Private Fund

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private investment funds are those which do not solicit public investment.

Private funds are classified as such according to exemptions found in the Investment Company Act of 1940.

Hedge funds and private equity funds are two of the most common types of private investment funds.

3C1 funds are privately traded funds that are exempt from SEC registration through the Investment Company Act of 1940.

The 3(c)(7) exemption refers to a segment of the Investment Company Act of 1940 that allows private funds to sidestep some SEC regulations. 3C7 is shorthand for the 3(c)(7) exemption.

A hedge fund is an actively managed investment pool whose managers may use risky or esoteric investment choices in search of outsized returns.

A real estate investment group (REIG) invests in real estate by buying, selling, and financing properties. Read how to get started investing in REIGs.

Privately owned refers to businesses that have not offered shares to be traded on a public exchange.

Created by Congress, the Investment Company Act of 1940 regulates the organization of investment companies and the product offerings they issue.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

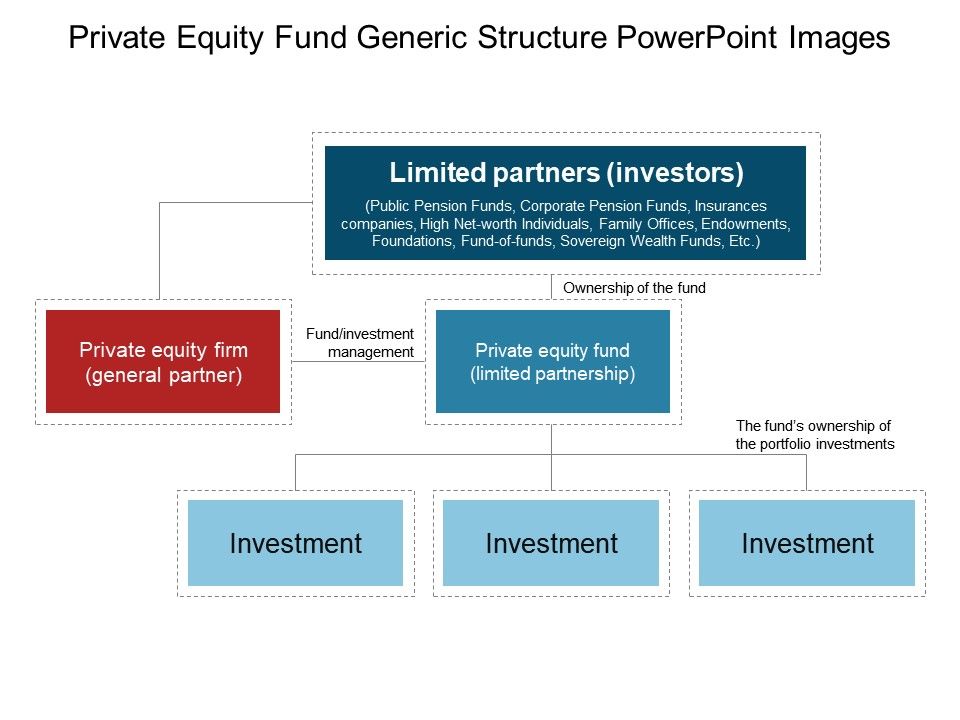

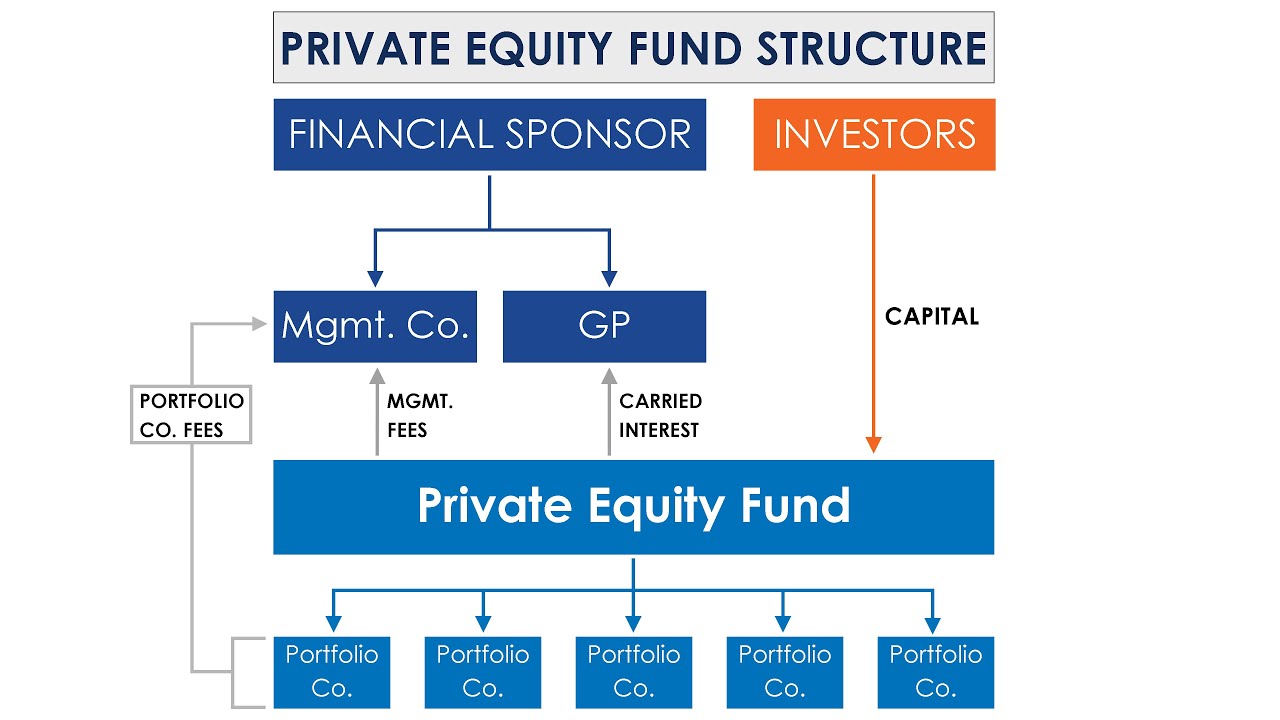

A private investment fund is an investment company that does not solicit capital from retail investors or the general public. Members of a private investment company typically have deep knowledge of the industry as well as investments elsewhere. To be classified as a private fund, a fund must meet one of the exemptions outlined in the Investment Company Act of 1940 . The 3C1 or 3C7 exemptions within the Act are frequently used to establish a fund as a private investment fund. There is an advantage to maintaining private investment fund status, as the regulatory and legal requirements are much lower than what is required for funds that are traded publicly.

Private funds are expected to meet certain criteria to keep their status. Generally, the requirements limit both the number and type of investors that can own shares in the fund. In the U.S., under the aforementioned Investment Company Act of 1940, a 3C1 fund can have up to 100 accredited investors , and a 3C7 fund can have a soft limit of around 2,000 qualified investors. Both the definition of qualified and accredited investor come with individual wealth tests. Accredited investors need to have more than $1 million in net worth without counting their primary residence and/or $200,000 in annual income for an individual and $300,000 for a couple. Qualified investors have to hold assets in excess of $5 million.

A private investment fund may choose to stay private for a number of reasons. As mentioned, the regulations around private investment funds are much looser than for public funds. Private investment funds enjoy more freedom in how they handle everything from reporting to redemptions . This allows private investment funds to look at illiquid investments that a public fund would shun due to the difficulties of regular valuation and liquidation in the case of rising redemptions. Many hedge funds are private investment funds so they can continue to use aggressive trading strategies that the manager of a public fund would avoid due to the potential for investor lawsuits resulting from unreasonable risk-taking. Most importantly, there is no public reporting of positions for private investment funds, which allows them to avoid tipping their hand to the market and eroding the profitability of a stealthily built position.

In addition to investment flexibility, private investment funds can be vehicles of choice for handling significant family wealth. Extremely wealthy families can create private investment funds to invest the wealth with the family members as shareholders. Often a company serves as the initial structure for this arrangement, and it is repurposed to create a capital investment arm from the profits of the business. In this case, the family doesn't want or need outside capital, so there is no incentive to take the fund public.

Private Fund means an issuer that would be an investment company as defined in section 3 of the Investment Company Act of 1940 but for Section 3(c)(1) or 3(c)(7) of that Act.

Private Fund means an investment vehicle the securities of which are not registered under the Securities Act of 1933 and which is excluded from the definition of an “investment company” under Section 3(c)(1) or 3(c)(7) of the Investment Company Act of 1940 .

Private Fund means a Fund that is not registered under the Securities and Exchange Act of 1933 , as amended or the 1940 Act .

Private Fund means an entity that:

Private Fund means an issuer that qualifies for an exclusion from the definition of an investment company pursuant to section(s) 3(c)(1) or 3(c)(7) of the Investment Company Act of 1940 , 15 U.S.C. 80a.

Private Fund means any Fund other than a Public Fund .

Private Fund means any pooled investment vehicle that would be an “investment company” under the Investment Company Act but for Section 3(c)(1) or 3(c)(7) of the Investment Company Act for which an IA Subsidiary acts as investment adviser , general partner , managing member , manager or sponsor .

Private Fund means a MLIM Private Fund or a BlackRock Private Fund, as the case may be.

We use cookies on our site to analyze traffic, enhance your experience, and provide you with tailored content.

Private Fund Subject to the terms of Schedule 5.4, Seller agrees that nothing in this Agreement shall prevent Purchaser from segregating any private fund advised by the Transferred Employees into separately managed accounts, or converting such fund to a fund registered under the Investment Company Act.

The Code of Ethics applies to each Registered Investment Company or Private Fund Client or series thereof (each of which is considered to be a Company for this purpose) for which any of the Companies listed above presently or hereafter provides investment advisory or principal underwriting services, other than a money market fund or a fund that does not invest in Securities.

Clients that are Affiliated Mutual Funds, Private Fund Clients or a series thereof.

Requests for such approval shall be submitted to the CCO on the “BGIM Private Fund Pre-Approval Form” (See Appendix D).

Name of the Private Fund : Private Fund Identification Number: (include the "805-" prefix also)Yes No NOTE: You must complete question 6 for each master-feeder arrangement regardless of whether you are filing a single Schedule D, Section 7.B.(1).

For purposes of this Code, an account which is managed by William Blair or any of its affiliates, which is not a registered investment company and in which Access Persons or other principals of William Blair hold interests (“ Private Fund Account”) will not be deemed an Access Person hereunder if the aggregate beneficial ownership of all Access Persons and principals of William Blair in such Private Fund Account represents less than 10% of the total interests in the Private Fund Account.

https://www.investopedia.com/terms/p/privateinvestmentfund.asp

https://www.lawinsider.com/dictionary/private-fund

Cock Sucking Lingerie Babe Ass Pounded Xxx

Mary And Jandro Porn

Sex Com My Videos

Private Investment Fund Definition - investopedia.com

Private Fund Definition: 263 Samples | Law Insider

Private Fund Search - Private Fund Data

Private Funds - Dechert

Private Fund | Principal Asset Management

Private-equity fund - Wikipedia

The Private Funds Law 2020 and Mutual Funds …

Private Fund - UOB Asset Management

The Cayman Islands Private Funds Law: what you …

Private Funds (Annual Returns) Regulations, 2021

Private Fund