for the purpose of U.S. federal income tax law was governed by the so-called " Kintner regulations," which were named after the prevailing taxpayer [15] in the 1954 legal precedent of that name. [16] As promulgated by the Internal Revenue Service (IRS) in 1960, the Kintner regulations set forth a complex six-factor test for determining whether such business associations would be taxed as corporations or partnerships. [16] The Wyoming LLC statute was tailored by the Wyoming Legislature to exploit an important flaw in the Kintner regulations—all six factors were supposed to be of "equal significance". [14] This part of the regulations implied that it might be possible to structure an entity with both limited liability and pass-through ta

https://corporatefinanceinstitute.com/resources/knowledge/strategy/limited-liability-company-llc/

https://en.wikipedia.org/wiki/Limited_liability_company

Erotic Art Pics

Slime Wave More Slime Porn

Brazilian Foot Gagging

Limited Liability Company (LLC) - Definition, Advantages ...

Limited liability company - Wikipedia

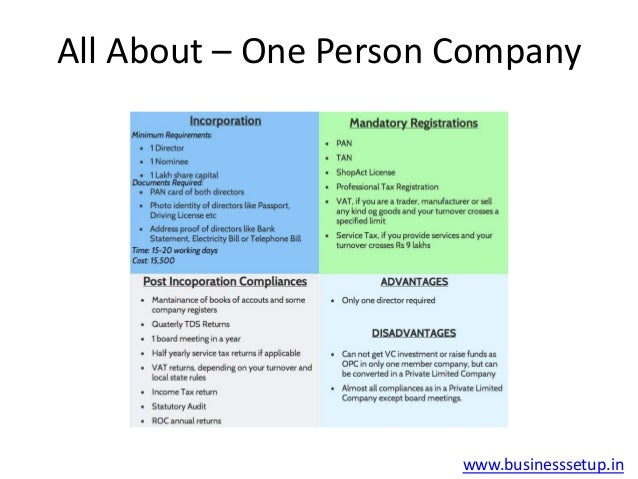

What Is a Private Limited Company? - Definition ...

Private limited company - Wikipedia

Private Limited Company: Definition, Advantages, Disadvantages

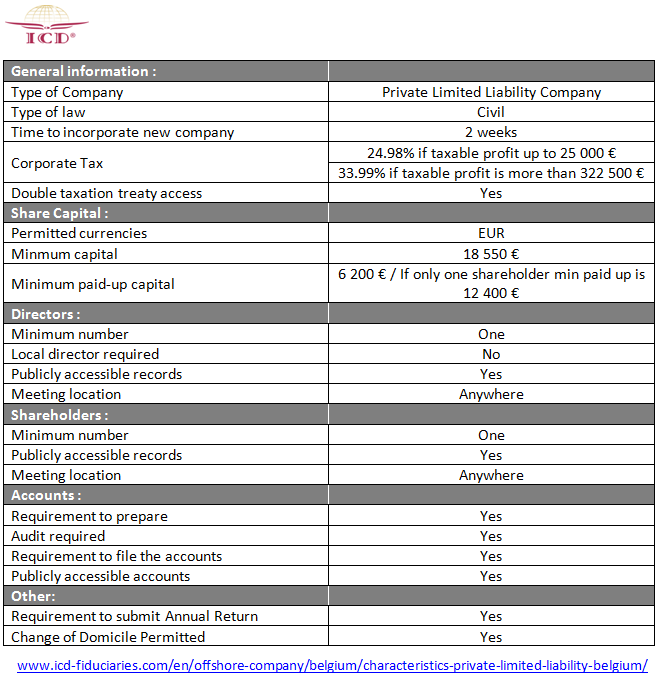

Private limited liability company (SARL) — Business ...

What Is Private Limited Company- Definition, Features ...

Difference Between LLC and Private Limited Company ...

Private limited liability company - Versli Lietuva

Private Limited Liability Company