Private Equity Russia

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

РекламаCarta — платформа для управления реестром акционеров с высоким потенциалом роста

Финансовые услуги оказывает: АО "Инвестиционная компания "ФИНАМ", АО "Банк ФИНАМ"

РекламаКупите 25DEGREES Russia (25D15-RU01-20-30) в ЭЛЬДОРАДО. · Москва · круглосуточно

Most private equity activity in Russia takes place at “financial-industrial groups,” which are basically local investment groups that do a bit of everything. Examples include Alfa Group, Basic Element, Summa Group, Renova and a few others with a huge amount of assets, money, and connections (essential for doing anything here).

www.mergersandinquisitions.com/russi…

Which is the best private equity firm in Russia?

Which is the best private equity firm in Russia?

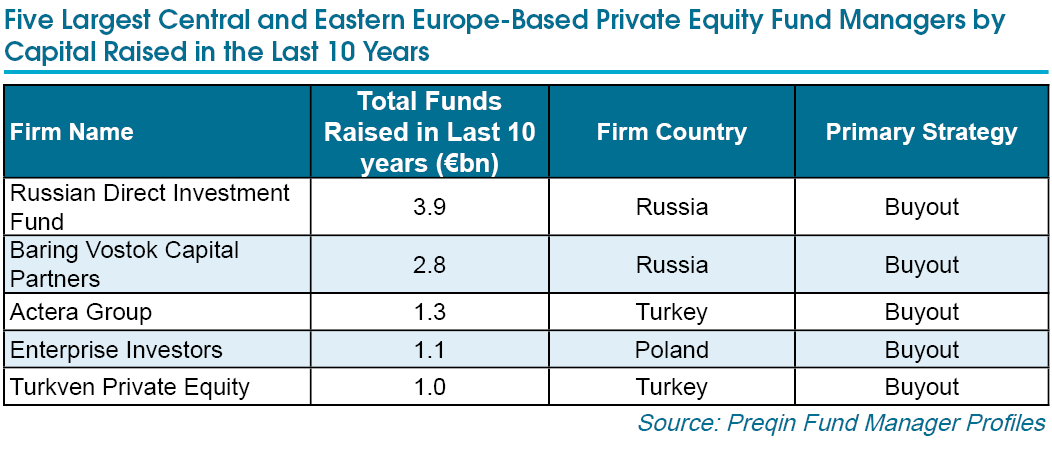

The firm mainly emphasizes buyout and co-investment funds. Russia Partners: Russia Partners have raised over $1.1 billion in capital commitments during the last 10 years. This firm concentrates on the late stage of growth expansion plans of companies. Russian Direct Investment Fund: This firm also focuses on co-investment and growth.

www.wallstreetmojo.com/private-equity-in-r…

What does VPE capital fund do in Russia?

What does VPE capital fund do in Russia?

The Fund aims to be the investment window for international institutional funds to invest into Russia. VPE Capital endeavours to find companies looking for growth capital with ambitious, experienced management teams wanting to work with international PE funding managed by a team dedicated to the Russian market.

www.vpe-capital.com/strategies/private-eq…

Where does UFG invest in private equity in Russia?

Where does UFG invest in private equity in Russia?

UFG Private Equity invests in companies across Russia and the CIS. Our particular focus is on Russia. UFG Private Equity target investment universe is mid-sized businesses with revenues generally between $20 and $400 million.

Which is the leading real estate company in Russia?

Which is the leading real estate company in Russia?

The leading online real estate classifieds company in Russia with a longstanding success story. Has a total monthly Internet audience of over 6 million unique visitors. Large, high-quality database of over 2 million property listings. A network of private clinics in the regions of Russia. Currently manages 27 clinics in 5 cities.

https://www.mergersandinquisitions.com/russia-private-equity

18.03.2015 · Most private equity activity in Russia takes place at “financial-industrial groups,” which are basically local investment groups that do a bit of everything. Examples include Alfa Group, Basic Element, Summa Group, Renova and a few others with a huge amount of assets, money, and connections (essential for doing anything here).

https://www.crunchbase.com/hub/russian-federation-private-equity-firms

Top Investor Types Private Equity Firm, Venture Capital, Accelerator, Corporate Venture Capital, Incubator Organizations in this hub have their headquarters located in Russian Federation, Europe; notable events and people located in Russian Federation are also included. This list of private equity firms headquartered in Russian …

Ch 4. Private equity in Russia – Russian corporates in the global capital markets

The Evolution of the Russian Private Equity Market - David Bernstein

Keiser Report | Summer solutions: The private equity problem | E1708

Keiser Report: American Capitalist Cancer (E1251)

Keiser Report: Brand Equity Erosion (E1353)

https://www.wallstreetmojo.com/private-equity-in-russia

Overview of Private Equity in Russia

Private Equity Services Offered in Russia

Top Private Equity Firms in Russia

Private Equity Recruitment in Russia

Private Equity Culture in Russia

Salaries in Private Equity in Russia

Private Equity Exit Opportunities in Russia

Conclusion

Recommended Articles

As the private equity market in Russia is smaller, the teams are also smaller. As a result, just after joining, you would be able to get a lot of exposure and will handle a lot of deals. Moreover, you will know every member through and through. Even you would be able to walk into the room of MD and can talk to him/…

https://www.vpe-capital.com/strategies/private-equity-infrastructure/russia

Russia. Private Equity. The Russian economy has faced numerous challenges over the last 30 years, from terms-of-trade shocks to international sanctions. But with the disruption comes opportunities as well as challenges. Despite the geopolitics, Russia …

Directory of Private Equity and Venture Capital from Russia provides listing of top investment firms based in Russia to …

XIII Russian Private Equity Congress and IX Venture Investors Forum Hosted by: PREQVECA and Cbonds Congress © 2009 PRE Q VECA Phone: +7 (812) …

Elbrus Capital Funds are leading Russia and CIS-focused private equity funds with US$1 billion of assets. Since the establishment of the first fund in 2007, Elbrus Capital Funds …

https://www.ufgam.com/private-equity

UFG Private Equity invests in fast-growing companies in Russia and CIS countries, focusing on Healthcare, BPO (Business Processes Outsourcing), Telecom & Technology, and Consumer Staples & Retail. The three UFG …

РекламаКрасивые букеты от 1 550 руб. Доставка 0 руб. по Москве. Работаем 24/7. Заказать! · Москва · пн-пт круглосуточно

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Discover How To Break Into Investment Banking, Hedge Funds or Private Equity, The Easy Way.

I agree to my personal data being stored and used to receive this content *

We respect your privacy. Please refer to our full privacy policy.

Out of all the country-specific articles I’ve published, the one that generated the most controversy – by far – was the one on investment banking in Russia.

No one could agree on the salaries and bonuses paid by different banks, whether or not you need to know the language, or even how much vodka you have to drink to understand the industry.

So I decided to jump back into the well of controversy once again, this time focusing on how one reader made the transition from audit to investment banking to private equity in Russia…

…and how the finance industry there has been affected by “recent developments”:

From Business School to Audit to Investment Banking Startup

Q: You know how this works. What drew you into the insanity?

A: I went to a top business school in Russia, and got very interested in finance and investing due to some great lecturers who also worked in consulting and private equity.

So I started reading all the finance classics (books about Michael Milken, Drexel Burnham Lambert, etc.) and finding out more about IB online.

During my second year of study, I was offered an interesting job as an executive at a small construction company, which I decided to try. I focused on analyzing and improving business processes at the firm.

It was interesting and challenging at first, but after 2 years I decided that I wanted to work in the investment business, so I started looking for an IB job in Russia.

But deal activity was low, the industry was and still is small, and no one wanted to hire an entry-level candidate with no previous IB experience.

So after several months of searching, a Big 4 audit job opened up and I interviewed there, eventually accepting an offer.

I got very lucky because the firm was hiring specifically for the annual audit of their biggest banking client – one of the Top 3 banks in Russia – so I learned a lot from that one engagement.

At the same time, I was studying for the CFA and still searching for IB jobs on the side.

Q: So when you say “searching,” were you networking and reaching out to contacts in the industry?

Headhunters can be helpful as well, but only if you have the right experience.

After I finished the annual audit, I received a job offer at a new IB boutique started by the Founder and ex-Managing Director of one of the best-known existing boutiques in Russia at the time.

That offer was the best chance I had of breaking in, given my audit background, so I accepted it.

The firm actually had good deal flow, for a boutique, and I got all the other usual benefits: more responsibility, more client exposure, and the ability to work in different industries.

A: Right. About 1.5 years into it, a headhunter approached me and told me about a senior analyst position at a big real estate private equity firm with solid deal flow and promising deals.

The pitch was: “You’ll get more challenging and prominent deals, plus you might be promoted to Associate within 1 year.”

Q: Good pitch. Was the headhunter telling the truth, though?

I was actually promoted after only 1.5 months at the firm, because one Associate was fired and they needed someone to take over ASAP – plus, they were busy with deals and couldn’t spend months searching for someone new.

Into Private Equity, by Way of Real Estate

Q: So what was the recruiting process like for real estate private equity in Russia?

A: Overall, it was fairly similar to the process in any other country: you answer the usual questions about why you want to do RE PE and how your previous experience is connected to real estate.

In the later rounds, you get case study questions with models and presentations.

More senior candidates have to prove their track record, demonstrate how well-connected they are, and show that there’s “chemistry” between them and the Partners and top managers.

The typical case study is in the form of a real estate development or acquisition, and they ask candidates to estimate how much the fund could pay for a plot of land or a property to achieve a 25%+ IRR.

It isn’t extremely complicated compared to what you do on the job, but it does test your understanding of the industry, your ability to find information, and how well you can use models to support your arguments.

Q: Thanks for sharing that description.

A: Most people at PE firms here come from 1 of 3 backgrounds:

So if you’re not from one of those backgrounds, it will be almost impossible to get in because the industry is so small and the requirements are so specific.

You do see some foreigners working here, but most of them are in very senior roles. Junior and mid-level people are 99% Russian natives.

The Private Equity Landscape: A Barren Plain in Siberia?

Q: So what is the private equity industry there like overall?

A: Well, you have to divide this into “pre-sanction” and “post-sanction” times. As of right now (2015) everything here is in crisis mode because of the sanctions and the plummeting currency, so distressed deals and distressed assets are very common.

But if you want to know about the previous situation: there are a few big international PE firms here, but the industry is definitely dominated by smaller, local firms.

The most prominent PE firm overall is Baring Vostok Capital Partners (BVCP), with very successful investments such as Yandex (Russian’s main search engine).

TPG Capital opened its Moscow office in 2008, and among the top 20 global PE firms by AUM they’re still the only one with a presence here (Carlyle had a Moscow office but shut it down in 2005). TPG also owns ~39% of Lenta, one of the biggest retail chains in Russia.

Most private equity activity in Russia takes place at “financial-industrial groups,” which are basically local investment groups that do a bit of everything.

Examples include Alfa Group, Basic Element, Summa Group, Renova and a few others with a huge amount of assets, money, and connections (essential for doing anything here).

Some of these are similar to Berkshire Hathaway, but they also get the benefit of government backing.

Typical local PE funds here include UFG, Russia Partners, Elbrus Capital, Da Vinci Capital, and many others.

There is a very thin line between “the government” and actual investment firms here, and some of these could be labeled “quasi-government.”

Many deals are highly dependent on government policies and knowing the right people in the right ministry/department.

Q: Well, I can see why Carlyle shut down its office.

A: Yes. US and European firms in Russia really need a person who understands local business and political processes, and who can maintain good “government relations.”

Q: Fair enough. Anything else to note?

A: It’s also worth mentioning venture capital careers in Russia, since they have drawn a lot of attention over time.

On the venture capital side, the most well-known firm is Digital Sky Technologies or “DST Global” (Yuri Milner and Alisher Usmanov), with investments in Facebook, Alibaba, Zynga, Groupon, Xiaomi, and various Russian social networks.

They took a very interesting approach by going after companies that were too big for traditional VC or growth equity funds, but too small for traditional PE funds – and it happened at a time when companies wanted to delay going public for much longer than in previous decades.

There are other VC / growth equity-type firms here as well, such as the state-owned Rusnano. It aims to co-invest in ventures that will be useful for the Russian economy and society.

Other examples of VC and growth equity firms include ABRT, E.Ventures, and Runa Capital, which are all investing in software, internet, and e-commerce ventures in Russia.

Another example is Buran Venture Capital, which is smaller and newer but has focused on e-commerce, mobile, and new media.

So there’s definitely some tech startup and venture capital activity here, but overall the country is still dominated by traditional industries.

And on the private equity / late-stage side, what’s the split between growth equity deals and traditional leveraged buyouts?

Do you actually see both deal types, or did you see both deal types in the past?

A: In “pre-sanction times,” yes. Overall capital committed to private equity was less than in the other BRIC countries, but both deal types existed.

One example of an older deal that used debt was Renova’s acquisition of Corbina Telecom from IDT Telecom in 2005.

It was a $146 million USD deal funded with $90 million of debt, and then Renova flipped the company to Golden Telecom for $240 million within 1 year, yielding a 3x multiple and 300% IRR.

The biggest special situations / turnaround fund in Russia is A1, which is part of Alfa Group.

Q: And are there any differences in the deal process or in valuation / financial modeling?

A: The main process difference is that everything is more dependent on the whims of the government than in other countries, so deals often drag on and on, die, and come back to life multiple times.

The technical work itself isn’t that much different, but investors here tend to require higher IRRs, sometimes north of 25%, due to the high geopolitical risk.

Cross-border deals are also quite common.

I think a lot of readers would be interested in what a distressed deal in Russia might look like, given the current environment – can you give us an overview?

A: Sure. I’ve been working almost entirely on distressed assets and restructurings rather than “normal deals,” so I’ve had a good amount of exposure.

A “classic” distressed deal here would look like this:

From a lender’s point of view, there are several options:

The company’s point of view is “I’m #*$#$’d like Tony Montana at the end of Scarface, and I’ll do anything to compromise and work out a deal with the lenders.”

If a distressed company has no foreign currency-denominated debt, but demand for its goods has plummeted (e.g., most likely Russian car dealers in the future), PE investors might be more interested.

They would focus on any firms that suddenly have low EBITDA due to a high fixed cost base, such as manufacturers, and then buy the firms at a discount, restructure them and optimize costs, and then hold onto those firms until the economy improves and demand for goods is restored.

So this strategy comes down to assessing firms’ fixed vs. variable cost bases and estimating which firms are just suffering from a temporary drop in demand vs. more serious long-term problems.

Exit Opportunities: Escaping the Sanctions

Q: So what do most people there do after working in PE?

A: I’m mainly working with distressed assets and special situations now, so I want to get more involved with normal deals and gain more experience in developed markets.

Q: So you’re looking for IB/PE jobs outside of Russia?

A: Yeah, I’m looking to move to Europe at the moment.

As you can imagine, though, there are some obstacles for Russians to overcome…

Q: Good luck with that. And thanks for your time!

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street. In his spare time, he enjoys memorizing obscure Excel functions, editing resumes, obsessing over TV shows, traveling like a drug dealer, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

I agree to my personal data being stored and used to receive this content *

We respect your privacy. Please refer to our full privacy policy.

That case about debt in euro becoming harmful in terms of leverage because of currency fluctuations ? Why not just use hedging currency derivatives or forward contracts? Or is the derivative market also under-developed?

The derivative market is extremely advanced in Russia. Have you ever looked at the costs of hedging your FX exposure??? Most companies don’t like to “waste” money on this and take away from their profit

Thanks for the great blog and offerings

I’m a Malaysian medical graduate who happened to know a director / founder of PE firm focusing in sub Saharan Africa.

He invited me to join his firm and I was very tempted. My goal is to work myself up to Partners / learning what is needed to making my own successful investments

However I do have some concerns too

1. What do you think of PE in Africa?

2. How do I do due diligence on the PE firm before deciding to work for them?

3. How do I get prepared for this career change?…from medical to PE

Your pro input is greatly appreciated

1. Don’t know much about it, sorry. It’s promising but not really developed in most places yet except for South Africa.

2. Go and meet them in-person, see if they have a real office, and contact people who have worked there before to see what they say.

3. Learn about deal analysis, learn accounting, valuation, and financial modeling, and read up on the industry, how PE funds are structured, what they do, and so on.

Do you have any courses / tutorials you can recommend?

For more structured / step-by-step training, see the full courses we offer: http://breakingintowallstreet.com/biws/breaking-into-wall-street-courses

Go

Distilling Industry Vintage Label Design

Prinzzess Lesbian Scenes

Pick Up Pov Porno Video

Thick Pantyhose Legs In Miniskirt

Massage Sexy 18

List of top Russian Federation Private Equity Firms ...

Private Equity in Russia | Top Firms List | Salaries | Jobs

Russia - VPE Capital

Russian Private Equity & Venture Capital Investors ...

PREQVECA - Private Equity and Venture Capital

Elbrus Capital - elbcp.com

Private Equity — UFG Asset Management

Private Equity Russia