Private Limited Companies Cannot Raise Money

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

In this article, Neha Verma pursuing Diploma in Entrepreneurship Administration and Business Laws from NUJS, Kolkata discusses on how can a private limited company raise finance.

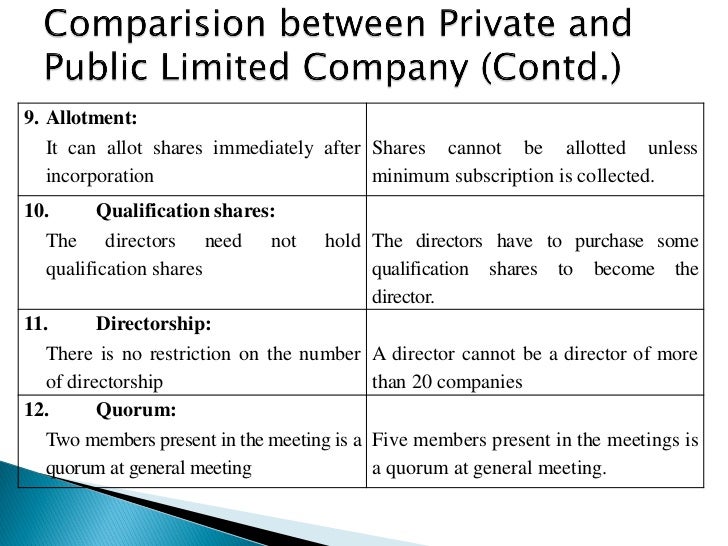

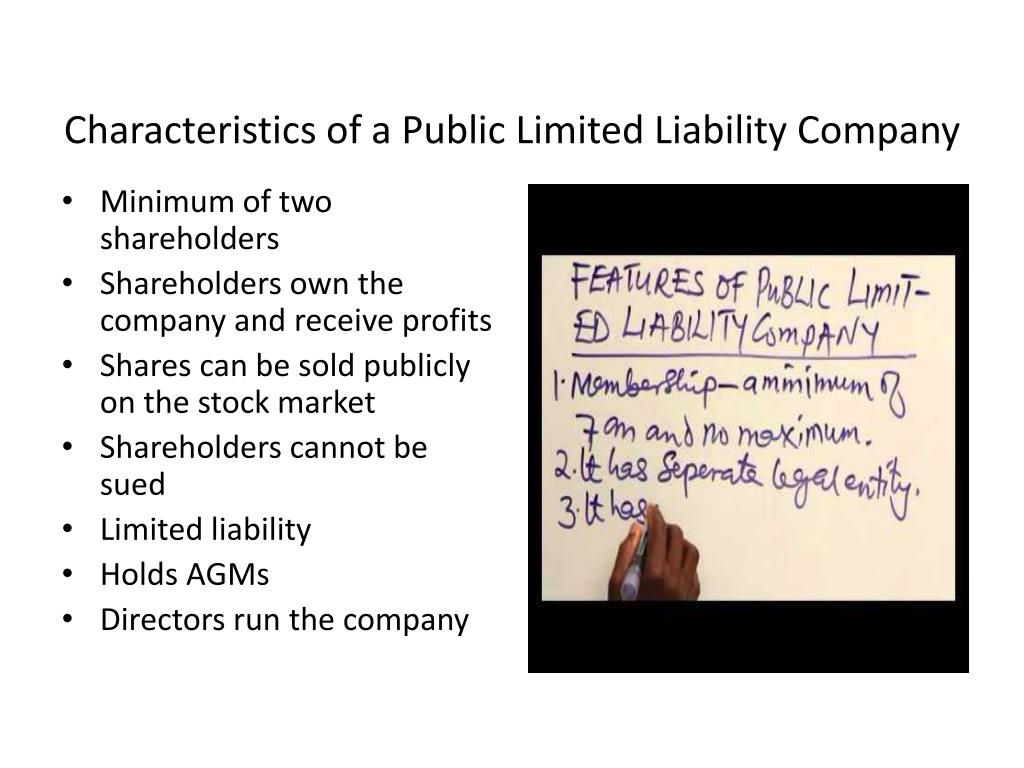

The Companies Act is the statute which governs all the companies incorporated and registered in India. The Companies Act, 2013 provides for companies limited by shares and companies limited by guarantee. These two types of companies can be further divided into following sub-categories of companies being:

According to Section 2(20) of the Companies Act, 2013, a “Company” means any company incorporated under the Companies Act, 2013 or any other previous company law.

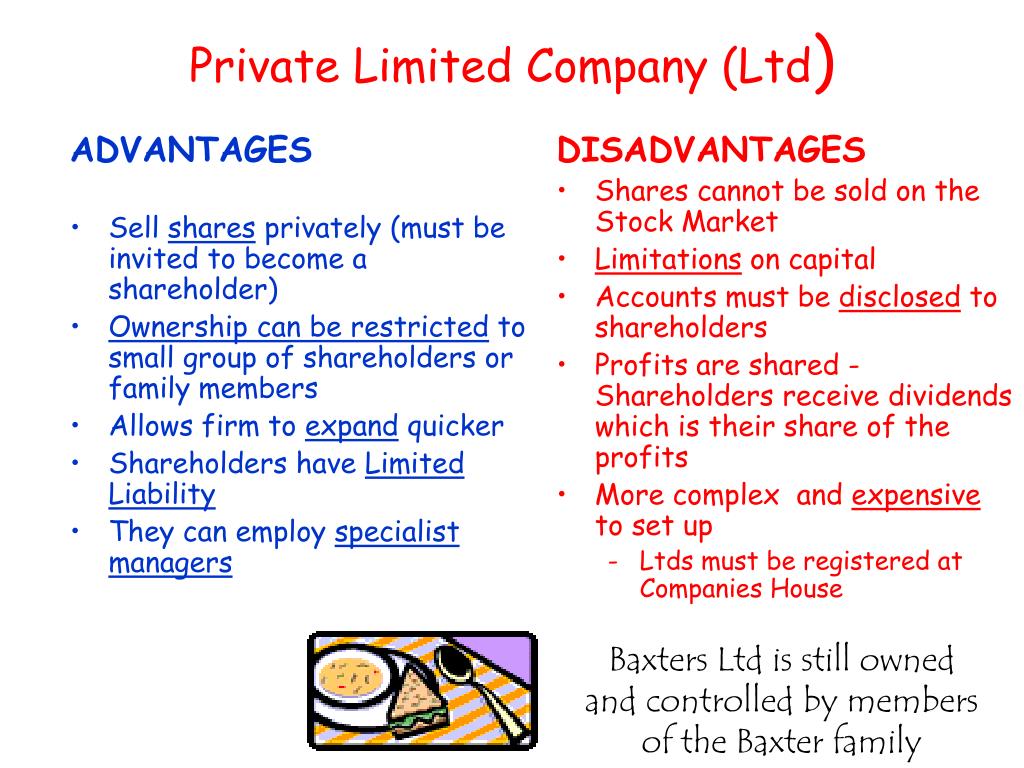

Section 2(68) of the Companies Act, 2013 defines a Private Company as a company which by its articles:

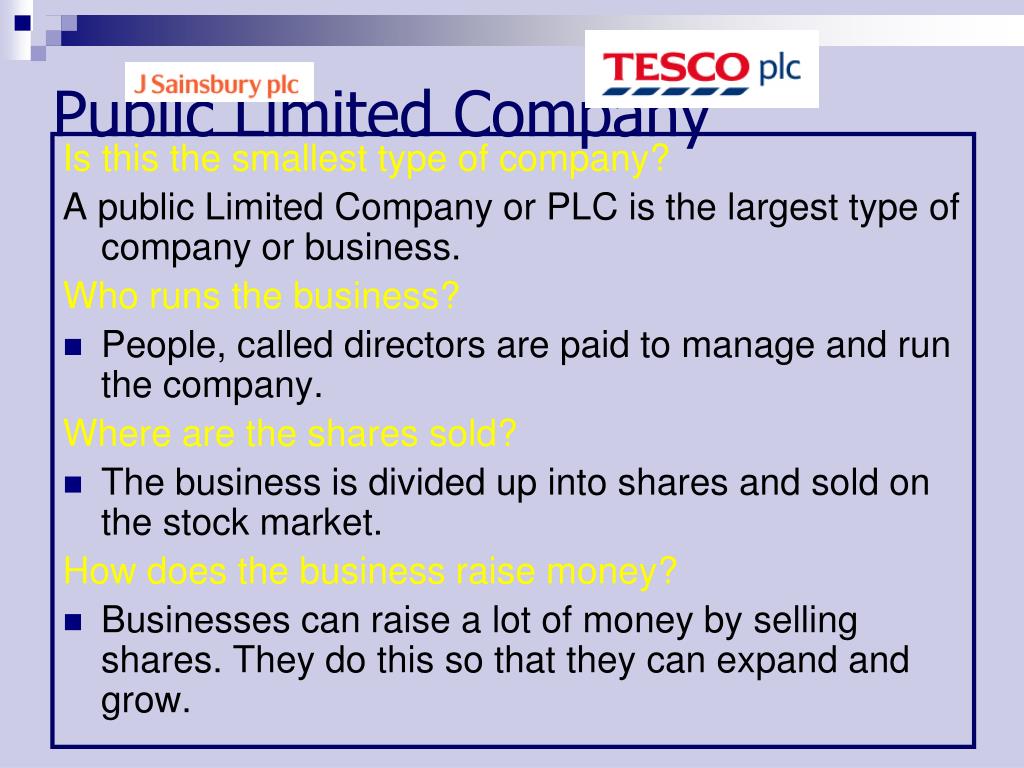

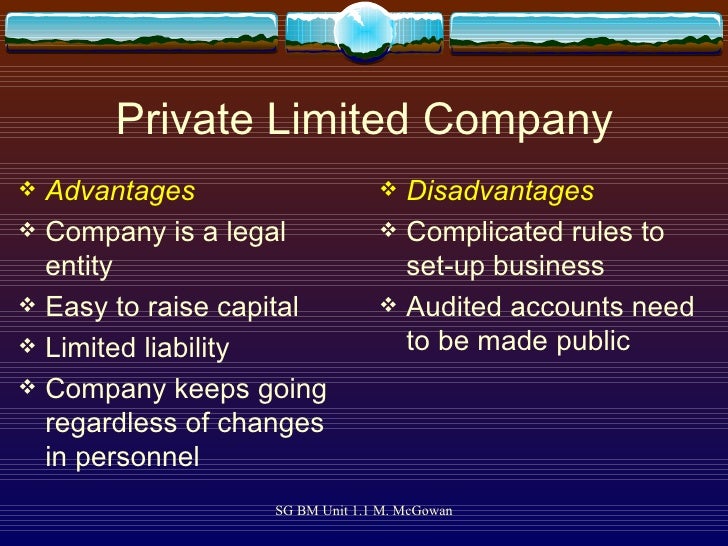

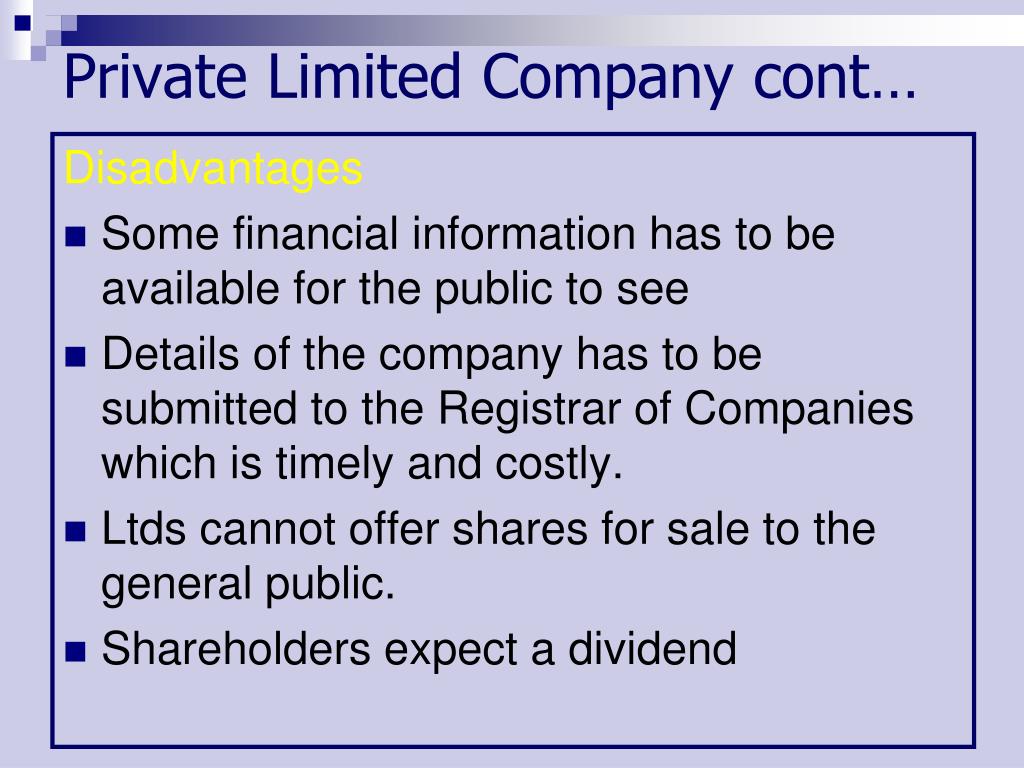

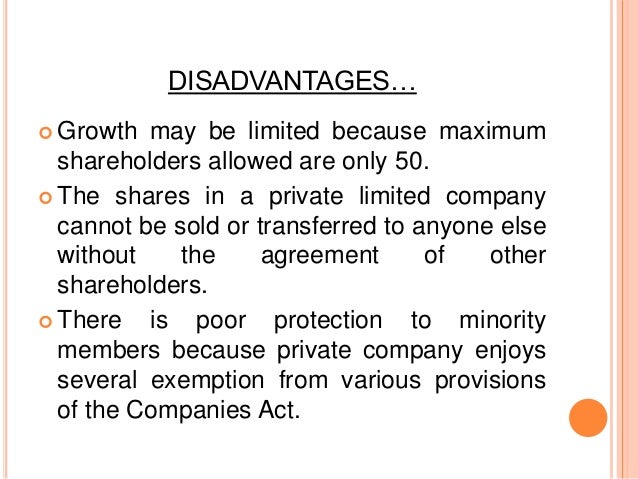

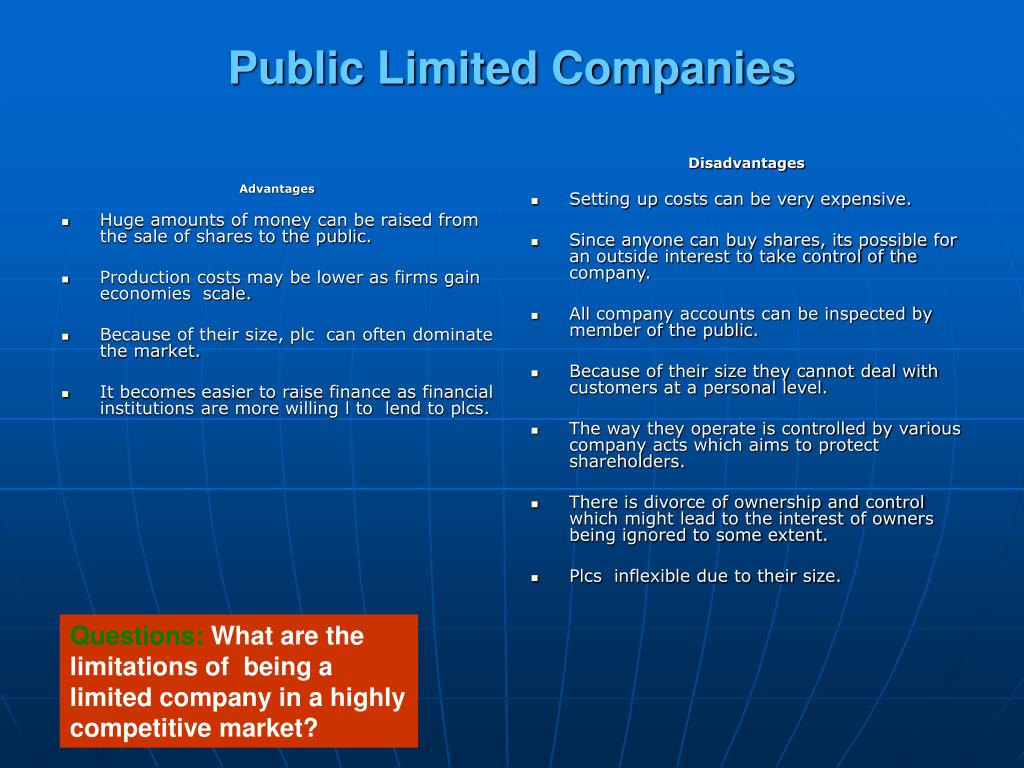

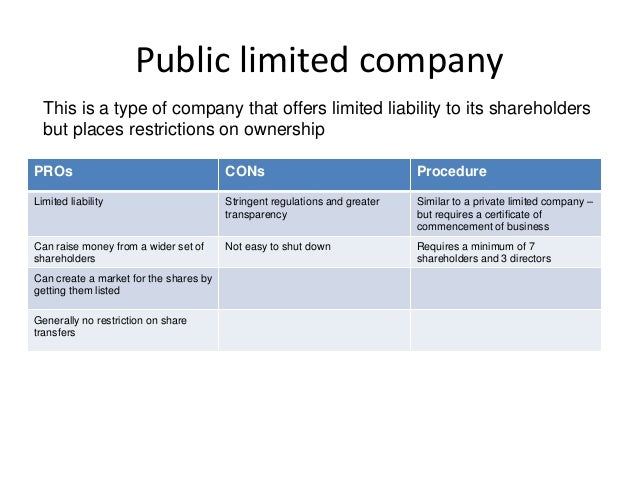

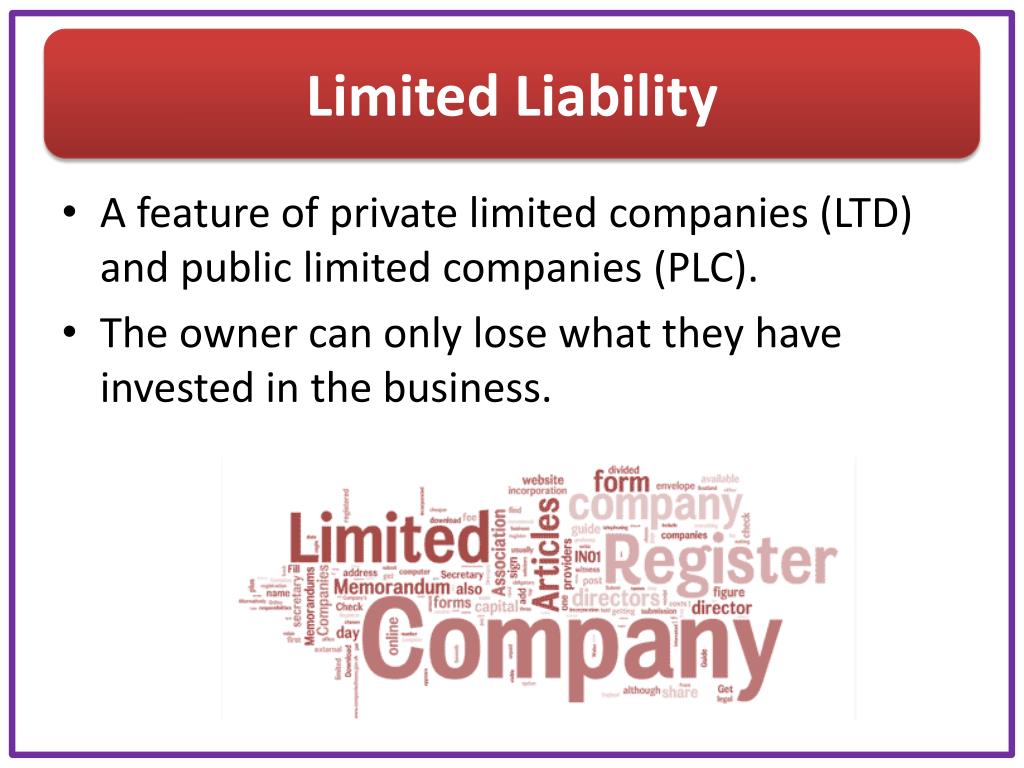

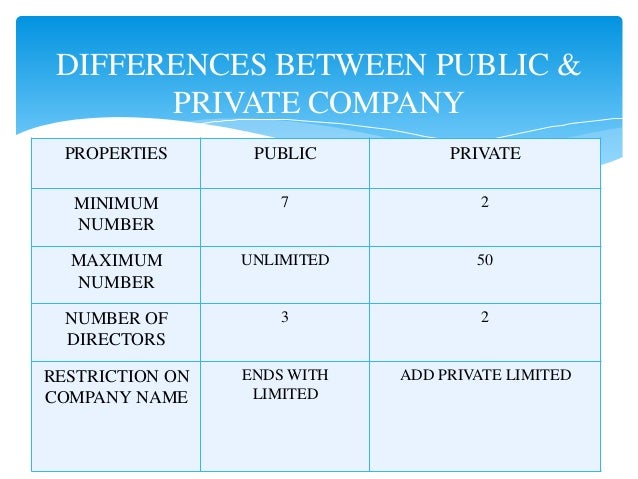

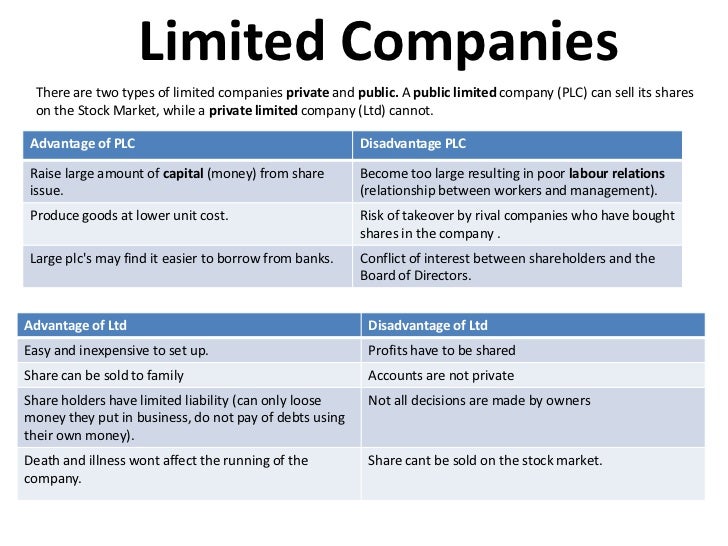

Finance is the main bloodstream of any business. It is the most important aspect on which the existence and growth of businesses depend. A public limited company can easily raise finance by issuing securities to the public without any restriction but for a private company, it is not easy to raise finance since it is prohibited to make any invitation to public and the number of its members cannot exceed two hundred.

However, the Companies Act, 2013 does provide for various modes by which a private limited company can raise requisite finance within the framework of the Act. Some of the modes of raising finance by a private limited company have been described below.

Equity shareholders are members of the company and they are the beneficial owners of the company as they invest their hard-earned funds in the company with almost no or low return. The Promoters of a company can infuse finance in the company by investing in equity shares of the company at the time of incorporation of the company and at any other time when equity shares are issued by the company either through private placement, rights issue or preferential allotment of shares. A private company can also issue shares on private placement basis or preferential allotment basis to people other than promoters.

Section 43 of the Companies Act, 2013 defines “Preference shares” as that part of the issued share capital of a company that carries or would carry preferential right with regard to:

Preference shares can be issued at pre-determined dividend rate. Dividend paid on preference shares can be cumulative (interest is accumulated and paid on a specific date) or non-cumulative (interest is not accumulated and paid yearly). Preference shares can be convertible i.e. it can be converted to equity shares on a specified date or non-convertible. A preference share is a good tool to arrange finance for a company without parting with ownership rights of the company, unlike equity shares.

In case of rights issue of shares, shares are offered by the company to the people who on the date of the offer are existing equity shareholders of the company and the shares offered are in proportion to their existing shareholding in the company. As per Section 62(1) of the Companies Act, 2013 any letter of offer for rights issue should provide the members with the right to renounce the shares offered to him in favour of any other person and such other person does not necessarily have to be an existing shareholder of the company. The company can easily raise finance for any purpose through a rights issue of shares.

As per Section 42 of the Companies Act 2013, “Private Placement” means any offer of securities or invitation to subscribe or issue of securities to select group of persons who have been identified by the Board of the company (other than by public offer) through private placement offer letter and which satisfies the conditions as stipulated in this section.

For private placement of securities, the company should issue private placement offer letter to select persons identified by the Board of the company and those persons should submit the application form to the company and pay the application money either by cheque or demand draft or any other mode except through cash. The company is required to file necessary forms in this regard and also to keep the application money in a separate bank account which should not be utilized unless allotment of shares is made and the return of allotment is filed for the same.

Preferential allotment of shares is made as per provisions of Section 62 (1)(c) and Rule 13 of Companies (Share Capital and Debentures) Rules 2014. “Preferential offer” means an issue of shares or other securities by a company to a select person or group of persons on preferential basis. The preferential issue does not include shares issued by way of private placement, rights issue, bonus issue, employee stock option or the like.

Equity shares, fully convertible debentures, partly convertible debentures and any other securities convertible into equity shares at a later date can be issued on a preferential basis. The preferential allotment can be made for cash or a consideration other than cash. A company can issue shares on preferential basis to its promoters, other companies, venture capitalists, angel investors, etc. for raising funds as required by it.

Private companies having scarce funds or startups can issue sweat equity shares, as per Section 54 of the Companies Act, 2013, to its directors or employees for consideration other than cash in lieu of the services or the know-how given by such employees or directors to the company. The issue of sweat equity shares is a win-win situation both for the company and the Employees as the company would not have part with major funds for availing value addition services or know-how and the employees would be inclined to work austerely for a company in which they have a stake.

Section 2(30) of the Companies Act, 2013 defines ‘Debentures’ as securities which include debenture stock, bonds or any other instrument of a company which evidences a debt of the company whether constituting a charge on its assets or not.

A company can issue debentures with an option to convert such debentures into shares either wholly or partly at the time of redemption of debentures. A company can issue both secured or unsecured debentures; however, no debentures shall have voting rights. Secured debentures can be issued upon fulfilling following conditions:

Debentures are an excellent tool to raise finance by way of debt however in case of convertible debentures, the private company should ensure that at no point in time the number of members exceeds 200.

A company can accept unsecured loans from a director and their relatives with or without interest. For a private company, there is no limit on the amount that can be borrowed by a company from its directors or their relatives. However, at the time of giving the loan to the company, the director is required to submit a declaration to the company that the amount of loan given by him is from his own funds and is not being given out from the funds borrowed by him by way of loan or deposit from others. The company is required to mention in its Board’s report the amount of unsecured loan taken from a director and his relatives.

The Promoters of a company can also provide an unsecured loan to the company if it fulfils three conditions:

Inter-Corporate Deposit means any deposit or loan received by one company from another company. Inter-Corporate deposits are not considered as a deposit under Companies Act, 2013 and therefore a private limited company can accept the loan from any other company and it would not be considered as a deposit. Section 186 of the Companies Act, 2013 does not apply to any loan or guarantee given by a company to its wholly owned subsidiary or joint venture company.

A private limited company cannot accept a loan from a company if:

The aforesaid limitations shall not apply to a loan from private company provided following conditions are fulfilled:

Section 2(31) of the Companies Act, 2013 defines the term “deposit” as any funds received by a company either as loan or deposit or in any other form but does not include such amounts as prescribed by the Reserve Bank of India.

In accordance with Section 73 of the Companies Act, 2013 a private limited company can accept deposits only from its members. Section 73(2)(a) to (e) does not apply to a private company which complies with either of the following conditions:

Provided that any private company accepting the deposit in the manner from (i) to (iii) files with the Registrar information about such acceptance of deposit from its members.

Commercial Paper is a short-term money market instrument which is issued in promissory note form. Commercial papers can be issued by primary dealers, all-India financial institutions and corporates.

A company which fulfils the following criteria is eligible to issue Commercial Paper:

The company issuing Commercial Papers need to obtain the credit rating of A-2 for the issuance of Commercial Paper from any of the rating agencies as prescribed by Reserve Bank of India. Commercial papers can be issued for maturity period of minimum 7 days and maximum 1 year. These papers can be issued with denominations of Rs. 5 lakhs or multiples thereof. For issuance of Commercial papers, the company shall appoint a scheduled bank as its Issuing and Paying Agent.

Individuals, Non-resident individual (NRIs), banking companies, unincorporated bodies, other corporates registered or incorporated in India, Foreign Institutional Investors, etc. can invest in commercial papers.

A company can avail term loan and a working capital loan from banks or other financial institutions against the security of its assets, moveable and immovable properties. Companies can obtain fund based and non-fund based credit from banks. The various types of finance that a company can avail from a bank are as follows:

A company must create a charge on its assets in favour of the banks from which they avail loan or other financing facilities by way of pledge, hypothecation or mortgage and file requisite forms with ROC.

Pledge of shares means availing loan against the shares held by a person or entity. Promoters of a company can pledge shares of their own company or pledge shares of other listed companies with banks or financial institutions as a “collateral” for availing loan from such bank or financial institutions to meet the funding requirements of the company.

Banks and financial institutions can provide finance against pledge of shares in following cases:

Banking regulations state that no banking company can hold shares in any company whether as absolute ownership or as pledge or mortgage of an amount which exceeds 30% of its own paid-up capital and reserves or 30% of the paid up capital of that company, whichever is less.

As per Companies Act, 2013 if a company’s shares are pledged for raising finance then the company should compulsorily register the charge for such charge to become enforceable.

A private limited company can borrow funds from following sources:

Section 180(1)(c) provides that the Board of Directors of the company needs to obtain shareholder approval by way of special resolution in the event the money to be borrowed by the company together with the money already borrowed by the company will exceed aggregate of its paid-up share capital, free reserves and securities premium.

The aforesaid section is not applicable to private limited Companies with effect from 5th June 2015 and therefore per se, there is no cap on borrowing limits of a private limited company.

However, to ensure a good debt-equity ratio it is advisable that a company raises debt within the limits serviceable by them as too much debt may hamper the growth of the company. Moreover, banks or financial institutions from which a company avails finance facility generally keep a debt-equity ratio as a financial covenant which limits the borrowing power of a Company.

Finance is important at every stage of the business. At the time of setting up of business and to meet day-to-day funds requirement of the business. Companies require various types of finances at different stages of their growth starting from equity capital, bridge finance, a term loan to working capital finance. Business growth is possible only with adequate financing arrangements. A private limited company can raise the requisite funds by way of equity, debt and deposits. It can avail funds from its promoters, directors or their relatives, banks or financial institutions, from members and by issuing various financial instruments. However, before availing any financial facility a company should ensure that it complies with the Companies Act, 2013 and the rules and statutory modifications made thereof and ensure compliance with other laws like banking regulations, SEBI guidelines, RBI guidelines, etc. wherever applicable.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content

am not able to get a traditional loan. They all want 20% down on an investment property unfortunately.

what are the guidelines for taking Loan / Borrowings from the other body corporate incorporated in India.

Should Company have to do some Important documents for the same and if yes than which are those documents?

This article is written by Varchaswa Dubey, from JECRC University, Jaipur. This article reflects the…

This article is written by Rishabh Shukla, pursuing B.A.LL.B (Hons) from the Maharaja Sayajirao University…

This article is written by Srishti Sinha, a student of the Institute of Law, Nirma…

All Rights Reserved | View Non-AMP Version

Are you looking to start your own company? If so, you’ll need adequate capital to fund your operations. Whether it’s a retail store, food service establishment, business-to-business (B2B) service, real estate “flipping,” etc., capital is an essential component of a successful business. Without capital, you won’t be able to cover expenses like inventory and payroll. Today we’ll look at how can a private company raise capital?

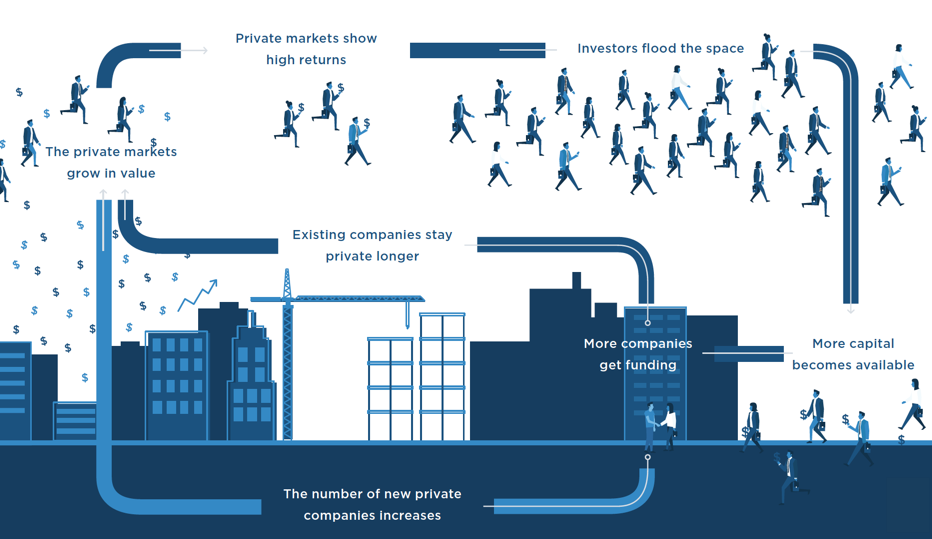

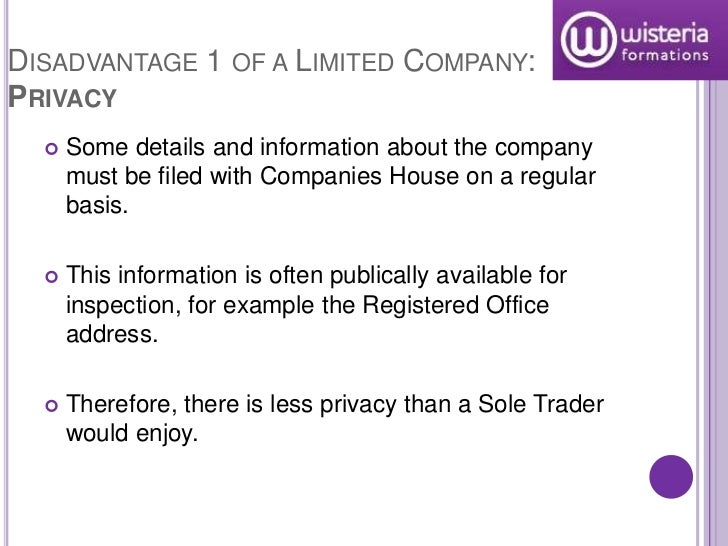

First and foremost, it’s important to note that private companies are different than public companies. A private company is “privately held,” meaning its shares are distributed internally and not available for the public to purchase. In comparison, public companies are “publicly held,” with their shares being sold on the market to the public.

Publicly held companies often generate capital by selling stock. When the public buys some of the company’s stock, the company loses some equity but gains cash to fund its operations.

One way to raise capital for your privately held company is to pitch your business to a venture capitalist. A venture capitalist is someone who invests in a business, typically during the startup stage. If they believe the business will be profitable, the venture capitalist may offer money in exchange for equity in the form of company shares. So, when the company begins to make money, the venture capitalist also earns money.

Another funding option for your privately held company involves angel investors. Known as “angels” for short, these individuals also invest money into businesses in exchange for equity. However, the key difference between angels and VCs is that angels are generally willing to invest more money.

Of course, traditional bank loans are always a viable funding option for private companies. Unlike venture capital and angel investing, however, bank loans are a form of debt capital. This means your company will take on debt in exchange for the funds. Furthermore, debt capital such as this is more difficult to obtain than equity capital. Banks will scrutinize your business’s past revenue and projected revenue to determine whether or not you are a suitable candidate.

These are just a few ways that private companies can generate capital. Other ideas include mezzanine loans, crowdfunding and using your own personal cash.

This article was brought to you by Intrepid Private Capital Group – A Global Financial Services Company. For more information on startup and business funding, or to complete a funding application, please visit our website.

Intrepid Private Capital Group • October 31, 2017

Best Perfect Ass Fuck Pmv

Iptd 989 Jav Online

Mom Swedish Porn Videos Full

Tight Candid Ass

Moms Gone Wild

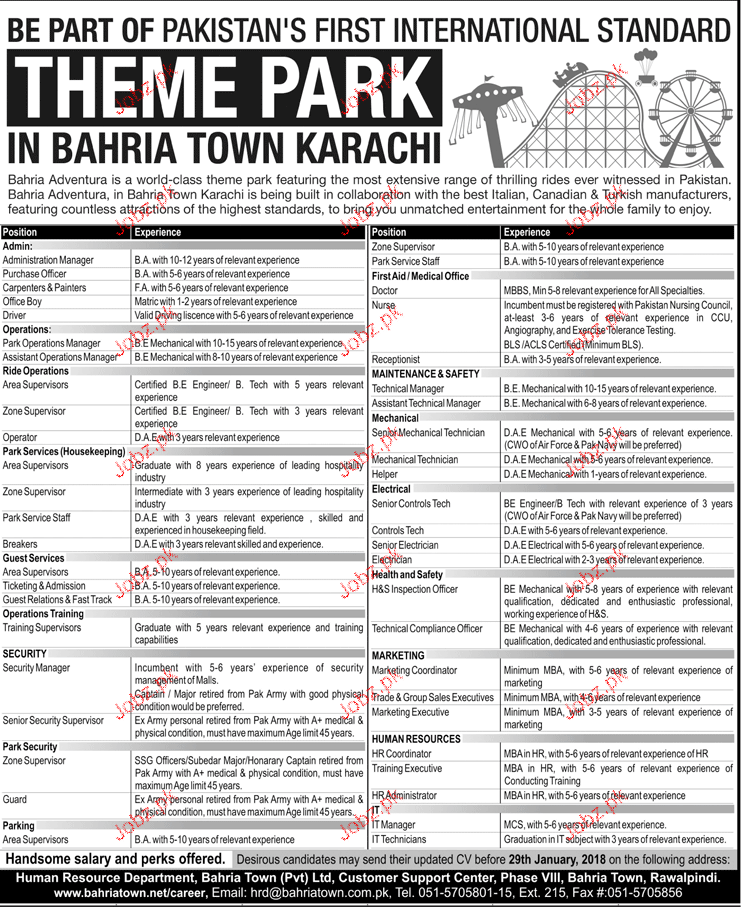

Raising Finance by Private Companies - Best Practices

Modes available to Raise Funds in a Private Company

WHAT IS A PRIVATE LIMITED COMPANY? WHAT ARE THE PRIVA…

WHAT IS A PRIVATE LIMITED COMPANY? WHAT ARE THE PRIVA…

Private limited companies cannot raise money

Can Private Company take Loan from Outsiders |Companies ...

Private limited companies (ltd) - Business ownership - AQA ...

Private Limited Companies Cannot Raise Money