Private Limited

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Limited

Start Up Loans uses cookies on this website. Please visit our Cookie Policy to find out more or if you're happy to receive all cookies, please continue browsing.

Many start up businesses choose to operate as a private limited company. Unlike working as a sole trader or being in a partnership a limited company is a legal entity in its own right. It has a different structure and more complex requirements such as different tax and legal obligations.

The biggest different between going it alone as a sole trader and forming a limited company is that a limited company has special status in the eyes of the law. Part of a limited company’s definition is that it is incorporated – formally set up and registered with Companies House – and it issues shares to its shareholders.

Unsure what legal structure is right for your business? HMRC has a handy video that explains the different legal structures you can use when setting up your company:

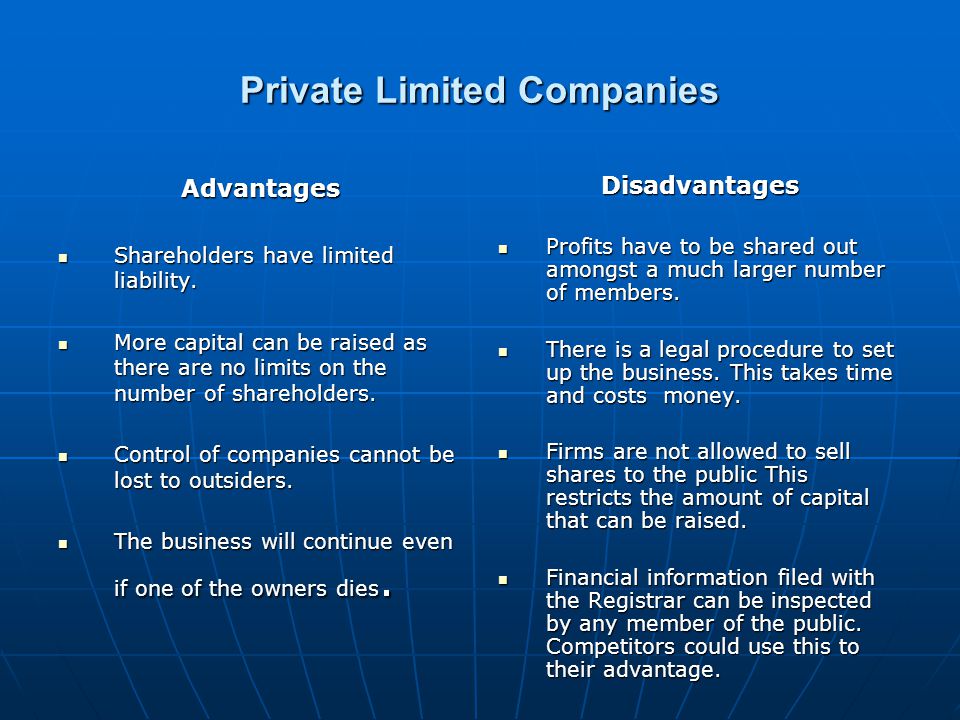

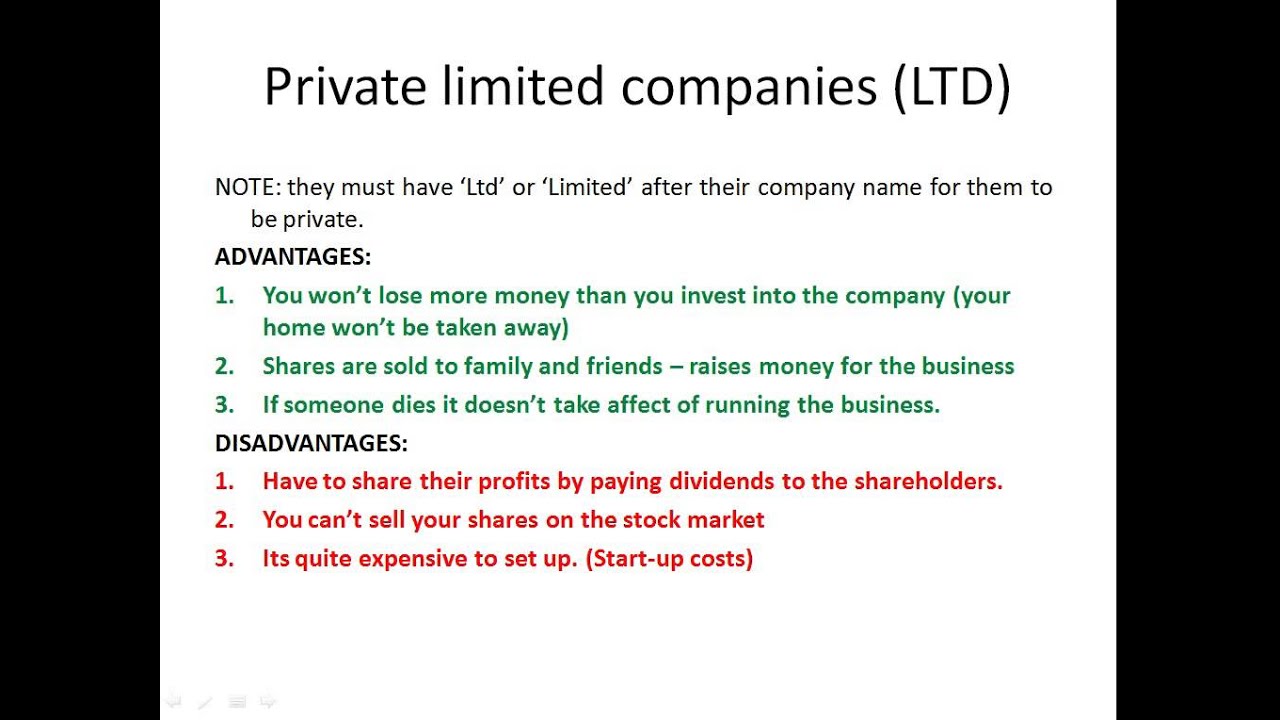

Limited companies can be private or public. Unlike a publicly limited company, where shares are traded on the stock exchange, a private limited company does not publicly trade shares and is limited to a maximum of 50 shareholders.

An example of a private limited company is often a local retailer, such as a shop or restaurant, that does not have a national presence. An example of a publicly limited company is a large corporation such as chain of retailers or restaurants with shares that anyone can buy and sell.

Most private limited companies are small as there is no minimum capital requirement to incorporate a limited company aside from the issuing of at least one share. Initial share capital is commonly around £100 and accounts filed with Companies House are usually modified accounts.

A private limited company is the most common form of UK company incorporation. It is set up directly by registering the company with Companies House. It operates as a distinct legal entity to its directors and shareholders – the company is an ‘individual’ in its own right. This means that all the business assets, liabilities and profits belong to the company itself and the shareholders are not wholly responsible for debts incurred by the company.

Being a director of a limited company is different to being self-employed or operating as a sole trader. A director of a private limited company is considered an employee of the company and, in the event of a legal dispute or problems with debt, it is the private limited company itself that is sued or pursued rather than the directors. This means if the company fails the director’s personal assets such as family home or savings are not at risk – unlike a sole trader, who is held personally accountable for any unpaid debts or legal bills arising from a dispute or insolvency. The shareholder’s liability is limited to the shares they hold in the business – hence the ‘limited’ part of the business structure name.

There are lots of characteristics of a private limited company that cover issues such as borrowing money, paying pensions, reporting business accounts, selling the business or raising capital, and how you pay yourself.

The owners of private limited companies are known as shareholders and each holds a certain number of shares in the business. This means you can set up a limited company yourself – you’d own 100% of all the shares – or with others, dividing the available shares between the shareholders.

To become a shareholder you must purchase one or more shares issued by the company and these are issued when you form the company with each share representing an equal percentage of the business. Additional shares can be created and issued after the business is incorporated and the more shares you hold, the larger the percentage of the business you own.

Directors – known as company officers – manage limited companies and they can be shareholders as well. A limited company must have at least one director and most company owners are directors – meaning you can own and manage a limited company yourself or with others.

While setting up a limited company and operating it can be a time-consuming task with lots of requirements there are some clear advantages to setting up a private limited company.

Setting up and running a limited company is no small undertaking and while there are many benefits it’s worth noting the potential downsides to setting up a limited company.

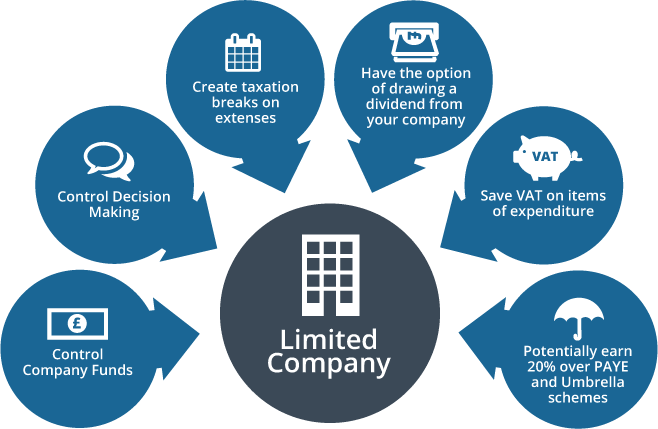

A private limited company must register with HMRC and pay corporation tax on any profits it makes within its financial year – and corporation tax is in addition to any income tax and National Insurance contributions (NICs) employees and directors must pay. A limited company can also pay dividends to shareholders and these are subject to income tax, though exempt from NICs. Payments to employees have to be made via PAYE and the company must as pay NICs to HMRC as part of an employee’s salary.

Employee salaries are classified as a business expense however and can be offset against profits along with all other expenses. This means that a limited company can pay staff, incur costs and purchase services from suppliers and still claim these as expenses to offset tax payable on the income the company generates. The company’s profit is then subject to corporation tax at the current rate of 20%.

Unlike a sole trader, limited companies have differences when it comes to pensions too. Employee pensions can be more generous in terms of benefits and limits – whereas a sole trader can only have a personal pension. However, a limited company has to consider pension arrangements for all employees.

Directors can also borrow from a limited company but be aware that there is a tax charge of 32.5% for loans that are not repaid within nine months of the year end.

Finally, accounts must be prepared annually for a limited company and filed with HMRC and Companies House, and accounts must meet accounting standards.

Loans are strictly for 18s and over. Personal loans for business use only. Finance is subject to status. Terms and conditions apply.

The Start-Up Loans Company is a wholly owned subsidiary of British Business Bank plc. It is a company limited by guarantee, registered in England and Wales, registration number 08117656, registered office at 71-75 Shelton Street, Covent Garden, London, England, WC2H 9JQ. British Business Bank plc is a development bank wholly owned by HM Government. British Business Bank plc and its subsidiaries are not banking institutions and do not operate as such. They are not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). A complete legal structure chart for the group can be found at www.british-business-bank.co.uk © 2021 British Business Bank plc

Private Limited Company | Characteristics, Advantages, etc. | LegalRaasta

What is a private limited company | The essential guide | Start Up Loans

What is a Private Limited Company? | The Formations Company

private limited company - это... Что такое private limited company?

Private limited company – limited by shares ( Ltd .) - Company Bug

Categories Categories

Select Category

businessnews (29)

Case Studies (5)

Running your Business (49)

Starting a business (50)

Uncategorized (106)

Popular Articles

A guide to tax for UK small businesses

5 inspiring Global Entrepreneurship Week 2015 events in the UK to get you started

What Tax Means To Your Business – Part 3

How to set up a cleaning business

What Tax Means To Your Business – Part 2

Can't find the answer you're looking for? Don't worry we're here to help!

Contact support

Copyright © 2020 TheFormationsCompany.com Ltd | Registered in England. Registered No. 06924361 | Registered Office: 130 Old Street, London EC1V 9BD.

Site Map

Even if you are 100% confident about your business idea, you may decide it’s best to limit your personal liability for debt if your company ever gets into financial trouble. That’s exactly what a private limited company is set up to help with.

A private limited company is a company that can either be limited by shares or by guarantee :

This means that the company is owned by shareholders. The liability of each shareholder is limited to the original value of the shares issued to them.

When a private company is limited by guarantee, it has members who act as its guarantors. These members contribute a previously agreed amount to support the company in times of trouble.

When setting up your business it’s a good idea to look well into the future to decide where you want to be and where you wish to take your business. If you’re looking to grow your business setting up as a private limited company will help you to share the load and eventually, as the company is a separate legal entity, you could even take a back seat.

But there’s much more to gain from setting up as a private limited company, and while there’s more administration to set up, opting for the help of a formations agent can make it quick, easy and cheaper than you think.

There are two main advantages of a private limited company. First, it is a separate legal entity , meaning that if it hits bad times you won’t be personally liable – either financially or legally. Setting up as a limited company also makes it less personal when it comes to running your company, as you can share the responsibilities with others much more easily.

With the ability to bring many more people into the mix you’ll be able to benefit from others’ expertise and skills, helping you to keep a clear head for business.

As well as limiting your personal liability, you’ll also find there are tax benefits. This is another of the advantage of a private limited company. With the company paying Corporation Tax on taxable profits, you may be protected from higher income tax rates yourself.

A private limited company also has the advantage of more tax-deductible allowances and costs, which are redeemable against profit.

Let’s say you’re a business owner, you’re working as a sole trader and you wish to take time off. If you become unwell or if you simply wish to retire, your business will also need to go on hold or close. Setting up as a private limited company means you can choose other people to take control when you’re not there.

Many see the paperwork involved with setting up and running a private limited company as a barrier to getting started. There’s certainly a lot to consider when setting up a private limited company. However, much of the hassle can be removed when you use a formations agent to help. Considerations include:

Registering with Companies House, you’ll need to pay a fee. Using a formations agent you’ll probably find this is cheaper than going direct and costs a lot less than you may think .

The financial information you need to file is more complex when you’re registered as a private limited company. However, this information can also help you to keep a keen eye on your company’s productivity and profitability. And your accounts don’t need to cost the earth to get right.

The profits of a limited company are distributed among shareholders or channelled back into the business. Many private limited companies benefit from this and with investment from profits may grow more successfully.

Setting up a private limited company is a simple process and you could be the owner of your own company in a matter of hours. If you’re not ready just yet, continue to browse the knowledge base for more advice on some of the key terms associated with setting up a business.

Teen Drink Pee

Overwatch Training

Pissing Peeing Toilet

Video Porno Double Penetration In Teen

Naked Big