Private Limited Liability Company

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

РекламаИнтернет-магазин yoox.com. Новые поступления каждую неделю · пн-пт 10:00-22:00

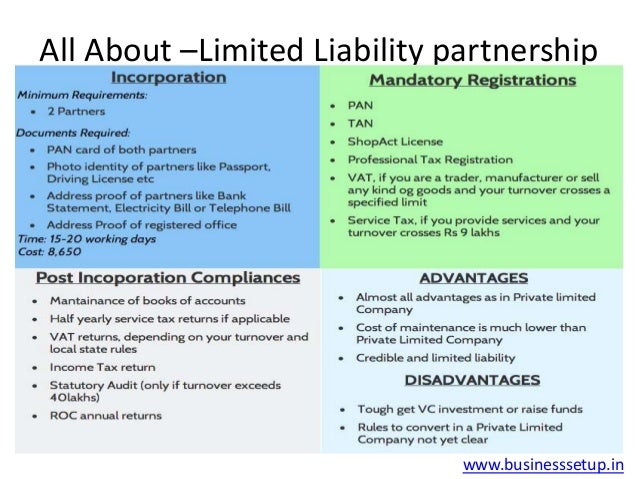

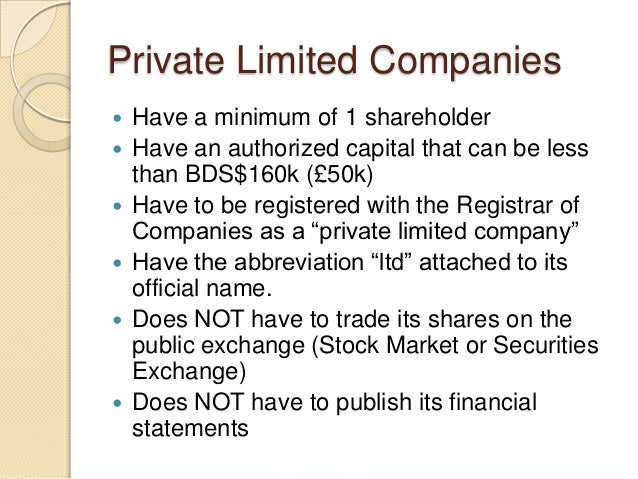

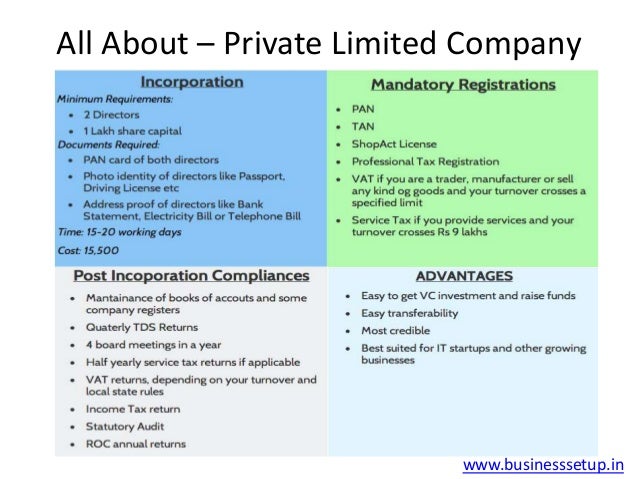

A private limited liability company may be set up as such although a qualifying private company may have the status of a private exempt company. A private limited liability company is a company which, by its Memorandum and Articles of Association: prohibits any invitation to the public to subscribe for any of its shares or debentures.

gvzh.mt/malta-law/company-corporate-finance/inc…

What is the definition of a private limited company?

What is the definition of a private limited company?

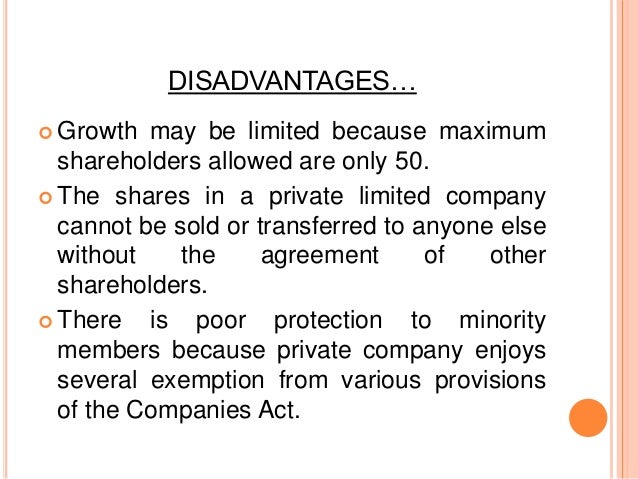

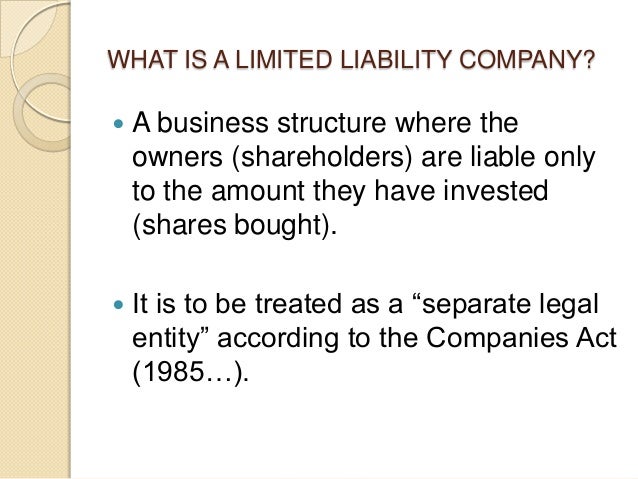

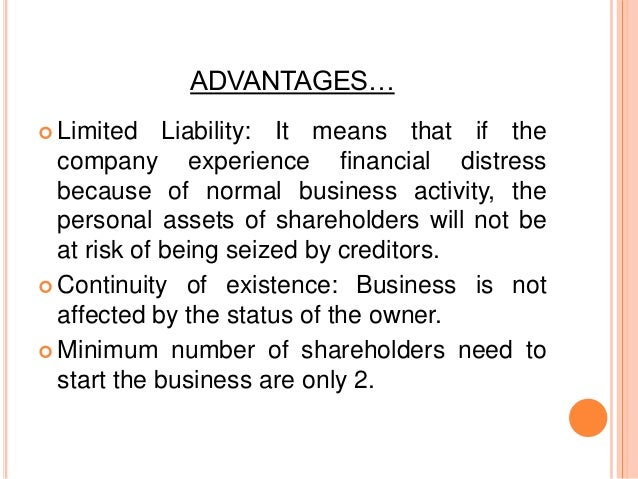

Lesson Summary. Let's review. A private limited company, or LTD, is a type of privately held small business entity, in which owner liability is limited to their shares, the firm is limited to having 50 or fewer shareholders, and shares are prohibited from being publicly traded.

study.com/academy/lesson/what-is-a-pri…

What are the different types of limited liability companies?

What are the different types of limited liability companies?

Types of Limited Liability Companies. In the UK there are four types of limited companies. These are: Private Limited Company (limited by shares) Private Limited Company (limited by guarantee) Private Unlimited Company. Public Limited Company.

www.ltdcompany.co.uk/company-formatio…

How to establish a private limited liability company in Lithuania?

How to establish a private limited liability company in Lithuania?

When establishing a private limited liability company in Lithuania, the amount of the authorized capital must be 2 500 Eur. In order to obtain a residence permit in Lithuania, your investment / value of the share capital must be at least 14 481 Eur . Also, You will have to recruit 3 citizens of Lithuania as an employees.

www.enterpriselithuania.com/en/start/type…

Can a director of a limited liability company in the UK?

Can a director of a limited liability company in the UK?

You are unable to be a director in a UK Limited Liability Company if you are: Unlike Public Companies and Private Companies with traded shares, a Private Limited Company is not required to have an annual general meeting. If at least 5% of the shareholders of a Limited Liability Company UK call for an AGM, a notice has to be issued within 14 days.

www.ltdcompany.co.uk/company-formatio…

https://corporatefinanceinstitute.com/.../knowledge/strategy/limited-liability-company-llc

02.07.2020 · A limited liability company (LLC) is a business structure for private companies Privately Held Company A privately held company is a company’s whose shares are owned by individuals …

https://study.com/academy/lesson/what-is-a-private-limited-company-definition...

What is a Private Limited Company? A private limited company, or LTD, is a type of privately held small business entity. This type of business entity limits owner liability to their shares, limits...

Общество с ограниченной ответственностью

О́бщество с ограни́ченной отве́тственностью — в российском законодательстве, учреждённое одним или несколькими юридическими и/или физическими лицами хозяйственное общество, уставной капитал которого разделён на доли; участники общества — учредители — не отвечают по его обязательствам и несут риск убытков, связанных с деятельностью общества, в пределах стоимости принадлежащих им долей или акций в уставном капитале общества, но только до тех пор, пока общество не находится в стадии банкротства. При банкротстве общества участники могут понести субсидиарную ответственность по долгам общества всем имеющимся у них имуществом.

www.ltdcompany.co.uk/company-formation/limited-liability-company

The private limited company is by law required to record the minutes of every meeting. Since this task is usually undertaken by a secretary, appointing one would relieve the directors. Official records that a …

https://en.m.wikipedia.org/wiki/Private_limited_company

Ориентировочное время чтения: 11 мин

A private limited company is any type of business entity in "private" ownership used in many jurisdictions, in contrast to a publicly listed company, with some differences from country to country. Examples include the LLC in the United States, private company limited by shares in the United Kingdom, GmbH in Germany, société à responsabilité limitée in France, and sociedad de responsabilidad limitada in the Spanish-speaking world. The benefit of having a private limited company is that there is limited liability. However, shares can only be …

A private limited company is any type of business entity in "private" ownership used in many jurisdictions, in contrast to a publicly listed company, with some differences from country to country. Examples include the LLC in the United States, private company limited by shares in the United Kingdom, GmbH in Germany, société à responsabilité limitée in France, and sociedad de responsabilidad limitada in the Spanish-speaking world. The benefit of having a private limited company is that there is limited liability. However, shares can only be sold to shareholders in the business, which means that it can be difficult to liquidate such a company.

PRIVATE LIMITED LIABILITY COMPANY PART 1

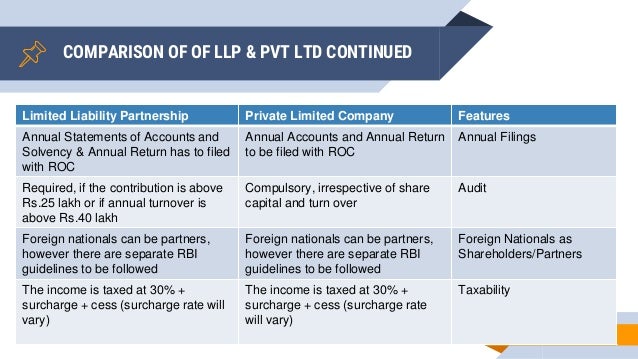

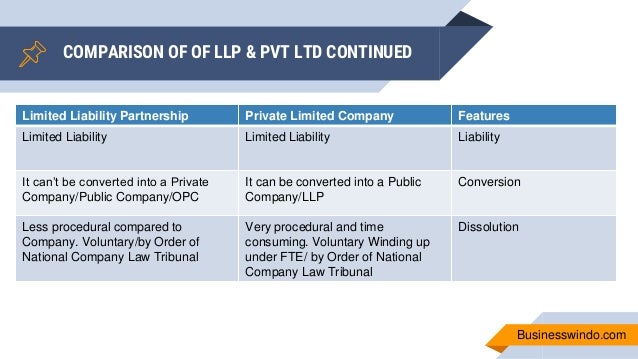

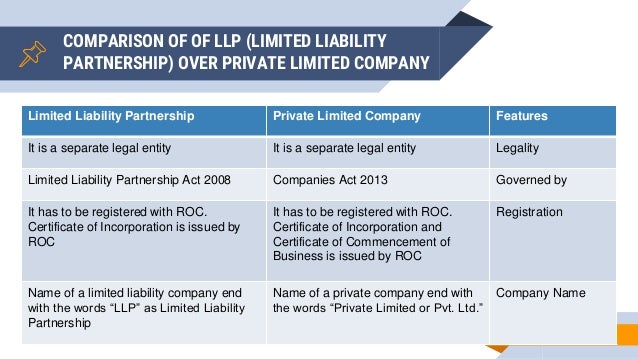

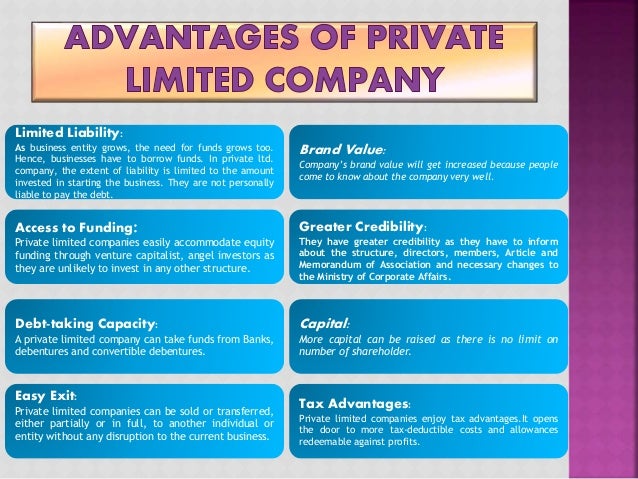

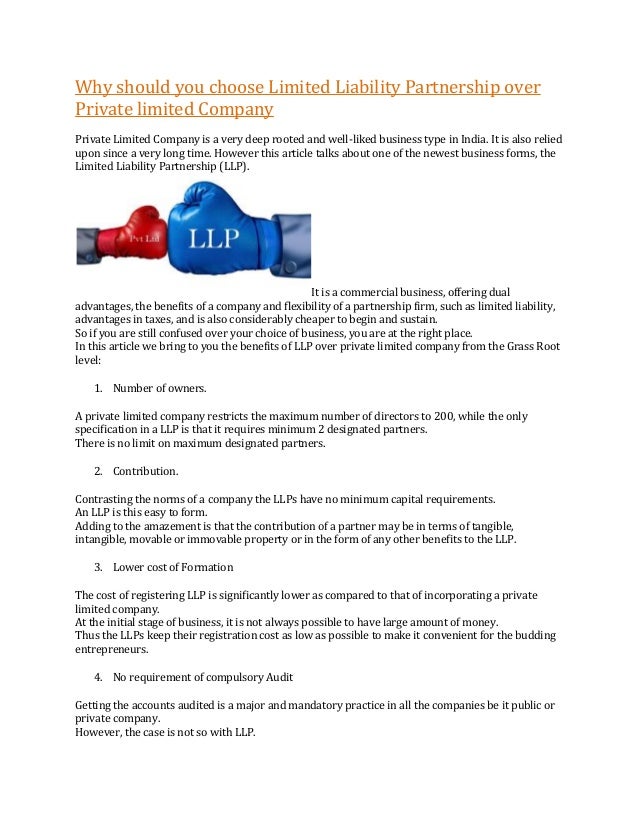

Private Limited Company Vs Limited Liability Partnership

9 Difference between Private Limited Company and Limited Liability Partnership

https://www.iedunote.com/private-limited-company

Private limited companies, according to Apex, are treated as a single entity, making the company responsible for all debts. If anything happens to the company, its members are not personally affected; members are only liable for unpaid shares. “Officers of the company retain their company salaries, they cannot be made bankrupt, and they are free to form a new company,” says Apex.

https://gvzh.mt/.../limited-liabilities-companies/private

General

Capital Issues

Resolutions

Accounts

Change of Status – Private & Public

A private limited liability company may be set up as such although a qualifying private company may have the status of a private exempt company. A private limited liability company is a company which, by its Memorandum and Articles of Association: 1. restricts the right to transfer its shares; 2. limits the number of its members to 50; and 3. prohibits any invitation to the public to subscribe for any of its shares or debent…

https://www.linguee.ru/английский-русский/перевод/private...

Примеры перевода, содержащие „private limited liability company“ – Русско-английский словарь и система поиска по миллионам русских переводов.

РекламаИнтернет-магазин yoox.com. Новые поступления каждую неделю · пн-пт 10:00-22:00

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Combining the aspects of both partnerships and corporations

Home › Resources › Knowledge › Strategy › Limited Liability Company (LLC)

A limited liability company (LLC) is a business structure for private companiesPrivately Held CompanyA privately held company is a company’s whose shares are owned by individuals or corporations and that does not offer equity interests to investors in the form of stock shares traded on a public stock exchange. in the United States, one that combines aspects of partnershipsGeneral PartnershipA General Partnership (GP) is an agreement between partners to establish and run a business together. It is one of the most common legal entities to form a business. All partners in a general partnership are responsible for the business and are subject to unlimited liability for business debts. and corporations.CorporationA corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial institutions. Limited liability companies benefit from the flexibility and flow-through taxation of partnerships and sole proprietorships,ProprietorProprietor means to have ownership of something. Sole proprietorship is the simplest form of business where one person owns the business. while maintaining the limited liability status of corporations.

If you’re looking to start a company, make sure to check out CFI’s introduction to corporate finance course!

Limited liability companies offer flexibility and protection. This makes the corporate structure appealing to business owners. Rather than shareholders,Stakeholder vs. ShareholderThe terms “stakeholder” and “shareholder” are often used interchangeably in the business environment. Looking closely at the meanings of stakeholder vs shareholder, there are key differences in usage. Generally, a shareholder is a stakeholder of the company while a stakeholder is not necessarily a shareholder. business owners of limited liability companies are referred to as members.

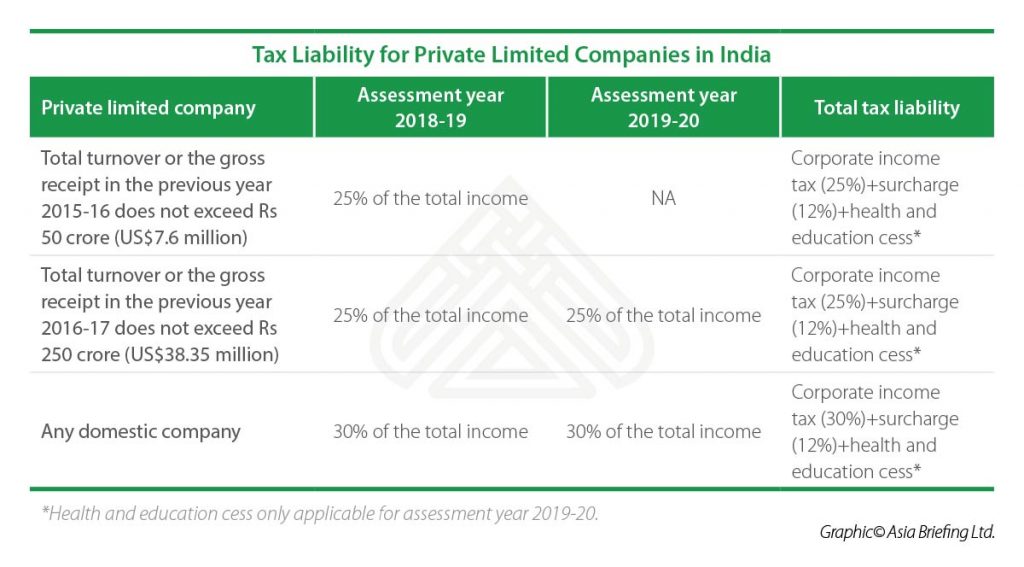

An LLC can choose between different tax treatments. They can choose to adopt the tax regime of sole proprietorships, partnerships, S corporations, or C corporations. This provides the company with the option of being treated as a flow-through entity, so long as it does not choose to be treated as a C corporation.

The income of a flow-through entity is treated as the income of its owners. That means that owners of an LLC are able to avoid double taxation. With double taxation, income gets taxed both at the corporate level and also when distributed as dividendsDividendA dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend. to owners. With an LLC, income is only taxed at an individual member level, rather than at the company level.

If the company chooses to be taxed as a partnership, its income can be allocated across members in forms other than ownership percentage. Members agree upon this in the operating agreement.

The operating agreement of the company acts in a way similar to the bylaws of a corporation. Below is a comparison of terms between an LLC and a corporation:

The document governs the company’s finances, organization, structure, and operations. Unlike corporations that are required to appoint officers or a board of directorsBoard of DirectorsA board of directors is a panel of people elected to represent shareholders. Every public company is required to install a board of directors., an LLC is more flexible with its management structuresCorporate StructureCorporate structure refers to the organization of different departments or business units within a company. Depending on a company’s goals and the industry. This, too, is decided on and stated in the operating agreement.

Limited liability companies additionally benefit from the advantages of corporations. The largest benefit is the company’s limited liability status. The company exists as its own legal entity. This protects members and owners from being held personally liable for the operations and debts of the business.

A simple example would be if an employee of the company is found conducting illegal environmental activities. Legal action can be threatened against the company to pay for damages. The court can go after the assets of the firm, but not the owners, to pay for the damages. The exception would be if the owner was aware of the illegal activities and continually allowed them to happen.

The main disadvantages of limited liability companies are the fees and taxes associated with the business structure. However, as LLCs are governed differently by each state, regulations also become a disadvantage.

Though owners of a limited liability company benefit by avoiding double-taxation, they are required to pay self-employment taxes. These taxes are paid twice as the owner is both the employee and the employer.

Some states also demand an annual fee for the limited liability benefits that LLCs provide their members. This fee is sometimes referred to as a franchise tax. For example, the state of California charges an $800 annual fee that increases with net incomeNet IncomeNet Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through for limited liability companies.

As mentioned previously, an LLC is governed by state law, which can drastically change how the company behaves in different scenarios. As an example, when a member of the limited liability company passes away, some states may dissolve the company. In other states, the company will continue to exist and the deceased member’s membership shares are passed to their executor.

These cases show the default resolutions set by the state. Members of an LLC can decide how they want the company to proceed in situations such as the above, and note it in the operating agreement. As you can see, the operating agreement is a critical document that members should not ignore when creating the company.

It is also important to consider how the company might function in international markets. For example, an American LLC is likely to be treated as a corporation in Canada, as the distinction between the two is not recognized in Canada.

Looking into starting a business? Corporate Finance Institute offers other resources that will help you expand your knowledge and achieve your goals. Check out the CFI links below:

Learn to perform Strategic Analysis in CFI’s online Business Strategy Course! The comprehensive course covers all the most important topics in corporate strategy!

Fine Naked Girl Pictures

Porno Hairy Old Men

Best Porno Pictures Mature Of Brasil

Nfl Point Spreads Week 7

Extreme Belly Fisting

Limited Liability Company (LLC) - Definition, Advantages ...

Limited Liability Company (UK Ltd). Private Limited ...

Private limited company - Wikipedia

Private Limited Liability Company | Limited Liability ...

private limited liability company - Русский перевод ...

Private Limited Liability Company

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)