Private Fund

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

https://www.investopedia.com/terms/p/privateinvestmentfund.asp

A private investment fund is an investment company that does not solicit capital from retail investors or the general public. Members of a private investment company typically have deep knowledge...

https://acesparks.com/private-fund-fund-recommended-by-donors-or-both-here-are-tips...

24.08.2021 · A fund recommended by a private foundation or donors for those who want a permanent way to help the good throughout their lives and …

Private Equity Fund Structure Explained

PM-CARES Public Or Private Fund? Documents Reveal Contradiction

How To Start A Private Equity Fund From Scratch

Private Equity Fund Investment Risks

Private Funds A fund that is established when an investor (or group of investors or juristic person) assigns a sum of money or assets to an investment …

28.03.2018 · Introduction to Private Fund. Background on Private Funds; Setting up a Private Fund; Investible assets; Differences between Private Funds and Mutual Funds; Principle operating guidelines; Key features of Private Funds

https://privatefunddata.com/private-fund-search

Search more than 30,000 private funds including hedge funds, private equity funds, real estaet funds, structured asset funds, and venture capital funds. Private Fund …

What's the definition of a private investment fund?

What's the definition of a private investment fund?

Private Investment Fund Defined. Reviewed by James Chen. Updated Mar 28, 2018. A private investment fund is an investment company that does not solicit capital from retail investors or the general public. To be classified as a private investment fund, a fund must meet one of the exemptions outlined in the Investment Company Act of 1940.

www.investopedia.com/terms/p/privateinves…

Can a family create a private investment fund?

Can a family create a private investment fund?

Extremely wealthy families can create private investment funds to invest the wealth with the family members as shareholders. Often a company serves as the initial structure for this arrangement, and it is repurposed to create a capital investment arm from the profits of the business.

www.investopedia.com/terms/p/privateinves…

What's the minimum investment for a private share fund?

What's the minimum investment for a private share fund?

Available for a minimum investment of $2,500 without investor accreditation requirements, the Private Shares Fund, a closed-end interval fund, offers individuals, family offices, and institutions an effective means to access the venture-backed asset class.

Is there advantage to maintaining private investment fund status?

Is there advantage to maintaining private investment fund status?

There is an advantage to maintaining private investment fund status, as the regulatory and legal requirements are much lower than what is required for funds that are traded publicly. Private investment funds are those which do not solicit public investment.

www.investopedia.com/terms/p/privateinves…

Private Fund Management is an authorised representative of Adviser Platform Lda. Adviser Platform Lda and Private Fund Management are authorised and regulated by the Autoridade de Supervisão de Seguros e Fundos de Pensões (Insurance and Pension Funds …

https://en.m.wikipedia.org/wiki/Private_equity_fund

Ориентировочное время чтения: 9 мин

A private-equity fund is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investorsmake an …

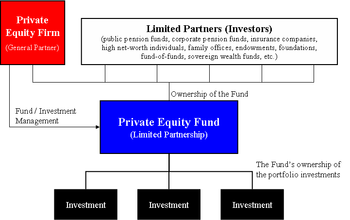

A private-equity fund is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investors make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors' point of view, funds can be traditional (where all the investors invest with equal terms) or asymmetric (where different investors have different terms).

A private-equity fund is raised and managed by investment professionals of a specific private-equity firm (the general partner and investment advisor). Typically, a single private-equity firm will manage a series of distinct private-equity funds and will attempt to raise a new fund every 3 to 5 years as the previous fund is fully invested.

Investment features and considerations

https://www.dechert.com/.../investment-funds/private-funds.html

Private fund manager M&A. Carried interest, management equity arrangements and other incentive structuring. Dechert is the only law …

https://www.principal.th/en/private-fund

Private Fund Is an investment platform which designed to cater individual preferences under investment vehicles …

РекламаКрасивые букеты от 1 550 руб. Доставка 0 руб. по Москве. Работаем 24/7. Заказать! · Москва · пн-пт круглосуточно

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

The managing of investments for clients who may be an individual, a group of individuals, or a juristic-person that has delegated an investment management company to perform these duties on their behalf. The client can take part in the establishment of the investment policy, investment objectives, and restrict risks within acceptable levels in the effort to obtain the best returns and benefits desired by the client. The investment management company will be involved in the asset allocation process, securities selection and determination of the appropriate timing of investments while taking into account the guidelines and investment limits prescribed by a written contract formed with the client. The portfolio structure has excellent flexibility and can be easily modified to match each client’s needs.

The client has ownership in the assets or fund which remain in the client's name while the investment management company's name is shown concurrently to indicate that it is being authorized to manage the client's investments on his/her behalf. Tax obligations associated with the investments will be according to the client's tax status.

Upon being appointed the fund manager, the investment management company shall appoint a “custodian” that has been approved by the Securities and Exchange Commission to safe keep the client’s assets and keep track of benefits associated with the securities invested by the private fund.

The client may consider investing in bank deposits, government debt securities, corporate debentures, equities, unit trusts of various mutual funds, property funds, and infrastructure funds, including derivatives and alternative investments, in either domestic or foreign markets.

Fees to cover the management of the private fund (Management Fee)

Fees to safekeep the assets (Custodian Fee)

Other fees such as stamp duty, brokerage fees, audit fees (if any), etc.

Private Funds

A fund that is established when an investor (or group of investors or juristic person) assigns a sum of money or assets to an investment management company to manage that money or assets on his/her behalf. The portfolio structure is highly flexible, able to be readily modified to suit the client’s demands.

Mutual Funds

A pooling of money from individual investors into a single large fund which is subsequently registered as a juristic-person. The investment management company then invests that money in various securities and assets in accordance to the fund’s investment policy as approved in the fund scheme. Each investor will be entitled to receive “unit trusts” as proof of ownership for his/her stake in the fund.

Investment policy can be set by the investor as desired

through joint consultation with the investment management company to customize investments that match the needs of the investor and can promptly be amended to respond to changing economic conditions.

Reduce the burden of investing

by oneself as private funds offer convenience, lessen the chore of monitoring investments by oneself, handle securities transactions and keep track of investment assets.

Investments are professionally managed

by experienced professionals in the field of asset management who are skilled at investment analysis, well-informed and proactive.

Portfolio risk is diversified

appropriately for the level of risk acceptable to the client.

Access to a wide variety of investment assets

either domestic or abroad, including deployment of modern investment tools.

Higher bargaining power

is naturally achieved through an investment management company with large assets under management.

A solid fund management administrative system

which is accurate, capable of producing daily reports to enable investors to stay up to date.

Differences Between Private Funds and Mutual Funds

© Copyright 2016 All Rights Reserved. SCB Asset Management Company Limited.

"Investors should familiarize themselves with the investment product, its features, conditions affecting returns, and risks, before making an investment decision."

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice

Cuckold Movie Watch Hd

Ass Back Home

Lesbians Rimming And Piss

Hard Orgasm Gif

Squirting Stories Part 2

Private fund, fund recommended by donors, or both: Here ...

About Private Fund | SCB Asset Management (SCBAM)

Private Fund | SCB Asset Management (SCBAM)

Private Fund Search - Private Fund Data

Private Fund Management

Private-equity fund - Wikipedia

Private Funds - Dechert

Private Fund | Principal Asset Management

Private Fund